Europe Trucks Market Size, Share, Trends & Growth Forecast Report By Class, Propulsion, Truck, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Trucks Market Size

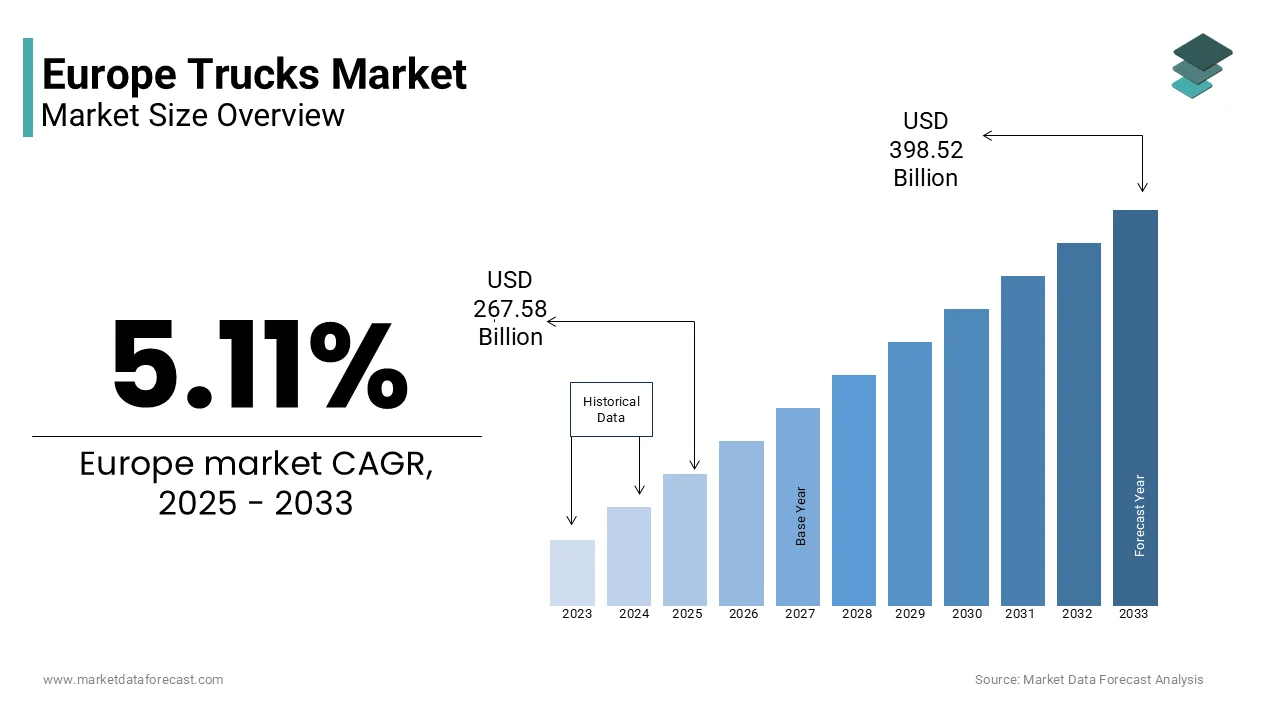

The Europe trucks market size was valued at USD 254.57 billion in 2024. The European market size is estimated to be worth USD 398.52 billion by 2033 from USD 267.58 billion in 2025, growing at a CAGR of 5.11% from 2025 to 2033.

Trucks are essential for transporting goods across densely populated urban centers and remote rural areas in countries where rail infrastructure is limited or less efficient. According to the International Road Union (IRU), road freight accounts for over 75% of inland freight transport in Europe, underlining the dominance of trucks in the transport ecosystem. In 2023, the European Environment Agency reported that there were more than 6 million trucks registered across the EU-27 nations, with Germany, France, and Poland collectively accounting for over 40% of the total fleet. The average age of trucks in Europe has been decreasing slightly due to stricter emissions regulations and the push toward more sustainable transportation.

