Latin America Avocado Oil Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Pure/Refined Avocado Oil, Extra Virgin Avocado Oil), Application, And Country (Brazil, Mexico, Argentina, Chile And Rest Of Latin America), Industry Analysis From 2025 To 2033

Latin America Avocado Oil Market Size

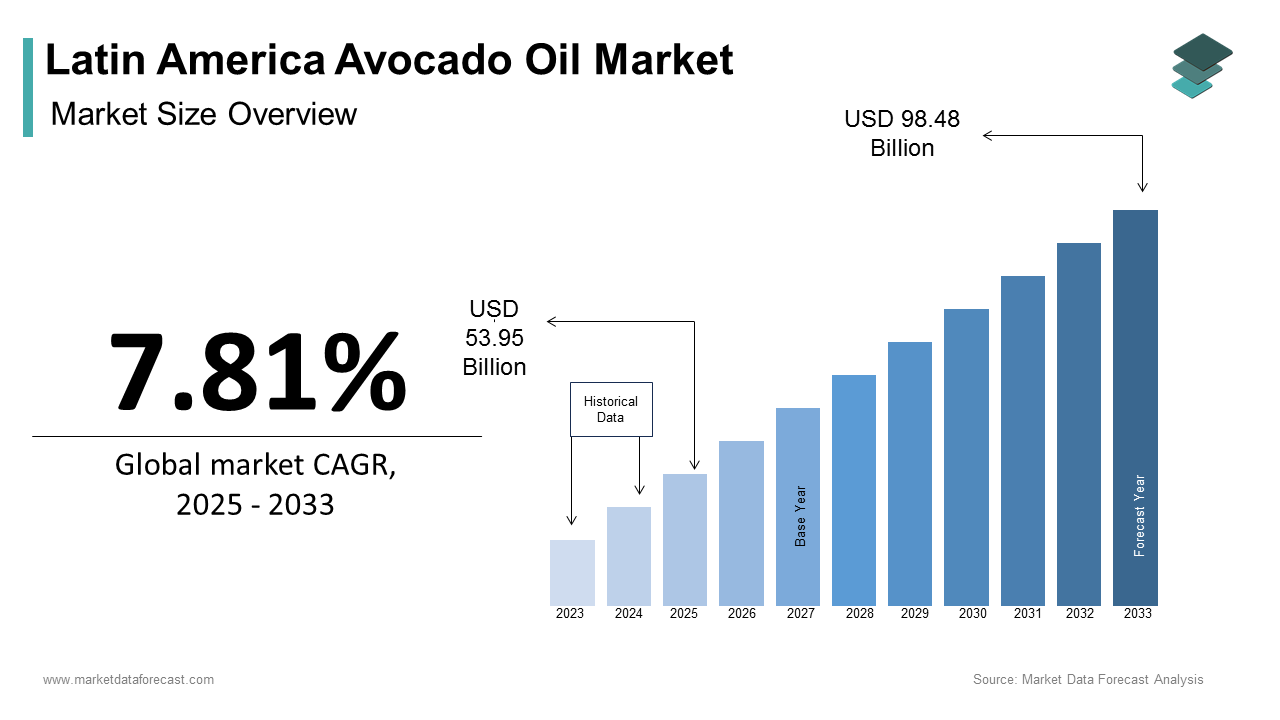

The Latin America Avocado Oil Market size was calculated to be USD 50.04 billion in 2024 and is anticipated to be worth USD 98.48 billion by 2033, from USD 53.95 billion in 2025, growing at a CAGR of 7.81% during the forecast period.

The Latin American avocado oil market is the production, processing, and commercialization of oil extracted from the pulp of avocados, primarily cultivated in countries such as Mexico, Peru, Colombia, and Chile. This oil is widely valued for its high nutritional content, rich monounsaturated fatty acid profile, and versatility across food, cosmetic, and pharmaceutical applications. As consumer awareness around health and wellness continues to grow, avocado oil has gained traction not only as a premium cooking oil but also as an ingredient in skincare and haircare products. According to the Food and Agriculture Organization (FAO), Latin America accounts for over 80% of global avocado production, with Mexico alone contributing nearly half of that figure. The region's dominance in avocado cultivation provides a natural advantage in developing a robust avocado oil industry. Moreover, increasing export volumes to North America and Europe have encouraged investment in oil extraction technologies and value-added processing. Besides, local governments and agricultural cooperatives are promoting sustainable farming practices to enhance yield quality and environmental conservation.

