Europe Recreational Boating Market Size, Share, Trends & Growth Forecast Report By Product (Inboard boat, Outboard boat, Inflatables), By Engine (Diesel, Gas), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Recreational Boating Market Size

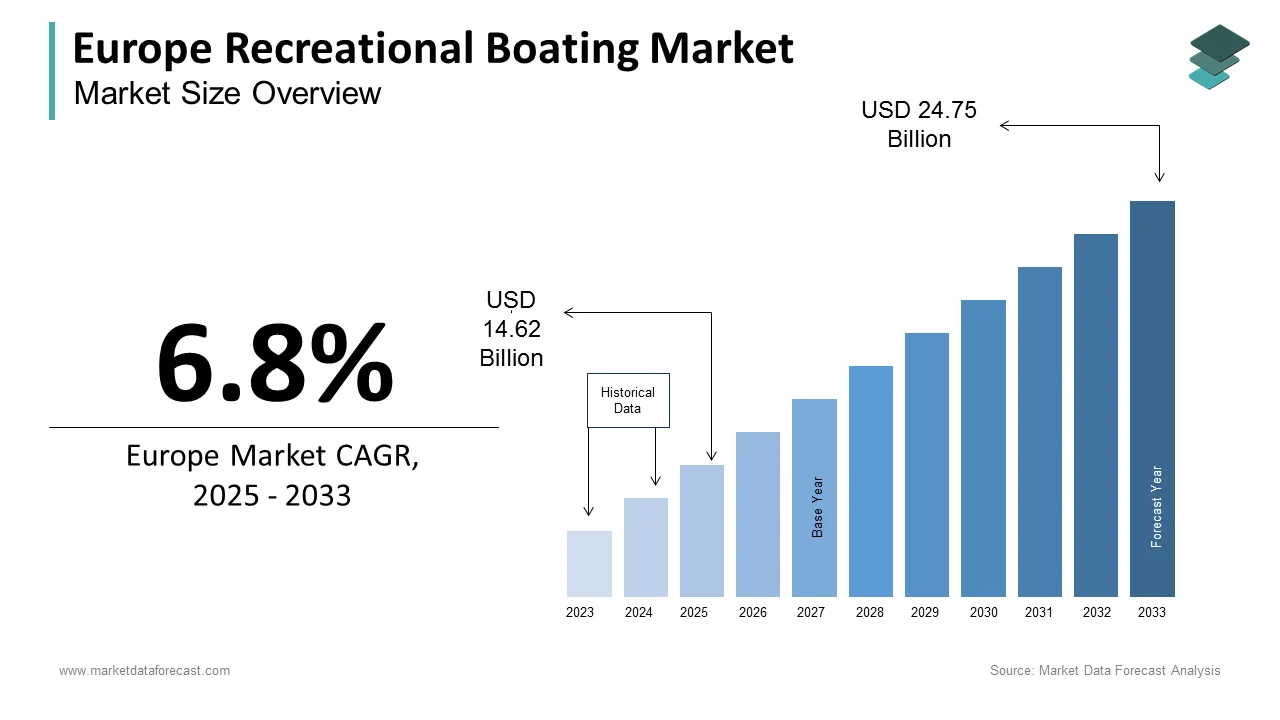

The recreational boating market size in Europe was valued at USD 14 billion in 2024. The European market is estimated to be worth USD 24.75 billion by 2033 from USD 14.62 billion in 2025, growing at a CAGR of 6.8% from 2025 to 2033.

Recreational boating is deeply intertwined with the rich maritime heritage, extensive coastline, and inland waterways of Europe, which collectively provide an ideal environment for boating enthusiasts. According to the European Boating Industry, the sector contributes significantly to the region’s economy, generating over €20 billion annually in revenue and supporting more than 32,000 businesses across the continent.

As of 2023, the recreational boating market in Europe is experiencing steady growth and is primarily driven by increasing disposable incomes, rising interest in outdoor activities, and advancements in boat design and technology. The United Nations World Tourism Organization highlights that coastal tourism, closely linked to boating, accounts for nearly 50% of all tourism revenue in Mediterranean countries, underscoring the sector’s economic importance. Furthermore, the growing trend of sustainable tourism has encouraged the adoption of eco-friendly boats powered by electric or hybrid engines, aligning with Europe’s green transition goals. France, Italy, and Germany are among the leading markets, with France alone boasting over 1.5 million registered recreational vessels, as reported by the French Nautical Industries Federation. Despite challenges such as fluctuating fuel prices and environmental regulations, the market remains resilient, reflecting its integral role in Europe’s leisure and lifestyle landscape.

