Global Lamps Market Size, Share, Trends & Growth Forecast Report By Product (Desk Lamp, Floor Lamp),Type(Reading Lamp, Decorative Lamp), Application (Residential/Retail, Commercial/Hospitality) and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Lamps Market Size

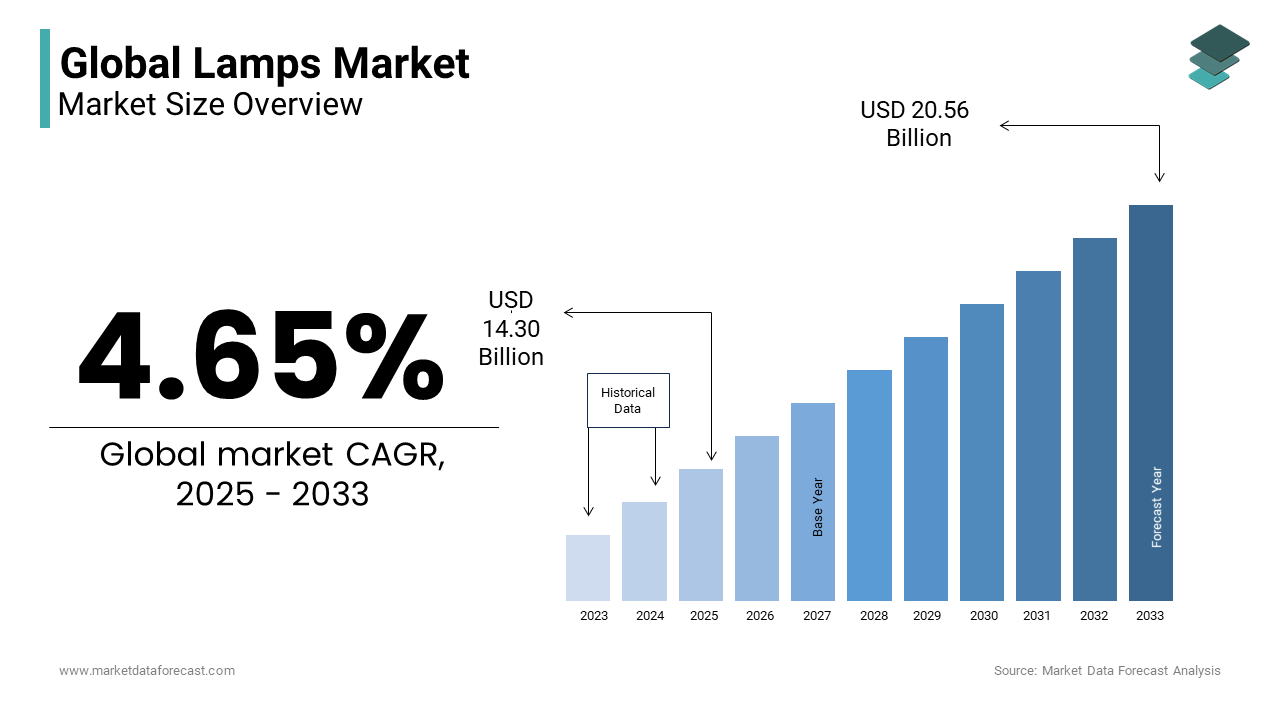

The global lamps market size was valued at USD 13.66 billion in 2024. The lamps market Size is expected to have 4.65 % CAGR from 2025 to 2033 and be worth USD 20.56 billion by 2033 from USD 14.30 billion in 2025.

Lamps are no longer merely utilitarian objects designed to illuminate spaces as they have become integral elements of interior design, energy efficiency initiatives, and smart home ecosystems. The modern lamp market encompasses a wide array of products, ranging from traditional incandescent and halogen lamps to energy-efficient LED lighting solutions and innovative smart lamps equipped with IoT capabilities. This diversification reflects shifting consumer preferences toward eco-consciousness, technological integration, and personalized home environments. According to the International Energy Agency, lighting accounts for approximately 15% of global electricity consumption, underscoring the critical role of lamps in both residential and commercial settings. According to the World Health Organization, inadequate lighting contributes significantly to eye strain and related health issues, emphasizing the importance of proper illumination in workspaces and homes.

