Global Identification Friend & Foe System Market Size, Share, Trends, & Growth Forecast Report by Component (Software and Hardware), Platform (Land, Airborne, Naval), & Region, Industry Forecast From 2024 to 2033

Global Identification Friend & Foe System Market Size

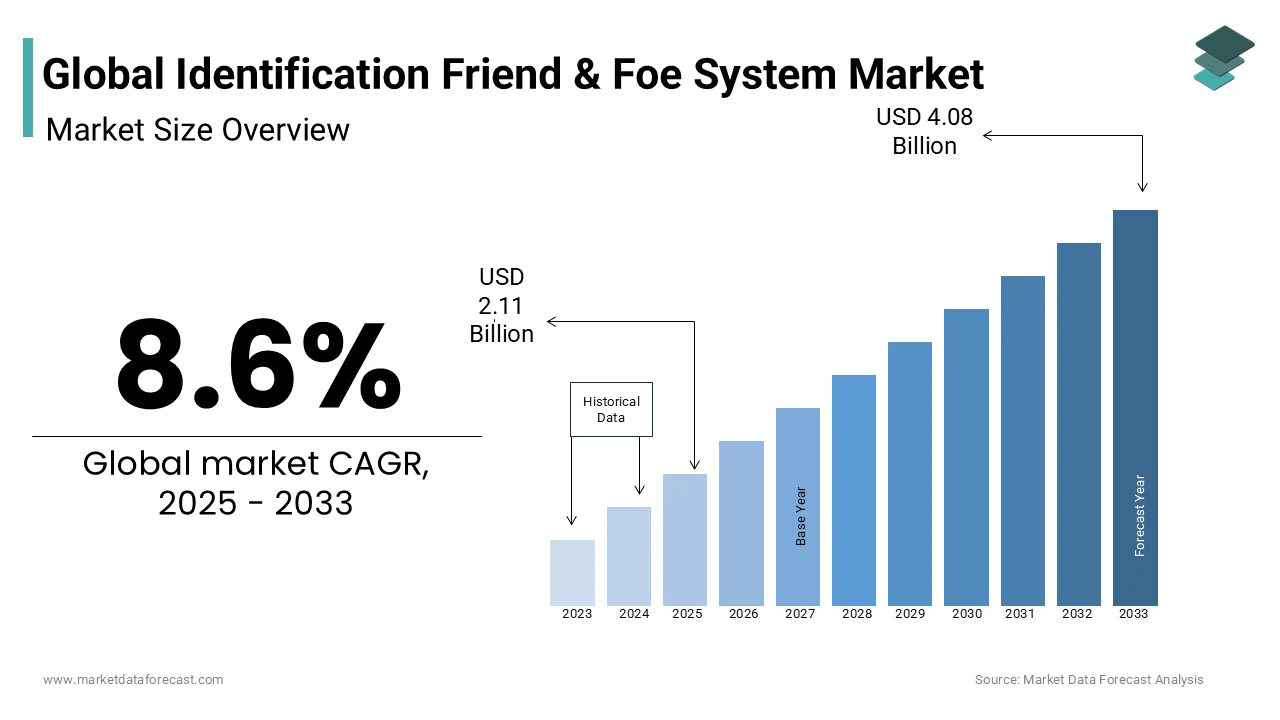

The global Identification Friend & Foe System Market was valued at USD 1.94 billion in 2024. The global market is expected to reach USD 2.11 billion in 2025 and USD 4.08 billion by 2033, growing at a CAGR of 8.6% during the forecast period 2025 to 2033.

The Identification Friend or Foe (IFF) System market is witnessing substantial growth due to rising defense budgets and the increased need for advanced security solutions in military and civil aviation sectors. IFF systems are crucial for distinguishing friendly forces from potential threats, particularly in crowded or hostile environments, where rapid identification is essential to prevent accidental engagements and ensure operational safety. The ongoing modernization of military equipment, especially in emerging markets, is a significant driver of demand for updated IFF systems. Additionally, increasing geopolitical tensions have encouraged several countries to strengthen their defense capabilities, further boosting IFF investments.

