Global HIV Diagnostics Market Size, Share, Trends & Growth Analysis Report – Segmented By Product (Consumables, Assays Kits & Reagents, Others Instruments, Software Services), Type, End User & Region - Industry Analysis From 2025 to 2033

HIV Diagnostics Market Size

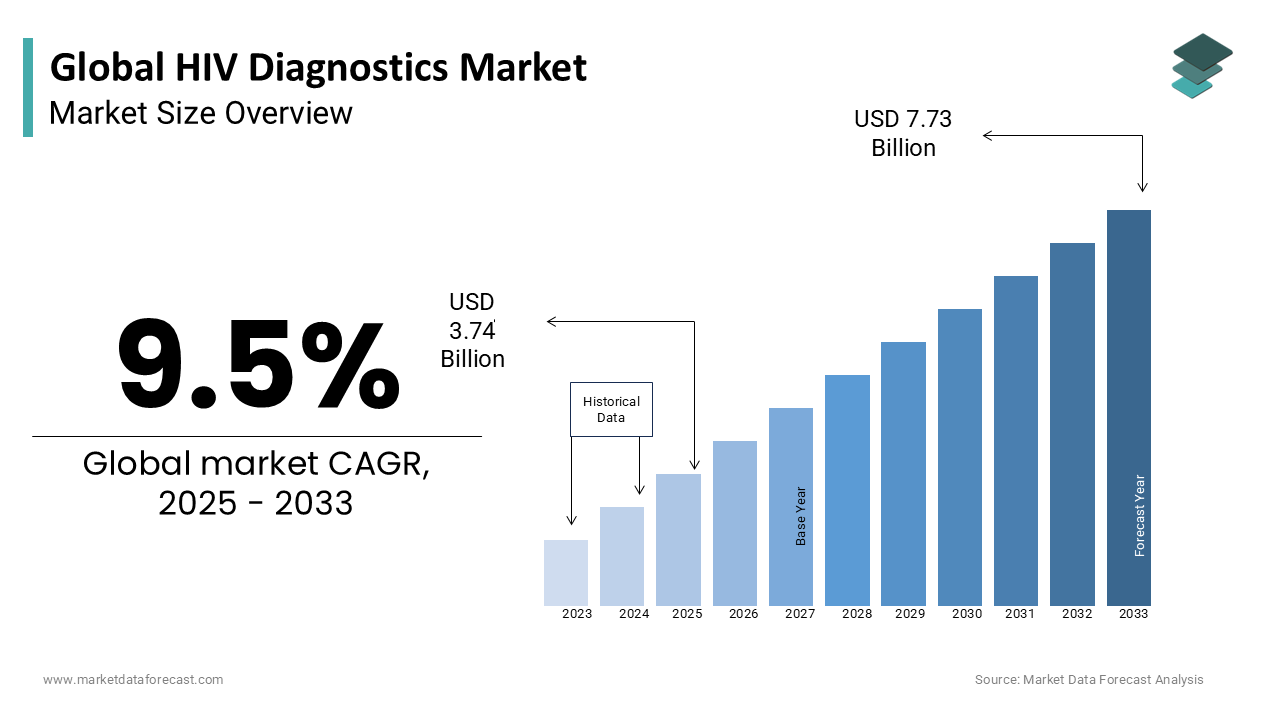

The global HIV diagnostics market size was valued at USD 3.42 billion in 2024. The HIV diagnostics market was valued at USD 3.74 billion in 2025. It's further predicted to be growing at a CAGR of 9.5% and a value of USD 7.73 billion by 2033.

The human immunodeficiency virus (HIV) is a retrovirus that causes AIDS. HIV affects immune cells and further weakens the immune system bringing a loss of capacity to fight against the organisms that cause diseases.

MARKET DRIVERS

Y-O-Y growth in the population diagnosed with HIV and the rise in demand for technologically advanced devices for diagnosing HIV with high accuracy are majorly promoting the global HIV diagnostics market growth.

Other significant factors such as the growing adoption rate of home kits for diagnosis and testing of HIV, growing investments from private and government organizations for developing effective diagnostic techniques for treating HIV patients, and the emergence of simple, rapid assays with visual testing better handling are further accelerating the growth rate of the global HIV diagnostics market.

According to the WHO, people diagnosed with HIV number in the millions, out of which a few million die yearly.

