Europe TIC Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Sourcing Type, Service Type, Application, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe TIC Market Size

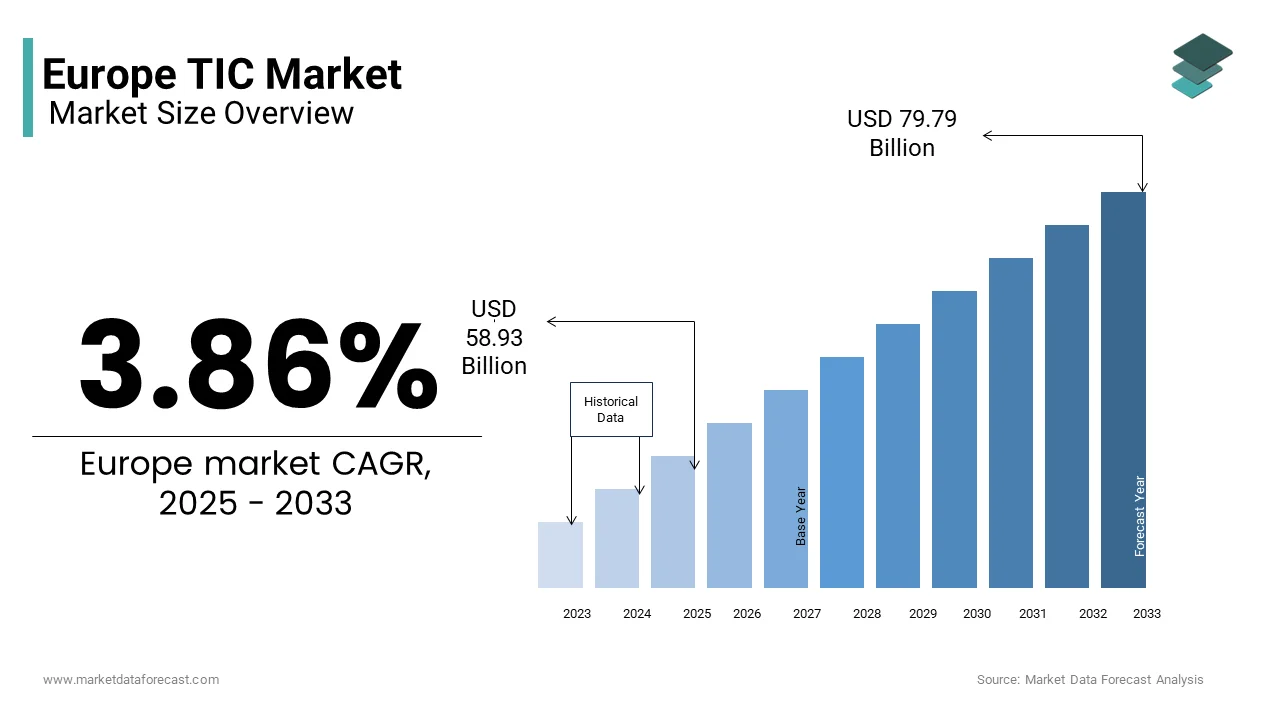

The Europe TIC market was valued at USD 56.74 billion in 2024 and is anticipated to reach USD 58.93 billion in 2025 from USD 79.79 billion by 2033, growing at a CAGR of 3.86% during the forecast period from 2025 to 2033.

The Europe Testing, Inspection, and Certification (TIC) market covers a wide range of services aimed at ensuring product compliance, quality assurance, safety standards, and regulatory adherence across multiple industries. This market plays a critical role in facilitating trade, enhancing consumer confidence, and supporting industrial innovation by validating that products, systems, and processes meet required specifications and legal mandates. The TIC sector serves diverse fields, including automotive, aerospace, healthcare, construction, energy, and consumer goods, where conformity assessment is essential for market access and operational integrity. Moreover, the European Union’s focus on harmonizing technical regulations through directives such as CE marking has reinforced the demand for independent third-party assessments.

