Europe Sanitary Napkin Market Size, Share, Trends & Growth Forecast Report By Type (Menstrual Pad, Pantyliner), Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Sanitary Napkin Market Size

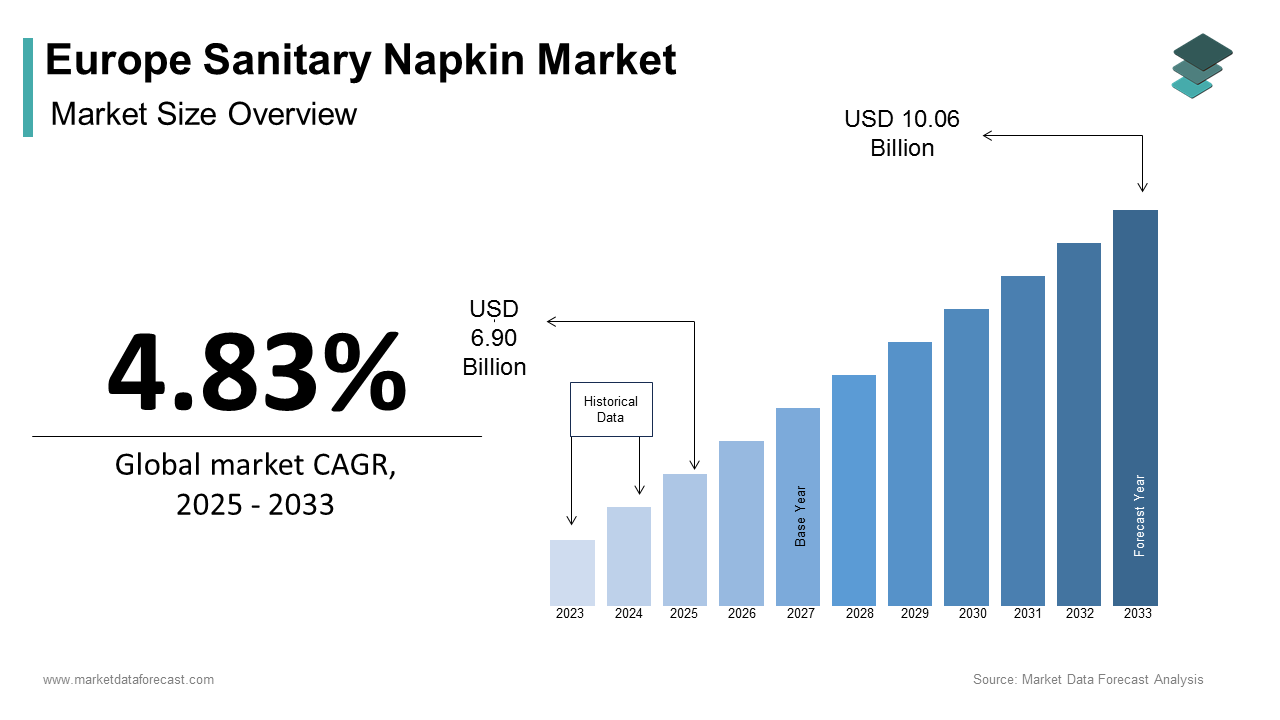

The Europe Sanitary Napkin Market size was calculated to be USD 6.58 billion in 2024 and is anticipated to be worth USD 10.06 billion by 2033, from USD 6.90 billion in 2025, growing at a CAGR of 4.83% during the forecast period.

The sanitary napkin is a broad range of feminine hygiene products designed to manage menstrual flow, offering consumers options in terms of absorbency, size, material composition, and environmental impact. As awareness around personal hygiene, sustainability, and health continues to evolve, so too does the demand for advanced and eco-friendly sanitary products across the continent. According to Statista, the European feminine hygiene market was valued at over €1.3 billion in 2024, with sanitary napkins accounting for a significant portion of this revenue. Moreover, government initiatives and NGO-led campaigns have played a crucial role in reducing stigma and improving access to menstrual hygiene products.

MARKET DRIVERS

Rising Awareness of Menstrual Health and Hygiene

One of the most influential drivers shaping the European sanitary napkin market is the growing awareness surrounding menstrual health and hygiene among younger generations. Educational campaigns led by governments, NGOs, and advocacy groups have played a pivotal role in dismantling taboos and encouraging open conversations about menstruation. According to Plan International UK, nearly 60% of young women in Europe have accessed formal menstrual education through school programs since 2020, which is contributing to more informed purchasing decisions and higher product adoption rates.

