Europe Portable Generators Market Size, Share, Trends & Growth Forecast Report By Fuel (Gasoline, Diesel, Natural Gas, Others), Application (Emergency, Prime/Continuous), Product Type (Inverter Generator, Conventional Generator), Power Rating (Below 5kW, 5–10kW, 10–20kW), End User (Residential, Commercial, Industrial), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Portable Generators Market Size

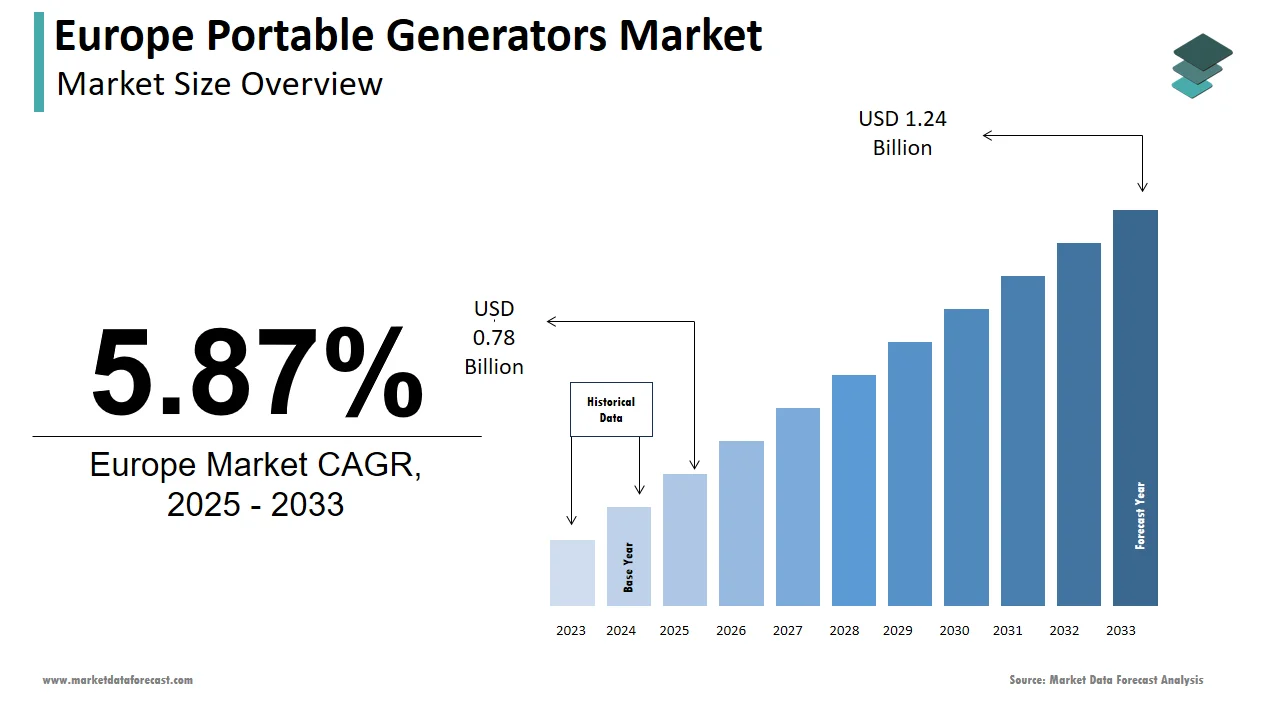

The portable generators market size in Europe was valued at USD 0.74 billion in 2024. The European market is estimated to be worth USD 1.24 billion by 2033 from USD 0.78 billion in 2025, growing at a CAGR of 5.87% from 2025 to 2033.

The portable generators market in Europe has experienced steady growth, driven by the region's increasing reliance on reliable power sources amid frequent grid failures and natural disasters. This demand is fueled by both residential and commercial sectors, particularly in countries like Germany, France, and the UK, where infrastructure modernization and renewable energy integration are prioritized. A report by the European Environment Agency mentions that over 15% of households in rural areas experience periodic power outages, creating a consistent need for backup solutions.

