Latin America Biodegradable Food Service Disposables Market Size, Share, Trends & Growth Forecast Report Segmented By Raw Material Type (Pulp and Paper, Biopolymers), Product Type, Distribution Channel, And Country (Brazil, Mexico, Argentina, Chile And Rest Of Latin America), Industry Analysis From 2025 To 2033

Latin America Biodegradable Food Service Disposables Market Size

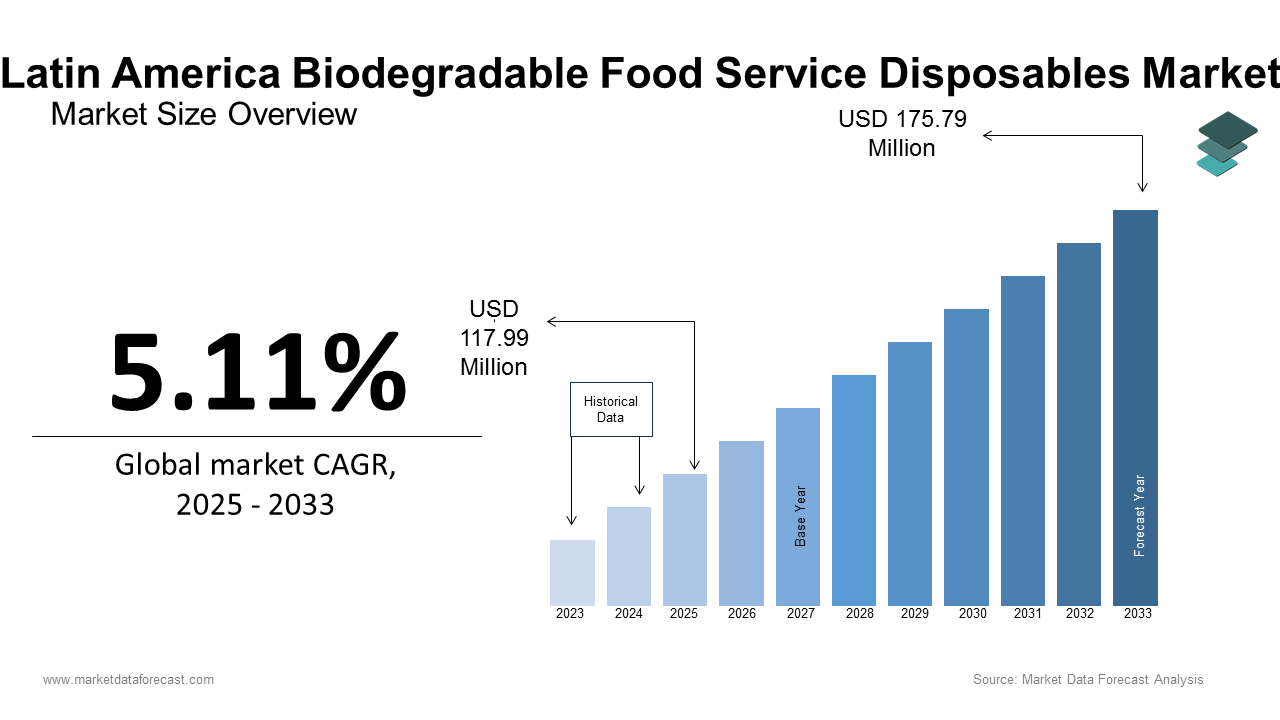

The Latin America Biodegradable Food Service Disposables Market size was calculated to be USD 112.25 million in 2024 and is anticipated to be worth USD 175.79 million by 2033, from USD 117.99 million in 2025, growing at a CAGR of 5.11% during the forecast period.

The biodegradable foodservice disposables market in Latin America covers a range of single-use products such as plates, cutlery, cups, and packaging made from renewable, compostable materials like cornstarch, bagasse, and PLA (polylactic acid). These alternatives are designed to replace conventional petroleum-based plastics, offering an environmentally sustainable solution that aligns with global sustainability goals. As environmental concerns intensify across the region, particularly in urban centers, businesses and consumers are increasingly seeking eco-friendly alternatives to traditional disposable items. According to the United Nations Environment Programme, plastic waste constitutes over 60% of marine debris in Latin American coastal waters, prompting governments and civil society organizations to advocate for sustainable consumption practices. In response, several countries have initiated national campaigns promoting biodegradable packaging and reduced plastic dependency. Moreover, the rise of green consumerism is reshaping purchasing behaviors. A study by the Economic Commission for Latin America and the Caribbean (ECLAC) found that more than half of surveyed consumers in Brazil, Mexico, and Colombia expressed a willingness to pay a premium for sustainable food packaging.

