Europe Telerehabilitation Skilled Nursing Care Center Market Size, Share, Trends & Growth Forecast Report By Application (Physical Therapy, Occupational Therapy, Speech Therapy), Component (Products [Software, Hardware], Services), End User (Healthcare Providers, Homecare), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Telerehabilitation Skilled Nursing Care Center Market Size

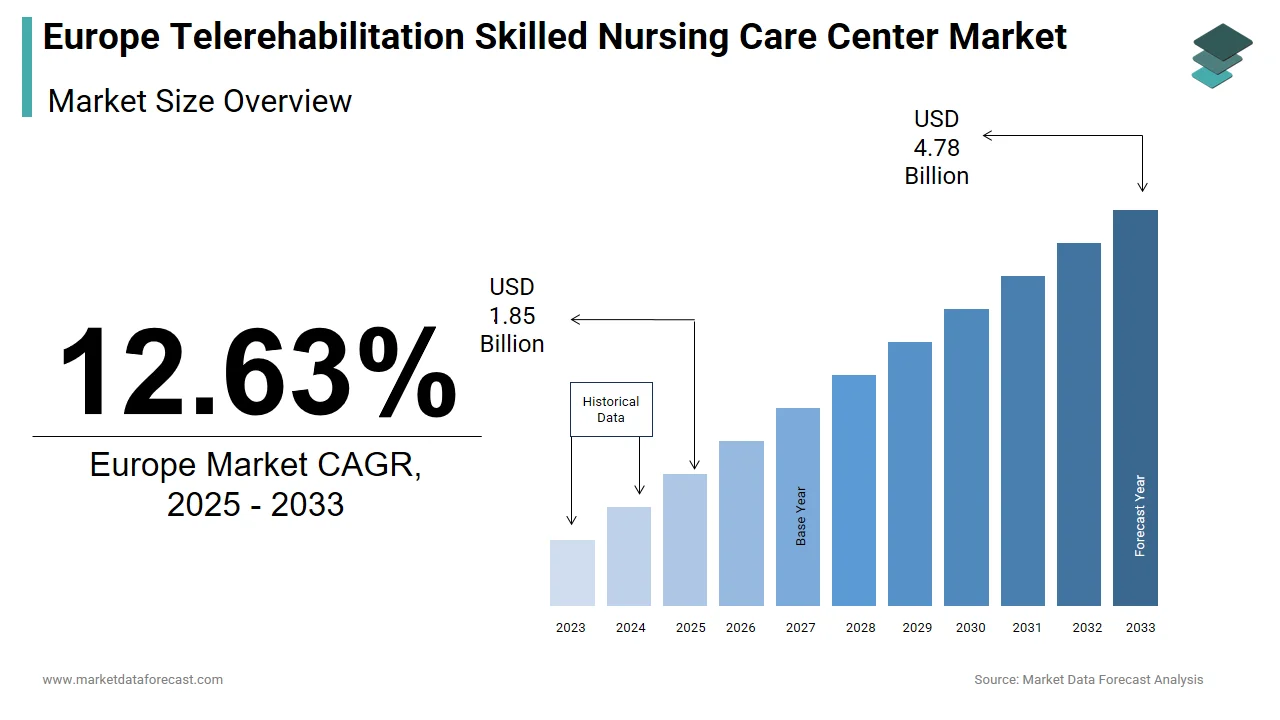

The size of the Europe telerehabilitation skilled nursing care center market was valued at USD 1.64 billion in 2024. This market is expected to grow at a CAGR of 12.63% from 2025 to 2033 and be worth USD 4.78 billion by 2033 from USD 1.85 billion in 2025.

The Europe telerehabilitation skilled nursing care center market refers to the integration of remote rehabilitation services into traditional skilled nursing facilities, enabling patients to receive continuous therapeutic support without requiring in-person visits. This model leverages digital health technologies such as video conferencing, wearable sensors, and AI-driven monitoring systems to deliver physiotherapy, occupational therapy, and speech therapy to elderly or post-acute patients residing in specialized care centers.

As Europe experiences a growing aging population, the demand for cost-effective, high-quality post-acute care has surged. Skilled nursing care centers have responded by incorporating telerehabilitation tools to enhance patient outcomes and streamline care coordination.

