Europe Positive Displacement Pumps Market Size, Share, Trends & Growth Forecast Report, Segmented By Type (diaphragm pumps , peristaltic pumps), End-User (chemicals industry, pharmaceuticals) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU), Industry Analysis From (2025 to 2033)

Europe Positive Displacement Pumps Market Size

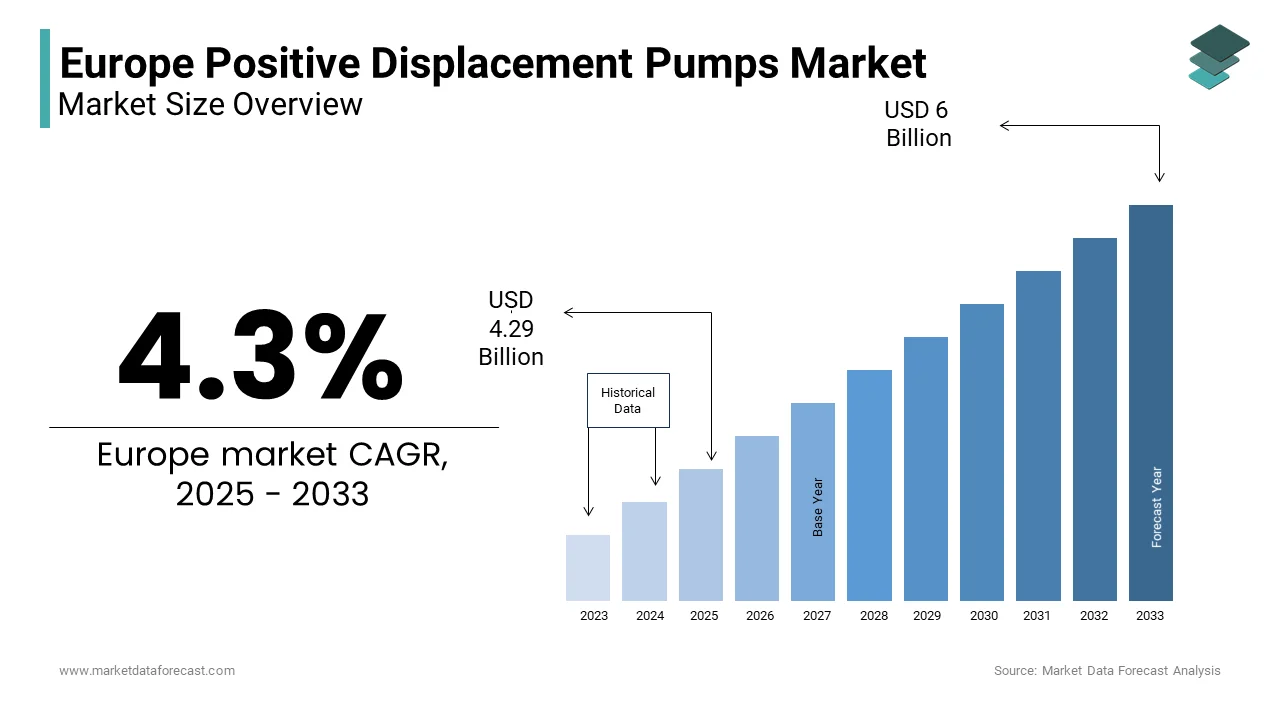

The Europe Positive Displacement Pumps Market Size was valued at USD 4.11 billion in 2024. The Europe Positive Displacement Pumps Market size is expected to have a 4.3 % CAGR from 2025 to 2033 and be worth USD 6 billion by 2033 from USD 4.29 billion in 2025.

The European positive displacement pumps market is driven by industrial demand and technological advancements. The market thrives due to the presence of key industries such as chemicals, food & beverage, and pharmaceuticals, which heavily rely on these pumps for precise fluid handling. Additionally, the growing emphasis on wastewater management has bolstered demand. Eurostat data reveals that over 80% of urban wastewater in Europe undergoes treatment by necessitating efficient pumping solutions.

