Europe Smart Ring Main Units Market Size, Share, Trends & Growth Forecast Report By Type (Gas-Insulated, Air-Insulated, Oil-Insulated, Solid Dielectric), Installation, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Smart Ring Main Units Market Size

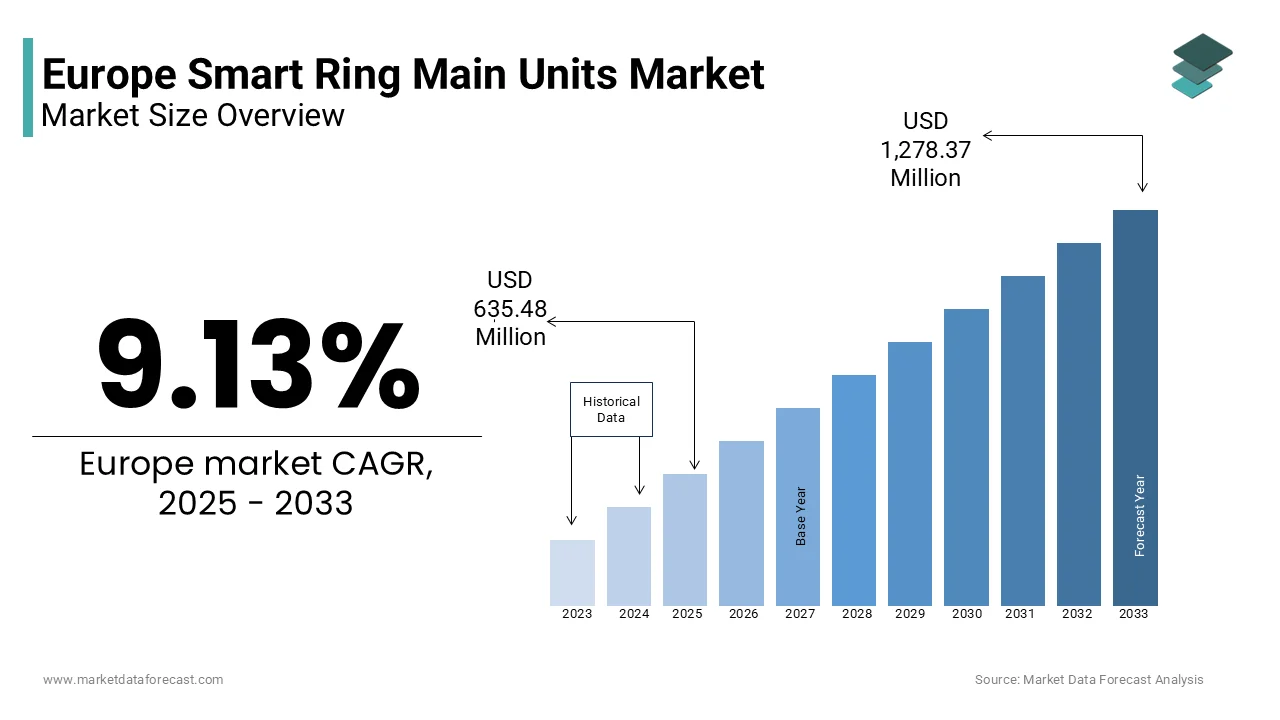

The Europe smart ring main units market size was valued at USD 582.31 million in 2024. The European market size is estimated to be worth USD 1,278.37 million by 2033 from USD 635.48 million in 2025, growing at a CAGR of 9.13% from 2025 to 2033.

Smart Ring Main Units (RMUs) are compact, modular electrical switchgear solutions designed for medium voltage distribution networks, enabling efficient power distribution with enhanced control and monitoring capabilities. These units play a crucial role in smart grid infrastructure by facilitating fault detection, load balancing, and remote operation through integrated communication protocols. In Europe, the adoption of smart RMUs is being driven by the increasing complexity of electricity distribution systems and the need for improved network reliability.