Moreover, the shift toward decentralized healthcare delivery has been accelerated by the aftermath of the pandemic, which emphasized the need for contactless care solutions. Also, several EU member states have introduced policy frameworks supporting telehealth adoption within institutional settings.

MARKET DRIVERS

Aging Population and Increasing Demand for Post-Acute Rehabilitation Services

One of the primary drivers fueling the Europe telerehabilitation skilled nursing care center market is the rapidly aging population, which has significantly increased the number of individuals requiring post-acute rehabilitation. With life expectancy rising across the continent, age-related conditions such as stroke, osteoarthritis, and mobility impairments have become more prevalent, necessitating structured rehabilitation programs. This demographic shift has led to a surge in admissions to skilled nursing care centers, where residents often require ongoing physical and occupational therapy to maintain independence. Telerehabilitation addresses this growing demand by enabling continuous therapy sessions without the logistical challenges associated with in-person visits. For example, virtual physiotherapy sessions delivered via secure platforms improved functional recovery among elderly patients recovering from hip fractures. These findings underscore how technology-enabled rehabilitation supports better clinical outcomes while reducing the burden on facility staff. Furthermore, national healthcare systems are increasingly recognizing the value of remote rehabilitation in managing long-term care needs. The UK’s National Health Service (NHS), for instance, has incorporated telerehabilitation modules into its long-term care strategy, encouraging skilled nursing centers to adopt these tools for improved patient engagement and treatment adherence.

Integration of Advanced Digital Technologies in Rehabilitation Programs

Another key driver of the Europe telerehabilitation skilled nursing care center market is the rapid integration of advanced digital technologies, including artificial intelligence (AI), Internet of Medical Things (IoMT), and cloud-based analytics, into rehabilitation programs. These innovations are transforming how therapy is administered, monitored, and optimized within institutional care settings. For instance, AI-powered rehabilitation platforms can analyze movement patterns and provide real-time feedback to both patients and therapists. Similarly, wearable sensors developed by companies like Philips and GE Healthcare allow caregivers to monitor vital signs and exercise performance remotely, ensuring timely interventions when necessary. In addition, cloud-based platforms enable seamless data exchange between skilled nursing facilities, hospitals, and home care providers. As reported by the European Connected Health Alliance, interoperable digital health records have enhanced continuity of care, especially for patients transitioning from acute care to rehabilitation settings. Governments and private stakeholders are investing heavily in infrastructure development to support these technologies.

MARKET RESTRAINTS

Limited Technological Infrastructure in Rural and Underdeveloped Regions

A major restraint affecting the Europe telerehabilitation skilled nursing care center market is the uneven distribution of technological infrastructure, particularly in rural and underdeveloped regions. Despite significant advancements in urban areas, many parts of Eastern and Southern Europe lack the necessary broadband connectivity, hardware, and digital literacy to support effective telerehabilitation services. This digital divide creates disparities in service availability, limiting the reach of telerehabilitation programs to underserved populations. Skilled nursing care centers in these regions often struggle to implement even basic telehealth functionalities due to outdated IT systems and limited funding. Moreover, the shortage of trained personnel who can operate digital rehabilitation tools further exacerbates the issue.

Regulatory and Data Privacy Challenges

Another significant constraint in the Europe telerehabilitation skilled nursing care center market is the complex regulatory landscape governing data privacy and cross-border telehealth operations. While the General Data Protection Regulation (GDPR) ensures high standards of patient confidentiality, it also imposes stringent requirements on data handling, storage, and transmission, complicating the implementation of remote rehabilitation services. Healthcare institutions must comply with strict encryption protocols, consent mechanisms, and data localization rules, which vary across EU member states. Moreover, the transfer of medical data between skilled nursing centers and external rehabilitation specialists remains a challenge.

MARKET OPPORTUNITIES

Expansion of Public-Private Partnerships to Enhance Telehealth Capabilities

An emerging opportunity for the Europe telerehabilitation skilled nursing care center market lies in the growing collaboration between public health authorities and private technology firms to expand telehealth capabilities within institutional care settings. Governments across Europe are increasingly recognizing the potential of digital rehabilitation to improve patient outcomes while reducing hospital readmissions. For example, the German Federal Ministry of Health has launched the “Digital Care Pact,” a joint initiative with tech companies and nursing associations aimed at equipping 10,000 care facilities with digital infrastructure by 2025. These partnerships not only accelerate the adoption of telerehabilitation but also facilitate knowledge exchange between clinicians and technologists, leading to more user-centric product development.

