Europe Veterinary Active Pharmaceutical Ingredients Market Research Report – Segmented By Service Type (In-House Manufacturing, Contract Outsourcing ) Synthesis Type, Animal Type & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis From 2025 to 2033

Europe Veterinary Active Pharmaceutical Ingredients Market Size

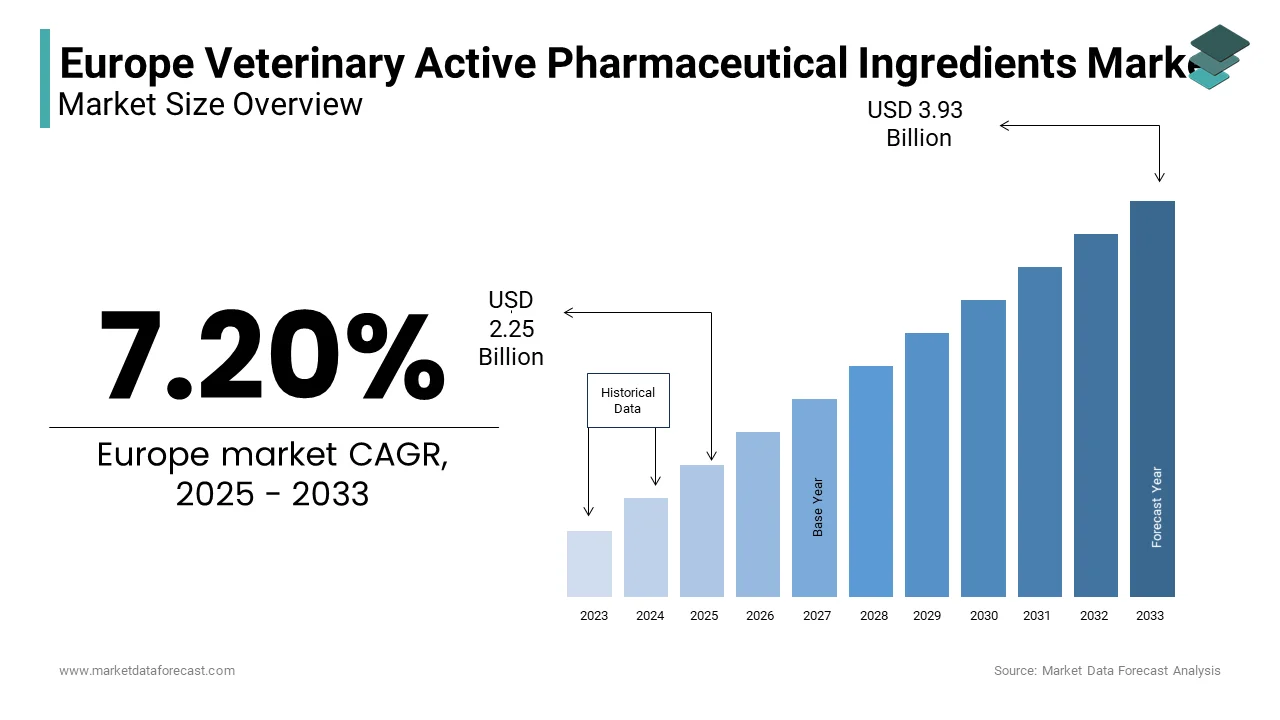

The Europe Veterinary Active Pharmaceutical Ingredients Market Size was valued at USD 2.1 billion in 2024. The Europe Veterinary Active Pharmaceutical Ingredients Market size is expected to have 7.20 % CAGR from 2025 to 2033 and be worth USD 3.93 billion by 2033 from USD 2.25 billion in 2025.

The Europe veterinary active pharmaceutical ingredients (vAPIs) market borders a diverse array of biologically active compounds used in the formulation of medicines for companion animals, livestock, and aquaculture. These ingredients are critical to the development of treatments for bacterial infections, parasitic infestations, metabolic disorders, and other health conditions affecting animals. The market is driven by the growing emphasis on animal health, increasing pet ownership, and stringent regulations governing food safety and disease prevention in farm animals.

According to the European Medicines Agency (EMA), the use of veterinary medicinal products in the EU has seen a steady shift toward more targeted and responsible applications, particularly with the reduction of antimicrobial usage due to concerns over antibiotic resistance. Moreover, the rise in zoonotic diseases and the One Health initiative—promoting integrated health management across humans, animals, and ecosystems—has reinforced the importance of robust veterinary pharmaceutical development. The European Commission’s updated Regulation (EU) 2019/6 on veterinary medicinal products further ensures that only high-quality, safe, and efficacious APIs are approved for use, reinforcing the region's leadership in responsible animal healthcare innovation.