MARKET DRIVERS

Increasing Regulatory Compliance Across Key Industries

One of the primary drivers of the Europe TIC market is the growing stringency of regulatory requirements across sectors such as pharmaceuticals, automotive, food safety, and renewable energy. Like, a significant portion of new chemical substances introduced into the EU market between 2021 and 2023 required third-party testing under REACH provisions. In the automotive sector, the shift toward electric vehicles has prompted new regulatory standards concerning battery safety, emissions, and electromagnetic compatibility. Similarly, the expansion of the EU Medical Device Regulation has led to a surge in demand for clinical evaluation and biocompatibility testing services. These evolving mandates necessitate continuous engagement with accredited TIC providers, ensuring that manufacturers remain compliant while maintaining market access.

Rising Demand for Product Quality Assurance in Global Supply Chains

A significant factor driving the Europe TIC market is the increasing reliance on independent quality verification in global supply chains. As international trade expands and sourcing becomes more geographically dispersed, businesses are turning to TIC providers to ensure consistency, reliability, and compliance throughout production cycles. In the food and beverage industry, companies exporting to the EU must adhere to strict hygiene and traceability norms under the European Food Safety Authority guidelines. Similarly, the aerospace sector relies heavily on certified inspection bodies to validate component durability and safety protocols. Furthermore, multinational corporations headquartered in Europe have been outsourcing their TIC functions to enhance efficiency and reduce internal compliance burdens. This trend is particularly evident among German and French firms, where supply chain transparency and product integrity have become central to brand reputation and investor trust.

MARKET RESTRAINTS

High Cost of Compliance Testing and Certification Services

A key restraint impeding the growth of the Europe TIC market is the high cost associated with compliance testing and certification, particularly for small and medium-sized enterprises (SMEs). The process of obtaining regulatory approvals often involves extensive laboratory testing, documentation audits, and repeated evaluations, all of which contribute to significant financial outlays. In industries such as medical devices and aerospace, where certification cycles can last up to two years, the financial burden becomes even more pronounced. Additionally, fluctuations in accreditation fees and the need for recertification every few years further exacerbate cost concerns. Moreover, the complexity of navigating multiple certification schemes—such as ISO, CE marking, and IECQ—requires specialized knowledge that many smaller firms lack. This leads to additional consultancy expenses, limiting their ability to compete effectively.

Fragmentation of Standards and Accreditation Frameworks Across Europe

Another significant challenge affecting the Europe TIC market is the fragmentation of standards and accreditation frameworks across different EU member states. Although the European Union has made strides toward harmonizing technical regulations, disparities still exist in national implementation, leading to inconsistencies in certification requirements and testing procedures. According to the European Accreditation Cooperation, as of 2023, there were notable differences in how certain CE marking directives were interpreted and enforced across countries like Poland, Italy, and Greece. This inconsistency complicates the work of TIC providers, who must navigate varying regional mandates, often requiring duplicate assessments for similar products. In addition, differences in accreditation bodies—such as DAkkS in Germany, UKAS in the UK, and COFRAC in France—create administrative hurdles for testing laboratories and certification agencies attempting to operate across borders. These variations not only delay time-to-market but also discourage investment in cross-border TIC operations. As a result, despite the presence of a unified European market, the lack of standardized enforcement mechanisms hampers efficiency and scalability in the TIC sector.

MARKET OPPORTUNITY

Expansion of Renewable Energy and Smart Infrastructure Projects

A major opportunity emerging in the Europe TIC market is the rapid expansion of renewable energy and smart infrastructure projects, which require extensive third-party validation for safety, performance, and regulatory compliance. Governments across the EU have set ambitious targets for decarbonization, prompting large-scale investments in wind, solar, hydrogen, and grid modernization initiatives. This transition necessitates comprehensive testing and certification of components such as photovoltaic panels, wind turbine blades, battery storage systems, and grid-connected inverters. Independent TIC providers play a crucial role in verifying compliance with standards such as IEC 61215 for solar modules and EN 61400-23 for wind turbines. As reported by WindEurope, more than 85% of newly installed offshore wind farms in 2023 underwent mandatory third-party inspections before commissioning. Beyond energy, the rollout of smart cities and digital infrastructure—encompassing intelligent transport systems, IoT-enabled buildings, and 5G networks—also demands rigorous conformity assessments. With increasing interconnectivity and cybersecurity concerns, TIC firms are being enlisted to evaluate both physical and digital compliance aspects.

