Global Hydraulic Fracturing Market Size, Share, Trends, & Growth Forecast Report – Segmented By Technology (Plug & Perf and Sliding Sleeve), Application (Shale Gas, Tight Gas, Tight Oil and Coal Bed Methane) & Region - Industry Forecast From 2024 to 2032

Global Hydraulic Fracturing Market Size (2024-2032):

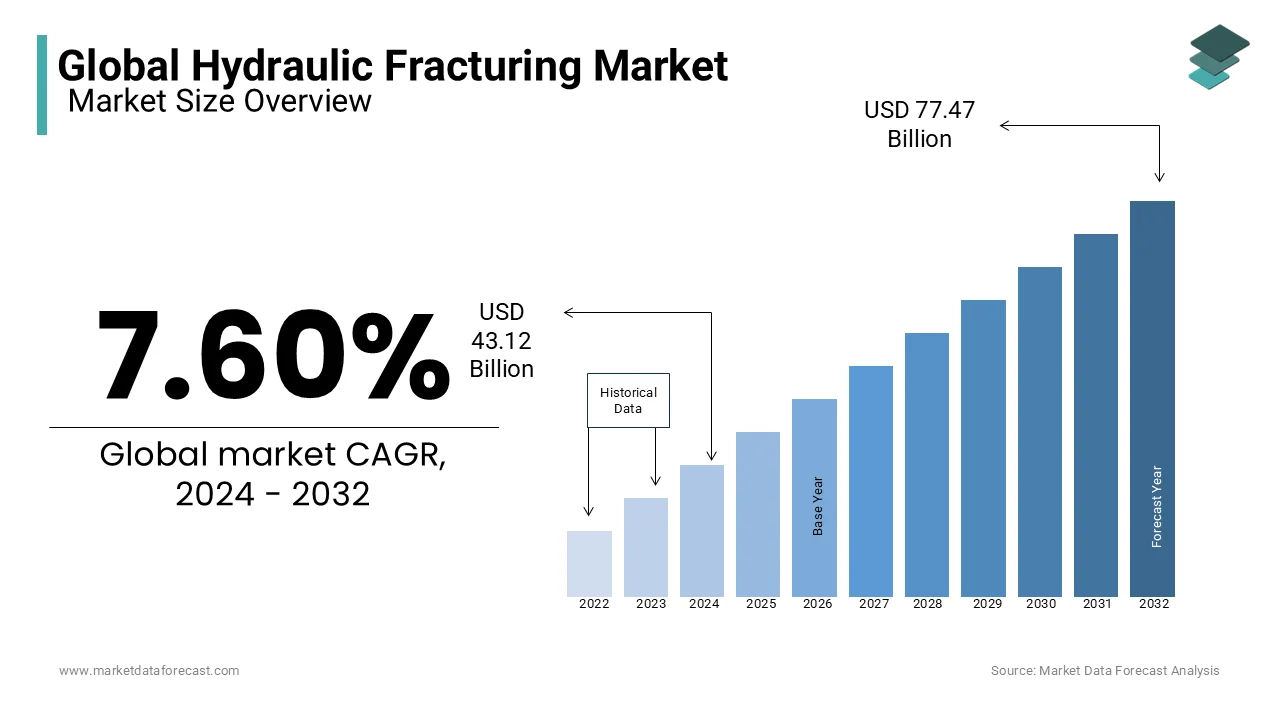

The Global Hydraulic Fracturing Market was valued at USD 40.07 billion in 2023 and is anticipated to reach USD 77.47 billion by 2032 from USD 43.12 billion in 2024, witnessing a CAGR of 7.60% during the forecast period 2024-2032.

MARKET SCENARIO

Fracturing fluids are employed in shale hydraulic fracturing processing to keep well viscous enough to create a proper fracture broad. These are water-based fracturing fluids mixed with proppants and thickeners, pumped in a controlled and monitored environment into the shale above the fracture pressure. Hydraulic fracturing is a fracture propagation technique in low-permeability reservoirs, such as shale, to increase the flow of oil and/or gas from the formation and ultimately improve productivity. Fluids, along with proppants, are injected at high pressure and flow into a reservoir to create fractures perpendicular to the wellbore, depending on the natural stresses of the formation, to maintain these openings during production. This technique is employed primarily to create sufficient permeability through the reservoir to extract oil and gas, which would otherwise be difficult to recover through natural production. The technique emerged as a result of the shale gas revolution in the United States, which now plays an important role in unconventional oil and gas exploration and production activities to produce untapped energy potential from solid rock.

