Global Foggers Market Size, Share, Trends, And Growth Forecasts Report – Segmented By Type (Thermal Foggers, And Cold Foggers) Application, (Applications, and Outdoor Application), And Region (North America, Latin America, Asia Pacific, Europe, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Foggers Market Size

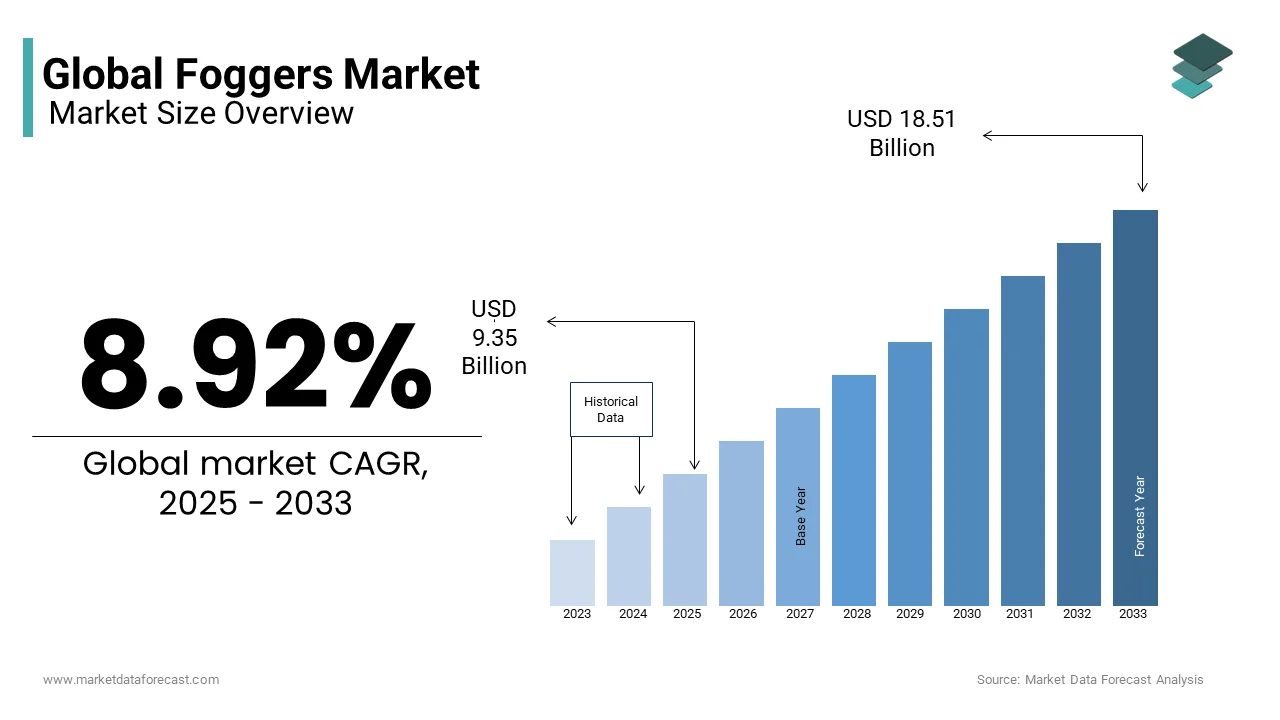

The global foggers market was valued at USD 8.58 billion in 2024 and is anticipated to reach USD 9.35 billion in 2025 from USD 18.51 billion by 2033, growing at a CAGR of 8.92% during the forecast period from 2025 to 2033.

Foggers are used to disperse fine particles of liquid or vapor into the air. These devices are predominantly employed for pest control, disinfection, odor elimination, and agricultural purposes. As per the Environmental Protection Agency, fogging technologies have gained prominence due to their efficacy in targeting airborne pathogens and pests, particularly in urban and rural settings. The global demand for foggers is on the rise and is driven by the increasing need for effective sanitation solutions, especially in the wake of public health crises such as the COVID-19 pandemic. According to the World Health Organization, the adoption of fogging systems has surged by over 25% since 2020, underscoring their critical role in maintaining hygiene standards across industries.

