Europe Smart Homes Market Size, Share, Trends, & Growth Forecast Report Segmented, By Product, Offering, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Smart Homes Market Size

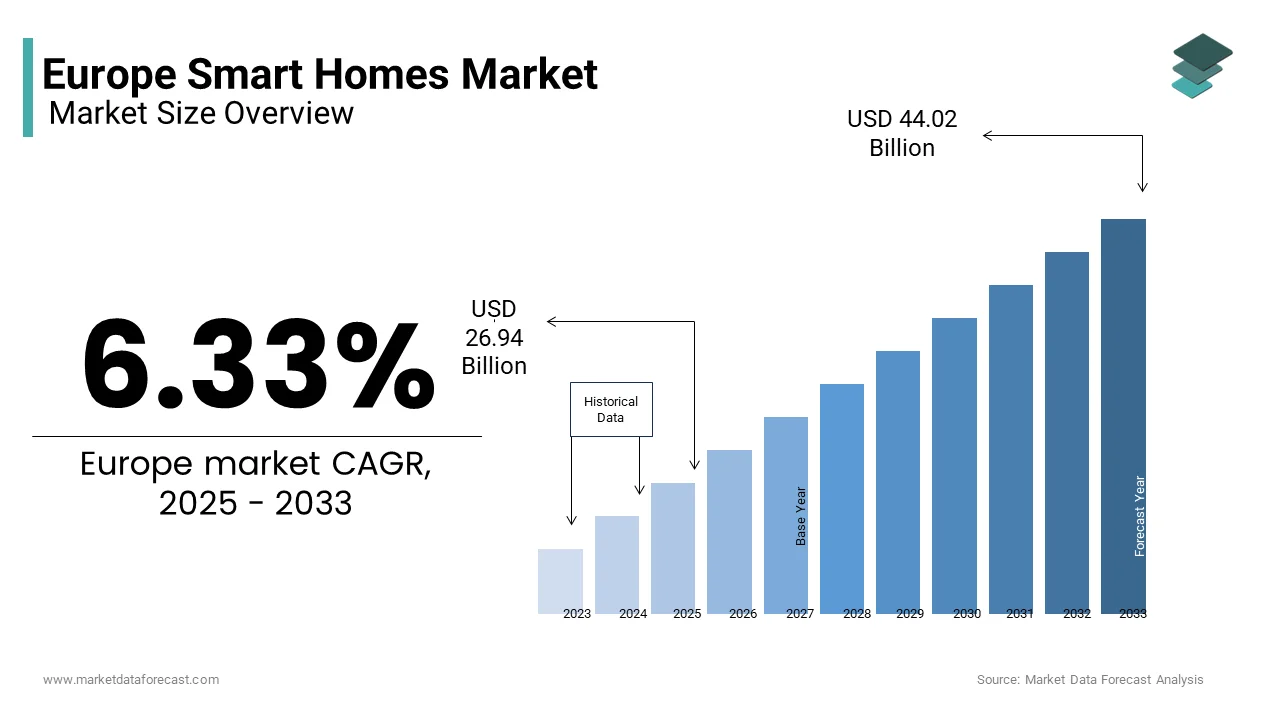

The Europe smart homes market was valued at USD 25.33 billion in 2024 and is anticipated to reach USD 26.94 billion in 2025 from USD 44.02 billion by 2033, growing at a CAGR of 6.33% during the forecast period from 2025 to 2033.

The Europe smart homes market is a pivotal part of the region's technology ecosystem, driven by a surge in demand for energy-efficient living solutions and interconnected devices. Also, this growth reflects the increasing adoption of IoT-enabled devices across urban households, particularly in countries like Germany, the UK, and France. Moreover, the market's expansion is further bolstered by favorable government policies promoting sustainable living. For instance, the European Green Deal emphasizes energy efficiency, encouraging homeowners to adopt smart thermostats and HVAC systems. Besides, the proliferation of 5G networks across Europe has enhanced connectivity, enabling seamless integration of smart home ecosystems.

MARKET DRIVERS

Rising Demand for Energy Efficiency

Energy efficiency stands as a cornerstone driving the Europe smart homes market, with homeowners increasingly prioritizing sustainable living. According to the International Energy Agency (IEA), residential energy consumption accounts for a significant share of Europe’s total energy usage, prompting governments to incentivize the adoption of smart technologies. Smart thermostats and HVAC controls have witnessed a surge in demand, with sales notably increasing since 2021. These devices enable users to monitor and optimize energy consumption, leading to significant cost savings. Furthermore, utility companies are collaborating with smart home providers to offer rebates for energy-efficient devices, further propelling adoption. The EU’s stringent regulations on carbon emissions have also played a critical role, compelling consumers to transition toward greener alternatives.

