Europe Virtual Reality Gaming Market Size, Share, Trends, Forecast, Research Report - Segmented By Device (Personal Computers, Gaming Consoles, Mobile Devices), Types of Games, and Region (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends, & Growth Forecast (2025 to 2033)

Europe Virtual Reality Gaming Market Size

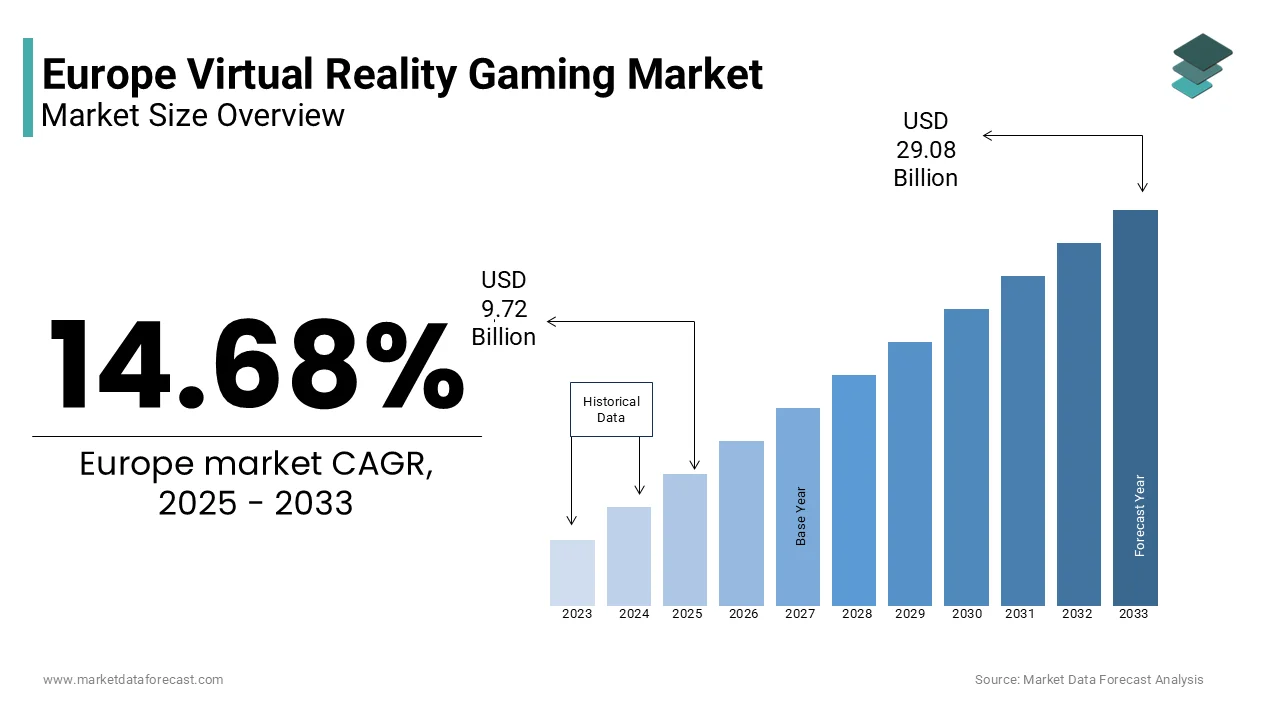

The Europe virtual reality gaming market size was valued at USD 8.48 billion in 2024. The global market size is expected to reach USD 9.72 billion in 2025 and USD 29.08 billion by 2033, with a CAGR of 14.68% during the forecast period.

