Global Halal Ingredients Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Ingredients for the Food & Beverages industry, Ingredients for the pharmaceutical industry and Ingredients for the cosmetic industry), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Halal Ingredients Market

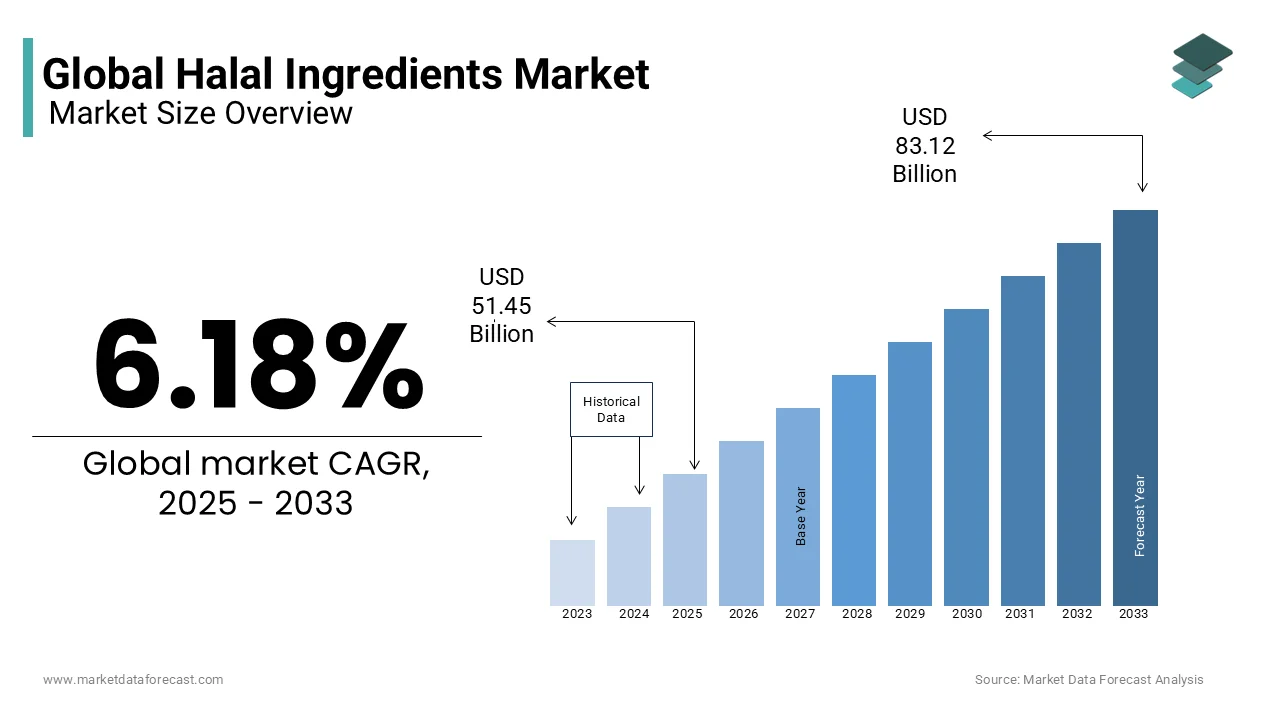

The global halal ingredients market was valued at USD 48.46 billion in 2024, and the global market size is expected to reach USD 83.12 billion by 2033 from USD 51.45 billion in 2025, growing at a CAGR of 6.18% from 2025 to 2033.

Due to the increasing need for dietary supplements and their health benefits, halal ingredients are finding applications in industries like healthcare and pharmaceuticals. Because of their busy lifestyles, consumers are witnessing a growing demand for on-the-go, convenient, nutritionally enriched, and functional food and beverage products. The increasing trends of healthy snacking and growing awareness of functional food & beverage products further drive the world market. Halal ingredients are allowed to be used in accordance with Islamic law, based on the belief that Muslims should eat food and use "halalan toyibban" cosmetics, which means permissible and healthy. Halal ingredients are also used in a variety of beauty products such as lipsticks, creams, and soaps, as there is a high demand for such components in cosmetic products.

