Europe VFDS Market Size, Share, Trends & Growth Forecast Report By Application (Pump, Fan, Compressor, Conveyor, Extruder), Power Rating, Voltage, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe VFDS Market Size

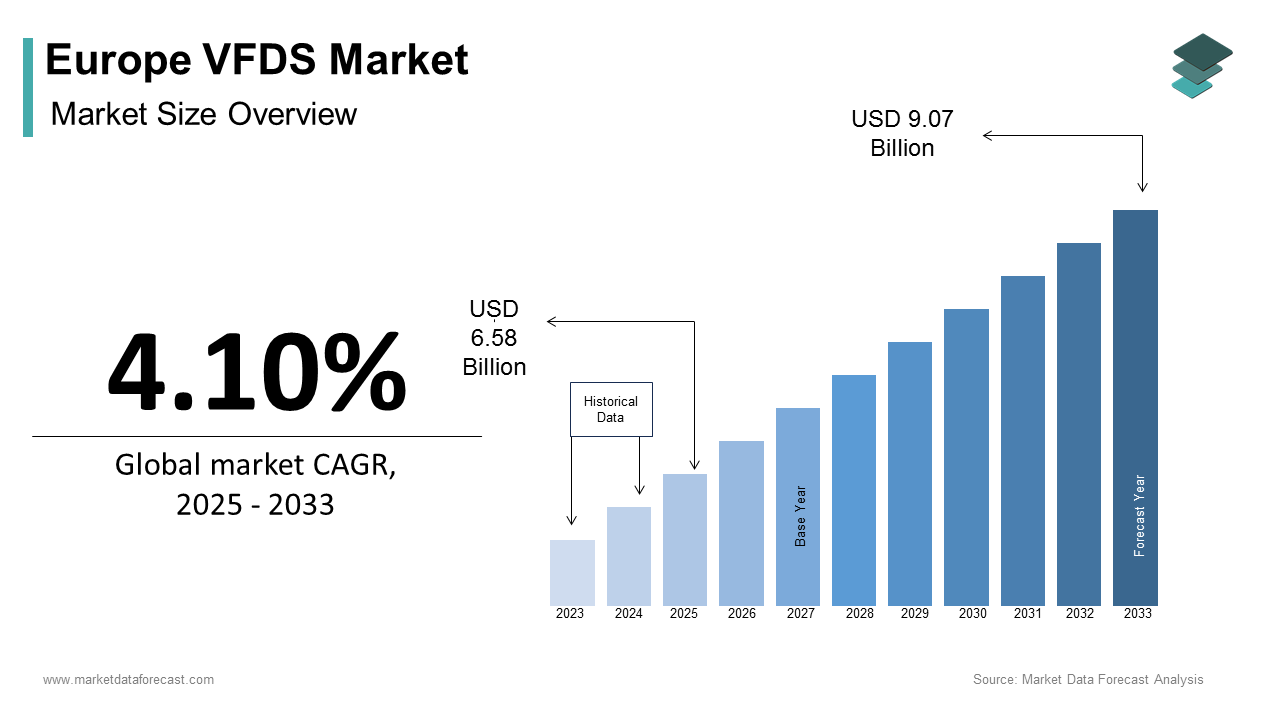

The Europe VFDS market size was calculated to be USD 6.32 billion in 2024 and is anticipated to be worth USD 9.07 billion by 2033, from USD 6.58 billion in 2025, growing at a CAGR of 4.10% during the forecast period.

The Europe variable frequency drive systems (VFDS) market refers to the part of industrial automation that involves the deployment of electronic devices capable of controlling the speed and torque of electric motors by varying the input frequency and voltage. These systems are widely used across industries such as manufacturing, energy, water treatment, and transportation to enhance operational efficiency, reduce energy consumption, and extend equipment lifespan. As industries in Europe increasingly prioritize sustainability and cost optimization, the adoption of VFDS has gained momentum. Also, the International Energy Agency highlights that industrial motor systems in Europe could save up to 18% of their electricity consumption through the adoption of efficient control technologies like VFDS. Moreover, stringent environmental regulations, such as the Ecodesign for Sustainable Products Regulation (ESPR), have pushed manufacturers toward more energy-efficient solutions.

