Latin America Insulin Delivery Devices Market Size, Share, Trends & Growth Forecast Report By Type, Application, Country (Mexico, Brazil, Chile, Argentina and Rest of the Latin America), Industry Analysis From 2025 to 2033

Latin America Insulin Delivery Devices Market Size

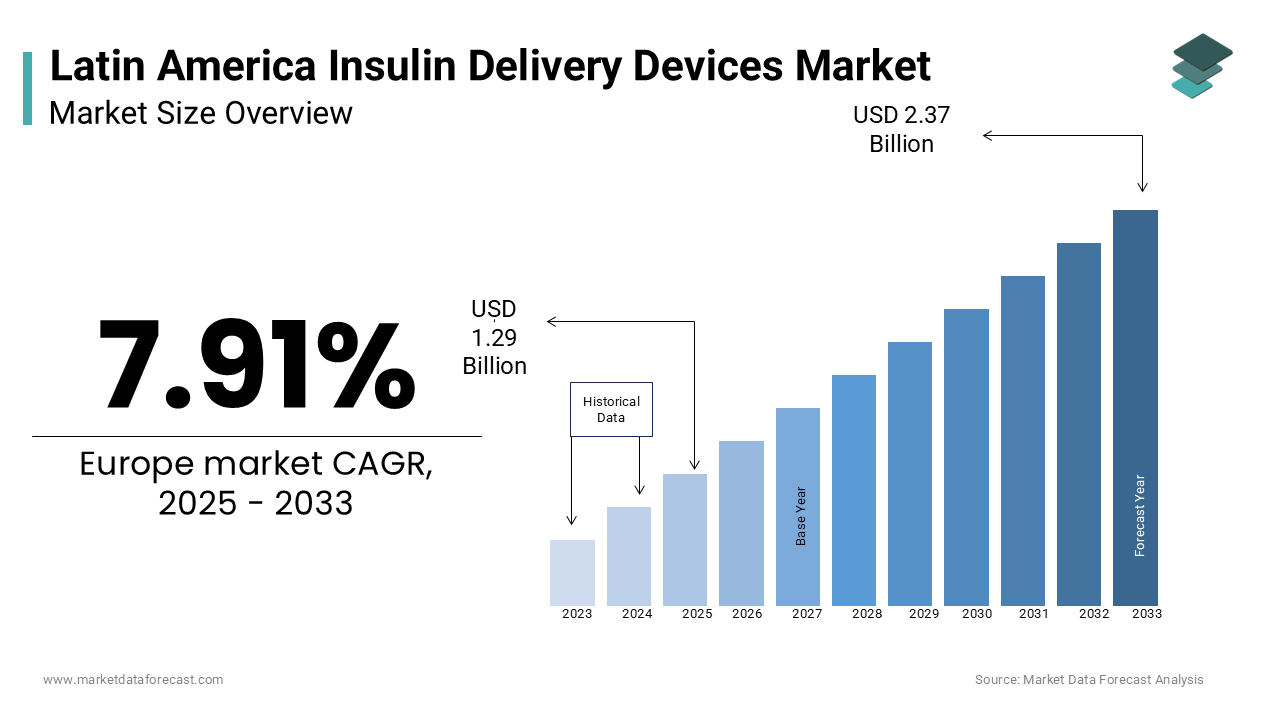

The insulin delivery devices market size in Latin America was valued at USD 1.2 billion in 2024. The Latin American market is estimated to grow at a CAGR of 7.91% from 2025 to 2033 and be worth USD 2.7 billion by 2033 from USD 1.29 billion in 2025.

MARKET DRIVERS

The growing number of people diagnosed with diabetes across Latin America is one of the major factors propelling the insulin delivery devices market in Latin America. Insulin maintains sugar levels in the blood and is essential for people who have type I diabetes & type II diabetes. Therefore, the development of insulin-delivery devices has been encouraged in the past years. These devices deliver insulin doses via the parenteral route rather than the oral route of administration. Insulin delivery devices promote the absorption rate of insulin into the bloodstream from the injection site to execute immediate pharmacological action of insulin. Some majorly used insulin delivery devices include insulin syringes, insulin pens, insulin pen needles, insulin pumps, and insulin jet injectors. Among the countries of the Latin American region, Brazil has the highest number of diabetes cases among adults. An estimated 15 million adults suffer from either type-1 diabetes or type-2 disorder. Diabetes is caused mainly due to obesity and adopting an unhealthy lifestyle. In addition, due to the high sugar content in daily food intake, there is a rising possibility of increased glucose levels in the blood. Diabetic cases can be seen in children of all ages. As a result, most people are using insulin delivery devices, which is driving the demand for these medical devices.

