Europe Used Cars Market Size, Share, Trends & Growth Forecast Report By Vehicle Type, Vendor Type Fuel Type, Distribution Channel, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Used Cars Market Size

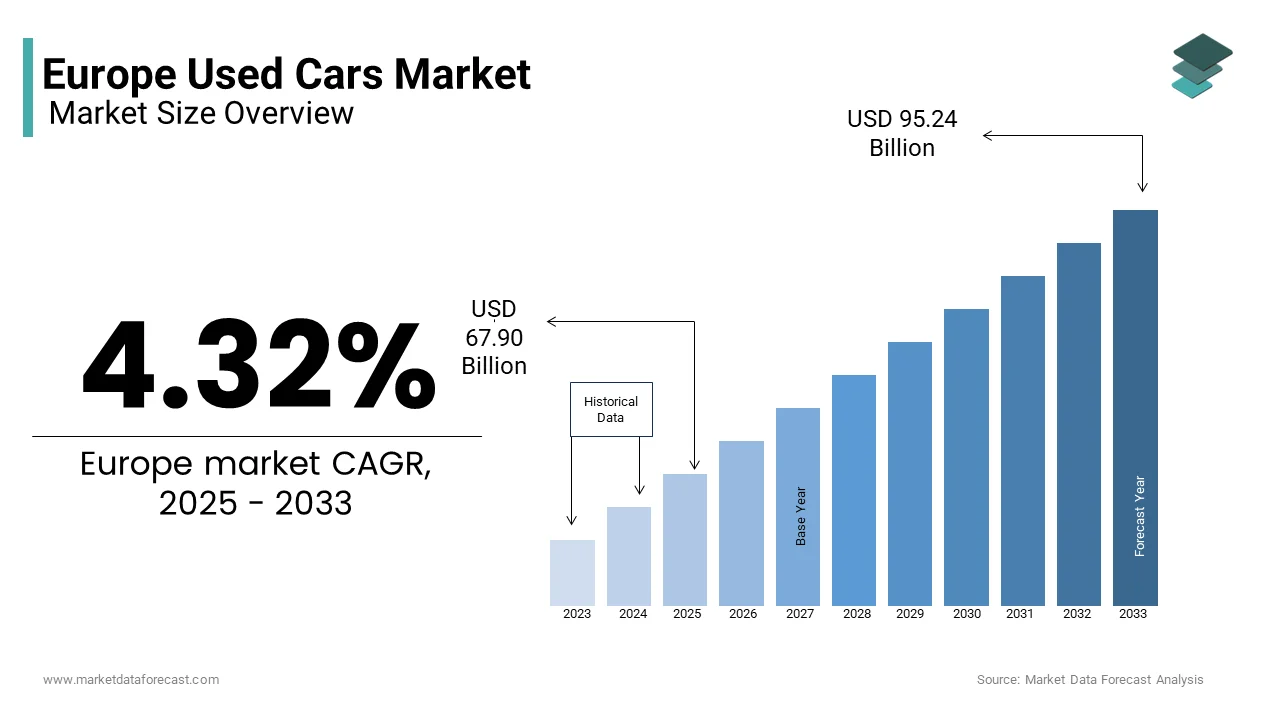

The Europe used cars market size was valued at USD 65.09 billion in 2024 and is anticipated to reach USD 67.90 billion in 2025 from USD 95.24 billion by 2033, growing at a CAGR of 4.32% during the forecast period from 2025 to 2033.

The used car plays a crucial role in the automotive ecosystem, offering cost-effective mobility solutions to consumers while facilitating vehicle turnover across borders. A key feature of this market is its high level of cross-border trade, driven by price differentials between Western and Eastern Europe. Countries like Germany, France, and the UK serve as major exporters of used vehicles, while nations such as Poland, Romania, and Bulgaria are significant importers.

Moreover, the rise of digital platforms has transformed how consumers buy and sell used cars, reducing information asymmetry and increasing transaction transparency. Companies like Auto1 Group, Mobile.de, and AramisAuto have capitalized on this shift by enhancing accessibility and efficiency. Additionally, changing attitudes toward car ownership, especially among younger generations, are influencing purchasing behavior, with more consumers opting for short-term ownership cycles or subscription-based models.