MARKET DRIVERS

Rising Pet Ownership and Humanization of Companion Animals

One of the primary drivers of the Europe veterinary active pharmaceutical ingredients (vAPIs) market is the significant increase in pet ownership and the growing trend of humanizing pets. Across major European countries such as the UK, Germany, and France, pets are increasingly viewed as family members, leading to greater consumer spending on premium veterinary care, including prescription medications and preventive treatments. According to FEDIAF, the European Pet Food Industry Federation, over 80 million households in Europe own at least one pet, with dogs and cats being the most common. This widespread companionship has led to higher demand for high-quality veterinary medicines, necessitating a steady supply of effective and safe vAPIs. Moreover, pet insurance adoption has risen significantly, allowing pet owners to access advanced treatment options previously reserved for human medicine. Also, pet insurance penetration rates have significantly grown annually since 2020, enabling broader access to therapeutic interventions requiring complex API formulations.

Expansion of Aquaculture and Livestock Farming Sectors

Another key driver influencing the Europe veterinary active pharmaceutical ingredients (vAPIs) market is the expansion of aquaculture and livestock farming sectors, which require continuous disease management to ensure food security and animal welfare. As the demand for animal-derived proteins increases, so does the need for efficient health management solutions to prevent outbreaks and maintain productivity. Like, aquaculture production in the EU almost 1.1 million tons in 2023, with Norway, Spain, and Greece leading in marine fish farming. These operations face challenges from infectious diseases such as sea lice infestations and bacterial infections, necessitating the use of antibiotics, antiparasitics, and vaccines containing specific vAPIs. Similarly, the European Commission reports that a significant number of livestock units were maintained in the EU in 2023, supporting dairy, beef, and poultry industries. Maintaining herd health through prophylactic and curative treatments is essential to meet both domestic consumption and export demands. As part of its sustainable agriculture strategy, the EU promotes responsible use of veterinary medicines, encouraging innovation in alternative therapies and precision dosing.

MARKET RESTRAINTS

Stringent Regulatory Framework Governing Veterinary Pharmaceuticals

A major restraint affecting the Europe veterinary active pharmaceutical ingredients (vAPIs) market is the stringent regulatory framework governing the approval, manufacturing, and use of veterinary medicines. According to the European Directorate for the Quality of Medicines & HealthCare (EDQM), the implementation of the revised Good Manufacturing Practice (GMP) guidelines for APIs has increased compliance costs for manufacturers. Many small and medium-sized enterprises (SMEs) struggle to meet these standards, limiting their ability to compete with larger, well-established players. Furthermore, the European Commission’s antimicrobial resistance (AMR) action plan has led to tighter controls on antibiotic use in livestock, reducing demand for certain classes of vAPIs traditionally used in farm animals. As reported by EFSA, the European Food Safety Authority, sales of veterinary antimicrobials in the EU declined between 2011 and 2021 due to policy interventions.

High Cost of Research and Development in Veterinary Therapeutics

Another significant restraint impacting the Europe veterinary active pharmaceutical ingredients (vAPIs) market is the high cost associated with research and development (R&D) in veterinary therapeutics. Developing new molecules or reformulating existing ones for animal use requires extensive preclinical and clinical testing, regulatory submissions, and post-market surveillance, all of which contribute to elevated investment risks. This financial burden discourages smaller firms from entering niche therapeutic areas, especially where commercial returns may be limited. Besides, the lack of standardized international regulatory pathways complicates global market access, forcing companies to duplicate trials and adapt formulations for different regions. Despite growing demand for innovative veterinary treatments, the capital-intensive nature of R&D remains a barrier to rapid market expansion, particularly for emerging biologics and specialty therapeutics targeting rare or complex animal diseases.

MARKET OPPORTUNITIES

Growth in Biologics and Vaccines for Animal Health

An emerging opportunity within the Europe veterinary active pharmaceutical ingredients (vAPIs) market is the increasing development and adoption of biologics and vaccines for animal health applications. As traditional antimicrobial agents face regulatory restrictions due to antimicrobial resistance (AMR) concerns, there is a growing shift toward biological alternatives such as monoclonal antibodies, recombinant proteins, and live attenuated vaccines. This growth is driven by the need to control transboundary animal diseases and support sustainable livestock production. Moreover, the European Commission has been promoting the use of biologics as part of its Green Deal and Farm to Fork Strategy, which encourages the reduction of chemical inputs in agriculture. The development of mRNA-based veterinary vaccines, inspired by human healthcare innovations, is also gaining traction, opening new avenues for rapid disease response and customized immunization protocols.

