Europe Refrigerated Transport Market Size, Share, Trends & Growth Forecast Report By Mode of Transportation(Refrigerated Road Transport, Refrigerated Sea Transport, Refrigerated Rail Transport, Refrigerated Air Transport), Technology, Temperature, Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Refrigerated Transport Market Size

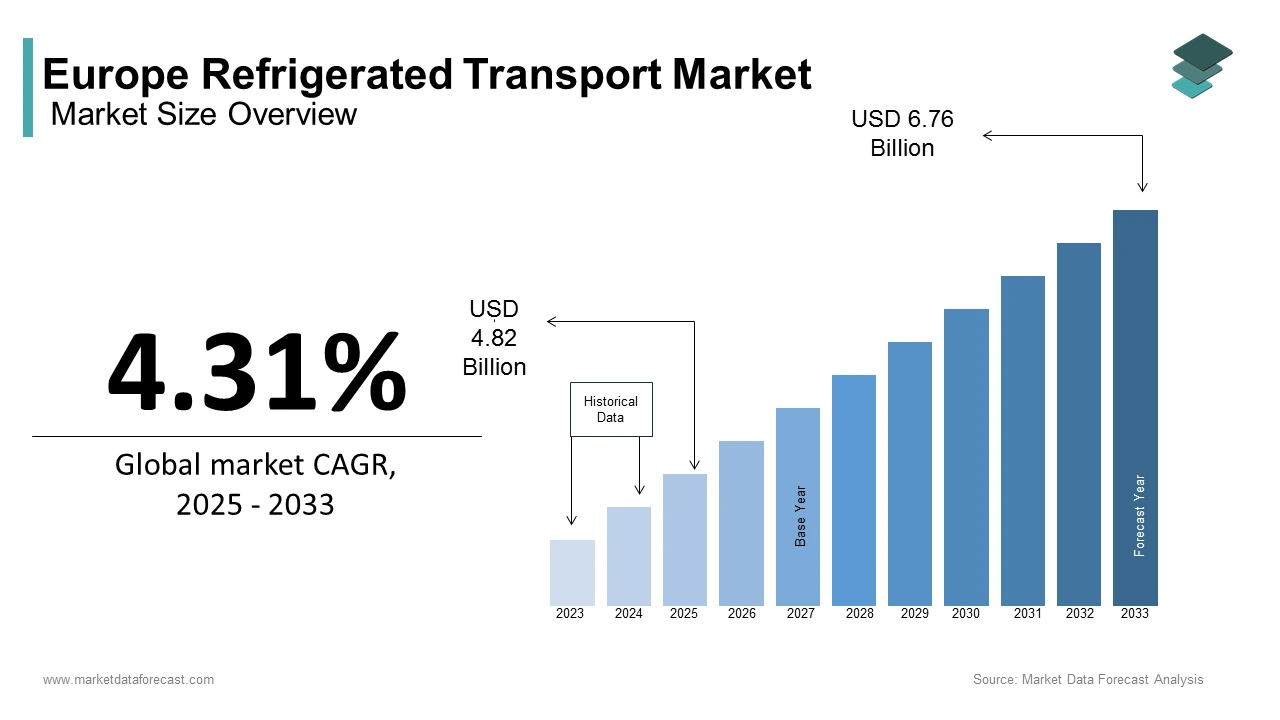

The Europe refrigerated transport market size was calculated to be USD 4.62 billion in 2024 and is anticipated to be worth USD 6.76 billion by 2033 from USD 4.82 billion in 2025, growing at a CAGR of 4.31% during the forecast period.

Refrigerated transport is the movement of perishable goods such as food products, pharmaceuticals, and chemicals across various industries to ensure their integrity and quality during transit. Refrigerated transport, often referred to as "cold chain logistics," leverages specialized vehicles equipped with advanced cooling systems to maintain precise temperature conditions throughout the supply chain. As consumer preferences shift towards fresh and high-quality products, coupled with stringent regulations governing food safety and pharmaceutical efficacy, the importance of this market has surged significantly.

