Latin America Automotive Lead Acid Batteries Market Size, Share, Trends and Growth Analysis Report, Segmented By Type, Application, Product, And By Country (Brazil, Mexico, Argentina, Chile & Rest of Latin America), Industry Analysis From (2025 to 2033)

Latin America Automotive Lead Acid Battery Market Size

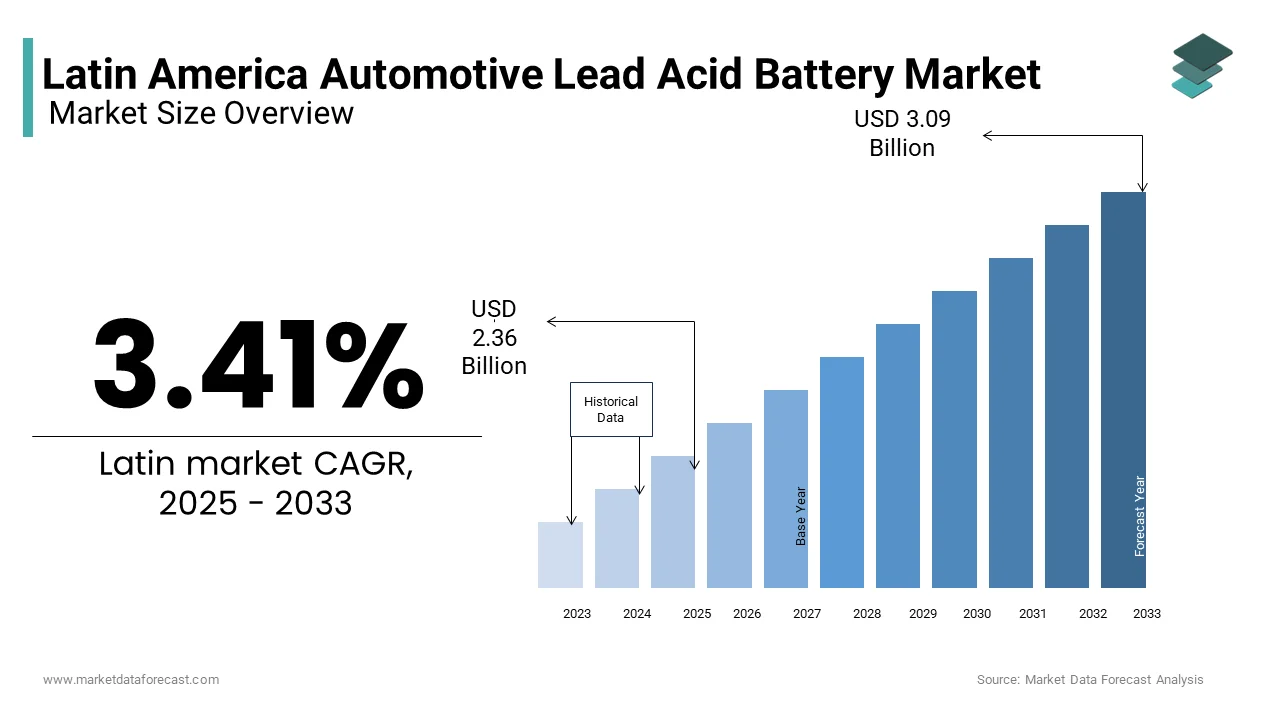

The Latin American automotive lead-acid battery market was valued at USD 2.29 billion in 2024 and is anticipated to reach USD 2.36 billion in 2025 from USD 3.09 billion by 2033, growing at a CAGR of 3.41% during the forecast period from 2025 to 2033.

The Latin American automotive lead-acid battery market refers to the segment of lead-based electrochemical energy storage systems primarily used in internal combustion engine vehicles for starting, lighting, and ignition functions. Latin America's automotive industry relies heavily on lead-acid batteries, particularly in passenger cars, commercial vehicles, motorcycles, and agricultural equipment. According to the International Energy Agency (IEA), over 80% of the vehicle parc in countries like Brazil, Mexico, and Argentina still runs on traditional fuel-powered engines, ensuring sustained demand for lead-acid batteries. Additionally, as per the United Nations Environment Programme (UNEP), Latin America has one of the highest rates of informal battery recycling, promoting both environmental concerns and economic dependencies linked to this sector.

