Global Feeding Systems Market Size, Share, Trends & Growth Forecast Report, Segmented By System Type (Conveyor Belt System, Self-Propelled System, Rail Guided System,), Offering (Software, Hardware, Service), Application (Swine Farm, Dairy Farm, Poultry Farm, Equine Farm) And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis from 2025 to 2033

Global Feeding Systems Market Size

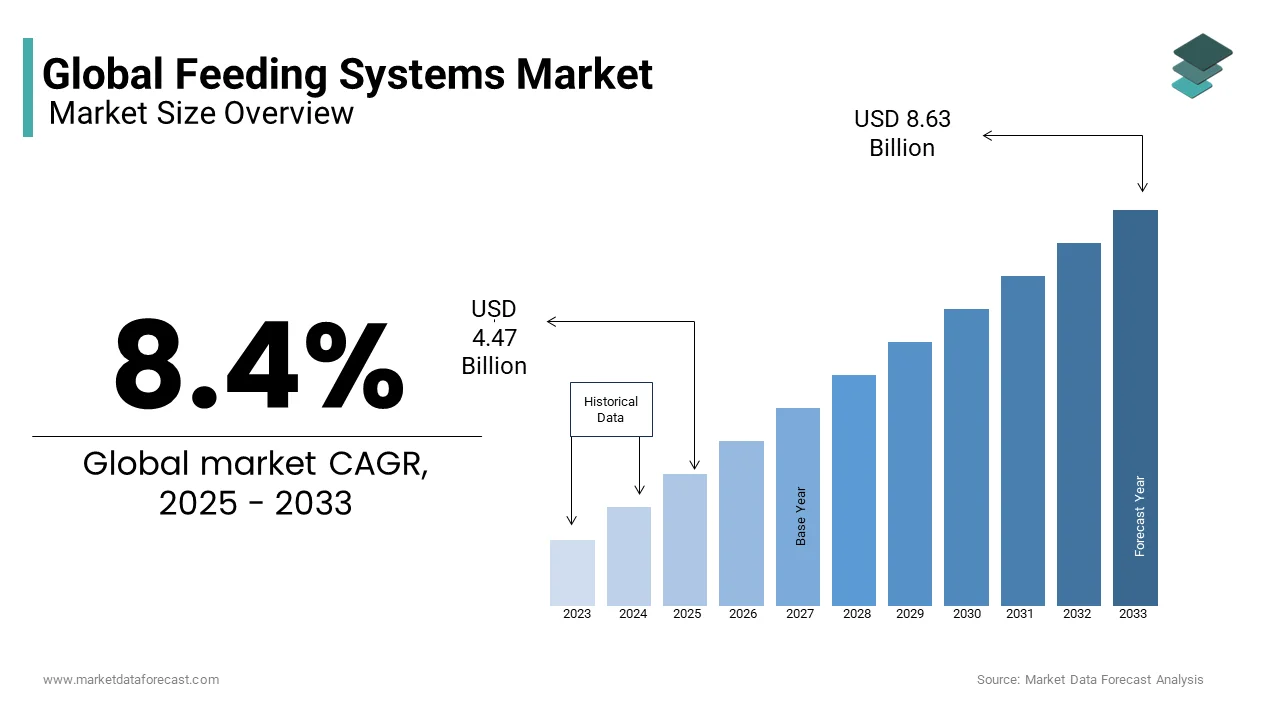

The global feeding systems market was valued at USD 4.12 billion in 2024 and is anticipated to reach USD 4.47 billion in 2025 from USD 8.63 billion by 2033, growing at a compound annual growth rate (CAGR) of 8.4% during the forecast period from 2025 to 2033.

MARKET DRIVERS

The global population's continuous growth is an important driver in the feeding systems market. As the population increases, the demand for food products, including meat, dairy, and agricultural goods, is on the rise. To meet this demand, these systems play a crucial role in optimizing resource utilization, reducing waste, and ensuring the well-being of livestock. They enable farmers and producers to meet the growing food requirements of the global population while adhering to environmental and ethical standards. As the world's population continues to expand, the feeding systems market is poised for further growth, with technology and innovation at the forefront to address the ever-increasing demand for food resources.

