Europe Vehicle Rental Market Research Report – Segmented By Duration (Short Term Rental, Long Term Rental) Vehicle Type (Passenger Car, Light Truck, Heavy/Medium Truck) Propulsion Type (IC Engine Vehicles, Electric Vehicles, Hybrids, Others) Application (Passenger Transport, Freight & Logistics, Petrochemicals, Construction & Mining, Industry & Food, Healthcare, Others) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis From 2025 to 2033

Europe Vehicle Rental Market Size

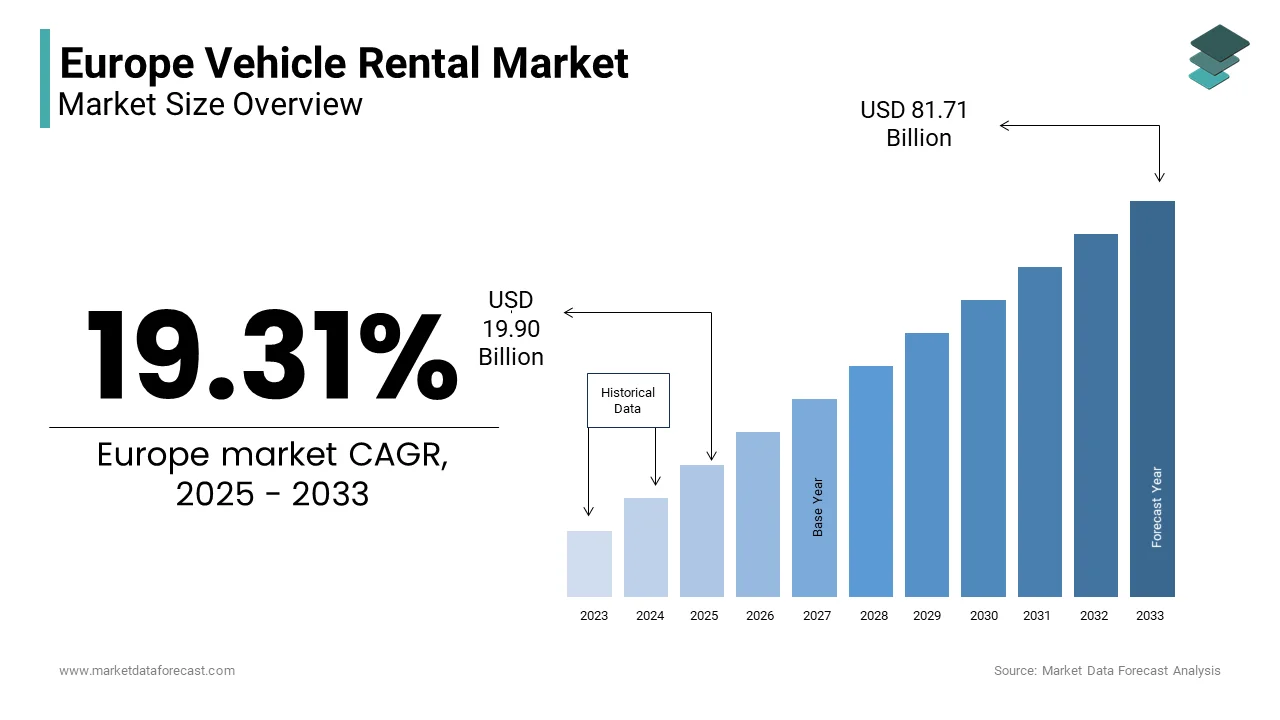

The Europe Vehicle Rental Market Size was valued at USD 16.68 billion in 2024. The Europe Vehicle Rental Market size is expected to have 19.31 % CAGR from 2025 to 2033 and be worth USD 81.71 billion by 2033 from USD 19.90 billion in 2025.