Rise In Outsourcing Of IT Services By Multinational Corporations

The increasing tendency among multinational corporations to outsource their Testing, Inspection, and Certification (TIC) needs presents a significant growth avenue for the Europe TIC market. Companies are shifting away from in-house compliance teams in favor of engaging specialized third-party providers that offer greater flexibility, scalability, and expertise in navigating complex regulatory landscapes. This shift is driven by the desire to reduce overhead costs, accelerate time-to-market, and leverage external expertise without investing in internal certification capabilities. For instance, automotive giants such as BMW and Renault have expanded their partnerships with independent TIC firms to streamline compliance across multiple jurisdictions. Similarly, pharmaceutical companies like Roche and Novartis have increasingly relied on contract testing laboratories to support clinical trials and drug registration processes. Apart from these, the globalization of supply chains has heightened the need for coordinated, cross-border TIC solutions. This growing reliance on external expertise is strengthening the role of European TIC providers in global value chains and positioning them as strategic partners for international businesses.

MARKET CHALLENGES

Intense Competition from Emerging Market TIC Providers

One of the foremost challenges facing the Europe TIC market is the rising competition from well-funded TIC service providers based in Asia and North America. Countries such as China, India, and the United States have rapidly developed their own testing and certification infrastructures, offering competitive pricing and expedited turnaround times that appeal to cost-conscious clients. European firms are encountering pressure as multinational clients increasingly diversify their TIC sourcing strategies to include low-cost alternatives abroad. In particular, Chinese certification bodies have gained traction in sectors such as electronics and textiles, leveraging their proximity to manufacturing hubs and streamlined regulatory pathways. Indian TIC firms, on the other hand, have capitalized on digital transformation trends, offering cloud-based compliance tools and AI-driven inspection analytics at reduced rates. Moreover, aggressive expansion strategies by Asian and American TIC conglomerates into European markets are intensifying domestic competition. Some global players have acquired European laboratories to strengthen their foothold, thereby challenging the dominance of traditional European firms.

Rapid Technological Advancements and Digital Transformation Demands

The pace of technological advancement and the ongoing digital transformation present a significant challenge for traditional players in the Europe TIC market. As industries adopt automation, artificial intelligence, blockchain, and the Internet of Things (IoT), the nature of testing, inspection, and certification is evolving beyond conventional methodologies. Legacy TIC providers face difficulties in keeping up with the demand for digitalized testing environments, predictive maintenance diagnostics, and remote inspection capabilities. Many traditional laboratories lack the infrastructure to perform cyber-physical system validations or assess software-driven compliance in autonomous systems. Additionally, the emergence of self-certification models supported by AI-powered risk assessment tools threatens to disrupt the traditional third-party certification model. Some tech-savvy startups are offering automated compliance solutions that bypass conventional TIC gatekeepers, particularly in software-driven industries such as fintech and healthtech.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.86% |

|

Segments Covered |

By Sourcing Type, Service Type, Application, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

SGS (Switzerland), Bureau Veritas (France), Intertek (UK), TÜV NORD (Germany), TÜV SUD (Germany), Eurofins Scientific (Luxembourg), TÜV Rheinland (Germany), CETECOM (Germany), DEKRA (Germany), Applus+ (Spain), Element Material Technology (UK), and DNV GL (Norway). |

