Global Gas to Liquids (GTL) Market Size, Share, Trends, & Growth Forecast Report – Segmented By Product (GTL Diesel and GTL Naphtha), By Application (Fuel Oil, Lubricating Oil, Process Oil and Others), & Region - Industry Forecast From 2024 to 2032

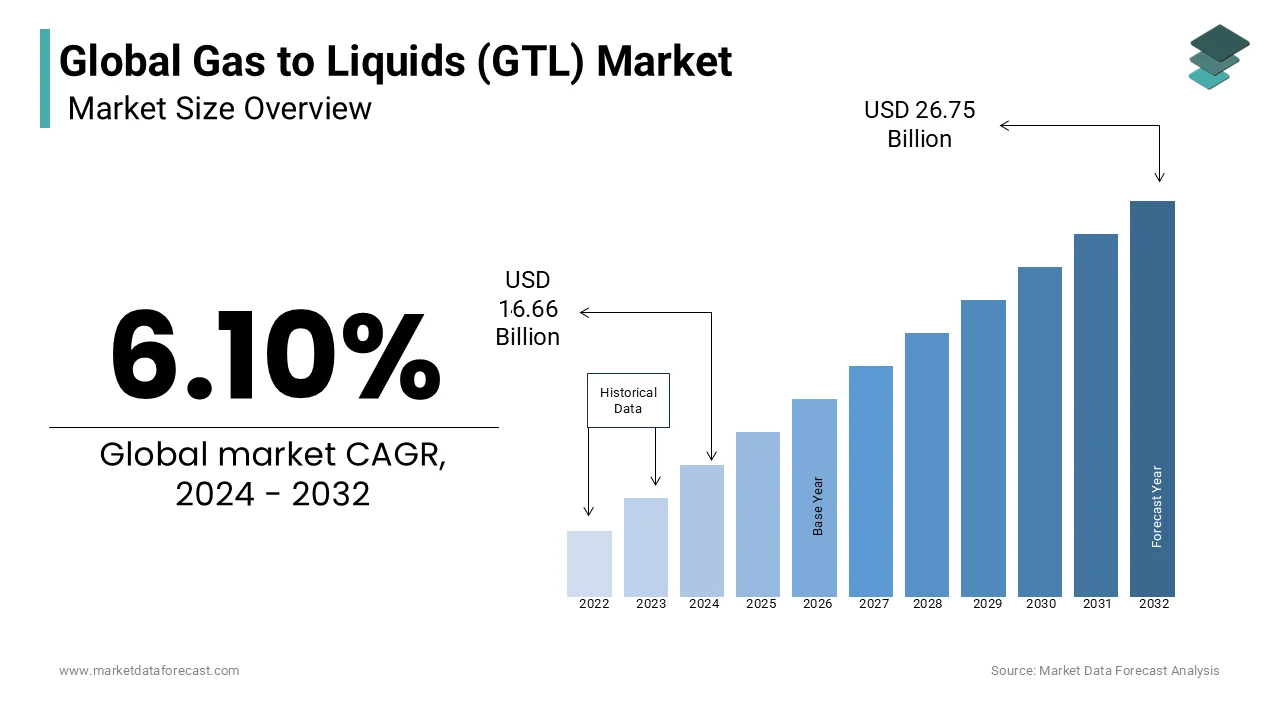

Global Gas to Liquids (GTL) Market Size (2024-2032):

The size of the global gas to liquids (GTL) market was worth US$ 15.70 Billion in 2023. The global market is anticipated to grow at a CAGR of 6.10% from 2024 to 2032 and be worth US$ 26.75 billion by 2032 from US$ 16.66 billion in 2024.

MARKET SCENARIO

Gas-to-Liquids (GTL) consists of converting natural gas into high-quality liquid fuels, which are traditionally obtained from crude oil. Today, the ever-increasing demand for energy and the growing world population has necessitated the development of alternative energy sources to alleviate the burden of conventional sources. With the increasing environmental considerations of conventional energy sources, clean energy sources are needed to reduce the carbon footprint. The conversion of natural gas to liquid fuels is a refinery process in which gaseous hydrocarbons are converted into longer-chain hydrocarbons such as diesel fuel or gasoline. Methane-rich hydrocarbons are converted to synthetic fuels through the Fischer-Tropsch process, the syngas-to-gasoline process, and the methanol-to-gasoline process. Liquid diesel fuel is of superior quality to conventional refinery diesel produced from crude oil. The premium low-emission fuel can be used alone or mixed with conventional diesel.

