Europe Subsea Umbilicals, Risers, and Flowlines Market Size, Share, Trends & Growth Forecast Report By Water Depth (Shallow, Deep, Ultra Deep), Product Type, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Subsea Umbilicals, Risers, and Flowlines Market Size

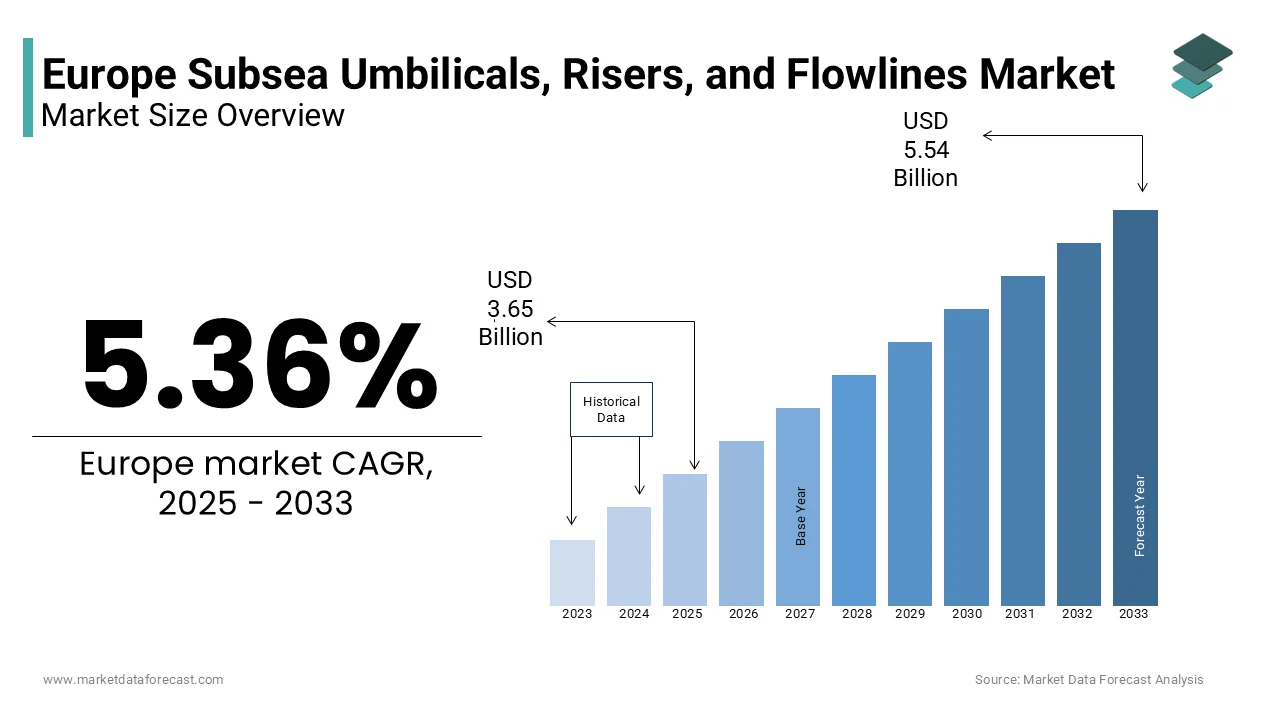

The Europe Subsea Umbilicals, Risers, and Flowlines market size was valued at USD 3.46 billion in 2024. The European market size is estimated to be worth USD 5.54 billion by 2033 from USD 3.65 billion in 2025, growing at a CAGR of 5.36% from 2025 to 2033.

The Europe subsea umbilicals, risers, and flowlines market is a critical segment of the offshore oil and gas industry, providing essential infrastructure for deepwater hydrocarbon extraction. Umbilicals are composite control lines used to transmit fluids, chemicals, power, and data between surface facilities and subsea equipment. Risers serve as conduits for transporting hydrocarbons from the seabed to production platforms or floating vessels, while flowlines carry oil and gas over shorter distances on the seabed.

