Global Industrial and Factory Automation Market Size, Share, Trends, & Growth Forecast Report - Segmented By Solution (SCADA, PLC, DCS, MES, Industrial Safety, PAM), By Component (Sensors, Industrial Robots, Machine Vision, Control valves, Industrial PC, Control devices), By Industry (Process and Discrete), & Region - Industry Forecast From 2024 to 2032

Global Industrial and Factory Automation Market Size (2024 to 2032)

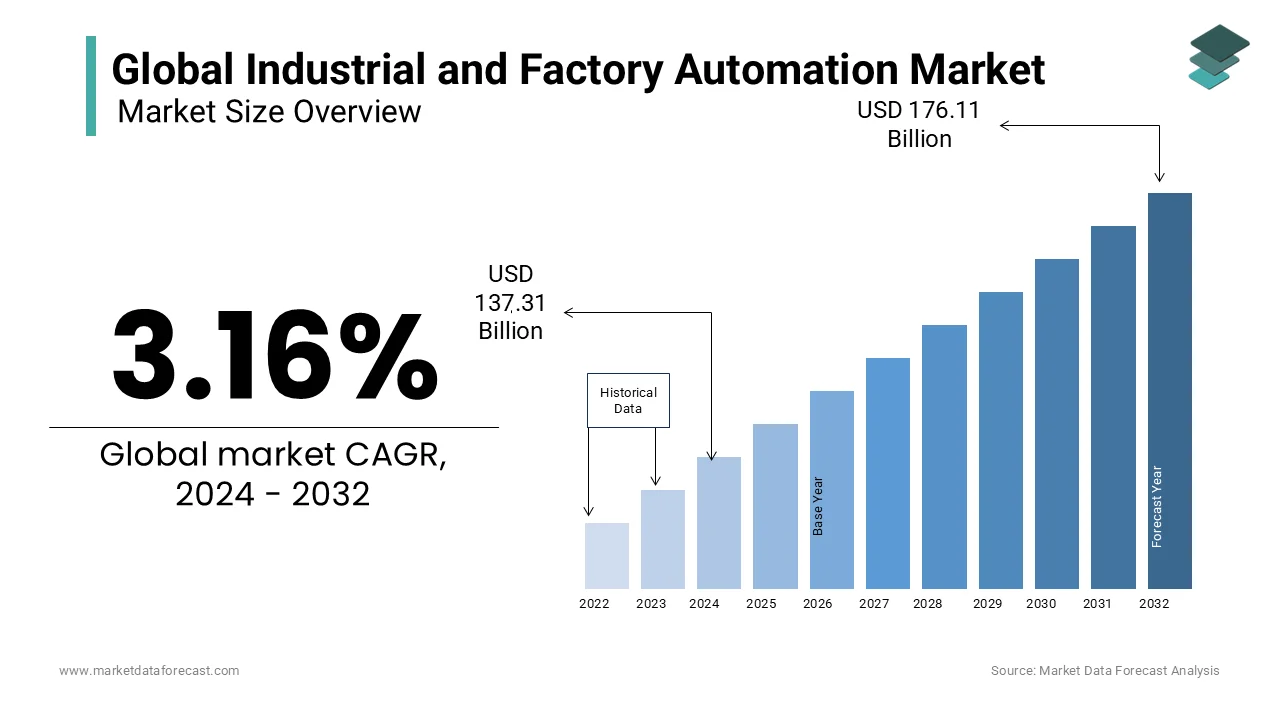

The global industrial and factory automation market was worth USD 133.10 billion in 2023. The global market is expected to reach USD 137.31 billion in 2024, it is estimated to reach USD 176.11 billion by 2032, growing at a CAGR of 3.16 % during the forecast period.

Current Scenario of the Global Industrial and Factory Automation Market

Industrial automation is the use of control systems, like machines or robotics, and information technology for the management of various processes and equipment in manufacturing to replace human beings.