This heightened awareness has also spurred demand for safer, dermatologically tested, and hypoallergenic sanitary products. As per Euromonitor International, consumer preference for products free from synthetic fragrances, chlorine, and dyes has increased by approximately 25% over the past three years. Additionally, social media platforms such as Instagram and TikTok have become instrumental in spreading information on menstrual wellness, influencing brand perceptions, and driving engagement with niche and premium product lines. Furthermore, workplace and institutional policies promoting menstrual health have contributed to steady market expansion. According to Eurostat, more than 40% of large corporations in Western Europe now provide free or subsidized sanitary products in office restrooms.

Increasing Demand for Organic and Eco-Friendly Products

A significant driver fueling the European sanitary napkin market is the rising consumer preference for organic and environmentally sustainable menstrual products. Many European women are opting for biodegradable, compostable, and organic cotton-based sanitary napkins with growing concerns about plastic waste and chemical exposure.

This shift is particularly pronounced in countries like Sweden, Denmark, and Germany, where sustainability is deeply embedded in public consciousness. Brands such as Natracare, Organic, and Daye have capitalized on this trend by introducing plant-based materials, recyclable packaging, and carbon-neutral production methods.

Additionally, regulatory support has played a role in accelerating this transition. The European Chemicals Agency (ECHA) has proposed restrictions on certain substances used in conventional sanitary products, prompting manufacturers to reformulate their offerings. This evolving mindset is reshaping product development strategies and reinforcing the long-term viability of sustainable sanitary napkins in the European market.

MARKET RESTRAINTS

Cultural Taboos and Stigma Surrounding Menstruation

Despite progress in education and policy reforms, cultural taboos and lingering stigma around menstruation continue to pose a significant restraint on the European sanitary napkin market. Although Western Europe has made substantial strides in normalizing discussions around menstruation, certain regions in Eastern Europe still experience hesitancy in openly discussing menstrual health. According to Plan International UK, nearly one in five girls in parts of Central and Eastern Europe feel ashamed to talk about their periods by discouraging regular product usage and limiting market penetration.

This stigma often translates into reluctance among retailers to prominently display sanitary products, especially in smaller towns and rural areas. As per UNICEF’s 2023 Gender and Hygiene Study, some local shops in Poland and Romania avoid stocking visible displays of sanitary napkins due to perceived social discomfort. This lack of visibility can lead to reduced accessibility and impulse purchases, indirectly affecting overall consumption levels.

Moreover, misinformation persists in some communities regarding the safety and necessity of using modern sanitary products. According to the HO Regional Office for Europe, misconceptions about reusable versus disposable products still influence purchasing behavior among lower-income groups. While awareness campaigns have helped mitigate these issues, deep-rooted attitudes remain a barrier to uniform market expansion, necessitating continued efforts in education and community outreach to ensure broader acceptance and uptake of sanitary napkins across the continent.

Regulatory Complexity and Product Approval Delays

Another key restraint impacting the European sanitary napkin market is the complex and sometimes inconsistent regulatory framework governing feminine hygiene products. Unlike medical devices or pharmaceuticals, sanitary napkins fall under general consumer goods regulations. However, they must still comply with stringent EU directives related to chemical safety, labeling, and environmental impact. According to the European Commission’s 2023 Product Compliance Report, delays in product approval due to compliance checks have affected the speed at which innovations reach the market. These regulatory hurdles disproportionately affect smaller and independent brands seeking to enter the market with novel formulations or sustainable alternatives. As per Deloitte’s 2024 Regulatory Impact Analysis, it takes an average of 9–12 months for new sanitary products to receive full compliance certification, compared to just 3–4 months in some other global markets. This extended timeline increases operational costs and reduces agility, especially for startups aiming to respond quickly to consumer trends.

Additionally, variations in national-level regulations within the EU create logistical challenges for pan-European distribution. According to PwC’s 2024 Trade and Compliance Review discrepancies in fragrance bans, dye restrictions, and packaging requirements across member states force manufacturers to produce multiple versions of the same product. These complexities hinder scalability and limit the diversity of available products, ultimately constraining market growth and innovation in the European sanitary napkin sector.

