Europe Remodeling Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By End-User, Distribution Channel, Project Type, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Remodeling Market Size

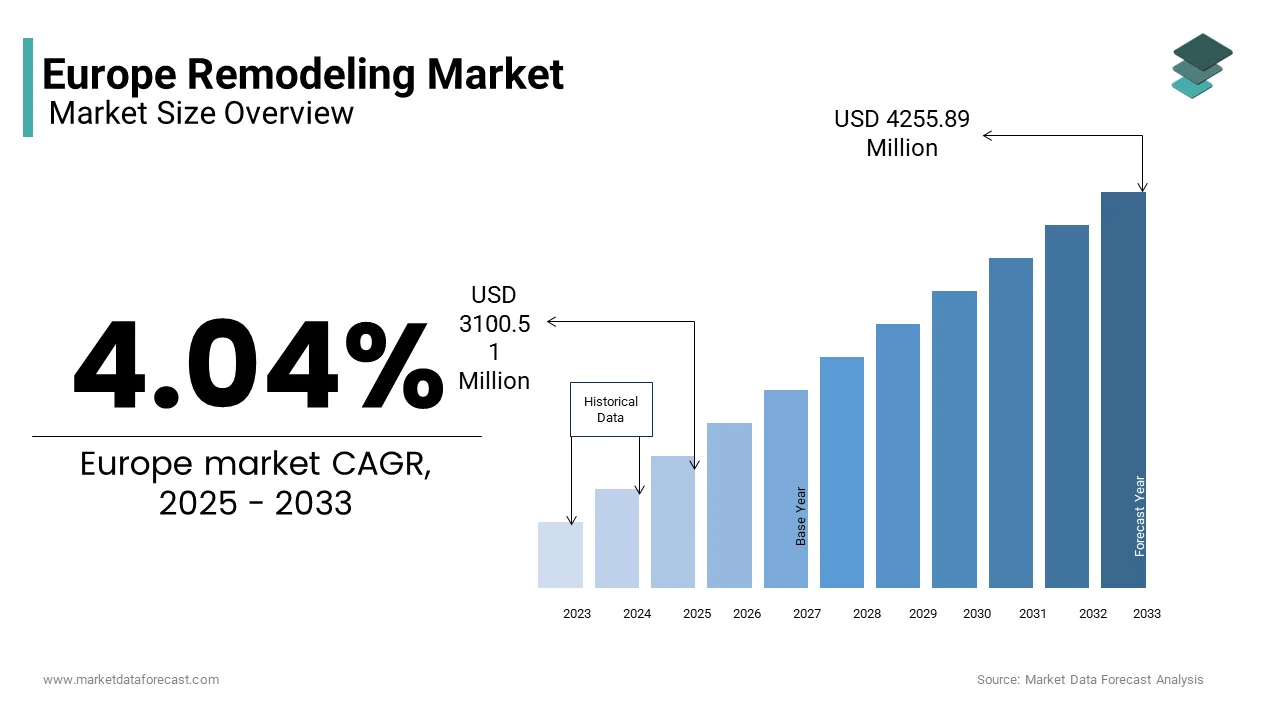

The Europe remodeling market was valued at USD 2980.03 million in 2024 and is anticipated to reach USD 3100.51 million in 2025 from USD 4255.89 million by 2033, growing at a CAGR of 4.04% during the forecast period from 2025 to 2033.

The Europe remodeling market includes a broad range of renovation and retrofitting activities aimed at upgrading residential, commercial, and institutional buildings. This includes interior and exterior modifications, energy efficiency improvements, aesthetic enhancements, and structural upgrades. A key trend shaping the European remodeling landscape is the growing emphasis on energy-efficient renovations. As part of the European Green Deal, the Renovation Wave Strategy targets doubling the annual renovation rate by 2030, with a focus on improving insulation, heating systems, and overall building performance. In addition, the European Environment Agency reports that buildings account for approximately 40% of total energy consumption in Europe, reinforcing the urgency of large-scale retrofitting efforts. Moreover, changing lifestyles and increased remote working have heightened demand for home office conversions, smart home integrations, and outdoor living space development. Countries like Germany, France, and Sweden are leading the way in adopting digital tools such as Building Information Modeling (BIM) and modular construction techniques to streamline remodeling projects.

