Latin America Vaccine Adjuvant Market Size, Share, Trends & Growth Forecast Report By Type (Aluminum Salts, Tensoactive Adjuvants, Adjuvant Emulsions, Bacteria Derived Adjuvants, Liposome Adjuvants, Carbohydrate Adjuvants), Route Of Administration, Mechanism Of Action and Country (Mexico, Brazil, Argentina, Chile and Rest of Latin America), Industry Analysis From 2025 to 2033

Latin America Vaccine Adjuvant Market Size

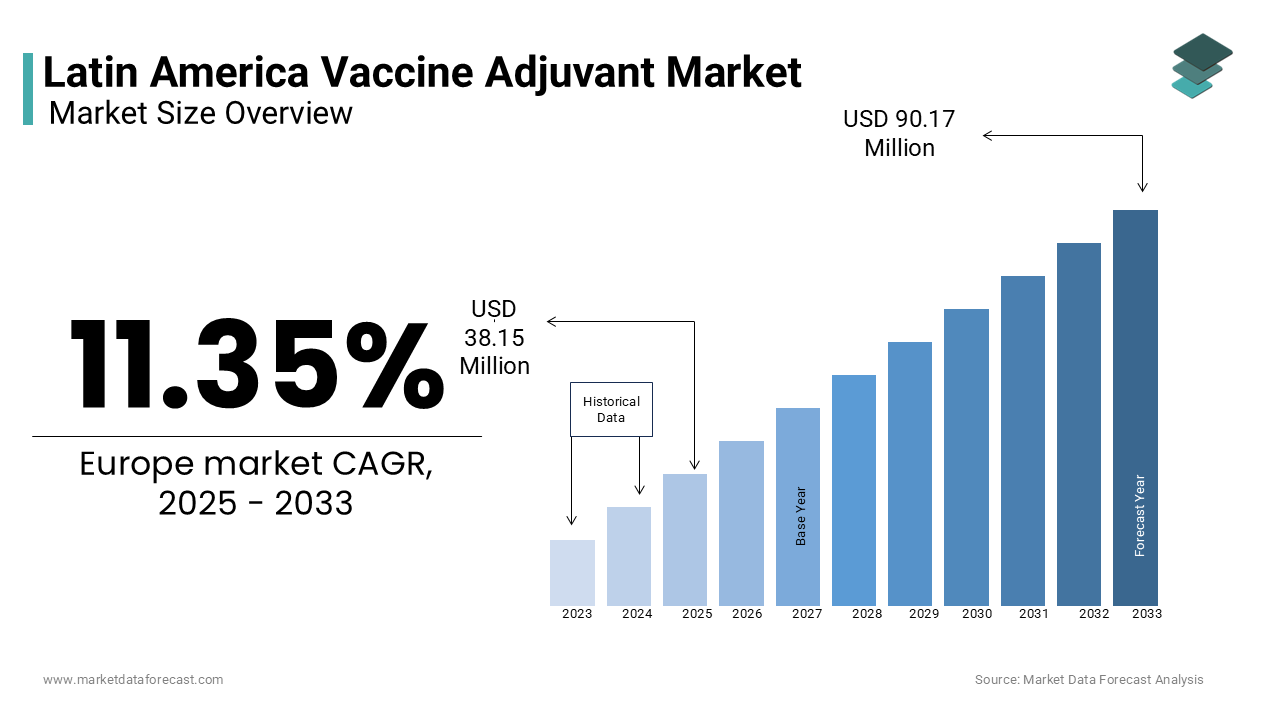

The Latin America Vaccine Adjuvant Market size was valued at USD 34.26 million in 2024. The vaccine adjuvant market in Latin America is expected to grow at a CAGR of 11.35% from 2025 to 2033 and be worth USD 90.17 million by 2033 from USD 38.15 million in 2025.

The vaccine adjuvants are important components in modern vaccine formulations, particularly for diseases such as influenza, HPV, diphtheria-tetanus-pertussis (DTP), and more recently, emerging infectious diseases like COVID-19. According to the Pan American Health Organization (PAHO), vaccination programs across Latin America have expanded significantly over the past decade, with national immunization schedules incorporating increasingly complex and multi-component vaccines that rely on adjuvants for optimal performance. As per the World Health Organization (WHO), approximately 80% of children in the region now receive basic vaccinations, up from 65% two decades ago, reflecting growing public health investment and infrastructure development.

