Global Fresh Fish And Seafood Market Size, Share, Trends & Growth Forecast Report By Product (Oily Fish and Shrimps), Application, Distribution Channel and Region, Industry Analysis From 2025 to 2033

Global Fresh Fish And Seafood Market Size

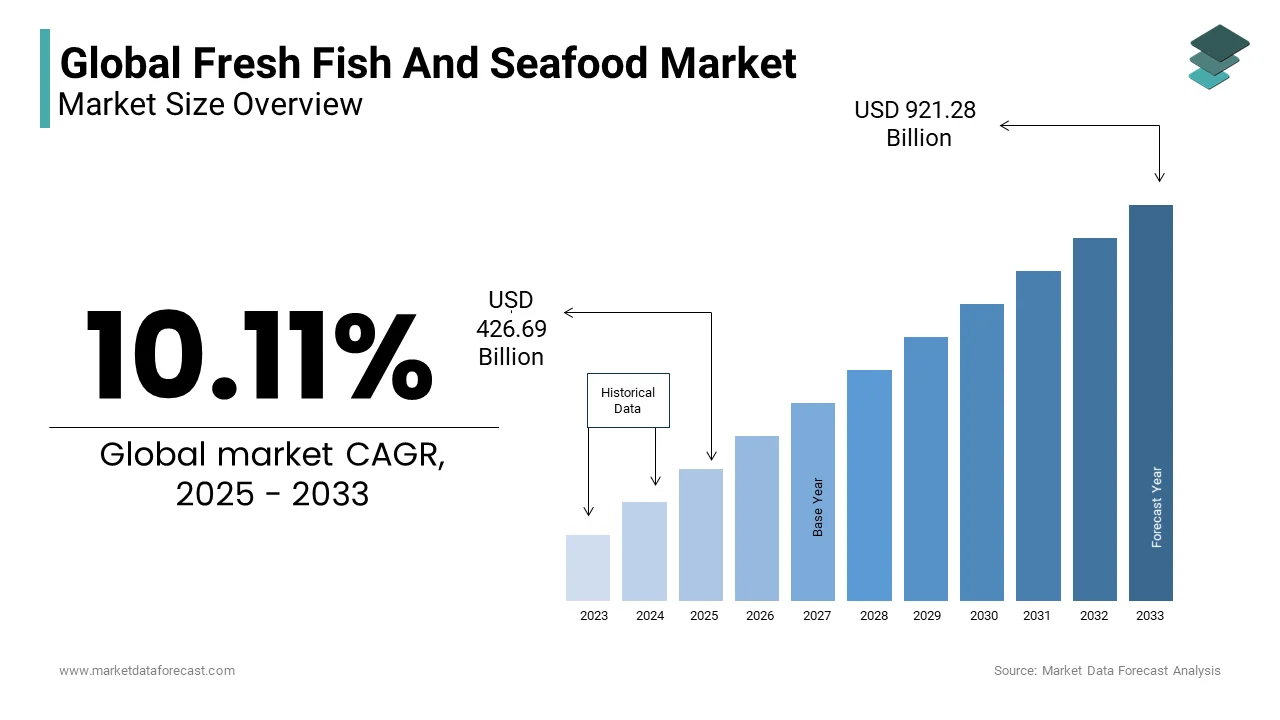

The Global Fresh Fish And Seafood Market Size was valued at USD 387.51 billion in 2024. The Fresh Fish And Seafood Market size is expected to have 10.11 % CAGR from 2025 to 2033 and be worth USD 921.28 billion by 2033 from USD 426.69 billion in 2025.