MARKET DRIVERS

One of the major drivers of the Europe truck market is the expansion of e-commerce and last-mile delivery demand, which has significantly increased the need for efficient and flexible freight solutions. This growth necessitates an expanded fleet of delivery vehicles, including medium and heavy-duty trucks tailored for urban and regional distribution. Urbanization and consumer expectations for faster deliveries have prompted logistics companies to invest in newer, more technologically advanced trucks equipped with telematics, route optimization tools, and alternative fuel capabilities. For example, DHL, DB Schenker, and other major logistics firms have announced substantial investments in expanding their fleets to meet rising demand. Additionally, the increasing reliance on road transport over other modes such as rail in Eastern Europe has further reinforced the importance of the trucking sector. In countries like Poland and Romania, where railway freight capacity remains underdeveloped, trucks account for over 80% of domestic freight movement, according to IRU data.

Another key driver of the Europe truck market is the accelerated adoption of alternative fuel vehicles, which is driven by stringent regulatory mandates and growing environmental consciousness among transport operators. The European Commission’s Fit for 55 legislative package, aiming to reduce greenhouse gas emissions by 55% by 2030, has placed significant pressure on the transport sector to decarbonize. In 2023, ACEA reported that registrations of alternatively fueled trucks increased by 29% compared to the previous year, which is marking one of the fastest-growing segments within the commercial vehicle industry. Companies like Volvo Trucks, Daimler Truck, and Scania have introduced a wide range of battery-electric models designed for regional haulage and urban logistics. Notably, Sweden and Germany have emerged as early adopters, with public and private funding initiatives supporting the transition. Moreover, large fleet operators, including IKEA Transport Services and DB Schenker, have pledged to electrify portions of their truck fleets by 2030. These commitments, along with government incentives and improving charging infrastructure, are creating a favorable environment for sustainable truck adoption.

MARKET RESTRAINTS

One of the major restraints affecting the Europe truck market is the ongoing shortage of skilled truck drivers, which has become a systemic issue hindering fleet expansion and operational efficiency. Despite rising demand for freight transport, the sector struggles to attract and retain professional drivers due to factors such as long working hours, physical strain, and relatively low job prestige. According to the International Road Transport Union (IRU), the European trucking industry faced a driver shortage of approximately 700,000 in 2023, with countries like Germany, France, and the UK experiencing the most acute gaps. This personnel deficit has led to increased labor costs and reduced service capacities, discouraging fleet operators from investing in additional trucks. However, these wage increases place financial pressure on smaller logistics firms, which is limiting their ability to scale operations. Furthermore, demographic trends exacerbate the challenge, as the median age of truck drivers in the EU exceeds 45 years, that is suggesting an aging workforce with fewer young replacements entering the profession. Regulatory changes, including stricter driving hour limits and mandatory rest periods imposed by the European Union, have further constrained the availability of driver resources. These constraints collectively slow down freight turnover rates and dampen overall demand for new trucks, acting as a significant drag on market growth.

Another major restraint in the Europe truck market is the rising cost of raw materials and components, which has placed immense pressure on manufacturers' profit margins and slowed production output. The truck manufacturing industry relies heavily on steel, aluminum, copper, and semiconductors, all of which have seen significant price volatility in recent years.

The ongoing semiconductor shortage, stemming from supply chain disruptions caused by the pandemic and geopolitical tensions, has also affected the production of electronic components used in modern trucks, such as ADAS (Advanced Driver Assistance Systems), infotainment units, and telematics modules. Additionally, inflationary pressures and rising energy costs have further inflated manufacturing expenses, especially in countries like Germany and Italy, where energy-intensive industries face higher electricity tariffs.