Technological advancements have been a transformative driver for innovation and efficiency in the feeding systems market. These advancements are transformative, offering farmers and producers cutting-edge solutions to enhance their operations. Automatic feeding systems have emerged, which take control over feeding schedules, portion sizes, and nutritional requirements for livestock, resulting in healthier animals and improved product quality. Therefore, efficiency and sustainability in the feeding systems market thrive on technological innovations that empower farmers to meet the ever-growing global food demand.

MARKET RESTRAINTS

High cost is a significant restraint in the feeding systems market due to the adoption of advanced and automated feeding systems. While these systems offer a myriad of benefits, their substantial upfront investment can present a formidable barrier, particularly for small-scale farmers and resource-constrained producers. The capital required for acquiring and installing automated equipment, infrastructure upgrades, and associated technologies can be a prospect for those with limited financial resources. Moreover, technology providers and manufacturers can explore cost-effective solutions and modular approaches, allowing for gradual adoption and scalability. By mitigating the financial burden of high initial costs, the feeding systems market can broaden its reach, empowering a diverse range of farmers and producers to embrace modern, sustainable, and efficient feeding practices. In doing so, it can further contribute to global food security and agricultural sustainability.

Impact Of Covid-19 On The Feeding Systems Market

The COVID-19 pandemic had a mixed impact on the feeding systems market. On the downside, the market experienced disruptions in supply chains and production, primarily due to lockdowns, labor shortages, and restrictions on the movement of goods. These challenges led to delays in the delivery of feeding system components and equipment, affecting the industry's ability to meet growing demand efficiently. Furthermore, the economic uncertainties and reduced budgets of many farmers and producers led to postponed or scaled-back investments in feeding technology, particularly among small-scale operators. However, over time, the pandemic highlighted the importance of automation and remote monitoring in maintaining essential agricultural operations during times of crisis. As a result, the market saw an increased interest in and adoption of advanced feeding systems that offered more efficient and contactless solutions. The emphasis on biosecurity and reducing the human presence on farms further accelerated the demand for automated feeding systems, as they could help minimize health risks to both animals and farm workers. This pandemic-induced shift towards automation is likely to have a lasting, positive impact on the feeding systems market in terms of technology adoption and resilience.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.4% |

|

Segments Covered |

By Offering, By Application, By Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

GEA Group AG, Cargill, Incorporated, DeLaval, Big Dutchman, Valco Companies, Inc., Fancom B.V., Roxell, Automatik-Gruppe, Skiold A/S, Guangdong Wenze Feed Co., Ltd., ForFarmers, Chore-Time, Guangzhou Huanan Poultry Equipment Co., Ltd., Buhler Group, Pas Reform Hatchery Technologies, Alltech, Agco Corporation, New Hope Group, Nutreco are playing a dominating role in global feeding systems market |

SEGMENT ANALYSIS

By offering Insights

Hardware holds a dominant position due to its fundamental role in automating feeding processes. Hardware components include feeding machines, sensors, feeding units, and any physical equipment used in the feeding systems. Hardware is often the most tangible and immediately visible part of the system. It is essential for automating feeding processes and ensuring the efficient delivery of feed to livestock. The prominence of hardware in the market is primarily driven by the necessity for physical components to construct and operate feeding systems. The demand for robust and efficient hardware remains high, as it forms the foundation of these systems.

The software holds the second largest share as it includes control systems, monitoring software, and data analytics tools. Software is becoming increasingly crucial for data-driven decision-making and remote monitoring and control of feeding systems. It enables farmers to optimize feed schedules, track animal health, and reduce waste. As the industry continues to embrace technology and data-driven solutions, software is gaining prominence in the feeding systems market.

Services encompass various aspects, including installation, maintenance, training, and consulting. Service providers support customers in selecting, implementing, and maintaining feeding systems. Services are vital for ensuring the proper functioning of the hardware and software components. They contribute to the long-term success of feeding systems by offering technical expertise and addressing issues promptly.