MARKET DRIVERS

Rising Cost of New Vehicles

One of the primary drivers behind the growth of the Europe used car market is the increasing cost of new vehicles, which has made them less accessible to a broad section of consumers. Inflationary pressures, supply chain disruptions, and higher manufacturing costs have collectively contributed to a sharp rise in new car prices across Europe. This trend has particularly affected middle-income households and young buyers who find it increasingly difficult to afford brand-new models. Additionally, financial institutions have tightened lending criteria amid rising interest rates, making auto loans more expensive. This sustained pressure on new car affordability is expected to continue driving demand for used vehicles, reinforcing the importance of this market segment in meeting consumer needs across Europe.

Expansion of Online Used Car Platforms

Another key factor propelling the Europe used car market is the rapid expansion of online sales platforms that streamline the buying and selling process. Traditional dealership models are being challenged by digital-first companies that offer transparent pricing, vehicle history checks, certified pre-owned programs, and home delivery services. Companies such as Auto1 Group, Cazoo, and Simplesale have capitalized on this transformation by leveraging artificial intelligence, big data analytics, and mobile-first interfaces to enhance user experience. These platforms enable sellers to receive instant valuations and buyers to access detailed inspection reports, reducing uncertainty and building trust. Moreover, government initiatives aimed at digitizing vehicle registration and taxation processes have further facilitated cross-border transactions.

MARKET RESTRAINTS

Regulatory and Emission Compliance Challenges

A significant restraint affecting the Europe used car market is the tightening regulatory environment surrounding emissions and vehicle compliance for imported second-hand vehicles. As part of broader efforts to reduce carbon emissions and improve air quality, several European countries have implemented stricter registration requirements for older or high-emission used cars. According to the European Commission, at least eight EU member states introduced additional restrictions on used car imports between 2021 and 2023, which is citing environmental and public health concerns.

For example, Germany and France imposed tighter limits on diesel vehicles registered before specific Euro emission standards, effectively limiting their resale potential in certain urban zones. Similarly, Belgium and Denmark introduced higher taxes on used cars with CO₂ emissions exceeding set thresholds, deterring buyers from purchasing older, less efficient models.

Declining Consumer Confidence Due to Scandals and Fraudulent Practices

Consumer confidence in the Europe used car market has been negatively impacted by recurring scandals involving odometer tampering, hidden accident histories, and misrepresentation of vehicle conditions. These fraudulent practices undermine trust in both private and dealership-based transactions, which is leading some buyers to delay or avoid purchases altogether. According to a 2023 report by the European Consumer Organization (BEUC), nearly one in five used car buyers in the EU encountered discrepancies between advertised and actual vehicle details by contributing to growing skepticism.

In response, governments and industry bodies have attempted to introduce standardized vehicle history reports and mandatory inspection protocols. However, inconsistencies in enforcement across national borders persist. For instance, while Germany maintains a centralized database for odometer readings, other countries lack similar safeguards, creating loopholes that fraudsters exploit. As per the European Anti-Fraud Office, over 150,000 cases of manipulated mileage records were detected in cross-border used car transactions in 2023 alone.

MARKET OPPORTUNITIES

Growth of Certified Pre-Owned (CPO) Programs

A major opportunity emerging in the Europe used car market is the expanding presence of Certified Pre-Owned (CPO) programs offered by manufacturers and authorized dealerships. These programs provide consumers with a structured, trustworthy alternative to traditional used car purchases by ensuring rigorous inspections, extended warranties, and vehicle history verification. Automotive brands such as BMW, Renault, and Volkswagen have significantly invested in their CPO offerings, recognizing the growing consumer preference for quality assurance and post-sale service packages. These programs often include benefits such as roadside assistance, complimentary maintenance, and flexible return policies, which appeal to risk-averse buyers seeking reliability alongside affordability.