MARKET DRIVERS

Expansion of National Immunization Programs

One of the primary drivers of the Latin America Vaccine Adjuvant Market is the ongoing expansion of national immunization programs across the region, which has significantly boosted vaccine procurement and administration volumes. Governments in countries such as Brazil, Mexico, Colombia, and Argentina have prioritized preventive healthcare strategies, leading to broader inclusion of adjuvant-dependent vaccines in routine immunization schedules. As per the Pan American Health Organization (PAHO), over 35 million doses of adjuvanted vaccines were distributed across Latin America in 2023, covering diseases like pneumococcal infections, hepatitis B, and human papillomavirus (HPV).

Rise in Infectious Disease Outbreaks and Pandemic Preparedness Initiatives

Another significant driver influencing the Latin America Vaccine Adjuvant Market is the increasing frequency of infectious disease outbreaks and the subsequent focus on pandemic preparedness initiatives. According to the World Health Organization (WHO), Latin America accounted for nearly 25% of global vaccine-preventable disease cases between 2020 and 2023, which is prompting governments and health agencies to invest in next-generation vaccine technologies. In response, several countries have initiated domestic vaccine production projects that integrate adjuvant technologies. For example, Argentina’s Ministry of Science and Technology collaborated with biotech firm Sinergium Biotech to develop an adjuvanted recombinant protein-based vaccine platform aimed at enhancing regional self-sufficiency. Meanwhile, Brazil's Butantan Institute incorporated adjuvant-enhanced formulations in its domestic vaccine pipeline, aligning with international standards for immunological potency.

MARKET RESTRAINTS

Limited Domestic Manufacturing Capabilities for Advanced Adjuvants

A major restraint affecting the Latin America Vaccine Adjuvant Market is the limited domestic manufacturing capacity for advanced adjuvant technologies within the region. According to the Inter-American Development Bank (IDB), only three countries in Latin America currently possess the technical infrastructure to produce basic aluminum hydroxide adjuvants, while no indigenous facilities exist for manufacturing next-generation adjuvants. This dependency creates supply chain vulnerabilities and increases costs for local vaccine manufacturers who must import these critical components. In Brazil, despite having one of the most developed vaccine ecosystems in the region, the Butantan Institute and Fiocruz continue to source key adjuvants from foreign suppliers such as SEPPIC (France) and MPL Adjuvants (USA).

Regulatory Hurdles and Lengthy Approval Processes

Stringent regulatory frameworks and prolonged approval timelines for adjuvant-containing vaccines present another significant barrier to the growth of the Latin America Vaccine Adjuvant Market. Unlike conventional vaccines, formulations containing novel or enhanced adjuvants require extensive preclinical and clinical evaluation to ensure safety, efficacy, and immunogenicity, often delaying market entry.

According to the Pan American Health Organization (PAHO), the average regulatory review period for adjuvanted vaccines in Latin America exceeds 18 months, compared to 10–12 months in high-income countries with more streamlined processes. This delay discourages both local and international manufacturers from launching new products in the region, limiting patient access and stifling innovation.

In Argentina, ANMAT (Administración Nacional de Medicamentos) has maintained rigorous testing protocols for imported adjuvants, resulting in extended time-to-market for updated vaccine formulations. Similarly, in Colombia, INVIMA (National Institute of Food and Drug Surveillance) requires additional post-marketing surveillance studies for adjuvant-based vaccines, adding complexity and cost to commercialization efforts.

MARKET OPPORTUNITIES

Increasing Investment in Local Vaccine Production Capacity

An emerging opportunity in the Latin America Vaccine Adjuvant Market lies in the growing government and private sector investments aimed at strengthening local vaccine production capabilities. Recognizing the strategic importance of self-reliance in immunization programs, several countries have launched initiatives to develop domestic manufacturing infrastructure for vaccines including adjuvant integration as part of broader biosecurity and health sovereignty goals. Similarly, in Argentina, the Ministry of Science and Technology collaborated with local biotech firms to create a pilot plant capable of producing oil-in-water emulsions an essential component of several modern vaccines. Additionally, Mexico’s National Institute of Public Health has initiated feasibility studies for integrating adjuvant production into existing vaccine manufacturing hubs, such as those operated by Laboratorios Liomont and Birmex.