Digitalization and Precision Animal Healthcare

Another significant opportunity shaping the Europe veterinary active pharmaceutical ingredients (vAPIs) market is the integration of digital technologies into precision animal healthcare. With advancements in data analytics, biosensors, and remote monitoring systems, veterinarians and farmers can now implement more targeted treatment strategies based on real-time animal health metrics. According to the European Innovation Partnership for Agricultural Productivity and Sustainability (EIP-AGRI), precision livestock farming technologies have been adopted on over 15% of EU farms, improving early disease detection and optimizing medication use. This shift allows for more accurate dosing and application of vAPIs, enhancing treatment efficacy while minimizing waste.

Apart from these, digital platforms developed by agritech startups and pharmaceutical firms enable better tracking of animal health trends, facilitating proactive disease management. The European Commission supports this transition through funding initiatives like Horizon Europe, which encourages the development of smart agricultural solutions.

MARKET CHALLENGES

Complexity in Supply Chain Management and Raw Material Availability

A major challenge confronting the Europe veterinary active pharmaceutical ingredients (vAPIs) market is the complexity in managing global supply chains and ensuring consistent availability of raw materials. The production of vAPIs relies on a network of suppliers providing specialized chemicals, excipients, and intermediates, many of which are sourced from outside the EU. Geopolitical tensions, trade restrictions, and logistical disruptions have led to extended lead times and price volatility, affecting production schedules and cost structures for European vAPI manufacturers. Furthermore, regulatory scrutiny on imported substances has intensified, with the EMA enforcing stricter documentation requirements for material sourcing and traceability. As reported by the European Chemical Industry Council (CEFIC), compliance with REACH and other chemical regulations has added layers of complexity to procurement processes. To mitigate these risks, some companies are exploring localized sourcing and vertical integration strategies.

Balancing Innovation with Cost Constraints in Public Sector Procurement

Another critical challenge facing the Europe veterinary active pharmaceutical ingredients (vAPIs) market is the difficulty in balancing innovation with cost constraints, particularly in public sector procurement and government-funded animal health programs. While there is growing demand for next-generation therapeutics, budgetary limitations often prioritize cost-effective generic APIs over newer, more expensive alternatives. As highlighted by the European Observatory on Animal Health, many national veterinary procurement tenders emphasize price competitiveness, limiting incentives for manufacturers to invest in novel formulations or advanced delivery mechanisms. This dynamic disproportionately affects SMEs and startups that rely on public contracts to sustain operations. Additionally, the European Centre for Disease Prevention and Control (ECDC) notes that despite rising awareness of antimicrobial resistance, the uptake of alternative therapies remains slow due to cost barriers and reimbursement limitations. This restricts market access for innovative VAPIs designed for precision applications or reduced resistance risk. Addressing this challenge requires coordinated efforts between policymakers, payers, and industry stakeholders to create frameworks that reward innovation without compromising affordability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.20 % |

|

Segments Covered |

By Service Type, Synthesis Type, Animal Type and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Zoetis Inc Class A, SeQuent Scientific, Ofichem Group, The Chem-Pro Group |

SEGMENT ANALYSIS

By Service Type Insights

The in-house manufacturing segment headed the Europe veterinary active pharmaceutical ingredients (vAPIs) market by accounting for a 61.3% of total demand in 2024. This command is mainly attributed to the strong presence of large, vertically integrated pharmaceutical companies that prefer to maintain full control over API production to ensure compliance, quality assurance, and intellectual property protection. Also, stringent regulations from the European Medicines Agency (EMA) on traceability and Good Manufacturing Practices (GMP) have encouraged established players to keep production in-house rather than rely on external vendors where oversight may be more complex. Moreover, with rising concerns about supply chain disruptions following the pandemic and geopolitical tensions, companies have increasingly prioritized internal capabilities to reduce dependency on third-party suppliers and ensure continuity of critical veterinary medicines across the continent.

The contract outsourcing segment is anticipated to grow at the fastest rate within the Europe veterinary active pharmaceutical ingredients market, with a projected CAGR of 8.4% between 2025 and 2033. This rapid expansion is driven by increasing R&D investments in niche therapeutic areas and the growing need for cost-effective API sourcing among mid-sized and emerging biotech firms. Furthermore, the complexity associated with producing high-potency APIs (HPAPIs) and biologicals has prompted smaller firms to outsource specialized manufacturing tasks that require advanced containment and biosecurity measures. With rising innovation and regulatory demands, contract outsourcing is becoming an essential strategy for scaling veterinary API production efficiently.