In recent years, the rise of remote work has driven demand for task lighting and ambient solutions tailored to home offices. Additionally, urbanization trends reported by the United Nations indicate that over half of the global population resides in cities, creating a heightened need for efficient lighting systems in densely populated areas. As environmental concerns grow, governments worldwide are implementing stricter regulations on energy usage, pushing manufacturers to innovate sustainable designs. According to the U.S. Department of Energy, widespread adoption of LED technology could reduce lighting energy use by nearly 50% by 2035. These factors collectively shape the contemporary lamps market into one that balances practicality, style, and ecological responsibility.

MARKET DRIVERS

Energy Efficiency Regulations and Sustainability Goals

Stringent energy efficiency regulations imposed by governments worldwide are a significant driver of the lamps market. According to the U.S. Department of Energy, the phasing out of inefficient lighting technologies, such as incandescent bulbs, in favor of energy-saving alternatives like LEDs. This regulatory push is aligned with global sustainability goals, including the Paris Agreement, which aims to reduce carbon emissions. According to the International Energy Agency, lighting accounts for about 15% of global electricity consumption, and transitioning to LED technology could cut this figure by nearly half by 2035. According to the European Commission, LEDs consume up to 80% less energy than traditional incandescent bulbs, making them a cornerstone of energy conservation strategies. These policies not only encourage manufacturers to innovate but also incentivize consumers to adopt eco-friendly lighting solutions, thereby propelling market growth.

Smart Home Integration and IoT Advancements

The proliferation of smart home technologies and the Internet of Things (IoT) is another key driver prompting the lamps market. According to the U.S. Census Bureau, over 40% of American households now incorporate smart devices, with smart lighting being one of the most popular categories. Smart lamps, equipped with features like voice control, dimming capabilities, and scheduling, offer enhanced convenience and energy savings. According to the National Institute of Standards and Technology, smart lighting systems can reduce household energy use by up to 30% through automation and adaptive brightness settings. Furthermore, the rise of remote work, as documented by the Bureau of Labor Statistics, has increased demand for customizable lighting solutions that support productivity and well-being. As IoT adoption continues to grow, the integration of lamps into connected ecosystems is expected to drive innovation and consumer interest in advanced lighting technologies.

MARKET RESTRAINTS

High Initial Costs of Advanced Lighting Solutions

The high upfront costs associated with advanced lighting technologies, such as smart lamps and premium LED fixtures, pose a significant restraint to market growth. As per U.S. Department of Energy, while LEDs are more energy-efficient, their initial purchase price can be up to five times higher than traditional incandescent bulbs. This cost barrier often discourages budget-conscious consumers, particularly in developing regions, from adopting these modern solutions. According to the International Labour Organization, economic uncertainties, such as inflationary pressures and fluctuating disposable incomes, further exacerbate affordability concerns. For instance, in 2022, global inflation rates reached multi-decade highs, impacting consumer spending on non-essential upgrades. While long-term savings on energy bills offset the initial investment, many households remain deterred by the immediate financial burden. This pricing challenge limits the widespread adoption of innovative lighting products by restraining market expansion.

Environmental Concerns Over Electronic Waste

The growing issue of electronic waste (e-waste) presents another major restraint for the lamps market. According to the United Nations Environment Programme, global e-waste reached 53.6 million metric tons in 2019, with lighting products contributing significantly due to their electronic components and short lifespans. Many energy-efficient lamps, including LEDs, contain materials like rare earth metals and plastics, which are challenging to recycle. According to the Environmental Protection Agency, only 17% of e-waste is recycled globally, leaving the remainder to accumulate in landfills, where toxic substances can leach into ecosystems. Furthermore, rapid technological advancements lead to frequent product replacements is exacerbating the problem. Manufacturers face increasing pressure to adopt sustainable practices, which can raise production costs and complicate supply chains. These environmental challenges hinder the market’s ability to achieve truly sustainable growth.