The transition toward decentralized energy generation, particularly from renewable sources, has intensified the demand for intelligent switching solutions that can manage bidirectional power flows and maintain grid stability. In addition, as per the International Energy Agency, a significant portion of European electricity distribution assets have surpassed their expected operational lifespan, prompting utilities to invest in modernized, digitally enabled equipment such as smart RMUs. Moreover, the European Commission’s Clean Energy Package emphasizes digitalization and automation across all levels of the energy value chain.

MARKET DRIVERS

Expansion of Renewable Energy Integration Requiring Advanced Grid Management

One of the primary drivers of the Europe smart ring main unit market is the rapid integration of renewable energy sources into the distribution grid. As countries shift toward solar, wind, and other distributed generation models, the need for advanced switching and protection systems becomes increasingly critical. Smart RMUs enable seamless coordination between centralized and decentralized energy flows, ensuring grid stability and minimizing disruptions caused by intermittent generation patterns. This surge has necessitated upgrades to medium voltage distribution infrastructure, where smart RMUs serve as key enablers of real-time monitoring and adaptive load management. Additionally, the deployment of smart RMUs has been instrumental in managing congestion and preventing overloads in regions with high penetration of rooftop solar and onshore wind farms. These units support automatic fault isolation and reconfiguration, enhancing system resilience and reducing downtime.

Urbanization and Modernization of Aging Electricity Infrastructure

Urbanization and Modernization of Aging Electricity Infrastructure

Another major driver fueling the growth of the Europe smart ring main unit market is the ongoing modernization of aging electricity distribution infrastructure, particularly in urban centers experiencing population growth and increased energy demand. Many European cities rely on decades-old electrical networks that lack the flexibility and responsiveness required to meet contemporary energy needs. Smart RMUs offer an efficient solution by replacing outdated switchgear with digitally integrated, space-saving alternatives that enhance reliability and operational efficiency. This demographic trend places immense pressure on utility providers to upgrade distribution systems to accommodate higher consumption levels while maintaining service continuity. Furthermore, the International Energy Agency highlights that a major share of Europe’s medium voltage assets are beyond their optimal operational lifespan, making them prone to failures and inefficiencies. Smart RMUs address these challenges by incorporating remote diagnostics, self-monitoring capabilities, and automated switching functions, thereby improving maintenance practices and reducing outage risks.

MARKET RESTRAINTS

High Capital Expenditure and Cost Sensitivity Among Smaller Utilities

A significant restraint affecting the Europe smart ring main unit market is the substantial initial investment required for procurement, installation, and integration of these advanced switchgear systems. While smart RMUs offer long-term benefits in terms of operational efficiency and reduced downtime, the upfront costs associated with their deployment often deter smaller utility providers and municipalities with limited financial capacity. Additionally, the average cost of a fully integrated smart RMU unit with SCADA connectivity is approximately two to three times higher than conventional switchgear. This price differential makes it challenging for financially constrained operators to justify immediate replacements, especially when older systems remain functionally viable despite lower performance levels. Moreover, funding mechanisms for grid modernization projects vary widely across the EU, leading to disparities in adoption rates. Countries such as Poland and Bulgaria face difficulties securing public or private financing due to less mature regulatory frameworks and weaker creditworthiness among local utilities.

Technical Complexity and Limited Skilled Workforce for Implementation

Another critical constraint impeding the widespread adoption of smart ring main units in Europe is the technical complexity involved in their deployment and the shortage of skilled personnel capable of managing sophisticated digital switchgear systems. Unlike traditional RMUs, smart variants require integration with supervisory control and data acquisition (SCADA) systems, cybersecurity protocols, and real-time analytics platforms—capabilities that many existing utility teams are not fully equipped to handle. This skills gap delays project timelines and increases reliance on external consultants, further escalating implementation costs. Apart from these, there has been a noticeable decline in specialized electrical engineering enrollments across several EU countries, exacerbating workforce shortages in the energy sector.

Furthermore, the diversity of communication protocols used in smart RMUs—ranging from IEC 61850 to DNP3—creates additional complications for engineers attempting to ensure interoperability across different vendor systems.

