Global Industrial Hose Market Size, Share, Trends & Growth Forecast Report – Segmented By Material (Natural Rubber, Nitrile Rubber, Polyvinyl Chloride(PVC), Silicone & Polyurethane), Media (Chemical, Water, Oil, Hot Water & Steam, Air & Gas, Food & Beverage), Industry (Automotive, Pharmaceuticals, Infrastructure, Oil and Gas, Food and Beverages, Chemicals, Water, Mining & Agriculture) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

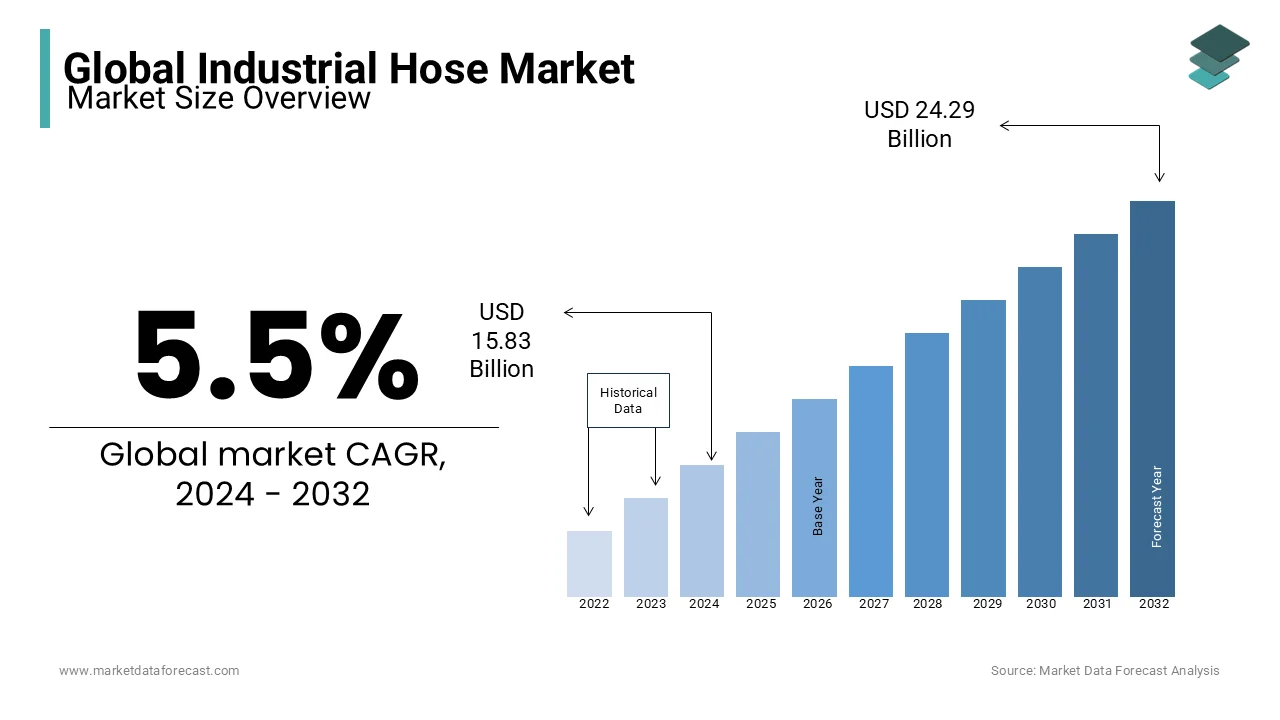

Global Industrial Hose Market Size (2024 to 2032)

The size of the global industrial hose market was worth USD 15 billion in 2023. The global market is anticipated to grow at a CAGR of 5.5% from 2024 to 2032 and be worth USD 24.29 billion by 2032 from USD 15.83 billion in 2024.

MARKET DRIVERS

The growth of industrialization in developing nations like China, India, and some other countries is driving the growth of the global industrial hose market.

The advancements in the agriculture industry using technology, the increase in the usage of the latest technology, and recently developed cultivating techniques that are done by machinery are among the reasons for the growth of the industrial hose market. The adoption of the latest technological advancements in various industries, such as automotive, healthcare, and many more, is the prime reason for the rise of the industrial hose market's market revenue. The automotive industry is one of the promising end-use applications for industrial hoses, which is estimated to expand with a noteworthy growth rate in the next few years.