MARKET DRIVERS

Rising Demand in the Food & Beverage Sector

The food & beverage industry is a significant driver of the positive displacement pumps market in Europe. These pumps are indispensable for processes like filling, dosing, and transferring viscous fluids such as syrups, oils, and creams. As per a study by the European Food Safety Authority, over 40% of processed foods require precise fluid handling is creating sustained demand for advanced pump systems. Furthermore, the increasing adoption of automation in food production facilities has amplified the need for reliable pumping solutions.

Stringent Environmental Regulations

Stringent environmental regulations in Europe have propelled the adoption of positive displacement pumps in wastewater management. This directive has spurred investments in advanced pumping technologies capable of handling sludge and other challenging materials. For example, Italy spent €2.5 billion on wastewater infrastructure upgrades in 2021, as reported by the Italian Ministry of Infrastructure. Similarly, France’s commitment to reducing water pollution has led to a 15% annual increase in demand for wastewater pumps, according to the French Water Partnership.

MARKET RESTRAINTS

High Initial Costs

One of the primary restraints in the European positive displacement pumps market is the high initial investment required for advanced models. This financial barrier is particularly evident in Eastern Europe, where industrial modernization is still underway. For instance, Romania’s industrial sector invests only 12% of its budget in advanced machinery, as per the Romanian Investment and Export Promotion Agency. Such constraints limit widespread adoption, especially among smaller players. Moreover, maintenance costs further compound the issue, with repair expenses also hindering the growth of the market.

Complex Maintenance Requirements

Another challenge is the intricate maintenance requirements associated with positive displacement pumps. The specialized training is often needed to operate and maintain these pumps, which increases operational complexity. According to the French National Institute for Industrial Skills, only 45% of plant operators in France are adequately trained to handle advanced pumping systems. This skills gap exacerbates the problem, particularly in countries with lower industrial maturity levels. As a result, businesses often hesitate to adopt these pumps is fearing prolonged downtimes and associated costs.

MARKET OPPORTUNITIES

Growth in Renewable Energy Applications

The renewable energy sector presents a significant opportunity for the positive displacement pumps market in Europe. According to the International Renewable Energy Agency (IRENA), renewable energy accounted for 41% of the EU’s electricity generation in 2022, with wind and solar leading the charge. These industries require specialized pumps for applications such as lubrication, cooling, and hydraulic fluid transfer in turbines and solar panel systems. Positive displacement pumps, particularly gear and screw types, are ideal for these high-pressure, precise operations. Moreover, the European Commission’s Green Deal aims to make Europe climate-neutral by 2050, driving further investments in renewables.

Expansion in Pharmaceutical Manufacturing

The pharmaceutical industry is another promising avenue for growth in the positive displacement pumps market. Europe is home to some of the world’s largest pharmaceutical hubs, with Germany and Switzerland leading innovation. The European Federation of Pharmaceutical Industries and Associations (EFPIA) reports that the EU pharmaceutical market was valued at €232 billion in 2022. Precision and hygiene are paramount in pharmaceutical manufacturing by making positive displacement pumps indispensable for processes like dosing, filling, and transferring sensitive fluids. Additionally, the rise of personalized medicine and biologics has created niche demands for highly accurate and contamination-free pumping systems. Manufacturers who can cater to these specific needs stand to benefit significantly from this expanding market segment.

MARKET CHALLENGES

Intense Competition and Price Wars

Intense competition among manufacturers poses a significant challenge to the European positive displacement pumps market. This saturation often leads to price wars by eroding profit margins for smaller players. For instance, in Italy, pump prices have dropped by an average of 15% over the past three years, as reported by the Italian Chamber of Commerce. Such pricing pressures force manufacturers to compromise on quality or invest heavily in marketing to differentiate their products. Furthermore, large multinational corporations dominate the market is leveraging economies of scale to undercut smaller competitors.