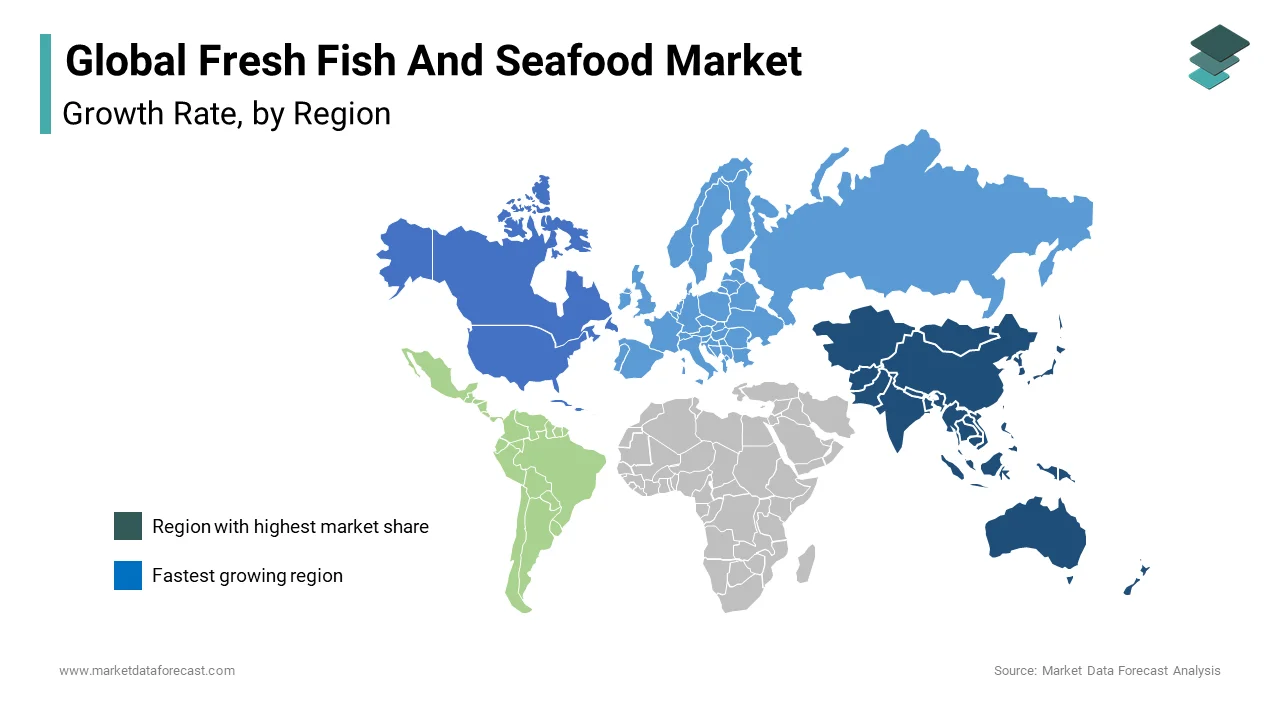

The fresh fish and seafood market exhibits a strong presence across Asia-Pacific, North America, and Europe, with Asia-Pacific leading the pack. According to the Food and Agriculture Organization (FAO), Asia-Pacific accounts for over 70% of global seafood production, driven by countries like China, India, and Indonesia, where aquaculture is a cornerstone of the economy. China alone produces approximately 58% of the world’s farmed fish, as per Statista, underscoring its dominance in the sector. North America follows closely, supported by robust demand for premium seafood products like salmon and shrimp. The U.S. Department of Commerce states that Americans consume an average of 16 pounds of seafood per capita annually, reflecting steady growth in consumption patterns. Meanwhile, Europe is witnessing increased imports of fresh fish due to stricter sustainability regulations on local fishing practices, as noted by the European Market Observatory for Fisheries and Aquaculture. Emerging markets in Latin America and Africa are also gaining traction, with rising investments in aquaculture infrastructure. For example, Chile has become a global leader in farmed salmon exports, generating over $5 billion annually.