The vehicle rental supports mobility needs across tourism, business travel, logistics, and temporary transportation requirements. According to Eurostat, over 80 million rental transactions were recorded across European countries in 2023, reflecting the growing reliance on flexible transport solutions. As per the European Automobile Manufacturers’ Association, there has been a notable shift toward electric and hybrid vehicle rentals in response to tightening emissions regulations and changing consumer preferences. Several governments have introduced incentives for eco-friendly car rentals, encouraging fleet electrification and sustainable mobility options. Moreover, the rise of digital booking systems, contactless rentals, and mobile app-based access has significantly enhanced customer convenience.

MARKET DRIVERS

Rise in Tourism and Cross-Border Travel

A primary driver of the Europe vehicle rental market is the significant growth in tourism and cross-border travel, which has reinvigorated demand for flexible and independent mobility solutions. Tourists increasingly prefer renting vehicles to explore regions beyond urban hubs in countries like Italy, Spain, France, and Germany, where road networks are extensive and well-maintained. Additionally, the Schengen Area facilitates seamless travel between 26 European countries, enabling tourists and business travelers to rent cars without facing border checks, thus enhancing convenience and appeal. As per the European Travel Commission, nearly 58% of international visitors opt for car rentals to maximize their travel flexibility and accessibility to rural attractions.

Car rental companies have capitalized on this trend by expanding their presence at major airports and railway stations, offering multilingual support, and integrating digital tools such as mobile reservations and self-service kiosks. Furthermore, the increasing popularity of road trips, especially among younger demographics and families, has reinforced this upward trajectory. Platforms like Google Maps and Waze have made navigation easier by reducing barriers to spontaneous travel and further stimulating vehicle rental adoption across the continent.

Increasing Adoption of Electric and Hybrid Vehicles in Rental Fleets

The integration of electric and hybrid vehicles into rental fleets has emerged as a key growth driver in the Europe vehicle rental market, supported by government incentives, regulatory mandates, and shifting consumer preferences. Rental companies such as Sixt, Europcar, and Hertz have responded by significantly expanding their electric and hybrid offerings. Government policies have played a pivotal role in accelerating this shift. Countries like Norway, Germany, and France offer tax exemptions, toll waivers, and dedicated parking benefits for electric car users, incentivizing both renters and fleet providers to prioritize cleaner alternatives. Additionally, the European Union’s stricter CO₂ emission targets for passenger vehicles have compelled rental firms to modernize their fleets more rapidly than anticipated.

Consumer awareness regarding sustainability has also influenced decision-making, with over 60% of surveyed renters in Germany and Sweden expressing preference for electric models when available, as per a 2023 study by Ipsos. This convergence of policy, technology, and behavior change is reshaping the rental landscape in favor of greener mobility.

MARKET RESTRAINTS

High Operational Costs and Fleet Management Challenges

One of the most pressing restraints affecting the Europe vehicle rental market is the high operational costs associated with fleet acquisition, maintenance, insurance, and regulatory compliance. These expenses create financial pressures on rental companies, which is limiting their ability to scale efficiently and maintain competitive pricing structures. According to Deloitte, fleet depreciation alone accounts for approximately 40% of operating costs for vehicle rental firms, making asset management a critical challenge. Unlike private car ownership, rental companies must frequently replace vehicles due to high usage rates and wear-and-tear, leading to elevated capital expenditures. In addition, insurance premiums have risen sharply in recent years due to increased accident claims and fraud risks, particularly in urban centers. Regulatory compliance also adds complexity, with varying taxation rules, emissions standards, and licensing requirements across different EU member states.

Impact of Economic Uncertainty and Declining Consumer Spending Power

Economic instability continues to pose a significant challenge to the Europe vehicle rental market, particularly in light of inflationary pressures, rising interest rates, and reduced disposable incomes among consumers. According to the European Central Bank, inflation in the Eurozone remained above 5% in early 2024, leading to tighter household budgets and cautious consumer behavior. Business travel, another major contributor to rental volumes, has also been affected by corporate budget constraints. Many enterprises have implemented cost-cutting measures, including reduced air travel and fewer long-distance meetings, which is translating into lower fleet utilization for business-oriented rentals.