MARKET DRIVERS

The Halal Ingredients Market benefits from the expansion of end-user industries, changes in consumer lifestyles, increased awareness, increased disposable income, and growth in the personal care sector. Furthermore, in the projected period, the surge in demand for halal processed foods, drinks, cosmetics, and pharmaceutical items provides profitable prospects for halal ingredients market competitors. Halal ingredients manufacturers in the food and beverage industry are also expected to benefit from the increased standardization in the halal certification sector. The high production costs of halal products, owing to the high cost of some halal components, may hamper Halal Ingredients Market expansion throughout the projection period. Furthermore, misconceptions about halal products may stymie the market's expansion during the projection period. The lack of consistency in halal requirements across nations is projected to pose a challenge to the expansion of the halal ingredients market. In the forecast period, the halal ingredients market is expected to face challenges due to a lack of universal standards and certification issues.

Food consumption is rising due to an increase in the global Muslim population, which is expected to propel the Halal Ingredients Market forward. Due to the increased demand for dietary supplements and their health advantages, halal ingredients are also gaining popularity in the healthcare and pharmaceutical industries. Due to their hectic lifestyles, consumers are increasingly seeking on-the-go, quick, nutritionally filled, and functional food and beverage products. During the forecast period, the market for halal ingredients is expected to be driven by rising trends in healthy snacking and increased knowledge about functional food and beverage products. Additionally, the growing preference for halal ingredients among modern consumers, owing to their eco-ethical concerns and readiness to pay a premium price for natural, organic, and earthy items, is propelling the Halal Ingredients Market forward.

MARKET RESTRAINTS

The high production costs of halal products, owing to the high cost of some halal components, may stymie the Halal Ingredients Market expansion throughout the projection period. On the other side, the lack of consistency in halal requirements across nations is projected to stymie the expansion of the Halal Ingredients Market. In the forecast period, the halal ingredients market is expected to face challenges due to a lack of universal standards and certification issues.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.18% |

|

Segments Covered |

By Type, Application & Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, Cargill, Halagel Group of Companies, Solvay, Koninklijke DSM N.V, Archer Daniels Midland Company, Amara Cosmetics, Del Monte Philippines Inc, Unilever Food Solutions, Tesco |

SEGMENTAL ANALYSIS

By Type Insights

The food & beverages segment dominated the market for halal ingredients in terms of value in 2023. Food companies concentrate on food technologies to offer halal goods to satisfy increasing consumer demand. Furthermore, companies focus on gaining consumer confidence through multiple marketing campaigns and developing a wide variety of food products for consumers, which stimulates market growth positively. Also driving the halal ingredients market in the food industry are the health benefits and cleanliness associated with halal-certified foods. Increasing standardization in the sector is projected to offer growth opportunities in the food and beverage industry to halal ingredient manufacturers.

By Application Insights

The F&B segment is estimated to account for a larger share during the forecast period. Flavors are added to food products to stimulate or convey a particular taste, maintain the character after processing, modify an existing flavor and mask an unwanted aftertaste. Flavor demand is due to growing consumer preferences for convenience foods and increasing consumer product demand. Also driving the market demand for halal-based flavors is the growing popularity of new and innovative flavors in ready-to-eat food items among the young generation. Due to the increasing demand, which is expected to generate competitive prospects for manufacturers on the market for halal ingredients, the majority of flavor firms are inclined to receive halal certification.