MARKET TRENDS

The hydraulic fracturing market has seen strong expansion due to increased shale gas exploration and development activities. The report classifies the hydraulic fracturing market, by region, by US shale, and by well type for US shale deposits, which are classified into horizontal and vertical wells.

MARKET DRIVERS

The main driver of the hydraulic fracturing market is the potential increase in recoverable resources and production.

This technique is employed for the recovery of oil and natural gas but is mainly employed for the recovery of unconventional gas. Today, natural gas is referred to as a transition fuel to be the chain between conventional resources and renewable energies. This is an advantage for the international natural gas market and, therefore, for the hydraulic fracturing market. If countries around the world allow the use of this technique, the recovery of resources is predicted to increase. Hence, hydraulic fracturing will prove beneficial for developing countries such as India, China, and Australia. As energy call increases in these countries, meeting that call will improve their expansion prospects. It is the driving force behind the pressure-pumping market. According to the Energy Information Agency (EIA), exploration and production activities in unconventional resources, such as shale gas and tight reservoir oil, are predicted to gain momentum in the coming years. This is predicted to prolong the depletion of conventional reserves for a few more years as a result of the shift to exploration for other hydrocarbon reserves. The above-mentioned factors are predicted to have a positive impact on the expansion of the hydraulic fracturing market during the foreseen period.

MARKET RESTRAINTS

Huge investment costs coupled with negative environmental impact could hamper the expansion of the hydraulic fracturing market size.

MARKET OPPORTUNITIES

The world's major oil and gas producers have experienced declining production levels due to the depletion of conventional reserves. Falling oil production levels are predicted to widen the gap between supply and call. The extraction of hydrocarbons from unconventional reserves has increased the collectors by horizontal drilling in combination with hydraulic fracturing techniques. Changing trends towards unconventional reserve development, including shale, packed reservoir gas, packed reservoir oil, and coal bed methane (CBM), are predicted to drive the expansion of the hydraulic fracturing market over the next few years. The application of these advanced mining techniques has also helped exploration and production companies increase performance in low-profit regions such as deep and ultra-deep seas and arctic regions.

MARKET CHALLENGES

Strict regulations and safety mandates from various national governments and regulatory bodies such as EPA and REACH due to potential environmental risks are estimated to hamper the expansion of the industry. Moratoriums and bans by various regional agencies in France, Romania, Tunisia, and Bulgaria against hydraulic fracturing should also remain a major challenge for industry players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.60% |

|

Segments Covered |

By Technology, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Baker Hughes GE (U.S.), Schlumberger (U.S.), National Oilwell Varco, Inc. (U.S.), Patterson-UTI Energy (U.S.), FracChem LLC (U.S.), TechnipFMC (UK), U.S. Silica Holdings (U.S.), Halliburton (U.S.), Nuverra (U.S.), FTS International (U.S.), and Others. |

SEGMENTAL ANALYSIS

Global Hydraulic Fracturing Market Analysis By Technology

Plug and perf and sliding sleeves are the two main technologies employed for simulation in multi-stage fracturing. Plug & perf was the most dominant hydraulic fracturing technique, accounting for more than 80% of worldwide turnover in 2021. This technique is widely employed for tubewell hydrofracturing and is predicted to experience moderate expansion over the period. Sliding sleeve technology is still in the development stage and is highly employed in naturally fractured and open-hole formations.

Global Hydraulic Fracturing Market Analysis By Application

The escalating number of ageing brownfields and mature fields is pushing industry operators to produce more crude oil from unconventional resources. Unconventional hydrocarbon reserves, including shale, compact oil and gas, and CBM, have dominated the worldwide hydraulic fracturing industry, accounting for more than 75% of total revenues in 2023. With the arrival of shale gas, the sector has become the largest application segment. The escalating call for natural gas from the power plant markets due to the provision of better energy efficiency will drive the expansion of the company during the foreseen period.