MARKET DRIVERS

Rising Demand for Pest Control Solutions

The escalating prevalence of vector-borne diseases has emerged as a pivotal driver propelling the growth of the foggers market. According to the Centers for Disease Control and Prevention, vector-borne illnesses such as malaria, dengue fever, and Zika virus have witnessed a resurgence, with cases increasing by approximately 30% globally over the past decade. This alarming trend has intensified the demand for efficient pest control mechanisms, with foggers being a preferred choice due to their ability to cover large areas and penetrate hard-to-reach spaces. Thermal foggers have gained traction in tropical regions where mosquito populations thrive. The Food and Agriculture Organization states that the agricultural sector alone accounts for nearly 60% of the global demand for fogging equipment, primarily to combat crop pests like locusts and aphids. This dual utility in both public health and agriculture underscores the significance of foggers as an indispensable tool. Furthermore, government initiatives aimed at eradicating disease vectors have bolstered market growth, with countries like India and Brazil allocating substantial budgets for pest management programs.

Increased Focus on Hygiene and Sanitation

The rising emphasis on hygiene and sanitation post-pandemic has significantly contributed to the expansion of the foggers market. According to the World Health Organization, the adoption of fogging systems for disinfection purposes increased by over 40% during the COVID-19 outbreak, as businesses and institutions sought reliable methods to sanitize large spaces. Cold foggers, known for their ability to produce ultra-fine mists, have become particularly popular in hospitals, schools, and commercial establishments. The Occupational Safety and Health Administration reports that industries such as food processing and pharmaceuticals have mandated the use of fogging systems to ensure compliance with stringent hygiene protocols. Additionally, the rise of smart cities and urbanization has amplified the need for advanced sanitation solutions, which is driving the integration of foggers in municipal waste management and public transport systems.

MARKET RESTRAINTS

Stringent Environmental Regulations

One of the primary restraints affecting the foggers market is the imposition of stringent environmental regulations governing the use of chemical-based solutions in fogging systems. According to the Environmental Protection Agency, certain pesticides and disinfectants used in foggers have been linked to adverse ecological impacts, including water contamination and harm to non-target species. This has led to the banning or restricted use of several active ingredients, thereby limiting the efficacy and versatility of fogging equipment. For instance, the European Chemicals Agency reports that over 20% of commonly used fogging chemicals have been phased out in the European Union due to their potential environmental hazards. Such regulatory constraints not only increase compliance costs for manufacturers but also reduce consumer confidence in the safety of fogging solutions. Furthermore, the shift towards eco-friendly alternatives has slowed market growth, as developing sustainable formulations requires significant research and development investments.

High Initial Costs and Maintenance Requirements

The high initial costs associated with acquiring and maintaining fogging equipment pose another significant restraint to market expansion. According to the United States Department of Agriculture, the average cost of a commercial-grade thermal fogger ranges between $500 and $2,000, while cold foggers can exceed $3,000 depending on specifications. These costs are prohibitive for small-scale users, particularly in developing regions where budget constraints are prevalent. Additionally, the maintenance of fogging systems requires specialized skills and regular servicing to ensure optimal performance, further adding to operational expenses. The International Trade Administration notes that nearly 35% of end-users cite maintenance challenges as a barrier to adopting fogging technologies. Moreover, the frequent replacement of parts and consumables, such as nozzles and filters, contributes to the overall cost burden. This financial strain limits the accessibility of foggers, particularly in rural and underdeveloped areas, thereby hindering market penetration and growth.

MARKET OPPORTUNITIES

Technological Advancements in Fogging Equipment

The integration of cutting-edge technologies into fogging systems presents a lucrative opportunity for market expansion. According to the National Institute of Standards and Technology, advancements such as automated controls, IoT-enabled foggers, and precision spraying mechanisms have revolutionized the functionality of these devices. Smart foggers equipped with sensors and connectivity features allow users to monitor and adjust operations remotely, enhancing efficiency and reducing resource wastage. The United States Patent and Trademark Office reports that over 150 patents related to innovative fogging technologies were filed in 2022 alone, indicating a surge in research and development activities. These technological upgrades cater to the growing demand for customizable and energy-efficient solutions, particularly in industries such as healthcare and agriculture. Furthermore, the adoption of solar-powered foggers has opened new avenues in off-grid applications, making them accessible in remote areas.