MARKET DRIVERS

Government Incentives and Energy Efficiency Policies

One of the primary drivers of the Europe remodeling market is the increasing availability of government incentives and energy efficiency policies aimed at encouraging homeowners and businesses to undertake renovation projects. Across the continent, national governments and the European Union have introduced financial support mechanisms such as tax credits, subsidies, and low-interest loans to promote energy-saving upgrades. According to the European Commission, the Renovation Wave Strategy aims to double the annual building renovation rate by 2030, with an estimated €275 billion in funding allocated through the Recovery and Resilience Facility to support this initiative. In Germany, the Federal Office of Economics and Export Control (BAFA) reported that more than 200,000 homeowners applied for energy-efficient renovation grants in 2023 alone, covering measures such as insulation, window replacement, and heat pump installations. Similarly, France’s "MaPrimeRénov'" scheme saw over 800,000 applications in the same year, reflecting strong public engagement in home improvement projects aligned with national carbon reduction goals. These programs not only reduce the financial burden on property owners but also stimulate demand across the construction supply chain, from architects and contractors to material suppliers.

Changing Lifestyles and Remote Work Trends

Another significant driver of the Europe remodeling market is the shift in lifestyle preferences and the rise of remote work, which has led to increased demand for home upgrades. This behavioral change has significantly influenced consumer spending patterns, with homeowners investing in spaces that enhance productivity, comfort, and overall well-being. Similarly, in Spain, real estate agencies reported higher property valuations for homes featuring renovated kitchens, upgraded bathrooms, and dedicated workspace areas. As hybrid work models become more entrenched and personal well-being gains priority, the demand for tailored, high-quality remodeling solutions continues to grow across the region.

MARKET RESTRAINTS

Rising Material and Labor Costs

A major restraint affecting the Europe remodeling market is the persistent rise in material and labor costs, which has made renovation projects more expensive and less accessible for many homeowners and small businesses. This has directly impacted project budgets and timelines, often forcing consumers to delay or scale down planned renovations. Labor shortages have further exacerbated the issue, particularly in countries like Italy and Poland, where skilled tradespeople are in short supply. The German Chamber of Skilled Crafts (ZDH) reported that a major share of craft businesses faced recruitment difficulties in 2023, contributing to longer wait times and higher contractor fees. In addition, rising fuel and transportation costs have added to overhead expenses, making logistics another pressure point for remodeling firms. As a result, many potential clients are opting for smaller-scale updates rather than comprehensive renovations, limiting the market's growth potential despite underlying demand for improved living and working environments.

Complex Regulatory Frameworks and Permitting Delays

Another critical constraint on the Europe remodeling market is the complexity of regulatory frameworks and prolonged permitting processes that vary significantly across countries and even within regions. Each EU member state enforces distinct building codes, zoning laws, and energy performance requirements, creating administrative hurdles for both homeowners and contractors. According to the European Committee for Standardization (CEN), while harmonized norms exist under the Energy Performance of Buildings Directive (EPBD), national implementation varies widely, complicating compliance for cross-border remodeling companies. Similarly, in Italy, ANCE (National Association of Construction Companies) reported that bureaucratic inefficiencies notably delayed small-scale remodeling jobs beyond expected completion dates. These challenges are compounded by evolving fire safety regulations, particularly in multi-family housing units, requiring costly retrofits.

MARKET OPPORTUNITY

Expansion of Sustainable and Eco-Friendly Remodeling Practices

A compelling opportunity emerging in the Europe remodeling market is the rapid adoption of sustainable and eco-friendly renovation practices. Governments, consumers, and industry stakeholders are increasingly prioritizing environmentally responsible materials, energy-efficient systems, and circular economy principles in home and commercial building upgrades. According to the European Environment Agency, the building sector accounts for a considerable portion of the EU’s final energy use, making green remodeling a crucial component of regional decarbonization strategies. Several countries have launched initiatives to encourage sustainable renovations. Meanwhile, Austria’s Climate and Energy Fund has incentivized thousands of homeowners to adopt passive house retrofitting techniques, including triple-glazed windows and thermal bridging insulation. The Netherlands has also mandated that all publicly funded renovation projects adhere to circular economy principles, promoting the reuse and recyclability of materials.

Digital Transformation and Smart Home Integration

Another transformative opportunity for the Europe remodeling market lies in the integration of digital technologies and smart home systems into renovation projects. Consumers are increasingly seeking connected living environments that offer enhanced security, energy efficiency, and convenience, driving demand for intelligent lighting, climate control, and automated shading systems during remodeling. Germany leads in smart home integration, with a significant increase in smart thermostat and sensor installations in remodeled properties. In the UK, major DIY retailers documented a major rise in sales of smart plugs, motion-controlled lighting, and voice-activated heating controls during the same period. Additionally, Norway has mandated that all new residential renovations include provisions for smart metering and energy management systems, ensuring long-term compatibility with grid optimization initiatives.