Adoption of Novel Adjuvant Platforms in Next-Generation Vaccines

Another significant opportunity in the Latin America Vaccine Adjuvant Market is the increasing adoption of novel adjuvant platforms in next-generation vaccines targeting both communicable and non-communicable diseases. As scientific understanding of immunology advances, there is growing interest in leveraging innovative adjuvants such as toll-like receptor agonists, ISCOMATRIX, and mRNA-based delivery systems to enhance vaccine effectiveness and broaden protective immunity.

According to the Pan American Health Organization (PAHO), several Latin American countries have begun exploring partnerships with global biotech firms to evaluate and implement cutting-edge adjuvant technologies for oncology vaccines, therapeutic immunotherapies, and future pandemic responses. In Brazil, the Butantan Institute has entered discussions with European pharmaceutical companies to co-develop adjuvant-adapted cancer vaccines tailored for the region’s population.

Additionally, academic institutions such as Argentina’s Institute of Biotechnology (INBIOTEC) are conducting clinical trials on plant-based adjuvants derived from saponins, offering potential alternatives to traditional aluminum salts. In Chile, the Universidad de Chile is researching liposomal adjuvants for tuberculosis vaccine enhancement, supported by funding from the country’s National Commission for Scientific and Technological Research (CONICYT).

MARKET CHALLENGES

High Cost of Advanced Adjuvant Technologies

A pressing challenge confronting the Latin America Vaccine Adjuvant Market is the high cost associated with advanced adjuvant technologies, which limits their widespread adoption in public health programs. Unlike conventional aluminum-based adjuvants, newer formulations such as squalene-in-water emulsions, toll-like receptor agonists, and nanoparticle-based systems involve complex manufacturing processes and stringent regulatory compliance, which contributes to higher pricing structures.

According to the World Health Organization (WHO), advanced adjuvants can increase the overall production cost of a vaccine by 30–50%, making them less accessible for budget-constrained national immunization programs. In countries such as Peru and Ecuador, where public health spending remains limited, this financial burden results in slower uptake of adjuvant-enhanced vaccines, especially when compared to lower-cost, conventional alternatives.

In Brazil, despite the presence of a strong domestic vaccine industry, the Butantan Institute noted that acquiring patented adjuvant technologies from multinational corporations involves costly licensing agreements and technology transfer fees.

Lack of Technical Expertise and Skilled Workforce

A fundamental challenge impacting the Latin America Vaccine Adjuvant Market is the shortage of specialized technical expertise and trained personnel required to develop, manufacture, and regulate advanced adjuvant-based vaccines. According to the Pan American Health Organization (PAHO), only a handful of universities and research institutions in Latin America offer comprehensive training programs in adjuvant science and vaccine formulation, which is limiting the pipeline of qualified professionals. In Argentina, the National Council for Scientific and Technical Research (CONICET) reported that fewer than 200 researchers nationwide specialize in immunomodulatory agents, hindering domestic innovation capacity. In Brazil, despite hosting some of the region’s most advanced vaccine production centers, Fiocruz acknowledged difficulties in recruiting specialists with experience in lipid-based adjuvant systems, forcing reliance on external consultants and international collaborations. Similarly, in Colombia, the National Institute of Health (INS) cited a lack of internal expertise in adjuvant stability testing and toxicological profiling, slowing down regulatory approvals.

SEGMENTAL ANALYSIS

By Type Insights

The aluminum salts segment accounted in holding 46.5% of the Latin America Vaccine Adjuvant Market share in 2024. One key driver behind this segment's leadership is the widespread incorporation of aluminum salts in national vaccination campaigns, particularly for diseases like diphtheria-tetanus-pertussis (DTP), hepatitis B, and pneumococcal infections. According to the Pan American Health Organization (PAHO), over 85% of pediatric vaccines distributed through the Revolving Fund contain aluminum-based adjuvants, which makes them the most utilized class across the region.

The adjuvant emulsions segment is projected to register a CAGR of 10.3% from 2025 to 2033. A key growth driver is the integration of emulsion-based adjuvants into newer vaccine formulations requiring enhanced immune stimulation and dose-sparing effects, especially during outbreaks and supply shortages. According to the World Health Organization (WHO), several Latin American countries have started procuring adjuvanted influenza vaccines containing squalene-based emulsions to improve protection among high-risk populations, including the elderly and those with comorbidities. Additionally, the expansion of domestic vaccine manufacturing capabilities in Brazil and Argentina has led to increased investment in emulsion technology. The Butantan Institute and ANLIS-Malbrán have both initiated pilot projects for the local production of adjuvant emulsions, supported by funding from national science councils.