Expansion into Emerging Markets

The untapped potential of emerging markets offers a significant growth opportunity for the foggers market. According to the World Bank, regions such as Southeast Asia, Sub-Saharan Africa, and Latin America are witnessing rapid urbanization and industrialization, leading to increased demand for pest control and sanitation solutions. In India, for instance, the Ministry of Health and Family Welfare has launched nationwide campaigns to combat vector-borne diseases, resulting in a 20% annual increase in fogger sales. Similarly, the African Development Bank highlights that agricultural modernization initiatives in Sub-Saharan Africa have spurred the adoption of fogging systems to protect crops from pests. These regions also benefit from favorable government policies and subsidies aimed at promoting public health and agricultural productivity. Additionally, the rising disposable incomes and awareness of hygiene practices among consumers in these markets further bolster demand. The International Monetary Fund projects that emerging economies will account for over 45% of the global foggers market by 2030, underscoring their pivotal role in shaping future growth trajectories.

MARKET CHALLENGES

Limited Awareness and Training Among End-Users

A significant challenge impeding the widespread adoption of foggers is the limited awareness and inadequate training among end-users regarding their proper usage and maintenance. According to the Occupational Safety and Health Administration, improper handling of fogging equipment can lead to inefficiencies, safety hazards, and even environmental damage. For instance, incorrect calibration of foggers may result in excessive chemical dispersion, posing health risks to humans and animals. The United Nations Industrial Development Organization reports that nearly 60% of users in developing countries lack access to comprehensive training programs, which hampers the effective deployment of these systems. This knowledge gap is particularly pronounced in rural areas, where literacy levels and technical expertise are relatively low. Moreover, the absence of standardized guidelines for fogger operation exacerbates the issue, leading to inconsistent outcomes and reduced consumer trust. Addressing this challenge requires collaborative efforts between manufacturers, governments, and educational institutions to develop targeted training initiatives and raise awareness about best practices.

Supply Chain Disruptions and Raw Material Scarcity

Another pressing challenge facing the foggers market is the vulnerability of supply chains and the scarcity of raw materials essential for manufacturing fogging equipment. According to the International Trade Administration, disruptions caused by geopolitical tensions, natural disasters, and pandemics have led to delays in the procurement of critical components such as nozzles, motors, and chemical formulations. The United States Geological Survey highlights that the availability of key raw materials, including metals and polymers, has been constrained due to fluctuating prices and export restrictions in major producing countries. These factors have resulted in increased production costs and prolonged lead times, adversely impacting market dynamics. Furthermore, the reliance on imports for certain components exposes manufacturers to currency fluctuations and trade uncertainties. The World Trade Organization notes that over 25% of companies in the foggers industry reported supply chain-related challenges in 2022, underscoring the need for diversification and localization strategies to mitigate risks and ensure business continuity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.92% |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Conic Systems S.L., Irritec, pulsFOG Dr. Stahl & Sohn GmbH, INSECT COP, Nixalite, DRAMM, VectorFog, and IGEBA GmbH and Others. |

SEGMENT ANALYSIS

Global Foggers Market By Type

The thermal foggers segment dominated the market and held 60.3% of the global market share in 2024 due to their superior ability to generate dense, visible plumes of vapor, making them highly effective for pest control and agricultural applications. According to the Food and Agriculture Organization, thermal foggers are particularly favored in tropical regions, where they are extensively used to combat mosquito-borne diseases and crop pests. The visibility of the fog allows operators to monitor coverage, ensuring thorough application. Additionally, their compatibility with a wide range of chemical formulations enhances their versatility. The affordability of thermal foggers compared to cold foggers further contributes to their widespread adoption, particularly in developing countries. The International Trade Administration reports that the demand for thermal foggers is projected to grow steadily, driven by increasing investments in public health and agricultural initiatives.