MARKET CHALLENGES

Supply Chain Disruptions Affecting Material Availability

A pressing challenge confronting the Europe remodeling market is the ongoing impact of supply chain disruptions on material availability and procurement timelines. Since 2021, global trade bottlenecks, geopolitical tensions, and production slowdowns have led to extended lead times and inconsistent product availability, particularly for lumber, plumbing fixtures, electrical components, and engineered flooring. This volatility has affected both professional contractors and DIY enthusiasts, with many facing order backlogs and price fluctuations that complicate budget planning and project execution.

Financing Constraints and Affordability Issues

Another significant challenge for the Europe remodeling market is the tightening financial environment and affordability concerns among homeowners. Despite available government incentives, many individuals face barriers in securing financing for substantial renovation projects due to rising interest rates, stricter lending criteria, and economic uncertainty. According to the European Banking Authority, mortgage lending to households declined in 2023 compared to the previous year, reflecting a broader credit contraction that affects home improvement investments. Similarly, in Italy, the Italian Banking Association (ABI) found that loan applications for home renovations decreased in 2023, partly due to increased borrowing costs and economic instability. Public funding schemes such as Germany’s KfW renovation program and France’s MaPrimeRéno have helped offset some of these financial pressures, but coverage remains uneven across the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

% |

|

Segments Covered |

By End-User, Distribution Channel, Project Type, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Andresen Corporation, Dow Inc., Jeld-Wen Holdings Inc., Kajaria Ceramics Limited, Kohler Co., Mohawk Industries.NC, Pella Corporation, Harvey Building Products, Seven Group Holdings Limited, The Home Depot, Masco Corporation, Neil Kelly Company, Case Design, Rockwool International, Henkel Construction. |

SEGMENTAL ANALYSIS

By End-Use Insights

The residential segment dominated the Europe remodeling market by accounting for 68% of total revenue in 2023. This leading position is primarily attributed to the vast stock of aging homes and the increasing desire among homeowners to enhance property value, improve energy efficiency, and accommodate lifestyle changes such as remote work and multi-generational living. In Germany, over 220,000 residential renovation permits were issued in 2023, driven by government-backed subsidies under the KfW Bank’s energy-efficient building program. Similarly, the UK’s Royal Institution of Chartered Surveyors (RICS) noted a 25% increase in home improvement projects focused on kitchens, bathrooms, and loft conversions between 2021 and 2023.

The commercial remodeling segment is projected to grow at the highest CAGR of 6.4% from 2025 to 2033, which is fueled by evolving workplace dynamics, retail space transformations, and sustainability mandates. As businesses adapt to hybrid work models and e-commerce-driven retail environments, there is an increasing need to retrofit office spaces, shopping centers, and hospitality venues to align with new functional and environmental expectations.

By Distribution Channel Insights

The wholesale to retailer remained the largest distribution channel in the Europe remodeling market by capturing 42.4% of total revenue in 2024. This dominance is associated with the traditional reliance of DIY consumers and professional contractors on physical retail outlets such as hardware stores, home improvement centers, and specialized trade shops. Also, DIY retailers such as Hornbach and Obi saw a key increase in sales volume between 2021 and 2023, largely due to the availability of diverse product ranges through well-established wholesale partnerships. In Spain, the National Association of Distributors and Self-Service (AND) highlighted that large-format home improvement stores accounted for nearly half of all renovation material purchases, benefiting from bulk procurement advantages and localized inventory management.

On the other hand, the wholesalers selling online are anticipated to advance at a rapid CAGR of 9.2% and are driven by digital transformation and the growing preference for streamlined procurement processes among both professionals and end consumers. According to McKinsey & Company, B2B construction and renovation suppliers in Europe increased their online presence between 2021 and 2023, offering faster access to materials, real-time pricing, and delivery tracking capabilities. Similarly, in the UK, Travis Perkins launched its digital procurement platform, Trade Direct, which recorded over 1 million transactions in its first full year of operation.

By Project Type Insights

The professional project type had the largest share of the Europe remodeling market, i.e., 62.5% of total revenue in 2025. This is mainly due to the complexity of modern renovation projects, which often involve structural modifications, electrical and plumbing upgrades, and compliance with local building codes. Similarly, in Italy, ANCE (National Association of Construction Companies) documented a major increase in formal contractor engagement for bathroom and kitchen renovations, supported by government-backed tax incentives for certified work. In France, the National Federation of Builders (Fédération Française du Bâtiment) emphasized that professional-led projects are more likely to qualify for financial aid linked to energy efficiency improvements.