MARKET OPPORTUNITIES

Expansion of Smart City Initiatives

The trend toward smart city development presents a significant opportunity for the lamps market. The United Nations projects that by 2050, nearly 70% of the world’s population will reside in urban areas, driving demand for intelligent infrastructure, including smart street lighting. According to the U.S. Department of Transportation, smart streetlights equipped with sensors and IoT capabilities can reduce energy consumption by up to 80% compared to traditional systems. These systems also enable real-time monitoring, predictive maintenance, and integration with other urban services like traffic management and public safety. For instance, as per the European Commission, cities adopting smart lighting solutions have achieved operational cost savings of up to 30%. As governments allocate substantial budgets to urban modernization, the lamps market stands to benefit from large-scale projects aimed at enhancing energy efficiency and sustainability in urban environments.

Rising Focus on Health and Well-being Lighting Solutions

Growing awareness of the impact of lighting on health and well-being is creating new opportunities for innovative lamp designs. According to the World Health Organization, improper lighting can lead to issues such as eye strain, headaches, and disrupted circadian rhythms, prompting demand for human-centric lighting solutions. As per the National Institutes of Health, tunable LED lighting, which adjusts color temperature and brightness throughout the day, can improve sleep quality and productivity by mimicking natural daylight patterns. Furthermore, as per the Centers for Disease Control and Prevention, proper lighting in educational and healthcare facilities enhances learning outcomes and patient recovery rates. With over 60% of U.S. households expressing interest in health-focused home improvements, according to the U.S. Census Bureau, manufacturers have a unique chance to develop specialized lighting products that cater to these evolving consumer priorities, unlocking untapped market potential.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

The lamps market faces significant challenges due to ongoing supply chain disruptions and shortages of critical materials. According to the U.S. Department of Commerce, the global semiconductor shortage, which began during the pandemic, has impacted the production of smart lighting systems reliant on advanced electronic components. Additionally, rare earth metals like gallium and indium, essential for LED manufacturing, are subject to geopolitical tensions and export restrictions, as noted by the International Energy Agency. These factors have led to increased production costs and delays in delivering innovative lighting solutions. According to the Bureau of Labor Statistics, transportation bottlenecks and rising freight costs further exacerbate these issues, with shipping expenses increasing by over 200% during peak disruption periods. Such instability hampers manufacturers' ability to meet growing consumer demand, creating a barrier to consistent market growth.

Regulatory Complexity Across Regions

Navigating the complex web of regional regulations poses another major challenge for the lamps market. The European Commission enforces stringent environmental standards, such as the Restriction of Hazardous Substances (RoHS) directive, which mandates the elimination of harmful materials like lead and mercury from lighting products. Similarly, the U.S. Environmental Protection Agency imposes rigorous energy efficiency benchmarks under programs like ENERGY STAR, requiring manufacturers to invest heavily in compliance testing and certification processes. According to the United Nations Industrial Development Organization, small and medium-sized enterprises often struggle to adapt to these diverse regulatory frameworks, particularly when expanding into international markets. Furthermore, frequent updates to these regulations create uncertainty, forcing companies to continuously innovate or risk non-compliance. This regulatory burden increases operational complexity and limits market accessibility for smaller players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.65 % |

|

Segments Covered |

By Product, Type, Application and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Signify (Philips Lighting),OSRAM GmbH.,Herman Miller Inc.,Inter IKEA B.V. |

SEGMENTAL ANALYSIS

By Product Insights

The desk lamps dominated the lamps market with a significant share of 45.1% in 2024 with their versatility and essential role in task lighting in home offices and educational settings. According to the Bureau of Labor Statistics, over 30% of the U.S. workforce now engages in remote work, driving demand for ergonomic and energy-efficient desk lighting solutions. Desk lamps are also pivotal in reducing eye strain, with the Centers for Disease Control and Prevention emphasizing their importance in preventing vision-related issues during prolonged screen use. Their affordability and adaptability to LED technology further solidify their leadership, making them indispensable in modern households.