The advent of business partnerships and the need for bulk creation of goods, favorable government initiatives to encourage automation systems, implementation of evolving technologies like IoT and AI in industry applications, insistence on automation technology and optimized resource consumption and financial policies framed by local financial firms to retain production facilities during the COVID-19 emergency are among the factors responsible for the growth. This is the second step after mechanization in the area of industrialization. Such automation allows most industries to work with versatility and improved efficiency.

MARKET DRIVERS

The upsurge of the notion of a business partnership is propelling the global industrial & factory automation market forward.

The productive flow of information throughout various units in enterprises is critical for efficient manufacturing operations. It allows businesses to grasp the method of transforming resources into products by utilizing IoT and IP systems. Internet-of-things systems can be used to monitor the position of field devices, ensure the correct flow of materials, maintain track of the inventory status, and notify goods as they move through the supply chain. Integrated companies can also quickly obtain the flow of data through the production chain, making it more straightforward for them to react to changes in the business environment. Real-time data assists producers in lowering operational costs, recognizing cyber theft risks, and producing following market demands. The elevated demand for improved productivity and the production of high-quality product lines is fueling the growth of innovative equipment and software systems. This requirement can be met by deploying advanced manufacturing strategies and applications provided by industrial and factory automation.

MARKET RESTRAINTS

The introduction of a new automated production facility necessitates the use of cutting-edge automation innovations and technologies. Data collection with them aids in reducing calculation errors while improving product quality and manufacturing plant efficiency. The establishment of these production facilities necessitates significant capital investments in machinery, operating systems, and instruction. For new companies who are establishing their first facility, investing such a substantial amount is challenging. As a result, before implementing industrial and factory automation systems, these businesses must conduct a thorough analysis of their return on investment.

Furthermore, due to the high costs of new and advanced systems and the lack of interoperability in legacy systems, several companies cannot replace their existing legacy systems. These legacy systems communicate using proprietary protocols, making connecting them to systems based on new technologies complicated. As a result, manufacturers incur high additional costs when upgrading their existing systems. Furthermore, the automation software systems used in industries necessitate ongoing maintenance and upgrades. As a result, small businesses cannot afford such costs. As a result, the charge is a significant impediment to the growth of the industrial & factory automation market. Following the initial capital investments, there is a need to maintain and upgrade industrial and factory automation systems and solutions. Maintaining and upgrading industrial and factory automation systems and solutions necessitates significant capital reinvestment. As a result, the need for substantial initial investments and maintenance reinvestments limits the growth of the industrial & factory automation market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.16 % |

|

Segments Covered |

By Solution, By Component, By Industry, and bireason |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Leaders Profiled |

General Electric, ABB Ltd., Emerson Electric Co., Rockwell Automation Inc., Siemens AG, Endress+Hauser Group, Schneider Electric, Yokogawa, Omron Corporation, Mitsubishi, Honeywell. |

SEGMENTAL ANALYSIS

Global Industrial and Factory Automation Market By Solution

The market is segmented into SCADA (Supervisory Control and Data Acquisition), PLC (Programmable Logic Controller), DCS (Distributed Control System), MES (Manufacturing Execution System), Industrial Safety, and PAM (Plant Asset Management).

In 2019, the Distributed Control System (DCS) captured the largest market share. A distributed control system (DCS) is a digital automated industrial control system with spatially separated control loops across a production plant, device, or regulation zone, instead of being centralized. DCSs are placed so that each element of a production facility is governed by one or more controllers, enabling different parts of the plan to receive instructions.

Global Industrial and Factory Automation Market By Component

The market is categorized into Sensors, Industrial Robots, Machine Vision, Control valves, Industrial PC, Control devices.

Sensors captured the largest market share in 2019. Sensors are growing in popularity in the industrial automation control market due to their widespread use in automotive, medical services, consumer devices, and armed services. In addition, makers are heavily automating these tasks with robotics, thanks to advancements in technology, force/torque sensors, and end-effectors. Polishing is an example of a repetitive and strenuous activity that can be automated for effective results.

