Europe Secondhand Luxury Goods Market Size, Share, Trends & Growth Forecast Report By Product Type (Handbags, Jewelry And Watches), Demography, Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Secondhand Luxury Goods Market Size

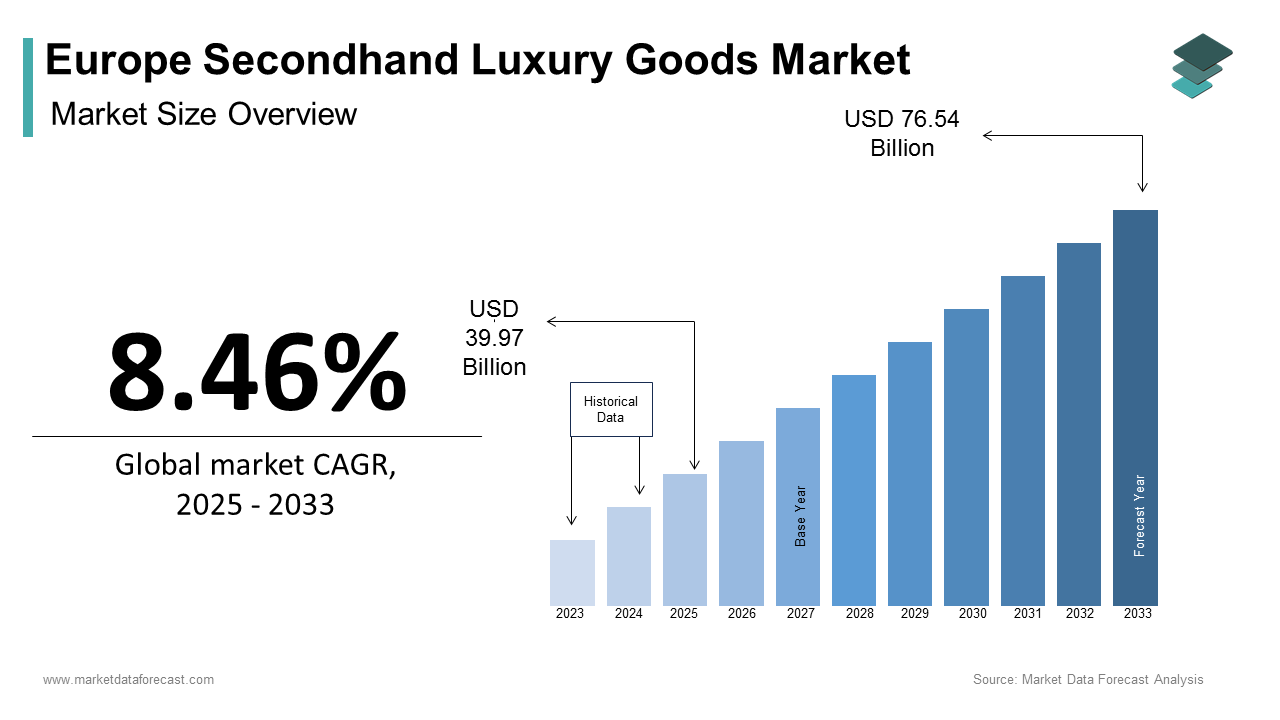

The Europe Secondhand Luxury Goods Market size was calculated to be USD 36.85 billion in 2024 and is anticipated to be worth USD 76.54 billion by 2033, from USD 39.97 billion in 2025, growing at a CAGR of 8.46% during the forecast period.

The Europe secondhand luxury goods market growth is driven by shifting consumer preferences toward sustainability, value preservation, and authenticity. Unlike traditional retail models, this market operates through reselling platforms, auction houses, consignment stores, and peer-to-peer exchanges that enable consumers to buy or sell pre-owned high-end products such as handbags, watches, jewelry, and apparel.

MARKET DRIVERS

Increasing Environmental Awareness Among Consumers

One of the most influential drivers shaping the European secondhand luxury goods market is the rising environmental consciousness among consumers in Western Europe. As awareness about the ecological impact of fast fashion and luxury manufacturing grows, more individuals are turning to sustainable alternatives such as buying pre-owned items. According to a 2024 survey conducted by Euromonitor International, approximately 67% of European consumers believe that purchasing secondhand goods is an effective way to reduce their carbon footprint. This sentiment is especially strong in countries like Sweden, the Netherlands, and Germany, where sustainability policies and green initiatives have been deeply integrated into public discourse.

