Global Food Authenticity Testing Market is Segmented by Technique (Meat speciation, Country of origin and aging, Adulteration tests, False labelling), By technology (PCR-based, LC-MS/MS, Isotope methods, Immunoassay-based, Others), By Food Tested (Meat & Meat Product, Dairy & Dairy Product, Cereal, Grain, and Pulse, Processed Food, Other) and by Regional Analysis (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast (2023 – 2028)

Food Authenticity Testing Market Size, Growth (2023-2028)

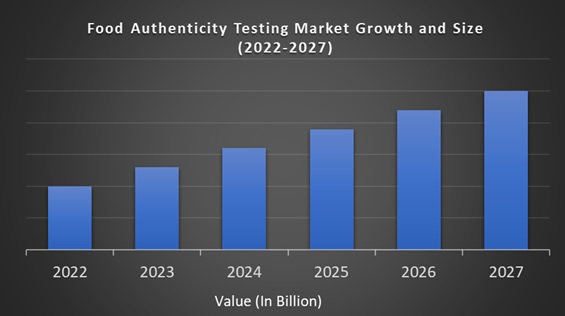

The Global Food Authenticity Testing Market size was US$ 7.50 Billion in 2022 and is anticipated to succeed in the valuation of US$ $ 9.1 Billion in 2028 and is predicted to register a CAGR of 7.6% during 2023-2028.

Food Authenticity Testing Market Scenario:

Food authenticity refers to testing food and beverages in the laboratory to verify their quality and ensure their authenticity. This includes performing verification, quality, purity, and use priority checks to ensure the validity of product label claims. Commonly used techniques include deoxyribonucleic acid (DNA) testing, chromatography, microscopy, polymerase chain reaction (PCR), immunoassays, and food allergen analysis. These tests help detect intentional substitution, addition, tampering, misrepresentation, or false misleading statements about a product for food, raw materials, or packaging. Food Authenticity Market Industry Runs Food certification tests which are commonly used for confectionery, packaged foods, meat and dairy products, grains, grains, legumes, juices, cooking oils, alcohol, and processed foods.

Recent Developments in Food Authenticity Testing Industry:

- SGS Announces the Official Opening of Its New Papua New Guinea Food Testing Laboratory - SGS provides a comprehensive range of food safety, quality, and sustainability services to assist businesses in increasing consumer confidence and making informed, risk-based decisions.

- The Ecotax department of EAS Group in Niefern recently assisted the tech start-up "apic ai" with their digital honey bee activity monitoring system.

REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 – 2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2028 |

|

CAGR |

7.6% |

|

Segments Covered |

By Technique, technology, Food Tested and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ALS Ltd, EMSL Analytical, Inc, Genetic ID NA Inc, Eurofins Scientific SE, Merieux NutriSciences Corporation, Intertek Group PLC, Microbac Laboratories Inc, SGS SA, Romer Labs and Others. |

Food Authenticity Testing Market Drivers:

Food Authenticity Testing Market Trend shows that Government agencies such as the Food and Drug Administration (FDA) are concerned about increasing cases of fraudulent activity and mislabelling in the food industry. The purpose of the authenticity test is to confirm the true condition of the food. According to the International Food Authenticity Assurance Organization (FAAO), food authenticity is arguable that the food or food ingredient is in the original, authentic, verifiable, intended form declared and labelled. It is a process to prove without. In recent years, more and more cases of food fraud have been reported around the world. The number of reports to the UK National Food Crime Unit increased from 796 to 1193, with 464 reports in the first three months of 2020. These are some of the important thing’s government agencies are doing to verify the authenticity of food. The authenticity test helps prove the authenticity of food and how it is stored. These are some of the factors driving the certification market.

Food Authenticity Testing Market Restraints:

The Restraining factors are lack of technical expertise in SMEs, increased mislabelling, limited funding and food processing resources. Growth opportunities in the market are the growing demand and popularity of clean-label foods, the increasing government initiative to monitor food authenticity, and technological advances in the pilot market. Several factors that challenge market growth are the lack of unified food safety quality standards and the challenges associated with brand equity.