MARKET DRIVERS

Rising Health Consciousness Among Consumers

One of the primary drivers of the fresh fish and seafood market is the growing awareness of health benefits associated with seafood consumption. Rich in omega-3 fatty acids, vitamins, and minerals, seafood is increasingly recognized as a vital component of a balanced diet. According to the World Health Organization (WHO), regular consumption of seafood reduces the risk of cardiovascular diseases by up to 30%, prompting governments and health organizations to promote its inclusion in daily meals. In developed regions like North America and Europe, this trend is further amplified by dietary guidelines. For instance, the U.S. Department of Agriculture (USDA) recommends at least two servings of seafood per week, driving retail sales upward. A NielsenIQ survey reveals that over 45% of consumers actively seek out seafood options labeled as “high in omega-3s,” creating opportunities for premium product lines. Additionally, restaurants and foodservice providers are incorporating more seafood-based dishes into their menus, catering to health-conscious diners. These factors collectively fuel demand for fresh fish and seafood globally.

Expansion of Aquaculture Practices

The rapid expansion of aquaculture that has revolutionized the availability and affordability of fresh fish and seafood is also contributing to the expansion of fresh fish and seafood market. According to the FAO, aquaculture now supplies over 50% of global fish consumption, surpassing wild-caught fisheries for the first time in history. Innovations in farming techniques, such as recirculating aquaculture systems (RAS), have improved yield and sustainability, making seafood more accessible to urban populations. Countries like Norway and Chile are leveraging advanced technologies to dominate global exports. For example, Norway’s salmon farming industry generated revenues exceeding $10 billion in 2022, as reported by the Norwegian Seafood Council. Similarly, Vietnam has emerged as a key player in pangasius production, exporting over 1.5 million metric tons annually. These advancements not only meet rising consumer demand but also address environmental concerns by reducing pressure on wild fish stocks, ensuring long-term market stability.

MARKET RESTRAINTS

Environmental Concerns and Sustainability Issues

The growing scrutiny over environmental concerns and unsustainable fishing practices is one of the major factors hampering the growth of the fresh fish and seafood market. Overfishing remains a critical issue, with the FAO estimating that 34% of global fish stocks are overexploited, threatening marine ecosystems. This depletion has led to stricter regulations, particularly in Europe, where the European Commission enforces quotas to prevent illegal fishing, limiting supply for commercial markets. Additionally, aquaculture faces criticism for its environmental impact, including water pollution and habitat destruction. As per a study published in Nature Sustainability, shrimp farming contributes to the loss of 10% of global mangrove forests, exacerbating climate change risks. Such challenges increase operational costs for producers, who must invest in sustainable practices to comply with international standards.

Supply Chain Disruptions and Spoilage Risks

Supply chain disruptions and spoilage risks are further hindering the expansion of the fresh fish and seafood market. Perishability is a critical issue, with improper handling and transportation leading to significant losses. According to the International Institute of Refrigeration, approximately 10-12% of global seafood production is lost annually due to inadequate cold chain infrastructure, particularly in developing regions. Geopolitical tensions and logistical bottlenecks further exacerbate the problem. For instance, the Russia-Ukraine conflict disrupted Black Sea trade routes, impacting exports of species like anchovies and mackerel, as reported by the Marine Stewardship Council. Additionally, rising fuel costs have increased shipping expenses, forcing suppliers to raise prices. These inefficiencies not only affect profitability but also limit accessibility for end consumers, creating obstacles to market expansion.

MARKET OPPORTUNITIES

Rise of E-Commerce Platforms

The integration of e-commerce platforms into the fresh fish and seafood market, enabling direct-to-consumer sales and expanding reach is one of the promising opportunities in the global market. According to eMarketer, online grocery sales grew by 35% in 2022, with seafood emerging as a popular category due to its convenience and freshness guarantees. Companies like Alibaba’s Freshippo and Amazon Fresh offer same-day delivery services, appealing to urban consumers seeking high-quality products. Advancements in packaging and cold chain logistics further enhance this opportunity. For example, innovations in vacuum-sealed packaging extend shelf life by up to 50%, reducing spoilage rates during transit. Additionally, partnerships with local fishermen ensure traceability and authenticity, addressing consumer concerns about sustainability. By capitalizing on digital transformation, stakeholders can tap into new demographics and drive revenue growth.

