Europe Trash Bags Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Material, End-Use, Distribution, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Trash Bags Market Size

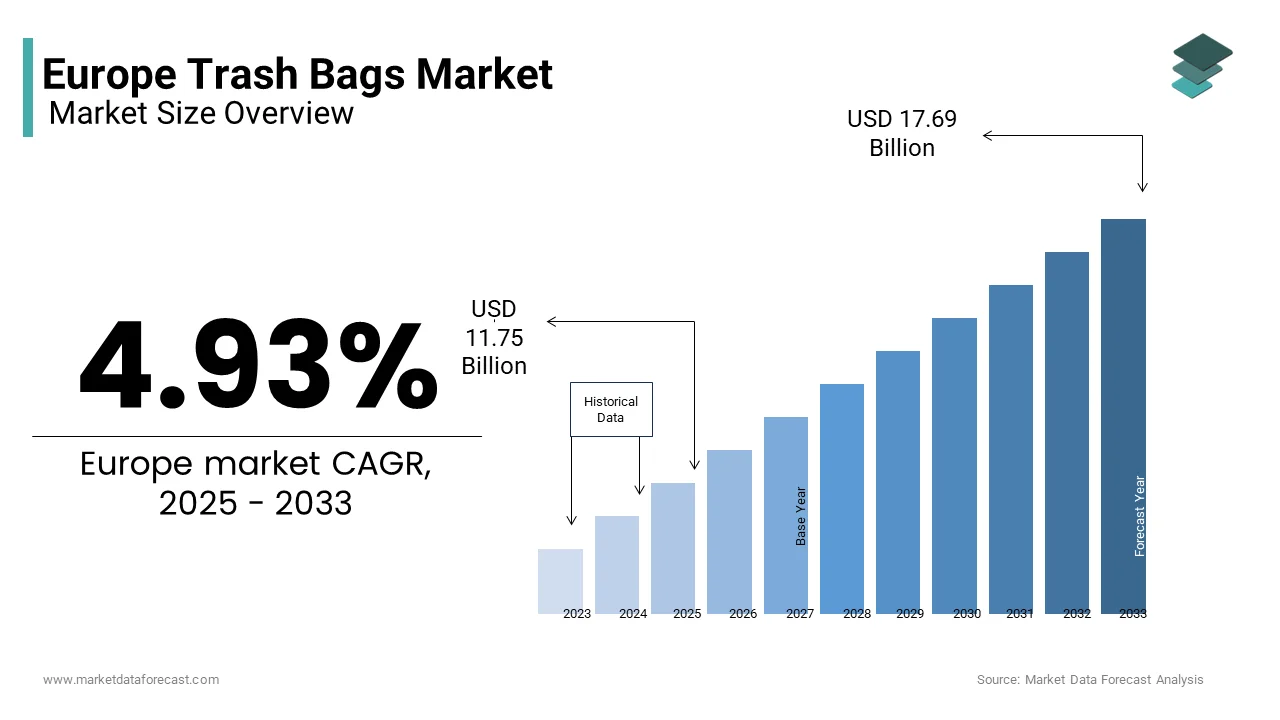

The Europe trash bags market size was valued at USD 3.32 billion in 2024 and is anticipated to reach USD 11.75 billion in 2025 from USD 17.69 billion by 2033, growing at a CAGR of 4.93% during the forecast period from 2025 to 2033.

The trash bag is deeply integrated into the waste management infrastructure. As per Eurostat, the European Union generates approximately 2.2 billion tons of municipal waste annually, with an increasing emphasis on sustainable disposal practices driving demand for efficient waste containment solutions. The Europe trash bags market is characterized by a robust regulatory framework, including the European Green Deal, which mandates the reduction of plastic waste and encourages the adoption of biodegradable materials.

Market conditions are shaped by the proliferation of e-commerce, which has amplified demand for durable packaging solutions. Additionally, the rise of single-person households, particularly in Western Europe, has fueled the need for smaller, convenient trash bags. According to a report by the European Environmental Agency, countries like Germany and France lead in market penetration due to stringent waste segregation policies.