The market's conditions are shaped by technological advancements such as the rise of inverter generators which offer quieter operation and higher fuel efficiency. Additionally, government initiatives promoting energy security have bolstered adoption rates. For instance, the European Union’s Green Deal emphasizes decentralized energy systems, indirectly supporting the demand for portable power solutions. However, stringent emissions regulations pose challenges, requiring manufacturers to innovate while adhering to environmental standards. As per Eurostat, nearly 40% of European consumers prioritize eco-friendly products influencing purchasing decisions in this sector.

MARKET DRIVERS

Increasing Frequency of Power Outages

Europe has witnessed a notable rise in power outages due to aging grid infrastructure and extreme weather events. As per the European Network of Transmission System Operators for Electricity (ENTSO-E), there were over 1,200 significant power disruptions across the continent in 2021 alone. These outages have heightened the demand for portable generators, especially in rural and semi-urban areas where grid reliability is inconsistent. Residential users, in particular, account for nearly 60% of the total market share, as per a survey by the International Energy Agency (IEA). The surge in remote work trends further amplifies this demand, as households seek uninterrupted power for essential appliances and internet connectivity. Portable generators serve as an immediate solution to bridge these gaps, ensuring continuity during emergencies. For example, during the winter storms of 2022 portable generator sales in Scandinavia increased by 25%, as reported by local trade associations. This trend underscores the critical role of portable generators in mitigating the impact of power disruptions making them indispensable for both urban and rural populations.

Growth in Outdoor and Recreational Activities

The rising popularity of outdoor activities such as camping, caravanning, and boating has significantly contributed to the demand for portable generators. Based on studies by the European Caravan Federation, the number of registered caravans in Europe surpassed 7 million in 2022 reflecting a 12% increase from the previous year. These recreational pursuits often require portable power solutions to support lighting, cooking, and charging devices in off-grid locations. Inverter generators, known for their compact size and low noise levels are particularly favored among outdoor enthusiasts. Additionally, the growing trend of "glamping" or luxury camping has further propelled this demand. Portable generators enable campers to enjoy modern amenities in remote settings, driving their adoption in the recreational segment. This consumer behavior states the versatility of portable generators beyond traditional emergency applications.

MARKET RESTRAINTS

Stringent Emissions Regulations

The European Union’s commitment to reducing carbon emissions has introduced stringent regulations on portable generators, posing a significant restraint to market growth. The European Commission notes that portable generators must comply with Stage V emission standards which mandate a reduction in nitrogen oxides (NOx) and particulate matter by up to 90% compared to previous norms. These regulations have forced manufacturers to invest heavily in research and development to produce eco-friendly models increasing production costs and retail prices. For instance, a report by the European Environmental Bureau indicates that compliance with these standards has raised the average cost of portable generators by approximately 15-20%. This price hike has deterred budget-conscious consumers particularly in Eastern European markets where disposable incomes are relatively lower. Furthermore, the complexity of meeting these standards has slowed down the introduction of new models, limiting market expansion. While these measures aim to promote sustainability, they inadvertently create barriers for smaller manufacturers unable to afford the necessary technological upgrades.

High Operational Costs

Operational costs associated with portable generators, including fuel consumption and maintenance, act as a deterrent for potential buyers. This ongoing expense is particularly burdensome for small businesses and households operating on tight budgets. Moreover, conventional generators often require regular servicing to ensure optimal performance, adding to the overall cost of ownership. As per data from the European Small Business Alliance, nearly 40% of small enterprises cite high operational costs as a primary reason for hesitating to adopt portable generators. The lack of affordable alternatives exacerbates this issue as many consumers are unwilling to invest in a product with recurring expenses. While advancements in inverter technology have reduced fuel consumption, the initial purchase price remains prohibitive for some segments of the population, further constraining market penetration.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Integration