MARKET DRIVERS

Regulatory Push for Industrial Energy Efficiency

One of the primary drivers of the Europe VFDS market is the regulatory emphasis on improving industrial energy efficiency. Governments and supranational bodies such as the European Union have introduced several directives aimed at reducing carbon emissions and optimizing energy consumption across sectors. The Ecodesign for Sustainable Products Regulation (ESPR), which replaced the earlier Eco-Design Directive, mandates higher efficiency standards for electric motors and associated control systems, including variable frequency drives. Germany, as one of the largest industrial economies in Europe, has implemented the Federal Ministry for Economic Affairs and Climate Action’s (BMWK) funding programs to support companies in upgrading to energy-efficient drive technologies. The mandatory adoption of VFDS in new industrial installations ensures compliance with these evolving norms, driving widespread deployment across production lines, HVAC systems, and pump operations.

Expansion of Renewable Energy Infrastructure

Another significant driver fueling the growth of the Europe VFDS market is the rapid expansion of renewable energy infrastructure, particularly in wind and solar power generation. Variable frequency drive systems play a crucial role in maintaining grid stability and optimizing energy conversion processes within renewable power plants. According to the International Renewable Energy Agency (IRENA), Europe saw a significant increase in new renewable capacity in 2023 alone, with offshore wind projects in the North Sea and Baltic regions leading the charge. In wind energy applications, VFDS is employed to regulate generator speed and improve energy capture under fluctuating wind conditions. Besides, in solar photovoltaic (PV) installations, VFDS assists in managing the output from inverters and storage systems, enhancing overall system efficiency. Denmark, a global leader in wind energy, has mandated the use of advanced drive systems in all new wind farms to meet its goal of 100% renewable electricity by 2030.

MARKET RESTRAINTS

High Initial Investment and Payback Period Concerns

A major restraint affecting the European VFDS market is the high initial investment required for the installation of variable frequency drive systems, which can deter small and medium-sized enterprises (SMEs) from adopting the technology. While VFDS offers long-term energy savings and operational benefits, the upfront costs—covering hardware, engineering, and integration—can be substantial. This financial burden is particularly pronounced in Eastern Europe, where industrial modernization budgets are limited. In contrast, larger corporations with access to green financing schemes or government subsidies are more likely to invest in energy-efficient technologies. Also, some industries perceive VFDS as optional rather than essential, especially in markets where energy prices remain relatively low. Until broader awareness and targeted financial incentives are introduced, cost sensitivity will continue to hinder the widespread adoption of variable frequency drive systems across Europe.

Technical Complexity and Skilled Labor Shortage

Another critical constraint on the Europe VFDS market is the technical complexity involved in designing, installing, and maintaining variable frequency drive systems, compounded by a shortage of skilled labor. VFDS requires specialized knowledge in electrical engineering, software configuration, and harmonic management to ensure seamless operation and prevent interference with other equipment. However, the European Centre for the Development of Vocational Training (CEDEFOP) reports that nearly 40% of industrial firms in Germany and Italy face challenges in finding qualified technicians proficient in advanced automation technologies. This skills gap is particularly evident in rural areas and smaller manufacturing hubs where training programs lag behind technological advancements. Moreover, maintenance of VFDS often requires remote diagnostics and real-time monitoring capabilities, which further complicate service delivery without adequate expertise. As a result, companies may experience delays in commissioning or troubleshooting, discouraging wider adoption.