MARKET DRIVERS

Urbanization and Population Growth

The Urbanization is a pivotal driver of the Europe trash bags market, with cities accounting for nearly 75% of the region’s population, as per the United Nations Department of Economic and Social Affairs. The increased waste generation is creating a higher demand for effective waste management tools. For instance, metropolitan areas like London and Paris generate over 1 million tons of municipal waste annually, according to the European Environment Agency. The rising number of households, particularly single-person units, further amplifies this demand. Data from Eurostat indicates that single-person households now represent 33% of all households in Europe is driving the need for compact and user-friendly trash bags.

Moreover, urban centers are witnessing a surge in commercial activities, which directly correlates to higher waste output. Retail outlets, restaurants, and offices require specialized trash bags tailored to their needs. The convenience offered by drawstring and star-sealed bags enhances their appeal, making them indispensable in densely populated areas.

Stringent Waste Management Regulations

Regulatory frameworks play a critical role in shaping the Europe trash bags market. The European Union’s Circular Economy Action Plan mandates strict waste segregation and recycling protocols, compelling businesses and households to adopt high-quality trash bags. According to the European Commission, member states generated 2.2 billion tons of waste in 2021, with only 40% being recycled. Countries like Sweden and Germany have implemented advanced waste management systems, driving innovation in biodegradable and compostable trash bags. The EU’s Single-Use Plastics Directive further accelerates this trend, pushing manufacturers to develop eco-friendly alternatives.

MARKET RESTRAINTS

Volatility in Raw Material Prices

The Europe trash bags market faces significant challenges due to the volatility of raw material prices, particularly polyethylene (PE), which accounts for over 70% of production costs. According to the International Energy Agency, fluctuations in crude oil prices directly impact PE pricing, given its petroleum-based origins. In 2022, the price of high-density polyethylene (HDPE) surged by 15%, as reported by Plastics Europe, squeezing profit margins for manufacturers. This unpredictability complicates long-term planning and investment in production capacity.

Moreover, geopolitical tensions and supply chain disruptions exacerbate cost pressures. For instance, the Russia-Ukraine conflict disrupted natural gas supplies, a key feedstock for PE production is leading to shortages across Europe. Such instability forces manufacturers to pass on costs to consumers, potentially stifling demand. While some companies are exploring alternative materials like bio-based polymers, these substitutes remain expensive and less scalable.

Environmental Concerns and Consumer Resistance

Environmental concerns represent another major restraint for the Europe trash bags market. Public awareness of plastic pollution has surged, with campaigns like the EU’s “Plastic-Free July” gaining traction. According to a survey by Ipsos, 65% of European consumers prefer eco-friendly products, yet skepticism about biodegradable trash bags persists. Critics argue that these alternatives often require specific composting conditions, limiting their effectiveness in traditional waste streams. Additionally, misconceptions about the recyclability of certain trash bags hinder adoption. The European Recycling Industries’ Confederation notes that improper disposal contaminates recycling streams, reducing overall efficiency. Regulatory measures, while well-intentioned, sometimes create confusion among consumers. For example, France’s ban on non-biodegradable bags has led to mixed reactions, with some users resisting the switch due to perceived inferior quality.

MARKET OPPORTUNITIES

Adoption of Biodegradable Bags

The growing emphasis on sustainability presents a significant opportunity for the Europe trash bags market, particularly through the adoption of biodegradable alternatives. This growth is driven by stringent regulations, such as the EU’s Single-Use Plastics Directive, which mandates the reduction of conventional plastic usage. Countries like Italy and Spain have already implemented bans on non-biodegradable bags by creating a fertile ground for innovation.

Consumer preferences are also shifting, with Nielsen data indicating that 55% of Europeans are willing to pay a premium for eco-friendly products. Manufacturers are capitalizing on this trend by developing compostable trash bags made from materials like polylactic acid (PLA) and starch blends. These products decompose within 90 days under industrial composting conditions, as verified by the European Standard EN 13432.