AIDS is the advanced stage of HIV that affects the immune system. People whose CD4 cells are lower than 200/mm are diagnosed as AIDS patients. This HIV test uses blood, serum, or urine samples, where blood samples give accurate diagnosis results. However, governments worldwide have conducted campaigns and educational seminars in colleges, corporate places, and other public places to raise awareness among people. Recently Kenya Medical Research Institute introduced its new Cobas Plasma Separation Card to collect and test samples quickly.

MARKET RESTRAINTS

The inappropriate functioning of regulatory bodies with stringent rules is one of the significant restraints to market growth. Additionally, High costs associated with nucleic acid testing (NAT) and advanced diagnostics of HIV and the lack of a proper regulatory framework for NAT in developing countries are further expected to hamper the growth rate of the global HIV diagnostics market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Test Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Abbott Healthcare, Alere Inc, Bristol-Myers Squibb, AbbVie Inc, Gilead Sciences, Janssen Therapeutics, Merck & Co., Inc, B.D. Biosciences, VIIV Healthcare, Beckman Coulter, Partec, Sysmex, Apogee Flow Systems, Zyomyx Inc., and Mylan Inc. |

SEGMENTAL ANALYSIS

By Product Insights

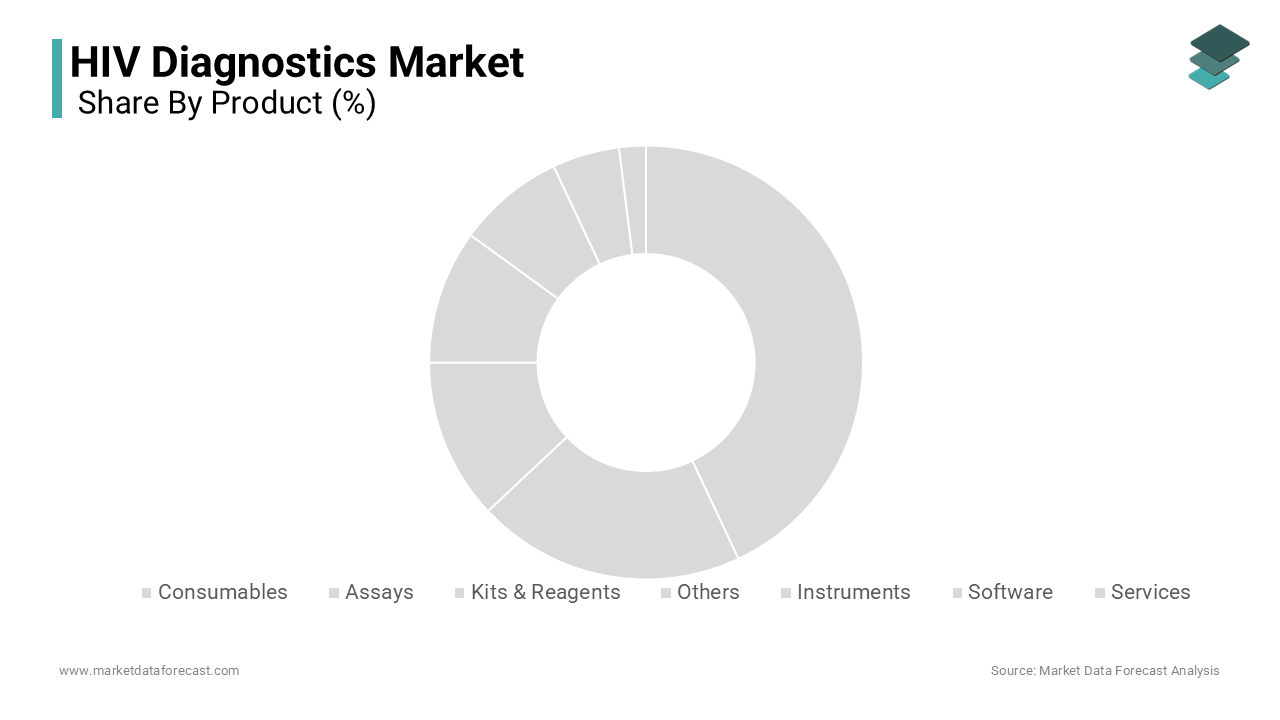

Based on the product, the consumables segment is estimated to play a dominating role among all in the global HIV diagnostics market during the forecast period. Factors such as the increasing incidence of HIV and AIDS, the increased number of hospitals and laboratories, and governments of various countries that have started working aggressively to control HIV/AIDS are expected to favor the segment's growth.