MARKET DRIVERS

Rising Disposable Incomes and Leisure Spending

One of the primary drivers of the European recreational boating market is the increase in disposable incomes and leisure spending across the continent. According to Eurostat, the average household disposable income in the European Union rose by 3.5% annually between 2019 and 2022, enabling consumers to allocate more resources toward luxury activities like boating. The United Nations World Tourism Organization highlights that Europeans spend approximately 10% of their disposable income on leisure and tourism, with coastal activities accounting for a significant share. Countries like Italy and Spain, which boast extensive coastlines, have seen a surge in demand for recreational boating, with Italy reporting over 800,000 registered boats as of 2023. This financial flexibility allows individuals to invest in high-value products such as yachts and motorboats, while also boosting ancillary services like marinas and maintenance. As economic stability continues, this trend is expected to strengthen further.

Growing Interest in Sustainable and Eco-Friendly Boating

Another major driver is the growing emphasis on sustainability, which has spurred innovation and consumer interest in eco-friendly recreational boating solutions. The European Environment Agency notes that maritime tourism contributes significantly to carbon emissions, prompting stricter environmental regulations and encouraging the adoption of green technologies. France’s Nautical Industries Federation reports that sales of electric and hybrid boats increased by 25% in 2022, reflecting a shift toward sustainable practices. Governments are also incentivizing this transition; for instance, Germany’s Federal Ministry for Economic Affairs offers subsidies for eco-friendly boat purchases, driving adoption rates. Additionally, the European Boating Industry estimates that 60% of new boating enthusiasts prioritize environmentally conscious options. This focus on sustainability not only aligns with Europe’s broader climate goals but also attracts environmentally aware consumers, ensuring long-term market growth.

MARKET RESTRAINTS

Fluctuating Fuel Prices and Operating Costs

A significant restraint for the European recreational boating market is the volatility of fuel prices, which directly impacts the operating costs of motorboats and yachts. According to Eurostat, fuel prices in Europe surged by an average of 30% between 2021 and 2022 due to geopolitical tensions and supply chain disruptions. This increase has made boating less affordable for many enthusiasts, particularly those relying on motorized vessels. The United Kingdom’s Marine Management Organisation highlights that fuel expenses account for nearly 40% of the total annual cost of operating a recreational boat, deterring potential buyers and reducing usage among existing owners. Additionally, rising maintenance and docking fees further exacerbate the financial burden. For instance, marina costs in popular destinations like the French Riviera can exceed €5,000 annually, as reported by the French Nautical Industries Federation. These high costs pose a challenge to market accessibility, particularly for middle-income consumers.

Stringent Environmental Regulations and Compliance Costs

Stringent environmental regulations aimed at reducing the ecological impact of recreational boating also act as a restraint for the market. The European Environment Agency emphasizes that maritime activities contribute significantly to water pollution and carbon emissions, prompting governments to enforce stricter rules on boat manufacturing and operation. For example, Sweden’s Environmental Protection Agency mandates the use of non-toxic antifouling paints, increasing production costs for manufacturers. Similarly, Italy introduced a law requiring older boats to meet modern emission standards, which has led to a decline in the resale value of legacy vessels. Compliance with these regulations often necessitates costly upgrades or replacements, discouraging both manufacturers and consumers. The European Boating Industry estimates that regulatory compliance adds approximately 15-20% to the overall cost of new boats, limiting affordability and market expansion.

MARKET OPPORTUNITIES

Expansion of Boating Tourism and Coastal Infrastructure

A significant opportunity for the European recreational boating market lies in the expansion of boating tourism, supported by investments in coastal infrastructure. The United Nations World Tourism Organization highlights that maritime tourism accounts for nearly 25% of all tourism revenue in Mediterranean countries, with over 200 million tourists annually engaging in water-based activities. Governments are capitalizing on this trend by upgrading marinas and developing eco-friendly docking facilities. For instance, Spain’s Ministry of Tourism announced a €500 million investment in 2023 to enhance its coastal infrastructure, aiming to accommodate an additional 100,000 vessels. Furthermore, Croatia’s National Tourist Board reports a 15% annual growth in nautical tourism, driven by its 1,200 islands and modernized marinas. These developments not only attract international tourists but also encourage domestic participation, creating a lucrative avenue for market growth.