Expansion into E-Commerce Channels

The rapid growth of e-commerce offers another lucrative opportunity for the Europe trash bags market. Statista reports that online retail sales in Europe reached €833 billion in 2022, with projections indicating continued expansion. This shift in consumer behavior has created a demand for durable and versatile trash bags suitable for packaging returns and managing household waste.

E-commerce platforms provide manufacturers with direct access to a broader customer base, enabling personalized marketing strategies. For instance, Amazon Europe’s private label program allows brands to showcase innovative products like scented or antimicrobial trash bags. Additionally, subscription models, where consumers receive regular deliveries of trash bags, are gaining popularity. According to McKinsey & Company, subscription services in Europe grew by 25% in 2021 that will further amplify the growth opportunities of the market.

MARKET CHALLENGES

Balancing Cost and Sustainability

One of the primary challenges facing the Europe trash bags market is reconciling affordability with sustainability. While biodegradable and compostable bags align with environmental goals, their production costs are significantly higher than traditional plastic alternatives. According to a study by the Ellen MacArthur Foundation, biodegradable bags can be up to 30% more expensive to manufacture due to the use of specialized materials and processes. This price disparity poses a barrier to widespread adoption, particularly among budget-conscious consumers.

Moreover, the lack of standardized composting infrastructure complicates matters. The European Compost Network estimates that only 35% of municipalities in Europe have facilities capable of processing biodegradable bags. Without adequate infrastructure, these products often end up in landfills, undermining their environmental benefits. Manufacturers must navigate these challenges by investing in cost-effective production techniques and collaborating with governments to expand composting networks. Failure to address these issues risks alienating both environmentally conscious consumers and price-sensitive buyers.

Navigating Complex Regulatory Landscapes

The fragmented regulatory landscape across Europe presents another significant challenge for the trash bags market. Each country enforces unique standards, creating compliance hurdles for manufacturers. For example, France’s anti-waste law prohibits the sale of non-biodegradable bags, while Germany focuses on recycling quotas, as per the Federal Ministry for the Environment. These inconsistencies increase operational complexity and raise costs.

Furthermore, frequent updates to regulations add layers of uncertainty. The European Commission’s recent proposal to introduce stricter labeling requirements for biodegradable products exemplifies this issue. To mitigate these challenges, companies must invest in legal expertise and adapt quickly to evolving mandates. However, small and medium-sized enterprises (SMEs) often lack the resources to comply, putting them at a competitive disadvantage.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.93% |

|

Segments Covered |

By Type, Material, End-Use, Distribution, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Berry Global Inc. Cosmoplast (UAE), Four Star Plastics (US), The Clorox Company (US), International Plastics, Inc. (US), Novolex (US), Novplasta (Slovakia), Inteplast Group, Ltd. (US), Poly-America, L.P., (US), and Reynolds Consumer Products (US). |

SEGMENTAL ANALYSIS

By Type Insights

The star sealed trash bags segment dominated the Europe trash bags market by capturing 45.6% of the total share in 2024. Their prevalence is attributed to their superior design, which ensures maximum durability and leak resistance. This makes them ideal for heavy-duty applications in industrial and institutional settings, where waste volumes are substantial. According to the European Federation of Waste Management, industrial waste accounts for 30% of total waste generated in Europe, underscoring the demand for robust trash bag solutions. Another driving factor is their versatility. Star sealed bags are compatible with automated waste collection systems, which are increasingly adopted across Europe. A study by the European Committee of Manufacturers of Machines for the Food Industry reveals that automation adoption rates have risen by 25% since 2018. Additionally, their seamless closure mechanism reduces spillage risks, enhancing user convenience. These attributes solidify their dominance in the market by ensuring sustained demand across diverse end-use sectors.

The drawstring trash bags segment is likely to achieve a fastest CAGR of 5.8% throughout the forecast period. This growth is fueled by their convenience and ease of use in residential settings. Drawstrings allow for effortless tying and carrying is addressing consumer preferences for user-friendly products. Eurostat reports that 60% of European households prioritize convenience when purchasing trash bags is making drawstring variants highly appealing. Urbanization further accelerates this trend. As per the European Environment Agency, urban areas generate 40% more waste per capita than rural regions is driving demand for efficient waste management solutions. Additionally, the rise of e-commerce has spurred the need for durable packaging materials, with drawstring bags often repurposed for shipping returns. Their adaptability and alignment with modern lifestyles position them as the fastest-growing segment is attracting significant investments from manufacturers.