MARKET DRIVERS

Continued Reliance on Internal Combustion Engine Vehicles

One of the primary drivers of the Latin American automotive lead-acid battery market is the continued reliance on internal combustion engine (ICE) vehicles across both private and commercial transport sectors. Despite global shifts toward electric mobility, ICE vehicles still constitute the vast majority of the automotive fleet in Latin America. According to the International Energy Agency (IEA), over 90% of registered vehicles in the region run on gasoline or diesel, necessitating the use of lead-acid batteries for essential functions such as engine starting and electrical system support.

In countries like Colombia and Peru, where new car penetration remains low, second-hand ICE vehicles imported from North America and Japan dominate the roads. The Organization of American States (OAS) reports that more than 60% of vehicles in circulation in these markets are over ten years old, requiring frequent battery replacements. This high replacement rate ensures a steady aftermarket demand for lead-acid batteries. Additionally, rural transportation networks and agricultural machinery continue to rely on traditional power sources due to limited charging infrastructure for electric alternatives. As long as ICE vehicles remain central to mobility and logistics, lead-acid batteries will maintain a strong presence in the Latin American automotive landscape.

Cost Advantage and Availability of Aftermarket Solutions

Another significant driver of the Latin American automotive lead acid battery market is the cost advantage offered by lead acid technology compared to newer alternatives such as absorbed glass mat (AGM) and lithium-ion batteries. According to Frost & Sullivan, lead acid batteries typically cost up to 60% less than AGM variants, which is making them the preferred choice for budget-conscious consumers and fleet operators. This price sensitivity is particularly pronounced in emerging economies such as Ecuador, Bolivia, and Central American nations, where disposable incomes remain relatively low. Moreover, the widespread availability of local manufacturing units and an extensive network of independent repair shops further supports the dominance of lead-acid batteries. In Brazil alone, companies such as Moura and ACDelco have established nationwide distribution channels that ensure quick access to replacement parts.

MARKET RESTRAINTS

Environmental Regulations and Waste Management Concerns

One of the primary restraints affecting the Latin American automotive lead-acid battery market is the increasing scrutiny surrounding environmental regulations and improper waste management practices. Lead-acid batteries contain toxic materials such as sulfuric acid and metallic lead, which pose serious health and ecological risks if not disposed of properly. According to the Pan American Health Organization (PAHO), exposure to lead contamination from improperly recycled batteries affects thousands of children annually, leading to neurological and developmental impairments.

In response, governments across the region have introduced stricter compliance requirements for battery production, disposal, and recycling. For example, in 2023, Argentina enacted a national law mandating certified collection centers for end-of-life batteries, significantly impacting informal market operations. Similarly, Brazil’s Ministry of Environment launched an initiative to track battery lifecycle emissions, imposing additional costs on manufacturers.

These regulatory pressures have prompted automakers and battery producers to explore alternative chemistries with lower environmental footprints. As awareness grows and enforcement intensifies, the Latin American automotive lead acid battery market faces mounting challenges in maintaining its historical growth trajectory without significant reformulation or improved recycling oversight.

Rise of Alternative Battery Technologies and Vehicle Electrification

A significant constraint on the growth of the Latin American automotive lead-acid battery market is the gradual rise of alternative battery technologies and the expanding adoption of electric vehicles (EVs). Lithium-ion and absorbed glass mat (AGM) batteries are increasingly being integrated into modern vehicles for start-stop systems and hybrid applications, reducing dependency on traditional lead-acid solutions. In urban centers such as Santiago and São Paulo, government incentives for cleaner mobility options are accelerating the transition away from lead-acid-based power systems. Chile, for instance, offers tax exemptions and subsidies for EV purchases, which is encouraging automakers to equip new models with lithium-ion auxiliary batteries alongside reduced reliance on lead-acid components.

Furthermore, original equipment manufacturers (OEMs) are integrating dual-battery systems in hybrid vehicles, where lithium-ion serves as the primary energy source and lead acid plays a secondary role. As per McKinsey & Company, this trend is expected to reduce lead-acid battery usage in new vehicles by nearly 15% by 2030. With electrification gaining momentum, the Latin American automotive lead-acid battery market must contend with declining integration in next-generation vehicle platforms.

