Global Feldspar Market Research Report - Segmentation By Type (Plagioclase Feldspar and K-Feldspar), By End Use (Glass, Ceramics and Fillers), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Feldspar Market Size (2024 to 2032):

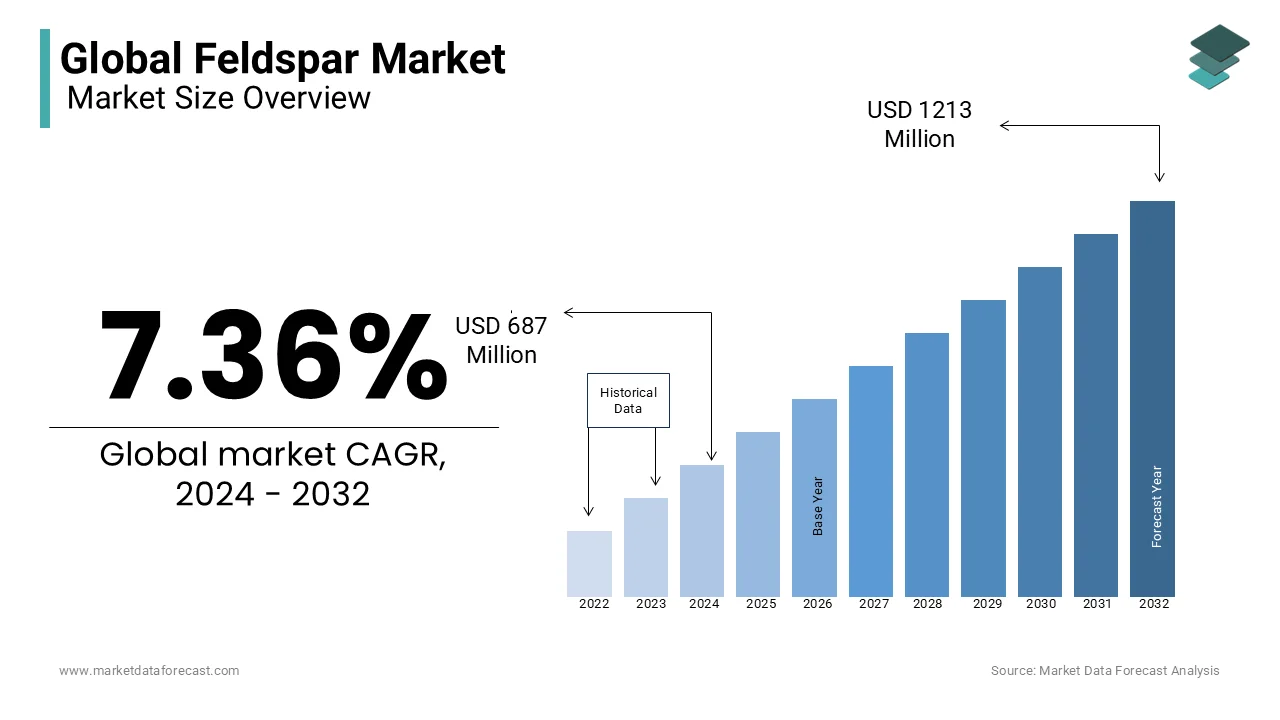

The Global Feldspar Market was valued at USD 640 million in 2023 and is predicted to reach USD 1213 million by 2032 from USD 687 million in 2024, with a compound annual expansion rate (CAGR) of 7.36% from 2024 to 2032.

Current Scenario of the Global Feldspar Market

Feldspar is widely employed in glass and ceramic manufacturing, with the glass industry being the main end-user. The escalating call for glass and ceramic products and coatings for welding rods, as well as thinners and fillers in the paint industry, are the main expansion drivers of the feldspar market. Furthermore, the escalating number of construction activities and the growing need for electronics are other dynamics that are predicted to increase market expansion during the outlook period 2024-2032. Feldspar is a group of rock minerals that make up aluminium silicate as the main mineral. In addition to aluminium silicate, other components of feldspar include potassium, soda, or lime. These rocky minerals make up 40-42% of the weight of the Earth's continental crust. Feldspars are primarily native rocks and magma. In some cases, feldspars are considered the main components of rock classification. Feldspars are essential components for the construction of stones. Most of the products we use in our daily lives are made from feldspar. The classification of various rocks is based on the presence of feldspar. Feldspar is one of the most abundant rocks on earth, which occurs in the form of crystals. It is widely employed in many everyday products such as drinking glasses, protective glass, fibreglass, tiles, showers, sinks, and tableware.

