Europe Soda Ash Market Size, Share, Trends & Growth Forecast Report By End-Use Industry (Glass, Soaps & Detergents, Water Treatment, Chemicals, Pulp & Paper, Metallurgy), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Soda Ash Market Size

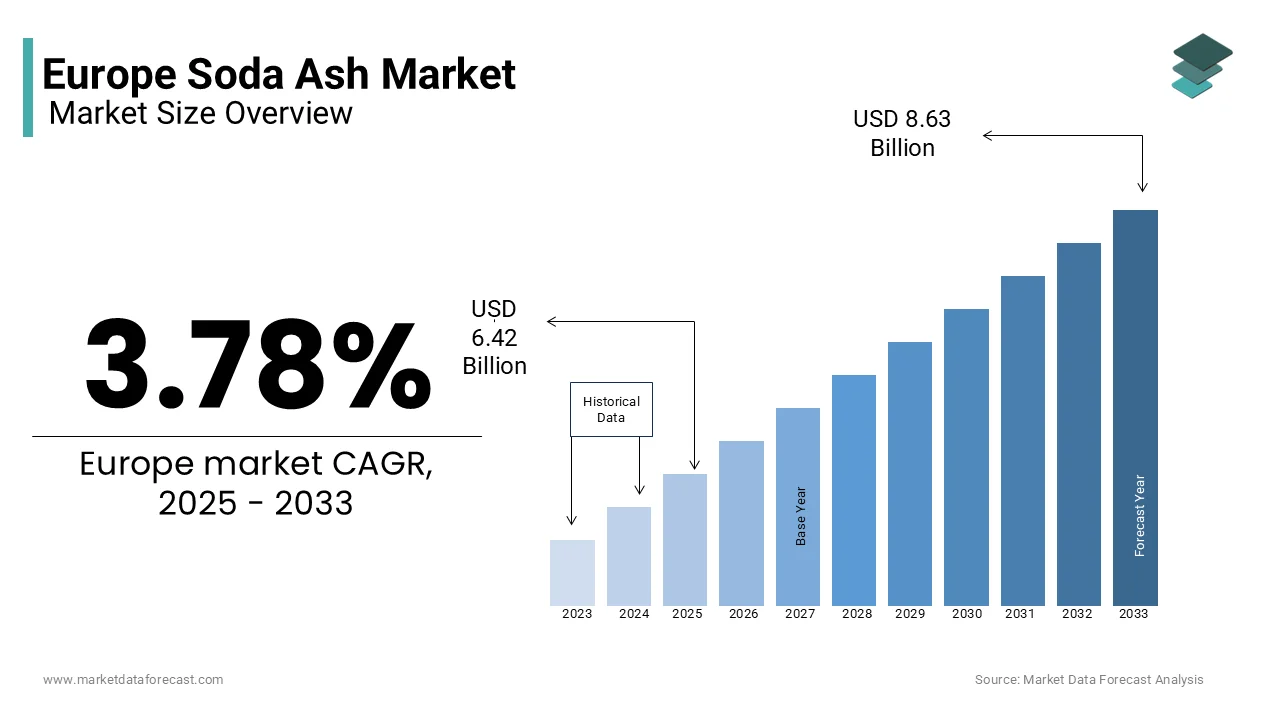

The Soda Ash market size in Europe was valued at USD 6.18 billion in 2024. The European market is estimated to be worth USD 8.63 billion by 2033 from USD 6.42 billion in 2025, growing at a CAGR of 3.78% from 2025 to 2033.

Soda ash or sodium carbonate (Na₂CO₃) is indispensable in industrial processes due to its alkaline properties and versatility and serves as a vital raw material across diverse sectors such as glass manufacturing, detergents, chemicals, and metallurgy. The demand for soda ash in Europe is on the rise due to the increasing demand for flat glass, container glass, and specialty chemicals. The European Environment Agency reports that soda ash consumption in the glass industry, which accounts for nearly 50% of total demand, grew by 6% annually between 2020 and 2023, driven by urbanization and infrastructure development. Additionally, the rise of eco-friendly detergents and water treatment solutions has bolstered demand for soda ash in household and industrial applications. The UK Office for National Statistics notes that investments in green technologies for soda ash production surged by 10% in 2022, further propelling this trend. As Europe continues to prioritize innovation and sustainable practices, the soda ash market is poised for robust expansion, playing a pivotal role in shaping the continent’s industrial and environmental future.

MARKET DRIVERS

Growing Demand in the Glass Manufacturing Industry

The increasing demand for soda ash in the glass manufacturing industry is a major driver of the European market. The European Environment Agency highlights that soda ash is a critical raw material in flat and container glass production, accounting for nearly 50% of total consumption. Eurostat reports that the glass industry’s demand for soda ash grew by 6% annually between 2020 and 2023, driven by urbanization, infrastructure development, and the growing emphasis on energy-efficient buildings. Additionally, the European Glass Federation notes that the rise of renewable energy projects, such as solar panels, has further boosted demand for high-quality glass, which relies heavily on soda ash. As Europe prioritizes sustainable construction practices under the EU Green Deal, the demand for soda ash in glass applications is set to increase, ensuring its prominence in the market.