MARKET OPPORTUNITIES

Rise of Smart Manufacturing and Industry 4.0

A compelling opportunity emerging in the Europe VFDS market is the growing integration of smart manufacturing and Industry 4.0 technologies. As European manufacturers embrace digital transformation, there is an increasing demand for intelligent motor control systems that can communicate with supervisory control and data acquisition (SCADA) platforms, cloud analytics, and predictive maintenance tools. Variable frequency drive systems are central to this shift, enabling real-time adjustments based on sensor feedback and machine learning algorithms. For instance, Siemens’ Digital Enterprise initiative has facilitated the deployment of VFDS equipped with embedded IoT modules that provide continuous performance data, allowing for proactive maintenance and energy optimization.

Growth of Electric Vehicle Charging Infrastructure

Another promising opportunity for the Europe VFDS market lies in the rapid expansion of electric vehicle (EV) charging infrastructure. As governments accelerate efforts to decarbonize transport, the deployment of fast and ultra-fast EV chargers has surged, requiring precise power control mechanisms to manage energy flow efficiently. Variable frequency drive systems play a critical role in ensuring stable and efficient power conversion within EV charging stations, particularly those utilizing bidirectional charging and vehicle-to-grid (V2G) technologies. These systems enable dynamic adjustment of current and voltage levels, improving battery longevity and grid responsiveness. In Norway, where EV adoption exceeds 90% of new car sales, national utility providers have integrated VFDS into charging infrastructure to optimize load balancing and minimize grid strain during peak hours. Furthermore, the European Alternative Fuels Observatory forecasts that over 3 million public EV charging points will be deployed across the EU by 2030, creating a sustained demand for high-performance drive systems.

MARKET CHALLENGES

Grid Instability and Harmonic Distortion

A pressing challenge confronting the Europe VFDS market is the issue of grid instability and harmonic distortion caused by the widespread adoption of variable frequency drive systems. While VFDS offer substantial energy efficiency benefits, they generate harmonic currents that can interfere with power quality and damage connected equipment if not properly mitigated. According to the European Committee for Electrotechnical Standardization (CENELEC), non-linear loads such as VFDS contribute majorly to power quality disturbances in industrial networks, leading to overheating, transformer losses, and potential system failures. To address these concerns, the European Union has implemented strict electromagnetic compatibility (EMC) regulations under the Low Voltage Directive, mandating that all new VFDS installations comply with defined harmonic emission limits. However, retrofitting older facilities with active filters and passive suppression components increases project costs and complexity. Manufacturers must therefore invest in advanced filtering technologies and adhere to stringent design guidelines to maintain grid compatibility.

Supply Chain Disruptions and Component Availability

Supply chain disruptions and component shortages pose a significant challenge to the Europe VFDS market, impacting production timelines and pricing stability. The ongoing semiconductor crisis, exacerbated by geopolitical tensions and logistical bottlenecks, has affected the availability of insulated-gate bipolar transistors (IGBTs), microprocessors, and capacitors—key components in variable frequency drive systems. Additionally, inflationary pressures have driven up raw material costs, particularly for copper, aluminum, and rare earth metals used in drive electronics and motor assemblies. Companies such as ABB and Schneider Electric have reported production slowdowns in their European factories due to component unavailability, according to internal procurement assessments from 2023. The war in Ukraine also disrupted supply routes for critical parts, particularly from Eastern European manufacturing hubs, adding another layer of uncertainty.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.10% |

|

Segments Covered |

By Application, Power Rating, Voltage, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

ABB Ltd, Siemens AG, Schneider Electric SE, Danfoss A/S, Rockwell Automation Inc., Eaton Corporation PLC, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, WEG Industries, Fuji Electric Co. Ltd |

SEGMENTAL ANALYSIS

By Application Insights

The pump application segment dominated the Europe variable frequency drive systems (VFDS) market by capturing 29.6% of total revenue in 2024. This leading place in the market is due to the widespread use of pumps in water treatment, heating, ventilation, and air conditioning (HVAC) systems across both municipal and industrial sectors. Germany stands out as a key adopter, with a large share of new commercial building HVAC installations incorporating variable frequency drives for pump control. With aging infrastructure requiring modernization and stringent efficiency regulations in place, such as the Ecodesign for Sustainable Products Regulation (ESPR), the demand for variable speed drives in pump systems continues to grow steadily across Europe.

