Global Infusion Pump Market Size, Share, Trends & Growth Forecast Report By Type, Product, Application, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Infusion Pump Market Size

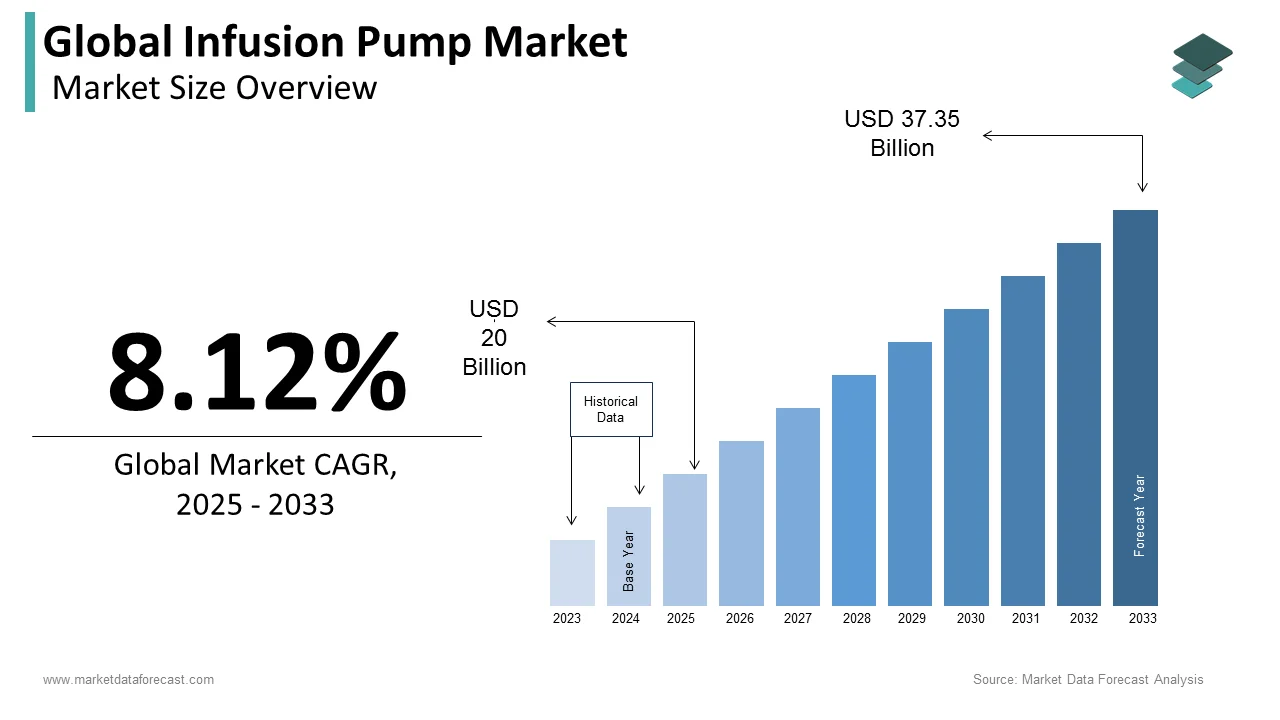

The size of the global infusion pump market was worth USD 18.5 billion in 2024. The global market is anticipated to grow at a CAGR of 8.12% from 2025 to 2033 and be worth USD 37.35 billion by 2033 from USD 20 billion in 2025.

MARKET DRIVERS

Y-O-Y growth in the prevalence of chronic diseases such as diabetes and cancer is anticipated to drive the global infusion pump market growth.

Cancer accounts for one death in every six and is the second major cause of death worldwide. In 2018, an estimated 9.6 million died of cancer. The growing incidence of diabetes worldwide is another major factor favoring the market growth. Around the world, 537 million people aged between 20 to 79 lived with diabetes in 2021. The incidence of diabetes among low- and middle-income countries compared to developed countries. Approximately 1.6 million people worldwide died of diabetes in 2016.

In addition, the growing aging population, rising demand for infusion pumps, increasing awareness and adoption of home healthcare, and a growing number of surgeries being performed worldwide are fuelling the market’s growth rate. Furthermore, the growing R&D activities and investments by the key market participants are further promoting the growth of the infusion pump market. Furthermore, the growing adoption of infusion pumps across emerging economies, increasing adoption of technological developments in manufacturing infusion pumps, and the rising number of initiatives from the governments in favor of the infusion pumps market are supporting the growth rate of the infusion pump market.

