Global Flight Data Monitoring Market Size, Share, Trends, & Growth Forecast Report by Component (Hardware, Software, and Services), Solution (On-Board and Ground), End-Use (Fleet Operators, Drone Operators, and Investigation Agencies) & Region, Industry Forecast From 2024 to 2033

Global Flight Data Monitoring Systems Market Size

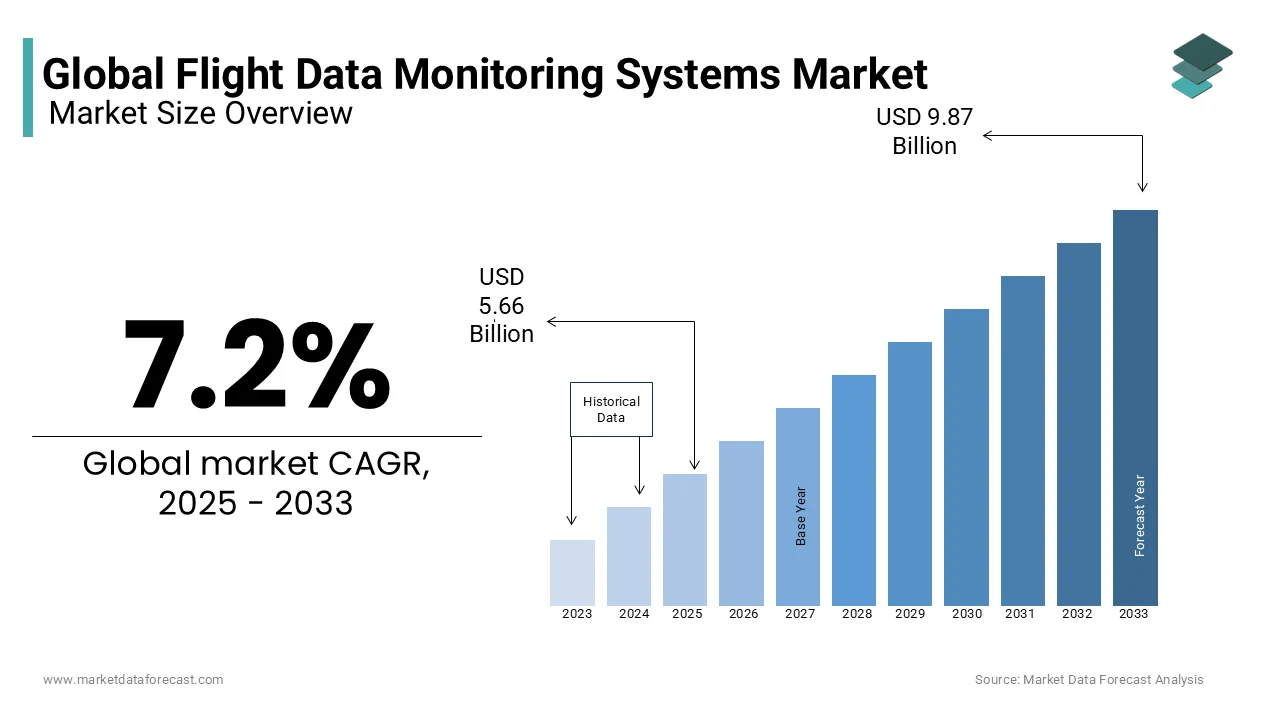

The global flight data monitoring systems market was worth USD 5.28 billion in 2024. The global market is predicted to reach USD 5.66 billion in 2025 and is expected to reach USD 9.87 billion by 2033, growing at a CAGR of 7.2 % during the forecast period 2025 to 2033.

The global aviation sector is experiencing significant growth in terms of passenger count and aircraft fleet. This is primarily due to increased business and leisure travel due to increased disposable income. Furthermore, the volume of cargo air fleet is steadily increasing in both developed and developing countries.The information gathered assists operators in managing operations, fuel efficiency, risk management, and compliance with standard operating procedures. The FDM is used by quality assurance personnel and maintenance technicians to improve fleet safety and operational efficiency. Because ensuring flight safety is critical in the aviation industry, demand for FDM is rising in tandem with increased aircraft deliveries.

MARKET DRIVERS

Monitoring and analyzing flight data have evolved into a volunteer safety program aimed at improving aviation safety through proactive flight-recorded statistics.

This initiative enables airlines to acquire certain digital data from flight data recorders placed on their aircraft. Following that, the data is used to identify specific events, which is referred to as a systematic management system (SMS). The SMS calculates deviations from norms and danger regions and establishes a baseline safety margin. Furthermore, if a potential risk trend is recognized, an appropriate risk management plan is implemented and its effectiveness is tracked until the trend returns to normal.