REGIONAL ANALYSIS

North America led worldwide business and accounted for more than 85% of total revenue in 2021. The United States and Canada together accounted for the majority of the worldwide hydraulic fracturing industry. The availability of key resources, including technology, skilled labour, and government support, along with increased exploration and production activity in unconventional reserves, can be attributed to the high market penetration in these regions. Asia-Pacific has immense potential for the expansion of the industry in the coming years. The availability of large technically recoverable CMB and shale reserves in China, Indonesia, and Australia, as well as large investments through FDI channels in the hydrocarbon sector in these countries, are predicted to create lucrative opportunities for participants. Bookings. in these regional markets.

The hydraulic fracturing industry is predicted to experience tremendous expansion in countries like Russia, Argentina, Poland, and Algeria during the foreseen period due to increased studies to develop large unconventional hydrocarbon reserves available. For example, in January 2016, Gazprom Neft examined an unconventional reservoir located in the Vyngayakhinskoye field and planned to undertake a nine-stage hydraulic fracturing to ensure the natural flow of dry crude from the well. Increased investment in oil and gas projects is the main factor driving the expansion of the hydraulic fracturing market in Saudi Arabia. For example, Saudi Aramco aims to invest $ 334 billion in the exploration and production of unconventional resources and to support service facilities and infrastructure projects.

KEY PLAYERS IN THE GLOBAL HYDRAULIC FRACTURING MARKET

Companies playing a prominent role in the global hydraulic fracturing market include Baker Hughes GE (U.S.), Schlumberger (U.S.), National Oilwell Varco, Inc. (U.S.), Patterson-UTI Energy (U.S.), FracChem LLC (U.S.), TechnipFMC (UK), U.S. Silica Holdings (U.S.), Halliburton (U.S.), Nuverra (U.S.), FTS International (U.S.), and Others.

RECENT HAPPENINGS IN THE GLOBAL HYDRAULIC FRACTURING MARKET

- EPA Launches National Study on Hydraulic Fracturing. The United States EPA is planning a nationwide study to see if reported water contamination in gas drilling areas is caused by the practice of injecting chemicals and water underground to fracture the gas rock.

DETAILED SEGMENTATION OF THE GLOBAL HYDRAULIC FRACTURING MARKET INCLUDED IN THIS REPORT

This research report on the global hydraulic fracturing market has been segmented and sub-segmented based on technology, application, and region.

By Technology

- Plug and Perf

- Sliding Sleeve

By Application

- Shale Gas

- Tight Gas

- Tight Oil

- Coal Bed Methane

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How does the hydraulic fracturing market contribute to global energy independence?

Hydraulic fracturing has been pivotal in increasing the supply of domestic oil and natural gas, especially in the U.S., reducing reliance on imported energy. This contributes to greater energy independence for countries with shale resources, potentially lowering global oil and gas prices and enhancing energy security.

What technological advancements are expected to impact the hydraulic fracturing market in the coming years?

Advances in digital oilfield technologies, such as real-time monitoring, data analytics, and automation, are expected to improve the efficiency and environmental impact of hydraulic fracturing. Additionally, advances in “green” fracturing fluids, low-emission equipment, and enhanced recovery methods like micro-seismic technology could significantly influence market dynamics.

What role does water management play in the hydraulic fracturing market?

Water management is critical due to the high volume of water required for fracturing. Efficient water sourcing, recycling, and disposal are essential to reduce costs and minimize environmental impact. New technologies for water treatment and reuse are increasingly important, especially in water-scarce regions.

How are global policies and regulations impacting the growth of the hydraulic fracturing market?

Policies and regulations vary widely across regions. While North America’s relatively favorable regulatory environment supports growth, restrictions in parts of Europe and heightened scrutiny in other regions may slow market expansion. Stricter environmental standards and incentives for greener technologies are likely to influence the market significantly in coming years.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com