MARKET RESTRAINTS

The impact of product recalls on infusion pump sales due to safety and effectiveness issues is a significant concern for device manufacturers. There were increasing incidences of errors and defective design in the infusing pump, like alarm errors, software issues, inadequate user interface design, battery failures, component damage, fires, sparks, electrical disconnections, or charring. These recalls have forced manufacturers to replace failed infusion pumps with the latest units and compensate victims of serious injuries caused by accidents. As a result, product recalls are impacting the overall sustainability of the infusion pump market. In addition, the lack of qualified professionals and standard usage guidelines is expected to impede market development as it can lead to incorrect use of pumps and increased risk of emergencies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

Based on Type, Product, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

Terumo Corporation, Avanos Medical, Inc., Nipro Corporation, Insulet Corporation, Tandem Diabetes Care, Inc., Jms Co., Ltd., Roche Diagnostics, Zyno Medical, Teleflex, Inc., Mindray Medical International Limited, Micrel Medical Devices S.A. |

SEGMENTAL ANALYSIS

Global Infusion Pump Market Analysis By Type

Based on the type, the accessories and consumables segment was the market leader in 2024 and is expected to grow the fastest during the forecast period. The devices segment is expected to grow at a healthy CAGR between 2025 to 2033.

Global Infusion Pump Market Analysis By Product

Based on the product, the insulin Infusion pumps segment had the largest share of the global infusion pump market in 2024 and is expected to grow the fastest during the forecast period. The ambulatory intravenous infusion pumps segment held the largest market share in 2024 and is expected to grow reasonably. These pumps are widely used to deliver liquid nutrients and medications to patients in emergencies and chronic conditions. In addition, the availability of smart pumps and insulin pumps will further contribute to the market's growth. In addition, the rising demand for enteral and syringe intravenous infusion pumps is also the main factor contributing to the development of the market.

Global Infusion Pump Market Analysis By Application

Diabetes had the largest market share in 2024 and is expected to grow reasonably. The increasing prevalence of diabetes due to unhealthy lifestyles and increasing demand for insulin pumps for home care are responsible for the massive revenue share. The pediatric segment also contributed significantly to the overall market revenue in 2024. It requires pumps to deliver fluids at a customizable and precise programmed rate.

The hematology sub-segment is expected to grow fastest among other segments. The main factor responsible for the high growth rate is rising surgeries and blood cancer cases. Intravenous pumps are used for hematology. It is the only way blood can be transfused into a patient, and these pumps are accurate, continuous, and manually or automatically can be operated.

Global Infusion Pump Market Analysis By End-User

Based on the end-user, the Hospitals segment had the largest share of the global infusion pump market in 2024 and is expected to grow at the highest rate. This is because hospitals have more funds to purchase infusion pumps thus, the revenue share might be the same during the forecast period. In addition, the availability of trained professionals to operate infusion pumps is a significant factor responsible for high growth.