MARKET DRIVERS

Rising Global Demand for Healthy Cooking Oils

One of the primary drivers of the Latin American avocado oil market is the escalating global demand for healthy and functional cooking oils, particularly among health-conscious consumers in developed markets. Avocado oil is increasingly favored for its high smoke point, rich content of oleic acid, and natural antioxidant properties, making it a preferred alternative to traditional oils like sunflower, soybean, and palm. Also, global consumption of specialty plant-based oils increased notably between 2020 and 2023, with avocado oil registering one of the fastest growth rates. In response, Latin American producers—especially in Mexico and Peru—have expanded their oil extraction capacities to meet rising export orders. The U.S., being the largest importer of Mexican avocados, has also become a key destination for refined avocado oil, driven by growing interest in clean-label and plant-based nutrition. Apart from these, leading supermarket chains and organic food retailers in North America and Europe have incorporated avocado oil into their premium product lines, further stimulating international demand. As per the United States Department of Agriculture (USDA), avocado oil imports into the U.S. grew by more than 18% annually over the past three years, reinforcing Latin America’s strategic role in supplying this niche yet expanding commodity.

Expansion of Avocado Cultivation and Processing Infrastructure

Another significant driver of the LatiAmericanca avocado oil market is the rapid expansion of avocado cultivation and downstream processing infrastructure, particularly in Mexico, Peru, and Colombia. These countries have experienced a boom in avocado orchard development due to favorable climatic conditions, government-backed agricultural incentives, and increasing private-sector investments. According to the Peruvian Ministry of Agriculture (MINAGRI), avocado planting areas in Peru expanded between 2021 and 2023, supported by improved irrigation systems and high-yield cultivars. This increase in fruit availability has provided a steady raw material base for avocado oil processors. Furthermore, advancements in oil extraction technology—such as mechanical pressing and centrifugation—have enabled higher efficiency and better oil quality retention, enhancing marketability both domestically and internationally. In Mexico, the state of Michoacán, which produces a substantial share of the country’s avocados, has witnessed a surge in small-scale oil mills that cater to artisanal and organic markets. Hence, with continued infrastructural development and access to technical expertise, Latin America is well-positioned to capitalize on the growing global appetite for avocado-derived products.

MARKET RESTRAINTS

High Production Costs and Limited Yield Efficiency

A major restraint affecting the Latin American avocado oil market is the relatively high production costs associated with oil extraction, which limit scalability and affordability. Unlike other vegetable oils that can be efficiently derived from seeds or kernels, avocado oil is obtained from the fruit’s pulp, requiring significantly larger quantities of raw avocados to produce a comparable volume of oil. According to the International Society for Horticultural Science (ISHS), it takes approximately 10 kilograms of avocados to produce just one liter of cold-pressed avocado oil, making it one of the most resource-intensive oils in terms of input requirements. This inefficiency translates into elevated production costs, which are ultimately passed on to consumers, restricting mass-market adoption. Also, many avocado farms in Latin America still rely on manual harvesting and traditional processing methods, further reducing throughput and increasing labor expenses. In countries like Colombia and Ecuador, where smallholder farmers dominate avocado production, the lack of mechanized processing infrastructure hinders economies of scale.

Seasonal Availability and Supply Chain Disruptions

Another significant constraint on the Latin American avocado oil market is the seasonal nature of avocado harvesting and the resulting supply chain disruptions that affect oil production consistency. Avocados are typically harvested during specific periods of the year, depending on the region and variety, which leads to fluctuations in raw material availability for oil extraction. Outside of this period, limited fresh avocado availability forces manufacturers to rely on stored or imported fruit, which can compromise oil quality and increase costs. Moreover, logistical bottlenecks—such as transportation delays, customs clearance issues, and storage limitations—exacerbate supply instability. Like, several oil mills reported production halts in 2023 due to delayed avocado deliveries. These seasonal and logistical challenges hinder the ability of avocado oil producers to maintain a consistent output, limiting their capacity to meet growing international demand in a timely and cost-effective manner.

MARKET OPPORTUNITIES

Growing Demand for Natural and Organic Personal Care Products

A significant opportunity for the LatiAmericanca avocado oil market lies in the expanding demand for natural and organic ingredients in the personal care and cosmetics industry. Avocado oil is highly valued for its emollient properties, rich vitamin E content, and deep moisturizing effects, making it a sought-after component in skincare, haircare, and body care formulations. Countries like Brazil and Colombia have seen a rise in domestic beauty brands incorporating avocado oil into shampoos, lotions, and facial serums, capitalizing on regional biodiversity and sustainable sourcing narratives. Additionally, international cosmetic companies are showing greater interest in Latin American avocado oil due to its perceived purity and ethical sourcing credentials. With growing investment in green chemistry and clean label initiatives, Latin American avocado oil producers are well-positioned to tap into this lucrative and expanding market segment.