Currently, there is a marked shift towards more technologically advanced IFF systems, including those that leverage Mode 5 and Mode S technology. These advanced modes enhance encryption and authentication capabilities, addressing modern cybersecurity challenges. The aviation sector, particularly commercial airlines, also contributes to market expansion due to stringent regulatory requirements for air traffic management and collision avoidance. However, high implementation costs and the complexity of integrating IFF systems with legacy equipment pose challenges. North America dominates the market, largely due to significant defense spending in the U.S., but Asia-Pacific is emerging as a key growth region due to increasing defense investments in countries like India and China.

MARKET TRENDS

Shift Toward Mode 5 IFF Technology

Mode 5 technology, an encrypted form of IFF, is becoming the new standard in military identification systems. It offers enhanced cybersecurity features over previous modes, significantly reducing the risk of signal interception or spoofing. By 2022, over 50% of new IFF installations in NATO countries integrated Mode 5, reflecting its rapid adoption in high security zonesift aligns with the increased global demand for robust encryption in military communications, particularly among NATO allies who aim to standardize defense technology.

The civil aviation sector is increasingly investing in IFF systems, mainly due to regulatory pressures for improved air traffic safety and collision avoidance. For example, the Federal Aviation Administration (FAA) mandated the use of IFF systems for certain classes of commercial and private aircraft in the U.S. as part of the broader Automatic Dependent Surveillance-Broadcast (ADS-B) requirements. According to a 2023 industry report, the civil aviation segment of the IFF market is expected to grow at a compound annual growth rate (CAGR) of 6.3% through 2032, driven by stricter safety protocols in air traffic management.

Geopolitical Tensions in Asia-Pacific Defense Expenditures

Rising geopolitical tensions are driving significant defense investment in Asia-Pacific, particularly in countries like India, China, and Japan. This increase directly supports the demand for IFF systems as these countries modernize and expand their defense capabilities. For example, India allocated $72.6 billion to its defense budget in 2023, a portion of which focuses on updating electronic warfare and identification systems. Consequently, tcific IFF market is projected to grow at a CAGR of 8.1% through 2032, outpacing growth in traditional markets like North America and Europe.

MARKET DRIVERS

Increased Military Modernization and Defense Spending

Increased defense budgets and modernization programs globally are fueling demand for advanced IFF systems. In 2023, global defense spending reached $2.24 trillion, with the U.S., China, and India leading investments in high-security identification technologies. For instance, the U.S. is adopting Mode 5 IFF systems, featuring encrypted identification to counter interception threats. The push for modern, interoperable IFF technology is projected to drive a 7% compound annual growth rate (CAGR) in the IFF market through 2030.

Growing Demand for Air Traffic Safety in Civil Aviation

The civil aviation sector’s emphasis on safety and regulatory compliance is a strong market driver. As global air traffic is set to grow at an annual rate of 3.4% through 2035, the need for accurate identification and collision avoidance systems increases. In line with the FAA’s ADS-B requirements, IFF systems are now mandated for many aircraft in the U.S., boosting adoption rates. By 2028, the civil aviation segment is expected to account for nearly 15% of the total IFF market share, reflecting the sector’s growing investment in secure identification.

Rising Geopolitical Tensions and Cross-Border Threats

Heightened geopolitical risks are prompting countries, especially in Asia-Pacific and the Middle East, to strengthen their defense capabilities with IFF technology. Defense budgets in regions like Asia-Pacific have seen annual increases of over 6%, with India, Japan, and South Korea focused on advanced electronic warfare systems. These regional security demands are expected to drive an 8.3% CAGR in the IFF market across Asia-Pacific through 2028, as countries prioritize identification technology to mitigate cross-border threats.

MARKET RESTRAINTS

High Implementation and Maintenance Costs

The advanced technology and secure communication protocols of modern IFF systems come with substantial costs. Implementing Mode 5 IFF technology, for instance, requires specialized encryption, interoperability testing, and regular upgrades to maintain compatibility with defense systems. This can make adoption prohibitively expensive, especially for smaller defense budgets. According to recent estimates, IFF installation and integration costs can exceed $200,000 per unit, with recurring maintenance costs adding significantly to the total expense. These high costs limit adoption, particularly in regions with constrained military budgets, slowing the overall identification friend & foe system market growth.