MARKET DRIVERS

Increasing Environmental Awareness Among Consumers

One of the key drivers of the Latin American biodegradable food service disposables market is the rising environmental consciousness among consumers. This shift reflects a broader cultural movement toward sustainability, where younger generations, particularly millennials and Gen Z, prioritize environmental responsibility in their purchasing decisions. Public education initiatives led by non-governmental organizations and academic institutions have played a significant role in this transformation. The Pan American Health Organization has actively supported awareness campaigns have stated that the health and ecological risks associated with plastic pollution. Additionally, social media platforms have amplified grassroots movements advocating for sustainable living, influencing both individual behavior and corporate strategies.

Regulatory Support and Government Initiatives

Government policies and regulatory frameworks are playing a crucial role in accelerating the growth of the biodegradable food service disposables market in Latin America. Several countries have implemented bans or restrictions on single-use plastics, creating a favorable environment for alternative materials. For instance, Chile introduced a nationwide ban on plastic bags in 2023, followed by legislation targeting expanded polystyrene containers used in food services. According to the Ministry of Environment, this regulatory action has spurred a 40% increase in demand for biodegradable packaging options within the retail and hospitality sectors.

Similarly, in Colombia, the National Environmental Licensing Authority (ANLA) mandated that all large-scale food vendors must transition to compostable packaging by 2025. As per data from the Colombian Coffee Growers Federation, more than 70% of coffee shops in Bogotá have already adopted biodegradable cups and cutlery to comply with these evolving regulations. In Brazil, municipal authorities in São Paulo and Rio de Janeiro have introduced tax incentives for companies using certified biodegradable packaging, further reinforcing the business case for sustainable alternatives.

MARKET RESTRAINTS

Higher Production Costs Compared to Conventional Plastics

Despite growing demand for sustainable alternatives, one of the primary restraints affecting the Latin American biodegradable foodservice disposables market is the higher production costs associated with biodegradable materials compared to conventional plastics. This price differential arises due to the raw material sourcing, specialized processing techniques, and lower economies of scale currently available in the bioplastics industry. This cost burden disproportionately affects small and medium-sized enterprises (SMEs), which constitute a significant portion of the food service sector in Latin America. Many local restaurant owners and street vendors indicate that they cannot afford to absorb additional expenses without passing them on to consumers, potentially reducing competitiveness. Furthermore, supply chain inefficiencies in certain parts of the region exacerbate the issue.

Limited Composting Infrastructure and Waste Management Challenges

A significant obstacle hindering the expansion of the Latin American biodegradable foodservice disposables market is the lack of adequate composting infrastructure and effective waste management systems. Unlike traditional plastics, which can be incinerated or landfilled with relative ease, biodegradable disposables require specific conditions such as industrial composting facilities to decompose efficiently. However, according to a 2023 report by the World Bank, less than 15% of municipal solid waste in Latin America is processed through formal recycling or composting channels.

In countries like Peru and Bolivia, landfilling remains the dominant disposal method, often leading to biodegradable materials ending up in unregulated dumpsites where decomposition occurs anaerobically, producing methane a potent greenhouse gas. Similarly, in Ecuador, only three cities have pilot composting programs in place, limiting the environmental benefits of using biodegradable packaging. Consumer confusion also contributes to improper disposal. A study by the National Institute of Ecology and Climate Change in Mexico found that over 60% of residents were unaware of how to correctly dispose of compostable products, which resulted in contamination of recycling streams and reduced effectiveness of biodegradable alternatives.

MARKET OPPORTUNITIES

Expansion of the Sustainable Tourism Sector

One of the most promising opportunities for the Latin American biodegradable food service disposables market lies in the rapid growth of the sustainable tourism sector. As travelers become more environmentally conscious, hotels, resorts, and tour operators are increasingly adopting eco-friendly practices to appeal to green-conscious visitors. According to the International Ecotourism Society, Latin America welcomed over 12 million eco-tourists in 2023, with destinations such as Costa Rica, Ecuador, and Peru leading the way in sustainable travel initiatives.