Over the forecast period, the European refrigerated transport is predicted to have substantial growth owing to the rise in international trade, increasing urbanization, and heightened awareness about food wastage reduction. Additionally, the emphasis of the European Union on sustainability has prompted investments in eco-friendly refrigeration technologies, which is further boosting the regional market expansion. As per a study published by Eurostat, nearly 30% of all food produced in Europe requires cold chain logistics, underscoring its pivotal role in the economy. Furthermore, the pharmaceutical sector’s reliance on temperature-sensitive drug distribution, particularly amid global health crises, has amplified demand for reliable refrigerated transport services.

MARKET DRIVERS

Increasing Demand for Perishable Food Products in Europe

The rising demand for perishable food products due to the urbanization and evolving consumer preferences is majorly driving the growth of the European refrigerated transport market. As urban populations expand, there is a growing need for fresh produce, dairy, and meat, which require temperature-controlled logistics to ensure quality and safety. Eurostat reports that over 40% of Europe's population resides in urban areas, driving increased supermarket and e-commerce sales of perishable goods. According to the European Food Safety Authority (EFSA), approximately 20% of all food transported across the continent relies on refrigerated logistics to prevent spoilage. This trend is further amplified by the rise in cross-border trade within the EU, with countries like Germany and France leading in exports of perishable goods. Such dynamics have necessitated robust cold chain infrastructure, propelling investments in refrigerated transport solutions.

Growing Pharmaceutical Industry and Temperature-Sensitive Logistics

The expanding pharmaceutical industry, particularly the transportation of temperature-sensitive vaccines and biologics is another major factor fuelling the regional market expansion. The European Medicines Agency (EMA) emphasizes that nearly 70% of medical products require controlled environments during transit, with vaccines alone accounting for a substantial share. The World Health Organization (WHO) reported that over 1 billion vaccine doses were distributed across Europe in 2021, all necessitating precise cold chain management. Additionally, the European Federation of Pharmaceutical Industries and Associations (EFPIA) states that the pharmaceutical sector contributes over €85 billion annually to the EU economy, creating a strong impetus for advanced refrigerated transport systems. This demand has been further underscored by global health crises, ensuring sustained growth in the need for specialized logistics tailored to pharmaceutical requirements.

MARKET RESTRAINTS

High Operational Costs and Infrastructure Challenges

High operational costs associated with maintaining and upgrading cold chain infrastructure is a primarily restraint to the European refrigerated transport market growth. Refrigerated vehicles and equipment require significant capital investment, coupled with ongoing expenses for fuel, maintenance, and compliance with environmental regulations. According to the European Environment Agency (EEA), the cost of operating a refrigerated truck is approximately 30% higher than that of a standard freight vehicle due to energy-intensive cooling systems. Additionally, Eurostat highlights that nearly 40% of small and medium-sized enterprises (SMEs) in the logistics sector struggle to afford advanced refrigeration technologies. These financial barriers are further compounded by regional disparities in infrastructure quality, particularly in Eastern Europe, where the European Investment Bank (EIB) notes a lack of adequate cold storage facilities. Such challenges hinder the scalability and efficiency of refrigerated transport operations.

Stringent Environmental Regulations and Carbon Emission Concerns

The rising pressure from stringent environmental regulations aimed at reducing carbon emissions from refrigerated transport is another significant restraint to the European market growth. The European Commission’s Green Deal mandates a 55% reduction in greenhouse gas emissions by 2030, compelling logistics providers to adopt cleaner technologies. However, the International Energy Agency (IEA) reports that refrigerated transport currently accounts for 2% of the EU’s total road transport emissions, posing a significant challenge for compliance. Moreover, the European Automobile Manufacturers' Association (ACEA) states that transitioning to low-emission refrigeration systems requires an estimated investment of €15 billion across the industry. Many operators face difficulties in balancing regulatory demands with profitability, as retrofitting existing fleets or purchasing new eco-friendly vehicles remains costly. This regulatory landscape creates a barrier to market expansion despite growing demand.