Growing Demand for Plant-Based Seafood Alternatives

The development of plant-based seafood alternatives that cater to the rising vegan and flexitarian population is another major opportunity in the global market. The demand for plant-based seafood is rapidly growing due to the increasing demand for sustainable and ethical food choices. Brands like Good Catch and New Wave Foods have introduced plant-based tuna and shrimp, gaining traction among eco-conscious consumers. These alternatives address environmental concerns while meeting dietary preferences. For instance, a study by the University of California found that plant-based seafood reduces carbon emissions by 70% compared to traditional fishing. Furthermore, collaborations with retailers and foodservice providers expand distribution channels, ensuring broader accessibility.

MARKET CHALLENGES

Price Volatility and Economic Uncertainty

Price volatility is a significant challenge for the fresh fish and seafood market, driven by fluctuating supply and demand dynamics. According to the FAO, global seafood prices experienced a 15% increase in 2022 due to inflationary pressures and geopolitical conflicts, impacting affordability for both consumers and businesses. For instance, the war in Ukraine disrupted grain exports, raising feed costs for aquaculture producers and forcing price hikes. Economic uncertainty further compounds this issue, particularly in developing regions where disposable incomes are limited. A report by the World Bank highlights that rising living expenses have reduced seafood consumption by 10% in low-income households, stifling market growth. Producers must navigate these challenges by optimizing costs and diversifying revenue streams to maintain competitiveness in an unpredictable economic environment.

Regulatory Compliance and Trade Barriers

Regulatory compliance and trade barriers are further challenging the growth of the fresh fish and seafood market, particularly in international trade. Stringent import-export regulations, such as those enforced by the European Union and the United States, require rigorous documentation and testing to ensure safety and sustainability. According to the International Trade Centre, non-compliance can result in shipment rejections, costing exporters millions annually. Trade disputes further complicate matters. For example, tariffs imposed during the U.S.-China trade war led to a 20% decline in seafood exports from China to the U.S., disrupting supply chains. Additionally, certifications like the Marine Stewardship Council (MSC) label, while enhancing credibility, involve lengthy and costly processes. These hurdles limit market access for small-scale producers, necessitating strategic investments in compliance and quality assurance to overcome barriers effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.11 % |

|

Segments Covered |

By Product,Application,Distribution Channel and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Mowi, Thai Union Group PCL, Cermaq Group AS, Huon Aqua, Stolt Sea Farm |

SEGMENTAL ANALYSIS

By Product Insights

The oily fish segment led the market by accounting for the 36.7% of the global market share in 2024. This segment includes popular species like salmon, mackerel, and sardines, which are rich in omega-3 fatty acids and other essential nutrients. The global demand for oily fish is driven by increasing health consciousness among consumers. According to a report by the World Health Organization (WHO), regular consumption of oily fish reduces the risk of cardiovascular diseases by up to 30%, making it a dietary staple for millions. Key factors propelling this dominance include rising awareness about the nutritional benefits of omega-3s, particularly in developed regions like North America and Europe. For instance, the U.S. Department of Agriculture (USDA) recommends at least two servings of oily fish per week, further boosting consumption. Additionally, innovations in aquaculture have improved the availability and affordability of species like farmed salmon, with global production exceeding 3 million metric tons annually. These trends ensure that oily fish remains the most sought-after category in the market.

The shrimps segment is predicted to witness a CAGR of 6.88% over the forecast period in the global market owing to their versatility in culinary applications and increasing popularity in both casual dining and gourmet cuisines. According to studies, the shrimp consumption accounts for nearly 20% of global seafood intake, with Asia-Pacific being the largest consumer. The advancements in cold chain logistics that ensure freshness during transportation is primarily driving the growth of the shrimps segment in the global market. For example, companies like Maersk have invested in temperature-controlled shipping containers, reducing spoilage rates by 15% annually. Moreover, the rise of value-added shrimp products, such as ready-to-cook meals, caters to urban lifestyles. Additionally, sustainable farming practices, like those adopted by Charoen Pokphand Foods, enhance supply chain resilience while meeting eco-conscious consumer demands.