Increasing Penetration of IoT Devices

The proliferation of Internet of Things (IoT) devices has revolutionized the Europe smart homes market, creating an interconnected ecosystem that enhances convenience and security. According to Gartner, the number of IoT devices in European households is expected to reach 1.2 billion by 2026, up from 700 million in 2022. This exponential growth is fueled by advancements in wireless communication technologies such as Zigbee and Z-Wave, which ensure seamless interoperability between devices. Smart speakers, for instance, serve as central hubs for controlling other connected devices, with Amazon Alexa and Google Assistant dominating the market. Moreover, the integration of AI-powered analytics into IoT systems enables predictive maintenance, enhancing the user experience. For example, smart security systems equipped with motion sensors and facial recognition have reduced break-ins in urban areas.

MARKET RESTRAINTS

High Initial Costs

One of the primary barriers hindering the widespread adoption of smart homes in Europe is the high initial investment required for installation and setup. This financial burden disproportionately affects middle-income families, particularly in Eastern Europe, where disposable incomes are lower compared to Western counterparts. For instance, a survey conducted by the European Consumer Organization revealed that a notable share of respondents cited affordability as a key deterrent to adopting smart home technologies. While long-term savings on energy bills can offset these costs, many consumers remain hesitant due to upfront expenses. Also, the complexity of integrating multiple devices from different manufacturers often necessitates professional installation, further inflating costs.

Privacy and Data Security Concerns

Privacy and data security concerns pose significant challenges to the Europe smart homes market, deterring potential adopters wary of cyber threats. According to a report by ENISA (European Union Agency for Cybersecurity), a large percentage of smart home devices lack robust encryption protocols, making them vulnerable to hacking attempts. High-profile breaches, such as the 2022 attack on a major smart lock manufacturer that exposed user credentials, have exacerbated consumer skepticism. A survey by YouGov highlighted that a significant portion of Europeans are apprehensive about sharing personal data with smart home providers, fearing misuse or unauthorized access. Regulatory frameworks like the GDPR aim to address these issues, but compliance remains inconsistent across vendors. Furthermore, the interconnected nature of smart home ecosystems amplifies risks, as a single compromised device can jeopardize the entire network. For instance, a study by Kaspersky Lab found that 30% of smart home routers were susceptible to malware attacks. These vulnerabilities not only undermine consumer trust but also impede broader market growth.

MARKET OPPORTUNITIES

Expansion of Smart Kitchens

Smart kitchens represent a burgeoning opportunity within the Europe smart homes market, driven by evolving consumer preferences for convenience and automation. Innovations such as smart refrigerators with inventory tracking systems and connected ovens capable of remote operation are gaining traction among tech-savvy consumers. For instance, Bosch’s Home Connect platform allows users to control kitchen appliances via smartphone apps, enhancing usability. Apart from these, rising awareness about food waste has spurred demand for smart storage solutions, with the European Commission estimating a key reduction in household waste through advanced preservation technologies. Urbanization trends further amplify this opportunity, as compact living spaces necessitate multifunctional appliances.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) presents a transformative opportunity for the Europe smart homes market, enabling personalized and adaptive environments. According to McKinsey, AI-driven smart home systems could generate €15 billion in annual revenue by 2028. These technologies facilitate predictive analytics, allowing devices to anticipate user needs and optimize performance. For example, AI-powered lighting systems adjust brightness based on natural light levels and occupancy patterns, enhancing comfort while reducing energy consumption. Similarly, ML algorithms enhance security systems by identifying anomalies in behavior, thereby preventing false alarms. Furthermore, partnerships between tech giants and startups are accelerating innovation, with companies like Siemens and Philips investing heavily in AI research.

MARKET CHALLENGES

Interoperability Issues

Interoperability remains a persistent challenge for the Europe smart homes market, hampering seamless integration across diverse devices and platforms. This fragmentation stems from the absence of universal standards, with proprietary protocols like Apple HomeKit and Google Weave dominating specific ecosystems. For instance, a homeowner using a Nest thermostat may face difficulties integrating it with a Philips Hue lighting system, limiting functionality. A survey by the European Smart Home Alliance revealed that 55% of consumers consider interoperability a critical factor when purchasing smart devices. Efforts to establish industry-wide standards, such as Matter (formerly CHIP), have shown promise but face resistance from established players reluctant to relinquish control.