The floor lamps segment is esteemed to witness a CAGR of 8.2% during the forecast period. This growth is fueled by rising urbanization and the increasing adoption of multi-functional home decor solutions. According to the United Nations, urban populations are expanding by 2.3% annually with the demand for space-saving lighting options like floor lamps. Additionally, advancements in smart lighting technology have enhanced their appeal. According to the National Institute of Standards and Technology, smart floor lamps with IoT integration can reduce household energy consumption by up to 25%. Their ability to provide ambient and task lighting simultaneously makes them ideal for compact living spaces, further accelerating their adoption.

By Type Insights

The decorative lamps segment was the largest by capturing 43.1% of the lamps market share in 2024 with the dual functionality as both lighting solutions and aesthetic enhancers in residential and commercial spaces. According to the National Association of Home Builders, over 60% of homeowners prioritize decorative elements during interior renovations, driving demand for stylish lamps. Decorative lamps are integral to creating ambiance, particularly in urban apartments where space optimization is crucial. With global urbanization rates rising, as noted by the United Nations, this segment remains pivotal in meeting consumer preferences for visually appealing and versatile lighting options.

The reading lamps segment is more likely to witness a fastest CAGR of 8.5% during the forecast period. This growth is fueled by the increasing prevalence of remote work and online education, which has heightened the need for task-specific lighting. According to the Bureau of Labor Statistics, over 35% of the U.S. workforce now operates remotely with the growing demand for ergonomic and eye-friendly lighting solutions. Also, according to the World Health Organization, improper lighting contributes to eye strain by making adjustable reading lamps essential for health-conscious consumers. Technological advancements, such as USB-charging capabilities and compact designs will further enhance their appeal.

By Application Insights

The Residential/Retail segment dominated the lamps market with significant share in 2024 due to the widespread adoption of energy-efficient LED lighting in households and retail spaces, driven by government incentives and consumer awareness. According to the National Retail Federation, proper lighting enhances product visibility and customer experience by making it crucial for retail environments. As per the International Energy Agency, residential lighting accounts for approximately 10% of global electricity consumption with urbanization increasing housing demand, this segment remains pivotal in shaping market trends.

The Commercial/Hospitality segment is anticipated to achieve a CAGR of 8.2% from 2025 to 2033. This rapid growth is fueled by rising investments in smart building technologies and sustainable infrastructure. According to the Environmental Protection Agency, commercial buildings adopting energy-efficient lighting can reduce operational costs by up to 30%. Furthermore, the World Tourism Organization reports a 5% annual increase in global hospitality sector revenues by driving demand for aesthetically pleasing and functional lighting solutions. Smart lighting systems, which offer automation and energy savings, are particularly popular in hotels and offices. As businesses prioritize sustainability and guest experience, this segment's expansion reflects its critical role in modernizing commercial spaces while addressing environmental goals.