Luxury fashion production is known for its resource-intensive processes, including leather tanning, synthetic dye usage, and excessive water consumption. As per Global Fashion Agenda’s 2023 Pulse Report, extending the active use of clothing by just nine months could lower carbon emissions by 20%–30%. In response, major luxury brands such as Gucci and Burberry have launched circularity programs, indirectly supporting the growth of the secondhand market. Additionally, younger consumers especially Gen Z are prioritizing ethical consumption. According to Deloitte’s 2024 Global Sustainability Survey, 73% of respondents under 30 factor sustainability into their purchase decisions. These behavioral shifts are fueling the expansion of online resale platforms and boutique consignment stores across Europe, which is reinforcing the environmental rationale behind the growing popularity of secondhand luxury goods.

Rising Demand for Affordable Luxury Among Younger Demographics

A significant driver propelling the European secondhand luxury goods market is the growing desire among younger consumers to own prestigious brands without paying full retail prices. Millennials and Gen Z, who constitute a large portion of the luxury market, often face financial constraints that make new designer items unattainable. As a result, they are increasingly turning to the secondary market to access iconic pieces from brands such as Louis Vuitton, Hermès, and Rolex at a fraction of the original cost. This trend is further supported by the rise of social media-driven aspiration, where personal image and brand visibility play crucial roles in self-expression. Platforms like Instagram and TikTok have amplified the visibility of vintage and pre-owned luxury, making it not only acceptable but fashionable to shop secondhand. Moreover, the entry of trusted authentication services on resale platforms has increased buyer confidence, reducing concerns about counterfeit products. As per Bain & Company, authenticated resale now accounts for over 40% of all secondhand luxury transactions in Europe.

MARKET RESTRAINTS

Counterfeit Products Undermining Consumer Trust

One of the key restraints affecting the European second-hand luxury goods market is the persistent issue of counterfeit products circulating within the resale ecosystem. Despite advancements in authentication technology, fake luxury items continue to infiltrate both online and offline channels, eroding consumer confidence and deterring potential buyers. Consumers seeking pre-owned luxury goods often lack the expertise to distinguish genuine items from fakes, especially when purchasing online. This issue is particularly pronounced on peer-to-peer marketplaces and independent resale sites that do not employ rigorous verification processes. High-profile cases involving forged Hermès bags and counterfeit Cartier watches have further fueled skepticism among buyers. In response, several established resale platforms such as Vestiaire Collective and Catawiki have introduced AI-powered authentication tools and expert verification teams. However, the proliferation of fake goods continues to pose a reputational risk, especially for newer entrants lacking robust anti-counterfeit mechanisms. Until the market achieves near-complete transparency and standardized verification protocols, counterfeit infiltration will remain a significant barrier to widespread adoption.

Regulatory Complexity and Taxation Policies Across European Countries

Another notable restraint influencing the European secondhand luxury goods market is the varying regulatory frameworks and taxation policies across different member states. Unlike new luxury goods, which follow uniform VAT structures and import regulations, the resale sector faces inconsistent tax treatments depending on jurisdiction. According to PwC’s 2024 Tax Guide on Circular Economy Models, several European countries impose differential VAT rates on secondhand goods, complicating pricing strategies for cross-border sellers. For instance, Italy applies a reduced VAT rate of 22% on secondhand luxury items, while Germany maintains a standard rate of 19%, which creates disparities that affect market competitiveness.

These inconsistencies create logistical and financial burdens for online platforms operating across multiple markets. As per EuroCommerce, a pan-European trade association, compliance with diverse customs duties and documentation requirements increases operational costs by up to 15% for multi-country resale businesses. Furthermore, some governments are exploring additional levies on secondhand transactions to balance revenue losses from declining new goods sales. France, for example, proposed a draft policy in early 2024 that would require sellers on peer-to-peer platforms to register and declare income beyond a certain threshold, potentially discouraging casual resellers. According to OECD guidelines, such regulatory fragmentation hampers scalability and innovation in the secondhand economy. While efforts are underway to harmonize tax policies under the EU Digital Services Act, current discrepancies continue to stifle market fluidity.