MARKET OPPORTUNITIES

One of the major opportunities shaping the Europe truck market is the development of smart highways and intelligent transport systems (ITS), which are enhancing the efficiency, safety, and sustainability of road freight. Governments across Europe are investing in connected infrastructure that enables real-time traffic management, automated toll collection, and platooning technologies—where multiple trucks travel closely together using vehicle-to-vehicle communication to improve aerodynamics and fuel efficiency. Countries such as the Netherlands, Sweden, and Germany have pioneered smart highway initiatives, including dynamic lane management, electric road systems (ERS), and adaptive lighting. For instance, Sweden's e-road technology allows electric trucks to draw power from overhead lines while in motion, extending their operational range without requiring larger batteries. Similarly, Germany has launched pilot programs for automated truck platoons on its Autobahn network under the “Platooning Europe” initiative, which involves collaboration between Daimler Truck, MAN, and other OEMs. These advancements in infrastructure are encouraging fleet operators to invest in next-generation trucks equipped with connectivity and automation features.

An emerging opportunity in the Europe truck market lies in the rapid deployment of green hydrogen refueling infrastructure, which is paving the way for long-haul hydrogen-powered trucks. As governments push for carbon neutrality, hydrogen is gaining traction as a viable alternative to diesel, particularly for heavy-duty applications where battery-electric vehicles face limitations in terms of weight and charging time. Germany and France are leading this shift, with substantial public-private investments in hydrogen corridors. Germany’s National Hydrogen Strategy allocates €9 billion to develop hydrogen-based mobility solutions, including dedicated refueling points along major freight routes. Truck manufacturers such as Volvo Trucks, Daimler Truck, and Iveco are developing hydrogen fuel cell variants optimized for long-distance hauling. These developments indicate that the Europe truck market is on the verge of a technological transformation, with hydrogen poised to play a central role in decarbonizing road freight and unlocking new growth possibilities.

MARKET CHALLENGES

One of the major challenges facing the Europe truck market is the increasing complexity and cost of regulatory compliance regarding emissions standards and safety requirements. The European Union has implemented increasingly stringent norms, with the latest Euro 7/VI standards set to come into effect in 2025, imposing tighter limits on nitrogen oxides (NOx) and particulate matter emissions. These regulations require extensive modifications to engine design, exhaust after-treatment systems, and onboard diagnostics, which is significantly raising development and production costs for manufacturers.

According to a study conducted by the German engineering association VDMA, compliance with Euro 7 could increase the cost of new trucks by up to 15%, potentially deterring small and medium-sized fleet operators from upgrading their vehicles. Additionally, the European Environment Agency (EEA) reports that meeting these stringent targets may require the use of rare metals such as platinum and palladium in catalytic converters, which is further straining supply chains and inflating material costs. Beyond emissions, regulatory bodies are enforcing new safety mandates, including mandatory installation of advanced driver-assistance systems (ADAS), automatic emergency braking, and intelligent speed assistance. While these measures enhance road safety, they add another layer of complexity and expense for manufacturers and fleet buyers alike.

Another pressing challenge for the Europe truck market is the fragility of global supply chains , which continues to disrupt manufacturing schedules, delay deliveries, and inflate costs. The trucking industry relies on a complex web of international suppliers for critical components such as semiconductors, batteries, sensors, and electronic control units. Recent geopolitical tensions, trade restrictions, and logistical bottlenecks have exposed vulnerabilities in this system, which is leading to prolonged production halts and inventory shortages. For instance, the Russia-Ukraine conflict disrupted access to critical raw materials like neon gas, which is essential for semiconductor manufacturing, causing ripple effects across the automotive sector. Moreover, China’s intermittent lockdowns during the pandemic severely impacted the production of battery cells and rare earth elements needed for electric trucks, delaying launches of new models from companies like Scania and Renault Trucks. Logistics provider DB Schenker notes that container shipping delays and rising freight costs have further compounded these issues, increasing component procurement costs by up to 20% for some manufacturers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.11% |

|

Segments Covered |

By Class, Propulsion, Truck, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Daimler Trucks, Volvo Trucks, Scania AB, MAN Truck & Bus, DAF Trucks, Iveco S.p.A., Renault Trucks, Ford Trucks, Nikola Corporation, Hyundai Motor Company, BYD Company Limited, Hino Motors, Tata Motors, Navistar International, and Isuzu Motors, and others. |

SEGMENT ANALYSIS

By Class Insights

The Class 8 trucks segment was the largest and held a dominant share of the Europe truck market in 2024. One key driver behind this segment’s dominance is the high demand for long-haul freight services, particularly in Germany, France, and Poland, where road transport remains the preferred mode due to underdeveloped rail freight networks. According to IRU (International Road Union), over 75% of inland freight movement in Europe relies on road transport, with Class 8 trucks forming the backbone of this system. Additionally, the expansion of e-commerce and just-in-time delivery models has increased the need for continuous and efficient long-distance freight solutions. As reported by McKinsey & Company, European logistics companies have added over 150,000 new Class 8 trucks to their fleets since 2020 to meet growing demand.