MARKET OPPORTUNITY

Expansion of Micro-Mobility and Light Transport Segments

An emerging opportunity for the Latin American automotive lead acid battery market lies in the rapid expansion of micro-mobility and light transport segments, including three-wheelers, e-rickshaws, and small delivery vehicles. These vehicles, often used in last-mile logistics and urban commuting, frequently rely on cost-effective lead-acid batteries due to their affordability and ease of maintenance. According to the Inter-American Development Bank (IDB), Latin America’s micro-mobility sector has grown by over 25% annually since 2020, driven by urbanization and gig economy demands.

In cities like Bogotá and Lima, ride-hailing and delivery services have adopted lightweight, battery-powered transport solutions that operate within short-range parameters, making lead-acid batteries a viable option. Local manufacturers have capitalized on this trend by introducing compact, sealed lead-acid (SLA) batteries tailored for these applications.

Moreover, government-backed initiatives promoting affordable transportation in underserved regions have encouraged the proliferation of low-cost electric tricycles and cargo bikes equipped with lead-acid systems. As infrastructure development continues and urban freight needs expand, the Latin American automotive lead-acid battery market stands to benefit from this evolving mobility landscape.

Growth of Industrial and Agricultural Machinery Demand

A notable opportunity for the Latin American automotive lead acid battery market is the increasing demand for industrial and agricultural machinery that continues to rely on lead acid technology for a reliable power supply. Equipment such as forklifts, tractors, irrigation pumps, and construction vehicles predominantly utilizes lead-acid batteries due to their durability, deep-cycle capabilities, and compatibility with existing charging infrastructures. Similarly, warehouse automation and logistics hubs have expanded across major cities, boosting demand for material handling equipment powered by lead-acid batteries. Companies in Mexico and Colombia have responded by setting up localized production facilities to cater to this growing industrial need.

MARKET CHALLENGES

Volatility in Raw Material Prices and Supply Chain Disruptions

One of the most pressing challenges facing the Latin American automotive lead-acid battery market is the volatility in raw material prices and frequent supply chain disruptions. Lead, sulfuric acid, and polypropylene, all essential components of lead-acid batteries, are subject to fluctuations influenced by geopolitical instability, trade policies, and global mining output. According to the U.S. Geological Survey (USGS), lead prices saw a year-over-year increase of nearly 17% in 2023, directly impacting production costs. In countries like Peru and Mexico, which rely on imported raw materials, currency devaluation has further exacerbated procurement difficulties.

Intense Competition from Global and Regional Battery Manufacturers

The Latin American automotive lead acid battery market faces intense competition among global players and regional manufacturers, resulting in aggressive pricing strategies and margin pressures. Multinational brands such as Exide Technologies, East Penn Manufacturing, and Johnson Controls compete against well-established local firms like Moura (Brazil) and Bolder Technologies (Mexico), creating a fragmented and highly contested market landscape.

According to Euromonitor International, over 150 active battery brands were present in Latin America in 2023, each vying for market share through localized marketing, extended warranties, and price promotions. This saturation makes differentiation difficult and forces companies to continuously invest in brand positioning and after-sales service enhancements.

Moreover, the prevalence of counterfeit and substandard products in informal markets undermines consumer trust in authentic brands. A 2023 study by the Latin American Automotive Components Association (ALACA) found that up to 30% of battery replacements sold in certain regions were unregulated or poorly manufactured, leading to safety concerns and eroding legitimate sales.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.11% |

|

Segments Covered |

By Product, Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

C&D Technologies, Inc., CSB Battery Co., Ltd., Hitachi Chemical Energy Technology Co., Ltd., East Penn Manufacturing Company, Enersys Inc., Exide Industries Ltd, Exide Technologies Inc., GS Yuasa Corporation, Johnson Controls Inc., Moura Accumulators SA (Brazil), and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The SLI (Starting, Lighting, and Ignition) batteries dominated the Latin American automotive lead acid battery market share in 2024 due to their widespread use across all types of internal combustion engine vehicles, ranging from passenger cars and commercial trucks to agricultural equipment.

