Europe Telematics Software and Service Market Size, Share, Trends & Growth Forecast Report Segmented By Channel, Solution, Offering Type, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Telematics Software and Service Market Size

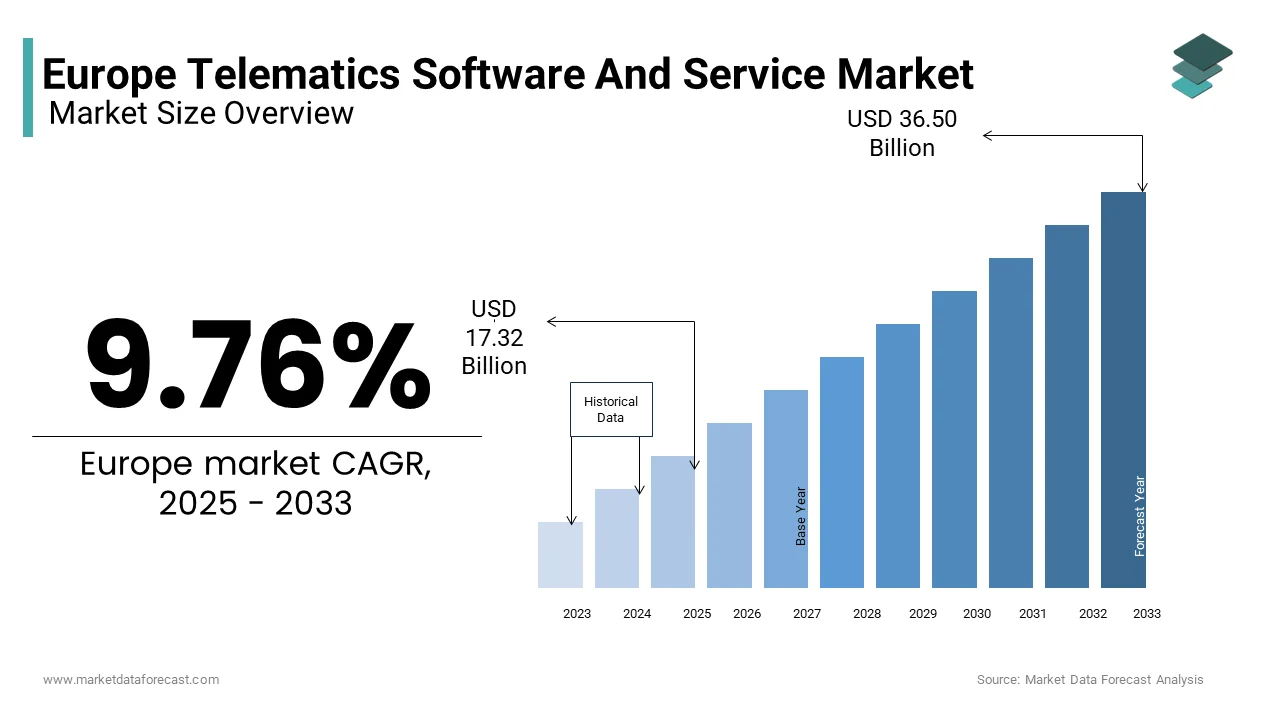

The Europe telematics software and service market was valued at USD 15.78 billion in 2024 and is anticipated to reach USD 17.32 billion in 2025 from USD 36.50 billion by 2033, growing at a CAGR of 9.76% during the forecast period from 2025 to 2033.

The Europe telematics software and service market covers digital solutions that enable real-time data exchange between vehicles and external systems, facilitating fleet management, driver behavior analysis, route optimization, and vehicle diagnostics. These technologies integrate GPS tracking, onboard diagnostics, wireless communications, and cloud-based analytics to enhance operational efficiency across automotive, logistics, insurance, and public transportation sectors. With increasing urbanization and regulatory focus on reducing emissions, telematics has become a cornerstone in transforming mobility and fleet operations. Moreover, the expansion of 5G networks and IoT-enabled infrastructure across countries like Germany, France, and the Netherlands is enabling more sophisticated telematics applications. In addition, the rise of usage-based insurance models and the need for enhanced road safety have further fueled demand. The UK's Department for Transport reported that fleet operators using telematics systems experienced a reduction in accident rates due to improved driver monitoring and feedback mechanisms.