By Test Type Insights

Based on type, the antibody tests segment is expected to be the leader in the global HIV diagnostics market during the forecast period due to the increasing number of blood donations, rising awareness of HIV and Aids among people, the emergence of novel and innovative medical practices, and technological advancements.

Elisa's test is the next segment that drives the market forward. The enzyme-linked immunosorbent assay (ELISA) tests need patient blood to detect antibodies. This test also takes oral fluids and urine to identify positive or negative HIV symptoms.

By End-User Insights

Based on end-user, the diagnostic laboratories segment is the most lucrative in the global HIV Diagnostics market due to the spreading awareness about HIV and AIDS among people in developing countries. Further, the increasing focus of private and government organizations inclines investments in developing advanced diagnostic laboratories with technologically advanced equipment and diagnostic techniques.

REGIONAL ANALYSIS

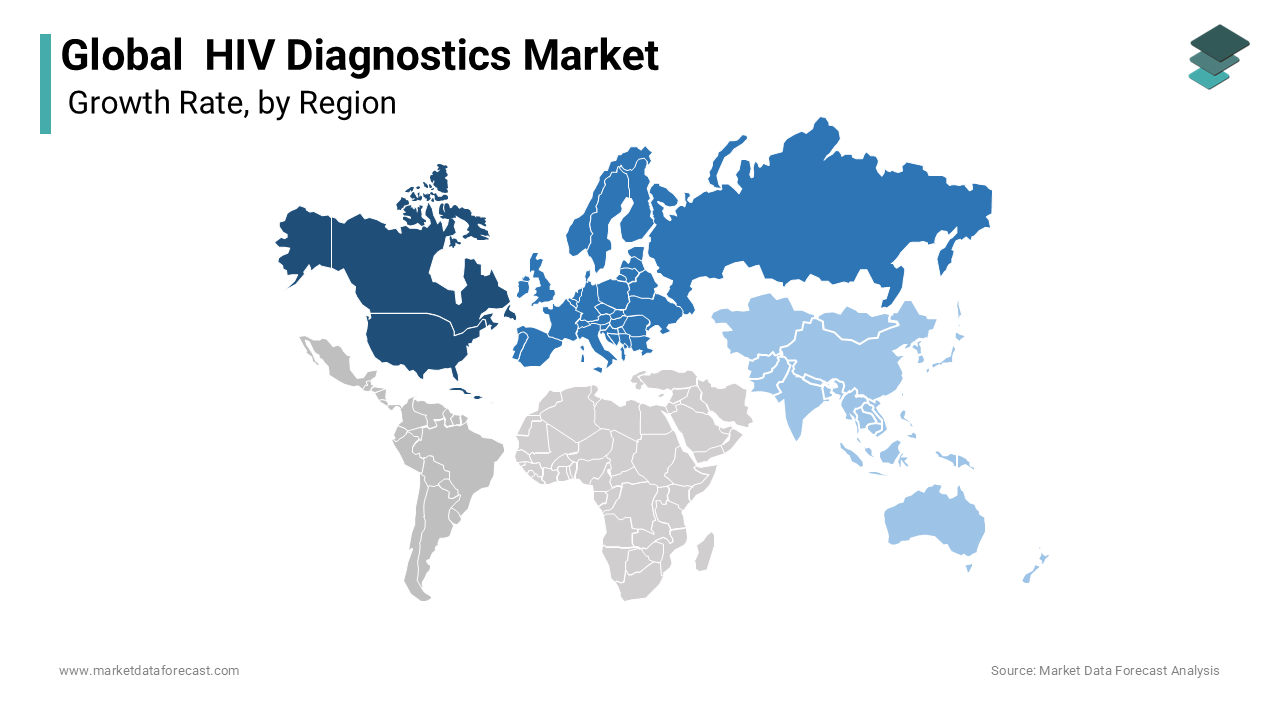

The global HIV diagnostics market was dominated by North America and accounted for a market share of 38% in the global market in 2024. Y-O-Y growth in the incidence of HIV growing focus of key market participants on developing novel drugs are some of the significant factors propelling the North American market growth. In addition, increasing awareness among people, government initiatives to prevent HIV, widening research, and developing health facilities are further boosting the growth rate of the North American market. In the U.S., the only home test approved by the U.S. Food and Drug Administration is called the Home Access Express Test. Based on this, these people need a further diagnosis, which drives the market forward. In the U.S., HIV tests are free in some areas and available at a lower cost. Per the Centers for Disease Control and Prevention (CDC), in 2019, nearly 34,900 new HIV infections occurred in the United States 2019. HIV screening is most commonly used in Canada, detecting HIV antibodies and the HIV p24 antigen. Rapid HIV test kits have recently been approved for licenses in Canada for point-of-care (POC) testing or self-testing. This requires a few drops of blood from a finger prick and provides results within several minutes. HIV diagnosis and testing are a significant step in knowing the status of the patient's condition. Canada increases testing rates and tests available for people to know about HIV status. Several policies and programs have been conducted across Canada for the prevention and further transmission of HIV.