SEGMENTAL ANALYSIS

By Sourcing Type Insights

The in-house segment held the largest share of the Europe Testing, Inspection, and Certification (TIC) market by accounting for 58% of total revenue in 2024. This dominance is primarily attributed to the continued reliance of large industrial enterprises on internal quality assurance systems to maintain control over compliance processes, reduce dependency on external vendors, and accelerate product development cycles. Similarly, pharmaceutical companies such as Roche and Bayer have maintained substantial in-house certification capabilities to ensure rapid regulatory submissions and adherence to stringent EU medical device regulations. Moreover, aerospace firms like Airbus and Safran continue to invest heavily in proprietary inspection frameworks to meet industry-specific standards such as EN 9100. The presence of well-established R&D centers across France, the UK, and Sweden further reinforces this trend, with companies preferring to integrate TIC into core operations rather than outsource critical functions.

Outsourced TIC services are the fastest-growing segment in the Europe market, projected to expand at a CAGR of 6.8%. This growth is being driven by increasing cost pressures, rising regulatory complexity, and the need for faster time-to-market among small and medium-sized enterprises (SMEs), which lack the resources to maintain internal compliance departments. Additionally, multinational corporations are also shifting toward third-party providers to streamline cross-border compliance, particularly in sectors such as consumer electronics and food safety. The expansion of digital platforms offering remote inspections and automated certification has further accelerated this shift.

By Service Type Insights

The testing services constitute the largest segment within the Europe TIC market by capturing an estimated market share of 44% in 2024. This dominance stems from the increasing demand for material analysis, product performance validation, and regulatory compliance testing across industries such as automotive, pharmaceuticals, aerospace, and consumer goods. In the automotive sector, the transition to electric vehicles has intensified demand for battery life cycle testing, crash simulations, and emissions assessments, with major manufacturers investing heavily in both in-house and third-party testing facilities. Besides, the healthcare industry remains a significant contributor, with the implementation of the EU Medical Device Regulation (MDR) requiring extensive clinical and biocompatibility testing.

Certification services represent the quickest advancing segment in the Europe TIC market, predicted to expand at a CAGR of 7.2% during the forecast period. This growth is fueled by the rising necessity for standardized compliance documentation, particularly in export-oriented industries and those subject to evolving regulatory frameworks. One of the primary drivers is the expansion of CE marking requirements across diverse product categories, including machinery, toys, and construction materials. Additionally, the introduction of the Carbon Border Adjustment Mechanism (CBAM) has led to a surge in demand for sustainability certifications, especially in energy-intensive sectors such as steel and cement. Another contributing factor is the growing emphasis on cybersecurity and data protection, prompting firms to seek ISO/IEC 27001 and GDPR-compliant certifications. Furthermore, the proliferation of environmental, social, and governance (ESG) reporting mandates has spurred demand for sustainability and carbon footprint certifications.

By Application Insights

The automotive industry accounts for the largest application segment in the Europe TIC market, representing approximately 39% of the total market value in 2024. This dominance is driven by the region's status as a global hub for automotive manufacturing and innovation, particularly in countries like Germany, France, and Italy, where leading OEMs and Tier-1 suppliers are based. The introduction of the General Safety Regulation (GSR) and the requirement for advanced driver-assistance systems (ADAS) compliance have significantly expanded the scope of TIC activities in this sector. In addition, the electrification of the automotive industry has created new testing demands for battery performance, charging infrastructure interoperability, and thermal runaway risks. Automotive manufacturers are increasingly engaging third-party TIC providers to navigate complex regulatory landscapes and expedite market approvals.

The aerospace industry is the rapidly surging application segment in the Europe TIC market, projected to grow at a CAGR of 8.1%. This acceleration is driven by the increasing demand for aircraft modernization, the development of next-generation propulsion systems, and the expansion of commercial space programs, all of which require stringent compliance with international safety and performance standards. Additionally, the aviation sector is undergoing a technological transformation with the introduction of hydrogen-powered aircraft and sustainable aviation fuels, which demand new testing protocols for structural integrity and combustion efficiency. The implementation of the EN 9100 standard for aerospace quality management has further reinforced the need for certified TIC services. Moreover, the post-pandemic recovery of air travel has led to higher aircraft production rates, with Airbus ramping up deliveries across Europe.