Hotels and airlines operating in these regions are replacing conventional plastic disposables with biodegradable alternatives to reduce their environmental footprint. For example, LATAM Airlines announced in 2023 that it would phase out single-use plastics on all domestic flights within Chile and Argentina, replacing them with compostable meal trays and utensils sourced from local manufacturers. Additionally, government-backed ecotourism certifications now include criteria related to sustainable packaging, incentivizing businesses to adopt biodegradable disposables. These developments present a significant opportunity for manufacturers to expand their presence in the hospitality and travel-related food service segments across Latin America.

Growth of E-commerce and Delivery-Based Food Services

The rapid expansion of e-commerce and food delivery services presents a substantial opportunity for the Latin American biodegradable food service disposables market. With digital platforms becoming the preferred method for food consumption, especially in urban areas, there has been a surge in demand for packaging solutions that balance convenience with sustainability. Leading delivery platforms such as Rappi in Colombia and iFood in Brazil have introduced sustainability commitments, pledging to ensure that at least 50% of their partner restaurants use biodegradable or recyclable packaging by 2025. In response, numerous startups and packaging manufacturers have entered the market, which is offering compostable containers, cutlery, and napkins tailored for food delivery applications. Moreover, investors are showing strong interest in companies developing innovative biodegradable materials. In 2023, a Brazilian packaging startup secured USD 10 million in venture capital funding to scale its production capacity and distribute its products across South America.

MARKET CHALLENGES

Lack of Standardization and Certification Frameworks

A major challenge facing the Latin American biodegradable food service disposables market is the absence of standardized certification frameworks to validate product claims regarding biodegradability and compostability. Unlike regions such as the European Union or North America, which have well-established labeling standards like EN 13432 and ASTM D6400, Latin American countries operate under varying regulatory guidelines, leading to inconsistencies in quality assurance and consumer trust.

According to a 2023 report by the Latin American Bioplastics Association, only five countries in the region such as Brazil, Mexico, Colombia, Chile, and Argentina—have developed preliminary certification processes for biodegradable packaging. Even within these nations, enforcement remains inconsistent, allowing some misleadingly labeled products to enter the market. The Brazilian Technical Standards Association (ABNT) noted that approximately 30% of products marketed as “biodegradable” did not meet internationally recognized decomposition timelines by undermining consumer confidence.

Additionally, the lack of harmonized standards complicates cross-border trade and investment. Importers and retailers face difficulties in verifying the authenticity of biodegradable claims, slowing down procurement decisions. To address this, regional trade organizations such as MERCOSUR have initiated discussions on establishing a unified certification system, but implementation remains in early stages.

Supply Chain Constraints and Raw Material Availability

Another pressing challenge impacting the Latin American biodegradable food service disposables market is the limited availability of raw materials and fragmented supply chains. Unlike conventional plastics, which benefit from mature global supply networks, biodegradable packaging relies on agricultural feedstocks such as corn, cassava, sugarcane, and potato starch resources that are subject to seasonal fluctuations and regional shortages.

According to a 2023 analysis by the Food and Agriculture Organization (FAO), drought conditions in parts of Argentina and southern Brazil disrupted starch and sugar yields, which is directly affecting the production capacity of biopolymer manufacturers. In response, several companies reported delays in meeting order deadlines by raising concerns about reliability in supply. Furthermore, the majority of biopolymer producers are concentrated in North America and Asia, forcing Latin American manufacturers to import raw materials at higher costs. The National Confederation of Industry in Brazil promoted that logistics bottlenecks and customs delays added an estimated 15–20% to procurement expenses by making domestic production less competitive.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.11% |

|

Segments Covered |

By Raw Material, Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Mexico, Argentina, Chile and Rest of Latin America |

|

Market Leaders Profiled |

Eco-Products, Vegware, Dart Container Corporation, Huhtamaki, Biopak, Genpak, Novamont S.p.A., Sabert Corporation, Pactiv LLC, Georgia-Pacific LLC |