By Material Insights

The high-density polyethylene (HDPE) trash bags segment was the largest with a prominent share of 52.3% in 2024 owing to their exceptional strength-to-weight ratio that is making them ideal for heavy-duty applications. The European Plastics Converters Association notes that HDPE bags can withstand weights up to 10 kilograms without tearing by ensuring reliability in industrial and institutional settings. HDPE is cheaper to produce compared to alternatives like LDPE or biodegradable materials is making it accessible to a wide range of consumers. Additionally, advancements in manufacturing technologies have improved their puncture resistance, further enhancing their appeal. According to Plastics Europe, production efficiency for HDPE bags has increased by 15% over the past decade, reducing costs and boosting market penetration. These attributes cement HDPE’s position as the preferred material choice.

The biodegradable polyethylene (PE) trash bags segment is likely to register a CAGR of 7.2% during the forecast period. This growth is driven by stringent environmental regulations and shifting consumer preferences. According to the European Bioplastics Association, biodegradable PE bags degrade within 90 days under industrial composting conditions by aligning with the EU’s sustainability goals. Nielsen data reveals that 65% of Europeans prioritize eco-friendly products, fueling demand for biodegradable alternatives. Moreover, innovations in material science have improved their performance, addressing earlier concerns about durability.

By End-Use Insights

The retail sector was the largest in the Europe trash bags market by accounting for 40.4% of share in 2024. The growth of the segment is driven by the proliferation of supermarkets and hypermarkets, which generate significant amounts of packaging waste. According to the European Retail Forum, the retail industry contributes to 25% of total municipal waste. Retailers require trash bags that are easy to handle and dispose of waste to ensure smooth operations. Drawstring and star-sealed bags are particularly popular due to their durability and ease of use. Additionally, the rise of e-commerce has amplified demand for retail trash bags, as they are often repurposed for shipping returns.

The institutional sector is anticipated to grow with a significant CAGR of 6.3% during the forecast period. This growth is fueled by the expansion of educational institutions, healthcare facilities, and government buildings, which require specialized waste management solutions. The European Health and Environment Alliance reports that hospitals alone generate 15% of hazardous waste in Europe is driving demand for high-quality trash bags. Stringent hygiene standards further accelerate adoption. Institutions prioritize leak-proof and odor-resistant bags to maintain cleanliness and safety. Additionally, the increasing focus on sustainability has led to the adoption of biodegradable bags in schools and universities. According to the European Commission, educational institutions are among the earliest adopters of green initiatives that is quietly contributing to the segment’s rapid growth.

By Distribution Channel Insights

The supermarkets and hypermarkets segment was the largest by capturing a prominent share of the Europe trash bags market in 2024 owing to their extensive reach and ability to offer a wide range of products at competitive prices. According to Nielsen, 70% of European consumers purchase trash bags from these outlets due to convenience and availability. Promotional strategies also play a crucial role. Supermarkets frequently offer discounts and bundled deals is encouraging bulk purchases. Additionally, the rise of private-label products has intensified competition, driving innovation and improving quality.

The e-commerce segment is attributed to register a CAGR of 8.5% during the forecast period. This growth is driven by the increasing penetration of online shopping platforms, which offer convenience and accessibility. Subscription models are gaining traction, allowing consumers to receive regular deliveries of trash bags. McKinsey & Company reports that subscription services grew by 25% in 2021. Additionally, e-commerce platforms enable manufacturers to engage directly with consumers, fostering brand loyalty.