The conveyor application segment is projected to register the highest CAGR of 8.6%. This rapid expansion is driven by increasing automation in manufacturing, logistics, and material handling industries, where precise motor control enhances operational efficiency and reduces mechanical wear. Similarly, the Netherlands’ Port of Rotterdam upgraded its cargo handling infrastructure with intelligent conveyor belts controlled by VFDS, improving load management and energy consumption. As e-commerce and just-in-time manufacturing expand, the need for adaptive conveying systems is propelling this segment forward at an accelerated pace.

By Power Rating Insights

The 0.5–20 kW power rating segment held the largest share of the Europe variable frequency drive systems (VFDS) market i.e. 34% of total revenue in 2024. This dominance is because of the extensive use of low-to-medium power drives in small-scale industrial machinery, HVAC equipment, and commercial appliances. According to the European Committee for Electrotechnical Standardization (CENELEC), a notable share of electric motors installed in non-heavy-industry applications fall within this power range, making them ideal candidates for VFDS retrofitting. In addition, the UK government’s Industrial Energy Transformation Fund has incentivized the replacement of inefficient fixed-speed motors with energy-saving VFDS units in the sub-20 kW range.

The >200 kW power rating segment is anticipated to grow at the fastest CAGR of approximately 9.1% from 2025 to 2033 which is fueled by rising demand in heavy industries such as steel, cement, mining, and large-scale renewable energy projects. These high-power drives are essential for controlling massive compressors, fans, and extrusion machines that require precise speed modulation and significant energy savings. In Italy, the steel and petrochemical industries have increasingly adopted VFDS for blast furnace blowers and gas turbines, with Confindustria noting a 15% reduction in energy costs after implementation. The European Commission’s Green Deal initiative has also encouraged investments in ultra-efficient drive systems for large-scale industrial operations.

By Voltage Insights

The low voltage segment commanded the biggest portion of the Europe variable frequency drive systems (VFDS) market i.e. 68.1% of total revenue in 2024. This prominence is primarily due to the widespread deployment of low-voltage drives in general-purpose industrial motors, HVAC systems, pumps, and consumer appliances operating at standard voltages of 230V to 690V. Germany remains a leading adopter, with the German Electrical and Electronic Manufacturers’ Association (ZVEI) reporting that more than half of all new motor installations in SMEs now include low-voltage VFDS to meet energy efficiency regulations under the Ecodesign for Sustainable Products Regulation (ESPR). As industries continue to prioritize flexibility, affordability, and compliance, the low-voltage segment remains the cornerstone of the European VFDS market.

The medium voltage segment is predicted to accelerate at the highest CAGR of 8.3% and is driven by increasing demand in large-scale industrial and energy infrastructure projects. Medium voltage VFDS, typically operating at 2.3 kV to 13.8 kV, are crucial for managing high-power applications such as compressors, pumps, and extruders in steel mills, chemical plants, and renewable energy facilities. In Spain, the energy transition plan has led to a surge in medium voltage VFDS installations in combined cycle power plants and desalination facilities, with Red Eléctrica de España reporting an improvement in grid stability following their deployment. Similarly, Norway’s Equinor has integrated medium voltage drives into offshore oil and gas platforms to enhance process control and reduce maintenance costs.

REGIONAL ANALYSIS

Germany maintained the largest market share in the European variable frequency drive systems (VFDS) market and contributed 23.8% of total regional revenues in 2024. This is attributed to the country’s strong industrial base, advanced manufacturing sector, and proactive policies supporting energy efficiency and digital transformation. Additionally, Germany’s push for Industry 4.0 has accelerated the adoption of smart drive systems integrated with IoT-enabled monitoring and predictive maintenance features. Companies such as Siemens and Bosch Rexroth have played pivotal roles in advancing local VFDS capabilities, while government-backed initiatives like the "Energiewende" program promote clean energy transitions.