MARKET DRIVERS

Increasing Integration of VR Technology in Competitive Gaming and eSports

One of the key drivers of the Europe virtual reality gaming market is the growing integration of VR into competitive gaming and eSports ecosystems. As traditional eSports continue to gain mainstream acceptance, developers and tournament organizers are exploring immersive formats that enhance player engagement and spectator experience. Games like VRChat , Population: ONE , and Echo VR have laid the foundation for competitive VR eSports, offering real-time physical interaction and spatial awareness that differentiate them from conventional gaming. In response, major event producers such as ESL and DreamHack have introduced dedicated VR segments in their annual lineups, particularly in countries like Sweden, Poland, and the Netherlands where eSports culture is deeply rooted. Additionally, local governments in cities such as Berlin and Prague have supported these initiatives through grants and venue sponsorships, recognizing the potential for job creation and technological innovation.

Furthermore, universities and private academies across the region have begun offering VR-specific training programs for aspiring eSports athletes and developers, signaling institutional backing for long-term growth. With increasing investment from both the public and private sectors, VR-enabled eSports are expected to play a pivotal role in expanding the market’s reach beyond casual gamers and into professional and semi-professional domains.

Expansion of VR Arcades and Social Gaming Centers

Another significant driver of the Europe virtual reality gaming market is the rapid expansion of VR arcades and social gaming centers across major urban hubs. These venues offer immersive, shared experiences that overcome the limitations of home-based setups, making VR accessible to a broader audience without requiring personal investment in expensive equipment. According to the European Leisure Network (ELN), the number of VR arcade locations in Western Europe increased by nearly 40% between 2021 and 2023, with London, Paris, and Barcelona emerging as hotspots for this trend.

These centers cater not only to individual gamers but also to group activities such as corporate team-building events, birthday parties, and school field trips, thereby diversifying revenue streams. For instance, in Germany, VR Park Munich reported hosting over 120,000 visitors in 2023, with bookings for multi-player sessions accounting for more than 60% of total usage. Similarly, in Spain, companies like Zero Latency Madrid have expanded their offerings to include live-action VR escape rooms and simulation-based adventure games, enhancing customer retention and repeat visits.

Additionally, partnerships between arcade operators and leading VR developers have led to exclusive content releases, further incentivizing foot traffic. As per data from the International Association of Amusement Parks and Attractions (IAAPA), 68% of consumers who experienced VR at an arcade expressed interest in purchasing a headset for home use within six months. This exposure effect is playing a crucial role in educating the public about VR capabilities and driving long-term market penetration.

MARKET RESTRAINTS

High Cost of Entry-Level VR Equipment and Accessories

A major restraint impacting the Europe virtual reality gaming market is the relatively high cost of entry-level VR equipment and accessories, which limits mass adoption among price-sensitive consumers. While premium headsets such as Meta Quest Pro and HTC Vive Elite come with advanced features including eye-tracking and higher-resolution displays, they often exceed €1,000, placing them out of reach for many casual gamers. Even mid-tier models like the PlayStation VR2 and standalone Quest 3 require additional expenditures on compatible consoles or PCs, further increasing the financial burden.

According to a survey conducted by the German Institute for Consumer Research (DIWR) in 2023, nearly 45% of respondents cited affordability as the primary barrier to VR adoption. This sentiment was especially prevalent in Southern and Eastern Europe, where average disposable income levels are lower compared to Western counterparts. In Italy, for example, less than 8% of households owned a VR headset, despite a strong domestic gaming community.

Moreover, ongoing costs such as subscription services, downloadable content (DLC), and replacement components add to the total ownership expense. Until pricing structures become more consumer-friendly or financing options expand, cost constraints will continue to hinder widespread VR adoption across several European markets.

Limited Content Diversity and Developer Support

Another key constraint on the Europe virtual reality gaming market is the limited diversity of available content and insufficient developer support, which restricts user engagement and long-term retention. While early adopters benefit from a growing library of immersive titles, many of these games suffer from short lifespans, minimal updates, and lack of cross-platform compatibility. According to a study by the British Interactive Media Association (BIMA), only 22% of VR games released in Europe in 2023 received post-launch updates beyond three months by contributing to declining user interest.