Rising Demand for Remote Monitoring Solutions in Chronic Disease Management

Another promising opportunity for the Europe telerehabilitation skilled nursing care center market is the increasing demand for remote monitoring solutions tailored to chronic disease management. As the prevalence of conditions such as diabetes, cardiovascular diseases, and respiratory disorders rises among the elderly, skilled nursing centers are seeking innovative ways to support long-term rehabilitation and prevent deterioration. Remote monitoring tools, including wearable devices and mobile applications, enable caregivers to track patients’ progress continuously and intervene proactively when anomalies occur. Moreover, the integration of predictive analytics into these systems allows for early detection of complications, potentially avoiding emergency transfers to hospitals.

MARKET CHALLENGES

Resistance to Technology Adoption Among Elderly Patients and Staff

One of the most pressing challenges in the Europe telerehabilitation skilled nursing care center market is the resistance to technology adoption among elderly patients and caregiving staff. Many older adults, particularly those with cognitive impairments or limited exposure to digital tools, struggle to engage with virtual rehabilitation platforms, leading to low participation rates. Moreover, caregivers, many of whom are middle-aged or older themselves, often lack the digital skills required to assist patients with telerehabilitation equipment, creating a bottleneck in service delivery. To address this issue, several nursing facilities have initiated digital literacy programs, but progress remains slow.

Reimbursement Uncertainty and Lack of Standardized Payment Models

Another critical challenge facing the Europe telerehabilitation skilled nursing care center market is the lack of standardized reimbursement models and inconsistent coverage policies across EU member states. While some countries offer partial or full reimbursement for remote rehabilitation services, others do not recognize telerehabilitation as a billable healthcare activity, discouraging providers from investing in these solutions. For instance, in Germany, certain aspects of telerehabilitation are covered under statutory health insurance, but limitations exist regarding the types of services reimbursed. Conversely, in Italy and Spain, reimbursements are largely restricted to pilot programs or research-based initiatives rather than routine clinical practice. The absence of uniform payment structures makes it difficult for skilled nursing centers to justify the upfront costs of implementing telerehabilitation infrastructure.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application, Component, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Care Innovations, LLC., Koninklijke Philips N.V., Included Health Inc. (Doctor on Demand, Inc.), Humanus Corporation, MIRA Rehab Limited, American Well Corporation, UniQuest Pty Limited (NeoRehab), NeuroTechR3, Inc., Hinge Health, Inc., PT Genie, and others. |

SEGMENTAL ANALYSIS

By Application Insights

The Physical Therapy segment had the largest market share by accounting for 58.3% of the Europe telerehabilitation skilled nursing care center market in 2024. This dominance is primarily driven by the high prevalence of musculoskeletal disorders, post-surgical recovery cases, and mobility impairments among the aging population residing in skilled nursing facilities. These conditions often require structured physical therapy interventions, making it the most frequently prescribed form of rehabilitation in long-term care settings. Moreover, advancements in remote monitoring technologies have significantly improved the delivery of physical therapy through telerehabilitation platforms. Additionally, national healthcare systems are increasingly integrating digital physical therapy into discharge planning and post-acute care pathways.

The Speech Therapy segment is projected to grow at the fastest CAGR of 12.4% during the forecast period, outpacing other applications within the Europe telerehabilitation skilled nursing care center market. While currently smaller in size compared to physical therapy, this segment is experiencing rapid expansion due to increasing recognition of speech and swallowing disorders among the elderly and post-stroke patients. According to the European Stroke Organisation, approximately 1.1 million stroke cases occur annually across Europe, with nearly 60% of survivors experiencing some degree of communication or swallowing impairment. This growing patient pool necessitates ongoing speech therapy interventions, many of which can now be delivered remotely through secure video conferencing and AI-assisted tools. In recent years, several clinical trials have validated the efficacy of telerehabilitation in speech therapy. A multicenter study led by University College London demonstrated that patients undergoing remote speech therapy after stroke achieved comparable improvements in language function to those receiving in-person treatment, with a higher satisfaction rate due to convenience and flexibility. Furthermore, regulatory bodies such as the UK's National Institute for Health and Care Excellence (NICE) have endorsed the use of telehealth-based speech therapy as a viable alternative, especially in rural areas where access to specialists is limited.