COUNTRY-LEVEL ANALYSIS

Germany held the largest market share in the Europe TIC market by accounting for 23.7% of total regional revenue in 2024. The country’s prominence is underpinned by its robust industrial base, stringent regulatory environment, and high levels of investment in automotive, chemical, and mechanical engineering sectors. The automotive industry, dominated by brands such as BMW, Mercedes-Benz, and Volkswagen, remains a major consumer of TIC services, particularly in emissions testing and functional safety assessments. Moreover, Germany hosts several globally recognized certification bodies, including TÜV Rheinland and DEKRA, which play a pivotal role in shaping industry standards and facilitating international trade. The country’s commitment to digital transformation is also evident, with increasing adoption of AI-driven inspection tools and remote monitoring systems across manufacturing units. Besides, the government’s push for renewable energy and Industry 4.0 initiatives has amplified demand for specialized testing in smart grid technologies and automation systems.

The United Kingdom sees strong demand amid regulatory shifts in the Europe TIC market. Despite Brexit-related disruptions, the UK remains a major center for testing, inspection, and certification due to its well-developed infrastructure, strong regulatory framework, and high concentration of accredited laboratories. The healthcare industry, particularly in light of post-pandemic reforms, has seen a surge in demand for medical device certifications, with the Medicines and Healthcare products Regulatory Agency (MHRA) implementing new UKCA marking requirements. The aerospace sector also plays a crucial role, with companies like Rolls-Royce and BAE Systems relying heavily on independent TIC providers for engine testing and component certification. Also, the UK’s financial services industry has increasingly adopted cybersecurity certifications to align with FCA (Financial Conduct Authority) guidelines, further expanding the scope of TIC services. Post-Brexit trade agreements have also prompted businesses to undergo dual certifications for both UKCA and CE marking, creating additional demand for TIC firms.

France occupies a notable position in the Europe TIC market. The country’s market dynamics are shaped by stringent regulatory enforcement, a strong presence of multinational corporations, and increasing focus on sustainability and digital transformation. The French National Metrology and Testing Laboratory (LNE) plays a central role in coordinating national testing initiatives and promoting European harmonization efforts. The expansion of the EU Battery Passport initiative has also influenced demand for certification services, particularly in the electric vehicle supply chain. Companies such as Renault and TotalEnergies have actively engaged TIC providers to validate compliance with circular economy directives and raw material traceability standards. Moreover, the healthcare sector has witnessed a surge in certification activity following the implementation of the EU Medical Device Regulation (MDR). Hospitals and medical equipment manufacturers are increasingly relying on accredited bodies to ensure timely approvals and regulatory alignment.The

Italian market is supported by its vibrant manufacturing sector, growing exports, and increasing emphasis on product quality and safety. The country’s industrial landscape, particularly in machinery, fashion, and automotive components, drives consistent demand for testing and certification services. The textile and footwear industries, concentrated in regions like Lombardy and Veneto, have been particularly active in seeking certifications related to chemical safety and sustainability. The automotive sector remains another key contributor, with companies such as Fiat Chrysler Automobiles (now Stellantis) investing in advanced testing labs for electric drivetrain validation. In addition, the construction industry has seen increased demand for CE marking of building materials under the Construction Products Regulation (CPR).

Spain is witnessing an increasing urbanization and infrastructure development, driving demand, which is supported by rising urbanization, infrastructure modernization, and growing awareness of product safety and compliance. The country’s economic recovery post-pandemic has spurred investments in transportation, energy, and real estate, all of which rely on extensive testing and certification. The expansion of renewable energy projects, particularly in solar and wind power, has led to increased testing of photovoltaic modules and turbine components to meet IEC and EN standards. The food and beverage industry remains a key user of TIC services, with Spanish exporters seeking certifications such as GlobalG.A.P. and BRCGS to ensure compliance with EU and international food safety regulations. Major companies like Mahou San Miguel and Freixenet have incorporated third-party audits into their quality assurance protocols.