Independent developers face particular challenges due to high production costs, fragmented hardware ecosystems, and limited visibility on major app stores. Unlike traditional AAA studios with substantial funding, smaller teams often struggle to justify VR-exclusive projects when return on investment remains uncertain. The European Game Developers Federation (EGDF) reported that in 2023, just 15% of indie developers considered VR as a primary platform, which is citing low sales volume and technical complexities as deterrents. Additionally, while console and PC platforms benefit from extensive third-party support, VR-specific titles frequently lack the depth and replayability seen in non-immersive genres. A survey by the Nordic Games Association found that 58% of European VR owners played fewer than five different games within the first six months of purchase.

MARKET OPPORTUNITIES

Rising Adoption of Cloud-Based VR Gaming Platforms

A promising opportunity for the Europe virtual reality gaming market lies in the rising adoption of cloud-based VR gaming platforms that eliminate the need for high-end hardware. Cloud VR leverages remote server infrastructure to stream high-quality immersive experiences directly to lightweight headsets via high-speed internet connections. This model significantly reduces upfront costs and technical barriers, which is making VR gaming more accessible to a broader audience.

According to the European Telecommunications Network Operators’ Association (ETNO), the rollout of 5G networks across major European cities has enabled faster, lower-latency data transmission, which is critical for real-time VR interactions. Countries such as Germany, the Netherlands, and Sweden have already established commercial cloud VR services through partnerships between telecom providers and gaming firms. For instance, Deutsche Telekom launched a cloud VR initiative in 2023 that allows subscribers to stream VR games on affordable standalone headsets, bypassing the need for powerful local hardware.

In addition, industry leaders such as Meta and Sony have been actively developing cloud-compatible versions of their flagship VR platforms. As per reports from the European Gaming Industry Forum (EGIF), cloud VR is expected to drive a 35% increase in new user acquisitions over the next five years, particularly among younger demographics who prefer flexible, subscription-based gaming models.

Growing Use of VR in Educational and Corporate Training Applications

Another significant opportunity for the Europe virtual reality gaming market is the expanding use of VR in educational and corporate training applications, which indirectly drives consumer familiarity and market penetration. According to the European Commission’s Directorate-General for Education, Youth, Sport and Culture, over 200 higher education institutions across Europe had integrated VR-based learning modules into their curricula by 2023. Institutions in Finland and Estonia, known for their digital-first education policies, reported a 40% improvement in student engagement and knowledge retention when using VR-enhanced teaching methods. This growing exposure to immersive technology among students is likely to translate into stronger consumer interest in VR gaming. Similarly, corporate training programs in industries such as automotive manufacturing and healthcare have embraced VR simulations to improve skill development and safety protocols. BMW and Siemens, for example, have deployed VR training systems across their European facilities, which is exposing thousands of employees to the benefits of immersive technology.

MARKET CHALLENGES

Health and Safety Concerns Associated with Prolonged VR Use

A major challenge facing the Europe virtual reality gaming market is the growing concern regarding health and safety risks associated with prolonged VR use. In response, national health agencies in several European countries have issued advisories recommending usage limits, particularly for children and individuals prone to vestibular disorders. The UK’s National Health Service (NHS) has highlighted concerns over potential impacts on posture, coordination, and cognitive development among young users, urging parents to monitor screen time closely. Additionally, anecdotal reports of accidents caused by users losing spatial awareness during gameplay such as tripping or colliding with objects—have raised liability concerns among manufacturers and venue operators. As a result, regulatory bodies are increasingly scrutinizing product labeling and user guidance provided by VR headset makers. Addressing these health-related apprehensions through improved ergonomics, adaptive gameplay mechanics, and enhanced user education will be crucial for maintaining consumer confidence and ensuring sustainable market growth.

Fragmentation of Hardware Ecosystems and Compatibility Issues

Another pressing challenge confronting the Europe virtual reality gaming market is the fragmentation of hardware ecosystems and persistent compatibility issues across different VR platforms. Unlike traditional gaming, where cross-platform support is increasingly common, VR remains highly segmented, with proprietary headsets, controllers, and software stores limiting interoperability. This fragmentation creates confusion among consumers and discourages broad adoption due to uncertainty over future-proofing investments.