Limited Awareness Among Consumers

Limited awareness about the benefits and functionalities of smart home technologies constitutes another significant hurdle for the Europe smart homes market. This knowledge gap is particularly pronounced in rural areas, where exposure to digital innovations is minimal. Furthermore, marketing campaigns often fail to communicate the tangible advantages of smart homes, focusing instead on technical specifications that alienate non-tech-savvy audiences. The European Federation of Digital Innovation Hubs estimates that targeted educational initiatives could boost adoption rates. However, without concerted efforts to demystify smart home technologies, the market risks stagnation, as uninformed consumers remain hesitant to invest in unfamiliar solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.33% |

|

Segments Covered |

By Product, Offering, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Johnson Controls Inc. (Ireland), Honeywell International Inc. (US), Schneider Electric (France), Siemens (Germany), ASSA ABLOY (Sweden), Amazon.com, Inc. (US), Apple Inc. (US), ADT (US), Robert Bosch (Germany), ABB (Switzerland), Samsung Electronics. |

SEGMENTAL ANALYSIS

By Product Insights

The lighting controls managed the Europe smart homes market by capturing a 28.4% share in 2024. This leading position is associated with their affordability and ease of installation, appealing to both tech enthusiasts and casual users. According to the European Lighting Industry Federation, smart lighting systems reduce energy consumption, aligning with the EU’s sustainability goals. In addition, advancements in LED technology have lowered costs, making these products accessible to a wider audience. The growing trend of home automation further bolsters demand, as lighting controls integrate seamlessly with voice assistants and mobile apps.

.

The smart speakers segment is the fastest-growing segment, with a CAGR of 22.3%. This rapid expansion is fuelled by their role as central hubs for managing other devices. Also, the integration of AI enhances functionality, enabling features like real-time translation and personalized recommendations. Amazon Alexa dominates the market. Additionally, partnerships with streaming services have expanded use cases, driving adoption among younger demographics.

Smart speakers are the fastest-growing segment, with a CAGR of 22.3%. This rapid expansion is fueled by their role as central hubs for managing other devices. Also, the integration of AI enhances functionality, enabling features like real-time translation and personalized recommendations. Amazon Alexa dominates the market, accounting for a notable share of sales in recent years. Additionally, partnerships with streaming services have expanded use cases, driving adoption among younger demographics.

By Offering Insights

The behavioral offerings led the Europe smart homes market by holding a 60.3% share in 2024. This dominance is linked to their ability to analyze user habits and optimize device performance. For instance, behavioral thermostats adjust settings based on occupancy patterns, reducing energy waste. These solutions achieve a higher satisfaction rate compared to proactive alternatives.

Proactive offerings exhibit the highest growth rate, with a CAGR of 19.5%. These systems anticipate user needs through predictive analytics, enhancing convenience. For example, proactive security systems detect anomalies before breaches occur, offering superior protection.

COUNTRY-LEVEL ANALYSIS

Germany commanded a 25.4% share of the Europe smart homes market. Its prowess is because of a combination of high disposable incomes, robust technological infrastructure, and proactive government policies promoting energy efficiency. For instance, the German Energy Efficiency Strategy (EES) mandates the integration of smart technologies in new residential buildings, driving adoption rates. Urban centers like Berlin and Munich are hotspots for smart home innovation, with a major share of households already equipped with IoT-enabled devices. The country’s emphasis on sustainability has also fueled demand for smart thermostats and HVAC systems. Additionally, Germany’s strong manufacturing base enables local production of smart devices, reducing costs and enhancing affordability. The presence of global tech giants and domestic innovators further strengthens its dominance, making it a benchmark for other European nations.

Spain is the fastest-growing market in Europe. This rapid expansion is driven by urbanization trends and increasing internet penetration, particularly among younger demographics. Government initiatives, such as subsidies for smart home installations under the National Digitalization Plan, have played a pivotal role in accelerating adoption. For example, households adopting smart lighting systems receive reimbursement, incentivizing mass-market participation. Madrid and Barcelona are leading this transformation, with smart security systems witnessing unprecedented demand due to rising urban crime rates. Furthermore, partnerships between local utilities and tech companies have enabled bundled offerings, such as discounted smart thermostats tied to energy plans, making these solutions more accessible.

France, Italy, and the UK are poised for steady growth, albeit at varying paces. France, with its focus on eco-friendly living, is seeing increased adoption of smart HVAC controls, supported by the French Environment and Energy Management Agency (ADEME), which offers tax credits for energy-efficient upgrades. Italy, despite economic challenges, is experiencing a surge in smart kitchen appliances, driven by urbanization and a growing appetite for convenience. The UK, meanwhile, benefits from early adoption and robust 5G infrastructure, enabling seamless device integration.

KEY MARKET PLAYERS

Johnson Controls Inc. (Ireland), Honeywell International Inc. (US), Schneider Electric (France), Siemens (Germany), ASSA ABLOY (Sweden), Amazon.com, Inc. (US), Apple Inc. (US), ADT (US), Robert Bosch (Germany), ABB (Switzerland), Samsung Electronics. are the market players that are dominating the Europe smart homes market.