Moreover, financial institutions and leasing companies have begun aligning their end-of-contract vehicle returns with CPO certification, ensuring a steady pipeline of well-maintained, low-mileage cars. As per data from BNP Paribas Personal Finance, nearly 40% of leased vehicles entering the secondary market are now being funneled into CPO programs, enhancing market predictability and value retention.

Digital integration is further strengthening the appeal of CPO vehicles. Online platforms now allow consumers to filter listings based on certification status, service history, and warranty coverage, improving decision-making transparency.

Rise of Subscription-Based Vehicle Models

An emerging opportunity in the Europe used car market is the growing popularity of vehicle subscription services, which offer flexible access to used cars without the long-term commitment of ownership. These models allow consumers to pay a monthly fee for a fully maintained, insured, and road-ready vehicle, typically with the option to switch or cancel after a defined period. This model appeals particularly to younger, urban-based consumers who prioritize mobility flexibility over asset ownership. Startups such as Finn, Flexdrive, and Elba Drive have capitalized on this trend by offering curated fleets of pre-owned vehicles tailored to lifestyle preferences, ranging from compact city cars to family SUVs. Unlike traditional leasing, subscription services often include insurance, maintenance, and roadside assistance, simplifying the ownership experience.

Additionally, automakers and fleet operators are repurposing off-lease vehicles into subscription pools, extending their revenue lifecycle beyond initial ownership. Volkswagen’s WeDeliver and Renault’s Mobilize Up are examples of established players integrating used car subscriptions into their broader mobility strategies.

MARKET CHALLENGES

Supply Chain Disruptions Impacting Inventory Availability

One of the foremost challenges facing the Europe used car market is the ongoing impact of global supply chain disruptions, which have affected the availability and flow of used vehicles across regions. While new car production delays have indirectly boosted used car demand, they have also created bottlenecks in sourcing and distributing pre-owned inventory. According to the European Logistics Association, container shipping delays and semiconductor shortages in 2023 disrupted the movement of imported used cars, particularly between Northern and Southern Europe.

Labor shortages in the logistics and transport sectors have further exacerbated the issue. Truck driver deficits in the UK and the Netherlands reached record levels in 2023, delaying domestic redistribution of used cars and increasing operational costs. These inefficiencies have resulted in regional price disparities and uneven market liquidity, complicating valuation consistency.

Shift Toward Electric Vehicles and Residual Value Uncertainty

A significant challenge confronting the Europe used car market is the transition toward electric vehicles (EVs) and the associated uncertainty regarding their residual values and long-term reliability. As EV adoption accelerates due to government incentives, emissions regulations, and consumer interest, traditional internal combustion engine (ICE) vehicles face depreciation risks, particularly for older models. Meanwhile, the used EV market remains relatively underdeveloped, with limited historical data on battery degradation, repair costs, and lifespan predictability. This knowledge gap has created hesitation among both buyers and financiers, limiting liquidity and pricing stability. Additionally, the lack of standardized battery health assessments and inconsistent charging infrastructure across European countries has complicated cross-border used EV trade. Norway, despite leading in EV penetration, faces challenges in exporting older models due to varying acceptance levels in other EU markets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.32% |

|

Segments Covered |

By Vehicle Type, Fuel Type, Sales Channel, Category |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

Volkswagen AG, Renault Group, PSA Group (Stellantis), BMW Group, Lookers Plc, Emil Frey AG, Autorola Group Holding, Pendragon Plc, AUTO1.com. |

SEGMENTAL ANALYSIS

By Vehicle Type Insights

The hatchback segment was the largest Europe used car market share by accounting for 38.2% of share in 2024. One major factor contributing to their popularity is affordability. Hatchbacks tend to be more cost-effective than larger vehicle types, both in terms of purchase price and maintenance costs. Additionally, hatchbacks are preferred among first-time buyers and younger consumers due to their ease of handling and lower insurance premiums. In countries like Germany, France, and the Netherlands, where city driving dominates, hatchbacks such as the Volkswagen Golf, Ford Focus, and Renault Clio remain top choices in the used market. Furthermore, strong residual values and high demand in Eastern European markets have reinforced hatchbacks' appeal as export vehicles.