MARKET DRIVERS

Around the world, the ever-increasing demand for energy, government policies supporting clean fuel production, and initiatives to convert natural gas waste into liquid fuels are the main factors driving the global gas-to-liquids market.

In recent years, several large companies have started the development of synthetic fuels using gas-liquid technology. According to the World Bank, nearly 150 billion cubic meters of freely available natural gas can be transformed into useful liquid fuels using gas-to-liquid technologies. From an environmental point of view, the GTL method produces much more environmentally friendly products. Diesel products produced with gas-liquid technology contain almost no sulfur and have a lower density, few aromatics, and a high cetane number. Growing concern over fossil fuel depletion, coupled with the need for alternative energy sources, is expected to drive growth in the gas-to-liquid market. The growing demand for FT routes to monetize natural gas reserves that are stranded and unavailable for use will also help the market grow. Additionally, methane-rich gases that are converted into clean synthetic fuels are expected to drive the growth of GTL technology. In addition, the other factors that may support the growth of the gas-to-liquid market include the increasing demand for clean energy sources, the increasing need for liquid fuels due to convenient storage and transportation conditions, strict government regulations to control the footprint of carbon to promote cleaner fuel sources, increased transport activities, urbanization, and rapid population growth. Additional factors that are driving market growth include higher industrial growth and increased use of fuel oil, especially in boilers, as well as other equipment to produce heat and power.

MARKET RESTRAINTS

The high cost involved in developing gas-to-liquid conversion plants, combined with the size limitations of slurry and stationary reactors, is the main limitation in this market.

MARKET OPPORTUNITIES

With the increasing consumption of natural gas, especially in countries such as India, Japan, and China, the introduction of small-sized microchannel reactors instead of conventional reactors may open opportunities for the gas-to-liquids market. The increasing consumption of natural gas, especially in China, Japan, and India, and the availability of microchannel reactors may open up opportunities for the GTL market.

MARKET CHALLENGES

The high capital investment costs associated with the refining process may discourage the growth of the GTL market during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 – 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2032 |

|

CAGR |

6.10% |

|

Segments Covered |

By Product, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Royal Dutch Shell (Netherlands), Chevron Corporation (US), Sasol Limited (South Africa), Petro SA (South Africa), Velocys PLC (US), ORYX GTL (Qatar), OLTIN YO’L GTL (Uzbekistan), Linc Energy (Australia), Compact GTL (UK), Primus Green Energy (US), Gas Techno (US), and NRG Energy (US), and Others. |

SEGMENTAL ANALYSIS

Global Gas to Liquids (GTL) Market Analysis By Product

Among these, GTL diesel will have the highest market share during the forecast period. GTL diesel is of higher quality compared to conventional refinery diesel obtained from crude oil.

Global Gas to Liquids (GTL) Market Analysis By Application

Among these, fuel oil will dominate the market during the forecast period. Fuel oil is an advanced heavy fuel oil used in boilers and other equipment to generate heat and power in manufacturing operations and processes. Its particularity is that it helps improve the performance and reliability of the entire boiler system from the storage tank to the chimney.