MARKET OPPORTUNITIES

Integration with Smart Cities and Digital Infrastructure Initiatives

A significant opportunity driving the Europe smart ring main unit market is its growing integration with smart city initiatives and broader digital infrastructure development plans. As urban centers strive to become more sustainable, efficient, and technologically advanced, the demand for intelligent power distribution solutions has surged. Smart RMUs, with their ability to facilitate real-time monitoring, remote control, and predictive maintenance, align perfectly with the objectives of smart city frameworks. These projects aim to optimize energy usage, reduce carbon emissions, and enhance grid resilience through the deployment of digital switchgear such as smart RMUs. For example, in Copenhagen, the municipal utility company implemented a smart grid program that included the installation of RMUs equipped with IoT-enabled sensors to improve fault detection and minimize service interruptions. These efforts are supported by Horizon Europe, the EU’s flagship research and innovation funding program, which encourages the development of interconnected urban energy ecosystems.

Adoption of Digital Substations and Automation Technologies

The increasing adoption of digital substations and automation technologies presents a compelling opportunity for the Europe smart ring main unit market. As utilities seek to enhance grid reliability, reduce operational costs, and integrate renewable energy sources more efficiently, the transition from conventional to digital substations is accelerating. Smart RMUs play a pivotal role in this transformation by serving as modular, intelligent nodes within automated distribution networks. These substations leverage smart RMUs equipped with embedded sensors and communication interfaces to provide continuous monitoring of electrical parameters, enabling proactive maintenance and faster fault resolution.

Moreover, digital substations incorporating smart RMUs can reduce maintenance costs and improve outage response times. This efficiency gain is particularly valuable for grid operators managing complex, decentralized power flows from renewable sources. The European Network of Transmission System Operators for Electricity (ENTSO-E) has also endorsed the expansion of digital infrastructure, emphasizing its role in supporting grid flexibility and cybersecurity.

MARKET CHALLENGES

Interoperability Issues Across Vendor-Specific Communication Protocols

One of the foremost challenges confronting the Europe smart ring main unit market is the lack of standardization in communication protocols across different manufacturers, resulting in interoperability issues that hinder seamless integration within multi-vendor environments. Smart RMUs must interface with various grid automation systems, SCADA platforms, and enterprise software applications to deliver their full functionality. However, the absence of universally adopted standards complicates data exchange, limits scalability, and increases operational complexity. However, progress has been slow due to varying national regulations, vendor-specific implementations, and legacy infrastructure constraints. This fragmentation not only increases deployment costs but also restricts utilities from selecting best-in-class components without worrying about compatibility concerns.

Regulatory Fragmentation and Compliance Requirements Across European Countries

Regulatory fragmentation across European countries poses a significant challenge to the uniform expansion of the smart ring main unit market. Each country maintains distinct technical specifications, certification procedures, and compliance requirements for electrical equipment, making it difficult for manufacturers to deploy standardized products across multiple markets. This inconsistency increases both time-to-market and development costs, discouraging smaller players from entering the space.

According to the European Union Agency for Regulation and Competitiveness in Energy (ACER), differences in national grid codes and conformity assessment procedures have created administrative hurdles for suppliers seeking pan-European market access. This situation is particularly pronounced in Central and Eastern Europe, where regulatory frameworks are still evolving compared to Western European counterparts. The lack of a unified regulatory approach hampers economies of scale and slows down the adoption of standardized smart RMU solutions across the continent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.13% |

|

Segments Covered |

By Type, Installation, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

ABB, Eaton, Schneider Electric, CG Power and Industrial Solutions Ltd., Siemens, Lucy Group Ltd., LS ELECTRIC Co., Ltd., HD HYUNDAI ELECTRIC CO., LTD., Toshiba Energy Systems & Solutions Corporation, alfanar Group, CHINT Group, and Bonomi Eugenio SpA, and others. |