By Application Insights

Swine farms are dominating the market as they manage the nutrition of pigs, ensuring proper growth and health. These systems are designed to deliver feed in controlled portions and are equipped with features to minimize feed wastage. Automated feeders and ad libitum systems are commonly used in swine farming. While swine farms place significant importance on feeding systems, the dominance may not be as pronounced as in dairy or poultry due to the diversity of feeding methods used in the industry.

Dairy farming is the second significant factor, as it ensures the proper nutrition of dairy cattle. Automated feeding systems are used to provide precise and individualized diets, monitor feed intake, and optimize milk production. TMR (Total Mixed Ration) systems are commonly used in dairy farms, where various feed components are mixed and delivered to the cows. These systems aim to maximize milk production and overall herd health. The dominance of feeding systems in dairy farming is significant due to the highly regulated and data-driven nature of the industry.

Poultry farms utilize feeding systems for broilers, layers, and turkeys. These systems provide automated feed delivery to optimize growth and egg production. Poultry feeding systems can be designed for various types of feeds, from pellets to crumbles. The dominance of feeding systems in poultry farming is considerable, especially in large-scale commercial operations where precise feed management and automated data collection are essential for profitability.

Equine farms, including those breeding and raising horses, also benefit from feeding systems. These systems can automate feed delivery and portion control for horses, helping to ensure a balanced diet. However, the dominance of feeding systems in equine farming is relatively lower than in other segments, as many equine operations prefer more hands-on and individualized feeding approaches.