COUNTRY ANALYSIS

Top 5 Leading Countries in the Europe Trash Bags Market

Germany was the top performer in the Europe trash bags market by accounting for 25.4% of share in 2024 with the stringent waste management policies and a robust recycling infrastructure. The German Federal Environment Agency reports that the country recycles over 67% of its municipal waste, creating consistent demand for high-quality trash bags tailored to sorting requirements. Urbanization further amplifies consumption, with cities like Berlin generating approximately 1.2 million tons of waste annually. Retail giants such as Aldi and Lidl drive sales through private-label offerings, while e-commerce growth boosts accessibility. According to Eurostat, online retail penetration in Germany reached 80% in 2022. Additionally, consumer preferences for eco-friendly alternatives align with the EU’s Green Deal is fostering innovation in biodegradable bags.

France trash bags market is deemed to exhibit a CAGR of 10.2% in the next coming years. The country’s growth is attributed to be driven by its proactive stance on sustainability, exemplified by the Anti-Waste Law banning single-use plastics. The French Ministry of Ecological Transition notes that this legislation has spurred demand for biodegradable trash bags, which now account for 25% of total sales. Urban centers like Paris contribute significantly by generating over 3 million tons of waste annually. Retail chains such as Carrefour and Leclerc play a pivotal role, offering affordable and innovative products. According to report by Nielsen, 70% of French consumers prioritize environmentally friendly options is accelerating adoption.

The UK is growing steadily with the post-brexit regulations have intensified focus on domestic waste management that is driving demand for durable trash bags. The UK Environment Agency estimates that households generate 26 million tons of waste annually by necessitating efficient containment solutions. Supermarkets like Tesco and Sainsbury’s dominate distribution is leveraging promotional strategies to boost sales. The urbanization also plays a role, with London alone producing 1.1 million tons of waste yearly.

Italy is anticipated to grow steadily with the rising prominence of ban on non-biodegradable bags, implemented in 2011. Tourism and hospitality sectors amplify demand in cities like Rome and Milan. Retailers such as Coop Italia emphasize eco-friendly products, catering to environmentally conscious consumers. According to Ipsos, 60% of Italians prefer sustainable options, driving manufacturers to innovate.

Spain’s growth is propelled by urbanization and rising household waste levels. Madrid and Barcelona collectively generate over 2 million tons of waste annually, according to the Spanish Ministry of Ecological Transition. Environmental awareness is another driver, with 55% of Spaniards favoring biodegradable options, per Nielsen data.

KEY MAKRET PLAYERS

The major market players include are Berry Global Inc. Cosmoplast (UAE), Four Star Plastics (US), The Clorox Company (US), International Plastics, Inc. (US), Novolex (US), Novplasta (Slovakia), Inteplast Group, Ltd. (US), Poly-America, L.P., (US), and Reynolds Consumer Products (US), are the market players that are dominating the europe trash bags market.

Top 3 Players In The Europe Trash Bags Market

Berry Global Group

Berry Global Group is a leading innovator in the Europe trash bags market, renowned for its diverse product portfolio. The company focuses on sustainability, launching bio-based and recyclable trash bags that align with EU regulations. Their advanced manufacturing facilities enable cost-efficient production, ensuring competitive pricing. Berry Global collaborates with major retailers to expand its reach is leveraging partnerships to enhance brand visibility. Their commitment to research and development positions them as a pioneer in eco-friendly solutions.

Novolex Holdings LLC

Novolex Holdings LLC specializes in high-performance trash bags tailored to institutional and industrial needs. The company emphasizes durability and leak resistance, addressing key consumer pain points. Novolex invests heavily in automation, improving production efficiency and scalability. Their strategic acquisitions have expanded their footprint across Europe, enabling access to emerging markets.

Inteplast Group

Inteplast Group excels in producing high-density polyethylene (HDPE) trash bags, catering to both retail and industrial segments. The company’s focus on affordability and reliability appeals to budget-conscious consumers. Inteplast’s global supply chain ensures consistent availability, even amid disruptions. Their participation in sustainability initiatives underscores their commitment to reducing environmental impact.