The SUV segment is likely to grow with a CAGR of 9.1% in the coming years. This rapid expansion reflects shifting consumer preferences toward larger, more versatile vehicles that offer enhanced comfort, safety, and all-terrain capability. A primary driver behind this trend is lifestyle-oriented purchasing behavior, particularly among families and suburban dwellers who prioritize space and elevated driving positions. Moreover, automakers have significantly expanded their SUV lineups in recent years, increasing availability in the secondary market. Another key factor is the perception of durability and longevity associated with SUVs, which appeals to both private buyers and commercial fleets. Residual values for mid-sized SUVs remained stable despite broader market fluctuations, as reported by CAP HPI, reinforcing buyer confidence.

By Fuel Type Insights

The gasoline-powered vehicles segment accounted in holding 47.6% of the Europe used car market share in 2024. One of the key factors driving gasoline’s leading position is the widespread adoption of smaller, fuel-efficient engines that meet modern Euro emission standards. Unlike older diesel models, which face increasing restrictions in Low Emission Zones (LEZs), gasoline cars are generally permitted in most urban centers, enhancing their resale appeal. Additionally, gasoline vehicles tend to be more affordable to purchase and maintain compared to diesel or electric alternatives. Furthermore, younger buyers and urban commuters increasingly favor gasoline cars due to their suitability for short-distance travel and reduced complexity compared to hybrid or electric systems.

The electric vehicle (EV) segment is likely to grow with a CAGR of 34.3% during the coming years. A key driver behind this surge is the expanding availability of second-hand electric cars, as early adopters upgrade to newer models equipped with improved battery technology. Moreover, declining battery costs and extended warranties offered by manufacturers have eased concerns about long-term reliability. Infrastructure development has also played a crucial role. Countries like Norway, Germany, and the Netherlands lead in EV adoption, which is benefiting from supportive policies and robust certification programs.

By Sales Channel Insights

The independent dealers segment was the largest and held 42.1% of the Europe used car market share in 2024. These dealerships operate outside the manufacturer-backed franchised network and play a vital role in meeting regional demand through localized offerings and competitive pricing strategies. Additionally, these dealers often provide personalized service, extended payment plans, and warranty options tailored to individual buyer needs, enhancing trust and satisfaction. Moreover, digital transformation has empowered independent dealers to enhance visibility and reach.

The peer-to-peer (P2P) sales channel is witnessing the fastest CAGR of 22.3% in the coming years. This rapid expansion is driven by the increasing preference for direct, transparent transactions between private sellers and buyers, facilitated by digital platforms that streamline the process.

A key factor behind this growth is the convenience and control P2P platforms offer to individuals looking to sell their vehicles independently. Websites such as Autotrader, Catawiki Cars, and Wizzcar enable sellers to list their cars with detailed history reports, while buyers benefit from real-time communication and flexible negotiation options. Moreover, digital verification tools and mobile inspection services have reduced fraud risks and increased transaction confidence. Platforms like CarNext and Cinch now offer certified P2P listings with third-party inspections, bridging the gap between informal sales and professional dealer offerings.

Additionally, economic pressures have prompted more consumers to sell their cars directly rather than trade them in at dealerships. Data from BNP Paribas Personal Finance indicated that private used car sales rose by 18% in Germany and France in 2023, reflecting heightened participation in the P2P marketplace.

COUNTRY-LEVEL ANALYSIS

Germany was the largest by accounting for 19.2% of the Europe used car market share in 2024. A key driver of Germany’s dominant position is its well-established automotive industry, which ensures a consistent flow of high-quality used cars into the market. With one of the highest per capita car ownership rates in Europe, frequent vehicle turnover contributes to a robust secondary market. Additionally, Germany serves as a primary source of used car exports to Central and Eastern Europe. Countries such as Poland, the Czech Republic, and Hungary rely heavily on imported German vehicles due to their reputation for reliability and engineering excellence.