As per the findings of the European Consumer Electronics Association (ECEA), in 2023, there were over 15 distinct VR headset models available in Europe, each with varying performance levels, input methods, and exclusive game libraries. Major brands such as Meta, HTC, Sony, and Valve operate independent content stores with minimal cross-purchasing options, forcing users to buy the same title multiple times if switching platforms. This issue is particularly pronounced in multiplayer and social VR spaces, where friends may be unable to play together due to incompatible hardware.

Moreover, inconsistent software updates and developer support further exacerbate the problem. Independent studios often prioritize specific platforms based on user base size, leaving other ecosystems with outdated or missing titles. The European Game Developers Federation (EGDF) notes that in 2023, nearly 30% of VR games were available exclusively on one platform, which is limiting accessibility and fragmenting the player community. Until greater standardization and open-source collaboration emerge, this hardware and software divide will remain a significant obstacle to cohesive market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.68% |

|

Segments Covered |

By Device, Type of Games, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Sony Corporation, Microsoft Corporation, Nintendo Co., Ltd., Electronic Arts, Inc., Meta Platforms, Inc. (Meta), Samsung Electronics Co., Ltd. (Samsung Group), Ultraleap Limited (Leap Motion, Inc.), HTC Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Linden Research, Inc., and others. |

SEGMENTAL ANALYSIS

By Device Insights

The personal computers segment was the largest and held 46.5% of the Europe virtual reality gaming market share in 2024 owing to the superior performance capabilities of PC-based VR systems, which offer higher resolution, better graphics fidelity, and greater processing power compared to alternative platforms. The flexibility of PCs allows for hardware upgrades and customization, making them an attractive option for tech-savvy gamers who seek optimal performance. Additionally, major VR headsets such as HTC Vive Elite, Valve Index, and Oculus Rift S are designed exclusively for PC integration, reinforcing this ecosystem's stronghold. Moreover, the open nature of PC platforms fosters independent game development and modding communities, enhancing content availability and longevity. As per data from Steam’s VR hardware survey, over 3 million active VR users were based in Europe in 2023, predominantly using PC-connected setups.

The mobile devices represent the fastest-growing segment within the Europe virtual reality gaming market, projected to expand at a CAGR of 19.4% from 2023 to 2030 . This rapid growth is largely attributed to the widespread availability of smartphones equipped with advanced sensors, gyroscopes, and high-resolution displays, enabling cost-effective VR experiences without the need for dedicated hardware. According to Eurostat, over 85% of Europeans aged between 16 and 44 owned a smartphone in 2023 , creating a vast potential user base for mobile VR gaming.

Google Cardboard-compatible applications and standalone VR apps available on iOS and Android have made immersive experiences more accessible to casual users. In countries like Spain and Poland, where disposable incomes are relatively lower, mobile VR solutions accounted for nearly 40% of all VR-related downloads, as reported by the European Digital Content Observatory (EDCO). Furthermore, the integration of augmented reality (AR) features into mobile VR games has enhanced interactivity, particularly in location-based and social gameplay formats.

Another key driver is the growing popularity of cloud-streamed VR content, allowing mobile users to access high-quality immersive experiences without requiring powerful onboard hardware. As per the findings of the European Telecommunications Network Operators’ Association (ETNO), the rollout of 5G networks in urban centers across Germany, Italy, and Sweden has significantly improved streaming performance , further accelerating adoption. With continued improvements in mobile processors, display technologies, and network infrastructure, mobile VR gaming is poised to reach mass-market appeal in Europe.

