Global Industrial Batteries Market Size, Share, Trends, & Growth Forecast Report - Segmentation By Type (Lead-Acid, Nickel-Based, Lithium-Based), End-user Industry (Telecom & Data Communication, Uninterruptible Power Supply (UPS)/Backup, Industrial Equipment, Grid-Level Energy Storage), & Region - Industry Forecast From 2024 to 2032

Global Industrial Batteries Market Size (2024 to 2032)

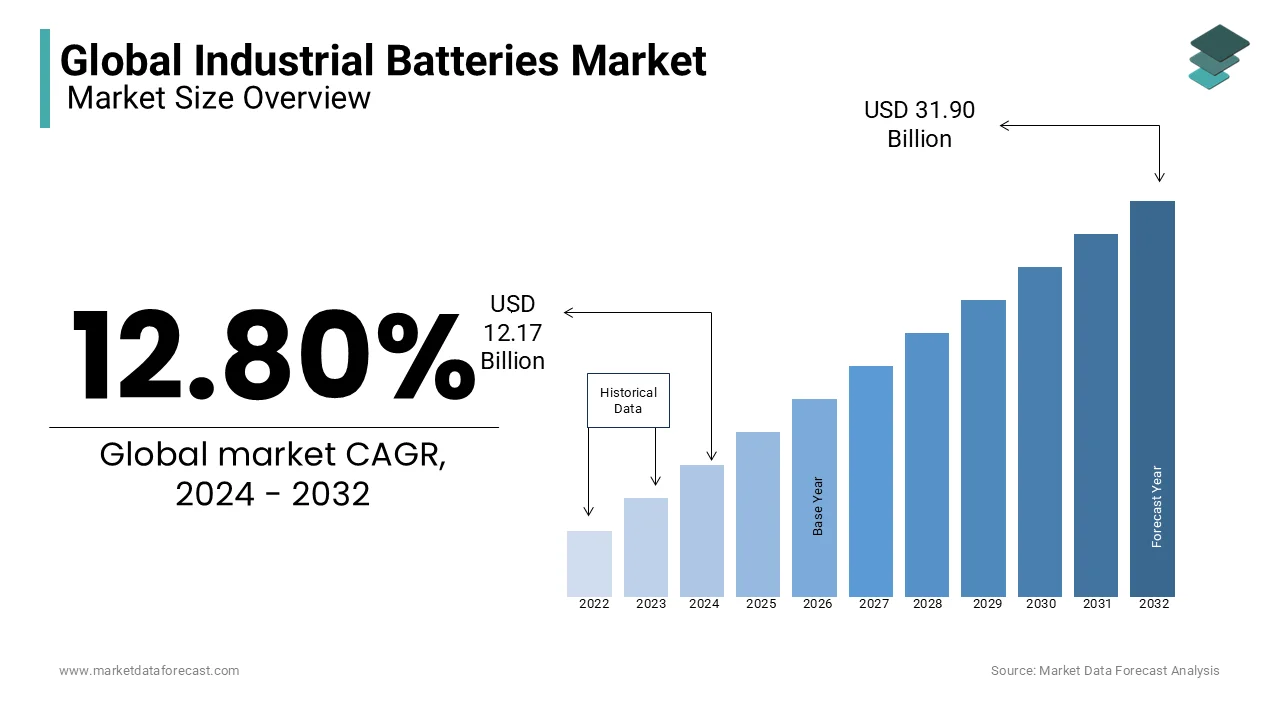

The Global Industrial Batteries Market is anticipated to grow from USD 10.79 billion in 2023 to reach a valuation of USD 31.90 billion by 2032 from USD 12.17 billion in 2024 and is predicted to register a CAGR of 12.80% during the foreseen period.

Current Scenario of the Global Industrial Batteries Market

Industrial batteries are electrochemical devices that convert higher-level active materials into an alternating state during discharge. Battery materials are the most common chemicals and metals used to make primary and secondary batteries. These materials depend on properties such as crystallinity, crystal size and shape, porosity, doping, and surface modification. Based on these properties, battery performance is measured based on energy density, power density, stability or cyclability, price, and safety.