MARKET OPPORTUNITIES

Expansion of Direct-to-Consumer Subscription Models

An emerging opportunity in the European sanitary napkin market is the growing popularity of direct-to-consumer (DTC) subscription models that offer personalized, recurring deliveries of menstrual products. As digital commerce evolves, consumers increasingly seek convenience, customization, and discretion when managing their monthly needs. Subscription services allow consumers to tailor product choices based on cycle length, flow intensity, and preferred materials, enhancing user satisfaction. As per McKinsey & Company, nearly 30% of European women aged 18–35 now use a subscription-based service for menstrual products, appreciating the benefits of doorstep delivery and automatic replenishment. Brands such as Flex and Daye have successfully integrated these models, combining convenience with sustainability by offering refill packs and minimizing plastic content.

Moreover, DTC platforms enable stronger brand-consumer relationships through data analytics and targeted engagement. Subscription-based models are redefining how sanitary napkins are marketed and distributed, which is presenting a lucrative avenue for future market expansion by streamlining supply chains and reducing reliance on traditional retail channels.

Growing Demand for Reusable and Washable Sanitary Pads

A significant opportunity in the European sanitary napkin market lies in the rising interest in reusable and washable sanitary pads, reflecting broader consumer trends toward sustainability and cost efficiency. As environmental awareness intensifies among millennials and Gen Z, many women are seeking alternatives to single-use products that contribute to landfill waste and plastic pollution. According to Euromonitor International, sales of reusable sanitary products in Europe increased by 17% in 2023, which is signaling a shift in consumer behavior.

Reusable pads, often made from organic cotton, bamboo fiber, or antimicrobial fabric blends, offer a long-term solution that reduces both environmental impact and ongoing expenses. Countries such as Sweden, the Netherlands, and Austria have seen particularly strong adoption rates, supported by government-backed initiatives promoting menstrual sustainability.

In response, major brands and startups alike are expanding their portfolios to include reusable variants. According to McKinsey & Company, several established feminine hygiene brands have introduced hybrid product lines, blending disposables with reusable options to cater to diverse preferences. Furthermore, online communities and influencer-led advocacy have played a crucial role in educating consumers about proper care and usage, fostering greater confidence in reusable alternatives.

MARKET CHALLENGES

Balancing Cost Affordability with Sustainable Innovation

One of the primary challenges facing the European sanitary napkin market is striking a balance between affordability and the growing demand for sustainable, high-quality products. While consumers increasingly seek eco-friendly alternatives such as biodegradable or organic cotton-based sanitary pads, these products often come at a premium price point, making them less accessible to lower-income groups. According to Euromonitor International, organic sanitary napkins typically cost 20–40% more than conventional options, limiting widespread adoption despite rising environmental awareness. This pricing disparity is particularly evident in Eastern and Southern Europe, where economic disparities persist and disposable income remains lower than in Western counterparts. As per Eurostat, nearly 17% of women in countries like Bulgaria and Greece reported difficulty affording menstrual products in 2023. Public health advocates argue that without subsidies or bulk procurement mechanisms, sustainable options may remain out of reach for a significant portion of the population.

Additionally, manufacturers face pressure to maintain profitability while investing in greener materials and ethical sourcing practices. According to McKinsey & Company transitioning to biodegradable components can increase production costs by up to 30%, complicating pricing strategies. Governments and NGOs are working to bridge this gap through subsidized distribution programs, but until sustainable sanitary products achieve cost parity with conventional ones, affordability will remain a persistent challenge across the European market.

Managing Brand Perception Amidst Increased Competition

As the Europe sanitary napkin market becomes increasingly saturated, managing brand perception amidst heightened competition poses a significant challenge for market participants. With a growing number of domestic and international players entering the space ranging from established multinational brands to niche eco-conscious startups differentiation has become more difficult. According to McKinsey & Company, over 60 new menstrual hygiene brands entered the European market between 2020 and 2024, intensifying pressure on existing players to reinforce brand loyalty and trust.

One of the key battlegrounds for differentiation is product positioning, particularly regarding sustainability, comfort, and transparency. As per Deloitte’s 2024 Consumer Trust Survey, 54% of European consumers associate brand credibility with clear ingredient disclosure and ethical manufacturing practices. However, the proliferation of greenwashing tactics where brands exaggerate eco-friendly claims without substantive backing has led to consumer skepticism, undermining genuine sustainability efforts.