By Types of Games Insights

The science fiction segment was the largest by capturing 24.3% of the Europe virtual reality gaming market share in 2024 with the genre’s inherent compatibility with immersive storytelling and world-building, which aligns seamlessly with VR’s experiential strengths. One of the key drivers is the appeal of futuristic narratives that allow players to explore alien worlds, interact with AI characters, and experience zero-gravity environments all of which are uniquely amplified through VR immersion. Titles such as Half-Life: Alyx , Lone Echo , and Starship Commander have set new benchmarks for interactive sci-fi experiences, attracting both hardcore and casual gamers. As per a survey conducted by the Nordic Game Development Forum (NGDF), nearly 62% of VR users in Scandinavia cited sci-fi as their preferred genre, which is appreciating the sense of exploration and technological wonder these games provide. Additionally, developer interest in science fiction remains strong due to its adaptability to multiplayer, cooperative, and simulation-based gameplay. The European Interactive Software Association (EISA) noted that sci-fi VR games generated the highest average playtime per user by indicating stronger retention rates.

The puzzle games segment is likely to grow with a CAGR of 21.6% from 2025 to 2033. The growth of the segment is driven by offering players hands-on problem-solving experiences that leverage motion controls, spatial reasoning, and environmental interaction. According to the European Leisure Software Publishers Association (ELSPA), VR puzzle games saw a 42% increase in downloads across Europe in 2023, which is outpacing other genres in terms of user acquisition and engagement.

Furthermore, educational institutions and cognitive therapy programs in several European countries have begun integrating VR puzzle games to enhance mental agility and motor coordination, indirectly boosting public awareness and acceptance. The French National Center for Scientific Research (CNRS) reported that VR-based puzzles showed measurable benefits in memory retention and spatial cognition among elderly participants, reinforcing their broader appeal beyond entertainment.

REGIONAL ANALYSIS

The United Kingdom was the largest contributor of the Europe virtual reality gaming market with 13.2% of share in 2024. The country benefits from a mature digital gaming ecosystem, high internet penetration, and strong institutional support for emerging technologies. According to UKIE, the trade body representing the UK interactive entertainment industry, over 38 million people in the UK engaged in video gaming regularly in 2023, with VR adoption steadily increasing among tech-savvy consumers.

London, Manchester, and Edinburgh have become focal points for VR startup incubation and investment, with government-backed initiatives such as the Digital Catapult program fostering innovation in immersive media. Additionally, the UK has been at the forefront of integrating VR into competitive gaming, with events like the VR League and DreamHack London featuring dedicated VR eSports tournaments.

France VR gaming market, driven by the rapid expansion of immersive entertainment venues and strong academic research into extended reality (XR) applications. According to the French Ministry of Culture, more than 150 VR arcades operated nationwide in 2023 , with Paris, Lyon, and Marseille serving as major hubs for experiential gaming. These centers cater to both individual and group audiences, offering multiplayer escape rooms, flight simulations, and interactive storytelling experiences.

In addition to public access, France has seen significant investment in VR-based education and corporate training. Institutions such as INSEAD and École Polytechnique have incorporated VR simulations into business and engineering curricula, exposing students to immersive learning tools. The European Digital Economy Observatory (EDEO) notes that French universities accounted for 18% of all VR-related research projects in Europe in 2023, contributing to long-term technological advancement.

Moreover, local developers have gained recognition for innovative narrative-driven VR titles, supported by funding from organizations like Bpifrance and CNC. With a growing domestic appetite for immersive content and favorable policy frameworks, France is solidifying its position as a key player in the European VR gaming landscape.

Spain contributes around 9% to the Europe virtual reality gaming market , distinguished by the rising popularity of VR in social, cultural, and tourism-oriented applications. According to the Spanish Association of Video Game Companies (AEVI), VR gaming adoption in Spain increased by 28% in 2023 , driven by younger demographics and expanding retail distribution of VR headsets.

Madrid, Barcelona, and Valencia have emerged as hotspots for VR arcade expansion, with operators integrating live multiplayer experiences and virtual concerts to attract diverse audiences. The International Association of Amusement Parks and Attractions (IAAPA) reported that Spanish VR venue operators recorded a 40% rise in bookings for team-based experiences , highlighting the social appeal of the medium.