By Route of Administration Insights

The intramuscular route of administration dominated the Latin America Vaccine Adjuvant Market by capturing 42.3% of the share in 2024. One major driver behind this dominance is the standardization of intramuscular injection protocols in national immunization schedules for combination vaccines such as DTP, hepatitis B, and pneumococcal conjugates. Another significant factor is the compatibility of intramuscular delivery with commonly used adjuvants like aluminum salts and emulsions, which enhance antigen presentation without requiring specialized delivery devices. In Brazil, the Ministry of Health reported that more than 75% of annual vaccine doses distributed through the National Immunization Program utilize intramuscular administration, ensuring consistent demand for compatible adjuvant formulations.

The subcutaneous route of administration segment is likely to grow with an estimated CAGR of 9.7% in the next coming years due to the increasing use of subcutaneously administered vaccines for diseases such as yellow fever, measles-mumps-rubella (MMR), and certain rabies vaccines, which benefit from localized immune activation and reduced reactogenicity. Another major factor is the development of novel subunit and protein-based vaccines requiring adjuvant-enhanced immunogenicity without the need for deep muscle penetration, aligning with patient comfort and logistical efficiency. In Argentina, the National Administration of Drugs, Foods and Medical Devices (ANMAT) approved several new subcutaneously administered vaccines in 2024, supporting further adoption.

REGIONAL ANALYSIS

Brazil Vaccine Adjuvant Market Insights

Brazil was the top performer with 38.2% of the Latin America Vaccine Adjuvant Market share in 2024. A key growth driver is the presence of major domestic vaccine producers such as Fiocruz and the Butantan Institute, which play a crucial role in supplying adjuvant-containing vaccines for national immunization campaigns. According to the Ministry of Health, over 80 million doses of DTP-HepB-Hib and pneumococcal conjugate vaccines were administered in 2024, all of which incorporate aluminum-based or emulsion-type adjuvants. Additionally, Brazil has been investing in local adjuvant formulation research, with institutions like ANVISA and the Carlos Chagas Institute developing capabilities in squalene-based emulsions and toll-like receptor agonists. These initiatives aim to reduce dependency on imported components while enhancing vaccine efficacy.

Mexico Vaccine Adjuvant Market Insights

Mexico was positioned second with 12.3% of the Latin America Vaccine Adjuvant Market share in 2024. A major growth factor is the expansion of Mexico’s domestic vaccine production capacity, particularly through institutions like Laboratorios Liomont and Birmex, which have integrated adjuvant technologies into their product pipelines. According to the Secretariat of Health, Mexico procured over 40 million doses of adjuvanted vaccines in 2024, including human papillomavirus (HPV) and hepatitis B vaccines, many of which rely on aluminum hydroxide formulations.

Additionally, the government’s focus on strengthening pandemic preparedness has led to increased collaboration with global pharmaceutical companies to develop locally adapted vaccines incorporating modern adjuvant platforms. The National Institute of Public Health (INSP) has also initiated feasibility studies for indigenous adjuvant development, aiming to enhance self-sufficiency.

Argentina Vaccine Adjuvant Market Insights

Argentina Vaccine Adjuvant Market is likely to grow with prominent growth opportunities in the next coming years. A key growth driver is the national push toward vaccine self-reliance, exemplified by collaborations between the Ministry of Science and local biotech firms such as Sinergium Biotech and ViroVax. Another major factor is the expansion of PAHO-supported vaccine procurement mechanisms, allowing Argentina to access high-quality adjuvant-containing vaccines at favorable pricing. The Ministry of Health also reported a 15% increase in adjuvanted HPV vaccine distribution in 2024, which is targeting improved cervical cancer prevention rates.

Chile Vaccine Adjuvant Market Insights

Chile vaccine adjuvant market growth is likely to have a prominent CAGR with the presence of high immunization coverage, proactive health policies, and integration of advanced vaccine formulations contributing to its rising influence in the region. Additionally, the expansion of clinical research initiatives involving novel adjuvant systems is gaining traction, supported by academic institutions like the Universidad de Chile and the Pontifical Catholic University of Chile.