REGIONAL ANALYSIS

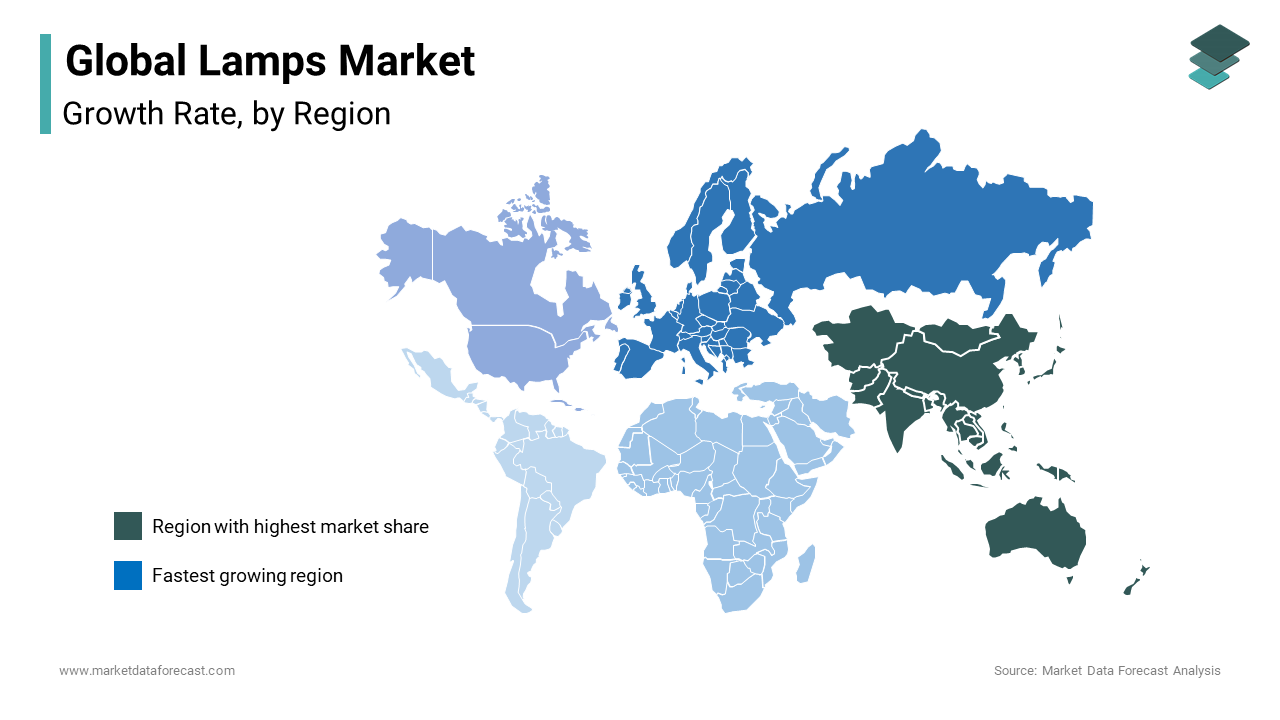

Asia-Pacific led the lamps market in 2024 by capturing 40.1% of the total share. This dominance is driven by rapid urbanization, with the United Nations projecting that 68% of the region's population will reside in cities by 2050. The region's manufacturing hubs, particularly in China and India, contribute significantly to production capacity and technological innovation. According to the U.S. Department of Commerce, energy-efficient lighting adoption in Asia-Pacific is bolstered by government initiatives like India’s UJALA program, which distributed over 370 million LED bulbs. Additionally, rising disposable incomes and infrastructure development further propel demand. As a hub for both production and consumption, Asia-Pacific remains pivotal to the global lamps market.

Europe lamps market is expected to register a CAGR of 8.7% during the forecast period. This rapid growth is driven by stringent energy efficiency regulations and ambitious sustainability goals, such as the European Green Deal, which aims to achieve carbon neutrality by 2050. According to the International Energy Agency, lighting accounts for approximately 12% of Europe’s electricity consumption by prompting governments to incentivize the adoption of LED and smart lighting technologies. Additionally, the rise of smart city initiatives across major European cities, including Berlin and Amsterdam, has accelerated demand for connected lighting systems. According to Eurostat, over 60% of European households now prioritize energy-efficient products, further boosting market expansion.

North America is expected to witness steady growth, supported by smart home integration and energy-saving policies. The U.S. Department of Energy projects a 6% annual increase in LED adoption, driven by consumer awareness and technological advancements. Meanwhile, Asia-Pacific will remain a dominant player due to urbanization and manufacturing hubs, though growth may stabilize compared to previous years. Latin America shows moderate potential, with the Inter-American Development Bank emphasizing renewable energy projects driving lighting demand. In the Middle East and Africa, solar-powered lamps are gaining traction, particularly in remote areas, supported by electrification efforts. Collectively, these regions will contribute to a balanced global market, blending innovation with accessibility.