The class 6 trucks segment is projected to register a CAGR of 6.8% between 2025 and 2033. Class 6 trucks, typically used for regional delivery, construction, and municipal services, are gaining traction due to shifting transportation dynamics and increasing urbanization. Eurostat reports that e-commerce sales in the EU reached €817 billion in 2022, necessitating more flexible and cost-effective transport options tailored for city centers and suburban areas. Class 6 trucks, with their optimal balance of payload capacity and maneuverability, are ideal for such applications. Additionally, municipal modernization initiatives are boosting procurement of refuse collection vehicles, utility trucks, and sanitation equipment, many of which fall under the Class 6 category. The European Environment Agency notes that over 40 cities across Europe have launched green fleet modernization programs since 2021, prioritizing cleaner and more compact trucks for urban operations. With manufacturers like Iveco and MAN introducing hybrid and electric variants within this class, adoption is expected to accelerate further, which is reinforcing its status as the fastest-growing segment in the European truck market.

By Propulsion Insights

The diesel-powered trucks segment was accounted in holding a significant share of the Europe truck market in 2024. Diesel engines continue to dominate due to their proven reliability, high torque output, and widespread refueling infrastructure across the continent. One of the key drivers sustaining diesel’s dominance is its superior performance in long-haul and heavy-duty applications , where alternative fuels still face limitations. According to the International Energy Agency (IEA), diesel engines offer higher energy density compared to electric or hydrogen alternatives, making them more suitable for extended journeys without frequent refueling stops. This is especially crucial in Eastern Europe, where charging infrastructure for electric trucks remains underdeveloped.

The electric trucks segment is projected to register a CAGR of 28.4% in the next coming years. One major factor driving this growth is the implementation of stringent emissions regulations , particularly the European Commission’s Fit for 55 package, which mandates a 100% reduction in CO₂ emissions from new trucks by 2040. In response, manufacturers such as Scania, Daimler Truck, and Renault Trucks have expanded their electric offerings. According to ACEA, electric truck registrations in the EU surged by 41% in 2023. Another significant driver is the increasing investment in charging infrastructure , which is alleviating range anxiety among fleet operators. The European Alternative Fuels Observatory reports that as of mid-2023, over 6,000 public fast-charging stations for commercial vehicles were operational across the EU, with Germany and the Netherlands leading deployment. Additionally, companies like IKEA Transport Services and DB Schenker have committed to electrifying large portions of their fleets, further accelerating adoption.

By Truck Insights

The heavy-duty trucks segment was the largest by occupying 44.3% of share in 2024. A key driver behind the heavy-duty segment’s leading position is the continued reliance on road transport for international trade within the EU’s integrated supply chain network. According to the European Environment Agency (EEA), over 75% of inland freight movement in Europe occurs via road, with heavy-duty trucks serving as the primary workhorses. Countries like Germany, France, and Poland, which together account for nearly half of all freight tonnage in the region, depend heavily on these vehicles to maintain efficient logistics flows.

The medium-duty truck category is likely to register a CAGR of 7.1% in the next coming years. Medium-duty trucks, typically used for regional deliveries, municipal services, and distribution logistics, are benefiting from evolving transportation needs and urban mobility strategies.