Moreover, fluctuating fuel prices have added uncertainty to travel planning, discouraging potential renters who perceive driving as a variable-cost alternative to public transport. As per BP Statistical Review of World Energy, diesel prices in several European markets remained volatile throughout 2023, influencing last-minute decisions to forgo car rentals.

MARKET OPPORTUNITIES

Expansion of Car-Sharing and Peer-to-Peer Vehicle Rental Models

An emerging opportunity in the Europe vehicle rental market lies in the rapid expansion of car-sharing and peer-to-peer (P2P) rental models, which are transforming traditional car usage patterns and unlocking new revenue streams. These models allow individuals and businesses to rent out underutilized vehicles through digital platforms, which is promoting resource efficiency and reducing the need for full-time ownership.

According to Frost & Sullivan, the P2P car rental segment in Europe grew by 22% in 2023, with platforms like Turo, Drivy, and Kluger gaining traction in urban centers such as Berlin, Paris, and London. These services appeal to younger, tech-savvy consumers who prioritize flexibility, affordability, and sustainability over vehicle ownership.

Governments and municipalities are also supporting shared mobility initiatives as part of broader urban decarbonization efforts. Cities like Amsterdam and Copenhagen have introduced incentives for shared electric vehicle (EV) rentals, encouraging residents to adopt zero-emission transport alternatives. Additionally, fleet operators are exploring hybrid models that integrate P2P sharing into their existing rental infrastructure. Enterprise Rent-A-Car and Sixt have launched pilot programs allowing customers to rent vehicles from private owners, by leveraging excess capacity while maintaining brand oversight.

Growth of Long-Term and Corporate Lease Agreements

Another significant opportunity emerging in the Europe vehicle rental market is the increasing adoption of long-term lease agreements and corporate fleet outsourcing. Businesses across logistics, delivery services, construction, and healthcare sectors are increasingly opting for flexible fleet solutions rather than purchasing vehicles outright, which is recognizing the advantages of cost predictability, maintenance coverage, and fleet scalability. According to BCG, the corporate long-term car rental segment in Europe expanded by 15% in 2023, driven by the rise of gig economy platforms, e-commerce delivery networks, and remote field service operations. Companies like Amazon, Uber, and DHL have entered into large-scale fleet contracts with rental providers to meet growing mobility and logistics demands.

One of the key factors fueling this trend is the shift toward fixed monthly expenditure models, which help businesses avoid depreciation risks and benefit from comprehensive service packages that include insurance, roadside assistance, and scheduled maintenance. As per a report by McKinsey & Company, fleet-as-a-service models are expected to capture over 20% of the commercial vehicle market by 2030. Additionally, sustainability considerations are influencing corporate fleet decisions. Many organizations are choosing to partner with rental companies that offer low-emission and electric vehicles, aligning with their ESG commitments. As per EY, 68% of surveyed European firms indicated plans to transition their fleets to electric by 2027, relying on rental providers to facilitate this shift.

MARKET CHALLENGES

Regulatory Complexity and Compliance Burdens

The Europe vehicle rental market faces a complex and fragmented regulatory environment, with varying national laws governing insurance, taxation, emissions, and cross-border rentals. This diversity creates operational inefficiencies, increases administrative costs, and hinders pan-European expansion for rental companies. According to PwC, compliance with differing VAT regimes across EU member states has become a major challenge, with some countries imposing higher levies on rental services compared to private vehicle purchases. For example, Germany applies a standard 19% VAT rate on car rentals, whereas France offers reduced rates for certain categories, complicating pricing harmonization efforts. Insurance regulations also vary significantly, requiring rental firms to tailor policies based on jurisdiction. In Italy, third-party liability limits are set higher than in other EU nations, necessitating additional coverage adjustments for cross-border rentals. As per a study by Marsh & McLennan, compliance with these disparate insurance requirements can increase operational costs by up to 12%.