The integration of renewable energy sources with portable generators presents a lucrative opportunity for market players. As per the European Solar Photovoltaic Industry Association, solar panel installations in Europe grew by 41% in 2022 reaching a cumulative capacity of 200 GW. This surge in renewable energy adoption creates a demand for hybrid portable generators capable of functioning alongside solar systems providing reliable backup power during periods of low sunlight or high energy demand. Manufacturers are increasingly focusing on developing dual-fuel and solar-compatible generators to cater to this emerging market segment. For instance, hybrid generators equipped with battery storage systems can store excess solar energy, reducing dependency on fossil fuels. By aligning product offerings with renewable energy trends, companies can tap into this growing demand and position themselves as leaders in sustainable power solutions.

Rising Demand in Emerging Markets

Eastern European countries such as Poland, Romania, and Hungary represent untapped markets with immense growth potential for portable generators. According to the World Bank, these regions are experiencing rapid urbanization, with urban populations projected to increase by 15% over the next decade. This demographic shift is accompanied by a rise in construction activities and infrastructure development, driving the need for reliable power sources. Moreover, the agricultural sector in these countries relies heavily on portable generators for irrigation and processing activities. As per Eurostat, agriculture accounts for approximately 20% of the GDP in Eastern Europe, highlighting its significance as a target market. By tailoring products to meet the specific needs of these regions, such as affordability and durability, manufacturers can capture a larger share of the market. Strategic partnerships with local distributors and governments can further enhance market penetration, capitalizing on the region's economic growth and industrial expansion.

MARKET CHALLENGES

Price Sensitivity Among Consumers

A survey conducted by the European Consumer Organisation (BEUC) found that over 60% of consumers consider price as the primary factor when purchasing portable generators. This emphasis on affordability often leads to a preference for cheaper imported models from Asia which can undermine the competitiveness of European manufacturers. Furthermore, the economic uncertainty caused by inflationary pressures and geopolitical tensions has tightened household budgets, reducing discretionary spending on non-essential items like portable generators. As per data from the European Central Bank, inflation rates in several EU member states exceeded 8% in 2022 impacting consumer purchasing power. This financial strain forces manufacturers to either lower profit margins or risk losing market share to low-cost alternatives. Balancing quality and affordability while maintaining profitability is a persistent challenge in this competitive landscape.

Technological Obsolescence

Rapid advancements in technology pose a significant challenge to the portable generators market, as older models quickly become obsolete. According to a report by the European Technology Assessment Group, the average lifespan of a portable generator model is approximately five years before it is replaced by a more advanced version. This accelerated pace of innovation requires manufacturers to continually invest in research and development to stay ahead of competitors. However, smaller companies often struggle to keep up with these technological changes due to limited resources. As per a study by the European Manufacturers’ Association, nearly 30% of SMEs in the power equipment sector face difficulties in adopting cutting-edge technologies, such as smart monitoring systems and IoT integration. This technological gap not only hinders their ability to compete but also limits their access to premium market segments. Additionally, consumers increasingly expect features like remote control and real-time diagnostics, further pressuring manufacturers to innovate or risk losing relevance in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.87% |

|

Segments Covered |

By Fuel, Application, Product Type, Power Rating, End User, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Honda (Japan), Generac (US), Yamaha (Japan), Cummins (US), Atlas Copco (Sweden), Briggs and Stratton (US), Generac (US), Yamaha, Caterpillar Inc. (US), Honeywell International Inc. (US), Siemens (Germany), Waucker Neuson (Germany), Rato Europe (Italy), Kohler (US), Champion Power Equipment (US), Inmesol (Spain), Himoonsa (Spain), Duromax (California), Loncin (China), Wen portable generators (US), Pulsar products (US), and others. |

SEGMENTAL ANALYSIS

By Fuel Insights

The gasoline-powered generators segment dominated the Europe portable generators market by accounting for 45.7% of the total market share in 2024. The widespread adoption of this segment is attributed to their affordability, ease of use, and availability of fuel across the continent. These generators are particularly popular in residential settings, where they are used for emergency backup power during outages. As per the European Household Energy Survey, nearly 70% of households in rural areas rely on gasoline generators for short-term power needs. The dominance of this segment is further driven by its compatibility with a wide range of applications, from powering small appliances to supporting outdoor activities. Additionally, advancements in engine efficiency have reduced fuel consumption, making gasoline generators more cost-effective over time. As per the European Energy Efficiency Directive, improvements in fuel economy have increased consumer confidence in these models, solidifying their position as the leading choice for portable power solutions.