Food Authenticity Testing Market Segmentation Analysis:

By Technique:

- Meat speciation

- Country of origin and aging

- Adulteration tests

- False labelling

Based on this technique, PCR-based techniques are increasingly being used in food authenticity testing. This is a molecular technique that uses DNA to analyse meat and foods and provide accurate test results. This technique amplifies DNA fragments extracted from food samples to accurately identify the various DNAs in a product. This allows you to verify the authenticity of the product and confirm the product's claims. LCMS / MS is the second largest technology segment on the market. This technique is also used to detect the authenticity of food. The test market with PCR-based technology is primarily defined by the wide applicability and accurate measurement of adulterants, meats, or GMOs in products, even at detection levels as low as 0.1%.

By Technology:

- PCR-based

- LC-MS/MS

- Isotope methods

- Immunoassay-based

- Others

Based on food tested, the processed foods segment is expected to be the largest segment, and the meat and meat products segment is expected to grow the fastest in the market. The growth of the processed food segment is due to a number of processing applications for products such as infant formula, packaged foods, wine and other processed foods. Demand for food certification services in this segment remains high due to the increasing number of processed food frauds and counterfeiters. Due to these factors, the processed food segment is expected to be the largest in the food safety testing market.

By Food Tested:

- Meat & Meat Product

- Dairy & Dairy Product

- Cereal, Grain, and Pulse

- Processed Food

- Other

By food tested, The food authenticity market is divided into meat and meat products, dairy and dairy products, grains, grains and legumes, processed foods, and others based on food tested. Processed foods are a major segment of the food authenticity market, but meat and meat products are gaining popularity and are expected to experience the highest growth.

Geographical Segmentation Analysis:

- North America - the United States and Canada

- Europe - United Kingdom, Spain, Germany, Italy, and France

- The Asia Pacific - India, Japan, China, Australia, Singapore, Malaysia, South Korea, New Zealand, and Southeast Asia

- Latin America - Brazil, Argentina, Mexico, and Rest of LATAM

- The Middle East and Africa - Africa and Middle East (Saudi Arabia, UAE, Lebanon, Jordan, Cyprus)

Food Authenticity Testing Market Regional Analysis:

Based on Regional Analysis, Geographically, Europe is a leader in the global market due to the presence of highly active food companies in the region and its readiness to comply with the strictest regulations of the market. In the United Kingdom, for example, the Food Standards Agency (FSA) is the regulatory agency for ensuring the highest food standards in the country. The FSA has set up a National Food Crime Unit and a Food Fraud Unit to monitor all types of food fraud, including counterfeiting or mislabeling of both imported food and local produce.

In recent years, there have been several food frauds in China and India. Indian fishing and dairy are very susceptible to such cases. 5000 kg of formalin preserved fish was found on an Indian truck. Farmers are issued electronic IDs for product traceability to prevent widespread food fraud. Therefore, these cases have led to an increase in food certification in these Asian countries.

Key Players in the Market:

Major Key Players in the Global Food Authenticity Testing Market are

- ALS Ltd

- EMSL Analytical, Inc

- Genetic ID NA Inc

- Eurofins Scientific SE

- Merieux NutriSciences Corporation

- Intertek Group PLC

- Microbac Laboratories Inc.

- SGS SA

- Romer Labs

Frequently Asked Questions

What is the growth outlook for the food authenticity Testing market?

The global food authenticity testing market is expected to record wide positive growth of 7.6.GR from 2023 to 2028. Growth is primarily driven by increased demand for clean labels and genuine food products in profitable markets.

Which is the largest market for food authenticity testing players?

The Asia-Pacific region will be the most profitable source of income due to its large population base. Most of the demand for food inspection can be stimulated by the world's most densely populated countries, China and India. This is due to the highest penetration of adult foods in these countries.

Which food category is likely to be widely adopted for food authenticity testing?

In the meat and meat products segment, meat consumption is increasing worldwide and food authenticity testing is expected to be fully utilized. In recent years, due to complaints about the availability of low-quality meat, countries have enforced strict guidelines for testing and selling meat quality around the world.

Who are the major players in the food authenticity testing market?

Currently, the global food authenticity testing market is full of market players from EMSL Analytical Inc., Genetic ID NA Inc., Eurofins Scientific SE, Merieux NutriSciences Corporation, Intertek Group PLC, Microbac Laboratories Inc., SGS SA and Romer. I am. Lab.

Which region has the largest share of the food authenticity testing market?

Europe holds the highest share in 2022.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]