Intensifying Competition from Ride-Hailing and Mobility-as-a-Service Providers

The Europe vehicle rental market is encountering heightened competition from ride-hailing platforms and Mobility-as-a-Service (MaaS) providers, which are altering consumer preferences and mobility consumption patterns. Companies like Uber, Bolt, and Free Now have gained widespread adoption, particularly in urban areas where convenience and on-demand availability outweigh the perceived benefits of car rentals. According to Statista, ride-hailing services in Europe recorded over 1.8 billion trips in 2023, with younger demographics increasingly viewing car ownership or rentals as unnecessary. As per a McKinsey & Company survey, 41% of millennials and Gen Z respondents in major European cities preferred using ride-hailing apps instead of renting a car for occasional travel.

Public transport improvements in cities like Vienna, Amsterdam, and Stockholm have further diminished the necessity for car rentals, particularly among environmentally conscious travelers who prioritize sustainability over convenience. As per UITP, urban rail and bus ridership increased by 14% in 2023, coinciding with slower-than-expected rebound in short-term rentals.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.31% |

|

Segments Covered |

By Duration, Vehicle Type, Propulsion Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Europcar Mobility Group SA (France), SIXT SE (Germany), Petit Forestier (U.K.), Arval (France) |

SEGMENT ANALYSIS

By Duration Insights

The short-term vehicle rental segment dominated the Europe vehicle rental market with significant share in 2024 owing to the high demand from tourists, business travelers, and individuals requiring temporary transportation solutions due to personal circumstances such as vehicle repairs or relocation. According to Eurostat, over 80 million rental transactions were recorded across European countries in 2023, with more than two-thirds classified under short-term rentals lasting less than a week. The tourism sector remains a key contributor, with international tourist arrivals within the EU reaching over 450 million in 2023, as per the European Travel Commission. Additionally, digitalization has enhanced convenience and accessibility.

The long-term vehicle rental segment is swiftly emerging with a CAGR of 9.3% during the forecast period. One of the key drivers behind this trend is the shift toward fixed monthly expenditure models that help businesses avoid depreciation risks and benefit from comprehensive service packages including insurance, roadside assistance, and scheduled maintenance. Moreover, sustainability considerations are influencing corporate fleet decisions. Many organizations are choosing to partner with rental companies that offer low-emission and electric vehicles, aligning with their ESG commitments. In the consumer space, younger demographics are also embracing long-term rentals as an alternative to ownership, particularly in urban areas where parking constraints and maintenance costs discourage private car purchases. As per Frost & Sullivan, P2P and subscription-based car leasing models saw a 22% growth in 2023, reinforcing the broader appeal of long-term flexibility.

By Vehicle Type Insights

The passenger cars segment was the largest and held a dominant share of the Europe vehicle rental market in 2024. This overwhelming dominance stems from the widespread use of cars for personal travel, tourism, and business mobility, which is making them the most frequently rented vehicle type across the region. A key driver of this segment’s prominence is the presence of well-established rental operators such as Europcar, Sixt, Hertz, and Avis, which maintain extensive fleets at major airports and city centers. Additionally, the shift toward digital booking systems has significantly improved customer convenience. Moreover, the increasing availability of electric and hybrid passenger cars in rental fleets has attracted environmentally conscious consumers.

The light truck segment is likely to grow with an anticipated CAGR of 8.6% in the next coming years. This growth is primarily driven by the surge in last-mile delivery services, construction activities, and small business logistics needs, which require versatile and cost-effective transport solutions. According to Eurostat, the logistics and delivery sector in Europe experienced a 14% increase in activity in 2023, spurred by the expansion of e-commerce and on-demand services. Light trucks are particularly favored by micro-enterprises, freelancers, and small businesses engaged in trades such as plumbing, electrical work, and furniture delivery. Urbanization and infrastructure development projects have also contributed to rising demand. In cities like Amsterdam, Madrid, and Stockholm, municipal authorities are encouraging the use of electric light trucks to reduce emissions and congestion.