The DIY (do-it-yourself) remodeling segment is predicted to accelerate at a CAGR of 5.7% in the coming years. This is propelled by increased accessibility to online tutorials, affordable toolkits, and modular renovation solutions tailored for self-installation. According to the European DIY Retail Association (EDRA), more than a significant portion of Europeans undertook at least one home improvement project without professional assistance, marking a notable shift in consumer confidence and purchasing behavior. Additionally, the European Consumer Electronics Association observed a surge in smart home automation kits sold online, empowering homeowners to manage lighting, climate control, and security features independently.

COUNTRY-LEVEL ANALYSIS

Germany had the biggest share of the Europe remodeling market, i.e., 20.7% of total regional revenues in 2024. This leading position is attributed to the country’s extensive aging housing stock, strong public funding mechanisms, and proactive policies promoting energy efficiency and sustainable development. The German government’s KfW Bank offers generous low-interest loans and grants for energy-efficient building upgrades, encouraging homeowners to undertake insulation, window replacement, and heating system retrofits. Moreover, the German Energy Agency (dena) reports that building energy performance requirements have intensified, prompting widespread adoption of professional remodeling services. Major cities like Berlin, Munich, and Frankfurt have seen a surge in apartment renovations aimed at improving indoor air quality and thermal comfort. The French remodeling market is advancing and is driven by strategic government support and growing homeowner interest in energy-efficient renovations. Also, the country spent a substantial amount on residential and commercial remodeling in recent years, with a particular emphasis on kitchen and bathroom upgrades, insulation works, and smart home integrations. Parisian real estate agencies also observed a growing trend of eco-renovation among middle-income homeowners aiming to reduce utility costs.

The United Kingdom is focusing on smart home integration and is supported by strong investments in smart home integration and domestic energy conservation programs. With sustained policy support and a growing culture of home personalization, the UK remains a key player in the European remodeling industry.

Italy is propelled by expanding tax incentives and renovation vouchers introduced under the National Recovery and Resilience Plan (PNRR). The Italian National Association of Construction Companies (ANCE) reported that professional remodeling activity grew in 2023, particularly in Milan, Rome, and Naples, where property owners sought to modernize aging apartments and comply with updated fire safety regulations. Additionally, the Italian Renewable Energy Agency (ERSE) noted an increase in solar-integrated roofing and heat pump installations, reinforcing the link between remodeling and decarbonization efforts.

Spain is seeing a rising demand for sustainable remodeling, which is driven by increasing demand for sustainable remodeling and supportive government policies. Additionally, real estate developers are increasingly marketing remodeled properties with EPC A ratings, responding to growing buyer awareness of long-term energy savings.

KEY MARKET PLAYERS

Andresen Corporation, Dow Inc, Jeld-Wen Holdings Inc, Kajaria Ceramics Limited, Kohler Co, Mohawk Industries Inc, Pella Corporation, Harvey Building Products, Seven Group Holdings Limited, The Home Depot, Masco Corporations, Neil Kelly Company, Case Design, Rockwool International, Henkel Construction. are the market players that are dominating the Europe remodeling market.

Top Players in the Market

Saint-Gobain S.A.

Saint-Gobain is a global leader in sustainable building materials and plays a pivotal role in the Europe remodeling market by offering innovative solutions for energy-efficient renovations. The company provides high-performance insulation, glass, drywall, and interior finishing products tailored for residential and commercial retrofitting projects. Saint-Gobain supports the transition toward nearly zero-energy buildings (nZEB) through its extensive product portfolio and technical expertise.

The company contributes significantly to the global remodeling industry by setting benchmarks in eco-friendly construction practices and material innovation. Through brands like Isover, Weber, and CertainTeed, Saint-Gobain delivers comprehensive renovation systems that enhance comfort, reduce energy consumption, and improve indoor air quality.

BASF SE – Construction Chemicals Division

BASF’s Construction Chemicals division is a major player in the Europe remodeling market, specializing in advanced materials that enhance durability, efficiency, and sustainability of renovation projects. The company offers a wide range of products, including tile adhesives, waterproofing solutions, flooring compounds, and insulation materials, designed for the modernization of aging infrastructure.

BASF contributes to the global market by integrating chemical innovation into building renovation, enabling better performance, faster application, and longer lifespan of remodeled structures. Its solutions support green building certifications and compliance with EU energy efficiency directives.

Knauf Insulation

Knauf Insulation is a leading provider of thermal, acoustic, and fire protection insulation solutions used extensively in residential and commercial remodeling projects across Europe. The company specializes in mineral wool, EPS, and XPS insulation materials that help reduce energy consumption and improve indoor climate conditions.