Moreover, digital marketing dynamics add another layer of complexity. Social media influencers and peer reviews play a decisive role in shaping brand perception, yet negative feedback or viral controversies can rapidly damage reputation. According to Statista, nearly 40% of European consumers have changed their preferred brand based on online reviews or influencer endorsements in the past two years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.83% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Procter & Gamble, Kimberly-Clark, Essity AB, Johnson & Johnson, Edgewell Personal Care, Ontex Group, Lil-Lets Group, Unicharm Corporation, Daio Paper Corporation, Corman S.p.A. |

SEGMENTAL ANALYSIS

By Type Insights

The menstrual pads segment was the largest and held a dominant share of the European sanitary napkin market in 2024. The growth of the segment is attributed to their widespread use across all age groups and the necessity for high-absorbency products during heavy menstrual flow days. According to Euromonitor International, over 85% of menstruating women in Western Europe rely on standard or ultra-absorbent pads as a primary hygiene product, which makes them an essential category within the feminine care industry.

One key driver behind this segment’s stronghold is the continued preference for disposable hygiene products, especially among working professionals and students who require convenience and discretion. Additionally, major brands such as Johnson & Johnson, Procter & Gamble, and Essity have invested heavily in product innovation, introducing features like odor-neutralizing layers, breathable materials, and leak-proof technology to enhance user comfort and retention. According to McKinsey & Company, these continuous improvements have contributed to sustained demand by ensuring that menstrual pads remain the most widely used type of sanitary protection across Europe.

The pantyliners segment is likely to grow with a CAGR of 9.2% in the next coming years with the ascent reflecting evolving consumer preferences toward lightweight, discreet, and multi-functional menstrual hygiene solutions that cater to light flow days, post-menstruation, and everyday freshness needs. A significant driver of this growth is the increasing adoption of pantyliners among younger demographics, particularly millennials and Gen Z, who prioritize comfort, mobility, and aesthetics. According to Deloitte’s 2024 Consumer Health Survey, nearly 58% of female respondents aged 18–30 reported using pantyliners regularly by citing improved confidence and reduced irritation compared to traditional pads. Additionally, rising awareness about vaginal health and hygiene has led to increased usage of pantyliners beyond menstruation, including for managing discharge, spotting, and postpartum recovery. As per Euromonitor International, this shift in perception has expanded the utility of pantyliners beyond their original function, contributing to broader market penetration. Furthermore, manufacturers have introduced ultra-thin and biodegradable variants to align with sustainability trends, further enhancing appeal. With continued innovation and shifting lifestyle patterns, pantyliners are poised for sustained high-growth momentum in the European sanitary napkin landscape.

By Distribution Channel Insights

The supermarkets and hypermarkets segment was the largest accounting for 38.6% of the Europe sanitary napkin market share in 2024 due to the widespread accessibility, competitive pricing, and established retail presence of supermarket chains such as Carrefour, Tesco, and Rewe, which offer a broad range of both branded and private-label sanitary products. According to Statista, over 65% of European women prefer purchasing sanitary napkins from supermarkets due to their affordability and easy availability. Additionally, private-label offerings from major retailers have gained traction, offering cost-effective alternatives to premium-branded products while maintaining acceptable quality standards. As per Euromonitor International, private-label sanitary products accounted for nearly 28% of all supermarket sales in 2024, which reinforces their role in driving volume growth. Moreover, strategic shelf placements, promotional campaigns, and loyalty-based discounts have further strengthened the appeal of this channel by ensuring its continued dominance in the European sanitary napkin market.

The online distribution channel is lucratively growing with a CAGR of 11.5% in the coming years. This rapid expansion is fueled by the increasing preference for digital shopping, enhanced e-commerce infrastructure, and the rise of direct-to-consumer (DTC) brands offering personalized and eco-friendly menstrual products.

A key driver behind this growth is the convenience and privacy offered by online platforms, allowing consumers to explore a wider variety of products, read reviews, and opt for subscription-based models that ensure timely replenishment. According to McKinsey & Company, nearly 44% of European women now purchase sanitary products online, with a notable surge among urban and digitally savvy consumers. Additionally, DTC brands such as Daye, Flex, and OrganiCup have leveraged targeted digital marketing and influencer collaborations to build brand awareness and customer loyalty. The integration of AI-driven recommendations and carbon-neutral shipping practices has further boosted consumer trust and engagement.