By Propulsion Type Insights

The Internal combustion (IC) engine vehicles segment was accounted in holding a prominent share of the Europe vehicle rental market in 2024. Diesel vehicles in the light and medium commercial segments, remained preferred for their fuel efficiency and reliability in long-haul applications. One of the primary reasons for IC engine dominance is cost-effectiveness. As per McKinsey & Company, IC engine rentals typically cost 25–30% less than comparable electric or hybrid models, making them attractive to budget-conscious travelers and small businesses. Additionally, the second-hand vehicle market plays a crucial role. Rental companies frequently sell off high-mileage IC engine cars after 18–24 months of use, benefiting from stable residual values. However, this segment faces mounting pressure from regulatory changes and environmental concerns. Several European cities have introduced ultra-low emission zones, restricting older IC engine vehicles from entering certain areas.

The electric vehicles (EVs) segment is lucratively to grow with a CAGR of 24.1% in the next coming years. According to the European Environment Agency, new electric vehicle registrations in the EU surpassed 1.3 million units in 2023, indicating a strong transition away from internal combustion engine vehicles. Rental companies such as Sixt, Europcar, and Hertz have responded by significantly expanding their electric offerings. Government policies have played a pivotal role in accelerating this shift. Countries like Norway, Germany, and France offer tax exemptions, toll waivers, and dedicated parking benefits for electric car users, incentivizing both renters and fleet providers to prioritize cleaner alternatives. Additionally, the European Union’s stricter CO₂ emission targets for passenger vehicles have compelled rental firms to modernize their fleets more rapidly than anticipated.

By Application Insights

The passenger transport segment was the largest and held 61.2% of Europe vehicle rental market share in 2024. According to Eurostat, over 80 million rental transactions were recorded across European countries in 2023, with more than two-thirds linked to personal or business-related passenger transport. Tourism remains a critical pillar, with international tourist arrivals within the EU reaching over 450 million in 2023, as per the European Travel Commission. Renting a car allows visitors to explore beyond urban centers in countries like Italy, Spain, and France, where road networks are extensive and well-maintained. Business travel is another significant contributor. As per the European Business Travel Association, corporate rentals accounted for nearly 40% of all passenger transport-related vehicle hires in 2023, driven by conferences, trade fairs, and regional meetings. Companies such as Europcar and Sixt have capitalized on this trend by offering corporate loyalty programs, digital booking tools, and fleet customization options tailored to enterprise clients.

The freight and logistics application segment is likely to grow with an anticipated CAGR of 11.2% in the next coming years. This rapid ascent is being driven by the exponential growth of e-commerce, last-mile delivery demand, and the increasing reliance on outsourced fleet management by logistics companies. According to Eurostat, the logistics sector in Europe experienced a 14% increase in activity in 2023, spurred by the expansion of e-commerce and on-demand services. One of the key catalysts behind this growth is the rise of contract logistics and third-party logistics (3PL) providers who prefer renting rather than owning fleets. As per McKinsey & Company, over 45% of logistics firms in Germany and the Netherlands opted for vehicle rentals in 2023 instead of purchasing vehicles outright, citing cost efficiency and scalability as key advantages. Rental companies have responded by expanding their commercial vehicle offerings. Enterprise, Sixt, and Europcar have increased their light commercial vehicle fleets by 18% since 2022, according to internal company reports. These vehicles are increasingly available with hybrid and electric propulsion options, aligning with environmental regulations and client expectations.

