Europe Subsea Pumps Market Size, Share, Trends & Growth Forecast Report By Type (Centrifugal, Helico-Axial, Hybrid Pump, Twin Screw, Co-Axial, Electrical Submersible Pump), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Subsea Pumps Market Size

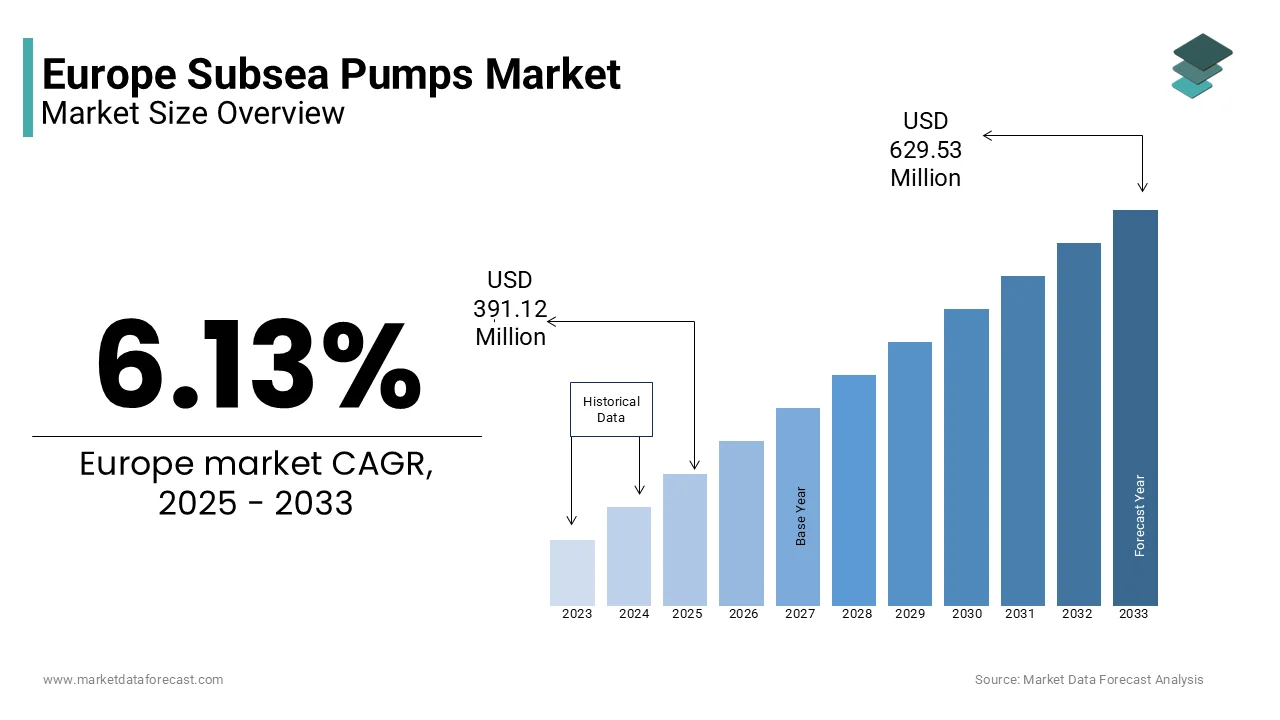

The Europe Subsea Pumps market size was valued at USD 368.53 million in 2024. The European market is estimated to be worth USD 629.53 million by 2033 from USD 391.12 million in 2025, growing at a CAGR of 6.13% from 2025 to 2033.

MARKET DRIVERS

The Europe Subsea Pumps market is witnessing substantial growth fueled by increasing offshore exploration activities and the rising demand for efficient oil and gas extraction technologies. Europe’s Subsea Pumps market growth is attributed to the growing adoption of enhanced oil recovery techniques and the shift toward deeper offshore reserves. Additionally, the escalating focus on reducing carbon footprints has spurred innovation in subsea pump designs is optimizing energy efficiency.