Lithium Ion Batteries (LIBs) are expected to experience significant growth in the industrial batteries market during the forecast period mainly due to their favourable capacity-to-weight ratio. The price of LIB is generally higher than that of other batteries. However, the major market players have invested in R&D activities to improve the performance and price of LIB in order to achieve economies of scale. Lithium-ion batteries are seeing massive demand in the battery energy storage market, due to falling prices. The United States Department of Energy (DOE) has announced an interim price target of $ 125 / kWh for 2021, and lithium-ion battery prices are expected to drop to $ 73 / kWh by 2025. Additionally, lithium-ion batteries Batteries are expected to occupy the largest share of the battery energy storage market in the coming years as they require little maintenance, are lightweight, and have a reliable lifecycle, volume, and efficiency of high loading/unloading. Globally, forklift orders doubled from 2010 to 2020. The United States saw an increase of almost 160% between 2010 and 2020. The increase was in part due to the need to modernize and replace obsolete capital goods. In addition, the growing demand for rapid product delivery has resulted in improvements in logistics and distribution, both in developed and emerging regions, such as North America, Europe, and the Asia Pacific. This, in turn, is likely to drive demand for industrial lithium-ion batteries in the material handling industry for years to come.

MARKET DRIVERS

Rapid industrialization, increasing demand for high-capacity energy storage, and increasing uninterrupted demand for electric power in the world are some of the major factors driving the growth of the industrial batteries market over the years.

In addition, the growing demand for standby power in the industrial sector, along with the higher recycling efficiency and energy density of industrial lead-acid and lithium batteries, are supporting the market growth. In addition, the growing demand for industrial batteries in various sectors, including the material handling industry, data centers, automotive, construction, telecommunications, power generation, and utilities, is likely to stimulate the growth of the industrial batteries market. In addition, fast-growing industries, including telecommunications, IT, automotive, power, and energy, among others, are further driving the demand for industrial batteries globally.

MARKET RESTRAINTS

The high cost of capital associated with the safety concerns of battery charging and disposal of lead-acid batteries are expected to limit the growth of the market to some extent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

12.80% |

|

Segments Covered |

By Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Johnson Controls Inc. (U.S.), Exide Technologies Inc. (India), Enersys Inc. (U.S.), Saft Groupe S.A. (France), GS Yuasa Corporation (Japan), Northstar Battery Company LLC (Sweden), C&D Technologies, Inc. (U.S.), Robert Bosch GmbH (Germany), East Penn Manufacturing Company (U.S.), and Toshiba International Corporation (Japan), and Others. |

SEGMENTAL ANALYSIS

Global Industrial Batteries Market Analysis By Type

Lead-acid batteries accounted for the bulk of over 48% in 2023 and are expected to be the dominant segment during the forecast period. Lead-acid batteries find application in uninterruptible power supply systems (UPS) because they offer high power density and longer life. A UPS system is an electrical equipment that provides power in the event of failure of the main power supply or input power sources. The high electrical processing capacity of lead-acid batteries is expected to drive the growth of the segment during the forecast period.

They are also used in electrical industry applications, including forklifts, due to their low cost, reliability, and well-established supply chain. Rapid industrialization and an increasing number of manufacturing units are expected to drive the growth of the segment in the future. Expansion of storage space, growth of the e-commerce industry, and strong demand for forklift replacement, along with growing investments from players in emerging economies, are also expected to drive segment growth over the next eight years.

The lithium-based products segment is expected to register the highest CAGR during the forecast period. Lithium-ion batteries are used in many industrial applications, such as UPS systems, industrial automation systems, and grid-level storage systems. The demand for renewable energy sources is increasing due to the depletion of fossil fuels and environmental pollution caused by non-renewable sources. Renewable sources, like wind and solar, produce variable energy and must be converted into storable forms. Energy storage systems (ESS) help store these renewable energy sources for later use. Hence, the increasing use of ESS is expected to increase the demand for lithium-ion batteries during the forecast period.

Global Industrial Batteries Market Analysis By End-User

The grid-level energy storage segment is expected to register the fastest CAGR of over 10% during the forecast period. The growth of the global energy storage systems market is expected to amplify the consumption of industrial batteries over the next two years. Grid energy storage systems are expected to compete with traditional or conventional power generation, transmission, and distribution systems.