Increasing Adoption of Functional Foods and Nutraceuticals

Another emerging opportunity in the Latin American avocado oil market is its integration into functional foods and nutraceutical products, driven by rising consumer interest in health-enhancing dietary choices. Avocado oil is naturally rich in monounsaturated fats, phytosterols, and lutein, all of which contribute to cardiovascular health, cholesterol regulation, and eye health. According to the Global Organization for EPA and DHA Omega-3s (GOED), there has been a notable uptick in the formulation of fortified food products containing plant-based oils with added health benefits. In response, Latin American food manufacturers are incorporating avocado oil into salad dressings, energy bars, and omega blends aimed at health-conscious consumers. Additionally, nutraceutical firms are exploring avocado oil derivatives for use in supplements targeting joint health and inflammation reduction. Moreover, collaborations between research institutions and agribusinesses are fostering innovation in avocado oil encapsulation and bioavailability enhancement, opening new avenues for product diversification.

MARKET CHALLENGES

Intense Competition from Alternative Plant-Based Oils

One of the foremost challenges facing the Latin American avocado oil market is the intense competition from alternative plant-based oils that offer similar nutritional profiles at lower price points. Consumers seeking heart-healthy oils often opt for options like olive oil, sunflower oil, and grapeseed oil, which are more readily available and less expensive than avocado oil. Like, global olive oil consumption remains consistently high, with prices remaining more stable due to mature production cycles and extensive supply networks. This presents a challenge for avocado oil producers who must justify a premium pricing model based on perceived health benefits and superior sensory attributes. Apart from these, newer entrants such as safflower oil and flaxseed oil are gaining traction in health-conscious markets, further fragmenting consumer preferences. In Latin America, where price sensitivity is a key purchasing factor, especially in domestic retail channels, avocado oil struggles to penetrate mass-market segments.

Regulatory and Certification Hurdles in Export Markets

Another critical challenge for the LatiAmericanca avocado oil market is navigating the complex regulatory and certification requirements imposed by international buyers, particularly in North America and Europe. These markets demand strict compliance with food safety standards, traceability protocols, and sustainability certifications, which can be difficult for smaller producers to meet. For example, the European Union requires avocado oil exports to comply with Codex Alimentarius standards, ensuring purity, authenticity, and absence of adulteration. In addition, obtaining certifications such as USDA Organic, Fair Trade, or Non-GMO Project Verified adds layers of complexity and cost to the production process, especially for independent processors and cooperatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.81% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Mexico, Argentina, Chile and Rest Of Latin America |

|

Market Leaders Profiled |

Kevala, Bella Vado, AvoHass, Sesajal S.A. de C.V., Grupo Industrial Batellero, Olivado Ltd, Ahuacatlan Avocado Oil, La Tourangelle, Spectrum Organics, Dipasa. |

SEGMENTAL ANALYSIS

By Type Insights

Pure or refined avocado oil was the largest segment in the Latin American avocado oil market accounting for 38.9% of total consumption in 2024. This dominance is primarily driven by its widespread use in industrial food processing and commercial cooking applications due to its higher smoke point, longer shelf life, and cost-effectiveness compared to unrefined variants. According to the Inter-American Institute for Cooperation on Agriculture (IICA), refined avocado oil is extensively used in packaged foods, salad dressings, and frying oils where consistency and heat stability are crucial. Mexico leads this segment, with large-scale processors such as Grupo Coppel and Naturafit incorporating refined avocado oil into their product lines for both domestic and export markets. Additionally, the growing adoption of avocado oil in ready-to-eat meals and frozen food products has further boosted demand.

Extra virgin avocado oil is projected to grow at the fastest CAGR of 9.6%, outpacing other oil types in the Latin American market. This rapid expansion is attributed to rising consumer preference for minimally processed, cold-pressed oils that retain high nutritional value and natural antioxidants. Its rich content of monounsaturated fats, vitamin E, and lutein makes it attractive for wellness-focused diets and functional food formulations. In addition, local producers in Colombia and Peru have capitalized on the clean-label movement by marketing small-batch, ethically sourced extra virgin avocado oil to niche export markets in Europe and North America. With increasing investment in artisanal production and direct-to-consumer branding strategies, this segment is poised for sustained high-growth performance.