Complex Integration with Legacy Systems

Many military and civil aviation organizations operate with a mix of legacy and modern equipment, making the integration of new IFF systems challenging. Ensuring seamless compatibility between old and new systems often requires extensive customization, which can lead to operational delays and additional expenses. In NATO, for instance, interoperability issues are common as member nations transition to Mode 5 IFF while still relying on older Mode 4 equipment. This integration complexity increases deployment timelines, with some projects requiring up to 18 months to achieve full operational capability, thus impeding rapid adoption of IFF systems.

Stringent Regulatory Standards and Compliance

IFF systems are subject to strict regulatory and compliance standards, particularly in civil aviation, where safety and security are paramount. Meeting these standards requires significant investment in research, testing, and certification, which lengthens product development cycles and raises costs. The International Civil Aviation Organization (ICAO) mandates rigorous testing to verify that IFF systems do not interfere with other communication or navigation equipment. Compliance requirements can delay the launch of new systems by several months, limiting market growth and discouraging smaller companies from entering the entification friend & foe system market growth.

MARKET OPPORTUNITIES

Rising Demand for UAV Identification Systems

The rapid expansion of unmanned aerial vehicle (UAV) deployments in defense and commercial sectors is creating a strong demand for specialized IFF systems. By 2029, the global UAV market is projected to reach $340.8 billion, growing at a CAGR of 26.4% between 2024 to 2029. Integrating IFF systems in UAVs is crucial for preventing misidentification, especially in military environments where UAVs operate alongside manned aircraft. Several defense agencies are exploring lightweight, energy-efficient IFF solutions specifically designed for UAVs, creating a significant growth opportunity in this emerging segment.

Increased Investment in Cybersecurity for Defense Communication

As threats to military communication networks grow, there is a rising focus on cybersecurity within IFF systems to safeguard classified information. The global defense cybersecurity market was valued at $16.2 billion in 2022, is expected to grow at a CAGR of 7.4% through 2030. This trend presents an opportunity for manufacturers to develop and market IFF systems with enhanced encryption and secure data transmission. Mode 5 IFF technology, known for its advanced encryption capabilities, aligns well with this demand and is increasingly a standard requirement in NATO and allied defense systems.

Expanding Market in Asia-Pacific Due to Defense Modernization

Asia-Pacific, particularly countries like India, South Korea, and Japan, is seeing a significant rise in defense spending aimed at modernizing equipment and enhancing interoperability. In 2023, defense spending in the region grew by 6.4%, with specific allocations for electronic warfare and identification technology upgrades. Governments are actively investing in IFF systems as part of broader defense modernization programs, with the Asia-Pacific IFF market forecasted to grow at a CAGR of 8.1% through 2028. This trend presents an opportunity for IFF manufacturers to capitalize on the growing demand by offering region-specific solutions tailored to local defense needs.

MARKET CHALLENGES

Rapid Technological Advancements Outpacing Integration Capabilities

The IFF market is evolving quickly, with advanced technologies like Mode 5, artificial intelligence (AI), and machine learning being integrated into identification systems. However, many defense and civil aviation organizations face challenges keeping up with these advancements due to compatibility issues with existing infrastructure. Integrating AI-based solutions requires significant upgrades to current systems, often involving extensive reconfiguration and testing. According to a 2023 industry report, up to 30% of defense organizations in North America are struggling with integration delays, which can extend implementation timelines by over a year. This gap between technological progress and real-world deployment capabilities creates substantial challenges for IFF adoption.

Limited Skilled Workforce for IFF System Operations and Maintenance

The specialized skills required to operate, maintain, and troubleshoot modern IFF systems are in short supply, particularly as systems grow more complex. Many organizations report difficulty in finding personnel with the necessary training in advanced encryption, electronic warfare, and cybersecurity—all essential skills for managing modern IFF technology. This skill shortage is a significant barrier to growth, with the global cybersecurity talent gap alone estimated to exceed 3.4 million professionals as of 2023. The lack of skilled personnel can lead to operational inefficiencies and extended downtimes, affecting the reliability of IFF systems in critical applications.