As the growth of this industry gains momentum, manufacturers are expected to invent and adopt new types of business models for deploying and operating storage assets. It is believed that this will further affect operational capacity, allowing networks to operate more reliably and profitably through the use of industrial batteries.

The driving force will become the largest segment in 2023, accounting for over 34% of the global share. Due to the broad scope of products in engine industry applications, including forklifts, the segment will maintain its leading position throughout the forecast period.

Rapid industrialization and an increasing number of manufacturing units are expected to drive segment growth further. In addition, the expansion of storage space, the growth of the e-commerce industry, and the growing demand for forklift replacements will support the growth of the segment over the next eight years.

REGIONAL ANALYSIS

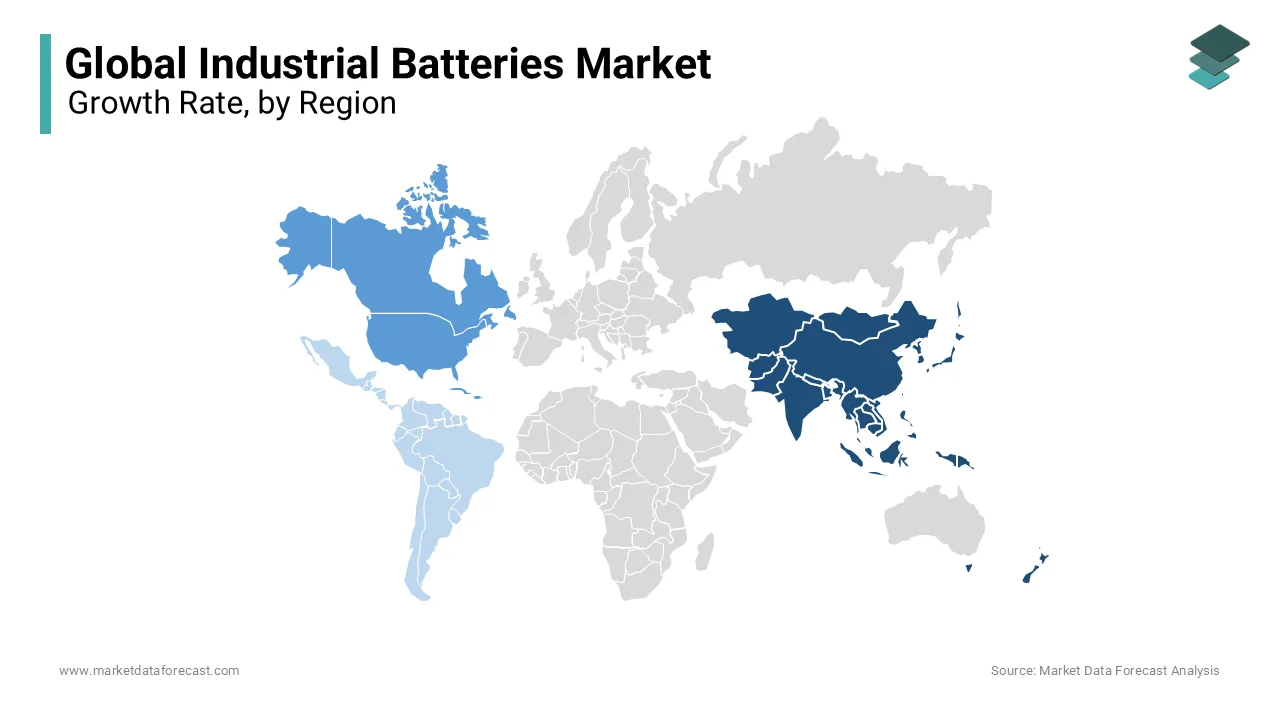

Asia-Pacific accounted for the majority of the industrial battery in 2023 and is expected to continue to dominate during the forecast period.

The industrial batteries market in Asia-Pacific is mainly driven by China, India, Japan, and South Korea. In 2022, the total capacity of the energy storage project in China reached 1,028.5 MW, an increase of 226% over the 2023 capacity. The recently added grid-side energy storage capacity in China reached 208.6 MW, which represents around 36% of the new capacity installed in 2019 in the country. The grid-side energy storage industry was the largest consumer of energy storage facilities in 2023 in terms of capacity. Factors such as the significant growth in renewable energy production capacity, energy storage targets published by utilities in 2023, and falling battery costs have led to additional storage capacity in the industry's energy on a large scale in the country.