By Application Insights

The food and beverages segment held the largest share of the Latin American avocado oil market, propelled by its growing incorporation into culinary products, salad dressings, baking ingredients, and gourmet cooking oils. Also, avocado oil’s high smoke point (around 520°F for refined versions) makes it ideal for sautéing, roasting, and frying, positioning it as a versatile alternative to olive and coconut oils. In Brazil and Mexico, avocado oil is increasingly being adopted in artisanal breads, dips, and plant-based spreads aimed at health-conscious consumers. Supermarket chains have expanded their premium oil sections to include avocado oil blends, reflecting strong retail demand. Moreover, food service operators in upscale restaurants and cafes across Latin America are using avocado oil in signature dishes to appeal to customers seeking healthier dining options.

The personal care and cosmetics segment is anticipated to register the highest growth in the Latin American avocado oil market, expanding at a CAGR of 10.4% during the forecast period. This surge is fueled by the rising demand for natural and plant-based skincare and haircare products, particularly among younger consumers who prioritize clean beauty and ethical sourcing. The oil's high content of oleic acid, vitamin A, and potassium makes it an effective emollient and skin regenerator, appealing to manufacturers of anti-aging and hydration-focused formulations. Brazilian brands have incorporated locally sourced avocado oil into premium skincare ranges targeting eco-conscious buyers.

REGIONAL ANALYSIS

Mexico had the biggest share of the Latin American avocado oil market, leveraging its status as the world’s top avocado producer. According to the United Nations Food and Agriculture Organization (FAO), Mexico accounts for a significant share of global avocado production, with Michoacán state contributing majorly to national output. This abundant supply provides a strong foundation for oil extraction and downstream value addition. The country benefits from a well-established avocado export infrastructure, which supports both fresh fruit and oil-based product shipments to the U.S., Canada, and Europe. The Mexican Avocado Producers Association (APEAM) notes that avocado oil exports have grown steadily, with new investments in cold-press facilities enhancing product quality. Domestically, rising interest in gourmet and health-oriented cooking oils has spurred retail demand, while the cosmetic industry increasingly incorporates avocado oil into skincare and haircare formulations.

Brazil’s avocado cultivation is concentrated in states such as São Paulo, Minas Gerais, and Bahia, where favorable tropical conditions support year-round production. According to the Brazilian Institute of Geography and Statistics (IBGE), domestic avocado output reached record levels in recent years, providing ample raw material for oil extraction. While Brazil traditionally focused on fresh fruit exports, there has been a strategic shift toward value-added derivatives, including cold-pressed avocado oil for both culinary and cosmetic uses. The rise of natural beauty brands has contributed to increased demand for avocado oil in skincare and body care products.

Peru is emerging as a major exporter of both fresh avocados and derived oil products. This growth has facilitated greater availability of surplus fruit for oil processing, especially in the coastal regions of Lima, Ica, and La Libertad. Peru’s avocado oil exports have gained traction in European and North American markets due to certifications such as USDA Organic and Fair Trade, enhancing its competitive edge. Domestic consumption is also rising, particularly in health-conscious urban centers like Lima and Arequipa.

Chile is operating as a niche yet rapidly developing segment within the region. Although Chile is not among the top avocado producers, it has strategically positioned itself as a supplier of high-quality, sustainably produced avocado oil for specialty markets. According to the Chilean Agricultural Research Institute (INIA), avocado cultivation in central and coastal regions has seen gradual expansion, supported by modern irrigation techniques and integrated pest management systems. The country’s proximity to Pacific Rim trade routes facilitates avocado oil exports to North America and Asia, where demand for premium plant-based oils is growing. Besides, Chilean companies are investing in small-scale oil mills that cater to the gourmet and organic food sectors.

LEADING PLAYERS IN THE LATIN AMERICAN AVOCADO OIL MARKET

Grupo Coppel (Mexico)

Grupo Coppel is a leading player in the Latin American avocado oil market, known for its vertically integrated approach that spans avocado cultivation, oil extraction, and branded product distribution. The company has positioned itself as a premium supplier of both refined and extra virgin avocado oils tailored for culinary and cosmetic applications. With a strong presence in North American and European export markets, Grupo Coppel emphasizes quality assurance, traceability, and sustainable sourcing. Its investment in cold-pressed oil technology and partnerships with organic certification bodies have enhanced brand credibility and consumer trust.

Natura &Co (Brazil)

Natura &Co plays a significant role in the avocado oil market through its use of locally sourced ingredients in natural skincare and haircare products. As part of its broader commitment to botanical-based formulations, Natura integrates avocado oil into high-end beauty lines distributed across Latin America and beyond. The company leverages Brazil’s biodiversity and sustainable agricultural practices to differentiate its offerings in global clean beauty markets. By aligning avocado oil production with ethical sourcing and environmental responsibility, Natura strengthens its position in both regional and international value chains.