Global Industrial and Factory Automation By Industry

The market can be categorized into Process Industry and Discrete Industry. In 2019, the process industry dominated the global market. Additives, food, beverages, petroleum, base metals, paper and paper products, drug companies, and other sectors illustrate process industries. The process industry is the primary end-user of DCS (Distributed Control System) because it typically involves monitoring and managing fluids such as oil, milk, and water. Throughout the manufacturing process, the DCS, in conjunction with valves and other tools, constantly regulates and controls the liquid flow and the blending of these industrial components. In addition, PLCs (Programmable Logic Controller) is extensively used in process industries like food services, oil and gas, and water services.

REGIONAL ANALYSIS

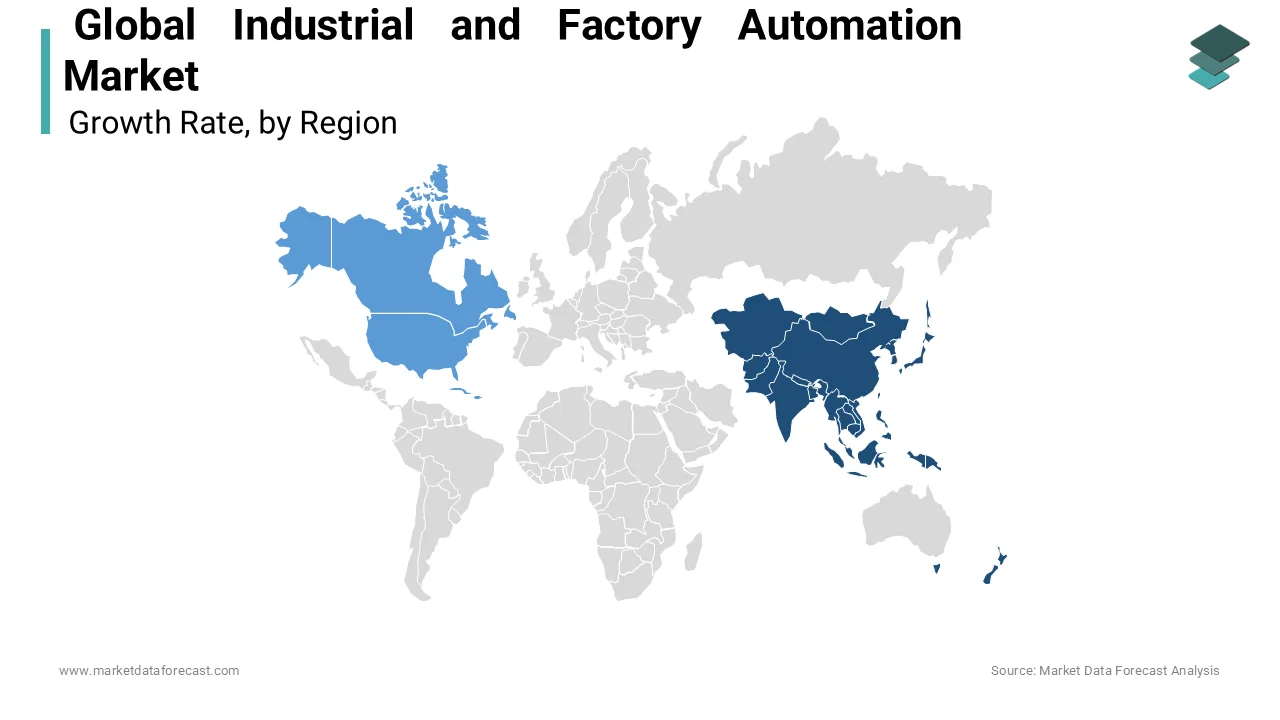

Industrial and Factory Automation Market are divided into three regions based on regional analysis: North America, Europe, and the Asia Pacific.

Over the projected period, Asia Pacific is anticipated to witness significant growth in the Industrial and Factory Automation market, followed by Europe. North America is comprised of three countries: the United States, Mexico, and Canada. This area's affluence is due to its seamless integration of markets. In terms of profit, the market is growing steadily. The United States dominates the economy of the North American region due to its highly diverse industrial demand. Compared to Europe and some parts of Asia, producers in this region have a lot more flexibility in terms of improvements and advancement. Nevertheless, a few businesses in North America have attained a saturation point, necessitating the development of new approaches to conquer market inadequacies.