SEGMENTAL ANALYSIS

By Raw Material Type Insights

The pulp and paper segment was the largest in the Latin AAmericanbiodegradable foodservice disposables market accounting for 45.4% of the share in 2024. One key driver is the region’s strong agricultural base, particularly in Brazil and Argentina, where sugar production generates substantial quantities of bagasse, a byproduct increasingly utilized in eco-friendly packaging. According to the Brazilian Sugarcane Industry Association (UNICA), over 60 million tons of sugarcane bagasse were generated in 2023, with nearly 15% diverted toward biodegradable product manufacturing. A 2023 survey by the Economic Commission for Latin America and the Caribbean (ECLAC) found that 68% of consumers in urban areas prefer pulp-based packaging due to its perceived environmental benefits.

The biopolymers segment is likely to grow with an esteemed CAGR of 14.2% in the next coming years. This rapid expansion is driven by increasing demand for high-performance, durable alternatives to petroleum-based plastics across food packaging applications.

A primary factor fueling this growth is the surge in investment in biopolymer production infrastructure. In 2023, Braskem, a leading Brazilian petrochemical company, expanded its green polyethylene production capacity to meet rising demand from the food service industry. According to the Latin American Bioplastics Association, biopolymer production in the region increased by 18% in 2023 compared to the previous year. Moreover, advancements in bio-based PLA and PHA materials have enabled manufacturers to produce transparent cups, rigid cutlery, and microwaveable container products previously dominated by traditional plastics. The Inter-American Development Bank noted that biopolymer-based disposables accounted for 22% of new product launches in the Latin American food packaging sector in 2023.

By Product Type Insights

The clamshells and containers segment was the largest and held 32.3% of the hare in 2024. A major driver behind this segment's leadership is the increasing popularity of online food ordering platforms such as Rappi, iFood, and Uber Eats. According to Statista, digital food delivery revenues in Latin America grew by over 27% in 2023, prompting restaurants and delivery services to adopt leak-proof, durable, and eco-friendly containers. Clamshell-style packaging made from bagasse or molded fiber has become a preferred choice due to its structural integrity and compostability. Furthermore, regulatory initiatives promoting sustainable packaging solutions have encouraged large restaurant chains to replace plastic takeout containers with biodegradable alternatives. In Mexico, for instance, the National Commission for the Efficient Use of Energy reported that 40% of fast-casual dining outlets had switched to compostable clamshells by mid-2023.

The biodegradable cutleries segment is likely to grow with an anticipated CAGR of 13.9% in the future period. This growth is primarily driven by shifting consumer preferences and regulatory pressure on single-use plastic utensils. A key factor contributing to this trend is the implementation of plastic bans targeting disposable cutlery in several Latin American cities. For example, in Chile, the Ministry of Environment enforced a nationwide ban on polystyrene and plastic cutlery in commercial food establishments starting in early 2023. Additionally, food delivery platforms and quick-service restaurants are increasingly bundling biodegradable cutlery with meals to enhance brand sustainability credentials. In Colombia, national chain restaurants reported a 30% increase in customer satisfaction scores after introducing wooden and cornstarch-based utensils.

By Distribution Channel Insights

The business-to-business (B2B) distribution channel segment dominated the Latin America biodegradable foodservice disposables market share in 2024. A key driver of this segment’s leadership is the increasing number of corporate sustainability commitments among large foodservice operators. Additionally, government-backed green certification schemes are encouraging businesses to source biodegradable products through formal B2B channels. In Brazil, the National Institute of Environment (IBAMA) launched an initiative in 2023 that incentivizes certified eco-friendly suppliers, making it easier for businesses to access verified biodegradable products.

The business-to-customer (B2C) segment is projected to grow with a CAGR of 12.4% during the forecast period. This rise is largely driven by the increasing availability of biodegradable food service disposables through retail stores, e-commerce platforms, and direct-to-consumer brands catering to environmentally conscious households. One major contributing factor is the growing awareness among individual consumers regarding plastic pollution and sustainable living. According to a 2023 study by LatinFocus Consensus Forecast, more than 60% of surveyed consumers in São Paulo, Bogotá, and Buenos Aires indicated a preference for purchasing biodegradable disposables for personal use, particularly in home offices and picnicking activities.