MARKET OPPORTUNITIES

Adoption of Advanced Technologies and Digitalization

The adoption of advanced technologies and digitalization to enhance operational efficiency is a notable opportunity to the European market. The European Commission’s Digital Transport and Logistics Forum highlights that integrating IoT sensors, GPS tracking, and real-time monitoring systems can reduce cold chain disruptions by up to 25%. According to Eurostat, nearly 60% of logistics companies are investing in digital solutions to improve transparency and compliance with temperature-sensitive shipments. Additionally, the European Investment Bank (EIB) estimates that smart logistics technologies could save the industry approximately €10 billion annually by optimizing routes and reducing fuel consumption. These innovations not only address inefficiencies but also align with sustainability goals, enabling operators to meet regulatory standards while improving service quality. This technological shift presents a lucrative avenue for growth in the refrigerated transport sector.

Expansion of E-Commerce and Cross-Border Trade

The rapid expansion of e-commerce and cross-border trade is another major opportunity for the Europe refrigerated transport market. The European Union’s Directorate-General for Trade reports that intra-EU trade in perishable goods has grown by 15% annually over the past five years, driven by consumer demand for fresh products. Furthermore, Statista forecasts that the e-commerce food delivery segment in Europe will reach €30 billion by 2025, necessitating robust cold chain logistics. The European Food Safety Authority (EFSA) notes that online grocery sales account for 10% of total food retail, with this figure expected to double by 2030. As businesses strive to meet the growing demand for home-delivered perishables, there is a pressing need for scalable and reliable refrigerated transport solutions. This trend positions the market to capitalize on the booming e-commerce ecosystem and international trade dynamics.

MARKET CHALLENGES

Rising Fuel Costs and Energy Dependency

The growing cost of fuel and energy dependency that significantly impacts operational expenses is one of the biggest challenges to the European refrigerated transport market. The European Commission’s Directorate-General for Energy reports that fuel costs account for approximately 30% of total logistics expenses, with refrigerated transport being particularly energy-intensive due to cooling systems. According to Eurostat, diesel prices in Europe increased by over 25% in 2022, further straining the industry. Additionally, the International Energy Agency (IEA) highlights that refrigerated vehicles consume nearly 20% more fuel than standard freight vehicles, exacerbating cost pressures. This challenge is compounded by fluctuating energy prices and geopolitical uncertainties, which create instability for logistics providers. As a result, companies face difficulties in maintaining profitability while meeting the growing demand for temperature-controlled transportation services.

Workforce Shortages and Skill Gaps in the Logistics Sector

The persistent workforce shortages and skill gaps within the logistics sector that hinder the efficient operation of refrigerated transport networks is another major challenge to the European market. The European Transport Workers’ Federation (ETF) estimates that the logistics industry faces a shortfall of over 400,000 qualified drivers across Europe, with refrigerated transport being particularly affected due to its specialized requirements. Eurostat data reveals that the average age of truck drivers in Europe is 47, indicating an aging workforce with limited new entrants. Furthermore, the European Centre for the Development of Vocational Training (Cedefop) notes that only 15% of logistics workers receive formal training in advanced cold chain management practices. This lack of skilled personnel creates bottlenecks in service delivery and increases operational risks, making it a critical challenge for the industry to address.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.31% |

|

Segments Covered |

By Mode of Transportation, Technology, Temperature, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

STEF, Schmitz Cargobull, NewCold, Lineage Logistics, Magnavale, Kuehne+Nagel, Nagel-Group, GEODIS, DB Schenker, AGRO Merchants Group, Baltic Logistic Solutions, Beno-Trans, Blue Water Shipping, Deutsche Post AG, FRIGO Coldstore Logistics, Gartner KG, Kloosterboer, Magnum Logistics OU, MSC Mediterranean Shipping Company, Noatum Logistics, Nordfrost, PLG Logistics and Warehousing, PostNL. |

SEGMENTAL ANALYSIS

By Mode of Transportation Insights

The refrigerated road transport segment dominated the market in Europe by accounting for 70.8% of the Europe refrigerated transport market share in 2024. The dominance of the refrigerated road transport segment is driven by their flexibility, cost-effectiveness, and door-to-door delivery capabilities. The European Automobile Manufacturers' Association (ACEA) reports that there are approximately 500,000 refrigerated trucks in operation, serving critical industries like food and pharmaceuticals. This mode is vital for intra-EU trade, with the European Commission stating that road freight accounts for 75% of all goods transported within the region.