REGIONAL ANALYSIS

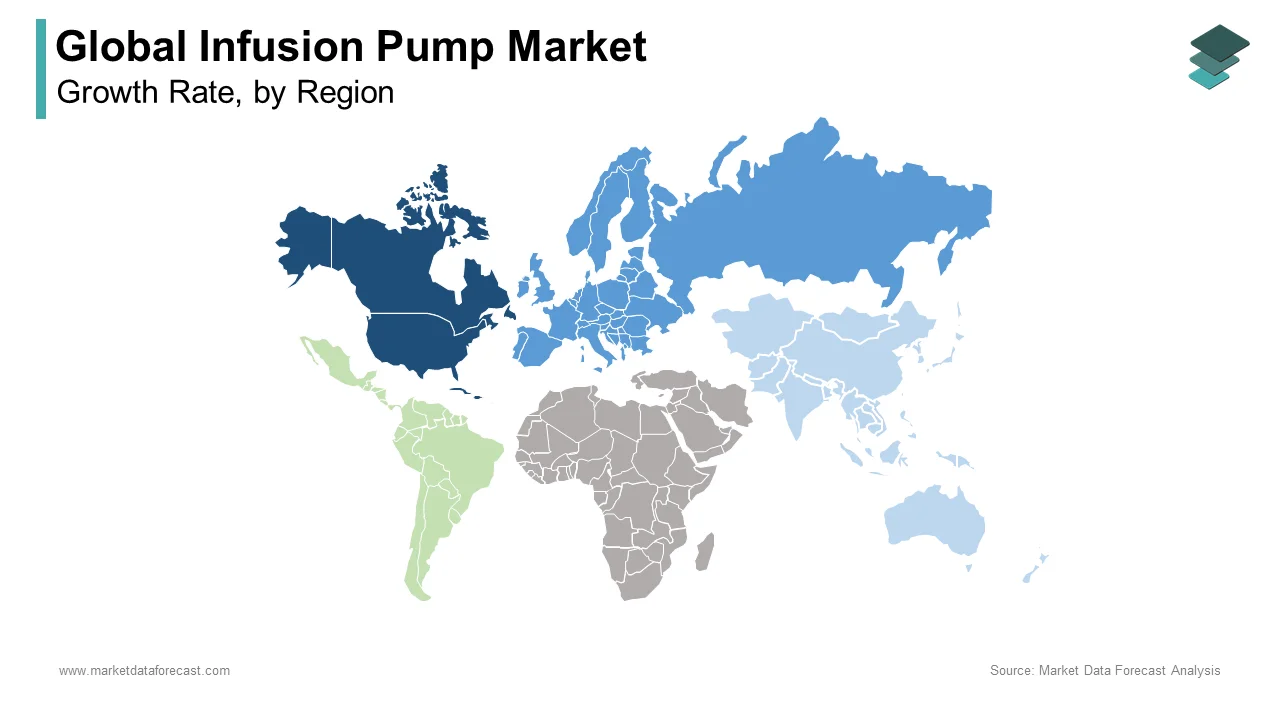

North America had the highest revenue share in 2024 in the global insulin pump market.

The main factors responsible for this are the increasing geriatric population and the prevalence of chronic diseases. The high adoption of these pumps due to their effective work has made this region a market leader. The presence of global players has ensured that the technology used is continuously evolving and updated. The U.S. infusion pump market is expected to account for the most significant share of the North American market during the forecast period.

The European infusion pump market is predicted to grow at a CAGR of 6.2% during the forecast period.

The Asia Pacific infusion pump market is expected to grow the fastest during the forecast period. The increase in population in countries like India and China and rising government intervention to provide quality healthcare are the major factors responsible for the high growth rate. In addition, the region’s countries are densely populated; these countries are also popular due to the low cost of treatment and surgery, making them the preferred markets for medical tourism is majorly propelling the infusion pump market in the APAC.

The Latin America infusion pump market is projected to grow at a CAGR of 7.8% during the forecast period.

The infusion pump market in the Middle East and Africa is forecasted to register a steady CAGR during the forecast period.

KEY MARKET PLAYERS

Some of the notable companies dominating the global insulin pump market analyzed in this report are Terumo Corporation, Avanos Medical, Inc., Nipro Corporation, Insulet Corporation, Tandem Diabetes Care, Inc., Jms Co., Ltd., Roche Diagnostics, Zyno Medical, Teleflex, Inc., Mindray Medical International Limited, Micrel Medical Devices S.A., Ypsomed Holding Ag, Becton, Dickinson And Company, B. Braun Melsungen AG, Baxter International Inc., Fresenius Kabi, ICU Medical, Inc., Smiths Medical, Medtronic PLC and Moog Inc.

DETAILED SEGMENTATION OF THE GLOBAL INSULIN PUMP MARKET INCLUDED IN THIS REPORT

This market research report on the global insulin pump market has been segmented and sub-segmented based on type, product, application, end-user, and region.

By Type

- Accessories and Consumables

- Devices

By Product

- Volumetric infusion pumps

- Insulin infusion pumps

- Enteral infusion pumps

- Ambulatory infusion pumps

- Syringe infusion pumps

- Patient-controlled analgesia (PCA) pumps

- Implantable infusion pumps

By Application

- Chemotherapy/Oncology

- Diabetes

- Gastroenterology

- Analgesia/pain management

- Pediatrics/neonatology

- Hematology

- Other applications

By End-User

- Hospitals

- Home care settings

- Ambulatory care settings

- Academic and research institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the growth rate of the global infusion pump market?

Between 2025 and 2033, the global market for infusion pumps is estimated to be growing at a CAGR of 8.12%.

Does this report include the impact of COVID-19 on the infusion pumps market?

Yes, we have studied and included the COVID-19 impact on the global infusion pumps market in this report.

Which region led the infusion pumps market in 2024?

Geographically, the North America regional market led the infusion pumps market in 2024.

Who are the key players operating in the infusion pump market?

Terumo Corporation, Avanos Medical, Inc., Nipro Corporation, Insulet Corporation, Tandem Diabetes Care, Inc., Jms Co., Ltd., Roche Diagnostics, Zyno Medical, Teleflex, Inc., Mindray Medical International Limited, Micrel Medical Devices S.A., Ypsomed Holding Ag, Becton, Dickinson And Company, B. Braun Melsungen AG, Baxter International Inc., Fresenius Kabi, ICU Medical, Inc., Smiths Medical, Medtronic PLC and Moog Inc. are some of the major companies in the global infusion pump market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com