REGIONAL ANALYSIS

Brazil was the largest and held 35.4% of the Latin America biodegradable foodservice disposables market share in 2024. A key factor contributing to Brazil’s market dominance is the presence of global biopolymer producers like Braskem, which has invested heavily in green polyethylene production. According to the Brazilian Chemical Industry Association, domestic biopolymer output increased by 19% in 2023, which supports the expansion of biodegradable packaging manufacturers. Additionally, regulatory initiatives such as municipal-level plastic bans in São Paulo and Rio de Janeiro have accelerated the adoption of eco-friendly disposables. The National Confederation of Industry reported that biodegradable packaging adoption in the food service sector rose by 28% in 2023, driven by both policy mandates and consumer demand.

Mexico ranks second in the Latin America biodegradable foodservice disposables market, holding approximately 22% of total regional revenue. The country benefits from a strong food service industry and progressive environmental policies that support the transition away from conventional plastics. A major growth catalyst is the implementation of plastic restrictions in urban centers. In 2023, the Mexican Ministry of Environment enforced a nationwide ban on expanded polystyrene food containers, prompting restaurants and retailers to seek biodegradable alternatives. According to the National Chamber of the Transformation Industry (CANACINTRA), biodegradable packaging imports increased by 24% in the same year.

Argentina biodegradable food service disposables market was accounted in holding 10.2% of the share in 2024. A significant factor influencing growth is the introduction of the National Plastic Reduction Law in 2022, which mandated the gradual elimination of single-use plastics in the food service industry. According to the Argentine Environmental Fund, compliance with these regulations led to a 17% increase in biodegradable packaging adoption in Buenos Aires alone during 2023.

Moreover, consumer-driven demand for sustainable products is gaining traction. A survey conducted by the University of Buenos Aires revealed that 55% of respondents preferred dining establishments that used compostable cutlery and containers. Additionally, local startups are entering the biodegradable packaging space, supported by government grants and private investments. These dynamics contribute to Argentina’s evolving yet promising position in the regional market.

Chile biodegradable food service disposables market is likely to grow with prominent growth opportunities in the next coming years. One of the primary drivers is the country’s comprehensive plastic ban policy, which includes restrictions on single-use plastics in restaurants, cafes, and supermarkets. The Chilean Ministry of Environment reported that in 2023, over 45% of food service businesses in Santiago had fully transitioned to biodegradable packaging, up from 28% in 2022.

LEADING PLAYERS IN THE LATIN AMERICA BIODEGRADABLE FOODSERVICE DISPOSABLES MARKET

Novamont S.p.A.

Novamont is a global leader in biodegradable materials and plays a pivotal role in shaping sustainable packaging solutions across Latin America. The company specializes in developing bio-based polymers used in cutlery, plates, and food containers that meet international compostability standards. In Latin America, Novamont collaborates with local manufacturers and government bodies to promote circular economy principles and support regulatory efforts against single-use plastics. Its presence in the region has been instrumental in advancing biodegradable product innovation and raising awareness about environmentally responsible consumption.

Ecovative Design LLC

Ecovative Design is known for its cutting-edge mycelium-based packaging technology, which offers a completely natural and compostable alternative to traditional disposables. In Latin America, the company has partnered with startups and research institutions to explore scalable applications of fungal-based materials in food service packaging. Ecovative contributes to the development of a more sustainable supply chain by promoting biodegradable alternatives that require minimal processing and energy input. Its influence extends beyond product development into education and advocacy, helping shape regional policies on green packaging and waste reduction.

TIPA Compostable Packaging Ltd.

TIPA is a pioneer in fully compostable flexible packaging solutions and has expanded its footprint in Latin America by supplying biodegradable films used in food service disposables such as bags, wraps, and pouches. The company’s commitment to zero-waste systems aligns with growing consumer demand for sustainable packaging options. In Latin America, TIPA works closely with eco-conscious brands and retailers to replace plastic-based products with certified compostable alternatives. Through strategic partnerships and market education initiatives, TIPA supports the transition toward a more sustainable food service industry in the region.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies adopted by key players in the Latin AAmericanbiodegradable foodservice disposables market is product innovation through material diversification. Companies are investing heavily in research and development to create new formulations using locally available agricultural byproducts, enhancing both performance and sustainability. This approach allows them to cater to diverse customer needs while reducing dependency on imported raw materials.