REGIONAL ANALYSIS

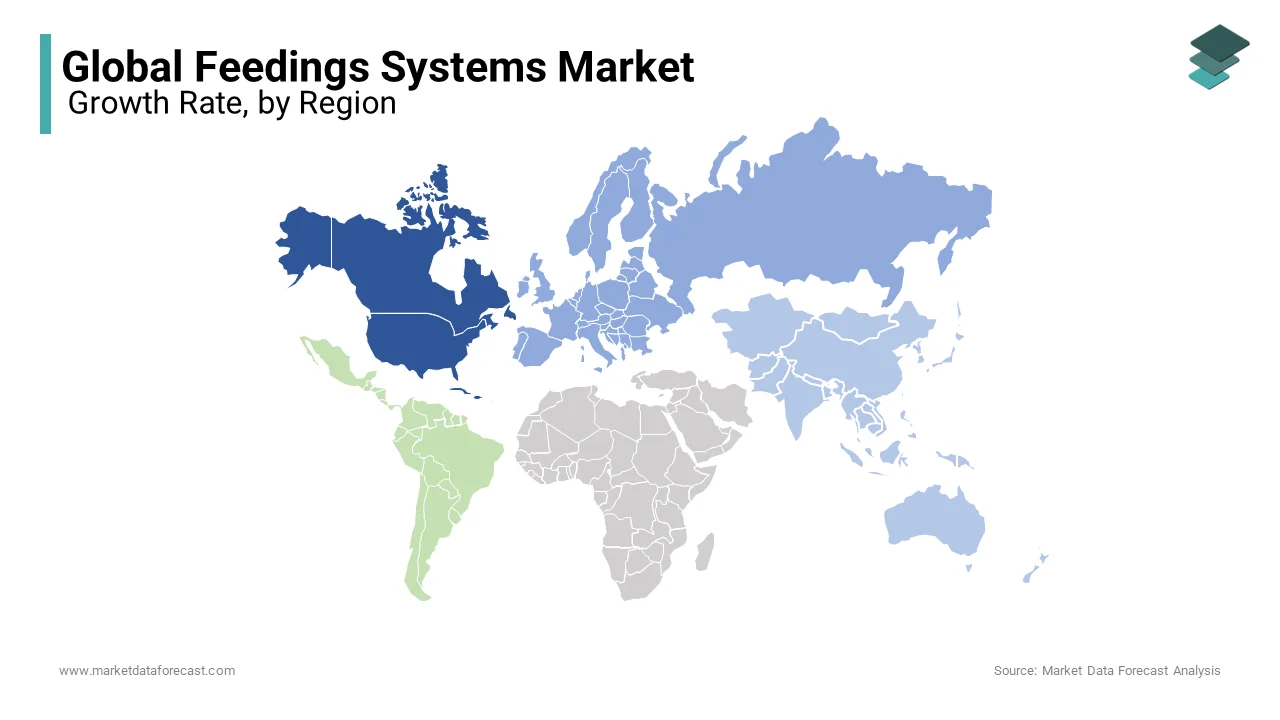

North America boasts a dominant position in the feeding systems market. This prominence is largely attributed to the advanced state of agricultural technology, particularly in the United States and Canada. The region places a strong emphasis on large-scale commercial farming, where feeding systems are integral to optimizing efficiency, reducing labor costs, and ensuring precise feed management. The well-established dairy, poultry, and swine industries in North America rely heavily on automated feeding systems for improved productivity and data-driven decision-making.

Europe also holds a significant share of the Feeding Systems Market. The European Union's stringent regulations on animal welfare and environmental sustainability have encouraged the adoption of modern feeding practices. Dairy and poultry farming, as well as swine production, are prevalent in Europe, and the need for precise feed management has driven the growth of feeding systems. Furthermore, European countries are increasingly integrating smart technologies and data analytics into their feeding systems, contributing to their prominence.

The Asia Pacific region is witnessing rapid growth in the Feeding Systems Market. The adoption of feeding systems is expanding, driven by the region's increasing demand for animal products and a shift toward more efficient and sustainable farming practices. While North America and Europe dominate the market, Asia Pacific is a rapidly growing and influential player.

Latin America is characterized by its diverse agricultural landscape, with a notable presence of livestock and poultry farming. While the adoption of feeding systems is on the rise, the market in this region is still developing. Economic factors, such as budget constraints for smaller farms, can affect the penetration of feeding systems.

The Feeding Systems Market in the Middle East and Africa is steadily evolving. The region's predominantly arid climate and unique farming practices impact the types of animals raised and, consequently, the demand for feeding systems. As agriculture and livestock farming continue to develop, the adoption of automated feeding systems is gradually increasing. However, the market is smaller compared to the aforementioned regions, partly due to the varying levels of infrastructure and technology adoption.

KEY MARKET PLAYERS

GEA Group AG, Cargill, Incorporated, DeLaval, Big Dutchman, Valco Companies, Inc., Fancom B.V., Roxell, Automatik-Gruppe, Skiold A/S, Guangdong Wenze Feed Co., Ltd., ForFarmers, Chore-Time, Guangzhou Huanan Poultry Equipment Co., Ltd., Buhler Group, Pas Reform Hatchery Technologies, Alltech, Agco Corporation, New Hope Group, Nutreco are playing a dominating role in global feeding systems market.

RECENT HAPPENINGS IN THE MARKET

- In 2022, Abbott Laboratories expanded its range of infant feeding systems, including specialized products for babies with dietary restrictions.

- In 2022, Arla Foods introduced feeding systems with an emphasis on organic and locally sourced ingredients for baby formula.

- In 2023, Hipp Organic developed new feeding systems that are free from additives and preservatives, catering to parents seeking natural options.

MARKET SEGMENTATION

This research report on the global feeding system market has been segmented & sub-segmented based on the offering, application, region.

By Offering

- Hardware

- Software

- Service

By Application

- Dairy farm

- Poultry farm

- Swine farm

- Equine farm

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

what is the size of global feeding system market?

The global feeding system market is expected to grow to USD 4.47 billion in 2025.

what is the growth of global feeding systems market?

The global Feeding Systems Market is expected to reach USD 8.63 billion by 2033.

what are the key market players in feeding systems market?

GEA Group AG, Cargill, Incorporated, DeLaval, Big Dutchman, Valco Companies, Inc., Fancom B.V., Roxell, Automatik-Gruppe, Skiold A/S, Guangdong Wenze Feed Co., Ltd., ForFarmers, Chore-Time, Guangzhou Huanan Poultry Equipment Co., Ltd., Buhler Group, Pas Reform Hatchery Technologies, Alltech, Agco Corporation, New Hope Group, Nutreco are playing a dominating role in global feeding systems market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]