Knauf plays a critical role in advancing energy-efficient renovations, particularly under the European Green Deal’s Renovation Wave initiative. Its products are widely adopted in deep renovation programs aimed at upgrading older buildings to meet current environmental standards. By emphasizing sustainability, recyclability, and performance optimization, Knauf supports both public policy goals and private sector efforts to create healthier, more energy-conscious living and working environments throughout Europe.

Top Strategies Used by Key Market Participants

One major strategy employed by leading players in the Europe remodeling market is product innovation focused on sustainability, where companies develop low-carbon, recyclable, and high-performance materials that align with tightening environmental regulations and consumer demand for greener homes and commercial spaces.

Another key strategy is strategic partnerships and collaborations, particularly with architects, contractors, and government agencies, to ensure integration of new materials and technologies into large-scale renovation initiatives and public housing upgrades.

Lastly, digital transformation and e-commerce expansion allow companies to reach a broader customer base, streamline procurement, and offer online advisory services, virtual design tools, and direct-to-consumer delivery models that enhance user experience and purchasing convenience in the evolving remodeling landscape.

COMPETITION OVERVIEW

The competition in the Europe remodeling market is highly fragmented, featuring a mix of multinational corporations, regional manufacturers, national retail chains, and independent contractors vying for market share across diverse end-user segments. Established players such as Saint-Gobain, Knauf Insulation, and BASF leverage their brand strength, broad product portfolios, and deep distribution networks to maintain leadership positions. However, mid-sized firms and local contractors are gaining traction by focusing on specialized services, localized sourcing, and personalized client engagement strategies.

A defining feature of the competitive landscape is the increasing emphasis on sustainability, with companies racing to introduce eco-friendly materials, digitalized project management tools, and smart home integration capabilities. Additionally, the growing adoption of energy-saving renovations and government-backed incentive schemes has intensified competition among suppliers and service providers seeking to capture demand driven by policy mandates and shifting consumer expectations.

Brand differentiation is increasingly tied to technical expertise, environmental credentials, and customer-centric service delivery.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Saint-Gobain launched a new line of prefabricated wall and ceiling panels in Germany, targeting fast-track residential renovations and reducing on-site labor time while improving thermal performance and acoustic comfort.

- In March 2024, Knauf Insulation partnered with a French energy consultancy firm to develop an integrated insulation and ventilation system specifically designed for historic building retrofits, addressing moisture control and energy efficiency challenges in older housing stock.

- In June 2024, BASF introduced a digital renovation advisory platform in Spain, allowing homeowners to receive customized product recommendations and connect directly with certified contractors, enhancing customer engagement and streamlining the renovation process.

- In September 2024, Fundermax, an Austrian panel manufacturer, acquired a German facade renovation startup to expand its offerings in energy-efficient exterior cladding solutions, reinforcing its position in the growing retrofit segment across Central Europe.

- In November 2024, Fermacell, a subsidiary of Etex Group, expanded its production capacity in Poland to meet rising demand for gypsum fiberboards in multi-family housing renovations, particularly in Eastern and Central European markets experiencing increased government-backed refurbishment activity.

MARKET SEGMENTATION

This research report on the Europe remodeling market is segmented and sub-segmented into the following categories.

By End-Use

- Residential

- Commercial

By Distribution Channel

- Direct selling

- Online direct selling to the consumer

- Wholesale to retailer

- Wholesale to consumer

- Wholesalers selling online

By Project Type

- DIY

- Professional

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What’s driving growth in the European remodeling market?

Aging housing stock—over 35% of European homes were built before 1970—and rising energy efficiency standards are fueling demand for residential and commercial renovations.

How is the EU’s Green Deal influencing remodeling trends?

The push for carbon neutrality by 2050 has triggered incentives for thermal insulation, solar installations, and energy-efficient windows under programs like Renovation Wave and national recovery plans.

Which remodeling segments are growing fastest in Europe?

Energy-efficient retrofits, bathroom upgrades, and smart home integrations are leading growth, especially in Western and Nordic countries with high renovation budgets.

How are labor shortages impacting remodeling timelines and costs?

A skilled labor gap—particularly in Germany, France, and the UK—is causing project delays and cost inflation, prompting increased investment in prefabricated solutions and modular construction.

What role does digitalization play in the European remodeling sector?

Building Information Modeling (BIM), 3D scanning, and AI-based project management tools are improving design accuracy, cost control, and client engagement across renovation projects.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com