Expansion in Detergents and Water Treatment Applications

The expansion of soda ash usage in detergents and water treatment applications is another key driver propelling the European soda ash market. The UK Office for National Statistics reports that demand for eco-friendly detergents surged by 8% annually between 2020 and 2023, driven by consumer awareness and EU regulations promoting biodegradable cleaning products. Soda ash serves as a key ingredient due to its excellent cleaning and softening properties. Furthermore, the European Environment Agency highlights that soda ash is widely used in water treatment processes to regulate pH levels and remove impurities, with demand growing by 5% annually amid rising urbanization and industrialization. As Europe continues to invest in sustainable water management and green household products, soda ash remains indispensable, driving steady growth in these sectors.

MARKET RESTRAINTS

Stringent Environmental Regulations on Production

Stringent environmental regulations targeting soda ash production pose a significant challenge to the European market. The European Environment Agency highlights that traditional soda ash manufacturing processes, particularly the Solvay process, are energy-intensive and emit substantial amounts of greenhouse gases, leading to increased scrutiny under the EU Emissions Trading System (ETS). Eurostat reports that compliance with these regulations has raised production costs by up to 20% since 2020, particularly for smaller manufacturers. Additionally, FranceAgriMer notes that restrictions on carbon emissions have forced companies to invest in cleaner technologies, further straining profitability. While these measures aim to reduce environmental impact, they also slow market growth by increasing operational costs and complicating supply chains, limiting the industry's ability to meet rising demand efficiently.

Competition from Substitute Materials

Competition from substitute materials presents another major restraint for the European soda ash market. The European Chemical Industry Council (CEFIC) reports that alternative chemicals, such as caustic soda and lime-based products, are increasingly replacing soda ash in certain applications like detergents and water treatment due to their lower costs and reduced environmental impact. Eurostat highlights that substitutes captured approximately 15% of potential soda ash applications in 2022, driven by advancements in formulation technologies. Furthermore, the UK Office for National Statistics notes that consumer preferences for phosphate-free detergents have accelerated this shift, reducing soda ash demand in household cleaning products. While soda ash remains versatile, its higher cost and environmental concerns compared to substitutes limit adoption in specific sectors, creating challenges for market expansion.

MARKET OPPORTUNITIES

Growth in Renewable Energy and Solar Glass Applications

The increasing adoption of renewable energy solutions presents a significant opportunity for the European soda ash market. The European Environment Agency reports that soda ash is a critical component in the production of solar glass, which is essential for photovoltaic panels. Eurostat highlights that Europe’s solar energy capacity expanded by 25% annually between 2020 and 2023, driven by the EU Green Deal’s renewable energy targets. This surge has directly increased demand for high-quality flat glass, which relies heavily on soda ash. Additionally, FranceAgriMer notes that investments in solar infrastructure are projected to grow by 15% annually, further boosting soda ash consumption. As Europe accelerates its transition to clean energy, the demand for soda ash in solar glass manufacturing is set to rise, positioning it as a key growth driver in the market.

Expansion in Eco-Friendly Detergents and Cleaning Products

The rising demand for eco-friendly detergents and cleaning products offers another promising opportunity for the European soda ash market. The UK Office for National Statistics reports that consumer spending on biodegradable and phosphate-free detergents grew by 10% annually between 2020 and 2023, driven by EU regulations promoting sustainable household products. Soda ash serves as an effective and environmentally friendly alternative to phosphates, enhancing cleaning performance while reducing water pollution. Furthermore, the European Environment Agency highlights that soda ash’s role in industrial cleaning applications, such as pH regulation and descaling, has grown by 7% annually, supported by stricter water treatment standards. As industries and consumers prioritize sustainability, soda ash is poised to benefit significantly from this shift toward greener cleaning solutions.

MARKET CHALLENGES

Volatility in Raw Material and Energy Costs

The volatility in raw material and energy costs poses a significant challenge to the European soda ash market. The European Environment Agency reports that soda ash production is highly energy-intensive, with energy expenses accounting for approximately 40% of total production costs. Eurostat highlights that energy prices surged by 60% in 2022, driven by geopolitical tensions and supply chain disruptions, severely impacting manufacturers' profitability. Additionally, FranceAgriMer notes that fluctuations in the availability and pricing of key raw materials, such as limestone and sodium chloride, have further strained operations. Smaller producers, in particular, face difficulties in absorbing these financial pressures, limiting their ability to innovate or expand capacity. This cost instability creates uncertainties in meeting rising demand and hinders long-term growth prospects for the market.