Therefore, the growth seen in the deployment of energy storage in 2023 is expected to continue in the coming years, which in turn is expected to be one of the main drivers of the industrial batteries market in the country, during the forecast period. On the other hand, the Indian retail market is growing at a rapid pace with urbanization and increasing purchasing parity per capita in the country. Large foreign retail chains are entering the country, and domestic retail chains have also expanded their business due to growing demand. In order to maintain efficient and fast logistics operations, the demand for material handling equipment, such as forklifts to maintain warehouse operations, is increasing in the country. This, in turn, is expected to drive the demand for industrial batteries in the country during the forecast period. Likewise, countries like Japan and South Korea have faced a growing demand for material-handling equipment in recent years.

North America is expected to be the second largest regional market to which the United States is the main contributor. The strong manufacturing base and rapid growth of the automotive industry in the U.S. will increase the demand for commercial vehicles. , such as those that run on battery forklift trucks, which will drive demand for industrial batteries in the years to come.

In Europe, demand for industrial batteries is expected to increase in several countries including Italy, Germany, Spain, the UK, France, and Russia, due to increased spending on innovation and the growing purchasing power of manufacturers. In addition, the presence of large car manufacturers, especially in Germany, is expected to drive the growth of the market.

Latin American countries such as Argentina, Colombia, and Brazil are also expected to experience substantial growth due to the proliferation of industries, as well as the participation of new technologies and inventions in industrial batteries.

KEY PLAYERS IN THE GLOBAL INDUSTRIAL BATTERIES MARKET

Companies playing a promising role in the global industrial batteries market include Johnson Controls Inc. (U.S.), Exide Technologies Inc. (India), Enersys Inc. (U.S.), Saft Groupe S.A. (France), GS Yuasa Corporation (Japan), Northstar Battery Company LLC (Sweden), C&D Technologies, Inc. (U.S.), Robert Bosch GmbH (Germany), East Penn Manufacturing Company (U.S.), and Toshiba International Corporation (Japan), and Others.

RECENT HAPPENINGS IN THE GLOBAL INDUSTRIAL BATTERIES MARKET

- In December 2020, Saft, a subsidiary of TOTAL, is launching a new brand of batteries in India.

- In Nov 2020, Inverted Energy launched the latest lithium-ion battery plant in Okhla. The company is betting on new demand in the near future to increase its capacity. Telangana has launched its electric vehicle policy, which exempts the first 200,000 electric vehicles from road tax. We want to foster the transition to more reliable, more economical, more durable, and made-in-India lithium-ion batteries, ”said Rahul Raj, co-founder of Inverted Energy.

- In August 2020, Inverted Energy is launching a new range of lithium-ion batteries for electric vehicles and solar power plants. Inverted Energy has launched its new line of lithium-ion batteries for electric vehicles, solar power plants, and home use. Commercial production of the batteries is scheduled to begin on October 2. The company will initially supply the batteries of certain manufacturers of electric vehicles and large solar projects.

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL BATTERIES MARKET IS INCLUDED IN THIS REPORT

This research report on the global industrial batteries market has been segmented and sub-segmented based on type, end-user, and region.

By Type

- Lead-acid Batteries

- Lithium-based Batteries

- Nickel-based Batteries

- Others

By End-User

- Telecom & Data Communication

- Industrial Equipment

- Uninterruptible Power Supply (UPS)/Backup

- Grid-Level Energy Storage

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Frequently Asked Questions

What is the Industrial Batteries Market growth rate during the projection period?

The Global Industrial Batteries Market is expected to grow with a CAGR of 12.80% between 2024 and 2032.

What can be the total Industrial Batteries Market value?

The Global Industrial Batteries Market size is expected to reach a revised size of USD 31.90 billion by 2032.

Name any three Industrial Batteries Market key players?

GS Yuasa Corporation (Japan), Northstar Battery Company LLC (Sweden), and C&D Technologies, Inc. (U.S.) are the three Industrial Batteries Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com