MARKET OPPORTUNITIES

Expansion of Online Resale Platforms with Enhanced Authentication Technology

A significant opportunity emerging in the European secondhand luxury goods market is the rapid expansion of online resale platforms equipped with advanced authentication technologies. As digital commerce gains dominance, consumers are increasingly favoring e-commerce-based resale solutions that offer convenience, variety and verified authenticity. According to Bain & Company, the online segment of the European secondhand luxury market grew by 14% in 2023, outpacing traditional brick-and-mortar channels. This growth is being driven by the integration of artificial intelligence (AI), blockchain, and machine learning tools that enhance product verification and traceability.

Leading platforms such as Vestiaire Collective, The RealReal, and Catawiki have deployed AI-assisted image recognition systems capable of detecting counterfeit materials with over 98% accuracy, as reported by Forbes in 2024. Blockchain-based provenance tracking is also gaining traction by allowing buyers to verify the history and previous ownership of high-value items like vintage watches and rare handbags. According to McKinsey & Company, 61% of European consumers prefer purchasing secondhand luxury goods through platforms that provide digital certificates of authenticity. This technological evolution is attracting new entrants and encouraging traditional retailers to invest in digital resale ventures. For instance, Selfridges launched its “Re/Design” initiative in 2024, offering authenticated pre-owned items with embedded NFC chips for real-time verification.

Strategic Collaborations Between Luxury Brands and Resale Platforms

An emerging opportunity in the European secondhand luxury goods market is the increasing collaboration between established luxury brands and authorized resale platforms. Traditionally, many high-end fashion houses avoided engaging with the secondary market due to concerns over brand dilution and loss of control. However, recent years have seen a strategic shift, with brands recognizing the economic and reputational benefits of participating in the resale ecosystem. According to Bain & Company, as of 2024, over 30% of top-tier European luxury brands have either partnered with certified resale platforms or launched proprietary resale initiatives.

Notable examples include Gucci’s partnership with The RealReal and Richemont’s acquisition of Watchfinder, a UK-based pre-owned watch specialist. These collaborations allow brands to maintain oversight of how their products are presented and priced in the secondary market while benefiting from extended customer engagement. As per Euromonitor International, brands involved in official resale programs have reported a 10–15% increase in customer retention and lifetime value. Furthermore, these partnerships help reinforce brand authenticity and reduce exposure to counterfeit goods. According to Deloitte’s 2024 Luxury Industry Outlook, 45% of European consumers perceive resale offerings as more trustworthy when endorsed directly by the brand.

MARKET CHALLENGES

Balancing Brand Prestige with Accessibility in the Resale Market

One of the primary challenges facing the European secondhand luxury goods market is maintaining the exclusivity and prestige associated with luxury brands while simultaneously catering to a broader, more accessible consumer base through resale. Luxury houses have long relied on controlled distribution and high price points to cultivate an aura of exclusivity. However, the growing prevalence of pre-owned luxury items available at significantly discounted rates threatens to undermine perceived value. According to McKinsey & Company, nearly 35% of European luxury consumers believe that the increased availability of secondhand products diminishes the status associated with owning a new luxury item.

This dilemma is particularly acute for heritage brands such as Hermès and Chanel, where scarcity and high retail prices traditionally reinforce desirability. As per Bain & Company, the resale market for iconic handbags like the Birkin and Kelly has grown by 18% annually since 2020, with some pre-owned models even exceeding their original retail value. While this appreciation can benefit owners, it also raises concerns for brands about losing control over pricing and positioning. In response, some companies have introduced proprietary resale services to manage brand narratives, as seen with Gucci Vault and LVMH-backed Nona Source. Striking the right balance between accessibility and exclusivity remains a complex challenge, which requires strategic brand positioning and selective engagement with resale platforms to preserve long-term brand equity.

Fragmented Consumer Perception of Value and Authenticity

A significant challenge confronting the European secondhand luxury goods market is the fragmented consumer perception of value and authenticity, which varies widely based on demographic, regional, and socio-economic factors. While younger, digitally savvy consumers tend to view secondhand luxury as a smart financial and ethical choice, older or more affluent buyers often associate pre-owned items with diminished status or compromised quality.