COUNTRY LEVEL ANALYSIS

Germany held 21.3% of the Europe vehicle rental market share in 2024. Frankfurt Airport, Munich Airport, and Berlin Brandenburg Airport serve as key rental hotspots, with major players like Sixt, Europcar, and Hertz maintaining significant presence. A key driver of Germany’s rental dominance is the country’s well-developed road network and high car dependency.

The United Kingdom vehicle rental market is growing with a strong presence despite post-Brexit regulatory adjustments and fluctuating economic conditions. London Heathrow, Gatwick, and Manchester Airports remain key rental hubs, serving both domestic and international travelers. British Airways Holidays and Virgin Atlantic have partnered with rental agencies to offer bundled travel packages, enhancing convenience for international visitors. However, Brexit-related disruptions have impacted cross-border rentals, particularly affecting UK-based businesses operating in continental Europe.

France vehicle rental market growth is driven by its status as one of the world’s most visited countries and a leader in sustainable mobility initiatives. Paris-Charles de Gaulle and Orly airports serve as major rental gateways, with global and local operators such as Europcar and ADA providing extensive coverage across urban and rural areas. A key driver of France’s rental market is its proactive stance on decarbonization. Under the “France 2030” investment plan, the government has allocated €1.5 billion to promote zero-emission mobility.

Spain vehicle rental market growth is driven by its thriving tourism industry and geographic appeal as a gateway to North Africa and Mediterranean islands. Madrid-Barajas and Barcelona-El Prat airports serve as primary rental hubs, accommodating millions of international visitors annually. As per the Spanish Ministry of Transport, over 11 million rental transactions were recorded in 2023, with tourism accounting for nearly 60% of all bookings. The country’s scenic routes, coastal drives, and historical landmarks make car rentals a preferred choice for travelers seeking independence from public transport limitations.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Vehicle Rental Market are Europcar Mobility Group SA (France), SIXT SE (Germany), Petit Forestier (U.K.), Arval (France), LeasePlan Corporation (Netherlands), The Hertz Corporation (U.S.), TIP Trailer Services Group (Netherlands), Heisterkamp Group (Netherlands), Allied Vehicle Rentals Ltd. (Netherlands), Enterprise Holdings, Inc. (U.S.)

The competition in the Europe vehicle rental market is characterized by a dynamic mix of multinational corporations, regional operators, and emerging mobility-as-a-service providers. Established players such as Sixt, Europcar, and Hertz dominate due to their extensive networks, brand recognition, and robust digital infrastructures. However, they face increasing pressure from agile startups and peer-to-peer rental platforms that leverage technology to offer more flexible and cost-effective alternatives.

Market differentiation is increasingly driven by fleet composition, particularly the adoption of electric and hybrid vehicles in response to environmental regulations and changing consumer preferences. Companies are investing heavily in green mobility initiatives to meet EU sustainability targets and appeal to eco-conscious renters. Additionally, digital capabilities—such as mobile bookings, AI-based pricing, and seamless insurance integrations—are becoming critical competitive advantages.

Pricing strategies also play a central role in attracting customers, with discount models, subscription-based rentals, and bundled travel packages gaining traction. As economic uncertainties persist, affordability remains a key decision-making factor, prompting established firms to refine their value propositions while maintaining profitability.

Amid shifting travel behaviors, regulatory pressures, and technological disruptions, the race for innovation, sustainability, and customer-centricity continues to intensify, shaping the future landscape of the European vehicle rental sector.

Top Players in the Market

Sixt (Germany)

Sixt is a leading global player in the vehicle rental market with a strong presence across Europe. The company offers a wide range of mobility solutions including short-term rentals, long-term leases, and car-sharing services. Known for its premium brand positioning and digital-first approach, Sixt has invested heavily in mobile app development, AI-driven customer service, and fleet modernization. It plays a pivotal role in shaping trends such as electric vehicle integration and contactless rentals, which is influencing industry standards beyond Europe into international markets.