Europe plays a central role in this sector due to its extensive offshore energy operations in the North Sea, Norwegian Sea, and Barents Sea. The region hosts some of the world’s most mature and technically advanced offshore fields, many of which require continuous maintenance and upgrades to sustain production levels. As per the UK Offshore Operators Association, more than 150 offshore platforms were operational in UK waters alone, necessitating robust subsea infrastructure to support ongoing exploration and development activities. Moreover, the transition toward marginal field developments and decommissioning of aging assets has led to greater reliance on flexible flowline systems and retrofitting capabilities.

MARKET DRIVERS

Expansion of Offshore Oil and Gas Exploration in the North Sea

One of the primary drivers of the Europe subsea umbilicals, risers, and flowlines market is the renewed focus on offshore oil and gas exploration in the North Sea. Despite the global push for decarbonization, European nations have increasingly turned to domestic hydrocarbon reserves to enhance energy security and reduce dependence on foreign imports following geopolitical disruptions.

According to the Norwegian Petroleum Directorate, offshore Norway produced over 4 million barrels of oil equivalent per day in 2023, supporting both domestic consumption and exports to other EU countries. This level of production has spurred investment in new subsea tie-back projects, where umbilicals and flowlines play a crucial role in connecting satellite wells to existing infrastructure. These initiatives rely heavily on advanced subsea systems to ensure efficient and safe transportation of hydrocarbons from reservoir to processing facility.

Technological Advancements in Flexible Pipe Systems

A second major driver shaping the Europe subsea umbilicals, risers, and flowlines market is the increasing adoption of flexible pipe systems designed for harsh environments and complex subsea terrain. Unlike rigid steel pipelines, flexible pipes offer superior resistance to corrosion, bending stress, and thermal expansion, making them ideal for deepwater applications and long-distance subsea tiebacks. As per the findings published by DNV GL, a leading classification society in marine and energy sectors, the use of unbonded flexible pipes in offshore developments increased in 2023 compared to the previous year. These pipes, often integrated into dynamic riser systems and subsea manifolds, provide greater installation flexibility and reduced maintenance requirements, thereby extending asset life. Besides, manufacturers such as TechnipFMC and Baker Hughes have introduced next-generation hybrid flowlines that combine thermoplastic composites with traditional steel layers to improve weight efficiency and durability. This innovation aligns with the industry’s need to develop cost-effective solutions for marginal fields and ultra-deepwater environments.

MARKET RESTRAINTS

High Capital Expenditure and Project Delays

One of the most significant restraints affecting the Europe subsea umbilicals, risers, and flowlines market is the substantial capital expenditure required for subsea infrastructure projects. The design, procurement, and deployment of umbilicals, risers, and flowlines involve complex engineering, specialized materials, and highly skilled labor, all of which contribute to elevated project costs. Such financial commitments often deter smaller independent operators from pursuing new developments, especially in lower-return fields where economic viability remains uncertain. In addition to capital intensity, project execution delays further hinder market growth. Regulatory approvals, permitting challenges, and logistical issues related to vessel availability frequently extend timelines.

Environmental Regulations and Permitting Hurdles

Another pressing restraint influencing the Europe subsea umbilicals, risers, and flowlines market is the growing scrutiny surrounding environmental regulations and permitting procedures. European governments and regulatory bodies have intensified their focus on reducing carbon emissions and minimizing the ecological footprint of offshore operations. As per the European Environment Agency, the approval process for new offshore oil and gas projects has become increasingly stringent, requiring comprehensive environmental impact assessments (EIAs) before permits can be issued. In 2023, several proposed developments in the North Sea faced prolonged review periods, delaying final investment decisions and slowing down infrastructure spending. Moreover, public opposition to fossil fuel projects has led to stricter permitting conditions. These regulatory pressures are compelling operators to invest more in sustainable practices, including leak detection systems and eco-friendly materials for umbilicals and flowlines.

MARKET OPPORTUNITIES

Development of Carbon Capture and Storage (CCS) Infrastructure

An emerging opportunity within the Europe subsea umbilicals, risers, and flowlines market is the development of carbon capture and storage (CCS) infrastructure. As part of broader decarbonization efforts, European governments and energy companies are investing in CCS to mitigate greenhouse gas emissions from industrial and energy sectors. According to the Global CCS Institute, Europe accounted for over 30% of global CCS project announcements in 2023, with Norway, the UK, and the Netherlands leading in cross-border CO₂ transport initiatives. Subsea flowlines are integral to these projects, serving as the primary conduits for transporting captured carbon dioxide from onshore sources to offshore storage sites beneath the seabed. Moreover, the Northern Lights project—a joint initiative by Equinor, Shell, and TotalEnergies—is pioneering the development of a full-scale CO₂ transport and storage system in the North Sea. As outlined by Gassnova, the Norwegian state enterprise overseeing the project, the initiative will utilize purpose-built subsea pipelines and monitoring systems to safely inject and store millions of tons of CO₂ annually.