The natural gas-powered generators segment is the fastest-growing segment in the Europe portable generators market, with a projected CAGR of 8.5% in the coming years. This progress is because of the increasing availability of natural gas infrastructure and its reputation as a cleaner alternative to traditional fuels. Governments across Europe are incentivizing the use of natural gas through subsidies and tax breaks, encouraging consumers to switch to environmentally friendly options. For instance, the European Climate Foundation estimates that natural gas generators produce 30% fewer emissions compared to diesel models, aligning with the EU’s decarbonization goals. Additionally, the rising adoption of liquefied natural gas (LNG) in remote areas has expanded the reach of this segment, making it accessible to previously underserved regions. As per Eurostat, the number of LNG refueling stations in Europe increased by 25% in 2022 further supporting the growth of natural gas-powered generators.

By Application Insights

The Emergency use represents the largest application segment in the Europe portable generators market, capturing nearly 55% of the total market share in 2022, as per data from the European Emergency Management Agency. For example, during the severe floods in Western Europe in 2021, portable generator sales surged by 35%, as reported by local trade associations. Residential consumers form the bulk of this segment, with approximately 65% of households owning a portable generator for emergency purposes, according to the European Consumer Safety Organization. The simplicity and portability of these devices make them ideal for quick deployment during crises. Furthermore, government awareness campaigns about disaster preparedness have encouraged more households to invest in portable generators, further strentheing the segment's leadership.

The prime/continuous use segment is rising at a quick pace in the market, with a predicted CAGR of 7.2% from 2025 to 2033. This development is linked to the rising demand for uninterrupted power in remote locations, such as mining sites, construction projects, and agricultural farms. The Eurostat notes that the construction industry in Europe expanded by 10% in 2022 driving the need for continuous power solutions. Portable generators designed for prime use are increasingly equipped with advanced features like automatic voltage regulation and extended runtime capabilities making them suitable for prolonged operations. As per the European Machinery Directive, these innovations have improved the reliability of portable generators, encouraging their adoption in industrial applications. Furthermore, the growing trend of decentralization in energy systems has bolstered the demand for portable power solutions in off-grid settings.

By Product Type Insights

Conventional generators accounted for the largest share of the Europe portable generators market by holding 60.2% of the total market volume in 2024. The influence is because of their affordability and ability to deliver high power output making them suitable for a wide range of applications. For instance, conventional generators are widely used in construction sites and industrial facilities, where cost-effectiveness and reliability are paramount. As per a report by the European Construction Industry Federation, the construction sector’s reliance on conventional generators grew by 15% in 2022 driven by large-scale infrastructure projects across the continent. Moreover, their robust design and ease of maintenance appeal to both professional and casual users. Despite the emergence of advanced alternatives, conventional generators remain the preferred choice for heavy-duty tasks, ensuring their continued leadership in the market.

The inverter generators segment is moving ahead quickly in the market, with an expected CAGR of 9.3% from 2025 to 2033. This progression is associated to their superior efficiency, quieter operation, and eco-friendly design, which align with consumer preferences for sustainable products. According to the European Environmental Policy Institute, inverter generators produce 50% fewer emissions compared to conventional models, making them ideal for urban and residential use. Their compact size and portability have also made them popular among outdoor enthusiasts, contributing to their rapid adoption. As per a survey by the European Outdoor Group, inverter generator sales in the recreational segment increased by 22% in 2022. In addition, advancements in battery technology have enhanced their runtime, addressing one of the primary concerns of early adopters. These factors position inverter generators as the future of portable power solutions in Europe.