MARKET DRIVERS

Expansion of Connected Vehicle Ecosystems and Smart City Initiatives

One of the primary drivers fueling the Europe telematics software and service market is the rapid expansion of connected vehicle ecosystems, supported by national smart city initiatives and growing investments in intelligent transportation systems. Governments across Europe are increasingly integrating telematics into urban mobility frameworks to improve traffic flow, reduce congestion, and lower emissions. According to the European Commission’s Directorate-General for Mobility and Transport, over 40 cities across the EU have launched large-scale smart mobility projects incorporating real-time vehicle tracking, predictive maintenance, and remote diagnostics via telematics platforms. Cities such as Barcelona, Vienna, and Stockholm are leading this transformation by deploying connected bus fleets and integrating telematics into public transit control centers. In addition, automakers are embedding advanced telematics units (TCUs) directly into new vehicles, enhancing connectivity and enabling features like emergency call services, remote locking, and over-the-air software updates. This convergence of government-led smart infrastructure development and automotive industry innovation is significantly accelerating the adoption of telematics software and services across Europe.

MARKET DRIVERS

Rising Demand for Usage-Based Insurance and Driver Behavior Monitoring

Another major driver of the Europe telematics software and service market is the growing popularity of usage-based insurance (UBI) and driver behavior monitoring systems among insurers and fleet operators. These technologies leverage real-time data from telematics devices to assess driving patterns, risk profiles, and claim likelihood, allowing for personalized premium structures and safer road practices. As per the European Insurance and Occupational Pensions Authority (EIOPA), UBI policies accounted for a significant share of all motor insurance contracts issued in the Netherlands and Sweden in 2023, driven by consumer preference for fairer pricing based on actual driving habits rather than demographic factors. Moreover, fleet management companies are adopting telematics-based driver scoring tools to monitor acceleration, braking, and idling behaviors. Insurance providers such as Allianz and AXA have partnered with telematics solution vendors to offer plug-and-play OBD-II devices and smartphone-integrated apps that capture relevant data points.

MARKET RESTRAINTS

Data Privacy Concerns and Regulatory Complexity Across EU Member States

One of the primary restraints affecting the Europe telematics software and service market is the complexity surrounding data privacy regulations and the varying enforcement approaches across EU member states. While the General Data Protection Regulation (GDPR) provides a unified framework for personal data protection, its interpretation and application to vehicle-generated data remain inconsistent, creating compliance challenges for telematics service providers.

For instance, the German Federal Commissioner for Data Protection has imposed stricter consent requirements for accessing vehicle telemetry data compared to regulators in Spain or Poland. Furthermore, consumers are becoming increasingly cautious about how their location, driving behavior, and vehicle performance data are used. A survey conducted by the European Consumer Organisation (BEUC) found that a notable level of respondents were reluctant to use telematics-based services due to concerns about surveillance and potential misuse of personal information.

High Implementation Costs and Technical Integration Challenges

Another significant constraint in the Europe telematics software and service market is the high cost of implementation and the technical complexities associated with integrating telematics systems into legacy vehicle fleets and enterprise IT infrastructures. While newer commercial vehicles come with embedded telematics modules, retrofitting older fleets requires additional hardware installations, software licensing, and training, which can be prohibitively expensive for small and medium-sized enterprises (SMEs). This financial burden discourages widespread adoption, particularly among independent haulers and regional logistics firms. Additionally, integrating telematics software with existing ERP, fleet management, and dispatching systems often requires extensive customization. So, these upfront costs and integration hurdles continue to limit the scalability of telematics solutions in certain segments of the European market.

MARKET OPPORTUNITY

Growth of Electric Vehicle Fleets and Need for Advanced Battery Management Systems

An emerging opportunity for the Europe telematics software and service market lies in the rapid expansion of electric vehicle (EV) fleets and the corresponding demand for advanced battery monitoring and energy management solutions. As European nations push toward carbon neutrality, EV adoption is surging, necessitating telematics systems capable of providing real-time insights into battery health, charging efficiency, and range prediction. According to the European Alternative Fuels Observatory, over 2.5 million electric cars were registered in the EU in 2023, representing a 22% increase from the previous year. This shift is prompting automakers and fleet operators to invest in telematics platforms that optimize charging schedules, locate available fast-charging stations, and prevent battery degradation through predictive analytics. Moreover, telematics-based battery diagnostics are being integrated into after-sales service offerings, enabling proactive maintenance and extending vehicle longevity. Companies like Bosch and Continental are developing cloud-connected EV telematics suites tailored for fleet managers and ride-hailing services.