Supply Chain Disruptions

Supply chain disruptions remain a persistent challenge for the positive displacement pumps market in Europe. According to the European Logistics Association, supply chain bottlenecks cost the manufacturing sector approximately €100 billion in lost revenue in 2022. Key components such as seals, gaskets, and motors are often sourced globally is making the industry vulnerable to geopolitical tensions and trade restrictions. For example, Germany experienced a 20% delay in pump deliveries in 2022 due to semiconductor shortages, as per the German Mechanical Engineering Industry Association. Similarly, Brexit-induced customs delays have impacted the UK market, with lead times increasing by 30%, according to the British Pump Manufacturers’ Association. These disruptions not only hinder timely project completions but also escalate operational costs by creating challenges for manufacturers striving to meet customer demands efficiently.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.3 % |

|

Segments Covered |

By Type, End-User, and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Wilo SE , Sulzer Ltd. ,Alfa Laval AB , Grindex AB , KSB SE & Co. KGaA , SPT Pumpen |

SEGMENT ANALYSIS

By Type Insights

The diaphragm pumps segment was the largest by accounting for 29.1% of the Europe positive displacement pumps market share in 2024. Their versatility across industries such as chemicals, pharmaceuticals, and water treatment drives their dominance. According to the European Chemical Industry Council, the demand for corrosion-resistant pumps grew by 7% annually between 2020 and 2022. Additionally, the growing emphasis on safety and environmental compliance has bolstered adoption, as diaphragm pumps prevent leaks and spills.

The peristaltic pumps segment is expected to witness a CAGR of 9.5% from 2025 to 2033. Their growth is fueled by increasing demand in the pharmaceutical and biotechnology sectors, where sterile fluid transfer is essential. A surge in demand for contamination-free pumping solutions is additionally fuelling the growth of the market. According to the French National Institute for Industrial Skills, peristaltic pumps account for 35% of all fluid handling equipment used in biopharmaceutical production. Their ability to handle shear-sensitive fluids and maintain product integrity makes them ideal for these applications. Furthermore, technological advancements, such as improved tube materials and motor efficiency, are enhancing their appeal by driving rapid adoption across various end-user industries.

By End-User Insights

The chemicals industry was the largest end-user segment with 32.5% of the Europe positive displacement pump market share in 2024. The extensive use of positive displacement pumps in processes like chemical dosing, transfer, and mixing is gearing up the growth of the segment. The need for precise and reliable fluid handling in hazardous environments further amplifies demand. Additionally, the shift towards sustainable practices, such as green chemistry and waste reduction, has increased the adoption of energy-efficient pumps. According to Eurostat, over 60% of chemical plants in Europe upgraded their pumping systems in 2021 to comply with environmental regulations.

The pharmaceuticals sector is likely to experience a CAGR of 10.2% from 2025 to 2033. The rise of personalized medicine and biologics has created a surge in demand for precise and contamination-free pumping solutions. For example, Switzerland’s pharmaceutical exports grew by 15% in 2022, reflecting increased production activities that rely heavily on advanced pumping technologies. According to the French National Institute for Industrial Skills, pharmaceutical manufacturers in Europe have adopted positive displacement pumps for critical processes like dosing and filling. The segment’s growth is further propelled by stringent regulatory standards that mandate high levels of accuracy and hygiene.

COUNTRY LEVEL ANALYSIS

Germany led the European positive displacement pumps market by occupying 25.4% of the share in 2024, owing to its robust industrial base, particularly in chemicals and manufacturing. For instance, Germany’s chemical industry contributes huge investments annually to the economy is driving demand for advanced pumping solutions. The country’s focus on innovation and sustainability further strengthens its position with the presence of industrial facilities adopting energy-efficient pumps.