MARKET RESTRAINTS

One significant restraint impacting the Europe Subsea Subsea Pumps is the high capital investment and operational costs associated with deploying and maintaining these systems. Subsea Pumpsare intricate pieces of equipment designed to withstand extreme pressures, corrosive environments, and low temperatures, which makes their manufacturing and installation expensive. According to a cost analysis by the Society of Petroleum Engineers, the initial capital outlay for subsea pumping systems can range from 50millionto150 million per project, depending on the depth and complexity of the field. This financial burden often discourages smaller operators from adopting the technology, in regions with lower oil prices. Additionally, as per data published by Offshore Magazine, maintenance costs for Subsea Pumpscan account for up to 25% of the total lifecycle expenses due to the challenges of accessing equipment located thousands of feet below the surface. These factors create barriers to widespread adoption during periods of economic uncertainty when companies prioritize cost containment over technological upgrades.

Another restraint is the technical and environmental risks associated with subsea pump operations. Equipment failures or leaks in deepwater environments can lead to catastrophic consequences, both environmentally and financially. According to a study conducted by the European Marine Safety Agency, subsea system malfunctions account for nearly 15% of offshore accidents, with repair times averaging six months due to the complexity of interventions in remote locations. Furthermore, as per an analysis by Lloyd’s Register, the increasing focus on environmental regulations in Europe has heightened the scrutiny on subsea technologies, with non-compliance potentially resulting in fines exceeding €10 million. This regulatory pressure adds another layer of complexity for operators who must balance innovation with compliance. Additionally, harsh marine conditions, such as those found in the North Sea, exacerbate wear and tear, reducing equipment lifespan. These combined challenges make subsea pump deployment less attractive for projects in environmentally sensitive areas where the stakes are higher and margins thinner.

MARKET OPPORTUNITIES

One significant opportunity for the Europe Subsea Subsea Pumps lies in the growing emphasis on renewable energy integration and hybrid offshore systems. The Subsea Pumpsare increasingly being explored for applications beyond traditional oil and gas, such as supporting offshore wind farms and hydrogen production. According to a report by the European Wind Energy Association, offshore wind capacity in Europe is projected to reach 150 GW by 2030, with floating wind farms expected to play a pivotal role. Subsea Pumpscan enhance the efficiency of these installations by managing water cooling systems or facilitating hydrogen transfer from electrolysis units located offshore. Furthermore, as per DNV, an international accredited registrar and classification society is integrating subsea technologies into renewable projects could reduce operational costs by up to 20% by making them more competitive against conventional energy sources. This diversification into renewables not only broadens the market scope but also aligns with Europe’s broader sustainability goals by positioning subsea pump manufacturers as key contributors to the energy transition.

The advancements in digitalization and predictive maintenance technologies is enhancing the growth opportunities for the Europe Subsea Subsea Pumps. The adoption of Industry 4.0 solutions, such as IoT-enabled sensors and AI-driven analytics, is transforming how Subsea Pumpsare monitored and maintained. According to a study by McKinsey & Company, predictive maintenance can reduce equipment downtime by up to 50% while cutting maintenance costs by 20-30%. For instance, Equinor has reported a 35% improvement in pump reliability after implementing real-time monitoring systems in its subsea operations. These innovations enable operators to address issues proactively, minimizing costly repairs and extending equipment lifespan.

MARKET CHALLENGES

One of the major challenges facing the Europe Subsea Subsea Pumps is the complexity of installation and maintenance in ultra-deepwater environments. Those exceeding 1,500 meters in the Atlantic Margin or the Mediterranean, the technical demands on Subsea Pumpsincrease significantly. According to a study by the International Maritime Organization, the cost of deploying subsea equipment in ultra-deepwater fields can be three times higher than in shallow-water projects due to the need for specialized vessels and robotics. Additionally, as per a report by Subsea Valley, an industry cluster organization, over 40% of subsea pump failures are attributed to installation errors or harsh environmental conditions, which are exacerbated by limited accessibility for repairs. The high reliance on remotely operated vehicles (ROVs) for maintenance further complicates operations, with average intervention costs reaching €2 million per event. These logistical and financial hurdles make deepwater projects less attractive for smaller operators and slow down the adoption of subsea pumping technologies despite their potential to unlock untapped reserves.