The French car market is promptly growing with a strong presence in both domestic transactions and cross-border driven by evolving consumer preferences and regulatory influences.

A major growth driver is the tightening emissions policy, which has accelerated the turnover of older, non-compliant vehicles. The French government’s bonus-malus system incentivizes cleaner car purchases while discouraging the circulation of high-emission models. Simultaneously, France has seen a surge in certified pre-owned (CPO) vehicle sales. Major automakers such as Renault, Peugeot, and Citroën have expanded their factory-backed CPO programs, offering extended warranties and digital verification services.

The United Kingdom's used car market is growing with a strong presence despite Brexit-related disruptions and evolving regulatory frameworks. A primary driver of the UK used car market is the persistent affordability gap between new and used vehicles. Rising interest rates and inflation have made new car purchases less accessible, pushing more consumers toward the secondary market. Moreover, the transition to ultra-low emission zones and plug-in grants has influenced purchasing behavior. Online car trading platforms have also gained momentum. Companies such as Cazoo, We Buy Any Car, and Cinch have transformed the buying experience with home delivery, remote inspections, and digital finance options.

Italy's used car market is likely to be driven by its large vehicle parc, aging fleet, and strong reliance on the secondary market for mobility solutions. According to UNRAE, the Italian automotive association, used car sales outnumbered new car registrations by a ratio of nearly 3:1 in 2023, which emphasizes the sector’s significance in the national automotive landscape.

Spain's used car market growth is likely to be driven by the relatively young demographic profile and high proportion of first-time buyers who rely on pre-owned vehicles for affordability. As per a 2023 report by Banco de España, nearly 67% of car buyers under the age of 35 opted for used models due to limited access to credit and rising new car prices.

TOP PLAYERS IN THE MARKET

Auto1 Group – Digital Disruptor of Traditional Used Car Sales

Auto1 Group is one of the leading digital platforms in the Europe used car market, revolutionizing how dealers and consumers buy and sell pre-owned vehicles. By leveraging technology to streamline auctions, inspections, and logistics, the company has created a transparent and efficient marketplace that connects buyers and sellers across Europe. Auto1’s focus on digital integration, rapid payment processing, and cross-border trade has significantly enhanced liquidity in the used car sector. Its expansion into new markets and continuous investment in AI-driven valuation tools have positioned it as a key player shaping the future of vehicle resale.

Cazoo – Pioneering Online Retail of Certified Used Cars

Cazoo is a major force in the direct-to-consumer segment of the Europe used car market, offering a seamless online platform for purchasing certified pre-owned vehicles. The company emphasizes convenience by providing home delivery, flexible financing options, and comprehensive warranty packages. Cazoo has played a crucial role in shifting consumer behavior toward digital car buying, particularly among younger and first-time buyers. Its commitment to quality assurance and customer experience has set new benchmarks in the industry. As a result, Cazoo continues to expand its influence and redefine expectations in the used car retail space.

Arval – Fleet Management and Used Car Resale Specialist

Arval, a subsidiary of BNP Paribas, plays a vital role in the Europe used car market through its extensive fleet management services and large-scale remarketing operations. With a strong presence across multiple European countries, Arval manages vehicle leasing contracts and facilitates the resale of off-lease cars, ensuring a steady supply of high-quality used vehicles. The company contributes to market stability by maintaining structured exit strategies for leased assets and promoting sustainable mobility solutions. Arval’s expertise in data analytics, lifecycle optimization, and digital remarketing enhances efficiency and trust within the used car ecosystem.

Top Strategies Used by Key Market Participants

Digital Transformation and E-commerce Integration

Leading players in the Europe used car market are heavily investing in digital platforms to enhance user experience, improve transparency, and facilitate seamless transactions. Online valuation tools, virtual inspections, and contactless delivery options are becoming standard features, allowing consumers to engage with the market remotely and efficiently.

Expansion of Certified Pre-Owned (CPO) Programs

To build consumer confidence and differentiate themselves from traditional dealerships, major companies are expanding their certified pre-owned offerings. These programs include rigorous inspection processes, extended warranties, and service history verification, addressing concerns about reliability and hidden defects in used vehicles.