France is experiencing major progress in the Europe VFDS market, driven by strategic investments in industrial modernization and green technology adoption. The French Agency for Ecological Transition (ADEME) reported that energy consumption in the industrial sector declined between 2020 and 2023, largely due to the adoption of VFDS in pump, fan, and compressor applications. In the automotive industry, major manufacturers such as Renault and PSA Group implemented VFDS-based automation systems to enhance production efficiency and reduce carbon footprints. Additionally, the National Institute for Industrial Environment and Risks (INERIS) emphasized the role of VFDS in complying with new emissions standards introduced under the European Green Deal.

Italy contributes a major share to the Europe VFDS market, supported by expanding adoption in heavy industries such as steel, chemicals, and cement. Additionally, Enel X, the energy solutions arm of Enel Group, partnered with industrial firms to implement smart drive systems capable of real-time performance analytics. With ongoing investments in industrial decarbonization and automation, Italy maintains a solid foothold in the European VFDS market.

The United Kingdom holds notable share of the Europe VFDS market, driven by strong emphasis on sustainable infrastructure and industrial energy efficiency. The Industrial Energy Transformation Fund (IETF) provided targeted grants for companies replacing outdated motor systems with energy-efficient VFDS. Moreover, the UK government’s Clean Steel Strategy encouraged the use of VFDS in steel production to cut energy consumption and comply with upcoming emission limits. With sustained policy backing and a growing emphasis on green manufacturing, the UK remains a key player in the European VFDS landscape.

Spain is propelled by increasing demand in the renewable energy and industrial automation sectors. Additionally, the Barcelona Supercomputing Center collaborated with local manufacturers to develop AI-assisted VFDS solutions for precision control in production environments. With continued investment in clean energy and automation, Spain is strengthening its position in the European VFDS market.

LEADING PLAYERS IN THE EUROPE VFDS MARKET

Siemens AG

Siemens is a global leader in industrial automation and electrification, with a strong footprint in the Europe variable frequency drive systems (VFDS) market. The company offers a comprehensive portfolio of drives tailored for pumps, fans, compressors, and conveyor applications across diverse industries. Siemens is known for its innovative digitalization initiatives, integrating VFDS with Industry 4.0 technologies such as IoT, predictive analytics, and cloud-based monitoring. Its focus on energy efficiency and system integration has positioned it as a preferred partner for large-scale industrial clients seeking smart and sustainable motor control solutions.

ABB Ltd.

ABB plays a pivotal role in shaping the European VFDS landscape through its advanced power electronics and motion control technologies. The company provides scalable and modular drive systems designed to meet the specific needs of heavy industries, renewable energy projects, and process automation. ABB emphasizes sustainability, offering drives that significantly reduce energy consumption and carbon emissions. Its commitment to research and development ensures continuous innovation in compact drive design, ease of integration, and compatibility with evolving grid and industrial standards, making it a trusted name among European manufacturers and utility providers.

Schneider Electric SE

Schneider Electric is a key player in the Europe VFDS market due to its broad range of energy-efficient drives and its strong emphasis on green technology and digital transformation. The company integrates VFDS into its EcoStruxure platform, enabling seamless connectivity and real-time performance optimization for industrial users. Schneider focuses on delivering user-friendly, plug-and-play drive solutions for SMEs and commercial applications, while also supporting large enterprises in their decarbonization strategies. With a deep understanding of local regulatory frameworks and customer requirements, Schneider continues to expand its influence across both traditional and emerging sectors in Europe.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players in the Europe VFDS market is product innovation and digital integration , where companies continuously develop intelligent drive systems equipped with IoT capabilities, remote diagnostics, and predictive maintenance features. This approach enhances operational efficiency and aligns with the region’s push toward smart industry and energy management.