SEGMENT ANALYSIS

By Type Insights

The gas-insulated segment held the largest share of the Europe AMI electric meter market, accounting for a 38.2% of total value in 2024. This dominance is primarily attributed to the superior performance characteristics of gas-insulated ring main units (RMUs), particularly their compact design, high dielectric strength, and enhanced safety features, making them ideal for densely populated urban areas and industrial applications. According to the International Electrotechnical Commission, gas-insulated switchgear, especially those using sulfur hexafluoride (SF6) or alternative eco-friendly gases, has become the preferred choice for medium voltage distribution networks across Western Europe. Additionally, the European Union’s F-Gas Regulation has prompted manufacturers to develop low-GWP alternatives, ensuring compliance with environmental directives without compromising performance.

The solid dielectric RMU segment is projected to grow at the fastest CAGR of approximately 9.2%. This rapid expansion is fueled by increasing demand for environmentally friendly insulation solutions that eliminate the risks associated with gas leaks and oil contamination. Solid dielectric technology uses epoxy resin-based insulation materials that offer high mechanical durability, fire resistance, and minimal maintenance, aligning with the European Commission’s push for greener electrical infrastructure. The absence of pressurized components also simplifies installation and reduces operational complexity, making these units attractive for rural and semi-urban deployments. Furthermore, solid dielectric RMUs are increasingly being integrated into microgrid and decentralized energy systems, where safety and environmental compliance are critical.

By Installation Insights

The outdoor installation segment commanded the Europe AMI electric meter market, capturing a 56.8% of total market share in 2024. This leading position is primarily driven by the widespread deployment of smart meters in utility substations, distribution poles, and underground transformer stations, which require robust external enclosures to withstand harsh environmental conditions. Countries such as Germany and Spain have prioritized outdoor RMU installations in their national smart grid modernization programs, citing the need for reliable equipment in open-air substations that serve both urban and rural consumers. Additionally, according to the European Environment Agency, outdoor AMI electric meters are essential for managing power distribution in extreme climatic conditions, including heavy rainfall, snowfall, and temperature fluctuations. Also, outdoor RMUs play a crucial role in integrating renewable energy sources, particularly wind farms and solar parks located in remote regions.

The indoor installation segment of the Europe AMI electric meter market is experiencing the highest growth rate, registering a CAGR of approximately 8.7%. This acceleration is largely driven by rising demand for compact and space-efficient metering solutions within commercial buildings, data centers, and industrial facilities where indoor electrical rooms are standard. According to a study published by McKinsey & Company, the shift toward digitization in manufacturing and logistics sectors has increased the need for intelligent indoor RMUs that support real-time energy monitoring and predictive maintenance. In response, several European cities have introduced smart building codes requiring advanced metering systems to be housed indoors for easier access and protection against environmental degradation. Moreover, the European Commission’s Smart Cities and Communities Initiative encourages indoor RMU adoption in mixed-use residential towers and business hubs to facilitate localized energy trading and demand-side management.

By End-User Insights

Distribution utilities was the top performer in end-user segment in the Europe AMI electric meter market, holding a 45.6% of total market share in 2024. This is linked to the central role played by utility companies in deploying smart grid infrastructure to enhance network efficiency, improve billing accuracy, and comply with regulatory mandates. Furthermore, as per the International Energy Agency, distribution utilities in Italy, France, and the UK have completed or are nearing full coverage of residential smart metering, significantly boosting the segment’s market presence. Given their pivotal role in managing electricity distribution, distribution utilities remain the primary adopters of AMI electric meters across the region.

The transportation segment is emerging as the fastest-growing end-user category in the Europe AMI electric meter market, recording a projected CAGR of 10.3%. This rapid growth is driven by the electrification of public transport networks, including metro systems, light rail, and electric vehicle charging infrastructure, all of which require precise and intelligent energy measurement. Additionally, railway operators in Germany and Sweden have integrated AMI electric meters into traction substations to monitor energy consumption and optimize regenerative braking efficiency. Moreover, the European Green Deal’s “Sustainable and Smart Mobility Strategy” emphasizes the need for digitalized transport electrification, encouraging governments to mandate smart metering for charging stations and transit depots. With continued investment in clean mobility and grid-connected transport infrastructure, the transportation segment is poised for sustained high-growth in the AMI electric meter market.