Beyond entertainment, Spain has also embraced VR in heritage preservation and museum exhibits, with institutions like the Prado Museum launching immersive historical tours. Additionally, language learning platforms and vocational training centers have adopted VR simulations to enhance engagement and skill development. As per the findings of the Catalan Institute for Technology and Digital Innovation (ICTID), VR-based educational content consumption in Spain grew by 35% in 2023 , signaling broader acceptance of the technology beyond traditional gaming circles.

Germany holds the largest individual country share at 16% , driven by its strong industrial base, advanced telecommunications infrastructure, and institutional backing for immersive technologies. The country is home to several VR hardware and software companies, including subsidiary operations of global leaders such as Meta and HTC, which contribute to localized R&D and product development.

According to the German Federal Ministry of Education and Research (BMBF), Germany invested over €150 million in XR-related research initiatives in 2023 , focusing on applications in healthcare, engineering, and remote collaboration. Universities in Munich, Berlin, and Stuttgart have established dedicated VR labs, producing a steady pipeline of skilled professionals entering the sector.

Additionally, Germany has witnessed a surge in VR gaming adoption among professional eSports teams and event organizers. The German eSports Association (ESV) reported that VR-based competitions attracted over 100,000 participants in 2023 , with cities like Cologne hosting international tournaments. With strong manufacturing capabilities, high disposable incomes, and a culture of tech innovation, Germany remains the region’s most influential national VR gaming market.

Italy captures approximately 10% of the Europe virtual reality gaming market , characterized by growing investment in cloud-based VR services and educational applications. According to the Italian National Institute of Statistics (ISTAT), VR headset sales in Italy increased by 22% in 2023 , with a notable shift toward mid-range and wireless models that appeal to budget-conscious consumers.

Milan and Rome have become centers for VR startup activity, particularly in cloud-streamed gaming and enterprise training applications. Telecom Italia, in partnership with Meta, launched a pilot 5G-enabled VR gaming service in 2023, aiming to reduce reliance on high-end hardware and broaden access. The European Telecommunications Network Operators’ Association (ETNO) notes that Italy ranked third in Southern Europe for VR cloud content consumption , indicating strong potential for future growth.

Educational institutions are also embracing VR for language learning, medical simulations, and historical recreations. The University of Padua reported that VR-assisted teaching modules improved student engagement by 41% in 2023 , reinforcing the technology’s value beyond entertainment. With increasing government and private-sector support, Italy is strengthening its foothold in the European VR gaming market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Sony Corporation, Microsoft Corporation, Nintendo Co., Ltd., Electronic Arts, Inc., Meta Platforms, Inc. (Meta), Samsung Electronics Co., Ltd. (Samsung Group), Ultraleap Limited (Leap Motion, Inc.), HTC Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), and Linden Research, Inc. are the key players in the Europe virtual reality gaming market.

The Europe virtual reality gaming market is highly competitive, characterized by rapid technological evolution, shifting consumer expectations, and a fragmented vendor landscape. Major global players coexist with emerging local startups, creating a dynamic environment where differentiation hinges on product quality, ecosystem richness, and user engagement strategies. While established firms like Meta, Sony, and HTC dominate hardware sales, niche players are gaining traction through specialized offerings such as wireless mobility, modular design, and enterprise-grade applications. Software developers play a parallel role in shaping competition, as exclusive titles and cross-platform compatibility influence purchasing decisions. The market also sees growing convergence between VR, augmented reality (AR), and mixed reality (MR), with companies exploring hybrid solutions to cater to evolving consumer preferences. Regulatory considerations around data privacy, health implications, and ethical content consumption further shape the competitive dynamics. As investment flows into immersive technologies and cloud-based gaming gains momentum, the battle for market share is intensifying, with firms striving to deliver seamless, accessible, and socially integrated virtual experiences.