Top Strategies Used By Key Players

Product Innovation

Key players prioritize product innovation to meet evolving consumer demands. For instance, companies are developing biodegradable and compostable trash bags that comply with EU regulations. According to Mordor Intelligence, investments in R&D have increased by 20% since 2020, enabling manufacturers to introduce cutting-edge solutions. These innovations not only enhance market appeal but also align with sustainability goals is fostering long-term growth.

Strategic Partnerships

Strategic partnerships with retailers and distributors are crucial for expanding market reach. Companies collaborate with supermarkets and hypermarkets to offer private-label products is tapping into established customer bases. According to a report by McKinsey, partnerships have boosted sales by 15% in key markets. These alliances ensure product availability and enhance brand visibility by strengthening competitive positioning.

Sustainability Initiatives

Sustainability initiatives are central to market strategies, driven by regulatory mandates and consumer preferences. Manufacturers are investing in eco-friendly materials and processes, reducing their carbon footprint. According to the Ellen MacArthur Foundation, companies adopting sustainable practices have witnessed a 25% increase in consumer loyalty. These efforts not only comply with regulations but also resonate with environmentally conscious buyers.

Competition Overview

The Europe trash bags market is characterized by intense competition, with key players vying for dominance through innovation and strategic maneuvers. The market is fragmented, with multinational corporations and regional players coexisting.

Price wars and product differentiation are common tactics, particularly in saturated segments like HDPE bags. However, sustainability has emerged as a critical battleground, with companies racing to develop biodegradable alternatives. Regulatory frameworks, such as the EU’s Single-Use Plastics Directive, intensify competition by mandating eco-friendly solutions. Additionally, e-commerce platforms have leveled the playing field, allowing niche brands to challenge established giants. Consumer loyalty remains elusive, with 60% of buyers switching brands based on price or quality, as per Nielsen. This dynamic environment fosters innovation but also poses challenges for maintaining profitability.

RECENT HAPPENINGS IN THIS MARKET

- In April 2023, Berry Global Group launched a new line of compostable trash bags certified under the European Standard EN 13432, enhancing their sustainability portfolio.

- In June 2023, Novolex Holdings LLC partnered with Carrefour to introduce private-label biodegradable trash bags, expanding their retail presence in France.

- In August 2023, Inteplast Group invested $50 million in a state-of-the-art HDPE production facility in Germany, boosting capacity and reducing costs.

- In October 2023, Berry Global acquired a Dutch bioplastics startup, accelerating their transition to eco-friendly materials.

- In December 2023, Novolex introduced an antimicrobial trash bag line targeting healthcare institutions, capitalizing on hygiene trends post-pandemic.

MARKET SEGMENTATION

This research report on the europe trash bags market is segmented and sub-segmented into the following categories.

By Type

- Draw Tape/ Drawstring Bag

- Star Sealed Bags

- Others

By Material

- High Density Polyethylene (HDPE)

- Low Density Polyethylene (LDPE)

- Linear Low Density Polyethylene (LLDPE)

- Bio-degradable Polyethylene

- Others

By End-use

- Retail

- Institutional

- Industrial

By distribution channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- E-Commerce

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the current trends shaping the growth of the trash bags market in Europe?

This question explores emerging developments such as the shift toward biodegradable materials, demand from residential vs. commercial sectors, and regulatory influences like the EU’s plastic reduction targets.

How are sustainability and EU regulations impacting the demand for biodegradable and compostable trash bags?

This question addresses the impact of environmental concerns and legislation (e.g., the Single-Use Plastics Directive) on product innovation and consumer preferences.

Which countries in Europe are leading in the adoption of eco-friendly trash bags, and why?

This dives into regional dynamics—comparing Northern and Western European markets (like Germany, Sweden, and France) versus Eastern or Southern Europe.

Who are the major players in the European trash bags market, and what strategies are they using to stay competitive?

This gives insight into key companies (e.g., Berry Global, Novolex, or local European manufacturers) and their product innovation, pricing, or partnership strategies.

What are the main distribution channels for trash bags in Europe, and how is e-commerce influencing sales?

The main distribution channels that trash bags are sold—via supermarkets, B2B, or online platforms, and how consumer buying habits are shifting in the digital age.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com