Olaplex Naturales (Peru)

Olaplex Naturales specializes in artisanal and organic avocado oil production, focusing on small-batch processing that preserves nutritional integrity and sensory attributes. Based in Peru, the company exports to niche markets in Europe and North America, capitalizing on the rising demand for premium plant-based oils. Olaplex Naturales collaborates with local farming cooperatives to ensure consistent raw material supply while promoting fair trade principles. Its emphasis on transparency, purity, and storytelling around Andean agricultural heritage appeals to discerning consumers seeking authentic, high-quality avocado oil.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the LatiAmericanca avocado oil market is vertical integration, where companies control multiple stages of the supply chain—from avocado farming to oil extraction and final product packaging. This approach ensures better quality control, cost efficiency, and traceability, which are critical for meeting international food and cosmetic standards. Another important strategy is brand differentiation through sustainability and ethical sourcing, with companies emphasizing organic certifications, eco-friendly packaging, and support for smallholder farmers to appeal to conscious consumers. A third key strategy is product diversification and innovation, wherein firms develop new formulations such as infused oils, beauty serums, and functional foods to cater to expanding application areas. These strategic moves help companies capture broader market segments and strengthen their competitive positioning in both domestic and global avocado oil markets.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Latin American oil market include Kevala, Bella Vado, AvoHass, Sesajal S.A. de C.V., Grupo Industrial Batellero, Olivado Ltd, Ahuacatlan Avocado Oil, La Tourangelle, Spectrum Organics, Dipasa.

The competition in the Latin American avocado oil market is marked by a mix of large agro-industrial enterprises, specialty producers, and emerging startups vying for dominance in an evolving sector. While established players leverage vertical integration and global distribution networks to maintain market leadership, smaller producers focus on artisanal quality, organic certification, and niche branding to carve out unique positions. The market is witnessing increasing consolidation, with larger firms acquiring or partnering with local mills to secure raw material sources and enhance production capacity. Innovation is a key battleground, particularly in developing premium cold-pressed oils and value-added cosmetic and nutraceutical applications. Additionally, export-oriented strategies are intensifying competition as Latin American brands seek access to lucrative markets in North America and Europe. However, challenges such as regulatory compliance, pricing pressures, and supply chain constraints continue to shape the industry landscape, requiring companies to adopt agile and adaptive business models to sustain growth.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Grupo Coppel expanded its avocado oil bottling facility in Michoacán, Mexico, enhancing production capacity to meet rising export demand from the U.S. and Europe.

- In March 2024, Natura &Co launched a new line of skincare products featuring Brazilian-sourced avocado oil, targeting health-conscious consumers in South America and global eco-beauty markets.

- In August 2023, Olaplex Naturales entered into a strategic partnership with Peruvian farming cooperatives to ensure a stable supply of organic avocados for premium oil production.

- In October 2023, a Mexican avocado oil cooperative introduced a direct-to-consumer e-commerce platform to expand domestic retail reach and build brand loyalty among urban consumers.

- In February 2024, a Brazilian agri-tech firm unveiled a mobile avocado oil extraction unit aimed at supporting small-scale producers in remote regions and improving regional supply chain efficiency.

MARKET SEGMENTATION

This research report on the LatinAmerican avocadoo Oil Market has been segmented and sub-segmented based on type, application, and region.

By Type

- Pure/Refined Avocado Oil

- Extra Virgin Avocado Oil

By Application

- Food and Beverages

- Personal Care and Cosmetics

By Region

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

1. What are the key factors driving the growth of the avocado oil market in Latin America?

Growth is driven by rising health consciousness, increasing demand for natural and organic products, expanding culinary uses, and export opportunities to North America and Europe.

2. Which countries are the major producers and consumers of avocado oil in Latin America?

Mexico, Brazil, and Chile are among the leading producers and exporters, while growing domestic consumption is seen in Argentina, Colombia, and Peru.

3. Who are the key players in the Latin American avocado oil market?

Key players include Kevala, Bella Vado, AvoHass, Sesajal S.A. de C.V., Grupo Industrial Batellero, Olivado Ltd, Ahuacatlan Avocado Oil, La Tourangelle, Spectrum Organics, and Dipasa.

4. How is avocado oil distributed in the region?

Distribution channels include supermarkets/hypermarkets, online retailers, specialty health stores, and direct sales by manufacturers.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com