TOP PLAYERS IN THE MARKET

Meta Platforms (formerly Facebook)

Meta, through its Oculus brand, is a dominant force in the global and European VR gaming market. The company has significantly shaped consumer VR with devices like the Meta Quest series, offering standalone, high-quality immersive experiences. In Europe, Meta has fostered developer ecosystems, supported content creation, and expanded retail and online distribution channels. Its commitment to social VR applications like Horizon Worlds has also introduced new dimensions of multiplayer interaction, reinforcing its leadership position.

Sony Interactive Entertainment

Sony’s PlayStation VR platform has been instrumental in bringing virtual reality into mainstream console gaming across Europe. With the launch of PlayStation VR2, the company enhanced immersion through advanced haptics, eye-tracking, and higher-resolution displays. Sony continues to leverage its strong first-party studios and established PlayStation user base to drive VR adoption, making it a key player in bridging traditional gaming audiences with next-generation immersive experiences.

HTC Vive

HTC Vive remains a leading provider of premium PC-based VR systems, particularly among enthusiasts and professionals in Europe. Known for high-fidelity headsets like the Vive Elite and Vive Pro, HTC has contributed to enterprise and gaming applications of VR. By supporting open platforms and collaborating with developers, HTC has played a crucial role in expanding VR’s capabilities beyond entertainment, influencing both consumer and industrial use cases in the region.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

One major strategy employed by key players in the Europe virtual reality gaming market is continuous innovation in hardware and software integration , ensuring that VR systems offer superior performance, ergonomics, and ease of use. Companies are focusing on lightweight designs, improved visual fidelity, and intuitive control schemes to enhance user experience and encourage repeat engagement.

Another critical approach is expanding strategic partnerships with game developers, cloud service providers, and content creators to build a rich ecosystem of immersive experiences. These collaborations help ensure a steady flow of exclusive and cross-platform titles that attract diverse user segments, from casual gamers to professional training institutions.

Lastly, companies are investing heavily in localized marketing campaigns, VR arcade integrations, and educational outreach programs to raise awareness and drive adoption. By engaging directly with consumers and institutions, they aim to position VR as an essential part of digital entertainment and learning environments across Europe.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Meta launched a localized version of its Meta Quest Store tailored specifically for European users, featuring curated regional content and language support aimed at enhancing accessibility and user engagement across multiple countries.

- In June 2024, Sony partnered with a leading European eSports organization to integrate PlayStation VR2 into competitive gaming circuits, promoting VR-based tournaments and fostering community-driven gameplay experiences in key markets like Germany and France.

- In October 2023, HTC Vive announced a collaboration with a major European telecommunications provider to pilot 5G-enabled VR streaming services, aiming to reduce hardware dependency and expand access to immersive gaming in urban centers.

- In March 2024, Ubisoft unveiled a new VR-exclusive title developed in partnership with French and Polish studios, targeting European audiences with culturally relevant narratives and interactive gameplay designed specifically for immersive platforms.

- In September 2023, Valve expanded its Steam Playtesting program across several European cities, enabling local developers to test and refine VR games in real-world settings while strengthening its relationship with independent creators and publishers.

MARKET SEGMENTATION

This research report on the Europe virtual reality gaming market is segmented and sub-segmented into the following categories.

By Device

- Personal Computers

- Gaming Consoles

- Mobile Devices

By Types of Games

- Racing

- Adventure

- Fighting

- Shooting

- Mystery Thriller

- Puzzle

- Science Fiction

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth outlook for the Europe virtual reality gaming market?

The Europe VR gaming market is projected to grow from USD 9.72 billion in 2025 to USD 29.08 billion by 2033, at a CAGR of 14.68%.

2. What factors are driving the growth of the VR gaming market in Europe?

Growth is fueled by advancements in VR hardware and software, increasing consumer demand for immersive gaming experiences, and greater investment from gaming studios and tech companies.

3. What challenges does the European VR gaming market face?

Key challenges include the high cost of VR equipment, limited content variety, and the need for strong internet infrastructure to support multiplayer and cloud-based VR gaming.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com