Another critical challenge is the shortage of skilled professionals capable of managing advanced subsea technologies. The rapid evolution of subsea systems, including multiphase and electrically powered pumps, requires expertise in both traditional engineering and cutting-edge digital tools. According to a workforce analysis by Oil & Gas UK, the European energy sector faces a projected skills gap of approximately 30% by 2030, with subsea technology being one of the most underserved areas. Furthermore, as per data published by the European Federation of Energy Trainers, only 15% of current offshore workers have received training in digital subsea solutions like predictive analytics or AI-driven diagnostics. This lack of qualified personnel not only increases operational risks but also limits innovation and efficiency gains. Bridging this skills gap will require significant investment in education and training programs, which many companies are hesitant to undertake amid economic uncertainties.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.13% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Aker Solutions ASA, Baker Hughes Company, TechnipFMC PLC, Halliburton Company, Schlumberger Limited (OneSubsea), Sulzer Ltd., Flowserve Corporation, National Oilwell Varco (NOV), General Electric Company (GE Oil & Gas), Framo AS, Leistritz Pumpen GmbH, SPX Corporation, and others. |

SEGMENT ANALYSIS

By Type Insights

The electrical Submersible Pumps (ESPs) segment dominated the Europe Subsea Subsea Pumps with a share of 45.4% in 2024. This dominance is driven by their versatility and efficiency in handling high-volume fluid extraction across deepwater fields. ESPs are particularly favored in mature oilfields where natural reservoir pressure has declined, necessitating artificial lift solutions. According to Baker Hughes, ESP systems can increase production rates by up to 30% compared to conventional pumping methods by making them indispensable for maximizing recovery. Another factor propelling the market growth is the growing adoption of digitalization. As stated by DNV, over 60% of ESP installations now incorporate IoT-enabled sensors is allowing operators to monitor performance in real-time and reduce downtime by 25%. Furthermore, the rising demand for energy security in Europe has spurred investments in offshore projects, with Norway alone accounting for €10 billion in ESP-related expenditures in 2022, according to the Norwegian Petroleum Directorate.

The hybrid pumps segment is projected to reach highest growth rate during the forecast period. The growth of the segment is driven by their ability to combine the advantages of centrifugal and positive displacement technologies by enabling efficient operation in diverse subsea conditions. A key driver of this expansion is the increasing exploration of marginal fields, where hybrid pumps offer cost-effective solutions for low-pressure reservoirs. According to a report by Rystad Energy, hybrid pump systems can reduce operational costs by up to 20% in such fields due to their adaptability and lower maintenance requirements. Additionally, the push toward sustainability plays a crucial role. Equinor reported that hybrid pumps consume 15% less energy than traditional systems, aligning with Europe’s stringent environmental regulations. The European Investment Bank has allocated over €5 billion to support sustainable offshore technologies, further accelerating hybrid pump adoption. These factors, combined with their flexibility and alignment with green energy goals, make hybrid pumps the fastest-growing segment in the market.

By Application Insights

The subsea boosting segment was the largest and held 40.1% of the Europe prothrombin complex concentrate market share in 2024. The growth of the segment is attributed in the increasing need to enhance oil and gas recovery from mature fields, where natural reservoir pressure has declined over time. According to a study by Rystad Energy, subsea boosting systems can improve production rates by up to 25% by making them indispensable for operators seeking to maximize output. A key factor contributing to their dominance is the growing focus on cost efficiency. Equinor reported that subsea boosting reduces lifting costs by nearly 30% compared to traditional topside solutions in deepwater environments like the North Sea. Additionally, the integration of digital technologies is further propelling this segment. As per DNV, over 70% of new subsea boosting projects now incorporate predictive maintenance tools thereby reducing downtime by 15%.

The Subsea gas compression segment is esteemed to hit a CAGR of 9.2% during the forecast period. This rapid expansion is fueled by the rising demand for efficient natural gas extraction and transportation in regions like the Norwegian Continental Shelf. According to the Aker Solutions, subsea gas compression can increase recovery rates by up to 40% compared to conventional methods. Another driving factor is the shift toward cleaner energy sources. Natural gas is increasingly viewed as a transitional fuel, and subsea compression plays a pivotal role in reducing emissions during extraction. According to the International Energy Agency (IEA), subsea gas compression systems lower carbon emissions by 20% compared to topside alternatives. Moreover, the growing adoption of remote-operated systems has enhanced feasibility. Lloyd’s Register noted that advancements in automation have reduced intervention costs by 25%, making subsea gas compression more economically viable. These technological and environmental advantages position subsea gas compression as the most dynamic segment in the market.