Adoption of Digital Platforms for Boat Rentals and Experiences

The growing adoption of digital platforms for boat rentals and shared boating experiences presents another key opportunity for the market. Eurostat reveals that over 70% of Europeans aged 16-74 use online services for travel and leisure bookings, reflecting a shift toward convenience and accessibility. Platforms like Click&Boat and Sailo have capitalized on this trend, with Click&Boat reporting a 40% increase in users in 2022 alone. France’s Nautical Industries Federation notes that peer-to-peer boat rental platforms have expanded the customer base by attracting younger demographics who may not own boats but seek occasional boating experiences. Additionally, Germany’s Federal Ministry for Economic Affairs highlights that digitalization has reduced operational costs for small businesses, enabling them to offer competitive pricing. This technological integration not only boosts market reach but also fosters innovation in service delivery.

MARKET CHALLENGES

Seasonal Limitations and Weather Dependency

A significant challenge for the European recreational boating market is its dependence on favorable weather conditions, which limits activity to specific seasons. The European Environment Agency highlights that nearly 60% of boating activities in Europe are concentrated between May and September, leaving a substantial portion of the year underutilized. For instance, countries like Sweden and Denmark experience harsh winters, where waterways freeze, reducing boating opportunities by up to 70%, as reported by Sweden’s Maritime Administration. This seasonality impacts revenue streams for marinas, rental services, and maintenance providers, forcing businesses to adopt cost-cutting measures during off-peak months. Additionally, unpredictable weather patterns linked to climate change, such as storms and heavy rainfall, further disrupt boating schedules. These factors create financial instability for stakeholders, making it challenging to sustain operations year-round.

Limited Accessibility for New Entrants and Younger Demographics

Another major challenge is the limited accessibility of recreational boating for new entrants, particularly younger demographics, due to high costs and lack of awareness. Eurostat reports that only 12% of Europeans aged 18-34 participate in boating activities, compared to 35% of those aged 55 and above. The United Kingdom’s Marine Management Organisation notes that the average cost of purchasing a small motorboat exceeds €20,000, while annual maintenance can reach €3,000, deterring potential buyers. Furthermore, France’s Nautical Industries Federation highlights that fewer than 20% of young adults are aware of affordable entry points, such as boat-sharing platforms or subsidized training programs. This lack of engagement among younger populations threatens long-term market growth, as the industry struggles to attract the next generation of enthusiasts without addressing affordability and awareness barriers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Engine, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Azimut-Benetti Group, Bombardier Recreational Product (BRP), Ferretti, Groupe Beneteau, Sunseeker, Malibu Boats, HanseYachts, BAVARIA YACHTS, Princess Yachts, Grand Banks Yachts, Fountaine Pajot, Sunreef Yachts, Sessa Marine, Lurssen, X-Yachts, Solaris Yachts, Salona Yachts, Greenline Yachts, Nautor Swan, Amel Yachts., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The 201 to 500 HP segment led the market by holding 40.2% of the Europe recreational boating market share in 2024. The versatility of 201 to 500 HP segment that cater to both leisure and professional users, and its suitability for inland waterways and coastal navigation are majorly contributing to the domination of the segment in the European market. The French Nautical Industries Federation reports that this segment appeals primarily to individuals aged 35-55, who prioritize performance and reliability. Advancements in fuel-efficient engine technology have further enhanced its appeal amid rising fuel costs. This segment's dominance underscores its importance in addressing diverse consumer needs while maintaining affordability and functionality.

The center console segment is anticipated to witness the highest CAGR of 15.6% over the forecast period. Their adaptability for fishing, leisure cruising, and water sports drives their popularity, particularly in coastal regions like Spain and Greece. The United Nations World Tourism Organization highlights that demand for center consoles with 201-500 HP engines has surged due to their balance of power, stability, and fuel efficiency. Additionally, their lightweight design and lower maintenance costs attract younger demographics, expanding market reach. This rapid growth reflects the segment's role in diversifying recreational boating activities and fostering inclusivity among new enthusiasts.

By Engine Insights

The diesel engines segment dominated the market by accounting for 60.7% of the European market share in 2024. The domination of diesel engines segment is attributed to superior fuel efficiency and durability, making them ideal for long-distance cruising and larger vessels like yachts. Germany’s Federal Ministry for Economic Affairs highlights that over 70% of inboard boats in coastal nations such as Italy and Spain use diesel engines due to their high torque and reliability in challenging conditions. Despite higher upfront costs, diesel engines offer lower operational expenses, appealing to both leisure and professional users. Their dominance underscores their critical role in supporting Europe’s maritime tourism industry and ensuring sustainable, long-term performance for high-demand applications.