By Component Insights

The Services component accounted for the majority of the market by holding 63.1% of the total Europe telerehabilitation skilled nursing care center market in 2024. This segment involves virtual consultations, remote monitoring, digital therapy sessions, and patient management services facilitated through integrated platforms. This dominance stems from the growing reliance on outsourced rehabilitation services rather than standalone product purchases. Skilled nursing facilities increasingly prefer comprehensive service packages that include cloud-based software, therapist support, and real-time analytics, enabling seamless integration into daily operations without the need for extensive in-house infrastructure. This shift reflects a broader trend toward outcome-based healthcare delivery models. Also, regulatory frameworks in countries like France and Sweden encourage the adoption of managed service providers for telerehabilitation, ensuring compliance with data privacy laws and interoperability standards.

The Products segment is transforming into a rapidly expanding category, registering a CAGR of 11.2% over the forecast period. This quick rise is largely fueled by the rising deployment of hardware and software solutions designed specifically for remote rehabilitation in skilled nursing environments. Key products include wearable sensors, smart rehabilitation devices, telepresence robots, and mobile health applications that enable real-time tracking of patient progress. According to a survey conducted by the International Federation of Robotics, the installation of assistive robotic systems in European nursing homes increased in 2023, particularly for motor function rehabilitation. Moreover, the demand for portable and user-friendly rehab equipment has surged, especially in Eastern Europe, where facilities are upgrading their technology infrastructure. Moreover, leading medical device manufacturers such as Philips and Siemens Healthineers have introduced plug-and-play telerehabilitation kits tailored for institutional use, reducing setup complexity and accelerating adoption.

By End User Insights

The Healthcare Providers segment had the biggest market share in 2024. This control over the market is attributed to the widespread implementation of telerehabilitation within institutional care settings such as nursing homes, rehabilitation clinics, and long-term care facilities. Skilled nursing centers are increasingly adopting digital rehabilitation tools to enhance care continuity, reduce hospital readmissions, and improve patient engagement. Moreover, government initiatives aimed at modernizing healthcare delivery have played a crucial role in driving adoption among institutional providers. In the Netherlands, the Ministry of Health launched the “Digital Care for the Elderly” program, which provides subsidies to nursing homes investing in remote rehabilitation services, resulting in an increase in service utilization within two years. Also, healthcare providers benefit from centralized billing and streamlined documentation through integrated telerehabilitation platforms.

The Homecare segment is projected to grow at the highest CAGR of 13.6% during the forecast period, reflecting the expanding scope of telerehabilitation beyond institutional settings. Although home-based rehabilitation represents a smaller proportion of the market today, its adoption is rapidly increasing due to technological advancements and shifting patient preferences. One key driver is the growing number of elderly individuals opting to receive post-acute care in familiar environments rather than moving into institutional facilities. Furthermore, healthcare policies in several European countries now encourage home-based telerehabilitation to alleviate pressure on hospitals and nursing homes. The UK’s National Health Service (NHS) has expanded its "Hospital at Home" initiative, incorporating remote physiotherapy and occupational therapy services, which saw an increase in enrollment in 2023. Another contributing factor is the rise in insurance coverage for home-based digital rehabilitation. In Sweden, private insurers have started offering teletherapy packages as part of extended health benefits, allowing greater access for non-residential patients.

COUNTRY-LEVEL ANALYSIS

Germany had the largest market share by contributing 24.1% of the overall Europe telerehabilitation skilled nursing care center market in 2024. It keeps its lead position due to a combination of high healthcare expenditure, advanced digital infrastructure, and proactive government policies supporting telehealth integration. The Federal Ministry of Health has actively promoted digital transformation in elder care through initiatives such as the eHealth Law, which encourages the adoption of digital rehabilitation tools in nursing homes. Additionally, statutory health insurers like AOK and Barmer reimburse certain telerehabilitation services, facilitating widespread implementation. Moreover, partnerships between academic institutions like Charité Berlin and tech firms have resulted in pilot programs demonstrating the effectiveness of remote therapy in improving patient outcomes.