REGIONAL ANALYSIS

The United Kingdom was the top performer in the Europe Subsea Pumps market with 20.9% of share in 2024 owing to its advanced offshore infrastructure and decades-long expertise in hydrocarbon extraction. The North Sea remains a focal point, with over 450 subsea wells operational as of 2023, according to Oil & Gas UK. A key driver is the UK government's commitment to energy security by allocating £16 billion to offshore projects by 2030. Additionally, subsea boosting technologies are gaining traction, with BP reporting a 30% increase in recovery rates through their implementation. The UK’s stringent environmental regulations also foster innovation; for instance, Equinor’s Hywind Scotland project integrates subsea solutions with renewable energy systems, reducing carbon emissions by 25%.

Norway is swiftly emerging with a prominent CAGR o 10.2% in the next coming years. According to the Norwegian Petroleum Directorate, the country produces over 2 million barrels of oil equivalent daily, with subsea technologies playing a pivotal role. Subsea gas compression, pioneered by Equinor at the Åsgard field, has increased recovery rates by 40% is setting a benchmark for the industry. Norway’s strategic investments in digitalization further enhance its market position. As per DNV, over 70% of Norwegian subsea projects now incorporate predictive maintenance systems, cutting operational costs by 20%. Additionally, the government’s focus on green energy transition supports hybrid applications where Norway’s floating wind farms, like Hywind Tampen, integrate Subsea Pumpsto optimize energy transfer.

Germany subsea market is likely to have prominent growth opportunities during the forecast period by leveraging its robust industrial base and growing emphasis on energy diversification. While traditionally reliant on imports, Germany is increasingly investing in domestic offshore capabilities in the North Sea. According to the Federal Ministry for Economic Affairs and Climate Action, offshore wind capacity is set to reach 30 GW by 2030 is creating opportunities for subsea pump integration. Siemens Gamesa reported that subsea cooling systems in offshore wind farms reduce operational temperatures by 15%, enhancing efficiency. Furthermore, Germany’s push for hydrogen production propels demand for subsea injection systems.

France Subsea Subsea Pumps growth is rising lucratively with the growing investments. TotalEnergies’ operations in the Mediterranean showcase France’s growing role in deepwater exploration, with subsea boosting systems increasing production efficiency by 25%, according to IFP Energies Nouvelles. The country’s energy transition strategy emphasizes offshore wind, with plans to install 40 GW of capacity by 2050, as per the French Wind Energy Association.

Italy Subsea Subsea Pumps growth is driven by its strategic location in the Mediterranean and extensive offshore reserves. Eni’s Zohr gas field, one of the largest in the region, relies heavily on subsea separation technologies, which improve recovery rates by 35%, according to the Italian Ministry of Economic Development. Italy’s focus on energy independence is evident in its €10 billion investment plan for offshore projects through 2030. Subsea gas compression is another key area, with Saipem reporting a 20% reduction in emissions through its adoption. Moreover, Italy’s push for hybrid energy systems supports subsea innovations. As per the Italian Renewable Energy Association, the country aims to integrate 7 GW of offshore wind by 2030 by creating new avenues for subsea pump applications.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Aker Solutions ASA, Baker Hughes Company, TechnipFMC PLC, Halliburton Company, Schlumberger Limited (OneSubsea), Sulzer Ltd., Flowserve Corporation, National Oilwell Varco (NOV), General Electric Company (GE Oil & Gas), Framo AS, Leistritz Pumpen GmbH, and SPX Corporation are key market players of Europe Subsea Pumps.

The Europe Subsea Pumps is highly competitive, driven by demand for advanced technologies to support offshore oil and gas exploration. Major players like Baker Hughes, Schlumberger, and Aker Solutions dominate through continuous innovation and strategic partnerships. The region benefits from stringent safety regulations and growing investments in renewable energy integration, pushing companies to develop sustainable solutions. Intense rivalry fosters rapid technological advancements, with firms focusing on digitalization and automation. Smaller players also compete by offering niche products or localized services. Consolidation trends are evident as larger entities acquire smaller innovators to bolster portfolios. Additionally, competition extends beyond Europe, as European companies leverage their expertise to capture global opportunities.