By Synthesis Type Insights

The chemical-based APIs exhibited the biggest synthesis type in the Europe veterinary active pharmaceutical ingredients market by possessing an estimated 58.1% share in 2024. This segment's control is because of the widespread use of synthetic compounds in the formulation of antibiotics, antiparasitics, analgesics, and anti-inflammatory drugs for both companion and production animals. According to the European Directorate for the Quality of Medicines & HealthCare (EDQM), over 90% of commonly prescribed veterinary medicines in Europe contain chemically synthesized APIs due to their well-established manufacturing processes, cost efficiency, and broad therapeutic applicability. Moreover, the continued reliance on traditional disease management strategies in livestock farming, including the controlled use of antimicrobials, supports sustained demand for chemical-based APIs despite regulatory efforts to reduce antibiotic usage. The European Food Safety Authority (EFSA) notes that while sales of veterinary antimicrobials have declined in recent years, they still remain integral to managing bacterial infections in cattle, poultry, and swine, ensuring food safety and animal welfare.

The biological APIs are appearing as the highest accelerating synthesis type within the Europe veterinary active pharmaceutical ingredients market, projected to expand at a CAGR of 9.2% through 2033. This accelerated growth is driven by increasing investment in biologics such as vaccines, monoclonal antibodies, and recombinant proteins designed to combat infectious diseases and improve animal immunity. Furthermore, the European Commission’s Farm to Fork Strategy promotes the reduction of chemical inputs in agriculture, encouraging the adoption of biological therapeutics that align with sustainability goals.

By Animal Type Insights

The production animals was the principal segment of the Europe veterinary active pharmaceutical ingredients (vAPIs) market by accounting for a 56.6% of total demand in 2024. This is basically linked to the large livestock population across the EU and the continuous need for disease prevention and treatment in commercial farming operations. The European Food Safety Authority (EFSA) reports that respiratory and gastrointestinal infections remain the most common ailments affecting farm animals, necessitating the use of antibiotics, anthelmintics, and vaccines containing specific vAPIs. Although antimicrobial use has declined in recent years, therapeutic applications remain essential, especially in intensive rearing systems.

Companion animals are cropping up as the swiftest-rising segment within the Europe veterinary active pharmaceutical ingredients (vAPIs) market, projected to expand at a CAGR of 8.7%. This quick progress is driven by the increasing humanization of pets and rising consumer expenditure on premium veterinary care. According to FEDIAF, the European Pet Food Industry Federation, a significant number of households in Europe own at least one pet, with dogs and cats being the most prevalent. This trend has led to higher demand for prescription medications, specialty treatments, and preventive therapies tailored for companion animals. Moreover, pet insurance adoption has surged, allowing owners to access advanced treatment options previously reserved for human medicine. In addition, the rise in chronic conditions among aging pet populations—such as diabetes, arthritis, and kidney disease—is driving interest in long-term treatment regimens that incorporate targeted vAPIs.

COUNTRY LEVEL ANALYSIS

Germany held the largest share of the Europe veterinary active pharmaceutical ingredients (vAPIs) market by accounting for a 22.9% in 2024. As Europe’s largest economy and a global leader in pharmaceutical manufacturing, Germany plays a central role in the development and production of high-quality veterinary medicines. According to the German Veterinary Medical Association, the country hosts several major pharmaceutical firms specializing in animal health, including Boehringer Ingelheim Animal Health and Bayer Animal Health, which contribute significantly to vAPI research, formulation, and distribution. In addition, Germany maintains a robust livestock industry, with millions of cattle, pigs, and poultry requiring regular veterinary interventions to prevent disease outbreaks and ensure food safety. The Robert Koch Institute reports that zoonotic disease monitoring and antimicrobial stewardship initiatives are well established, influencing responsible API usage across both farm and companion animal sectors. Furthermore, the country benefits from a strong regulatory framework enforced by the Federal Institute for Drugs and Medical Devices (BfArM), ensuring compliance with EMA standards and fostering innovation in next-generation veterinary therapeutics.