REGIONAL ANALYSIS

Germany had the largest market share in the Europe AMI electric meter industry, contributing a 23.6% of total regional revenue in 2024. As Europe’s largest economy and a global leader in energy transition, Germany has made significant strides in deploying smart metering systems to support its ambitious decarbonization goals. Moreover, the integration of renewable energy sources, particularly wind and solar, has necessitated robust metering infrastructure to manage intermittent generation and ensure grid stability. With continued investment from both public and private sectors, Germany remains at the forefront of smart meter adoption in Europe.

France has achieved one of the highest smart meter penetration rates in Europe due to its well-structured and centrally coordinated deployment strategy. Enedis, the national grid operator, completed the rollout of its Linky smart meter program ahead of schedule. The success of the Linky rollout has set a benchmark for other EU nations considering large-scale smart meter implementations. Furthermore, France’s energy policy emphasizes nuclear-powered baseload generation alongside expanding renewable capacity, necessitating advanced metering for efficient demand-side management. With strong government backing and high consumer acceptance, France continues to be a key driver of AMI market growth in Europe.

Italy was among the first countries globally to implement a nationwide smart metering system, having launched its Telegestore project back in 2001—making it a pioneer in the space. Also, it’s early adoption of smart metering has led to substantial operational savings, reducing non-technical losses and enabling dynamic tariff structures that encourage off-peak consumption. Italy’s strategic focus on digitalizing its energy infrastructure aligns with broader European Union objectives.

The United Kingdom has made significant progress in smart meter deployment through its nationwide Smart Metering Implementation Programme (SMIP), managed by Ofgem. Like, this rollout has facilitated better energy usage insights, reduced supplier switching barriers, and supported the introduction of time-of-use tariffs that benefit consumers financially. Additionally, the UK government’s net-zero strategy, which targets a fully decarbonized power system by 2035, has reinforced the necessity of smart metering for managing distributed energy resources and demand response programs.

Spain’s national smart metering program, led by Red Eléctrica de España (REE), has seen steady progress. It’s commitment to renewable energy expansion has intensified the need for smart metering systems that can accommodate variable generation from distributed solar PV installations. According to the Institute for Diversification and Saving of Energy (IDAE), rooftop solar capacity in Spain surpassed 18 GW in 2024, up from just 5 GW in 2020, highlighting the growing interdependence between decentralized generation and advanced metering. As per Eurelectric, Spain’s smart metering initiatives are also fostering new business models such as peer-to-peer energy trading and virtual net metering.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

ABB, Eaton, Schneider Electric, CG Power and Industrial Solutions Ltd., Siemens, Lucy Group Ltd., LS ELECTRIC Co., Ltd., HD HYUNDAI ELECTRIC CO., LTD., Toshiba Energy Systems & Solutions Corporation, alfanar Group, CHINT Group, and Bonomi Eugenio SpA are the key market players in the Europe smart ring main unit market.

The competition in the Europe smart ring main unit market is characterized by a convergence of established global manufacturers and regionally focused innovators, all striving to meet the growing demand for intelligent and sustainable electrical infrastructure. With increasing investments in grid modernization, renewable energy integration, and smart city initiatives, the sector is witnessing heightened activity from both traditional power equipment suppliers and emerging digital solution providers. Vendors are under pressure to differentiate themselves not only through advanced product design but also through superior digital integration, interoperability, and customer support services. The market sees intense rivalry in areas such as modularity, environmental compliance, and cybersecurity, as utilities seek robust and future-ready RMU solutions. Additionally, the push toward standardization and cross-vendor compatibility is reshaping vendor strategies, compelling companies to align more closely with industry frameworks and regulatory directives. As a result, the landscape remains dynamic, with continuous innovation and strategic adaptation shaping the competitive dynamics across the region.