Regulatory and Export Restrictions on IFF Technology

IFF technology, particularly high-security Mode 5 systems, is subject to strict export controls and regulatory restrictions due to its defense applications and potential dual-use concerns. Countries have stringent guidelines on the export of sensitive identification technology, especially to regions with uncertain security standings. For example, U.S. International Traffic in Arms Regulations (ITAR) impose heavy restrictions on exporting defense-related technologies, limiting market access for many IFF manufacturers. This regulatory hurdle restricts market growth opportunities, especially in emerging markets where demand for advanced IFF systems is growing but access remains limited due to export constraints.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.6% |

|

Segments Covered |

By Component, Platform, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bae Systems, Thales Group, Leonardo, Raytheon Technologies, Hensoldt, Indra Company, Northrop Grumman, General Dynamics, Tellumat, Micro Systems, and others |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment dominated the IFF market and had 60.7% of the global market share in 2024. Hardware is essential for implementing IFF systems across defense and civil aviation sectors, as these physical components enable secure signal transmission and identification. Key factors driving hardware demand include increased defense budgets and the adoption of Mode 5 IFF systems, which require updated transponders for secure, encrypted identification. The rising military modernization and expansion in emerging markets further propelling the expansion of the hardware segment in the global market.

The software segment is predicted to witness a CAGR of 8.44% over the forecast period owing to the rising need for enhanced cybersecurity in IFF systems to protect against evolving cyber threats and to support secure, real-time communication. Software solutions that integrate artificial intelligence (AI) and machine learning (ML) for improved threat identification are gaining traction, particularly in North America and Europe. These advancements make software a critical component in IFF system upgrades, reflecting its fast-paced growth and increasing market share.

By Platforms Insights

The airborne segment captured 50.7% of the global market share in 2024. This segment includes IFF systems used in military aircraft, drones, and commercial aviation, where reliable identification is crucial for preventing friendly fire and ensuring air traffic safety. Increasing investments in aircraft modernization, especially in the U.S. and NATO countries, drive demand for airborne IFF systems. Mode 5 IFF adoption for enhanced encryption has also contributed to the segment’s prominence, as it is widely used across military aircraft platforms. The airborne segment is expected to grow at a compound annual growth rate (CAGR) of around 6% through 2030, with continued emphasis on airspace security amid rising geopolitical tensions.

The land segment is the fastest-growing in the IFF market and is expected to register a CAGR of 8.87% over the forecast period owing to the rising investments in ground-based defense systems, particularly in regions with heightened border security concerns such as Asia-Pacific and the Middle East. Many countries are investing in mobile and fixed IFF solutions for ground forces to enhance situational awareness and reduce the risk of misidentification during operations. The trend toward integrated ground-defense networks further fuels this demand, with IFF systems playing a key role in coordinated and secure ground-force movements.