Europcar Mobility Group (France)

Europcar is one of the largest vehicle rental companies in Europe, offering services in over 140 countries. The company emphasizes sustainability by expanding its electric and hybrid fleets and integrating eco-friendly practices into its operations. Europcar has also embraced digital transformation through self-service kiosks, dynamic pricing models, and integrated mobility platforms. Its strategic partnerships and acquisitions have strengthened its competitive edge by allowing it to cater to both individual travelers and enterprise clients with tailored transport solutions.

Hertz Global Holdings (United States, with major operations in Europe)

Hertz maintains a significant footprint in the European vehicle rental market, operating at major airports, city centers, and online platforms. The company has been at the forefront of fleet electrification, committing to large-scale EV deployments in partnership with automotive manufacturers. Hertz’s focus on customer-centric innovations, loyalty programs, and flexible rental terms has reinforced its relevance in a rapidly evolving market. Its influence extends beyond traditional rentals into emerging areas like peer-to-peer car sharing and corporate mobility solutions.

Top strategies used by the key market participants

One of the primary strategies adopted by key players in the Europe vehicle rental market is the expansion of electric and hybrid vehicle fleets to align with regulatory mandates and consumer demand for sustainable mobility. Major operators are prioritizing the integration of zero-emission vehicles, supported by partnerships with automakers and investment in charging infrastructure to enhance accessibility and convenience.

Another crucial strategy involves leveraging digital transformation to improve operational efficiency and customer experience. Companies are deploying AI-powered booking systems, mobile apps with real-time availability, and contactless check-in and return processes. These digital enhancements not only streamline operations but also provide personalized service offerings that cater to evolving traveler expectations.

Lastly, strategic collaborations and mergers are being used to strengthen market presence and diversify service portfolios. Leading rental firms are entering into joint ventures, acquiring smaller regional players, and forming alliances with ride-hailing and logistics companies to offer integrated mobility solutions. This enables them to capture new customer segments and expand their reach across urban and rural markets.

RECENT HAPPENINGS IN THE MARKET

In March 2024, Sixt announced an expanded partnership with BMW to integrate more electric vehicles into its European fleet by aiming to significantly increase the proportion of zero-emission cars available for rent in major cities.

In May 2024, Europcar launched a new digital platform that allows business clients to manage corporate vehicle rentals through a single interface, which is streamlining fleet management and enhancing user experience for enterprise customers.

In July 2024, Hertz introduced a pilot program in select European locations that enables customers to book and unlock rental cars using a smartphone app by reinforcing its commitment to contactless and tech-enabled mobility solutions.

In September 2024, Avis Budget Group expanded its long-term rental offerings across Germany and France, targeting small and medium-sized enterprises seeking flexible fleet solutions without the burden of ownership costs.

In November 2024, Localiza, a leading Latin American rental company, acquired a majority stake in a Portuguese car rental firm, strengthening its foothold in Southern Europe and supporting its broader European growth strategy.

MARKET SEGMENTATION

This research report on the europe vehicle rental market has been segmented and sub-segmented into the following categories.

By Duration

- Short Term Rental

- Long Term Rental

By Vehicle Type

- Passenger Car

- Light Truck

- Heavy/Medium Truck

By Propulsion Type

- IC Engine Vehicles

- Electric Vehicles

- Hybrids

- Others

By Application

- Passenger Transport, Freight & Logistics

- Petrochemicals

- Construction & Mining, Industry & Food

- Healthcare

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is the current size of the Europe vehicle rental market?

The Europe vehicle rental market is valued at several billion euros and is expected to grow steadily, driven by tourism, business travel, and urban mobility trends. Exact figures vary by source and year.

What are the key drivers of growth in the Europe vehicle rental market?

Major drivers include: Increasing international tourism Urbanization and mobility demand Rising demand for short-term transportation Growth of ride-sharing and app-based rentals

Who are the major players in the Europe vehicle rental industry?

Prominent companies include: Europcar Sixt Hertz Enterprise Rent-A-Car Avis Budget Group

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com