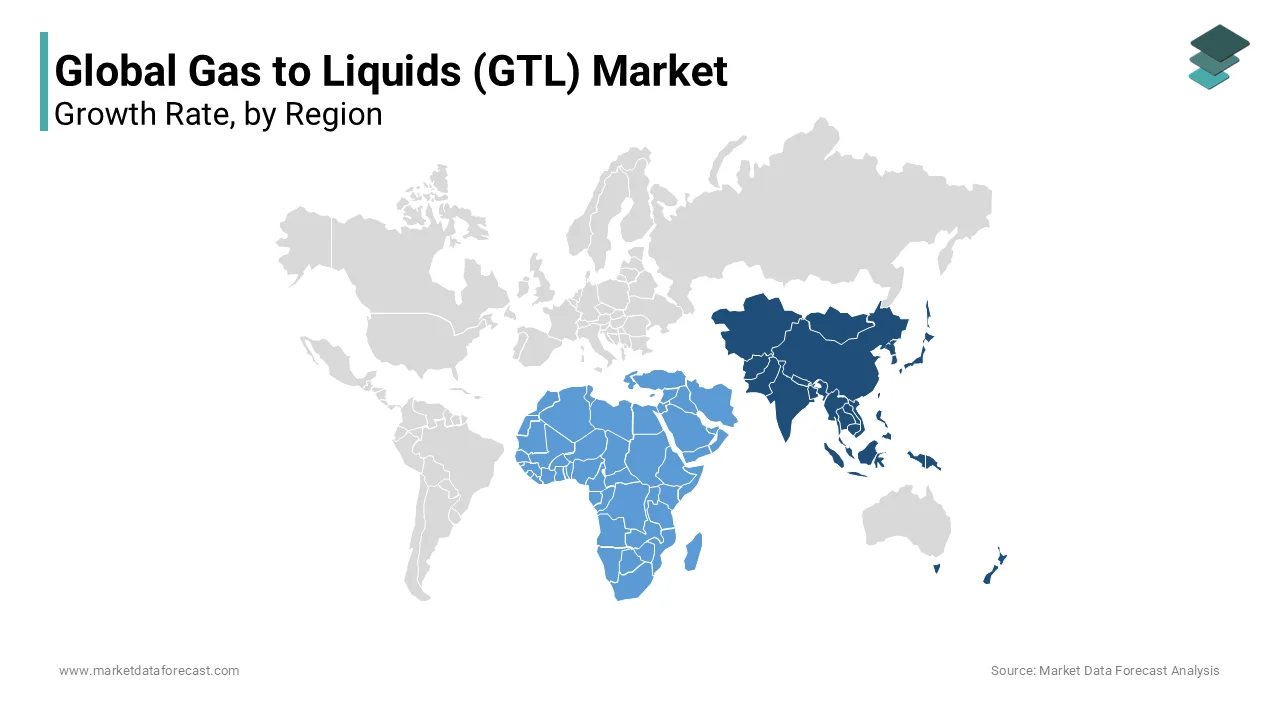

REGIONAL ANALYSIS

Increased factory construction due to higher energy consumption in Malaysia, Singapore, Japan, China, and India is expected to drive demand in the APAC region. Therefore, the regional market is likely to emerge as the fastest-growing segment during the forecast period. Qatar will remain in the driver's seat during the forecast period. There are currently two GTL factories in Qatar. One is based in the industrial city of Ras Laffan and is a joint venture of Sasol of South Africa and Qatar Petroleum. The second plant is again located in the same city and is operated by Shell and Qatar Petroleum.

The gas-to-liquid market in South Africa will have the second-largest share during the forecast period. The GTL plant is based in Mossel Bay, South Africa, and is operated by PetroSA. This plant has the capacity to produce 45,000 barrels of liquids per day, which includes special products, kerosene, gasoline, and diesel. The Asia-Pacific region market is expected to represent the largest share in terms of revenue and is expected to maintain its dominance over the forecast period. This dominance is attributed to increased gas installations in liquid factories due to increased energy consumption, and initiatives taken by the government in developing countries like Indonesia, Malaysia, Singapore, Japan, China, and India. The Middle East and Africa represent a significant share of world market revenue and are expected to experience considerable growth in the next period. Most of GTL's factories are located in Qatar, Nigeria, South Africa, and Mozambique.

KEY PLAYERS IN THE GLOBAL GAS TO LIQUIDS (GTL) MARKET

Companies playing a prominent role in the global gas to liquids (GTL) market include Royal Dutch Shell (Netherlands), Chevron Corporation (US), Sasol Limited (South Africa), Petro SA (South Africa), Velocys PLC (US), ORYX GTL (Qatar), OLTIN YO’L GTL (Uzbekistan), Linc Energy (Australia), Compact GTL (UK), Primus Green Energy (US), Gas Techno (US), and NRG Energy (US), and Others.

DETAILED SEGMENTATION OF THE GLOBAL GAS TO LIQUIDS (GTL) MARKET

This research report on the global gas to liquids (GTL) market has been segmented and sub-segmented based on product, application, and region.

By Product

- GTL Diesel

- GTL Naphtha

By Application

- Fuel Oil

- Lubricating Oil

- Process Oil

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Gas to Liquids Market growth rate during the projection period?

The Global Gas to Liquids Market is expected to grow with a CAGR of 6.10% between 2024-2032.

2. What can be the total Gas to Liquids Market value?

The Global Gas to Liquids Market size is expected to reach a revised size of US$ 26.75 billion by 2032.

3. Name any three Gas to Liquids Market key players?

OLTIN YO’L GTL (Uzbekistan), Linc Energy (Australia), and Compact GTL (UK) are the three Gas to Liquids Market key players.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com