The United Kingdom plays an important role in the market and that is driven by a well-developed healthcare ecosystem and robust policy support for digital health innovations. The National Health Service (NHS) has been instrumental in promoting remote rehabilitation as part of its broader digital strategy. The NHS Long Term Plan emphasizes the expansion of digital health services, including remote physiotherapy and speech therapy for elderly patients. Furthermore, the Care Quality Commission (CQC) has incorporated digital capability assessments into facility accreditation, incentivizing providers to adopt telerehabilitation tools.

France possesses a separate place in the European telerehabilitation skilled nursing care center market which is supported by progressive healthcare reforms and a focus on patient-centered care. The French government has prioritized digital health as part of its national innovation agenda, encouraging nursing homes to integrate remote rehabilitation services. Additionally, the country has witnessed rapid deployment of AI-powered rehabilitation platforms in skilled nursing centers. These developments, coupled with favorable regulatory guidance and growing physician acceptance, position France as a major contributor to the expansion of telerehabilitation in institutional care settings across Europe.

Spain is a growing emphasis on enhancing digital healthcare access in long-term care facilities. The Spanish Ministry of Health has launched several initiatives to integrate telerehabilitation into public health services, particularly in underserved regions. This demographic shift has increased the demand for post-hospitalization rehabilitation, prompting nursing homes to adopt remote therapy solutions. A study published in Revista Española de Salud Pública noted an increase in therapy adherence rates among residents who participated in these programs. Moreover, Spain’s participation in EU-funded digital health projects has facilitated the procurement of advanced rehabilitation technologies, positioning the country as a rising force in the regional telerehabilitation market.

Italy captures a notable share of the Europe telerehabilitation skilled nursing care center market, driven by an expanding patient base and enhanced access to digital rehabilitation services. With one of the oldest populations in Europe, where a key portion of citizens are aged 65 or above, Italy faces significant demand for efficient post-acute care solutions. Private healthcare providers and insurance companies are also playing a role in driving adoption, with several insurers introducing teletherapy packages as part of extended coverage plans. Additionally, universities such as the University of Milan are conducting clinical studies to validate the effectiveness of remote rehabilitation, further supporting market expansion.

KEY MARKET PLAYERS

Companies playing a prominent role in the European telerehabilitation skilled nursing care center market profiled in this report are Care Innovations, LLC., Koninklijke Philips N.V., Included Health Inc. (Doctor on Demand, Inc.), Humanus Corporation, MIRA Rehab Limited, American Well Corporation, UniQuest Pty Limited (NeoRehab), NeuroTechR3, Inc., Hinge Health, Inc., PT Genie, and others.

TOP LEADING PLAYERS IN THE MARKET

Philips Healthcare

Philips is a global leader in health technology, offering an extensive portfolio of digital rehabilitation and remote patient monitoring solutions tailored for skilled nursing care centers. The company plays a pivotal role in advancing telerehabilitation through its integrated telehealth platforms that support real-time physiotherapy, speech therapy, and chronic disease management. By combining AI-driven analytics with cloud-based communication tools, Philips enables caregivers to deliver personalized rehabilitation programs remotely, improving patient engagement and clinical efficiency across European nursing homes.

Siemens Healthineers

Siemens Healthineers has emerged as a key player by integrating advanced diagnostics with telerehabilitation services in long-term care settings. Its focus on connected care solutions allows seamless data exchange between skilled nursing centers and specialist rehabilitation providers. The company’s innovations include wearable sensors, virtual rehabilitation modules, and AI-assisted movement analysis systems that enhance post-acute recovery outcomes. With strong partnerships across European healthcare institutions, Siemens contributes significantly to the expansion of digital rehabilitation infrastructure and service delivery in institutional elder care.