REGIONAL ANALYSIS

Germany was the top performer in the EEuropeansanitary napkin market with 19.3% of the share in 2024 owing to a well-developed healthcare and retail infrastructure, high consumer awareness regarding personal hygiene, and a robust regulatory framework promoting product safety and transparency.

One of the primary drivers of market growth in Germany is the high level of brand consciousness and consumer preference for premium, dermatologically tested products. Additionally, government-backed initiatives aimed at improving menstrual health education have played a crucial role in normalizing discussions around hygiene, thereby boosting product adoption. According to McKinsey & Company, school-based awareness programs have contributed to increased acceptance of modern sanitary products among younger demographics. Furthermore, the country’s strong e-commerce ecosystem has enabled direct-to-consumer brands to reach niche markets effectively.

France's sanitary napkin market accounted by holding 14.3% of the share in 2024 with a growing emphasis on sustainability, product innovation, and regulatory support for menstrual equity. As one of the early adopters of eco-conscious hygiene products in Europe, France has witnessed a steady shift toward organic cotton-based and biodegradable sanitary options. A key factor fueling market expansion in France is the increasing consumer demand for environmentally friendly products. According to Euromonitor International, nearly 40% of French women prefer sustainable sanitary napkins over conventional ones, influenced by heightened environmental awareness and stricter regulations on plastic content in hygiene products. Additionally, the French government has implemented policies mandating free access to sanitary products in public institutions, as outlined in Ministère des Solidarités et de la Santé guidelines, which has further stimulated market growth.

The United Kingdom sanitary napkin market is expected to grow at faster rate with the proactive government policies, widespread awareness campaigns, and a dynamic retail environment. The UK has been at the forefront of addressing menstrual poverty and promoting equitable access to hygiene products, which has had a direct impact on market expansion.

One of the key drivers behind the UK’s strong market position is the implementation of the "Free Period Products Scheme," launched in 2020, which mandates schools and local authorities to provide free sanitary products to students. Additionally, social media and influencer-led advocacy have played a crucial role in shaping consumer behavior, particularly among millennial and Gen Z buyers. As per McKinsey & Company, nearly 50% of British women aged 18–30 now prefer purchasing sanitary products online, which favors brands that emphasize transparency, ethical sourcing, and sustainability. The presence of major retailers such as Boots, Sainsbury’s, and ASDA, along with the rise of DTC brands like Daye and Flex, has further diversified product offerings.

Italy's sanitary napkin market is expected to grow steadily with the changing consumer attitudes, increased health awareness, and gradual policy reforms aimed at improving menstrual hygiene access. A key factor influencing market expansion is the growing presence of international and domestic brands introducing innovative, dermatologically tested products tailored to Italian consumer preferences. Additionally, NGOs and advocacy groups have intensified efforts to promote menstrual health education in schools, contributing to increased awareness and acceptance. As per Plan International Italy, these initiatives have led to a 19% rise in the use of branded sanitary products among adolescent girls since 2021. Moreover, the emergence of online platforms offering discreet delivery and subscription services has expanded access beyond major metropolitan areas.

Spain's sanitary napkin market growth is driven by increasing awareness, government initiatives, and the expansion of modern retail formats. While historically lagging behind some Western European nations in terms of menstrual health education, Spain has made notable progress in recent years, particularly in urban centers like Madrid and Barcelona.

One of the primary drivers of market growth in Spain is the rising consumer interest in eco-friendly and organic sanitary products. According to Statista, nearly 30% of Spanish women now opt for biodegradable or plant-based sanitary napkins, driven by environmental concerns and increased exposure to sustainability messaging.

LEADING PLAYERS IN THE EUROPEAN SANITARY NAPKIN MARKET

Procter & Gamble (P&G)

Procter & Gamble is a dominant force in the European sanitary napkin market, known for its globally recognized brand Always (known as Whisper in some regions). P&G has been instrumental in shaping consumer expectations around comfort, hygiene, and discretion through continuous product innovation and extensive marketing campaigns. Its emphasis on sustainability, including the development of thinner, more absorbent pads with reduced plastic content, has influenced industry trends across Europe.