TOP PLAYERS IN THIS MARKET

Baker Hughes

Baker Hughes is a leading player in the Subsea Pumps by offering advanced pumping solutions tailored for offshore oil and gas extraction. The company focuses on innovation is leveraging digital technologies to enhance efficiency and reliability. Its contributions include developing high-pressure subsea boosting systems that improve production rates in deepwater fields. Baker Hughes also emphasizes sustainability, integrating energy-efficient designs into its products. Globally, it plays a pivotal role in advancing subsea technology, supporting projects in regions like Latin America, Africa, and Asia-Pacific. Its robust service network ensures operational excellence worldwide.

Schlumberger

Schlumberger stands out with its cutting-edge subsea pump technologies designed for challenging environments. The company invests heavily in R&D to deliver reliable equipment capable of handling extreme pressures and temperatures. Its contributions include multiphase pumping systems that optimize recovery rates. Schlumberger’s global presence allows it to serve diverse markets effectively, from Europe to North America and beyond. By collaborating with operators, it drives innovation while addressing environmental concerns through eco-friendly designs. This positions Schlumberger as a key enabler of efficient hydrocarbon extraction globally.

Aker Solutions

Aker Solutions specializes in subsea production systems, including Subsea Pumpscritical for enhanced oil recovery. Known for engineering expertise, the company develops durable pumps suited for harsh conditions. It contributes significantly to global markets by enabling cost-effective operations in remote locations. Aker Solutions’ modular designs ensure flexibility and scalability, meeting varied customer needs.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Product Innovation

Companies prioritize R&D to introduce next-generation Subsea Pumps featuring higher efficiency, durability, and adaptability to extreme conditions. Innovations such as multiphase pumps and intelligent monitoring systems help meet evolving industry demands.

Strategic Partnerships

Collaborations with oil majors and technology firms enable shared expertise and resource optimization. These alliances facilitate joint development of customized solutions and expand geographic reach.

Sustainability Initiatives

Firms increasingly adopt eco-friendly practices, designing low-emission pumps and promoting circular economy principles. This aligns with regulatory requirements and enhances brand reputation.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Baker Hughes launched its next-gen subsea multiphase pump series, designed for ultra-deepwater applications. This move strengthens its position in Europe’s demanding offshore sector.

- In June 2023, Schlumberger partnered with Equinor to co-develop subsea boosting systems optimized for Norwegian Continental Shelf projects, enhancing operational efficiency.

- In September 2023, Aker Solutions unveiled an AI-driven predictive maintenance platform for subsea pumps, improving reliability and reducing downtime across European installations.

- In January 2024, OneSubsea (Schlumberger) acquired a minority stake in a UK-based startup specializing in green subsea technologies, reinforcing its commitment to sustainable solutions.

- In November 2023, Baker Hughes signed a five-year service agreement with BP for subsea pump maintenance in Europe is escalating their position in lifecycle support services.

MARKET SEGMENTATION

This research report on the Europe subsea pumps market is segmented and sub-segmented into the following categories.

By Type

- Centrifugal

- Helico-Axial

- Hybrid Pump

- Twin Screw

- Co-Axial

- Electrical Submersible Pump (ESP)

By Application

- Subsea Boosting

- Subsea Separation

- Subsea Injection

- Subsea Gas Compression

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the Europe subsea pumps market by 2033?

The market is expected to grow from USD 391.12 million in 2025 to USD 629.53 million by 2033, at a CAGR of 6.13%.

2. What challenges does the Europe subsea pumps market face?

Challenges include high installation and maintenance costs, fluctuating oil prices, and the need for skilled professionals.

3. Who are the key players in the Europe subsea pumps market?

Major players include Aker Solutions ASA, Baker Hughes Company, TechnipFMC PLC, Halliburton Company, Schlumberger Limited (OneSubsea), Sulzer Ltd., Flowserve Corporation, and Framo AS.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com