France hosts a strong regulatory and agricultural base. The country benefits from a well-developed agricultural sector and a strong presence of pharmaceutical companies engaged in animal health product development. According to France Agrimer, the national agricultural agency, France is home to one of the largest livestock populations in the EU, including over 19 million cattle and 13 million pigs, necessitating continuous investment in veterinary medicines to manage disease risks and optimize productivity. Moreover, France serves as a hub for animal health research, with institutions like ANSES playing a pivotal role in monitoring antimicrobial resistance and advising on responsible API use. The French Ministry of Agriculture reports that the country has made significant progress in reducing antibiotic consumption in livestock while promoting alternative treatments based on vaccines and biologics. Additionally, Paris-based companies such as Ceva Santé Animale and Virbac are actively involved in developing innovative vAPIs for both production and companion animals, strengthening France’s influence in the European veterinary pharmaceuticals landscape.

The United Kingdom is maintaining a resilient position despite post-Brexit trade adjustments. The UK’s strong veterinary research ecosystem and well-established pharmaceutical industry continue to support robust demand for high-quality APIs used in both livestock and companion animal treatments. According to the Veterinary Medicines Directorate (VMD), the UK saw a slight decline in antimicrobial sales for veterinary use in 2023 but recorded an increase in the use of vaccines and alternative therapeutics, reflecting evolving treatment approaches aligned with global health guidelines. This trend has boosted demand for premium veterinary medicines, particularly those containing novel APIs for chronic disease management and wellness-focused treatments. Moreover, These initiatives encourage the development of sustainable and effective vAPIs tailored for both domestic and international markets.

Italy is positioning itself as a key player in livestock and aquaculture medicine. The country’s agricultural sector, particularly dairy and poultry farming, drives consistent demand for therapeutic and prophylactic veterinary treatments. Moreover, Italy plays a crucial role in Mediterranean aquaculture, producing significant volumes of farmed fish species such as sea bass and sea bream. The Italian National Institute of Health also emphasizes the importance of antimicrobial stewardship, with national policies aimed at reducing antibiotic use while promoting the adoption of vaccines and alternative treatments. With a strong domestic manufacturing base and strategic participation in EU-wide animal health initiatives, Italy remains a key contributor to the European vAPI market, particularly in therapeutic segments related to food-producing animals.

Spain is benefiting from a growing livestock industry and expanding animal health infrastructure. The country is a major producer of pork and poultry in the EU, necessitating continuous investment in veterinary medicines to support disease prevention and sustainable farming practices. These numbers underline the necessity for high-quality vAPIs to maintain animal health and ensure food safety standards. Moreover, Spain has seen increasing collaboration between academic institutions and pharmaceutical companies to develop innovative veterinary treatments. The University of Barcelona and other research centers are actively engaged in studying new API formulations for zoonotic disease prevention and antimicrobial alternatives. Also, the Spanish government has supported initiatives aimed at improving veterinary surveillance and biosafety protocols, aligning with EU-wide antimicrobial resistance (AMR) reduction targets.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Veterinary Active Pharmaceutical Ingredients Market are Zoetis Inc Class A, SeQuent Scientific, Ofichem Group, The Chem-Pro Group, Siflon Drugs & Pharmaceuticals, Vetpharma, Suanfarma Biotech, Menadiona, Excel Industries

The competition in the Europe veterinary active pharmaceutical ingredients (vAPIs) market is marked by a blend of established multinational corporations and agile regional players striving to capture market share through innovation, regulatory expertise, and strategic positioning. As demand for safe, effective, and sustainable animal health products intensifies, companies must continuously adapt to shifting regulatory landscapes, evolving treatment paradigms, and growing concerns over antimicrobial resistance.

Key players differentiate themselves through proprietary molecule development, advanced formulation technologies, and specialized manufacturing capabilities that cater to both livestock and companion animal sectors. The market also sees increasing convergence between human and veterinary pharmaceutical approaches, with innovations such as biologics, mRNA-based vaccines, and digital health monitoring influencing API development strategies.

At the same time, smaller and mid-sized enterprises are leveraging niche expertise in specialty APIs, contract manufacturing, or regional distribution networks to maintain relevance amid consolidation. The interplay between innovation, compliance, and cost efficiency defines the competitive environment, with firms that can balance these factors best poised for long-term success in this dynamic and highly regulated sector.

Top Players in the Market

Boehringer Ingelheim Animal Health

Boehringer Ingelheim Animal Health is a global leader in veterinary pharmaceuticals and holds a dominant position in the European veterinary active pharmaceutical ingredients (vAPIs) market. The company develops and manufactures a wide range of APIs used in vaccines, parasiticides, and therapeutic medicines for both companion and production animals. With a strong focus on innovation, Boehringer Ingelheim has been instrumental in advancing disease prevention strategies through novel API formulations that support antimicrobial stewardship and One Health initiatives. Its extensive R&D network and strategic collaborations with regulatory bodies ensure compliance with the highest safety and efficacy standards.