Another key strategy is strategic partnerships and collaborations, particularly with system integrators, automation solution providers, and energy service companies. These alliances help manufacturers expand their market reach, offer customized solutions, and integrate VFDS seamlessly into broader industrial ecosystems.

Lastly, localized expansion and after-sales support play a crucial role in strengthening market presence. Companies are investing in regional service centers, technical training programs, and customer-specific engineering to ensure faster deployment, better compliance with local regulations, and improved long-term reliability of their drive systems across diverse industrial environments.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Europe variable frequency drive systems market include ABB Ltd, Siemens AG, Schneider Electric SE, Danfoss A/S, Rockwell Automation Inc., Eaton Corporation PLC, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, WEG Industries, Fuji Electric Co. Ltd.

The competition in the Europe variable frequency drive systems (VFDS) market is characterized by a mix of established global players and specialized regional manufacturers striving to capture market share through differentiation and strategic positioning. As industries across the continent prioritize energy efficiency, automation, and sustainability, demand for high-performance VFDS continues to rise. Leading companies compete not only on product performance and technological sophistication but also on adaptability to regional regulatory standards and integration capabilities within evolving industrial ecosystems. While multinational corporations leverage their extensive R&D networks and brand recognition, mid-sized firms are increasingly focusing on niche applications and localized customization to gain traction. Additionally, the growing convergence of VFDS with digital platforms and renewable energy infrastructure has intensified competitive dynamics, prompting players to invest in software-enabled solutions and ecosystem partnerships. Ultimately, success in this market depends on a company’s ability to innovate rapidly, deliver reliable support, and align offerings with the shifting demands of Europe’s industrial and energy sectors.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Siemens launched a new series of compact variable frequency drives specifically designed for small and medium-sized enterprises across Germany and Austria, aiming to simplify integration and improve energy efficiency in light industrial applications.

- In March 2024, ABB expanded its digital services division in Sweden, introducing cloud-connected VFDS monitoring tools that enable real-time diagnostics and predictive maintenance for industrial customers in the Nordic region.

- In June 2024, Schneider Electric partnered with a French energy consultancy firm to deploy VFDS-based energy optimization solutions in municipal water treatment plants, enhancing process efficiency and reducing electricity consumption.

- In August 2024, Danfoss opened a new VFDS manufacturing facility in Poland, increasing production capacity to meet rising demand from Eastern European markets and strengthening regional supply chain resilience.

- In October 2024, Rockwell Automation acquired a German industrial software startup specializing in motor control analytics, aiming to enhance its VFDS offerings with AI-driven performance optimization for European manufacturing clients.

MARKET SEGMENTATION

This research report on the Europe VFDS Market has been segmented and sub-segmented based on application, power rating, voltage, and region.

By Application

- Pump

- Fan

- Compressor

- Conveyor

- Extruder

By Power Rating

- 0–0.5

- 0.5–20

- 20–50

- 50–200

- >200kW

By Voltage

- Low Voltage

- Medium Voltage

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the Europe VFDs market?

Growth is driven by increasing demand for energy efficiency, government regulations on energy consumption, industrial automation, and expansion of infrastructure projects.

2. Which industries are major users of VFDs in Europe?

Key industries include manufacturing, oil & gas, HVAC, water & wastewater treatment, mining, and power generation.

3. Who are the key players in the Europe VFDs market?

Major players include ABB Ltd, Siemens AG, Schneider Electric SE, Danfoss A/S, Rockwell Automation Inc., Eaton Corporation PLC, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, WEG Industries, and Fuji Electric Co. Ltd.

4. How do VFDs contribute to energy savings?

VFDs reduce energy consumption by adjusting motor speed to match the actual load requirement, which leads to significant energy and cost savings.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com