This divergence in perception affects market penetration and consumer conversion rates, particularly in high-income segments where brand-new purchases are still preferred. Additionally, regional differences play a role in shaping attitudes toward secondhand goods. As per Statista, German and Nordic consumers place a high emphasis on product longevity and condition, demanding stringent grading standards, while Southern European buyers may prioritize aesthetics over technical authenticity. According to The European Consumer Organisation (BEUC), nearly 40% of Europeans remain skeptical about the reliability of secondhand luxury products unless backed by third-party certification. This inconsistency necessitates targeted marketing strategies and enhanced education around the benefits and legitimacy of pre-owned luxury. Without a unified consumer understanding of value and authenticity, market players face ongoing difficulties in scaling their reach and building consistent demand across diverse customer groups.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.46% |

|

Segments Covered |

By Product Type, Demography, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Vestiaire Collective, Rebelle, Collector Square, Chrono24, Hardly Ever Worn It, HEWI London, Cudoni, The RealReal, Vinted, Farfetch |

SEGMENTAL ANALYSIS

By Product Type Insights

The handbags segment was the largest and held 32.1% of the Europe secondhand luxury goods market share in 2024 with high resale value and enduring demand for iconic designs from brands such as Hermès, Louis Vuitton, and Chanel. According to Bain & Company, handbags represent the most liquid category in the pre-owned luxury market, with select models like the Birkin and Kelly appreciating over time. The average price retention rate for these bags exceeds 150% of their original retail cost after five years, which makes them attractive not only as fashion accessories but also as investment assets. The continued appeal of handbags is further reinforced by consumer preferences for durable, easily authenticated items that maintain brand prestige. Additionally, digital authentication tools integrated into platforms like Vestiaire Collective and Catawiki have significantly enhanced buyer confidence. The combination of emotional attachment, status symbolism, and financial viability ensures that handbags remain the cornerstone of the European secondhand luxury market.

The jewelry and watches segment is swiftly emerging with a CAGR of 11.7% during the forecast period. This accelerated growth is largely attributed to increasing interest in vintage and collectible pieces, particularly among affluent buyers seeking rare or discontinued models. A key driver behind this surge is the growing trend of asset-backed consumption, where high-net-worth individuals view luxury jewelry and timepieces as tangible investments. Moreover, the expansion of certified authentication services has reduced risks associated with counterfeit products, boosting buyer confidence. Platforms such as Chrono24 and Catawiki have reported a 22% year-over-year increase in user engagement from European markets, according to Euromonitor International.

By Demography Insights

The women segment accounted for holding a dominant share of the European secondhand luxury goods market share in 2024. The growth of the segment is driven by women’s higher engagement in both purchasing and reselling luxury fashion, particularly in categories such as handbags, clothing, and small leather goods. One of the primary drivers behind this trend is the growing emphasis on personal style and curated wardrobes, especially among millennial and Gen Z women who prioritize sustainability without compromising aesthetics. As per Deloitte’s 2024 Global Sustainability Survey, 69% of European women under 35 factor environmental impact into their fashion purchases, making them more inclined toward pre-owned luxury alternatives. Additionally, social media influence on platforms like Instagram and Pinterest has amplified the visibility and desirability of unique or vintage pieces, encouraging repeat purchases in the secondhand segment. The combination of economic practicality, fashion-forward decision-making, and digital influence positions women as the central force shaping the European secondhand luxury market.

The unisex segment is likely to experience a CAGR of 14.3% from 2025 to 2033. This rapid ascent reflects broader cultural shifts toward gender-neutral fashion and inclusivity, particularly in urban centers across Scandinavia, Germany, and the Netherlands. A key driver behind this growth is the increasing preference for versatile, timeless designs that transcend traditional gender boundaries. Moreover, resale platforms like Depop and Vestiaire Collective have actively promoted unisex collections, leveraging algorithmic recommendations to match evolving consumer tastes.

By Distribution Channel Insights

The online distribution channel segment held 57.4% of the Europe secondhand luxury goods market share in 2024 with the rapid digitalization of resale platforms, which offer convenience, broad product selection, and enhanced trust mechanisms such as AI-powered authentication and blockchain-based provenance tracking. One of the primary factors driving online channel growth is the increasing reliance on e-commerce, particularly among younger demographics. Additionally, the integration of real-time authentication features has significantly boosted consumer confidence.

The offline segment is esteemed and is likely to register a CAGR of 9.8% in the next coming years with a renewed consumer preference for experiential shopping and the proliferation of consignment boutiques and pop-up stores in major metropolitan areas. According to McKinsey & Company, offline resale accounted for nearly 43% of total secondhand luxury transactions in Europe in 2024, with a notable uptick in foot traffic observed in cities such as Paris, Milan, and Copenhagen.