By Application Insights

One of the key drivers of the segment’s growth is the surge in urban logistics and last-mile delivery demand , fueled by the expansion of e-commerce. Medium-duty trucks, with their optimal balance of cargo capacity and maneuverability, are ideally suited for these applications, particularly in densely populated metropolitan areas. Additionally, government-led fleet modernization programs are encouraging the adoption of newer, more sustainable medium-duty trucks. The European Environment Agency highlights that over 30 cities across Europe have introduced green fleet incentives since 2021, promoting cleaner alternatives such as electric and compressed natural gas (CNG) models. Companies like DHL, UPS, and FedEx have also expanded their use of medium-duty electric trucks in urban delivery routes, aligning with corporate sustainability targets.

REGIONAL ANALYSIS

Germany was the top performer in the Europe truck market with 22.3% of the share in 2024. As Europe’s largest economy and a central hub for logistics and manufacturing, Germany maintains a vast commercial vehicle fleet to support domestic and cross-border freight movements. One of the key drivers of Germany’s market prominence is its well-developed logistics infrastructure , which facilitates seamless goods movement across the continent. Additionally, the government’s investment in smart highway technologies and automated transport corridors is enhancing efficiency and safety in freight logistics.

France was ranked second with 13.2% of the Europe truck market share in 2024. One of the primary factors contributing to France’s strong market position is its growing emphasis on green transportation through government-backed incentive programs. The French Ministry of Ecological Transition reported that in 2023, over €700 million was allocated to support the adoption of low-emission commercial vehicles, including electric and hydrogen-powered trucks. This initiative has spurred major logistics firms like Groupe RATP and Transdev to expand their eco-friendly fleets. Additionally, France benefits from a robust domestic manufacturing base, with companies such as Renault Trucks and Stellantis playing a significant role in supplying both national and international markets.

Spain truck market growth is growing at higher rate during the forecast period. A major driver of Spain’s market strength lies in its expanding logistics sector , supported by growing exports and imports through major ports such as Barcelona, Valencia, and Algeciras. According to Spain’s Ministry of Transport, Mobility, and Urban Agenda, road freight accounted for over 70% of inland cargo movement in 2023, reinforcing the dominance of trucks in the country’s transport ecosystem.

Moreover, Spain is increasingly investing in sustainable transport solutions , with government incentives promoting the adoption of electric and natural gas-powered trucks. The Spanish National Integrated Energy and Climate Plan (PNIEC) outlines a target of deploying 150,000 zero-emission commercial vehicles by 2030. Companies such as Iberdrola and Enagás are expanding charging and refueling infrastructure, facilitating the transition toward greener freight transport.

Italy truck market is likely to grow with an anticipated CAGR throughput the forecast period. One of the key factors underpinning Italy’s market position is its thriving industrial sector in automotive, food processing, and fashion industries, which rely heavily on road transport for distribution. Data from the Italian Road Haulage Association (Conftrasporto) indicates that over 75% of domestic freight is moved by trucks with the integral role of commercial vehicles in the country’s supply chain.

The United Kingdom truck market is likely to grow with prominent growth opportunities. A key driver of the UK’s market resilience is its strong e-commerce and retail sectors , which require efficient and timely delivery networks. Furthermore, the UK government has been actively promoting low-emission truck adoption through initiatives such as the Zero Emission Freight Trial and Plug-in Logistics scheme.

The Europe truck market is dominated by several global automotive giants, with Daimler Truck AG , Volvo Group , and Traton SE emerging as the top three players. These companies have established a strong presence across Europe through innovative product development, strategic partnerships, and extensive distribution networks.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the Europe truck market are Daimler Trucks, Volvo Trucks, Scania AB, MAN Truck & Bus, DAF Trucks, Iveco S.p.A., Renault Trucks, Ford Trucks, Nikola Corporation, Hyundai Motor Company, BYD Company Limited, Hino Motors, Tata Motors, Navistar International, and Isuzu Motors.

Competition in the Europe truck market is intense, characterized by a mix of established automotive giants and emerging players striving for technological advancements and market dominance. Manufacturers are locked in a race to innovate in the areas of electrification, autonomous driving, and connected vehicle ecosystems. At the same time, differentiation through advanced driver assistance systems, digital fleet management, and after-sales services has become a critical battleground. Strategic mergers, acquisitions, and collaborative R&D initiatives further shape the competitive landscape, enabling firms to optimize production costs and accelerate technology adoption.