Increasing Adoption of Predictive Maintenance and AI-Driven Fleet Analytics

Another promising opportunity for the Europe telematics software and service market is the rising adoption of predictive maintenance and AI-driven fleet analytics. Traditional reactive maintenance strategies are being replaced by data-driven approaches that leverage real-time vehicle diagnostics to anticipate failures before they occur, minimizing downtime and repair costs. According to a research paper published by the European Automotive Research Partners Association (EARPA), predictive maintenance powered by telematics has been shown to reduce unplanned vehicle breakdowns and cut maintenance expenses across commercial fleets. Telematics platforms now incorporate machine learning algorithms that analyze engine performance, brake wear, tire pressure, and other critical parameters to generate actionable alerts. For example, Daimler Trucks and Scania have integrated AI-enhanced telematics into their fleet offerings, enabling remote diagnostics and service scheduling. Additionally, logistics companies are leveraging telematics-based analytics to optimize routes, reduce fuel consumption, and comply with emission regulations.

MARKET CHALLENGES

Fragmented Standards for V2X Communication and Interoperability Issues

One of the most pressing challenges in the Europe telematics software and service market is the lack of standardized protocols for vehicle-to-everything (V2X) communication, leading to interoperability issues between different telematics systems and infrastructure components. V2X technology enables vehicles to communicate with each other (V2V), with roadside infrastructure (V2I), and with the broader network (V2N), but inconsistent standards hinder seamless integration. Yes, multiple competing communication protocols—including C-V2X and ITS-G5—are currently in use, complicating cross-border deployment and limiting scalability. Countries like Germany and France have favored cellular-based V2X, while others, including Italy and Spain, have pursued alternative approaches, resulting in a fragmented landscape. This divergence poses technical and logistical barriers for automakers and service providers seeking to deploy pan-European telematics solutions. The European Commission’s Joint Research Centre has called for greater harmonization to ensure uniformity in signal formats, message structures, and security protocols.

Cybersecurity Vulnerabilities in Connected Vehicle Networks

Another critical challenge facing the Europe telematics software and service market is the increasing exposure to cybersecurity threats targeting connected vehicle networks. As vehicles become more reliant on telematics for functions ranging from remote unlocking to autonomous driving, the attack surface for cybercriminals expands significantly.

According to the European Union Agency for Cybersecurity (ENISA), the number of reported cyber incidents involving vehicle telematics systems increased in 2023, with risks spanning unauthorized access, data breaches, and even remote manipulation of vehicle controls. A notable case involved a breach in a major European car manufacturer’s telematics platform, compromising thousands of user accounts. To address these concerns, the UN Economic Commission for Europe (UNECE) introduced the WP.29 regulation mandating cybersecurity management systems for vehicle manufacturers. However, compliance remains an ongoing challenge, particularly for smaller telematics service providers lacking robust security infrastructures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.76% |

|

Segments Covered |

By Channel, Solution, Offering Type, And By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

Mix Telematics, AT&T Inc., Geotab Inc., Verizon Telematics, Cisco Systems Inc., Aplicom Oy, Microlise Ltd, LG Electronics Inc, Trimble Inc, Ctrack Global (Inseego Corp.). |

SEGMENTAL ANALYSIS

By Channel Insights

The OEM channel held the largest market share by accounting for 65.4% of the Europe telematics software and service market in 2024. This dominance is primarily driven by the increasing integration of embedded telematics systems directly into new vehicles during manufacturing, ensuring seamless connectivity and standardized functionality across automotive brands. Moreover, regulatory mandates such as the eCall initiative, requiring all new vehicles sold in the EU to automatically transmit crash data to emergency services, s—have accelerated OEM adoption of telematics. As per the European Commission’s Digital Transport and Mobility Framework, this regulation alone has contributed to an increase in embedded telematics installations since its full implementation in 2018. Automakers like BMW, Volkswagen, and Renault are also expanding their proprietary telematics platforms to include features such as predictive maintenance, route optimization, and driver behavior analytics. These integrated solutions not only enhance user experience but also create recurring revenue streams through subscription-based service models, reinforcing the OEM segment's leadership position in the European telematics market.

The Aftermarket channel is projected to grow at the fastest CAGR of 10.8% during the forecast period, which is outpacing the OEM segment due to rising demand for retrofitting older vehicles with advanced telematics capabilities. Unlike factory-fitted systems, aftermarket solutions offer cost-effective upgrades for fleet operators, small businesses, and individual drivers seeking access to smart mobility features without purchasing new vehicles. This presents a significant opportunity for third-party providers offering plug-and-play OBD-II devices, GPS trackers, and cloud-connected dashcams that can be easily installed. Besides, insurance companies and logistics firms are increasingly adopting aftermarket telematics to implement usage-based insurance (UBI) programs and optimize fleet performance. A study conducted by the UK Road Safety Data Research Network found that fleet operators using aftermarket telematics saw a reduction in fuel costs and an improvement in route efficiency within one year of deployment.