Repurposing of Existing Subsea Infrastructure for Hydrogen Transport

Another promising opportunity for the Europe subsea umbilicals, risers, and flowlines market is the repurposing of existing offshore infrastructure for hydrogen transport. As the continent accelerates its transition to clean energy, hydrogen is gaining traction as a viable alternative to fossil fuels, particularly in heavy industries and power generation. Several pipeline operators are exploring the feasibility of converting decommissioned or underutilized subsea flowlines for hydrogen transportation, leveraging existing right-of-ways and seabed assets. The HyPipe project, supported by Germany’s Federal Ministry for Economic Affairs and Climate Action, is evaluating the technical and economic viability of adapting offshore natural gas pipelines for hydrogen distribution. As reported by DNV GL, initial studies suggest that certain steel-based subsea pipelines can be retrofitted to handle hydrogen with minimal modifications, significantly lowering entry barriers for large-scale deployment.

MARKET CHALLENGES

Aging Offshore Infrastructure Requiring Retrofitting and Maintenance

A major challenge confronting the Europe subsea umbilicals, risers, and flowlines market is the increasing need for retrofitting and maintenance of aging offshore infrastructure. Many of Europe’s offshore oil and gas fields have been in operation for several decades, necessitating costly interventions to maintain operational integrity and comply with modern safety standards. This includes legacy steel catenary risers and rigid flowlines that were not initially engineered for extended service, posing risks of material fatigue, corrosion, and leakage. In response, operators are investing in inspection, repair, and upgrade campaigns to extend asset lifespans. However, these retrofitting efforts come at a high cost, often requiring specialized vessels and remotely operated vehicles (ROVs). The technical complexity and financial burden of maintaining aging subsea systems present a persistent challenge for operators aiming to balance production continuity with economic sustainability.

Skilled Labor Shortage and Supply Chain Constraints

Another critical challenge facing the Europe subsea umbilicals, risers, and flowlines market is the shortage of skilled labor and ongoing supply chain constraints. The subsea industry requires highly specialized engineers, welders, and technicians capable of designing, installing, and maintaining complex subsea systems. However, recruitment and retention of qualified personnel have become increasingly difficult. This skills gap is exacerbated by the limited pipeline of training programs tailored to subsea engineering disciplines, hindering the ability of firms to scale operations efficiently. In parallel, supply chain bottlenecks continue to disrupt project timelines and increase lead times for critical components. As reported by Global Wind Energy Council, delays in sourcing high-grade polymers and corrosion-resistant steels—used extensively in umbilical and flexible flowline manufacturing—have contributed to extended delivery schedules.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.36% |

|

Segments Covered |

By Water Depth, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Schlumberger Limited, TechnipFMC plc., National Oilwell Varco, Oceaneering International, Inc., Halliburton, Aker Solutions, Vallourec, General Electric, Tenaris SA, Siemens, Saipem, McDermott, Prysmian Group, and others. |

SEGMENT ANALYSIS

By Water Depth Insights

The deepwater segment dominated the Europe subsea umbilicals, risers, and flowlines market by accounting for 54.2% of total demand in 2024. This dominance is primarily attributed to the extensive offshore hydrocarbon reserves located in water depths ranging from 500 to 1,500 meters across the North Sea, Norwegian Sea, and UK Continental Shelf.

According to the Norwegian Petroleum Directorate, over 60% of Norway’s active offshore fields are classified as deepwater developments, with new discoveries increasingly found in deeper zones that require advanced subsea infrastructure. These projects often involve complex tie-back systems that rely heavily on flexible flowlines and dynamic risers capable of withstanding high pressure and mechanical stress. Besides, the maturity of shallow-water fields has led operators to shift focus toward deeper reservoirs where production life cycles can be extended. Moreover, advancements in materials engineering and installation technologies have improved cost efficiency and reliability, making deepwater projects more economically viable.