KEY MARKET PLAYERS

Major Key Players in the Global Industrial & Factory Automation Market are General Electric, ABB Ltd Emerson Electric Co, Rockwell Automation Inc, Siemens AG, Endress+Hauser Group, Schneider Electric, Yokogawa, Omron Corporation, Mitsubishi, Honeywell.

RECENT HAPPENINGS IN THE MARKET

- SAP and Endress+Hauser partnered in the design of the Industrial Internet of Things (IIoT) solutions for the manufacturing industry in June 2018. The aim is to incorporate Endress+Hauser field methods as virtual twins into the SAP web platform. All businesses want to take advantage of the products and smart devices provided by SAP's Leonardo platform as well as Endress+Hauser's IIoT product. The intention is to jointly incorporate master and sensor information as well as assessment values into consumer, distribution and manufacturing processes and to create new digital services that rely on quantitative maintenance and predictive performance.

- Picnik Robotics and Formant formed a working relationship in October 2021 to extend both groups' capabilities and bring cloud-based mobile manipulation to the forefront of robotics.

- MOV.AI debuted its innovative Robotics Engine Platform in October 2021, allowing AMR manufacturers, automation integrators, and manual logistics vehicle manufacturers to construct AMRs suitable for 85 percent dynamic situations swiftly. The platform is powered by the most recent version of the MOV.AI software.

- Epson Conquers Automation Limitations with a No-Code, Convenient Epson RC+ Express Robot Teaching Environment in Oct 2021. Epson RC+ Express, an instinctive visual-based instructional environment, gives rapid, practical Epson SCARA robots for customers with very little to no coding experience, allowing manufacturers to rapidly and effortlessly build automated programs to alleviate time and cost barriers associated with running industrial robots.

- The Omron VT-S1080 3D AOI will be introduced in October 2021 as the most sophisticated combination of AI-assisted, new Omron technology to target the vital solder joint inspection process. The adaptability of the capabilities and the quantitative, IPC-compliant inspection technique contribute to the quality and dependability of your products. In addition, Omron's sophisticated offline productivity and data analysis solutions enable businesses to work more efficiently, lower skill levels, and achieve actual process improvement

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL AND FACTORY AUTOMATION MARKET INCLUDED IN THIS REPORT

This research report on the global Industrial and Factory Automation market has been segmented and sub-segmented based on solution, component, industry, and region.

By Solution

- SCADA (Supervisory Control and Data Acquisition)

- PLC (Programmable Logic Controller)

- DCS (Distributed Control System)

- MES (Manufacturing Execution System)

- Industrial Safety

- PAM (Plant Asset Management)

By Component

- Sensors

- Industrial Robots

- Machine Vision

- Control valves

- Industrial PC

- Control devices

By Industry

- Process Industry

- Discrete Industry

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the main factors driving the growth of the industrial and factory automation market globally?

The primary drivers include advancements in AI and IoT, the need for efficient and cost-effective manufacturing processes, increased labor costs, and the demand for higher production quality and flexibility. Additionally, government initiatives promoting smart manufacturing and Industry 4.0 are significant contributors.

What are the key technologies used in industrial and factory automation?

Key technologies include robotics, artificial intelligence (AI), Internet of Things (IoT), programmable logic controllers (PLCs), supervisory control and data acquisition (SCADA) systems, and human-machine interfaces (HMIs). These technologies work together to enhance efficiency, productivity, and safety in manufacturing processes.

What are the challenges facing the industrial and factory automation market?

Challenges include high initial costs of implementation, the need for skilled labor, cybersecurity threats, and interoperability issues between different automation systems. Additionally, smaller manufacturers may face difficulties in adopting these advanced technologies due to budget constraints.

How does industrial automation contribute to sustainability?

Industrial automation enhances energy efficiency, reduces waste, and optimizes resource utilization. Automated systems can monitor and manage energy consumption, leading to lower greenhouse gas emissions and a smaller environmental footprint. Sustainable practices are increasingly becoming a focus in automated manufacturing processes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com