REGIONAL ANALYSIS

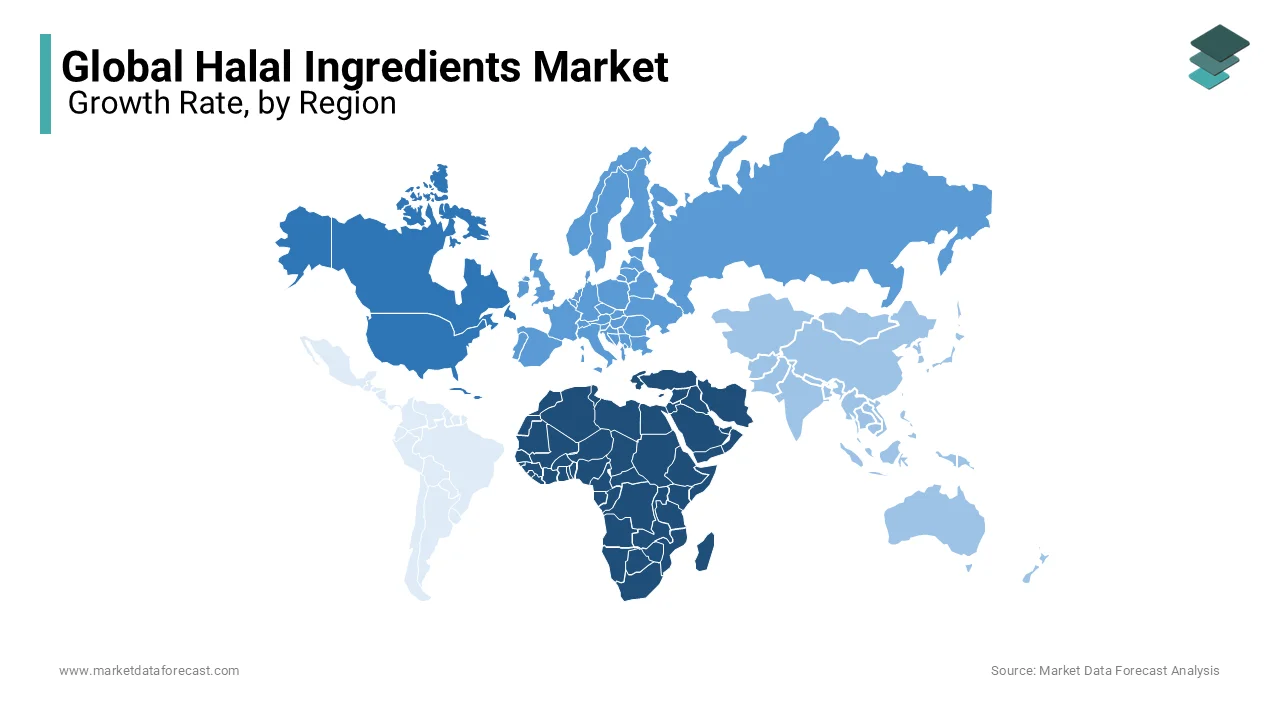

In 2023, the Middle East was the fastest-growing regional market for halal ingredients. Favourable government regulations in GCC countries drive halal nutrition. Global players in the Middle East are increasing their businesses to satisfy the expanding demand for halal ingredients. However, rapid economic growth is leading to growth in the food & drink and consumer product industries as a result of the stable political climate in countries like Saudi Arabia, Iran, and the UAE. Likewise, the growing population and increase in the region's disposable income are factors driving demand for products made with halal ingredients, which in turn is expected to drive the global market.

KEY MARKET PLAYERS

Key Players In Halal Ingredients Market are BASF SE, Cargill, Halagel Group of Companies, Solvay, Koninklijke DSM N.V, Archer Daniels Midland Company, Amara Cosmetics, Del Monte Philippines Inc, Unilever Food Solutions, Tesco

RECENT HAPPENINGS IN THE MARKET

- Croda International Plc declared its accomplishment in January 2019 to obtain Halal Certification for 15 ingredients of a biopolymer. Their Halal-compliant range consists of surfactants, emollients, fatty acids and alcohols, humectants, inorganic UV filters, lanolin and derivatives, rheology modifiers, gelling agents, specialty blends and bases, specialty cationic compounds, active ingredients as well as botanical extracts. This will help the company broaden its products and also satisfy consumers' needs and requirements.

- Solvay announced the launch of its latest natural-sourced product called Rhovanil US NAT in July 2018, which is halal certified. These innovative products meet consumer demand for natural products and also comply with US regulations on natural flavor. The brand is based on high-quality formulations based on natural and practical vanillin. Such an ambitious introduction of Halal ingredients in the industry would contribute to its future prediction growth.

MARKET SEGMENTATION

This research report on the global halal ingredients market has been segmented and sub-segmented based on type, application, & region.

By Type

- Ingredients for the Food & Beverages industry

- Ingredients for the pharmaceutical industry

- Ingredients for the cosmetic industry

By Application

- Pharmaceuticals

- Food & beverages

- Cosmetics

By Region

- North America

- Latin America

- Europe

- Middle East and Africa

- Asia Pacific

Frequently Asked Questions

1.What are halal ingredients?

Halal ingredients refer to substances that are permissible or lawful according to Islamic dietary laws.

2.Are there any regulations or certifications governing the halal ingredients market?

Yes, there are various certification bodies and regulations that govern the production, processing, and labeling of halal ingredients, ensuring they meet Islamic dietary requirements. These certifications assure consumers that products are halal-compliant.

3.What are some common applications of halal ingredients in food and beverage products?

Halal ingredients are used in a wide range of food and beverage products, including meat, dairy, confectionery, snacks, beverages, and processed foods. They can include halal-certified meat, poultry, seafood, fruits, vegetables, grains, additives, flavors, and preservatives

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]