The ultra-deepwater segment is anticipated to grow at the fastest rate within the Europe subsea umbilicals, risers, and flowlines market, with a projected CAGR of 8.3% between 2025 and 2033. This rapid expansion is driven by the increasing exploration of frontier basins and the development of marginal fields in extreme water depths beyond 1,500 meters. As per the UK Oil and Gas Authority, recent seismic surveys in the Atlantic Margin and Barents Sea have identified several ultra-deepwater prospects with significant hydrocarbon potential. Operators such as Equinor and BP have announced plans to explore these regions using next-generation subsea architectures that integrate advanced flexible flowlines and hybrid riser systems. Furthermore, government-backed initiatives aimed at extending the lifespan of offshore energy assets are encouraging investment in ultra-deepwater infrastructure. In addition, the growing adoption of floating production systems—particularly FPSOs and tension leg platforms—in ultra-deepwater settings is driving demand for dynamic risers and control umbilicals designed to handle movement and load variations.

By Product Type Insights

The flowlines represented the largest product segment in the Europe subsea umbilicals, risers, and flowlines market by capturing an estimated 49.4% share in 2024. This is because of the critical role flowlines play in transporting oil and gas over short distances from wellheads to processing facilities or manifolds on the seabed. According to DNV GL, a significant portion of all subsea production systems deployed in Europe utilize flexible flowlines due to their adaptability in uneven seabed conditions and resistance to mechanical fatigue. These pipelines are essential for maintaining uninterrupted flow assurance, particularly in deepwater developments where rigid alternatives are less feasible. Moreover, the aging nature of many North Sea fields has increased the need for reconfiguration and extension of existing flowline networks. In addition, the rise of marginal field developments—where cost-effective, modular subsea solutions are preferred—is further boosting the demand for standardized flowline configurations.

The umbilicals are coming up as the swiftest expanding product segment within the Europe subsea umbilicals, risers, and flowlines market, projected to progress at a CAGR of 7.9% through 2033. This accelerated growth is driven by the rising complexity of subsea control systems and the increasing deployment of remotely operated subsea installations. As outlined by TechnipFMC, modern subsea production systems rely extensively on integrated control umbilicals to transmit hydraulic fluids, electrical power, and fiber-optic signals between surface control rooms and downhole equipment. The shift toward digitalized subsea fields—where real-time monitoring and adaptive control are essential—has significantly increased the demand for high-performance umbilical solutions. These advanced systems enhance operational efficiency by enabling predictive maintenance and reducing downtime. Furthermore, the expansion of carbon capture and hydrogen transport projects is creating additional applications for umbilicals beyond traditional oil and gas use cases.

REGIONAL ANALYSIS

Norway had the largest share of the Europe subsea umbilicals, risers, and flowlines market, accounting for a 28.5% in 2024. As one of the world’s top oil and gas producers, Norway plays a pivotal role in shaping subsea infrastructure investments across the continent. This level of output necessitates continuous development of new subsea fields and upgrades to existing infrastructure. Moreover, Norway leads in subsea innovation, with companies like Aker Solutions, Equinor, and Subsea 7 pioneering advanced technologies in flexible flowlines, dynamic risers, and digital umbilical systems. The country also hosts major manufacturing and testing facilities that supply subsea components to global markets.

The United Kingdom has a strong historical base. The UK Continental Shelf (UKCS) has long been a hub for offshore energy production, with decades-old infrastructure requiring continuous maintenance and modernization. As per the Oil and Gas Authority, the UK approved over 25 new offshore developments in 2023, many of which involved subsea tie-backs and retrofits. Aging fields in the central and northern North Sea are being revitalized through enhanced subsea architectures, including flexible flowlines and intelligent umbilical systems. Apart from these, the UK government’s North Sea Transition Deal encourages operators to extend field lifespans while integrating lower-carbon technologies. This initiative has spurred investments in subsea carbon capture and hydrogen-ready infrastructure. Despite declining conventional production, the UK remains a key player in subsea technology deployment, supported by a robust supply chain and engineering expertise.