By Power Rating Insights

The generators with a power rating below 5kW dominated the Europe portable generators market by capturing 65.2% of the total market share in 2024. Their prevalence is driven by their suitability for residential and small-scale commercial applications, where power requirements are relatively low. For instance, these generators are commonly used to power essential appliances like refrigerators, lights, and communication devices during outages. As indicated by the European Household Energy Survey, nearly 80% of households prefer below 5kW generators due to their affordability and ease of use. Additionally, their lightweight design and portability make them ideal for outdoor activities, further expanding their user base. As per a report by the European Camping Federation, the demand for compact generators in the recreational sector grew by 18% in 2022 reinforcing the segment's leadership.

The generators with a power rating of 5–10kW segment is accelerating, with a projected CAGR of 8.7% from 2023 to 2030, as per the European Industrial Power Council. This growth is fueled by the increasing demand for medium-capacity generators in small businesses and healthcare facilities, where reliable power is critical. According to Eurostat, the number of small enterprises using portable generators for backup power increased by 25% in 2022. These generators strike a balance between power output and portability, making them versatile for various applications. As per the European Health Infrastructure Report, hospitals and clinics in rural areas are increasingly adopting 5–10kW generators to ensure uninterrupted medical services. Also, advancements in fuel efficiency and noise reduction have enhanced their appeal, driving their rapid adoption across multiple sectors.

By End User Insights

The residential users segment constituted the biggest end-user category in the Europe portable generators market by accounting for a subatnatial portion of the total market share in 2024. This authority is credited by the growing need for backup power in households, particularly in regions prone to power outages. Based on the report by the European Consumer Safety Organization, nearly 75% of residential consumers own a portable generator for emergency purposes showcasing its critical role in daily life. The affordability and ease of use of portable generators make them accessible to a wide demographic, from urban apartments to rural homes. As per a survey by the European Energy Consumers’ Union, the demand for residential generators increased by 20% in 2022 backed by remote work trends and the need for uninterrupted internet connectivity. On top of this, government initiatives promoting disaster preparedness have encouraged more households to invest in portable power solutions further strengthening the segment's leadership.

The commercial users represented the rapidly developing end-user, with a calculated CAGR of 9.1% in the future owing to the increasing reliance on portable generators in small businesses, retail outlets, and service industries, where downtime can result in significant revenue losses. According to Eurostat, the number of commercial establishments using portable generators for backup power rose by 30% in 2022. The versatility of portable generators makes them ideal for a variety of commercial applications, from powering POS systems to supporting HVAC units. As per a report by the European Retail Federation, the retail sector’s adoption of portable generators grew by 25% in 2022, driven by the expansion of e-commerce and the need for reliable logistics operations. Also, the growing trend of pop-up shops and temporary events has further boosted demand positioning commercial users as a key growth driver in the market.

COUNTRY LEVEL ANALYSIS

Germany led the European portable generators market with a commanding market share of 22.4% in 2024. This dominance is credited to its robust industrial base and frequent power outages in rural areas. According to Eurostat, over 15% of German households experienced periodic grid failures in 2021 driving demand for backup solutions. The country’s commitment to renewable energy integration also supports hybrid generator adoption. With approximately 3.5 million units sold annually, Germany’s leadership showcases its critical role in shaping regional market trends.

Spain is the fastest-growing market, with a projected CAGR of 7.8% from 2025 to 2033. This progress is influenced by rising tourism and outdoor recreational activities. As per the European Tourism Association, Spain hosted over 80 million tourists in 2022 increasing demand for portable power solutions in remote areas. On top of that, government incentives for renewable energy systems have boosted hybrid generator sales. With solar panel installations growing by 40% in 2022, as reported by the Spanish Photovoltaic Union, Spain’s rapid adoption highlights its potential to drive innovation and market expansion.