A key driver behind this growth is the tactile and personalized nature of in-store shopping, which appeals to high-net-worth consumers seeking premium service and immediate gratification. Additionally, luxury retailers and independent boutiques have been investing in curated experiences that blend retail with storytelling and expert curation. Moreover, seasonal trunk shows and exclusive drop events hosted by offline retailers have reinvigorated local markets, attracting both collectors and casual buyers. With strategic investments in customer experience and brand partnerships, the offline channel continues to carve a distinctive niche in the evolving secondhand luxury ecosystem.

REGIONAL ANALYSIS

The United Kingdom was the top performer in the European secondhand luxury goods market with an 18.3% share in 2024 of a mature resale ecosystem, a deep-rooted culture of vintage fashion, and a digitally advanced consumer base. One of the primary drivers of the UK market is the high level of brand awareness and early adoption of sustainable consumption trends. Additionally, the presence of established resale platforms such as Vestiaire Collective, The RealReal, and regional players like Preloved has expanded accessibility and trust in the market. Furthermore, the rise of influencer-driven fashion communities on platforms like Instagram and TikTok has amplified the appeal of vintage and pre-owned luxury. With favorable regulatory conditions and a strong emphasis on circular economy principles, the UK continues to serve as a pivotal market for secondhand luxury consumption in Europe.

France was positioned second with 16.4% of the European secondhand luxury goods market share in 2024. France possesses a deeply embedded cultural affinity for high-end fashion, which extends into the resale sector as the birthplace of many globally recognized luxury brands such as Louis Vuitton, Chanel, and Hermès. According to Bain & Company, the French secondhand luxury market generated over €3.5 billion in revenue in 2024, reflecting strong domestic demand and international collector interest.

A key driver behind this performance is the country’s well-established network of auction houses, vintage boutiques, and certified resale platforms. As per Statista, Paris alone hosts over 200 consignment stores specializing in pre-owned designer goods, making it a focal point for both local and international buyers. Consumer sentiment also plays a significant role; according to Euromonitor International, 67% of French respondents consider buying secondhand luxury to be a legitimate alternative to new purchases. The integration of blockchain-based authentication tools by platforms such as Vestiaire Collective has further bolstered buyer confidence.

Germany's secondhand luxury goods market growth is lucratively growing with prominent growth opportunities in the next coming years with the country’s high purchasing power, stringent quality expectations, and growing emphasis on sustainable consumption. Additionally, there is a strong cultural inclination towards longevity and durability in fashion, which aligns with the principles of the secondhand market. According to Deloitte’s 2024 Sustainability Survey, 71% of German respondents factor environmental considerations into their purchase decisions, making them more receptive to pre-owned alternatives. The presence of numerous regional consignment stores and pop-up shops in cities like Munich, Frankfurt, and Berlin further reinforces market penetration.

Italy's secondhand luxury goods market is esteemed to grow by maintaining a strong presence due to its intrinsic ties to the luxury fashion industry. As home to prestigious brands like Gucci, Prada, and Dolce & Gabbana, Italy benefits from a consumer base that is highly familiar with luxury craftsmanship and design. According to Bain & Company, Italian consumers spent approximately €2.2 billion on secondhand luxury goods in 2024, with a particular focus on heritage pieces and limited-edition collections.

SSpain'ssecondhand luxury goods market growth is driven by a combination of tourism, cultural appreciation for vintage fashion, and increasing digital adoption. One of the primary growth drivers in Spain is the influence of tourism and the influx of international visitors who contribute to the demand for pre-owned luxury goods. Additionally, Spanish consumers themselves are becoming more receptive to resale options, particularly among younger demographics. The expansion of online resale platforms such as Vestiaire Collective and Wallapop has further facilitated market access, with mobile commerce accounting for 68% of secondhand luxury transactions in Spain.

LEADING PLAYERS IN THE EUROPE SECONDHAND LUXURY GOODS MARKET

Vestiaire Collective

Vestiaire Collective is a leading European online marketplace specializing in secondhand luxury fashion, particularly catering to women’s apparel, handbags, and accessories. The platform has played a pivotal role in shaping consumer trust in pre-owned luxury by implementing rigorous authentication processes and fostering a community-driven shopping experience. Its curated approach and emphasis on sustainability have made it a preferred destination for conscious luxury consumers across France, Germany, and the UK.