France is positioning itself as a growing participant in the region’s offshore energy sector. Although traditionally reliant on nuclear power, France has begun exploring alternative energy sources, including offshore hydrocarbons and marine-based renewables. According to the French Ministry of Ecological Transition, France has several prospective offshore blocks under exploration, particularly in the Bay of Biscay and Mediterranean waters. While commercial extraction remains limited, early-stage feasibility studies are laying the groundwork for future subsea developments. Moreover, TotalEnergies has been actively involved in international subsea projects, leveraging French engineering firms for design and manufacturing support. This collaboration enhances domestic capabilities in umbilical and flexible pipe production, fostering local supply chain growth Also, France’s participation in cross-border hydrogen transport initiatives is opening opportunities for repurposing subsea infrastructure.

Italy is placed as a strategic Mediterranean hub and plays a crucial role in connecting Southern Europe with North African and Eastern Mediterranean hydrocarbon reserves. Also, Italy imports a substantial portion of its natural gas via subsea pipelines from Algeria and Libya. Maintaining and upgrading these aging infrastructures requires continuous investment in flowlines and riser systems capable of handling high-pressure transmission over long distances. Eni, Italy’s leading energy company, has been developing subsea projects in the Adriatic and Ionian Seas, focusing on marginal field developments and enhanced recovery techniques. These initiatives rely on modern subsea architectures featuring flexible flowlines and control umbilicals. Furthermore, Italy is exploring offshore carbon storage options to align with EU climate goals. This includes assessing the feasibility of converting decommissioned subsea pipelines for CO₂ transportation.

The Netherlands is benefiting from its well-established offshore gas infrastructure and proactive approach to energy transition. The Dutch North Sea sector has historically been a major contributor to European gas supply, necessitating extensive subsea pipeline networks. According to the Dutch Ministry of Economic Affairs and Climate Policy, the Netherlands is phasing out production from the Groningen gas field but continues investing in smaller offshore fields and carbon management projects. This shift is driving demand for compact subsea systems tailored for low-volume extraction and carbon injection. Besides, the Port of Rotterdam is spearheading large-scale hydrogen import initiatives, which will require dedicated subsea corridors for pipeline transport. Companies like Shell and Gasunie are evaluating existing flowlines for hydrogen compatibility, potentially repurposing them for clean energy transmission.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Schlumberger Limited, TechnipFMC plc., National Oilwell Varco, Oceaneering International, Inc., Halliburton, Aker Solutions, Vallourec, General Electric, Tenaris SA, Siemens, Saipem, McDermott, and Prysmian Group are the key players in the Europe subsea umbilicals, risers, and flowlines market.

The competition in the Europe subsea umbilicals, risers, and flowlines market is characterized by a convergence of established global engineering firms and regionally rooted suppliers vying for dominance in an increasingly sophisticated and capital-intensive sector. As offshore energy projects grow more technically demanding—particularly in deeper waters and harsher environments—companies must continuously innovate to stay ahead. The market landscape is shaped by technological differentiation, execution capability, and the ability to offer integrated solutions that align with evolving energy transition goals.

Key players differentiate themselves through proprietary engineering, digital monitoring systems, and specialized installation capabilities that ensure reliability and cost-effectiveness. At the same time, rising interest in repurposing subsea infrastructure for carbon capture and hydrogen transportation is opening new avenues for growth, prompting traditional oil and gas-focused firms to expand into these domains. Smaller and mid-sized enterprises are leveraging niche expertise in flexible pipe manufacturing or local service provision to remain relevant amid consolidation.

Moreover, the interplay between fluctuating hydrocarbon prices, regulatory pressures, and sustainability mandates adds complexity to strategic planning. Companies that successfully balance technical agility, environmental compliance, and collaborative project execution are best positioned to thrive in this highly competitive environment.

TOP PLAYERS IN THIS MARKET

TechnipFMC

TechnipFMC is a global leader in subsea engineering and construction, with a strong presence in the European market for umbilicals, risers, and flowlines. The company delivers integrated subsea production systems that enhance field recovery and operational efficiency. In Europe, it plays a crucial role in deepwater developments across the North Sea and Norwegian waters. Its expertise lies in designing and deploying flexible flowlines and dynamic risers tailored to extreme offshore conditions. TechnipFMC's collaboration with major oil and gas operators enables it to provide innovative solutions that address evolving subsea challenges, reinforcing its position as a preferred partner in complex offshore projects.