Tunstall Healthcare

Tunstall Healthcare specializes in telehealth and telecare solutions designed specifically for elderly and post-acute care environments. As a UK-based company with a strong presence across Europe, it offers end-to-end telerehabilitation platforms that support remote monitoring, video consultations, and home-based rehabilitation tracking. Tunstall’s solutions are widely adopted in public and private nursing homes, enabling continuous patient support while reducing hospital re-admissions. Its emphasis on user-friendly design and interoperability makes it a preferred partner for governments and care providers investing in digital transformation.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the Europe telerehabilitation skilled nursing care center market is developing integrated digital platforms that combine real-time monitoring, virtual therapy sessions, and patient engagement tools into a unified system. These platforms streamline rehabilitation workflows and improve care coordination between clinicians and patients within institutional settings.

Another critical approach is collaborating with healthcare institutions and government agencies to pilot and scale telerehabilitation services. Companies are forging strategic alliances with hospitals, nursing homes, and academic research centers to validate the effectiveness of their technologies and ensure alignment with clinical guidelines and policy frameworks.

Lastly, enhancing user experience through intuitive interface design and AI-powered personalization is a growing priority. By incorporating adaptive learning algorithms and voice-enabled navigation features, market leaders are making telerehabilitation more accessible for elderly users and caregivers, thereby increasing adoption rates across diverse patient populations.

COMPETITION OVERVIEW

The competition in the Europe telerehabilitation skilled nursing care center market is shaped by a dynamic mix of established medical technology firms, emerging digital health startups, and regional healthcare IT providers striving to capture market share through innovation and strategic positioning. While large multinational corporations dominate with comprehensive platform offerings and robust R&D capabilities, niche players are gaining traction by addressing specific therapeutic areas or focusing on user-centric design improvements. The market is witnessing increased collaboration between technology vendors and healthcare providers to co-develop tailored solutions that align with clinical needs and regulatory requirements. Additionally, the demand for interoperable systems that integrate seamlessly with electronic health records and existing facility infrastructure is driving product differentiation. As governments across Europe push for digital transformation in elder care, companies that can demonstrate measurable clinical impact and scalability are positioned to lead the evolving landscape. However, challenges such as varying reimbursement policies, data privacy concerns, and resistance from traditional care models continue to influence competitive dynamics, necessitating continuous adaptation and innovation.

RECENT MARKET DEVELOPMENTS

- In January 2024, Philips Healthcare launched a new AI-integrated telerehabilitation suite specifically designed for use in skilled nursing facilities, enhancing remote therapy delivery and real-time patient progress tracking.

- In March 2024, Siemens Healthineers partnered with a leading European geriatric care network to deploy its cloud-based rehabilitation platform across 200 nursing homes, aiming to standardize digital therapy protocols and improve care continuity.

- In June 2024, Tunstall Healthcare expanded its telecare offerings by introducing a voice-activated rehabilitation assistant, designed to help elderly patients engage more effectively with prescribed therapy exercises without requiring digital literacy.

- In August 2024, Hologic, a global medical technology company, acquired a European digital rehabilitation startup to strengthen its portfolio of remote patient engagement tools for post-acute care settings.

- In October 2024, Abbott announced a strategic collaboration with a pan-European nursing association to conduct training workshops on telerehabilitation best practices, aimed at increasing adoption among caregivers and therapists.

MARKET SEGMENTATION

This Europe telerehabilitation skilled nursing care center market research report is segmented and sub-segmented into the following categories.

By Application

- Physical Therapy

- Occupational Therapy

- Speech Therapy

By Component

- Products

- Type

- Software

- Hardware

- Type

- Services

By End User

- Healthcare Providers

- Homecare

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the Europe telerehabilitation skilled nursing care center market?

The Europe telerehabilitation skilled nursing care center market is driven by a rapidly aging population needing post-acute care, increased adoption of digital health technologies like AI and wearable sensors, and supportive government policies promoting telehealth integration in nursing facilities.

2. What challenges does the Europe telerehabilitation skilled nursing care center market face?

Challenges include uneven digital infrastructure across regions, especially in rural areas, complex regulatory requirements like GDPR for data privacy, resistance to technology adoption by elderly patients and staff, and inconsistent reimbursement policies across EU countries.

3. What opportunities exist in the Europe telerehabilitation skilled nursing care center market?

Opportunities lie in public-private partnerships to expand telehealth infrastructure, growing demand for remote monitoring of chronic diseases, integration of AI-driven rehabilitation tools, and expanding home-based telerehabilitation services alongside institutional care.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com