Top 3 Players in the market

Signify (formerly Philips Lighting)

Signify is a global leader in the lamps market, holding an estimated 12% market share, as per U.S. Department of Energy. The company has pioneered innovations in LED and smart lighting technologies, including its Philips Hue line of smart lamps, which integrate seamlessly with IoT ecosystems. Signify’s commitment to sustainability is evident in its transition to energy-efficient products, with over 80% of its revenue derived from sustainable solutions. The International Energy Agency notes that Signify’s advancements in connected lighting have reduced energy consumption in commercial and residential spaces by up to 30%. By focusing on both functionality and design, Signify continues to shape the future of intelligent and eco-friendly lighting.

OSRAM Licht AG

OSRAM Licht AG is another key player, contributing significantly to the global lamps market through its focus on advanced lighting solutions for automotive, industrial, and consumer applications. According to the European Commission, OSRAM’s innovative laser and LED technologies have positioned it as a leader in high-performance lighting systems. The company plays a pivotal role in promoting energy efficiency, with its products reducing energy use by up to 50% compared to traditional lighting. OSRAM’s acquisition by ams AG has further strengthened its capabilities in smart sensors and digital lighting solutions. Its strong presence in Europe and Asia-Pacific is due to its influence in driving technological advancements and meeting diverse consumer needs globally.

GE Lighting (a Savant Company)

GE Lighting, now part of Savant Systems, remains a prominent player in the lamps market, particularly in North America, where it holds approximately 9% of the market share, as per the U.S. Energy Information Administration. Known for its iconic incandescent bulbs, GE has successfully transitioned to LED and smart lighting solutions, aligning with global energy-saving trends. According to the National Institute of Standards and Technology, GE’s smart lighting products, such as Cync, offer voice control and automation features, appealing to tech-savvy consumers. GE Lighting’s emphasis on affordability and accessibility has made energy-efficient lighting more widely available, particularly in emerging markets. Its legacy of innovation and adaptability ensures its continued relevance in shaping the global lamps market.

Top strategies used by the key market participants

Product Innovation and Technological Advancements

Key players in the lamps market, such as Signify and OSRAM Licht AG, prioritize product innovation to maintain their competitive edge. Signify has heavily invested in smart lighting solutions, including its Philips Hue line, which integrates with IoT platforms for seamless home automation. According to the U.S. Department of Energy, smart lighting systems can reduce energy consumption by up to 30%, making them a critical focus for manufacturers. Similarly, OSRAM has developed advanced LED technologies, such as laser lighting for automotive applications, which enhance both functionality and aesthetics. These innovations not only cater to evolving consumer preferences but also align with global sustainability goals.

Strategic Acquisitions and Partnerships

Acquisitions and partnerships are pivotal strategies adopted by key players to expand their market presence. For instance, GE Lighting’s acquisition by Savant Systems enabled the integration of smart home technologies into its product portfolio, enhancing its appeal in the connected lighting segment. According to the European Commission, OSRAM’s acquisition by ams AG strengthened its capabilities in sensor technology, enabling the development of more sophisticated lighting solutions. Additionally, collaborations with tech companies, such as Signify’s partnership with Amazon Alexa, have allowed players to integrate voice control and AI-driven features into their products, further solidifying their dominance in the market.

Focus on Sustainability and Regulatory Compliance

Sustainability is a cornerstone strategy for leading companies aiming to strengthen their market position. Signify has committed to becoming carbon neutral by 2025, as reported by the International Energy Agency, and focuses on producing eco-friendly lighting solutions. Similarly, OSRAM emphasizes recyclable materials and energy-efficient designs to comply with stringent environmental regulations like the EU’s RoHS directive. The Environmental Protection Agency notes that these efforts resonate with environmentally conscious consumers and governments promoting green initiatives. By aligning their strategies with global energy-saving mandates, these companies not only enhance their brand reputation but also ensure long-term relevance in an increasingly eco-focused market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global lamps market are Signify (Philips Lighting),OSRAM GmbH.,Herman Miller Inc.,Inter IKEA B.V.,Artemide S.p.A.,Pablo Design,Lutron Electronics,Koncept Inc.,OttLite Technologies,Flos S.p.A.