Top Players In The Market

Google LLC

Google dominates the Europe smart homes market through its Nest ecosystem. Nest products, including thermostats, cameras, and smart speakers, are renowned for their user-friendly interfaces and seamless integration with Android devices. The company’s strategic focus on expanding its product portfolio and enhancing interoperability has solidified its position as a market leader.

Amazon.com, Inc.

Amazon is a trailblazer in the smart speaker category with its Alexa-powered Echo devices, as per Canalys. Beyond hardware, Amazon’s strength lies in its expansive ecosystem, which integrates third-party applications and services. The company’s aggressive pricing strategy and partnerships with retailers like IKEA have further bolstered adoption. Amazon’s investment in AI and machine learning ensures continuous innovation, maintaining its competitive edge.

Philips Lighting (Signify)

Philips Lighting, now rebranded as Signify, is a pioneer in smart lighting solutions. Its flagship product, Philips Hue, is synonymous with smart lighting, offering customizable color settings and energy-saving capabilities. The company’s collaboration with major platforms like Apple HomeKit and Google Assistant enhances compatibility, while its commitment to sustainability aligns with EU regulations.

Top Strategies Used By Key Players

Key players in the Europe smart homes market employ a variety of strategies to maintain their competitive advantage. Product diversification is a cornerstone, with companies expanding their portfolios to cater to diverse consumer needs. For instance, Google and Amazon have introduced budget-friendly options alongside premium products, ensuring accessibility across income brackets. Strategic partnerships are equally critical; collaborations with utility providers, real estate developers, and telecom operators enable bundled offerings that enhance value propositions. AI integration is another focal point, with firms investing heavily in machine learning to deliver personalized experiences. For example, Philips Lighting uses AI to optimize energy consumption based on user behavior. Additionally, companies prioritize interoperability, adhering to universal standards like Matter to ensure seamless connectivity across ecosystems. These strategies collectively drive innovation, foster consumer trust, and sustain market leadership.

COMPETITION OVERVIEW

The Europe smart homes market is characterized by intense competition, with established players and emerging startups vying for dominance. Established giants like Google, Amazon, and Philips leverage brand loyalty and extensive R&D budgets to maintain their foothold, while startups disrupt the landscape with niche solutions tailored to specific demographics. For instance, smaller firms focus on affordable, DIY smart home kits targeting price-sensitive consumers. Interoperability remains a key battleground, as companies strive to create cohesive ecosystems that integrate seamlessly with third-party devices. Regulatory compliance, particularly adherence to GDPR and cybersecurity standards, further differentiates competitors. Despite consolidation efforts, such as mergers and acquisitions, the market remains highly dynamic, with innovation serving as the primary driver of differentiation.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Google acquired Wyze Labs, enhancing its smart home portfolio by integrating Wyze’s affordable IoT devices into the Nest ecosystem, thereby expanding its reach among budget-conscious consumers.

- In June 2023, Amazon partnered with IKEA, launching a co-branded range of smart home products, including affordable lighting and security systems, aimed at democratizing access to smart technologies.

- In March 2023, Philips launched AI-driven lighting systems, introducing adaptive lighting solutions that adjust based on user behavior, setting new benchmarks for energy efficiency and personalization.

- In January 2024, Samsung introduced a Matter-compatible appliance, strengthening its SmartThings platform by ensuring full compatibility with the Matter standard, addressing interoperability concerns, and enhancing user experience.

- In November 2023, Bosch integrated AI into its Home Connect platform: Enabling predictive maintenance for smart kitchen appliances, reducing downtime and enhancing functionality for tech-savvy consumers.

MARKET SEGMENTATION

This research report on the Europe smart homes market is segmented and sub-segmented into the following categories.

By Product

- Lighting Controls

- Smart Speaker

- Entertainment

- Smart Kitchen

- HVAC Controls

- Security & Access Controls

By Offering

- Behavioural

- Proactive

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the smart home market in Europe?

The market is expanding rapidly due to rising demand for energy-efficient solutions, government support for green technologies, and increasing consumer interest in home automation and convenience.

What types of smart home technologies are most popular in Europe?

Top categories include smart thermostats, security systems, lighting controls, and voice-activated assistants. Energy management and remote control features are especially sought after in European households.

How are European governments influencing the smart home industry?

EU initiatives promoting energy efficiency, digital infrastructure, and sustainable living, such as the Green Deal and smart grid development, are encouraging the adoption of smart home systems across the region.

What challenges does the smart home market face in Europe?

Key challenges include high upfront costs, concerns over data privacy, integration issues between different platforms, and slower adoption in rural or lower-income areas due to infrastructure gaps.

How are consumer preferences shaping smart home trends in Europe?

European consumers prioritize minimalistic design, energy-saving features, and systems that offer real-time control and integration with mobile devices, driving innovation in sleek, user-friendly products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com