The RealReal

The RealReal is one of the largest online resellers of authenticated luxury goods in Europe, known for its seamless integration of technology and luxury resale. With a strong presence in the UK and expanding influence across continental Europe, the company has set industry benchmarks in product verification, logistics, and customer engagement. It has contributed significantly to legitimizing the resale sector as a credible extension of the luxury market.

Catawiki

Catawiki operates as an online auction platform offering a diverse range of secondhand luxury items, including watches, jewelry, handbags, and collectibles. The company has built a reputation for combining expert curation with accessible pricing, attracting both casual sellers and collectors. Its pan-European reach and multilingual interface support broad market accessibility, making it a key player in democratizing access to luxury resale.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the European secondhand luxury goods market is enhanced authentication and trust-building mechanisms. Leading platforms have invested heavily in AI-driven verification systems, blockchain-based provenance tracking, and expert human authentication to ensure product legitimacy and foster consumer confidence.

Another critical approach is strategic brand partnerships and collaborations. Several resale companies are working directly with luxury brands to create certified resale programs, which help maintain brand integrity while tapping into new customer segments and reinforcing credibility within the secondary market.

Also, the strategy involves expanding digital infrastructure and user experience optimization. Companies are enhancing their mobile apps, integrating personalized recommendations, and streamlining logistics to improve convenience and engagement, ensuring a seamless and secure buying and selling process tailored to modern consumer expectations.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the European secondhand luxury goods market include Vestiaire Collective, Rebelle, Collector Square, Chrono24, Hardly Ever Worn It, HEWI London, Cudoni, The RealReal, Vinted, and Farfetch.

The competition in the European secondhand luxury goods market is characterized by a dynamic interplay between established online platforms, emerging startups, and traditional brick-and-mortar retailers adapting to digital transformation. As sustainability concerns and shifting consumer preferences drive demand, players are increasingly differentiating themselves through enhanced authentication services, exclusive partnerships, and superior customer experiences. While global platforms like Vestiaire Collective and The RealReal dominate due to their scale and brand recognition, niche players are gaining traction by focusing on specific product categories or regional markets. The rise of AI-powered authentication tools and blockchain-based provenance verification has intensified rivalry, pushing companies to invest in technological innovation to build consumer trust. Additionally, luxury brands entering the resale space either independently or through partnerships are reshaping market dynamics, creating both opportunities and challenges for existing players. This evolving competitive landscape is marked by strategic acquisitions, localized marketing efforts, and a growing emphasis on circular economy principles by ensuring that the market remains highly contested yet promising for future growth.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Vestiaire Collective launched a dedicated AI-driven authentication feature integrated directly into its mobile app, allowing users to verify product details in real time, thereby improving trust and reducing return rates.

- In May 2024, RealReal expanded its logistics network across Germany and Italy, setting up regional fulfillment centers to streamline delivery times and enhance customer satisfaction in key European markets.

- In July 2024, Catawiki introduced a new consignment program for high-net-worth individuals, enabling private collectors to list rare luxury items with expert guidance, thus broadening its premium inventory base.

- In September 2024, Veepee rebranded its secondhand luxury section with a curated shopping experience, featuring limited-edition pieces and seasonal drops to attract affluent buyers seeking exclusivity.

- In November 2024, Depop partnered with independent designers and vintage curators across Europe to launch a “Sustainable Luxury” campaign, promoting unique, pre-owned designer wear through targeted social media initiatives and influencer collaborations.

MARKET SEGMENTATION

This research report on the European secondhand Luxury Goods Market has been segmented and sub-segmented based on product type, demography, distribution channel, and region.

By Product Type

- Handbags

- Jewelry And Watches

By Demography

- Women

- Unisex

By Distribution Channel

- Online

- Offline

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of this market in Europe?

Key drivers include increased consumer awareness of sustainability, affordability of luxury items, growth of online resale platforms, and changing fashion consumption habits.

2. Who are the major players in the European secondhand luxury goods market?

Key players include Vestiaire Collective, Rebelle, Collector Square, Chrono24, Hardly Ever Worn It, HEWI London, Cudoni, The RealReal, Vinted, and Farfetch.

3. How are products authenticated in the secondhand luxury market?

Many platforms use a combination of expert authentication teams, AI-based verification, and blockchain technology to ensure the authenticity of luxury goods.

4. Which countries in Europe lead the secondhand luxury goods market?

The United Kingdom, France, Germany, and Italy are among the top markets in Europe.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com