The refrigerated rail transport is expected to exhibit a CAGR of 6.8% over the forecast period due to the EU Green Deal that promotes sustainable logistics, as rail emits 70% less CO2 than road transport. According to the International Union of Railways (UIC), investments in TEN-T corridors are expanding rail’s capacity for temperature-controlled shipments. Although it holds only 10% of the market, its eco-friendly nature and cost efficiency for long-distance hauls make it increasingly attractive. The European Environment Agency (EEA) emphasizes rail’s role in reducing emissions, positioning it as a key solution for sustainable cold chain logistics.

By Technology Insights

The vapor compression systems segment held 65.1% of the European market share in 2024. The domination of the vapor compression systems segment in the European market is driven by their widespread adoption is due to their ability to provide precise temperature control and scalability for diverse applications, from food to pharmaceuticals. The International Institute of Refrigeration (IIR) states that these systems cool approximately 80% of all perishable goods transported in Europe. Despite being energy-intensive, advancements in eco-friendly refrigerants have improved sustainability. The European Environment Agency (EEA) highlights their cost-effectiveness and reliability, making them indispensable for large-scale operations.

The cryogenic systems segment is expected to progress at a notable CAGR of 7.2% over the forecast period. The rising demand for ultra-low temperature solutions, particularly in the pharmaceutical and biologics sectors is propelling the growth of the cryogenic systems segment in the European market. The World Health Organization (WHO) emphasizes their role in maintaining vaccine cold chains, especially during global health crises. Cryogenic systems produce zero direct emissions, aligning with the EU Green Deal’s decarbonization goals. Although they currently account for 10% of the market, their adoption is accelerating due to rising investments in advanced medical supply chains. The European Environment Agency (EEA) notes their potential to revolutionize sustainable cold chain logistics for high-value goods.

By Temperature Insights

The single-temperature systems segment led the market by holding 60.9% of the European market share in 2024. The domination of the single-temperature systems segment is attributed to their simplicity, reliability, and cost-effectiveness, particularly for transporting homogeneous goods like frozen foods and pharmaceuticals. The European Food Safety Authority (EFSA) highlights that these systems are essential for long-haul transportation, where maintaining consistent cooling is critical to prevent spoilage. According to the European Cold Chain Association (ECCA), single-temperature systems reduce operational complexity and maintenance costs, making them ideal for large-scale operations. With over 70% of frozen goods in Europe transported using these systems, they play a pivotal role in ensuring compliance with food safety regulations while minimizing logistical inefficiencies.

The multi-temperature systems segment is anticipated to record a CAGR of 5.8% over the forecast period owing to the rise of e-commerce and urban logistics, where mixed-load deliveries are increasingly common. Eurostat reports that multi-temperature systems optimize space utilization, enabling simultaneous transport of fresh produce, frozen items, and beverages. The European Environment Agency (EEA) emphasizes their role in reducing food waste and carbon emissions by consolidating shipments. As urbanization accelerates, their flexibility and alignment with sustainability goals make them indispensable for modern cold chain logistics, particularly in densely populated areas requiring efficient last-mile delivery solutions.

By Application Insights

The fresh fruits and vegetables segment held 36.1% of the European market share in 2024. The leading position of fresh fruits and vegetables segment in the European market is due to the growing consumer demand for fresh, healthy, and minimally processed foods. The European Food Safety Authority (EFSA) emphasizes that maintaining temperatures between 0°C to 4°C is critical to preserving their quality and safety. With over 20% of food waste in Europe attributed to improper storage and transport, as per the European Commission, efficient cold chain logistics are vital to reducing losses. This segment's importance lies in supporting sustainable food systems and ensuring a steady supply of nutritious produce across urban and rural areas.

The fish and seafood products segment is anticipated to showcase the fastest CAGR of 6.2% over the forecast period owing to the rising consumption of seafood, particularly in Mediterranean and coastal regions, and increased imports from global markets. The European Environment Agency (EEA) highlights that frozen fish and seafood require strict temperature control (below -18°C) to preserve freshness and nutritional value. The expansion of aquaculture and sustainable fishing practices has further boosted supply. As consumers shift towards healthier protein sources, the demand for frozen fish and seafood is surging, making this segment a key driver of growth in the refrigerated transport market.