Ceva Santé Animale

Ceva Santé Animale is a key player in the European vAPI landscape, known for its commitment to developing sustainable and effective veterinary solutions. The company invests heavily in research to create APIs tailored for poultry, swine, and aquaculture, addressing emerging health challenges with a focus on reducing antibiotic dependency. Ceva's presence across multiple animal health segments—ranging from vaccines to biologics—has positioned it as a versatile supplier in both domestic and export markets. By aligning its product development with EU sustainability goals, Ceva plays a vital role in shaping responsible veterinary medicine practices in Europe.

Virbac

Virbac is a prominent name in the European veterinary active pharmaceutical ingredients market, particularly in the companion animal segment. The company specializes in developing APIs for dermatological treatments, dental care, and parasitic control, catering to the growing demand for premium pet healthcare products. With manufacturing facilities across France and international partnerships, Virbac ensures high-quality API supply while maintaining strict adherence to regulatory requirements. Its emphasis on preventive healthcare and innovative delivery mechanisms enhances its competitive edge. Virbac’s continuous investment in R&D and expansion into digital veterinary tools further solidify its influence in the evolving European vAPI market.

Top strategies used by the key market participants

One major strategy employed by leading players in the Europe veterinary active pharmaceutical ingredients (vAPIs) market is innovation-driven R&D focused on biological and alternative therapeutics . Companies are investing heavily in developing biologics, vaccines, and targeted therapies to reduce reliance on conventional antibiotics and meet evolving regulatory expectations around antimicrobial resistance.

Another critical approach is strategic partnerships and collaborations with academic institutions and agritech firms . These alliances enable companies to access cutting-edge research, accelerate drug discovery, and align their product pipelines with emerging trends in precision animal healthcare and digital diagnostics.

Lastly, companies are emphasizing expansion into niche therapeutic areas and specialty companion animal medicine . With rising pet ownership and increasing consumer willingness to spend on premium veterinary treatments, firms are tailoring API formulations for chronic disease management, wellness applications, and geriatric care, enhancing brand differentiation and long-term market positioning.

RECENT HAPPENINGS IN THE MARKET

In February 2024, Boehringer Ingelheim announced a new research partnership with Wageningen University to develop next-generation veterinary APIs aimed at improving disease resistance in livestock without relying on traditional antibiotics. This initiative was designed to enhance the company’s portfolio of sustainable animal health solutions.

In May 2024, Ceva Santé Animale launched a dedicated biologics division based in Lyon, focusing on vaccine development and recombinant protein-based APIs for poultry and swine applications. The move was intended to expand Ceva’s leadership in alternative therapeutics and strengthen its presence in the European animal health market.

In July 2024, Virbac acquired a French biotech startup specializing in transdermal drug delivery systems, aiming to integrate novel administration technologies into its existing API formulations for companion animals, thereby improving treatment efficacy and user convenience.

In September 2024, Zoetis entered into a long-term supply agreement with a German contract manufacturing organization to secure stable sourcing of high-potency APIs used in equine and canine treatments, ensuring continuity of supply amid growing demand for specialty veterinary medicines.

In November 2024, Elanco Animal Health inaugurated a new veterinary API research facility near Barcelona, strengthening its regional footprint and enabling faster development cycles for species-specific therapeutics tailored to European regulatory and clinical needs.

MARKET SEGMENTATION

This research report on the europe veterinary active pharmaceutical ingredients market has been segmented and sub-segmented into the following categories.

By Service Type

- In-House Manufacturing

- Contract Outsourcing

By Synthesis Type

- Chemical-Based APIs

- Biological APIs

By Animal Type

- Production Animals

- Companion Animals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What are Veterinary Active Pharmaceutical Ingredients (APIs)?

Veterinary APIs are the biologically active components used in the manufacturing of medications for animals. They are responsible for the therapeutic effects of veterinary drugs.

What are the key drivers of growth in the European Veterinary API market?

Key drivers include: Rising pet ownership Increasing demand for animal-derived food products Growing awareness about animal health Government support for animal welfare

Which therapeutic areas are most common in veterinary APIs?

Popular therapeutic classes include: Antibiotics Antiparasitics Anti-inflammatories Vaccines Hormonal therapies

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com