By Solution Insights

The Embedded Solutions segment accounted for the majority of the market by contributing 58.1% of the total Europe telematics software and service market in 2024. This is caused by the increasing incorporation of built-in telematics units (TCUs) within new vehicles, offering superior reliability, continuous connectivity, and deeper integration with vehicle control systems compared to portable or smartphone-based alternatives. As reported by the International Organization of Motor Vehicle Manufacturers (OICA, over 75% of new commercial vehicles registered in Western Europe in 2023 were equipped with embedded telematics, supporting functions such as real-time diagnostics, emergency response, and over-the-air software updates. Furthermore, automakers are leveraging embedded telematics to deliver value-added services like remote locking/unlocking, battery health monitoring for electric vehicles, and predictive maintenance alerts. Regulatory support, including mandatory eCall compliance and intelligent transport system (ITS) directives, further reinforces the embedded segment’s leading position.

The Smartphone-Based Solutions segment is coming out as the fastest-growing, registering a CAGR of 12.3% over the forecast period. This growth is largely fueled by the widespread adoption of mobile applications that enable users to access telematics features without requiring dedicated hardware installation. These apps often leverage Bluetooth or Wi-Fi connectivity to communicate with onboard diagnostics (OBD-II) ports or vehicle sensors. Moreover, insurance companies and ride-hailing platforms are increasingly deploying smartphone telematics for usage-based insurance (UBI) and driver scoring systems. Also, the affordability and ease of deployment make these solutions attractive for small fleet operators and independent drivers who cannot afford embedded or portable telematics hardware. As mobile network speeds improve and app functionalities expand, the smartphone-based telematics segment is expected to maintain its rapid growth trajectory.

By Offering Type Insights

The Services segment had the biggest market share by contributing a2.3% of the overall Europe telematics software and service market in 2024. This control is attributed to the growing reliance on cloud-based analytics, real-time monitoring, and subscription-based service models that offer continuous value beyond initial hardware purchases. Telematics service providers are increasingly offering end-to-end solutions that include fleet tracking, route optimization, predictive maintenance, and driver behavior analytics. Moreover, the shift toward usage-based insurance (UBI), remote diagnostics, and over-the-air software updates has intensified demand for recurring service packages. As per the UK Department for Transport, fleet operators using telematics-as-a-service models have reported up to a reduction in fuel costs and a 30% improvement in vehicle utilization rates. In addition, government initiatives promoting connected mobility and digital infrastructure development are encouraging service-led deployments. The European Commission’s Intelligent Transport Systems Directive supports the proliferation of telematics services by mandating interoperability and data exchange standards across member states.

The Hardware segment is becoming as expanding rapidly, registering a CAGR of 9.6% over the forecast period. This progress is largely driven by the increasing need for retrofitting legacy vehicles with telematics capabilities, particularly in SMEs and regional transportation sectors that operate older fleets lacking built-in connectivity. Plug-and-play OBD-II devices, GPS trackers, and in-vehicle infotainment systems are gaining traction among independent haulers, taxi operators, and logistics firms seeking affordable yet effective telematics solutions. Additionally, the rise of electric and hybrid vehicles has increased demand for specialized telematics hardware that monitors battery health, charging patterns, and energy efficiency. Companies like Bosch and Continental have launched compact, AI-enabled telematics modules designed specifically for EVs, enhancing vehicle performance tracking and predictive maintenance capabilities. Furthermore, government-backed initiatives aimed at modernizing public transport fleets are accelerating hardware adoption. In Sweden, municipal bus operators have deployed IoT-enabled telematics gateways to support real-time scheduling and emissions monitoring.

COUNTRY-LEVEL ANALYSIS

Germany had the largest market share by contributing 24.5% of the overall Europe telematics software and service market. It maintains its leading position due to a strong automotive industry presence, high levels of vehicle connectivity adoption, and proactive government support for intelligent transportation systems. With major automakers like BMW, Mercedes-Benz, and Volkswagen headquartered in the country, Germany serves as a hub for embedded telematics innovation. According to the German Federal Ministry of Transport and Digital Infrastructure, over 80% of new passenger cars and 90% of commercial vehicles registered in 2023 included built-in telematics units. Moreover, Germany’s commitment to smart mobility is evident through its investment in 5G infrastructure and participation in pan-European V2X communication trials.