MARKET TRENDS

Ceramic tiles are one of the most important materials consumed in the construction industry. Therefore, the expansion of the ceramic tile market depends on the increase in construction spending worldwide. The construction sector is experiencing significant expansion, mainly in APAC countries such as China, India, and Malaysia. In 2015, China's construction spending was around $ 1.7 trillion. Therefore, the call for ceramic tiles increases with the expansion of the construction industry.

MARKET DRIVERS

The constant advancement of the construction industry, mainly in the residential and commercial fragments, is the significant factor probable to drive the feldspar industry for years to come.

In the construction industry, feldspar is mainly employed to make construction tiles, tableware, bathroom tiles, etc. Escalating products from the glass and ceramic industries in emerging countries is predicted to drive the market in the coming years. In ceramic and glass production, feldspar is employed primarily as a flux, to lower the melting temperature when added to ceramic or glass products. The escalating use of tableware, bathroom tiles, and building tiles is predicted to have a positive impact on the feldspar market over the anticipated years. Several infrastructure projects and investments made in emerging countries should stimulate the call for products in the coming years. These factors are predicted to fuel the feldspar market during the estimated period.

MARKET RESTRAINTS

Feldspar is employed primarily as a flux in the manufacture of glass and ceramics from quartz. However, glass and ceramic recycling have limited the expansion of the feldspar market.

MARKET OPPORTUNITIES

In ceramic and glass production, feldspar is employed primarily as a flux, to lower the melting temperature when added to glass or ceramic products. These factors are predicted to drive the feldspar market during the outlook period. Additionally, the continued development and advancement of the construction industry in the United States, especially in the residential and commercial sectors, is a key factor that is likely to drive the global feldspar market for years to come.

MARKET CHALLENGES

Nevertheless, changes in logistics and mining expenses could hamper the feldspar industry throughout the estimated period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.36% |

|

Segments Covered |

By Type, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

I-Minerals Inc., Quarzwerke GmbH, Adolf Gottfried Tonwerke GmbH, EczacibasiEsan, LB Minerals, U.S, Silica Company, El Waha Mining & Fertilizers, SP Minerals, SCR-Sibelco NV, Granite Rock Company, Imerys S.A., Feldspar Corp, and Others. |

SEGMENTAL ANALYSIS

Global Feldspar Market Analysis By End Use

The glassware segment led the market and represented more than 76.0% of worldwide volume in 2023. The expansion of the segment is largely influenced by the dynamics of the automotive, construction, and packaging industries.