Another key strategy is strategic collaborations with local governments and environmental organizations . Leading firms actively engage in policy advocacy and educational campaigns to promote biodegradable packaging adoption. These partnerships help align corporate objectives with national sustainability goals, which is creating a favorable regulatory environment for market expansion.

Companies are focusing on expanding distribution networks through digital platforms and direct-to-business sales channels By leveraging e-commerce and forming alliances with food delivery services, they ensure broader accessibility and faster market penetration. These strategies collectively strengthen their competitive position in the evolving biodegradable packaging landscape.

KEY MARKET PLAYERS AND COMPETITIVE OVERVIEW

Major Players in the Latin America biodegradable food service market include Eco-Products, Vegware, Dart Container Corporation, Huhtamaki, Biopak, Genpak, Novamont S.p.A., Sabert Corporation, Pactiv LLC, and Georgia-Pacific LLC.

The Latin American biodegradable food service disposables market is marked by a dynamic mix of global leaders and emerging regional players striving to capture a share of the expanding sustainable packaging sector. While multinational corporations bring technological expertise and established brand recognition, local manufacturers are gaining traction by offering cost-effective, region-specific solutions tailored to domestic supply chains and consumer preferences. Competition is increasingly centered around product differentiation, where innovation in materials, design, and functionality plays aaa crucialole in securing long-term contracts with restaurants, food delivery platforms, and retail outlets.

Market participants are also differentiating themselves through comprehensive sustainability messaging, emphasizing carbon neutrality, compostability certifications, and circular production models. As consumer awareness grows and regulatory pressure intensifies, businesses are under increasing scrutiny to demonstrate environmental responsibility. This has led to intensified collaboration between industry stakeholders, academia, and policymakers to develop standardized guidelines and improve infrastructure for composting and waste management. Additionally, the rise of eco-conscious startups is injecting fresh competition into the market, fostering an environment of continuous innovation and strategic positioning among both established and new entrants.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Novamont announced a partnership with a leading Brazilian packaging manufacturer to co-develop biodegradable food trays derived from cassava starch, aiming to reduce reliance on imported materials and enhance local supply chain efficiency.

- In May 2023, Ecovative Design launched an innovation hub in Colombia to test and refine mushroom-based packaging prototypes specifically designed for tropical climates, ensuring durability and rapid decomposition under local waste conditions.

- In September 2024, TIPA expanded its distribution network in Mexico by signing exclusive agreements with major supermarket chains, enabling widespread availability of its compostable food wraps and takeaway containers in retail outlets across the country.

- In March 2023, a Chilean bio-packaging startup received investment from a European sustainability fund to scale up the production of disposable plates made from agro-industrial residues, strengthening its position in the Andean market.

- In November 2024, a prominent Argentinian restaurant association collaborated with multiple biodegradable packaging suppliers to launch a certification program recognizing eateries that exclusively use compostable disposables, reinforcing industry-wide sustainability commitments.

MARKET SEGMENTATION

This research report on the Latin America Biodegradable Food Service Disposables Market has been segmented and sub-segmented based on raw material, product type, distribution channel, and region.

By Raw Material Type

- Pulp and Paper

- Biopolymers

By Product Type

- Clamshells and Containers

- Cutleries

By Distribution Channel

- Business to Business (B2B)

- Business to Customer (B2C)

By Region

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

1. What is driving the demand for biodegradable food service disposables in Latin America?

Key drivers include increasing environmental awareness, growing government regulations on plastic use, rising demand from the food delivery and takeaway sector, and consumer preference for sustainable products.

2. Which materials are commonly used in biodegradable food service disposables?

Common materials include PLA (polylactic acid), bagasse (sugarcane fiber), cornstarch, paper, bamboo, and palm leaves.

3. Who are the major players in the Latin America biodegradable food service disposables market?

Key players include Eco-Products, Vegware, Dart Container Corporation, Huhtamaki, Biopak, Genpak, Novamont S.p.A., Sabert Corporation, Pactiv LLC, and Georgia-Pacific LLC.

4. How are government policies influencing the market?

Several Latin American countries have introduced bans or restrictions on single-use plastics, boosting demand for biodegradable alternatives.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com