The United Kingdom is another key player in the market, driven by robust regulatory frameworks, high consumer adoption of smart mobility solutions, and a well-developed insurance telematics sector. The UK’s early embrace of usage-based insurance (UBI) has positioned it as a key player in driver behavior monitoring and fleet management. Additionally, despite Brexit-related uncertainties, the UK remains a leader in telematics innovation, with tech firms and startups developing AI-powered analytics tools for predictive maintenance and driver safety. Universities like Imperial College London are conducting research on next-generation telematics applications, including autonomous platooning and AI-enhanced vehicle diagnostics.

France commands a significant place in the European telematics software and service market and is supported by progressive policies promoting smart mobility and sustainable transport. The French government has actively encouraged the integration of telematics into both public and private vehicle fleets to reduce emissions and improve urban mobility. In addition, Paris and Lyon have implemented city-wide telematics networks to manage traffic flow and optimize public transport scheduling. Moreover, French automakers such as Renault and Stellantis are investing heavily in connected vehicle technologies.

Spain is making considerable strides in the market, with a growing emphasis on enhancing digital infrastructure and improving fleet efficiency. The Spanish government has introduced several initiatives aimed at modernizing transportation systems and promoting telematics adoption in logistics and public transit. Additionally, the Ministry of Transport has mandated telematics integration in intercity buses to enhance passenger safety and operational transparency. The rise of electric vehicle adoption is also driving demand for telematics solutions tailored to battery management and charging station accessibility.

Italy captures a major share of the Europe telematics software and service market, driven by an expanding consumer base and improved connectivity across major urban centers. With a large and diverse automotive industry, Italy is witnessing increased adoption of telematics in both personal and commercial vehicle segments. Cities like Milan and Rome are integrating telematics into traffic control and parking management systems to reduce congestion and enhance mobility. Private-sector players are also playing a key role, with Italian insurers offering telematics-based insurance plans that reward safe driving behaviors.

KEY MARKET PLAYERS

Mix Telematics, AT&T Inc., Geotab Inc., Verizon Telematics, Cisco Systems Inc., Aplicom Oy, Microlise Ltd, LG Electronics Inc., Trimble Inc., and Cand tTrackGlobal (Inseego Corp.) are the market players that are dominating the Europe telematics software and service market.

Top Players in the Market

Bosch Connected Mobility Solutions

Bosch is a global leader in automotive technology and plays a central role in shaping the Europe telematics software and service market through its advanced connected mobility offerings. The company delivers end-to-end telematics solutions that integrate vehicle diagnostics, fleet management, and cloud-based analytics to enhance driver experience and operational efficiency.

Bosch’s contributions extend beyond hardware integration to include AI-driven predictive maintenance, real-time traffic optimization, and V2X communication technologies. By collaborating with automakers, logistics firms, and public transport authorities, Bosch continues to drive innovation in smart mobility and connected vehicle ecosystems across Europe.

Continental AG

Continental is a major player in the European telematics space, offering a comprehensive suite of embedded and aftermarket telematics services tailored for passenger cars, commercial vehicles, and industrial fleets. The company specializes in integrating digital connectivity with core vehicle functions to improve safety, fuel efficiency, and user engagement.

Its telematics portfolio includes intelligent dashboards, remote diagnostics, emergency call systems, and fleet tracking platforms designed to support both private and enterprise customers. Through strategic partnerships with telecom providers and cloud service vendors, Continental enhances data interoperability and expands service reach across the continent.

By focusing on seamless integration and scalable digital infrastructure, Continental remains at the forefront of Europe’s evolving mobility transformation.

TomTom Telematics (now part of Bridgestone)

TomTom Telematics has long been recognized as a key provider of fleet management and location-based telematics services across Europe. Acquired by Bridgestone, the company continues to deliver robust SaaS-based solutions that optimize route planning, monitor driver behavior, and manage vehicle performance for large-scale logistics and transportation companies.

With a strong presence in Western Europe, particularly in the Netherlands, Germany, and France, TomTom’s platform supports thousands of businesses in reducing operational costs and improving sustainability. Its emphasis on intuitive user interfaces, real-time analytics, and integration with tire and maintenance management further strengthens its value proposition in the European telematics landscape.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the Europe telematics software and service market is deepening partnerships with automotive manufacturers and tier-1 suppliers to embed telematics capabilities directly into new vehicles. This ensures seamless integration, broader adoption, and recurring revenue through subscription-based service models.