KEY MARKET PLAYERS

SGS (Switzerland), Bureau Veritas (France), Intertek (UK), TÜV NORD (Germany), TÜV SUD (Germany), Eurofins Scientific (Luxembourg), TÜV Rheinland (Germany), CETECOM (Germany), DEKRA (Germany), Applus+ (Spain), Element Material Technology (UK), and DNV GL (Norway). Are the market players that are dominating the Europe TIC market?.

Top Players in the Market

TÜV Rheinland Group

TÜV Rheinland is a globally recognized leader in testing, inspection, and certification services with deep roots in the European market. Headquartered in Germany, the company offers a comprehensive portfolio covering industrial testing, product safety, cybersecurity, and sustainability assessments. TÜV Rheinland plays a crucial role in supporting global trade by ensuring compliance with international standards and regulatory frameworks. Its reputation for technical excellence and impartiality has made it a trusted partner across industries such as automotive, energy, healthcare, and consumer goods. With a strong presence in over 60 countries, TÜV Rheinland significantly influences global conformity assessment practices.

Bureau Veritas SA

Bureau Veritas is a French multinational corporation that provides a wide range of TIC services tailored to sectors including maritime, construction, agriculture, and manufacturing. Known for its commitment to quality and risk management, the company operates in more than 140 countries and serves as a key player in both public and private sector compliance initiatives. Bureau Veritas emphasizes innovation through digital transformation, offering smart inspection tools and cloud-based certification platforms. Its expertise in sustainability and ESG reporting has positioned it as a vital contributor to evolving environmental regulations. The company’s long-standing industry relationships and global reach reinforce its leadership status in the European TIC market.

SGS SA

SGS, headquartered in Switzerland, is one of the largest independent inspection, verification, testing, and certification companies worldwide. It supports clients across diverse industries such as food safety, pharmaceuticals, mining, and renewable energy. In Europe, SGS plays a pivotal role in ensuring product compliance with EU directives and facilitating market access for international exporters. The company invests heavily in research and development to stay ahead of technological advancements and regulatory changes. With a focus on integrity, transparency, and operational excellence, SGS continues to shape global TIC standards and maintain a dominant position in the European landscape.

Top Strategies Used by Key Market Participants

Expansion Through Strategic Acquisitions

Leading players in the Europe TIC market are increasingly pursuing strategic acquisitions to enhance their service portfolios and geographic reach. By acquiring niche laboratories, specialized certification bodies, or regional inspection firms, companies can quickly enter new markets and expand into emerging sectors. These acquisitions allow firms to diversify their offerings and strengthen their competitive edge in highly regulated industries.

Digital Transformation and Technology Integration

To improve efficiency and service delivery, major TIC providers are investing in digital technologies such as artificial intelligence, remote monitoring, and blockchain-based certification systems. These innovations enable real-time data analysis, predictive maintenance, and secure traceability, enhancing client trust and streamlining traditional processes. Digital transformation not only improves customer experience but also reduces turnaround times, making TIC services more agile and scalable.

Focus on Sustainability and ESG Certification Services

With growing emphasis on environmental responsibility and corporate governance, TIC firms are expanding their capabilities in sustainability verification and ESG compliance. Companies are developing dedicated service lines for carbon footprint assessments, circular economy certifications, and green building audits. This shift aligns with global policy trends and positions TIC providers as essential partners in helping businesses meet evolving sustainability mandates and investor expectations.

COMPETITIVE OVERVIEW

The competition in the Europe Testing, Inspection, and Certification (TIC) market is marked by a dynamic mix of established global leaders and regionally focused players striving for differentiation through specialization, innovation, and service diversification. While multinational firms like TÜV Rheinland, Bureau Veritas, and SGS dominate due to their extensive networks and brand credibility, numerous smaller and mid-sized organizations compete by offering customized solutions tailored to specific industry needs. The market remains highly fragmented, with intense rivalry observed particularly in Germany, France, and the UK, where demand for high-quality conformity assessment services is consistently strong.