The Asia Pacific is the next big global and regional market and is growing significantly due to high unmet demand in India and China. In the APAC market, India and China are contributing heavily to the growth of this regional market. China has been in an advanced position in the prevention of HIV for the last three years. The Joint United Nations Programme on HIV/AIDS shows that the number of people suffering has reduced yearly in China. China also launched the prevention of mother-to-child transmission of HIV by undergoing tests and diagnosis, which drives the market forward. Based on diagnosis and treatment, most of the medicine is given to patients who have HIV. India is in the third position in the increasing number of HIV/AIDS cases. According to India's National AIDS Control Program, rapid tests are adopted for the diagnosis of HIV.

The European market is predicted to showcase a promising CAGR between 2020 to 2025. Increase in disposable income and recently developed healthcare equipment to propel the demand of the market. Due to the increasing number of people living with undiagnosed HIV in the European Region, the market has driven the highest market share. In addition, in recent years, diagnoses of HIV have been increasing in this region.

The Middle East and Africa region has slow growth due to a lack of knowledge. In this region, South Africa has the highest HIV prevalence. In 2019, 16.5 million people had HIV (PLHIV) in Africa. Life-saving antiretroviral drugs (ARVs) are manufactured in this region to save lives. HIV infection is the main reason for most deaths in South Africa (S.A.), with the highest mortality rate. Early identification of these HIV symptoms helps with the treatment. Early diagnosis helps in reducing the risk of infection. HIV programs are being increased in South Africa to promote awareness of HIV among people and explain how it is acquired. In 2021, sub-Saharan Africa showed a considerable improvement in awareness of HIV. 84% of people are aware of TV in sub-Saharan Africa. Free HIV testing was conducted on International AIDS Day in Egypt by Egypt's health ministry. The Egyptian government provides all health services for all patients, especially those with chronic diseases, including AIDS.

KEY MARKET PLAYERS

Notable participants in this report in the global HIV diagnostics market are Abbott Healthcare, Alere Inc., Bristol-Myers Squibb, AbbVie Inc., Gilead Sciences, Janssen Therapeutics, Merck & Co., Inc., B.D. Biosciences, VIIV Healthcare, Beckman Coulter, Partec, Sysmex, Apogee Flow Systems, Zyomyx Inc., and Mylan Inc.

RECENT MARKET HAPPENINGS

- In 2022, to control HIV transmission, AMREF Health Africa launched the Afya Kamilifu Project. This Project will reduce the county's high burden of HIV and AIDS. The Project will also launch an HIV data monitoring system using innovative technology to give accurate results to the patients.

- In 2020, Atomo signed an agreement with PrEP Health Pty Limited to supply the Atomo HIV Self-Test to PrEP users in Australia.

- In 2020, OraSure Technologies developed rapid HIV tests.

- In November 2019, the Abbott Laboratories' scientific team discovered a new subtype of HIV called HIV-1 Group M, subtype L. The Abbott Laboratories team announced the discovery of this new strain.

MARKET SEGMENTATION

This market research report on the global HIV diagnostics market has been segmented and sub-segmented based on the product type, test type, end-user, and region.

By Product

- Consumables

- Assays

- Kits & Reagents

- Others

- Instruments

- Software

- Services

By Test Type

- Antibody Tests

- HIV Screening Tests

- Elisa

- Rapid Tests

- Home Access Dried Blood Spots

- HIV-1 Antibody Confirmatory Tests

- Western Blot Tests

- Indirect Immunofluorescence Assays (IFA)

- Line Immunoassays

- Radio-Immunoprecipitation Assays

- HIV-2 & Group O Diagnostic Tests

- Blood Antibody Tests

- DBS Tests

- Line ImmunoAssay (HIV2)

- Viral Identification Tests

- p24 Antigen Test

- Qualitative PCR Tests

- Viral Culture

- CD4 Testing

- Viral load testing

- Early Infant Diagnostics

By End-User

- Diagnostic Laboratories

- Hospitals

- Blood Banks

- Home Care Settings

- Other End-Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com