Intense Competition from Low-Cost Imports

Intense competition from low-cost imports presents another major challenge for the European soda ash market. The European Chemical Industry Council (CEFIC) highlights that imports from countries like Turkey and China account for nearly 25% of Europe’s soda ash supply, driven by lower production costs and aggressive pricing strategies. These imports often undercut domestic manufacturers, creating pricing pressures and eroding profit margins. Furthermore, the UK Office for National Statistics reports that non-EU imports sometimes fail to meet Europe’s stringent quality and environmental standards, leading to concerns about unfair trade practices. While anti-dumping measures have been introduced to mitigate this issue, they have not fully addressed the problem. As manufacturers strive to differentiate through innovation and sustainability, overcoming this competitive pressure remains a critical hurdle for market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.78% |

|

Segments Covered |

By End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Solvay AS, Tronox Ltd., Solvents, Zagros Petrochemical Company, Croda International, BASF SE, and others. |

SEGMENTAL ANALYSIS

By End Use Industry Insights

The glass segment was the largest end-use segment in the European soda ash market by accounting for 50.7% of the European market share in 2024. The critical role soda ash plays in glass manufacturing, particularly in flat glass, container glass, and specialty glass used for solar panels is majorly propelling the expansion of the glass segment in the European soda ash market. The European Glass Federation reports that soda ash consumption in this sector grew by 6% annually between 2020 and 2023, fueled by urbanization, infrastructure development, and the growing emphasis on energy-efficient buildings. Additionally, the UK Office for National Statistics notes that rising investments in renewable energy projects, such as solar panel production, have further boosted demand. As Europe prioritizes sustainable construction and clean energy, the glass and ceramics segment remains pivotal in driving the soda ash market.

The water treatment segment is the fastest-growing end-use industry in the European soda ash market and is projected to expand at a CAGR of 7.2% over the forecast period. The growth of the water treatment segment is primarily fueled by increasing demand for soda ash in municipal and industrial water treatment processes, where it is used for pH regulation, softening, and contaminant removal. The European Environment Agency highlights that stricter water quality standards under the EU Water Framework Directive have accelerated adoption, with demand growing by 8% annually since 2020. FranceAgriMer notes that rising urbanization and industrialization have intensified the need for effective water treatment solutions, further propelling soda ash usage. As Europe continues to invest in sustainable water management practices, the water treatment segment is set to play a transformative role in shaping the future of the soda ash market.

REGIONAL ANALYSIS

Germany held the largest share of the European soda ash market by holding 30.6% of the European market share in 2024. The lead of Germany in the European market is majorly driven by its robust glass manufacturing and chemical industries that extensively use soda ash for applications like flat glass, container glass, and specialty chemicals. The Federal Ministry for Economic Affairs and Climate Action highlights Germany’s focus on sustainability, with stringent EU regulations promoting eco-friendly solutions like energy-efficient building materials. Additionally, Germany’s advanced R&D capabilities and strong emphasis on renewable energy projects, such as solar panel production, further solidify its dominance, ensuring it remains a key player in shaping the future of the soda ash market.

France held a notable share of the European soda ash market in 2024. The prominence of France is largely attributed to its thriving detergents and water treatment sectors, where soda ash is extensively used for pH regulation, softening, and contaminant removal. France’s adherence to EU environmental regulations has accelerated the adoption of sustainable water management practices, meeting consumer demand for eco-friendly solutions. Additionally, the country’s growing emphasis on urbanization and industrialization has increased demand for soda ash in municipal water treatment and household cleaning products. With its reputation for innovation and commitment to green practices, France continues to be a significant contributor to the growth of the soda ash market, reinforcing its importance in Europe.

The UK is a notable market for soda ash in the European region and is predicted to witness a noteworthy CAGR during the forecast period. The soda ash market growth in the UK is fueled by rising investments in renewable energy projects, particularly solar panel production, which relies heavily on soda ash for high-quality glass. Additionally, urban infrastructure development and retrofitting aging buildings have boosted demand for flat and container glass, further driving soda ash consumption. The UK’s focus on achieving net-zero carbon emissions by 2050 has also spurred the adoption of sustainable industrial practices. This focus on innovation and environmental sustainability underscores the UK’s importance in the European soda ash landscape.

KEY MARKET PLAYERS

The major key players in Europe Soda Ash market are Solvay AS, Tronox Ltd., Solvents, Zagros Petrochemical Company, Croda International, BASF SE, and others.

MARKET SEGMENTATION

This research report on the Europe soda ash market is segmented and sub-segmented into the following categories.

By End-Use Industry

- Glass

- Soaps & Detergents

- Water Treatment

- Chemicals

- Pulp & Paper

- Metallurgy

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com