By Application Insights

The commercial segment captured the major share of 66.3% of the global market share in 2024. The leading position of commercial segment in the global market is attributed to the widespread use of seafood in restaurants, hotels, and catering services, particularly in coastal regions. According to the National Restaurant Association, seafood accounts for 15% of menu items in fine-dining establishments, reflecting its popularity among chefs and diners alike. The growing trend of seafood-based diets in urban areas is further boosting the expansion of the commercial segment in the global market. For instance, cities like New York and Tokyo have seen a surge in sushi bars and seafood-centric eateries, contributing to a 12% annual increase in commercial seafood sales. Additionally, partnerships between suppliers and foodservice providers streamline procurement, ensuring consistent quality and availability.

The residential segment is anticipated to register a CAGR of 7.7% over the forecast period in the global market. The growing home cooking trends and the availability of premium seafood options in retail outlets are driving the residential segment in the global market. As per a survey by NielsenIQ, more than 40% of households now prefer purchasing fresh seafood for home preparation, a shift accelerated by the pandemic. The proliferation of online grocery platforms offering doorstep delivery of fresh seafood is also boosting the expansion of the residential segment in the global market. For example, services like FreshDirect and Amazon Fresh enable consumers to access high-quality products without visiting physical stores. Furthermore, educational campaigns by organizations like the Global Aquaculture Alliance promote sustainable seafood choices, encouraging residential buyers to explore diverse options. These trends position residential applications as a rapidly expanding segment within the market.

By Distribution Channel Insights

The offline segment led the fresh fish and seafood market by holding 67.7% of the global market share in 2024. Traditional markets, supermarkets, and specialty seafood shops remain the primary sources for purchasing fresh products. In 2022 alone, offline sales exceeded $120 billion globally, underscoring their enduring relevance. The consumer trust in physical inspections and tactile experiences when selecting seafood is also boosting the expansion of the offline segment in the global market. Retail giants like Walmart and Tesco capitalize on this by offering wide assortments, including locally sourced and imported varieties. Additionally, promotional activities, such as discounts and loyalty programs, incentivize repeat purchases. Collaborations with local fishermen also enhance freshness and authenticity, reinforcing offline channels’ stronghold in the market.

The online segment is growing rapidly and is anticipated to exhibit a CAGR of 11.4% over the forecast period. The rise of e-commerce platforms and mobile apps has transformed how consumers access fresh fish and seafood. For instance, online seafood sales grew by 35% in 2022, driven by convenience and competitive pricing. The advancements in cold chain logistics and packaging technologies that ensure product freshness during transit is propelling the growth of the online segment in the global market. Companies like Alibaba’s Freshippo offer same-day delivery services, reaching urban consumers efficiently. Furthermore, virtual consultations via apps provide recipe suggestions and cooking tips, enhancing user engagement. Investments in secure payment gateways and customer reviews further boost confidence, positioning online channels as the future of seafood retailing.

REGIONAL ANALYSIS

Asia-Pacific led the fresh fish and seafood market by occupying 49.7% of the global market share in 2024. China leads production, accounting for 58% of global aquaculture output, while India and Indonesia are emerging as key players. As per a study by Statista, Asia-Pacific consumers prioritize affordability and freshness, driving demand for locally sourced products. Technological advancements in aquaculture, such as integrated multi-trophic systems, boost yield and sustainability. For instance, Vietnam’s pangasius farming industry supplies over 1.5 million metric tons annually, catering to domestic and international markets. These innovations ensure the region’s continued dominance in seafood production and trade.