The popularity of SLI batteries stems from their essential function in powering vehicle ignition systems, lighting, and auxiliary electrical components. In countries like Brazil and Mexico, where over 90% of registered vehicles still rely on conventional fuel-based engines, SLI batteries remain indispensable. According to the International Energy Agency (IEA), more than 85 million ICE vehicles were in operation across Latin America in 2023 by ensuring consistent demand for SLI battery replacements.

Additionally, the high replacement cycle of these batteries due to wear and tear further drives the segment. NielsenIQ reported that nearly 65% of vehicle owners replace their SLI batteries every 2–3 years, particularly in regions with extreme temperature variations that accelerate degradation.

The micro hybrid batteries segment is swiftly emerging with a CAGR of 6.4% from 2025 to 2033. Automakers such as Fiat Chrysler Automobiles (FCA), Renault-Nissan, and Toyota have introduced micro-hybrid variants tailored for Latin American markets, incorporating enhanced flooded batteries (EFB) and absorbed glass mat (AGM) technologies. Moreover, government incentives promoting fuel-efficient vehicles have accelerated this trend. Chile, for instance, offers tax benefits for eco-friendly models, encouraging automakers to integrate micro-hybrid battery systems.

By Type Insights

The flooded lead acid batteries segment was the largest and held 60.1% of the Latin America automotive lead acid battery market share in 2024. In countries like Argentina and Colombia, where affordability remains a key purchasing factor, flooded batteries continue to be the preferred choice for both OEMs and aftermarket consumers. According to the Latin American Automotive Components Association (ALACA), nearly 70% of battery replacements in rural areas involve flooded variants due to their availability and serviceability through local workshops. Additionally, the well-established recycling infrastructure supports the longevity of this segment. The United Nations Environment Programme (UNEP) estimates that over 90% of lead recovered from used flooded batteries in Brazil and Mexico is reused in new battery production, reinforcing economic viability and sustainability.

The Valve Regulated Lead Acid (VRLA) batteries are likely to grow with a CAGR of 5.8% in the coming years. VRLA batteries, including AGM (Absorbent Glass Mat) and gel variants, offer superior performance in high-electrical-demand applications, making them ideal for modern cars equipped with advanced electronics and energy recovery systems. Furthermore, urbanization and rising disposable incomes have boosted consumer preference for higher-quality, longer-lasting alternatives. In a survey conducted by NielsenIQ in late 2023, 51% of surveyed car owners in Santiago and São Paulo indicated a willingness to pay a premium for VRLA batteries due to perceived reliability and reduced maintenance needs.

By End Use Insights

The passenger cars segment held 54.3% of the Latin America automotive lead acid battery market share in 2024. According to the International Organization of Motor Vehicle Manufacturers (OICA), Latin America had over 70 million registered passenger cars in 2023, with Brazil and Mexico accounting for nearly two-thirds of this figure. These vehicles predominantly run on traditional internal combustion engines, necessitating the use of lead-acid batteries for ignition and electrical functions. Urban congestion and frequent short-distance travel also accelerate battery degradation, leading to higher turnover rates. With millions of vehicles on the road and a strong aftermarket presence, passenger cars remain the cornerstone of the Latin American automotive lead-acid battery market.

The light and heavy commercial vehicles segment is likely to experience a significant CAGR of 6.1% in the coming years. According to the Inter-American Development Bank (IDB), freight and logistics activity in Latin America grew by nearly 14% between 2020 and 2023, directly influencing demand for commercial vehicles. In Brazil alone, truck and van registrations rose by 11% in 2023, as noted by ANFAVEA (Brazilian Association of Vehicle Manufacturers), boosting battery consumption. Moreover, government initiatives promoting regional trade corridors and cold chain transportation have spurred investment in commercial fleets, further strengthening the need for durable and high-capacity lead-acid batteries. As supply chain expansion continues and urban mobility services grow, commercial vehicles are expected to drive significant demand for lead-acid batteries in Latin America.