MARKET RESTRAINTS

Many airline businesses lack experience in-flight data monitoring and analysis in-house. Because the qualified staff is necessary for proper flight data monitoring and analysis, many small and medium-sized businesses are still inefficient in FDMA. As a result, these factors are projected to slow down the growth of the global flight data monitoring and analysis market in the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.2% |

|

Segments Covered |

By Component, Solution, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Teledyne (US), Curtiss-Wright (US), Safran (France), FLYHT (Canada), Guardian Mobility (Canada), SKYTRAC (Canada), Scaled Analytics (Canada), Nest Aerospace (India), FlightDataPeople (UK), Helianalysis (UK), and others |

SEGMENTAL ANALYSIS

By Component Insights

The hardware category dominated the market. The flight data monitoring technology provides accurate information that helps to avoid accidents and issues. Material losses and insurance costs are reduced when flight mishaps are reduced. The method has enormous potential for determining the root causes and levels of risk associated with human errors, allowing for early detection of human factors concerns.

By Solution Insights

Flight data monitoring systems collect and evaluate on-board and ground-based aircraft operational characteristics. Data gathering, storage gear, and post-flight data analysis software are used to do this. Flight data monitoring data is utilised to improve operating efficiency and safety while also lowering maintenance costs.

By End-Use Insights

The fleet operators segment dominated the market. A fleet operator can use the flight data monitoring system to monitor and improve operational safety. The technology is essential for big aircraft with a take-off mass of more than 27,000 kg. The method has also been shown to be advantageous to fleet operators of smaller planes and helicopters. It is an important component of a fleet operator's management system and serves as a primary data source for monitoring operational safety.

REGIONAL ANALYSIS

During the forecast period, the Asia-Pacific area is expected to have the greatest CAGR values. This is primarily owing to an increase in new aircraft deliveries to airlines and armed forces of important countries in the APAC region, such as China, India, Japan, and South Korea, among others. Over the next two decades, Asia-Pacific is predicted to account for roughly 40% of new aircraft deliveries. This will lead to a significant increase in demand for flight data monitoring systems in the global market. Furthermore, as the fleet of aircraft grows, so does the demand for flight data monitoring services, which aids the APAC area in establishing dominance.

KEY MARKET PLAYERS

The major players in the Flight Data Monitoring Market include Teledyne (US), Curtiss-Wright (US), Safran (France), FLYHT (Canada), Guardian Mobility (Canada), SKYTRAC (Canada), Scaled Analytics (Canada), Nest Aerospace (India), FlightDataPeople (UK), and Helianalysis (UK).

RECENT HAPPENINGS IN THE MARKET

- L3Harris Technologies has completed the final major design milestone for the US Missile Defense Agency's Hypersonic and Ballistic Tracking Space Sensor program Phase IIb On-orbit Prototype Demonstration and has already commenced construction.

- Teledyne Photometrics, a Teledyne Technologies company, has announced a strategic agreement with Dotphoton AG, an image compression solutions provider, to enable robust storage of enormous volumes of images created by scientific imaging using integrated combinations of the two businesses' technologies. SpectraSensors Inc.'s Water Vapor Sensing System ("WVSS-II") product line has been bought by FLYHT Aerospace Solutions Ltd. The WVSS-II is a sensor that is mounted aboard airplanes and delivers near-real-time water vapor measurements throughout the flight. These findings have a direct impact on weather forecasting and aviation weather support.

MARKET SEGMENTATION

This research report on the global flight data monitoring market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Software

- Services

By Solution

- On-Board

- Ground

By End-Use

- Fleet Operators

- Drone Operators

- Investigation Agencies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle east and Africa

Frequently Asked Questions

What are the primary drivers of growth in the global FDM market?

The primary drivers include increasing focus on aviation safety, regulatory mandates for FDM implementation, rising air traffic, advancements in data analytics and IoT technologies, and the need for cost-effective and efficient flight operations.

What are the key applications of FDM systems?

Key applications of FDM systems include flight safety analysis, operational efficiency monitoring, maintenance planning, fuel management, and regulatory compliance. These applications help airlines improve performance, reduce costs, and enhance safety.

What technological advancements are shaping the FDM market?

Technological advancements such as the integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics, the use of big data analytics, advancements in real-time data transmission, and the implementation of cloud-based FDM solutions are significantly shaping the market.

How is the FDM market expected to evolve in the next 5-10 years?

The FDM market is expected to grow significantly, driven by advancements in technology, increasing adoption of FDM by emerging economies, and the continuous push for enhanced aviation safety. The integration of AI and ML will further revolutionize the market, making FDM systems more predictive and proactive.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com