REGIONAL ANALYSIS

Germany held the leading position in the Europe refrigerated transport market by accounting for 25.9% of the European market share in 2024. The dominating position of Germany in the European market is majorly due to its robust logistics infrastructure, advanced cold chain technologies, and strategic location at the heart of Europe, facilitating cross-border trade. The Federal Ministry for Economic Affairs and Climate Action highlights that Germany accounts for over 30% of all perishable goods transported within the EU, supported by its extensive network of highways and ports. Additionally, the country’s strong manufacturing base, particularly in pharmaceuticals and food processing, amplifies demand for temperature-controlled logistics. According to the German Logistics Association (DSLV), investments in eco-friendly refrigeration systems align with national sustainability goals, further solidifying its leadership position in the region.

France is another top performer in the European refrigerated transport market. The growth of the French market is attributed to its status as Europe’s largest agricultural producer, supplying fresh fruits, vegetables, and dairy products across the continent. The French Food Safety Agency (ANSES) emphasizes that stringent food safety regulations necessitate reliable cold chain solutions. Furthermore, France’s well-developed rail and road networks enhance its refrigerated transport capabilities. The European Investment Bank (EIB) notes that France’s focus on sustainable logistics, including electric refrigerated vehicles, positions it as a key innovator in the sector, driving both domestic and international demand.

Italy is likely to account for a prominent share of the European market over the forecast period owing to its thriving food and beverage industry, renowned for exporting high-value perishables like cheese, wine, and seafood. The Italian Ministry of Agriculture highlights that over 40% of Italy’s food exports require refrigerated transport, underscoring the sector’s importance. Additionally, Italy’s Mediterranean location serves as a gateway for global trade, boosting demand for efficient cold chain logistics. The European Cold Chain Association (ECCA) states that Italy’s adoption of advanced cooling technologies ensures compliance with EU standards while maintaining product quality, reinforcing its competitive edge in the European market.

KEY MARKET PLAYERS

Major players of the Europe Refrigerated Transport Market include STEF, Schmitz Cargobull, NewCold, Lineage Logistics, Magnavale, Kuehne+Nagel, Nagel-Group, GEODIS, DB Schenker, AGRO Merchants Group, Baltic Logistic Solutions, Beno-Trans, Blue Water Shipping, Deutsche Post AG, FRIGO Coldstore Logistics, Gartner KG, Kloosterboer, Magnum Logistics OU, MSC Mediterranean Shipping Company, Noatum Logistics, Nordfrost, PLG Logistics and Warehousing, PostNL.

DETAILED SEGMENTATION OF EUROPE Refrigerated Transport MARKET INCLUDED IN THIS REPORT

This research report on the Europe refrigerated transport market has been segmented and sub-segmented based on mode of transportation, technology, temperature, application, & region.

By Mode of Transportation

- Refrigerated Road Transport

- Refrigerated Sea Transport

- Refrigerated Rail Transport

- Refrigerated Air Transport

By Technology

- Vapor Compression Systems

- Air-Blown Evaporators

- Eutectic Devices

- Cryogenic Systems

By Temperature

- Single-Temperature

- Multi-Temperature

By Application

- Chilled Food Products

- Dairy Products

- Bakery and Confectionery Products

- Fresh Fruits and Vegetables

- Others

- Frozen Food Products

- Frozen Dairy Products

- Processed Meat Products

- Fish and Seafood Products

- Others

- Others

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key drivers of the Europe refrigerated transport market?

The key drivers include increasing demand for perishable food products, growth in pharmaceutical transportation, rising e-commerce, and technological advancements in refrigeration systems.

2. Which industries rely the most on refrigerated transport in Europe?

The food & beverage, pharmaceutical, and chemical industries are the primary users of refrigerated transport.

3. How are technological advancements improving refrigerated transport efficiency?

Innovations like IoT sensors, GPS tracking, real-time monitoring, and AI-powered route optimization are helping improve efficiency, reduce fuel consumption, and enhance compliance with temperature-sensitive logistics.

4. Who are the major players in the Europe refrigerated transport market?

Leading companies include STEF, Schmitz Cargobull, NewCold, Lineage Logistics, Kuehne+Nagel, Nagel-Group, GEODIS, DB Schenker, and Deutsche Post AG, among others.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com