Another critical approach is expanding digital ecosystems through integration with third-party platforms, including ERP systems, insurance risk assessment tools, and urban mobility networks. This enables telematics providers to offer holistic solutions that go beyond basic tracking to include predictive maintenance, usage-based insurance, and smart city coordination.

Lastly, investing in cybersecurity and data privacy frameworks is becoming increasingly vital. As regulatory scrutiny intensifies and consumer concerns grow, leading firms are strengthening encryption protocols, securing data transmission channels, and ensuring compliance with GDPR and emerging V2X communication standards to build trust and maintain competitive differentiation.

COMPETITIVE OVERVIEW

The competition in the Europe telematics software and service market is highly dynamic, characterized by a mix of global automotive suppliers, specialized telematics solution providers, and emerging tech startups striving to capture market share through innovation and strategic positioning. Established players like Bosch, Continental, and Valeo dominate due to their deep integration with vehicle manufacturing and extensive R&D capabilities. However, agile software-focused firms are gaining traction by offering flexible, cloud-native solutions tailored to specific use cases such as fleet optimization, driver monitoring, and smart city integration.

Strategic differentiation is increasingly being driven by data intelligence, scalability, and adaptability to evolving regulatory landscapes. Companies are investing heavily in AI-driven analytics, edge computing, and V2X communication technologies to stay ahead of shifting mobility demands. Additionally, the push toward electric vehicles and autonomous driving is reshaping the telematics ecosystem, prompting firms to expand their offerings beyond traditional tracking and diagnostics.

Collaboration between telematics providers, telecom operators, and government agencies is also playing a crucial role in defining the future trajectory of the market. In this environment, only those who can combine technical expertise with regulatory foresight and customer-centric innovation will be able to sustain leadership in the rapidly evolving European telematics sector.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Bosch announced a strategic partnership with a leading European telecommunications provider to develop a next-generation connected car platform leveraging 5G technology, aiming to enhance real-time vehicle diagnostics and over-the-air updates for OEMs and fleet operators.

- In March 2024, Continental launched an updated version of its fleet management software suite, featuring integrated AI-based driver behavior analysis and predictive maintenance alerts, expanding its appeal to logistics and transport companies seeking smarter operational insights.

- In June 2024, TomTom Telematics (Bridgestone) introduced a new carbon emissions tracking module within its fleet management system, enabling businesses to monitor and report environmental impact as part of growing sustainability initiatives across European markets.

- In August 2024, Siemens Digital Industries Software acquired a German startup specializing in vehicle-to-cloud telematics integration, enhancing its ability to offer scalable digital twin solutions for automotive and industrial fleet applications across Europe.

- In October 2024, Webfleet Solutions, a subsidiary of Bridgestone, expanded its dealer network in Eastern Europe, aiming to increase accessibility to its fleet tracking and route optimization services for SMEs and regional transport operators previously underserved by advanced telematics.

MARKET SEGMENTATION

This research report on the Europe telematics software and service market is segmented and sub-segmented into the following categories.

By Channel

- Original Equipment Manufacturers (OEM)

- Aftermarket

By Solution

- Smartphone

- Portable

- Embedded

By Offering Type

- Hardware

- Services (Entry-level, Mid-tier, High-end)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of telematics software and services in Europe?

Rising demand for fleet efficiency, fuel cost reduction, and regulatory compliance—especially with EU CO₂ emission targets and smart mobility directives—is accelerating telematics adoption across commercial sectors.

How are EU regulations shaping the telematics landscape?

The EU Mobility Package and Digital Tachograph (Regulation 165/2014) require real-time vehicle tracking and driver behavior monitoring, pushing fleets to integrate advanced telematics solutions.

Which industries are leading adopters of telematics services in Europe?

Logistics, construction, public transportation, and utilities are major users, with Germany, the UK, and France leading in deployment of vehicle diagnostics, route optimization, and asset tracking systems.

How is data privacy influencing telematics software development in Europe?

Strict GDPR compliance necessitates anonymized data processing, secure cloud storage, and transparent consent protocols in telematics platforms to protect driver and fleet data.

What role does 5G and IoT play in the future of European telematics?

The rollout of 5G networks and V2X (vehicle-to-everything) communication is enabling real-time analytics, predictive maintenance, and autonomous fleet support across smart city infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com