North America accounted for a substantial share of the global fresh fish and seafood market in 2024. The United States leads consumption trends, with Americans consuming an average of 16 pounds of seafood per capita annually. This demand is driven by health-conscious lifestyles and dietary guidelines promoting seafood intake. The advancements in aquaculture and cold chain logistics in North America is also propelling the regional market expansion. For instance, Alaska’s wild-caught salmon industry generates over $600 million annually, supported by sustainable fishing practices certified by the Marine Stewardship Council. Additionally, partnerships between retailers like Whole Foods and local fishermen ensure traceability, enhancing consumer trust.

Europe accounts for a notable share of the global market, with countries like Norway, Spain, and the UK leading production and consumption. According to the European Market Observatory for Fisheries and Aquaculture, seafood consumption in Europe exceeds 25 kilograms per capita annually, driven by cultural preferences and sustainability awareness. A major driver is the EU’s stringent regulatory framework, which promotes eco-friendly practices. Norway, for example, dominates global farmed salmon exports, generating revenues exceeding $10 billion annually. Innovations in recirculating aquaculture systems (RAS) further enhance supply chain efficiency. These dynamics position Europe as a hub for both traditional and innovative seafood solutions.

Latin America is anticipated to witness a healthy CAGR in the global market over the forecast period, with Chile and Peru as primary contributors. According to the FAO, Chile ranks second globally in farmed salmon production, generating revenues exceeding $5 billion annually. Peru’s anchovy fisheries also play a crucial role, supplying raw materials for fishmeal and oil industries. The growing investments in sustainable farming practices and export-oriented strategies are contributing to the growth of the Latin American market. For example, Chile’s adoption of advanced RAS technologies reduces environmental impact while improving product quality. Additionally, free trade agreements with the U.S. and Europe expand market access, fostering regional growth in the seafood sector.

The fresh fish and seafood market in Middle East and Africa is predicted to account for a notable share of the global market over the forecast period, with Egypt and Morocco emerging as key players. According to the African Development Bank, aquaculture in Africa is projected to grow at a CAGR of 8% through 2030, driven by rising urbanization and dietary shifts. Egypt leads tilapia production, contributing over 1 million metric tons annually, supported by government subsidies and technological upgrades. Meanwhile, Morocco’s sardine exports generate significant foreign exchange earnings, with annual revenues exceeding $1 billion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global fresh fish and seafood market are Mowi, Thai Union Group PCL, Cermaq Group AS, Huon Aqua, Stolt Sea Farm, Stehr Group, Leigh Fisheries, True World Foods, Grieg Seafood ASA, and Priory Fishery Ltd.

The fresh fish and seafood market is highly competitive, characterized by the presence of established giants and emerging players vying for market share. Key participants leverage their expertise in aquaculture, distribution networks, and sustainability certifications to differentiate themselves. Consolidation through mergers and acquisitions is common, enabling companies to expand geographically and diversify product portfolios. For instance, Thai Union Group’s acquisition of smaller firms has strengthened its position in niche segments like plant-based seafood.

Meanwhile, startups disrupt traditional dynamics by introducing innovative solutions such as lab-grown seafood and AI-driven supply chain management. Regional players also pose a threat, capitalizing on localized expertise to challenge global leaders. This competitive landscape drives continuous innovation, benefiting end-users through improved product quality, affordability, and sustainability.

Top Players in the market

Marine Harvest (Mowi ASA)

Marine Harvest, now rebranded as Mowi ASA, is a global leader in farmed salmon production, supplying premium-quality seafood to over 70 countries. Its vertically integrated operations span breeding, farming, and processing, ensuring consistent quality and traceability. Mowi’s focus on sustainability earned it certifications from organizations like the Aquaculture Stewardship Council (ASC), reinforcing its reputation as a trusted supplier. Investments in cutting-edge technologies, such as recirculating aquaculture systems (RAS), position Mowi at the forefront of eco-friendly seafood production.