Strategic Partnerships and Cross-Border Logistics Networks

Key players are forming strategic alliances with logistics providers and financial institutions to strengthen their supply chains and support international trade. These partnerships enable faster vehicle movement across borders, reduce transaction costs, and provide tailored financing options, reinforcing competitiveness in an increasingly integrated European market.

COMPETITION OVERVIEW

The competition in the Europe used car market is characterized by a convergence of traditional automotive retailers, digital-first disruptors, and fleet operators vying for dominance in a rapidly evolving landscape. While independent dealers continue to hold significant market share due to their localized presence and flexibility, they face increasing pressure from well-capitalized online platforms that offer greater transparency, convenience, and standardized quality checks. Established automotive brands and financial institutions are also stepping up their involvement through certified pre-owned programs and digital remarketing initiatives, aiming to capture a larger portion of consumer trust and loyalty.

At the same time, new entrants are reshaping customer expectations by introducing subscription-based models, AI-powered pricing engines, and blockchain-backed vehicle histories, enhancing credibility and reducing information asymmetry. This dynamic environment fosters innovation but also intensifies competitive pressures, pushing all participants to continuously refine their value propositions. Additionally, regulatory changes related to emissions, taxation, and cross-border trade add complexity, requiring companies to be agile in adapting their business models. As the market becomes more digitized and interconnected, only those firms that can balance scale, technology, and customer-centricity will maintain long-term success.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Auto1 Group announced the launch of a pan-European vehicle history verification system designed to enhance transparency and consumer confidence in used car transactions. This initiative aims to standardize documentation across national borders and reduce fraud risks, reinforcing Auto1’s dominance in digital used car sales.

- In June 2024, Cazoo expanded its logistics network by establishing regional distribution centers in Poland and Spain by enabling faster delivery times and broader geographic coverage. This move was intended to support the growing demand for online used car purchases and improve inventory turnover across Southern and Eastern Europe.

- In September 2024, Arval introduced a new digital remarketing platform that allows corporate clients to track the residual value of their fleets in real time and optimize exit strategies. This tool was developed to enhance asset management efficiency and position Arval as a leader in sustainable fleet lifecycle solutions.

- In November 2024, WeBuyAnyCar launched a mobile inspection service in Germany, allowing users to schedule at-home vehicle evaluations without visiting a physical location. This initiative was aimed at improving customer convenience and capturing a larger share of private seller transactions.

- In January 2025, Cinch, owned by Volkswagen Financial Services, partnered with a major insurance provider to offer integrated coverage packages with every used car purchase. This collaboration was designed to simplify post-purchase ownership and attract risk-averse buyers seeking added security.

MARKET SEGMENTATION

This research report on the Europe used cars market is segmented and sub-segmented into the following categories.

By Vehicle

- Hatchback

- Sedan

- SUV

- Others

By Fuel

- Gasoline

- Diesel

- Hybrid

- Electric

- Others

By Sales Channel

- Peer-to-peer

- Franchised dealers

- Independent dealers

By End Use

- Personal

-

Commercial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe Used cars market?

The current market size of the Europe used car market size was valued at USD 67.90 billion in 2025

How big is the Europe Used cars market?

The Europe used car market size was valued at USD 65.09 billion in 2024 and is anticipated to reach USD 67.90 billion in 2025 from USD 95.24 billion by 2033, growing at a CAGR of 4.32% during the forecast period from 2025 to 2033.

What are the market drivers that are driving the Europe Used cars market?

The Rising affordability and cost-effectiveness and the Shift toward sustainability and circular economy are the major market drivers that are driving the europe used cars market.

Who are the market players that are dominating the Europe used cars market?

Volkswagen AG, Renault Group, PSA Group (Stellantis), BMW Group, Lookers Plc, Emil Frey AG, Autorola Group Holding, Pendragon Plc, AUTO1.com. These are the market players that are dominating the Europe used cars market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com