TOP PLAYERS IN THIS MARKET

Daimler Truck AG, a spin-off from Daimler AG, leads the market with its robust portfolio of commercial vehicles under the Mercedes-Benz Trucks and Freightliner brands. The company has been at the forefront of developing electric and hydrogen-powered trucks, which is reinforcing its commitment to sustainable mobility while maintaining performance and reliability.

Volvo Group, headquartered in Sweden, is a major force in the European trucking industry, known for its advanced safety technologies and fuel-efficient models. Volvo has prioritized electrification and digitalization, offering a comprehensive range of trucks tailored for both urban logistics and long-haul transport, strengthening its dominant position.

Traton SE, part of the Volkswagen Group, brings together renowned brands such as MAN, Scania, and RIO, offering a diversified approach to commercial vehicle manufacturing and fleet management services. Traton’s focus on modular platforms and cross-brand synergies allows it to deliver cost-effective, high-performance solutions tailored for European freight demands.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe truck market employ a range of strategies to maintain and strengthen their competitive edge. One major approach is product innovation and electrification, where manufacturers continuously develop next-generation trucks featuring alternative powertrains, improved aerodynamics, and enhanced telematics systems to meet evolving regulatory and customer demands. Another key strategy is strategic partnerships and joint ventures, which allow companies to share research costs, expand into new markets, and integrate advanced technologies more efficiently. Lastly, digital transformation and fleet connectivity play a crucial role, with leading firms investing heavily in smart logistics solutions, predictive maintenance, and real-time monitoring tools that improve operational efficiency and enhance customer experience across the supply chain.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Daimler Truck AG launched its new battery-electric heavy-duty truck model, designed specifically for regional distribution and urban freight operations across Europe, which is aiming to expand its footprint in the growing electric truck segment.

- In May 2024, Volvo Group announced a strategic collaboration with a major European charging infrastructure provider to deploy fast-charging stations along key freight corridors by enhancing the viability of electric truck adoption for long-haul logistics.

- In July 2024, Traton SE introduced an integrated digital fleet management platform across its MAN and Scania dealer networks, which is allowing fleet operators to monitor vehicle performance, optimize routes, and reduce downtime through AI-driven analytics.

- In September 2024, Iveco unveiled a new line of hydrogen-powered trucks at the IAA Transportation show in Hannover, signaling a major shift toward zero-emission propulsion and reinforcing its commitment to decarbonizing road freight.

- In November 2024, Renault Trucks expanded its partnership with a French energy company to co-develop hydrogen refueling hubs in major logistics centers, which is supporting the deployment of its H2-powered commercial vehicles across France and neighboring countries.

MARKET SEGMENTATION

This research report on the Europe trucks market is segmented and sub-segmented into the following categories.

By Class

- Class 3

- Class 4

- Class 5

- Class 6

- Class 7

- Class 8

By Propulsion

- Gasoline

- Diesel

- Electric

- Natural gas

- FCEV

By Truck

- Light duty

- Medium duty

- Heavy duty

By Application

- Logistics & transportation

- Construction & infrastructure

- Retail & e-commerce

- Mining

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the truck market in Europe?

Key drivers include rising demand for commercial transportation, growth in the logistics and construction sectors, advancement in electric and autonomous trucks, and stringent emission regulations promoting fleet modernization.

2. Who are the key players in the Europe trucks market?

Leading companies include Daimler Trucks, Volvo Trucks, Scania AB, MAN Truck & Bus, DAF Trucks, Iveco S.p.A., Renault Trucks, Ford Trucks, Nikola Corporation, Hyundai Motor Company, BYD Company Limited, Hino Motors, Tata Motors, Navistar International, and Isuzu Motors.

3. What trends are shaping the future of the truck industry in Europe?

Important trends include the transition to electric and hydrogen-powered trucks, integration of ADAS and autonomous driving features, and digital fleet management solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com