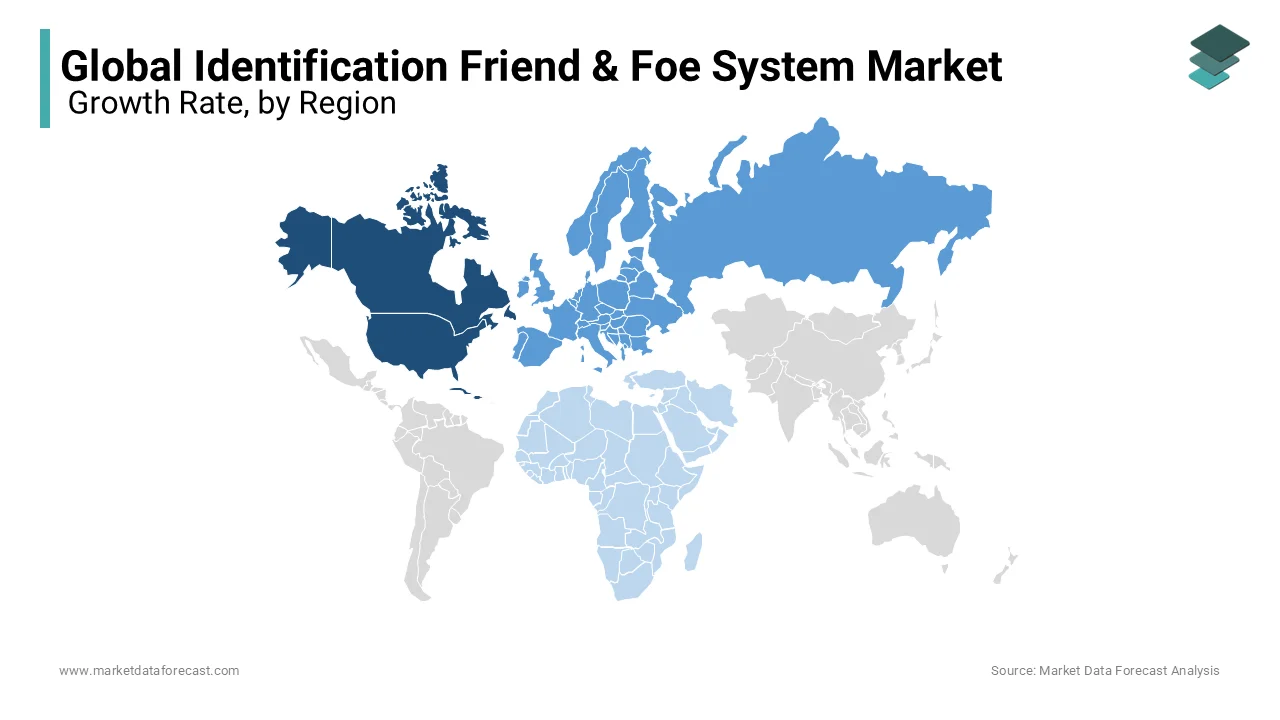

REGIONAL ANALYSIS

North America dominated the market by capturing 40.8% of the global market share in 2024. The United States is the primary contributor, driven by high defense spending, which exceeded $800 billion in 2023, as well as extensive adoption of advanced Mode 5 IFF systems across military platforms. Canada also supports this growth, though on a smaller scale, by upgrading its defense systems to align with NATO standards. North America’s market is bolstered by defense modernization programs and a focus on cybersecurity in defense communications. Geopolitical tensions and a proactive stance on military readiness keep this region at the forefront of the IFF market.

Europe captured 25.8% of the global IFF market share in 2024. Key contributors include the United Kingdom, Germany, and France, each with strong defense sectors and significant NATO commitments. Germany and France are heavily investing in defense modernization, with Germany’s defense budget set to exceed €50 billion by 2024, including allocations for secure identification systems. Rising defense budgets and heightened regional security concerns, especially in Eastern Europe, drive demand for IFF systems. Additionally, Europe’s focus on interoperability within NATO aligns well with Mode 5 upgrades, strengthening demand for IFF solutions across land, airborne, and naval platforms.

Asia-Pacific is the fastest-growing region in the global IFF market. The region’s growth is primarily fueled by rising defense budgets and modernization efforts, particularly in China, India, Japan, and South Korea. China, with a defense budget of over $225 billion, is rapidly advancing its military capabilities, focusing on developing indigenous technologies, including IFF systems. India, which allocated $72.6 billion to defense in 2023, is investing in IFF systems to enhance border security and interoperability with allied forces. Japan, amid rising regional tensions, is also modernizing its defense equipment, driving substantial demand for secure identification technologies. The geopolitical dynamics in the Asia-Pacific region make it a focal point for IFF investment, especially in land and airborne systems.

Latin America is expected to grow at a modest CAGR of 4.5% over the forecast period. Brazil and Mexico lead the region’s defense spending, focusing primarily on countering drug trafficking, border security, and internal security threats. Although defense budgets in this region are lower than in North America or Asia-Pacific, there is a growing interest in upgrading identification technologies, particularly in countries with active military or border security programs. Brazil, as the largest defense spender in the region, is increasingly investing in secure identification systems for air and ground forces, but overall growth remains limited due to budgetary constraints.