The cold foggers segment is anticipated to grow at a healthy CAGR of 9.8% over the forecast period. The rapid expansion of cold foggers segment is attributed to their ability to produce ultra-fine mists, making them ideal for indoor disinfection and odor control applications. According to the World Health Organization, the adoption of cold foggers surged during the COVID-19 pandemic, as they were widely used in hospitals, schools, and commercial establishments for sanitization purposes. Unlike thermal foggers, cold foggers do not rely on heat, preserving the integrity of sensitive chemicals and reducing the risk of fire hazards. The Occupational Safety and Health Administration highlights that industries such as food processing and pharmaceuticals have increasingly adopted cold foggers to comply with stringent hygiene standards. The versatility and eco-friendly nature of cold foggers position them as a key driver of future market growth.

Global Foggers Market By Application

The outdoor segment captured 68.4% of the global market share in 2024. The growth of the outdoor segment is majorly attributed to the extensive use of foggers in agriculture, public health initiatives, and pest control programs. According to the Food and Agriculture Organization, outdoor fogging systems are indispensable for managing crop pests and vector-borne diseases, particularly in regions with high pest infestations. The visibility and wide coverage of thermal foggers make them particularly suited for outdoor use, ensuring effective treatment of large areas. Additionally, government-led initiatives to combat diseases such as malaria and dengue have further propelled the demand for outdoor fogging solutions. The International Trade Administration reports that the outdoor segment is expected to maintain its leadership position, supported by increasing investments in public health infrastructure and agricultural modernization.

The indoor segment is estimated to witness the fastest CAGR of 10.5% over the forecast period due to the rising emphasis on hygiene and sanitation in enclosed spaces, particularly in the wake of the COVID-19 pandemic. According to the World Health Organization, cold foggers have gained significant traction for indoor disinfection due to their ability to produce fine mists that penetrate hard-to-reach areas without causing damage to surfaces. Industries such as healthcare, hospitality, and education have increasingly adopted indoor fogging systems to maintain cleanliness and prevent the spread of infections. The Occupational Safety and Health Administration highlights that the demand for indoor foggers is further bolstered by their compatibility with eco-friendly disinfectants, aligning with sustainability goals. The versatility and precision of indoor foggers position them as a critical component of future market expansion.