The lamps market is characterized by intense competition, driven by technological advancements, sustainability mandates, and evolving consumer preferences. Key players such as Signify, OSRAM Licht AG, and GE Lighting dominate the market by leveraging their strong brand presence, innovative product portfolios, and global distribution networks to maintain its position. According to the U.S. Department of Energy, these companies are at the forefront of transitioning from traditional lighting solutions to energy-efficient LEDs and smart lighting systems, which now account for a significant share of the market. The competitive landscape is further intensified by the entry of regional manufacturers, particularly in Asia-Pacific, who offer cost-effective alternatives, thereby increasing price pressure on established brands.

In addition to innovation, strategic collaborations and mergers play a crucial role in shaping competition. As per GE Lighting’s acquisition by Savant Systems, growing integration of lighting with smart home ecosystems. Similarly, OSRAM’s partnership with ams AG escalate the importance of sensor technologies in advancing connected lighting solutions. The European Commission notes that regulatory compliance and sustainability initiatives have also become key differentiators, with companies investing heavily in eco-friendly designs to meet stringent environmental standards.

RECENT HAPPENINGS IN THE MARKET

In March 2020, Signify, formerly known as Philips Lighting, acquired Cooper Lighting Solutions for $1.4 billion. This acquisition expanded Signify's presence in the North American market and enriched its portfolio with professional lighting solutions.

In December 2021, ams OSRAM sold Fluence, its horticultural lighting business, to Signify for $272 million. This divestment allowed ams OSRAM to streamline its focus on core technologies while enabling Signify to strengthen its horticultural lighting offerings.

In November 2022, LMPG Inc., the parent company of Lumenpulse, acquired Lumca Inc., a Canadian provider of innovative LED lighting solutions. This acquisition enhanced LMPG’s product offerings in site and area lighting, further solidifying its position in the architectural lighting segment.

In October 2022, Orion Energy Systems expanded beyond lighting by acquiring Voltrek, an electric vehicle charging station solutions company. This strategic move diversified Orion’s portfolio into the rapidly growing EV infrastructure market.

In November 2022, Legrand acquired Encelium, a commercial lighting controls brand. This acquisition strengthened Legrand’s position in the lighting controls market by integrating advanced energy-efficient solutions into its portfolio.

In 2022, Delta Light, a Belgian lighting company, acquired Lambent Lighting Group, which includes U.S. brands LF Illumination, Delray Lighting, Visual Lighting Technologies (VLT), and Softform Lighting. This move expanded Delta Light’s footprint in the North American architectural lighting market.

In 2022, ams OSRAM sold Traxon Technologies, along with its controls platform e:cue, to Hong Kong-based Prosperity Group. This divestiture was part of ams OSRAM’s strategy to focus on its core business areas while enabling Prosperity Group to expand its presence in digital lighting solutions.

In July 2019, Acuity Brands acquired OSRAM’s North American Digital Systems business. This acquisition enhanced Acuity’s LED driver and control technologies portfolio, strengthening its position in the intelligent lighting market.

In 2020, Signify introduced Interact City, a connected street lighting system that enables remote monitoring and control of urban lighting infrastructure. This innovation supports smart city initiatives by integrating lighting with IoT technologies for improved efficiency and sustainability.

In September 2020, Xiaomi launched the Mi Smart LED Bulb in India. This 7.5W smart bulb, controllable via Amazon Alexa and Google Assistant, reflects the growing trend of integrating smart home devices into the consumer lighting market.

MARKET SEGMENTATION

This research report on the Lamps Market has been segmented and sub-segmented into the following categories.

By Product

- Desk Lamp

- Floor Lamp

By Type

- Reading Lamp

- Decorative Lamp

By Application

- Residential/Retail

- Commercial/Hospitality

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What types of lamps are available in the market?

Table lamps, floor lamps, desk lamps, pendant lamps, wall lamps, and LED lamps.

Which lamp is best for reading?

Adjustable desk lamps with warm white LED bulbs are best for reading.

What factors should I consider when buying a lamp?

Consider brightness, energy efficiency, design, size, and bulb type.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]