TOP PLAYERS IN THIS MARKET

Siemens Energy

One of the leading players in the Europe smart ring main unit market is Siemens Energy, a global powerhouse in energy technology and infrastructure solutions. The company has been at the forefront of developing intelligent switchgear systems that integrate seamlessly with digital grid management platforms. Siemens' strong R&D focus enables it to deliver highly reliable, scalable, and secure smart RMUs tailored for medium voltage distribution networks across urban and industrial settings.

ABB Ltd.

Another key player is ABB Ltd., a Swiss multinational corporation known for its innovation in electrification and automation technologies. ABB offers a comprehensive portfolio of smart RMUs designed to support grid modernization, renewable integration, and decentralized energy systems. Its commitment to sustainability and digital transformation has positioned it as a preferred partner for utilities and industrial clients across Europe.

Schneider Electric

Schneider Electric, headquartered in France, is also a major contributor to the European smart RMU landscape. The company emphasizes modular, space-saving, and eco-efficient designs that align with Europe’s evolving grid resilience and decarbonization goals. Schneider’s EcoStruxure platform integrates smart RMUs into broader energy management ecosystems, enabling real-time monitoring, predictive maintenance, and improved operational efficiency across multiple sectors.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

A primary strategy employed by leading players in the Europe smart ring main unit market is product innovation and technological differentiation . Companies are investing heavily in research and development to introduce RMUs with enhanced digital capabilities, such as embedded sensors, remote diagnostics, and cybersecurity features that align with smart grid requirements.

Another critical approach is strategic partnerships and collaborations with utility providers, system integrators, and regulatory bodies . These alliances help vendors align their product roadmaps with regional deployment needs and ensure compliance with evolving technical and environmental standards across different European markets.

Lastly, expanding service offerings beyond hardware to include software-driven asset management and lifecycle support has become a key differentiator among top players. By offering end-to-end digital solutions, companies can provide added value to customers, ensuring long-term engagement and strengthening their competitive positioning in an increasingly sophisticated market environment.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Siemens Energy launched a next-generation gas-insulated smart RMU featuring integrated IoT connectivity and AI-enabled fault detection capabilities, aimed at enhancing grid reliability and supporting digital substation expansion across Germany and Scandinavia.

- In June 2024, ABB Ltd. formed a strategic collaboration with a leading European utility provider to co-develop a customized smart RMU platform optimized for high-penetration renewable integration, reinforcing its position in the distributed energy ecosystem.

- In August 2024, Schneider Electric introduced a new line of solid dielectric RMUs specifically designed for indoor applications in commercial and industrial facilities, targeting growth in smart building and microgrid deployments across France and Benelux countries.

- In October 2024, Efacec , a Portuguese energy technology firm, expanded its production capacity for smart RMUs to meet rising demand driven by Portugal's national smart grid initiative and regional exports to Southern and Eastern Europe.

- In December 2024, General Electric’s Grid Solutions division announced the deployment of its latest digital twin-enabled RMU management system in partnership with a major Italian DSO, aiming to improve predictive maintenance and outage response times across urban distribution networks.

MARKET SEGMENTATION

This research report on the Europe smart ring main units market is segmented and sub-segmented into the following categories.

By Type

- Gas-Insulated

- Air-Insulated

- Oil-Insulated

- Solid Dielectric

By Installation

- Outdoor

- Indoor

By End-User

- Distribution Utilities

- Industries

- Infrastructure & Transportation

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the smart ring main units market in Europe?

Key drivers include growing investments in smart grid infrastructure, increasing demand for reliable and automated power distribution, and the adoption of renewable energy sources.

2. Which industries are contributing most to the demand for smart ring main units in Europe?

Major contributors include utilities, renewable energy projects, industrial facilities, and urban infrastructure development.

3. Which countries in Europe are leading in the adoption of smart RMUs?

Countries such as Germany, France, the UK, and the Netherlands are at the forefront due to strong grid modernization initiatives and energy transition policies.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com