The market in Middle East and Africa (MEA) region is experiencing moderate growth in the IFF market. Key drivers include regional security concerns and military modernization efforts, particularly in the Gulf Cooperation Council (GCC) countries such as Saudi Arabia and the United Arab Emirates. Saudi Arabia, for instance, has a defense budget exceeding $50 billion, with substantial investments in advanced IFF systems to secure its air and ground forces. In Africa, countries such as South Africa are gradually adopting IFF technologies, though budget limitations restrict rapid growth. The MEA region’s focus on securing borders and strengthening defense capabilities in the face of regional tensions provides a steady demand for IFF systems.

KEY MARKET PARTICIPANTS

Some of the leading companies operating in the Global Identification Friend & Foe System Market are Bae Systems, Thales Group, Leonardo, Raytheon Technologies, Hensoldt, Indra Company, Northrop Grumman, General Dynamics, Tellumat, and Micro Systems.

RECENT MARKET HAPPENINGS

- In February 2024, Indra and Thales signed a strategic agreement to advance European defense technologies, including IFF systems. This collaboration focuses on radar, cybersecurity, and communications technologies to strengthen EU defense capabilities and ensure faster innovation

- In October 2024, Raytheon secured a contract with the U.S. Army to enhance Mode 5 and ADS-B IFF surveillance capabilities. The contract covers essential upgrades to transponders, encryption modules, and control panels to improve U.S. Army operational security

- In January 2024, Leonardo and Hensoldt expanded their "Team Skytale" partnership for Mode 5 IFF solutions. This collaboration aims to enhance IFF systems on over 400 UK military platforms, improving secure identification across air, land, and sea assets

- In March 2023, Northrop Grumman and BAE Systems won a $449.9 million U.S. Army contract to develop IFF systems for ground vehicles. This contract aims to upgrade the Army’s Ground Combat Vehicle with cutting-edge identification capabilities, enhancing ground force security

- In December 2023, Thales launched an upgraded TSA6000 IFF interrogator featuring flat fixed-array active antenna technology. This model provides 360° coverage and faster threat identification, making it ideal for modern IFF requirements

- In April 2024, General Dynamics announced a collaboration with Raytheon to develop IFF technology for the U.S. Navy, focusing on secure Mode 5 systems to improve naval fleet identification and interoperability

- In August 2023, Hensoldt introduced an advanced Mode 5 IFF cryptographic module to support NATO-aligned forces. This innovation enhances signal security and integration with multiple IFF platforms, marking Hensoldt’s commitment to cybersecurity in identification systems

- In May 2023, Indra secured a contract with Spain’s Ministry of Defense to deliver IFF systems for air and ground forces. This project includes secure Mode 5 capabilities, aimed at improving national defense security amid increasing regional tensions

- In September 2023, Tellumat launched a new portable IFF system for rapid deployment by ground forces. The system’s compact design and secure communication features support field identification in real-time, making it suitable for modern military operations

- In July 2024, Micro Systems signed a collaboration agreement with the Australian Defense Force to integrate IFF systems in training drones, improving secure identification and data accuracy during joint training exercises

MARKET SEGMENTATION

This research report on the global identification friend & foe system market has been segmented and sub-segmented based on the component, platforms, and region.

By Component

- Hardware

- Software

By Platforms

- Land

- Airborne

- Naval

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the main components of an IFF system?

The main components of an IFF system include the interrogator (which sends the signal), the transponder (which responds to the signal), and the cryptographic computer (which processes the codes to ensure secure communication).

What factors are driving the growth of the global IFF system market?

Key factors driving market growth include increasing defense budgets, modernization of military equipment, rising geopolitical tensions, and the need for advanced security systems to prevent friendly fire incidents.

How has technological advancement impacted the IFF system market?

Technological advancements have led to the development of more sophisticated and secure IFF systems. Innovations include better encryption methods, improved signal processing, and integration with other defense systems for enhanced situational awareness.

What is the future outlook for the global IFF system market?

The future outlook is positive, with continued growth expected due to ongoing military modernization programs, increased defense spending, and the rise of asymmetric warfare necessitating more advanced identification systems.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com