COUNTRY-LEVEL ANALYSIS

Brazil was the top performer of the Latin American automotive lead acid battery market with 36.3% of the share in 2024. Brazil has one of the largest automotive fleets in the region, with over 90 million registered vehicles. According to IBAMA, the Brazilian environmental agency, nearly 88% of these vehicles operate on internal combustion engines by ensuring sustained reliance on lead acid battery technology. São Paulo and Belo Horizonte serve as primary production hubs, where integrated supply chains ensure efficient manufacturing and distribution. Moreover, Brazil’s formalized battery recycling system, regulated under national environmental laws, enhances sustainability and resource recovery, supporting long-term market stability.

Mexico was positioned second by capturing 28.6% of the Latin American automotive lead acid battery market share in 2024. Mexico is home to numerous global automotive component suppliers and battery producers, including Exide Technologies and Johnson Controls, which leverage low-cost labor and established industrial clusters to support both OEM and aftermarket demand. According to the Mexican Automotive Industry Association (AMIA), over 3 million vehicles were produced in the country in 2023, each requiring a lead-acid battery for ignition and onboard electronics.

Argentina is showcasing steady growth opportunities for the Latin American automotive lead-acid battery market during the forecast period. Buenos Aires and Córdoba serve as primary centers of battery production and consumption, where companies like Bolder Technologies and local manufacturer Exide Argentina operate production units to meet domestic needs. Supermarkets and independent auto parts retailers play a crucial role in distributing replacement batteries, catering to budget-conscious consumers who prioritize affordability and availability. Additionally, Argentina’s agricultural sector, which accounts for nearly 10% of GDP, continues to utilize lead-acid batteries in tractors and farm machinery, ensuring consistent demand beyond the automotive sector.

Chile's automotive lead acid battery market is growing at a faster rate with a developed transportation infrastructure and relatively high vehicle ownership rate, supporting consistent demand, despite regulatory efforts aimed at promoting cleaner energy sources. Santiago and Valparaíso remain the main centers of battery consumption, where commercial fleets and public transport systems rely heavily on lead-acid technology for daily operations. According to the National Institute of Statistics (INE), Chilean vehicle registrations exceeded 5 million in 2023, with over 90% of these vehicles operating on ICE platforms.

KEY MARKET PLAYERS

C&D Technologies, Inc., CSB Battery Co., Ltd., Hitachi Chemical Energy Technology Co. Ltd., East Penn Manufacturing Company, Enersys Inc., Exide Industries Ltd, Exide Technologies Inc., GS Yuasa Corporation, Johnson Controls Inc., Moura Accumulators SA (Brazil), are the market players that are dominating the Latin America automotive lead acid batteries market.

Top Players in the Market

Exide Technologies

Exide Technologies is a leading global manufacturer of lead-acid batteries, with a strong presence across Latin America. The company serves both OEM and aftermarket segments, supplying reliable and cost-effective battery solutions tailored to regional automotive needs. Exide’s extensive distribution network ensures accessibility across multiple countries, reinforcing its brand trust among consumers and fleet operators. Its contributions to innovation in battery technology and sustainable recycling practices have positioned it as a key player not only in Latin America but also on the global stage.

Johnson Controls International (JCI)

Johnson Controls International plays a significant role in the Latin American automotive lead-acid battery market through its well-established brand, Optima Batteries. JCI leverages advanced manufacturing capabilities and a deep understanding of vehicle electrification trends to maintain relevance in evolving mobility landscapes. The company's emphasis on high-performance AGM and enhanced flooded batteries supports its dominant position in premium battery applications, making it a major contributor to both regional and international markets.

Moura Industria e Comércio S.A.

Moura is one of Brazil’s most prominent battery manufacturers and a dominant force in the Latin American automotive lead-acid battery sector. With decades of experience, Moura has built a reputation for producing durable, high-quality SLI and industrial batteries that cater to diverse transportation and energy storage applications. As a regional leader, Moura contributes significantly to local economic development while maintaining a competitive edge through continuous product refinement and environmental stewardship initiatives.

Top Strategies Used By Key Market Participants

One of the primary strategies employed by key players in the Latin American automotive lead-acid battery market is localized production and supply chain optimization, where companies establish or expand manufacturing facilities within the region to reduce costs, improve delivery times, and comply with local regulations. This approach allows firms to better serve domestic automakers and aftermarket distributors without relying heavily on imports.