The gas engines segment is a promising segment and is estimated to grow at a CAGR of 12.9% over the forecast period due to their affordability and suitability for smaller vessels like outboard boats and inflatables, which cater to casual users. The United Kingdom’s Marine Management Organisation reports that gas engines account for nearly 80% of sales in the below 200 HP category, driven by demand for lightweight, low-maintenance options. Advances in emission-reducing technologies have also aligned gas engines with Europe’s environmental goals, boosting adoption. Their accessibility attracts younger demographics and first-time buyers, fostering inclusivity. This growth highlights gas engines' importance in expanding recreational boating participation and diversifying market reach across inland waterways and coastal regions.

REGIONAL ANALYSIS

Italy held the dominating position in the European recreational boating market by holding a 25.4% of the European market share in 2024 due to the Italy’s extensive coastline, which spans over 7,600 kilometers, and its rich maritime heritage, fostering a deep-rooted boating culture. The Italian Nautical Industries Federation reports that the country is home to over 800,000 registered boats, supported by world-class manufacturing hubs in regions like Liguria and Tuscany. Additionally, Italy’s focus on luxury yachts and high-performance vessels attracts affluent international buyers, boosting exports. The government’s investments in marina infrastructure and tourism further solidify its position. With initiatives promoting eco-friendly boating, Italy continues to set benchmarks for innovation and sustainability in the industry.

France is another major market for recreational boating in Europe and is estimated to exhibit a CAGR of 7.8% during the forecast period. The Mediterranean and Atlantic coasts of France that offer diverse boating opportunities is one of the major factors boosting the French market growth. France boasts over 1,200 marinas and 1.5 million registered recreational vessels, as reported by the French Ministry of Ecological Transition. The country’s strong emphasis on nautical tourism, which contributes significantly to its economy, drives demand. Furthermore, France’s commitment to sustainability is evident in its adoption of electric and hybrid boats, supported by government subsidies. These factors, combined with robust domestic participation and a thriving rental market, ensure France remains a key player in the European recreational boating landscape.

Spain is likely to account for a substantial share of the European market during the forecast period due to the booming coastal tourism industry of Spain that attracts over 80 million international visitors annually, many of whom engage in water-based activities. The Spanish Nautical Association highlights that Spain has over 400 marinas, catering to both domestic and international boaters. Regions like Catalonia and Andalusia are particularly popular due to their modern facilities and scenic coastlines. Additionally, government initiatives to upgrade maritime infrastructure, including a €500 million investment in 2023, have enhanced accessibility and usability. Spain’s combination of natural advantages, tourism appeal, and policy support positions it as a dynamic and rapidly growing market within Europe.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe recreational boating market profiled in this report are Azimut-Benetti Group, Bombardier Recreational Product (BRP), Ferretti, Groupe Beneteau, Sunseeker, Malibu Boats, HanseYachts, BAVARIA YACHTS, Princess Yachts, Grand Banks Yachts, Fountaine Pajot, Sunreef Yachts, Sessa Marine, Lurssen, X-Yachts, Solaris Yachts, Salona Yachts, Greenline Yachts, Nautor Swan, Amel Yachts., and Others.

MARKET SEGMENTATION

This Europe recreational boating market research report is segmented and sub-segmented into the following categories.

By Product

Inboard boat

-

- Below 200 hp

- 201 to 500 hp

- 501 to 1000 hp

- Above 1000 hp

- Outboard boat

- By type

- Center console

- Express cruiser

- Pontoon

- Runabout bowrider

- Others

- By horsepower

- Below 200 hp

- 201 hp to 500 hp

- 501 hp to 1000 hp

- Above 1000 hp

- By type

- Inflatables

- By horsepower

- Below 200 hp

- 201 hp to 500 hp

- By horsepower

By Engine

- Diesel

- Gas

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth of the Europe recreational boating market?

The Europe recreational boating market is expected to grow from USD 14.62 billion in 2025 to USD 24.75 billion by 2033, at a CAGR of 6.8%.

2. What factors are driving market growth?

Increasing disposable income, rising interest in outdoor activities, and eco-friendly boating trends.

3. What challenges does the industry face?

Fluctuating fuel prices, high operational costs, and strict environmental regulations.

4. How is sustainability shaping the market?

Growing demand for electric and hybrid boats is driving eco-friendly innovations.

5. What are key opportunities in this sector?

Expansion of boating tourism, digital rental platforms, and improved coastal infrastructure.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com