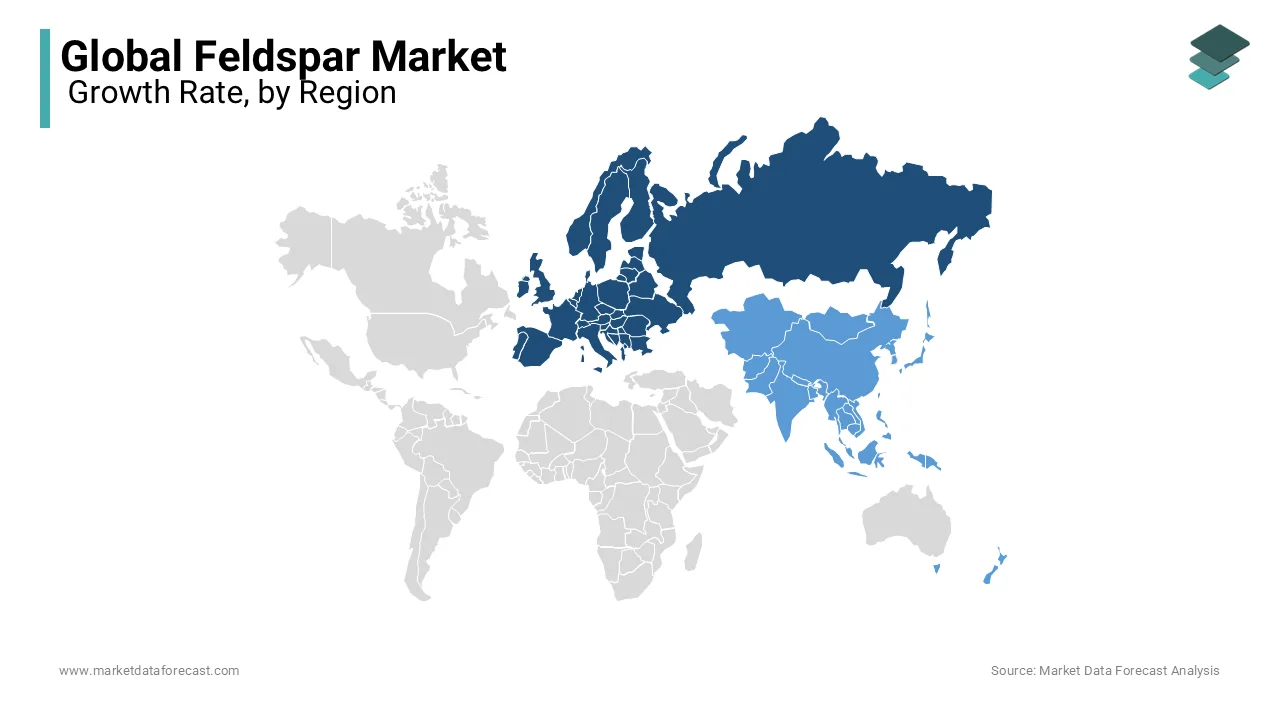

REGIONAL ANALYSIS

Europe occupied the majority of the global feldspar market in 2023 and is predicted to maintain its dominance in the coming years. The region is the largest producer of K-type feldspar. Italy is considered the second-largest producer of K-type feldspar in the world after Turkey. APAC is estimated to be the fastest-growing feldspar market during the foreseen period due to escalating calls for feldspar from the glass and ceramic industries in the region. China is the largest and most dynamic feldspar market in the region. India, Thailand, South Korea, and Malaysia are the other key markets for feldspar in the APAC region. The rising population increased urbanization and escalated investment in infrastructure projects are predicted to drive overall industrial expansion in the region, thereby growing the call for feldspar. The Indian government's “Make in India” initiative will also catalyze a call for feldspar from the local glass and ceramic manufacturing industries. Central and South America are predicted to experience the slowest expansion during the outlook period. Due to the emergence of the pandemic and the growing number of infected victims in Brazil, the region is experiencing enormous economic turmoil. Furthermore, the region is affected by geopolitical tensions in key countries, such as Colombia and Venezuela, which hampers industrial activities in the region.

KEY PLAYERS IN THE GLOBAL FELDSPAR MARKET

Companies playing a prominent role in the global feldspar market include I-Minerals Inc., Quarzwerke GmbH, Adolf Gottfried Tonwerke GmbH, EczacibasiEsan, LB Minerals, U.S, Silica Company, El Waha Mining & Fertilizers, SP Minerals, SCR-Sibelco NV, Granite Rock Company, Imerys S.A., Feldspar Corp, and Others.

RECENT HAPPENINGS IN THE GLOBAL FELDSPAR MARKET

- At medium temperatures, these hitherto unknown variants are stable at pressures in the Earth's upper mantle, where common feldspar generally cannot come into existence.

DETAILED SEGMENTATION OF THE GLOBAL FELDSPAR MARKET INCLUDED IN THIS REPORT

This research report on the global feldspar market has been segmented and sub-segmented based on type, end use, and region.

By Type

- Plagioclase feldspar

- K-Feldspar

By End Use

- Glass

- Ceramics

- Fillers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Feldspar Market growth rate during the projection period?

The Global Feldspar Market is expected to grow with a CAGR of 7.36% between 2024-2032.

2. What can be the total Feldspar Market value?

The Global Feldspar Market size is expected to reach a revised size of US$ 1213 million by 2032.

3.Name any three Feldspar Market key players?

SP Minerals, SCR-Sibelco NV, and Granite Rock Company, Imerys S.A. are the three Feldspar Market key players.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]