Another crucial tactic involves product differentiation and technological advancement, including the introduction of enhanced flooded batteries (EFB) and absorbed glass mat (AGM) technologies tailored for modern vehicles with start-stop systems. Companies are investing in R&D to develop longer-lasting, maintenance-free, and environmentally compliant battery variants that align with evolving consumer expectations and regulatory requirements.

Lastly, strategic partnerships and after-sales service enhancement have become essential tools for building brand loyalty and ensuring customer retention. Leading manufacturers are collaborating with automotive dealerships, independent repair shops, and logistics providers to streamline distribution networks and offer extended warranties, technical support, and certified recycling programs that reinforce consumer confidence in their products.

COMPETITIVE OVERVIEW

The Latin American automotive lead acid battery market is highly competitive, shaped by the presence of both multinational corporations and well-established regional manufacturers. This dynamic environment fosters continuous innovation, aggressive branding, and strategic expansion initiatives aimed at capturing a larger share of the replacement and original equipment segments. Global players such as Exide, Johnson Controls, and Bolder Technologies leverage economies of scale, advanced production capabilities, and extensive distribution networks to maintain dominance, while local brands capitalize on proximity to raw materials and consumer familiarity to offer cost-competitive alternatives.

Competition extends beyond pricing, with companies differentiating themselves through product quality, warranty periods, and alignment with sustainability goals. The market also experiences frequent product launches and reformulations designed to meet shifting consumer expectations around durability, performance, and responsible disposal. Additionally, the rise of micro-hybrids and commercial vehicles has intensified the need for manufacturers to innovate and adapt to new technological demands.

With increasing urbanization and rising disposable incomes, demand for automotive batteries continues to grow, prompting companies to invest in capacity expansion, localized marketing efforts, and improved recycling infrastructure. In this evolving landscape, adaptability and responsiveness to market dynamics remain critical success factors.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Exide Technologies launched a new line of high-cycle flooded batteries in Brazil, targeting commercial vehicle operators and offering extended durability under demanding conditions.

- In March 2024, Johnson Controls expanded its distribution network in Mexico, partnering with national auto parts retailers to increase accessibility and availability of its OPTIMA AGM battery range.

- In June 2024, Moura Industria opened a new battery recycling facility in Minas Gerais, aiming to enhance environmental compliance and ensure a stable supply of raw materials for future production cycles.

- In September 2024, Bolder Technologies introduced an exclusive digital platform in Argentina that connects directly with independent workshops to streamline battery replacements and improve after-sales support.

- In December 2024, East Penn Manufacturing entered into a joint venture with a Chilean logistics firm to strengthen its cold chain and spare parts delivery system, enhancing operational efficiency across South America.

MARKET SEGMENTATION

This research report on the Latin American automotive lead acid battery market is segmented and sub-segmented into the following categories.

By Product

- SLI Batteries

- Micro Hybrid Batteries

By Type

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

By Application

- Passenger Car

- LCVs/HCVs

- Two-Wheeler

- Three Wheels

By Country

- Brazil

- Argentina

- Chile

- Mexico

- Colombia

Frequently Asked Questions

What’s driving the demand for lead acid batteries in Latin America?

The rise of automotive production, renewable energy integration, and off-grid power needs—especially in countries like Brazil, Mexico, and Argentina—is fueling demand for reliable energy storage.

Which sectors are the largest consumers of lead acid batteries in the region?

Automotive (start-stop and SLI batteries) dominates, followed by telecom, industrial backup, and solar energy systems in rural and semi-urban areas.

How does battery recycling impact the market structure in Latin America?

Latin America has a growing informal recycling sector, especially in countries like Peru and Bolivia. However, stricter environmental laws in Brazil and Chile are promoting formal recycling ecosystems and driving demand for eco-friendly battery designs.

What challenges affect the lead acid battery supply chain in the region?

Volatile lead prices, import dependency for components, and limited domestic manufacturing capacity pose challenges, pushing for local production investments and supply diversification.

How are innovations influencing lead acid battery use in Latin America?

Enhanced flooded batteries (EFBs) and valve-regulated lead-acid (VRLA) technologies are being adopted in urban centers and by fleet operators to improve performance and reduce maintenance needs.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com