REGIONAL ANALYSIS

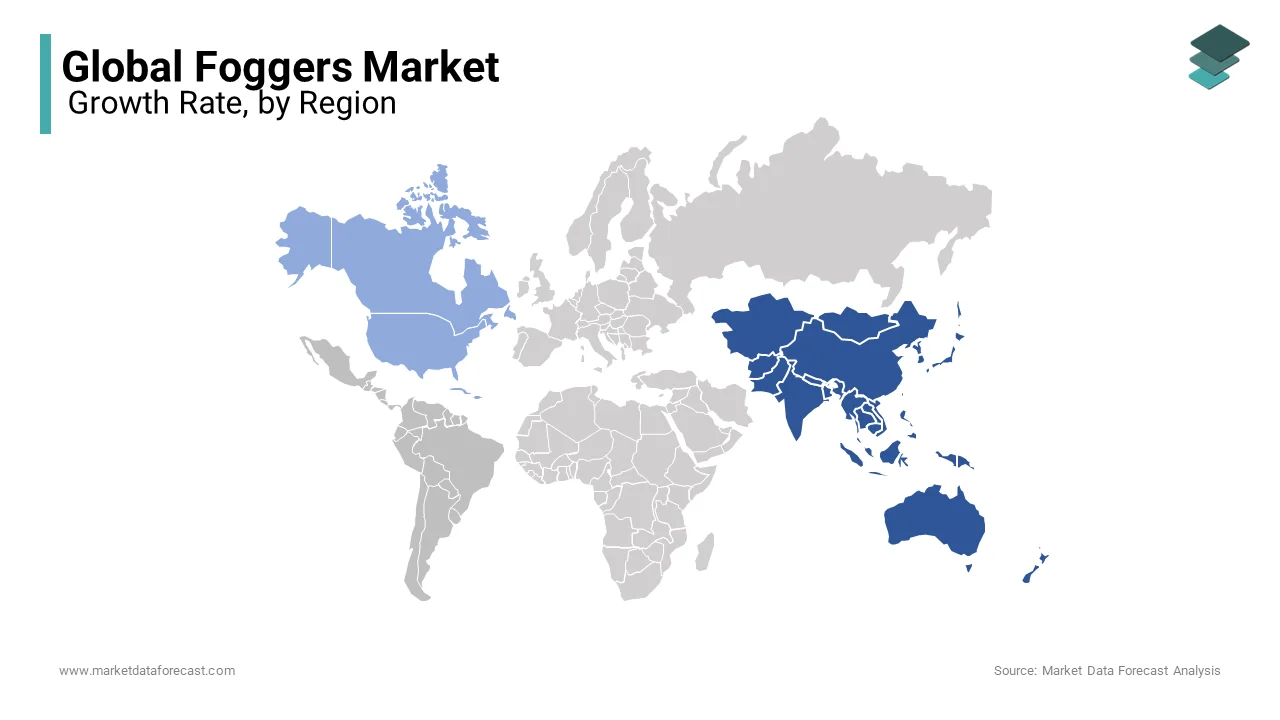

North America dominated the foggers market worldwide and occupied 30.8% of the global market share in 2024. The region's advanced healthcare infrastructure, stringent hygiene regulations, and high adoption of innovative technologies are majorly contributing to the domination of North America in the global market. According to the Centers for Disease Control and Prevention, the demand for foggers in North America has surged due to their widespread use in pest control and disinfection applications. The United States, in particular, accounts for the majority of the regional market, driven by government initiatives to combat vector-borne diseases and promote agricultural productivity. The presence of key market players and robust R&D activities further solidify North America's dominance in the foggers market.

Asia Pacific is the second-largest region in the foggers market. The rapid urbanization, increasing pest infestations, and rising awareness of hygiene practices are fuelling the foggers market expansion in the Asia-Pacific region. According to the World Health Organization, countries like India and China have witnessed a significant uptick in fogger adoption due to government-led health campaigns and agricultural modernization programs. The affordability and versatility of fogging systems make them particularly suitable for the region's diverse needs, ranging from pest control in rural areas to disinfection in urban centers.

Europe held a notable share of the global market in 2024 and is expected to grow at a healthy CAGR over the forecast period due to the stringent environmental regulations and a strong emphasis on sustainable pest control solutions. According to the European Environment Agency, the demand for eco-friendly foggers has increased, particularly in countries like Germany and France, where green initiatives are prioritized. The region's focus on innovation and quality ensures its continued relevance in the global foggers market.

Latin America is expected to register steady growth during the forecast period. The region's tropical climate and high prevalence of vector-borne diseases have propelled the adoption of fogging systems. According to the Pan American Health Organization, countries like Brazil and Mexico are investing heavily in public health programs, driving demand for pest control solutions. The agricultural sector also plays a significant role in boosting the regional market.

The Middle East and Africa is likely account for a moderate share of the global market over the forecast period. The market in this region is driven by increasing urbanization, agricultural expansion, and government-led health initiatives. According to the World Health Organization, countries like South Africa and Saudi Arabia are prioritizing the use of foggers to combat diseases and enhance agricultural productivity. Despite challenges such as limited awareness, the region's potential remains significant.

KEY MARKET PLAYERS

Some of the key players dominating this market include Conic Systems S.L., Irritec, pulsFOG Dr. Stahl & Sohn GmbH, INSECT COP, Nixalite, DRAMM, VectorFog, and IGEBA GmbH.

MARKET SEGMENTATION

This research report on the global foggers market is segmented and sub-segmented based on Type, Application, and Region.

By Type

- Thermal Foggers

- Cold Foggers

By Application

- Indoor Applications

- Outdoor Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global foggers market?

The current market size of the global foggers market was valued at USD 9.35 billion in 2025

In global foggers market which region is most dominated in this market?

The Asia Pacific holds the major share of the market due to the increasing use of foggers as an economical method of pest control and increasing expenditure on technological advancement in the agricultural industry.

Who are the market players that are dominating the global foggers market?

Some of the key players dominating this market include Conic Systems S.L., Irritec, pulsFOG Dr. Stahl & Sohn GmbH, INSECT COP, Nixalite, DRAMM, VectorFog, and IGEBA GmbH.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com