Spain is projected to register a CAGR of 8.7% with investments in renewable energy and wastewater management. The Spanish Ministry of Ecological Transition reports that renewable energy projects were initiated in 2022 by creating demand for specialized pumps.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Positive Displacement Pumps Market are Wilo SE , Sulzer Ltd. ,Alfa Laval AB , Grindex AB , KSB SE & Co. KGaA , SPT Pumpen , VANSAN Makina San. Tic. A.S., Flowserve Corporation, Xavitech Micropumps AB

The European positive displacement pumps market is highly competitive, characterized by the presence of both global leaders and regional players. Price competition is intense, particularly in commoditized product categories like gear pumps. However, differentiation through technological advancements, such as smart pumping solutions, provides a competitive edge. Regional players often focus on specific industries, such as food & beverage or pharmaceuticals by leveraging their expertise to build loyal customer bases. The market’s fragmented nature fosters innovation but also creates challenges for new entrants seeking to establish themselves amidst established giants.

Top Players In The Market

Grundfos

Grundfos, a Danish multinational, is one of the leading players in the European positive displacement pumps market. Its digital pump monitoring systems have gained significant traction, particularly in Germany and France, where smart industrial technologies are increasingly adopted. Grundfos’ commitment to sustainability aligns with the EU Green Deal, further solidifying its leadership position.

Sulzer Ltd

Switzerland-based Sulzer Ltd is another key player, renowned for its expertise in high-performance pumps. Sulzer’s acquisition of Nordic Water in 2021 expanded its wastewater treatment capabilities, catering to growing environmental regulations. Its focus on customization and service excellence has enabled it to maintain a competitive edge in the region.

Flowserve Corporation

Flowserve Corporation, a U.S.-based company with a significant European footprint. The company’s advanced diaphragm and piston pumps are widely used in critical applications, such as boiler feed systems and biopharmaceutical production. Flowserve’s strategic partnerships with European utilities and industrial giants have bolstered its market position by making it a trusted supplier across the continent.

Top Strategies Used By The Key Market Participants

Key players in the European positive displacement pumps market employ diverse strategies to strengthen their positions. Product innovation is a cornerstone, with companies like Grundfos investing heavily in IoT-enabled pumps that offer real-time monitoring and predictive maintenance. Strategic acquisitions also play a vital role; for instance, Sulzer’s acquisition of Nordic Water enhanced its wastewater portfolio. Partnerships with regional distributors ensure widespread market penetration, particularly in Eastern Europe. Additionally, sustainability initiatives, such as developing energy-efficient models, align with EU regulations and consumer preferences. These strategies collectively enable manufacturers to address evolving customer needs while maintaining competitive advantages.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Grundfos launched its iSOLUTIONS platform, integrating digital tools to optimize pump performance and reduce energy consumption. This initiative aims to enhance customer value through data-driven insights.

- In June 2023, Sulzer announced a €50 million investment in expanding its manufacturing facility in Poland, targeting increased production capacity for progressive cavity pumps.

- In August 2023, Flowserve Corporation partnered with a German renewable energy firm to develop specialized pumps for solar thermal power plants, aligning with Europe’s green energy goals.

- In October 2023, Verder Group acquired a Dutch peristaltic pump manufacturer to strengthen its pharmaceutical sector offerings by reflecting its focus on high-growth industries.

- In December 2023, Xylem Inc. introduced a new line of energy-efficient diaphragm pumps designed for wastewater treatment is addressing stringent EU environmental regulations.

MARKET SEGMENTATION

This research report on the europe positive displacement pumps market has been segmented and sub-segmented into the following categories.

By Type

- diaphragm pumps

- peristaltic pumps

By End-User

- chemicals industry

- pharmaceuticals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is the current size of the Europe Positive Displacement Pumps market?

The current market size of the Europe positive displacement pumps market was valued at USD 4.29 billion in 2025.

Which types of positive displacement pumps are most common in Europe?

The most widely used types include gear pumps, screw pumps, diaphragm pumps, lobe pumps, and piston/plunger pumps.

Which industries in Europe drive the demand for these pumps?

Key sectors include oil & gas, water & wastewater, food & beverage, chemical processing, pharmaceuticals, and power generation.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]