Thai Union Group

Thai Union Group excels in canned and frozen seafood products, with flagship brands like Chicken of the Sea and John West dominating retail shelves. The company processes over 4 million metric tons annually, leveraging Thailand’s strategic location for global exports. Thai Union prioritizes innovation, introducing plant-based seafood alternatives to cater to evolving consumer preferences. Collaborations with NGOs like the Global Ghost Gear Initiative demonstrate its commitment to reducing environmental impact, strengthening its competitive edge.

Nissui

Nissui is a Japanese conglomerate renowned for its diverse seafood portfolio, including tuna, salmon, and surimi-based products. The company operates one of the largest fishing fleets globally, ensuring steady supply chain resilience. Nissui’s investment in biotechnology has led to breakthroughs in fishmeal alternatives, addressing sustainability concerns. With a strong presence in Asia-Pacific and Europe, Nissui continues to innovate while meeting growing consumer demand for high-quality seafood.

Top strategies used by the key market participants

Sustainability Certifications

Leading players prioritize sustainability certifications to build consumer trust and comply with international standards. For example, Marine Stewardship Council (MSC) labels assure buyers of eco-friendly practices, boosting brand loyalty. Companies like Mowi ASA have invested heavily in sustainable aquaculture, reducing carbon footprints by 30% annually. These certifications not only enhance market access but also align with global environmental goals, ensuring long-term competitiveness.

Diversification of Product Portfolio

To cater to diverse consumer preferences, companies diversify their offerings through value-added products and plant-based alternatives. Thai Union Group, for instance, launched plant-based shrimp under its Good Catch brand, targeting vegan demographics. Similarly, Nissui introduced ready-to-cook meal kits, appealing to urban lifestyles. These innovations expand revenue streams while addressing shifting dietary trends, positioning players as versatile leaders in the market.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions strengthen market presence and operational efficiency. In April 2024, Nissui acquired a Norwegian salmon farming company, expanding its footprint in Europe. Such moves enhance supply chain resilience and foster knowledge sharing. Additionally, collaborations with local fishermen ensure traceability and authenticity, meeting consumer demands for transparency. These strategies enable companies to scale operations while maintaining competitive advantages.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Mowi ASA acquired a Norwegian salmon farming company, expanding its production capacity and solidifying its leadership in the European market. This move enhances supply chain resilience and boosts profitability.

- In June 2024, Thai Union Group launched a new line of plant-based seafood products under its Good Catch brand, targeting the growing vegan demographic. This initiative diversifies its portfolio and addresses evolving consumer preferences.

- In August 2024, Nissui partnered with a Japanese biotech firm to develop fishmeal alternatives using microbial fermentation, reducing reliance on wild-caught fish. This innovation aligns with sustainability goals and strengthens its competitive edge.

- In October 2024, Marine Harvest announced a $50 million investment in recirculating aquaculture systems (RAS), improving environmental performance and operational efficiency. This reinforces its commitment to eco-friendly practices.

- In December 2024, Thai Union Group signed a distribution agreement with Amazon Fresh, enabling direct-to-consumer sales of its frozen seafood products. This partnership expands accessibility and taps into the booming e-commerce segment.

MARKET SEGMENTATION

This research report on the global fresh fish and seafood market has been segmented and sub-segmented based on the type, application, and region.

By Product

- Oily Fish

- Shrimps

By Application

- Commercial

- residential

By Distribution Channel

- offline

- Online

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa.

Frequently Asked Questions

What types of seafood does Fresh Fish and Seafood Market offer?

Fresh Fish and Seafood Market offers a wide variety of fresh seafood, including locally caught fish, shrimp, crab, oysters, clams, lobster, and seasonal specialties.

How often does Fresh Fish and Seafood Market get new seafood deliveries?

Fresh Fish and Seafood Market receives fresh deliveries daily to ensure that customers get the highest quality seafood every time they visit.

Does Fresh Fish and Seafood Market offer cleaning and filleting services?

Absolutely! Fresh Fish and Seafood Market provides cleaning, filleting, and portioning services at no extra cost to make meal prep easier for you.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com