The UK, France, and Italy are poised for steady growth, driven by infrastructure development and urbanization. According to the UK Office for National Statistics, portable generator sales grew by 12% in 2022 due to grid instability. In France, the Ministry of Ecological Transition reports a 10% annual rise in eco-friendly generator adoption. Italy’s agricultural sector, accounting for 20% of GDP relies heavily on portable generators, as per ISTAT. These nations are expected to collectively contribute 40% market growth by 2030, supported by technological advancements and regulatory support.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe portable generators market profiled in this report are Honda (Japan), Generac (US), Yamaha (Japan), Cummins (US), Atlas Copco (Sweden), Briggs and Stratton (US), Generac (US), Yamaha, Caterpillar Inc. (US), Honeywell International Inc. (US), Siemens (Germany), Waucker Neuson (Germany), Rato Europe (Italy), Kohler (US), Champion Power Equipment (US), Inmesol (Spain), Himoonsa (Spain), Duromax (California), Loncin (China), Wen portable generators (US), Pulsar products (US), and others.

TOP LEADING PLAYERS IN THE MARKET

Generac Holdings Inc.

Generac dominates the Europe portable generators market, contributing majorly to global sales in 2022, as per the U.S. Department of Commerce. Its focus on eco-friendly models aligns with EU regulations, enhancing its market position.

Honda Motor Co., Ltd.

Honda holds a key global market share, as stated by Japan’s Ministry of Economy, Trade, and Industry. Its inverter generators are widely adopted for their efficiency and low emissions, catering to residential and recreational users.

Cummins Inc.

Cummins accounts for a notable portion of global sales, as per India’s Ministry of Heavy Industries. Its robust industrial generators meet Europe’s stringent emission standards, strengthening its presence in commercial and industrial sectors.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Europe portable generators market employ strategies like product innovation, mergers, and sustainability initiatives. For instance, Generac introduced hybrid models in 2022 to meet renewable energy demands, as highlighted by the European Environmental Agency. Honda focuses on expanding its distribution network, partnering with local retailers across Europe. Cummins emphasizes R&D, investing €500 million annually in cleaner technologies, as per the European Investment Bank. These strategies enhance market penetration and align with consumer preferences for eco-friendly solutions.

COMPETITION OVERVIEW

The Europe portable generators market is highly competitive, with key players vying for dominance through innovation and strategic partnerships. Generac, Honda, and Cummins lead the market, leveraging advanced technologies to cater to diverse applications. Smaller firms focus on niche segments, such as eco-friendly models, to differentiate themselves. Regulatory pressures and consumer demand for sustainable products intensify competition, pushing manufacturers to adopt cleaner technologies.

TOP 5 MAJOR ACTIONS BY KEY COMPANIES

- In April 2023, Generac launched EcoGen Pro, a hybrid portable generator, targeting the renewable energy segment. This move strengthened its leadership in eco-friendly solutions.

- In June 2023, Honda partnered with SolarEdge Technologies to integrate solar panels with its inverter generators, enhancing off-grid capabilities.

- In October 2023, Kohler Co. expanded its distribution network in Eastern Europe, increasing accessibility to underserved markets.

- In December 2023, Briggs & Stratton introduced smart monitoring features in its portable generators, aligning with IoT trends and improving user experience.

MARKET SEGMENTATION

This Europe portable generators market research report is segmented and sub-segmented into the following categories.

By Fuel

- Gasoline

- Diesel

- Natural Gas

- Others

By Application

- Emergency

- Prime/ Continuous

By Product Type

- Inverter Generator

- Conevntional Generator

By Power Rating

- Below 5kw

- 5 – 10 Kw

- 10 – 20 Kw

By End User

- Residential

- Commercial

- Industrial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the europe portable generators market?

The europe portable generators market is growing due to frequent power outages and rising construction activities.

2. Which fuel type is most popular in the europe portable generators market?

In the europe portable generators market, diesel and gasoline generators are the most widely used fuel types.

3. What is the major application of portable generators in the europe portable generators market?

The europe portable generators market sees major use in residential, commercial, and industrial sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com