A defining feature of this competitive environment is the increasing need for digital transformation, as firms race to integrate advanced technologies such as AI-driven analytics, remote inspections, and blockchain-based certification into their operations. Additionally, regulatory shifts—especially in areas like sustainability, medical devices, and cybersecurity—are compelling companies to continuously adapt and expand their service offerings. To maintain relevance and growth, market participants are actively engaging in strategic acquisitions, forming industry partnerships, and investing in R&D to stay ahead of evolving compliance landscapes. As the demand for third-party validation grows across sectors, competition is expected to intensify further, driving greater innovation and specialization within the European TIC industry.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, TÜV Rheinland launched a new digital certification platform designed to streamline compliance workflows and offer real-time access to test results and documentation for clients across Europe. This initiative was aimed at improving transparency, reducing processing times, and enhancing user experience in sectors such as automotive, electronics, and industrial equipment.

- In May 2024, Bureau Veritas acquired a leading Italian laboratory specializing in chemical compliance and environmental testing, reinforcing its presence in Southern Europe. This move enabled the company to expand its service offerings in line with REACH and CLP regulations, catering to the growing demand from manufacturers seeking localized conformity assessment support.

- In March 2024, SGS introduced a dedicated ESG verification unit within its European operations, responding to the rising need for sustainability reporting and carbon footprint assessments among multinational corporations. This strategic initiative positioned SGS as a preferred partner for companies navigating complex environmental regulations and investor-driven transparency requirements.

- In September 2023, DEKRA announced the expansion of its digital inspection capabilities by integrating AI-powered visual recognition technology into its existing infrastructure. This enhancement allowed for faster, more accurate assessments in sectors such as logistics, manufacturing, and transportation, strengthening DEKRA’s value proposition in the rapidly evolving TIC space.

- In July 2023, Intertek partnered with a German-based software firm to develop an integrated compliance management system for the medical device industry. This collaboration was intended to help manufacturers navigate the complexities of the EU Medical Device Regulation while accelerating time-to-market through automated documentation and audit trails.

MARKET SEGMENTATION

This research report on the Europe TIC market is segmented and sub-segmented into the following categories.

By Sourcing Type

- In-house services

- Outsourced services

By Service Type

- Testing

- Inspection

- Certification

- Others

By Application

- Consumer Goods and Retail

- Agriculture and Food

- Chemicals

- Construction and Infrastructure

- Energy and Power

- Industrial manufacturing

- Medical and Life Sciences

- Mining

- Oil & Gas and Petroleum

- Public Sector

- Automotive

- Aerospace

- Marine

- Railways

- Supply Chain and Logistics

- IT and Telecommunications

- Sports & Entertainment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving growth in Europe’s TIC market?

Stricter EU regulations on product safety, environmental impact (e.g., REACH, RoHS), and rising demand for third-party quality assurance—especially in automotive, pharma, and food—are fueling TIC services.

How are sustainability regulations shaping the TIC landscape in Europe?

With the EU Green Deal and CSRD (Corporate Sustainability Reporting Directive), TIC providers are expanding ESG verification, carbon footprint assessments, and green labeling audits.

Which sectors dominate the demand for TIC services in Europe?

Manufacturing, energy (especially renewables), construction, and life sciences are key sectors, driven by evolving safety, traceability, and compliance mandates across member states.

How is digital transformation influencing TIC service delivery?

AI-powered inspections, blockchain-based certification, and remote auditing tools are enhancing efficiency, especially in cross-border trade and during post-pandemic supply chain audits.

What role does harmonization of standards play in the European TIC market?

Unified EU frameworks (like CE marking and Notified Bodies) reduce testing redundancy and promote cross-border product acceptance, creating a strong demand for accredited TIC partners.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com