Also, the wide range of applications and options to choose from the various types of hoses are some of the prime factors for the increase in the global industrial hose market. Moreover, with the competitive spirit of the major players, prices of the hoses are made aggressively. These are the factors that are propelling the growth of the global industrial hose market. The growing demand for the automobile industry in the forecast is anticipating the growth of this industrial hose market because of the advantages they offer. The need for robust hoses in the manufacturing industries is one of the reasons that are likely to create several growth opportunities for newcomers.

MARKET RESTRAINTS

Although the industrial hose market is growing, one of its let-down factors is the lack of technicians who are aware of these industrial hoses. Less reach to the end-user is also hindering the global industrial hose market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.5% |

|

Segments Covered |

By Material, Media, Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Gates (US), Eaton(Ireland), Parker Hannifin(US), RYCO Hydraulics(Australia), Kurt manufacturers(US), NORRES (Germany), Piranha Hose Products(US), Transfer Oil S.p.A (Italy), Colex International(UK), Kanaflex Corporation(US), Pacific Echo Inc.(US, Merlett Technoplastic S.p.A (Italy), Semperit(Austria), Kuriyama of America Inc.(US), Salem-Republic Rubber company(US) |

SEGMENTAL ANALYSIS

Global Industrial Hose Market Analysis By Industry

The automotive segment dominated the industrial hose market in 2023 and is anticipated to showcase a prominent CAGR during the forecast period. The growth of the automotive segment is primarily driven by the increasing demand for improvements in car engine performance, which is increasing the adoption of turbochargers, fueling the usage of this industrial hose across the vertical.

REGIONAL ANALYSIS

During the forecast period, APAC is expected to hold the largest share of the industrial hose market. APAC is the leading market for industrial hoses in the automotive, infrastructure, and agricultural industries, with high demand driven by countries such as China, India, and Japan. APAC is a prospective market for industrial hoses due to increased urbanization, increased demand for automobiles, and modernization of agricultural procedures. High population density and increasing per capita revenue in this region, along with large-scale industrialization and urbanization, are driving the market growth.

KEY PLAYERS IN THE GLOBAL INDUSTRIAL HOSE MARKET

Companies playing a major role in the global industrial hose market include Gates(US), Eaton(Ireland), Parker Hannifin(US), RYCO Hydraulics(Australia), Kurt manufacturers(US), NORRES (Germany), Piranha Hose Products(US), Transfer Oil S.p.A (Italy), Colex International(UK), Kanaflex Corporation(US), Pacific Echo Inc.(US, Merlett Technoplastic S.p.A (Italy), Semperit(Austria), Kuriyama of America Inc. (US), and Salem-Republic Rubber Company (US).

RECENT HAPPENINGS IN THE MARKET

- In January 2019, the aftermarket division of the Eaton (Ireland) car group reached a distribution contract with Bezares SA to become the North American distributor for its portable power hydraulic portfolio. This collaboration will enable Eaton's aftermarket team to impact its partnership with Bezares to offer extensive portable hydraulic solutions that fulfill client requirements for PTOs and other hydraulic products

- In June 2018, Gates (US) launched a new line of premium, multipurpose hydraulic hose to satisfy replacement market and OEM needs. This new product is intended for apps across multiple sectors, such as agriculture, mining, construction, and other end-market apps.

- In April 2017, Eaton (Ireland) introduced a new hydraulic hose series, GH681, which has high-efficiency capacities and durability in environmental-severe applications such as small building machinery, agricultural cars, aerial lift platforms, and forestry machines.

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL HOSE MARKET INCLUDED IN THIS REPORT

This global industrial hose market research report has been segmented and sub-segmented based on material, media, industry, and region.

By Material

- Natural rubber

- Nitrile rubber

- Polyvinyl chloride (PVC)

- Silicone

- Polyurethane

By Media

- Chemical

- Water

- Oil

- Hot water and Steam

- Air and Gas

- Food and Beverages

By Industry

- Automotive

- Pharmaceuticals

- Infrastructure

- Oil and Gas

- Food and Beverages

- Chemicals

- Water and Wastewater

- Mining

- Agriculture

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com