In addition, the growing number of obese people, the rising focus of manufacturers on emerging markets such as Latin American countries, increasing demand for advanced technologies in diabetes therapy, increasing adoption of people towards quality healthcare, and rising public & private organizations' involvement to aware the people about new technologies for diabetes solutions are driving the growth of insulin delivery devices market in Latin America.

Furthermore, the rising adoption of technological advancements to manufacture more advanced insulin delivery devices and the increasing number of product launches favor the Latin American market growth. The growing focus of key market players on manufacturing different types of pens, syringes, and smart insulin devices, which help insulin patients to manage their glucose levels. They manufacture the device at an affordable price and make them pain-free during administration. In addition, increasing use of wearable, patient monitoring, and point-of-care devices for diabetes drives the market forward. Glucose monitoring devices are the most used device to note glucose levels at home without needing a medical professional.

MARKET RESTRAINTS

However, the low adoption of diabetic care devices (such as insulin delivery devices) and the high cost of product manufacturing are restraining the growth of the insulin delivery devices market in Latin America. In addition, the availability of oral insulin drugs is one of the major factors hampering the market growth in Latin America. People who are fearful of having injections prefer to have oral medication for managing the glucose levels in the body. In addition, the high cost of insulin delivery devices, low supply of insulin delivery devices in some regions, lack of awareness of the devices, and long time for device approvals are other factors restraining the market growth.

REGIONAL ANALYSIS

The Latin American insulin delivery devices market is expected to grow at a promising CAGR during the forecast period. The insulin market devices are at the growing stages. The market growth is attributed to an enormous patient pool in this region. Diabetes affects many people, especially those whose pancreas does not produce enough insulin as required by the body. Therefore, 29.6 million individuals in Latin America were diagnosed with diabetes in 2018, and the figure is expected to rise to 48.8 million by 2040. The market growth in Latin America is also driven by the growing aging population and increasing healthcare expenditure. Older people are more prone to the risk of hypoglycemia and other dosing errors during insulin intake. High dosage or low dosage of insulin may result in mortality. As a result, insulin pen devices are preferred due to being straightforward, accurate, and safe to provide insulin to older adults without any side effects. Older people use prefilled syringes as insulin delivery devices to reduce the error in taking the dosage. These prefilled syringes help people with memory loss, eye-vision problems, etc.

The insulin delivery devices market in Brazil is anticipated to hold a significant share of the Latin American market during the forecast period owing to the growing patient diabetic population. The increasing adoption of various insulin delivery devices for diabetic patients drives market growth in Brazil. In addition, the rising number of awareness programs regarding the availability and usage of insulin delivery devices for diabetic patients boosts regional market growth. The growing number of awareness programs helps to understand the factors for high glucose levels and when to take insulin as a treatment. It also helps explain the importance of having regular check-ups of glucose levels in the body for every age group. The factors mentioned above are expected to aid the insulin delivery devices market in Latin America.

Mexico is another lucrative regional market in Latin America and is expected to hold a considerable share of the Latin American market during the forecast period. The increase in the diabetic population is influencing the demand for insulin delivery devices; therefore, the device market is estimated to grow significantly during the forecast period. According to a recent national health survey, the incidence of self-reported diabetes in Mexico is 1.2%. Moreover, the increasing investments in developing new technologies & devices, growing awareness, and improved diagnostic and treatment rates are expected to encourage market growth.

During the forecast period, the market in Argentina is expected to showcase a healthy CAGR in the coming years owing to the presence of advanced glucose monitoring devices that pump insulin automatically by checking the glucose levels in the body. These devices are connected to the software in the mobile phone through Bluetooth and have a feature like an alarm for when the sugar level is too high and needs the doctor's consultation. In addition, type 1 diabetes mellitus is the most common type of diabetes seen in many people, which demands market growth in this region.

KEY MARKET PLAYERS

Companies playing a noteworthy role in the Latin American insulin delivery devices market profiled in this report are Becton, Dickinson, and Company (U.S.), Sanofi (France), Novo Nordisk A/S (Denmark), Julphar (U.A.E.), Eli Lilly and Company (U.S.), Biocon Ltd. (India), Ypsomed AG (Switzerland), Wockhardt Ltd. (India), B. Braun Meselgen AG (Switzerland) and Biodel Inc. (U.S.).

MARKET SEGMENTATION

This research report on the Latin American insulin delivery devices market has been segmented and sub-segmented into the following categories:

By Type

- Insulin Syringes

- Insulin Pens

- Insulin Pen Needles

- Insulin Pumps

- Insulin Jet Injectors

By Application

- Type I Diabetes

- Type II Diabetes

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com