Essity AB

Essity is a leading global hygiene and health company headquartered in Sweden, with a strong presence in the European sanitary napkin sector under brands like Libresse and Bodyform. The company is known for its bold branding strategies and commitment to women’s well-being, emphasizing skin-friendly materials and advanced leakage protection. Essity has played a key role in normalizing open conversations about menstruation through impactful advertising and educational initiatives across multiple European markets.

Johnson & Johnson

Johnson & Johnson has maintained a significant footprint in the European feminine hygiene space through its Stayfree brand, offering a wide range of sanitary products tailored to diverse consumer needs. Known for its dermatologically tested formulations, the company has focused on addressing skin sensitivity concerns and improving user experience. J&J's long-standing reputation for medical credibility and quality has made it a trusted name among consumers seeking reliable, high-performance sanitary solutions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the European sanitary napkin market is product innovation centered on sustainability and comfort. Companies are increasingly investing in biodegradable materials, organic cotton variants, and ultra-thin pad technologies that align with evolving consumer preferences for eco-conscious and discreet menstrual care options.

Another crucial approach is leveraging digital platforms for brand engagement and education. Leading companies are utilizing social media, influencer collaborations, and online communities to foster awareness, break taboos, and provide accurate information on menstrual health, thereby building stronger emotional connections with their target audience.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Europe sanitary napkin market include Procter & Gamble, Kimberly-Clark, Essity AB, Johnson & Johnson, Edgewell Personal Care, Ontex Group, Lil-Lets Group, Unicharm Corporation, Daio Paper Corporation, Corman S.p.A.

The competition in the European sanitary napkin market is marked by a blend of established multinational corporations, regional players, and emerging niche brands striving to capture consumer attention in an increasingly conscious and informed marketplace. As societal attitudes toward menstruation evolve and environmental concerns gain prominence, brands are redefining their value propositions to align with these shifting priorities. While legacy players continue to dominate due to their strong distribution networks and brand equity, challenger brands are leveraging sustainability narratives, innovative product formats, and digital-first strategies to carve out distinct identities. This dynamic landscape is further shaped by regulatory pressures, public health policies, and a growing demand for transparency in ingredient sourcing and manufacturing practices. The entry of reusable and organic product lines from both large and independent firms has intensified rivalry by pushing companies to differentiate not only through product performance but also through ethical positioning and community engagement.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Procter & Gamble launched a new line of compostable sanitary pads under the Always brand, developed using plant-based fibers and fully biodegradable components, which is reinforcing its commitment to sustainable feminine hygiene solutions in Europe.

- In June 2024, Essity introduced a digital menstrual wellness platform called "MyCycle," offering personalized health insights and product recommendations by enhancing consumer engagement and strengthening its brand presence across key European markets.

- In August 2024, Johnson & Johnson partnered with several European NGOs to expand access to menstrual hygiene education in schools, aiming to reduce stigma and improve product acceptance among younger demographics through targeted outreach programs.

- In October 2024, Daye, a UK-based DTC menstrual care brand, rolled out a nationwide subscription service across Germany and France, offering customizable monthly packs and expanding its reach beyond traditional retail channels.

- In December 2024, SCA Hygiene Products (a subsidiary of Essity) opened a new production facility in Poland, designed to meet the rising demand for premium sanitary products in Eastern Europe while ensuring compliance with strict EU sustainability standards.

MARKET SEGMENTATION

This research report on the European sanitary Napkin Market has been segmented and sub-segmented based on type, distribution channel, and region.

By Type

- Menstrual Pad

- Pantyliner

By Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online

- Specialty Stores

- Others

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key drivers of the Europe sanitary napkin market?

Key drivers include increasing awareness about menstrual hygiene, rising disposable income, government initiatives for women's health, and the growing availability of sanitary products.

2. Which countries in Europe have the highest demand for sanitary napkins?

The highest demand is observed in countries like the UK, Germany, France, and Italy due to their large populations, strong retail networks, and greater awareness.

3. Who are the leading companies in the Europe sanitary napkin market?

Some of the key players include Procter & Gamble, Kimberly-Clark Corporation, Edgewell Personal Care, Unicharm Corporation, and Essity AB.

4. How has the COVID-19 pandemic impacted the sanitary napkin market in Europe?

While there was some disruption in the supply chain initially, demand for essential hygiene products like sanitary napkins remained strong throughout the pandemic.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com