Aker Solutions

Aker Solutions is a key player in the European subsea infrastructure sector, known for its advanced engineering capabilities and long-standing partnerships with leading energy companies. The firm specializes in delivering high-integrity flexible pipes, steel catenary risers, and smart umbilical systems that support both conventional and emerging energy applications. With operations centered in Norway and the UK, Aker Solutions has been instrumental in advancing subsea technology for carbon capture and hydrogen transport initiatives. Its focus on digitalization and modular subsea architectures positions it at the forefront of sustainable offshore development in Europe.

Subsea 7

Subsea 7 is a dominant force in the offshore installation and subsea infrastructure market, offering end-to-end solutions for umbilicals, risers, and flowlines. The company combines engineering excellence with fleet capabilities to execute large-scale subsea projects efficiently. In Europe, Subsea 7 supports major developments in the North Sea and Atlantic margins by deploying cutting-edge technologies that improve project economics and reduce environmental impact. Its strategic investments in vessel modernization and digital monitoring systems enhance execution reliability. Through continuous innovation and strong client engagement, Subsea 7 maintains a leading role in shaping the future of subsea infrastructure in Europe.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

One major strategy employed by key players in the Europe subsea umbilicals, risers, and flowlines market is technology innovation and digital integration . Companies are investing heavily in R&D to develop advanced materials, hybrid systems, and smart monitoring solutions that enhance performance, reduce maintenance costs, and extend asset life. This includes the adoption of fiber-optic sensors in umbilicals and predictive analytics for real-time integrity management.

Another key approach is strategic alliances and joint ventures , particularly with energy majors and new entrants in the low-carbon space. By forming partnerships, firms can align with emerging trends such as carbon capture and hydrogen transport, enabling them to diversify their offerings and enter adjacent markets while leveraging existing infrastructure.

Lastly, companies are focusing on localization and supply chain optimization to strengthen their regional presence. Establishing manufacturing hubs and service centers closer to project sites improves delivery timelines and reduces logistical complexities.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, TechnipFMC announced a strategic collaboration with Equinor to co-develop next-generation subsea control umbilicals designed for ultra-deepwater carbon storage projects in the North Sea. This initiative aimed at integrating digital sensing capabilities to enable real-time monitoring and improve injection efficiency.

- In June 2024, Aker Solutions launched a dedicated hydrogen-ready subsea technology division based in Oslo, focusing on adapting existing flowline and umbilical designs for clean energy transmission. The move was intended to support Europe’s growing hydrogen infrastructure ambitions and position the company as a pioneer in the emerging sector.

- In August 2024, Subsea 7 inaugurated a new subsea integration center in Aberdeen, strengthening its regional footprint and enhancing its ability to deliver comprehensive engineering, procurement, and installation services for complex offshore developments.

- In October 2024, Saipem signed a long-term partnership agreement with TotalEnergies to jointly advance subsea projects in the Celtic Sea and Bay of Biscay, emphasizing modular system deployment and rapid deployment methodologies to reduce project timelines.

- In December 2024, Baker Hughes entered a joint venture with a Portuguese engineering firm to establish a flexible pipe manufacturing facility near Lisbon, aiming to serve Southern and Western European markets with localized production and faster turnaround times.

MARKET SEGMENTATION

This research report on the Europe subsea umbilicals, risers, and flowlines market is segmented and sub-segmented into the following categories.

By Water Depth

- Shallow

- Umbilicals

- Risers

- SCR

- Flexible

- Others

- Flowlines

- Deep

- Umbilicals

- Risers

- SCR

- Flexible

- Others

- Flowlines

- Ultra Deep

- Umbilicals

- Risers

- SCR

- Flexible

- Others

- Flowlines

By Product Type

- Umbilicals

- Risers

- SCR

- Flexible

- Others

- Flowlines

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the Europe SURF market?

Key drivers include increased offshore oil and gas exploration, technological advancements in deepwater drilling, and the rising demand for energy across Europe.

2. What challenges does the Europe SURF market face?

Challenges include high capital investment, harsh environmental conditions in offshore locations, and complexity in subsea installation and maintenance.

3. Who are the major players in the Europe SURF market?

Leading companies typically include TechnipFMC, Saipem, Subsea 7, Aker Solutions, and Oceaneering International, among others.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com