Colombia Adjuvant Market Insights

Colombia vaccine adjuvant market growth is driven by the improving healthcare infrastructure and expanding immunization coverage are driving steady growth in demand for adjuvant-containing vaccines. Another significant factor is the increasing focus on disease prevention and outbreak preparedness, with Colombia actively participating in regional vaccine stockpiling initiatives led by PAHO. The Colombian Ministry of Health also noted a 12% rise in adjuvanted flu vaccine usage in 2024, reflecting heightened awareness of the benefits of enhanced immune response.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Latin American vaccine adjuvant market profiled in this report are MPV Technologies, Avanti Polar Lipids, Novavax Inc., Brenntag Biosector, SEPPIC, Agenus, Inc., Invivogen, SPI Pharma, Inc., CSL Limited, and OZ Biosciences.

The competition in the Latin American vaccine adjuvant market is shaped by a mix of global pharmaceutical giants, regional vaccine manufacturers, and emerging biotech firms striving to expand their influence. While multinational corporations dominate due to their advanced technologies and established regulatory footprints, domestic producers are increasingly leveraging public-private partnerships and localized production capabilities to gain traction. The market landscape is further influenced by government-led immunization strategies, procurement mechanisms such as PAHO’s Revolving Fund, and growing emphasis on health security and pandemic preparedness.

Competition revolves around not only product efficacy and safety but also cost-efficiency, regulatory agility, and adaptability to regional epidemiological needs. As demand for next-generation vaccines rises, players are focusing on strengthening supply chains, improving adjuvant formulation know-how, and engaging in knowledge-sharing initiatives to overcome technological and logistical barriers. The evolving dynamics reflect a shift toward greater regional collaboration and self-sufficiency, with stakeholders positioning themselves to meet increasing demand for immunization solutions that incorporate cutting-edge adjuvant technologies.

Top Players in the Latin America Vaccine Adjuvant Market

GlaxoSmithKline (GSK)

GlaxoSmithKline plays a pivotal role in the Latin America Vaccine Adjuvant Market through its proprietary ASO adjuvant system, which is widely used in vaccines targeting malaria, HPV, and pandemic influenza. GSK's contributions extend beyond the region, influencing global vaccine development by enabling enhanced immune responses with lower antigen content. The company collaborates closely with public health agencies and local manufacturers to support immunization programs across Latin America.

Seqirus (a CSL Company)

Seqirus is a major player in the vaccine adjuvant space, particularly known for its expertise in MF59 oil-in-water emulsion technology used in seasonal and pandemic influenza vaccines. In Latin America, Seqirus supports regional preparedness by supplying adjuvanted flu vaccines tailored to prevalent strains. Its engagement with national health authorities enhances access to high-efficacy vaccines by reinforcing its strategic importance in both regional and global markets.

IDT Biologika

IDT Biologika contributes significantly to the Latin America Vaccine Adjuvant Market through contract manufacturing services and adjuvant formulation expertise. The company provides critical support for vaccine developers seeking to scale up production using well-characterized adjuvant platforms. With a focus on innovation and quality, IDT Biologika strengthens supply chain resilience and facilitates technology transfer initiatives aimed at enhancing regional vaccine self-sufficiency.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the Latin America Vaccine Adjuvant Market is technology transfer and local manufacturing partnerships, enabling regional producers to develop and commercialize adjuvant-containing vaccines with technical support from global innovators. This approach fosters self-reliance and ensures faster response to disease outbreaks.

Another key tactic involves collaborative research and development initiatives with academic institutions and government bodies, aimed at adapting advanced adjuvant platforms to regional disease profiles and healthcare needs. These collaborations enhance scientific capacity and accelerate regulatory approvals for next-generation vaccines.

The expansion of regulatory and distribution networks across multiple Latin American countries by allowing companies to navigate diverse approval processes more efficiently and ensure the timely delivery of adjuvant-based vaccines to public health programs and private healthcare providers.

MARKET SEGMENTATION

This research report on the Latin American vaccine adjuvant market is segmented and sub-segmented into the following categories.

By Type

- Aluminum Salts

- Tensoactive Adjuvants

- Adjuvant Emulsions

- Bacteria Derived Adjuvants

- Liposome Adjuvants

- Carbohydrate Adjuvants

By Route Of Administration

- Oral

- Intradermal

- Subcutaneous

- Intranasal

- Intramuscular

By Mechanism Of Action

- Immuno Stimulants

- Carriers

- Vehicle Adjuvants

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com