Latin America Bitumen Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Paving Grade Bitumen, Polymer Modified Bitumen), Application, And Country (Brazil, Mexico, Argentina, Chile And Rest Of Latin America), Industry Analysis From 2025 To 2033

Latin America Bitumen Market Size

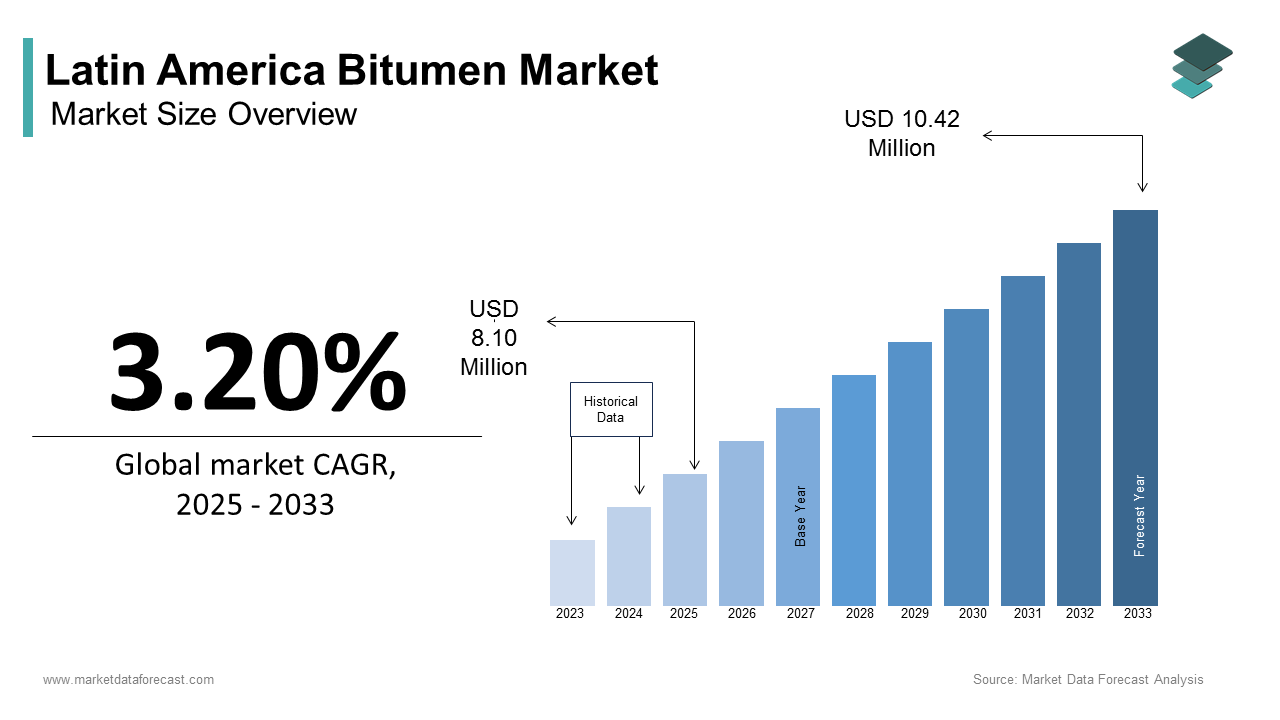

The Latin America bitumen market size was calculated to be USD 7.85 million in 2024 and is anticipated to be worth USD 10.42 million by 2033, from USD 8.10 million in 2025, growing at a CAGR of 3.20% during the forecast period.

Bitumen, commonly referred to as asphalt in its liquid form, is a viscous, black, and highly sticky material primarily derived from crude oil refining. It serves as a critical binding agent for road construction, waterproofing, and industrial applications. In Latin America, bitumen plays an essential role in infrastructure development, especially in expanding urban networks and maintaining rural roads. The Latin American bitumen market has experienced moderate growth over the past decade, driven by increased public and private investments in transportation and housing projects. According to the Economic Commission for Latin America and the Caribbean (ECLAC), infrastructure spending in the region rose by approximately 4.2% year-on-year in 2023, reflecting improved economic stability and developmental focus.

MARKET DRIVERS

Urbanization and Expansion of Road Infrastructure

Urbanization has been a significant catalyst for the Latin American bitumen market, with increasing population density demanding better transportation systems and road connectivity. According to the United Nations Department of Economic and Social Affairs (UN DESA), urban populations in Latin America are expected to reach 82% by 2030, up from 79% in 2020. This rapid urban migration necessitates extensive road construction and maintenance, directly boosting bitumen demand. Countries like Colombia and Peru have implemented aggressive infrastructure development plans under their national budgets, with Colombia allocating a substantial amount towards road projects between 2021 and 2023. Similarly, Mexico’s National Infrastructure Plan 2020–2024 included USD 22 billion for roadways, with over 60% dedicated to highways and urban roads. These developments have created a consistent need for bitumen in paving and surface dressing. Moreover, the Pan-American Highway project, which spans multiple Latin American countries, continues to require substantial volumes of bitumen for ongoing upgrades and expansions.

Government Investment in Public Infrastructure Projects

Government expenditure on public infrastructure has emerged as a crucial driver for the Latin American bitumen market, with several nations prioritizing road development to stimulate economic growth and regional integration. This initiative alone is projected to increase bitumen consumption annually through 2026. Argentina, too, has ramped up its infrastructure spending under the Ministry of Transport. The World Bank reported that Argentina's paved road network expanded during this period, further reinforcing bitumen demand. Meanwhile, Chile’s Public-Private Partnership (PPP) framework has attracted foreign capital into road construction, with USD 4.5 billion invested in toll roads since 2020.

MARKET RESTRAINTS

Volatility in Crude Oil Prices

One of the most pressing restraints affecting the Latin American bitumen market is the volatility in global crude oil prices. Since bitumen is a by-product of crude oil refining, fluctuations in petroleum prices directly impact production costs and supply chain stability. This led to a sharp increase in bitumen prices across Latin America, with Brazil witnessing a major rise in domestic bitumen costs within a single year. Argentina faced similar challenges, where local refineries struggled to maintain stable output due to high feedstock expenses. The International Monetary Fund (IMF) noted that inflation in Argentina reached 95% in 2023, partly attributed to rising energy and raw material costs, including bitumen. Furthermore, in Mexico, state-owned Pemex experienced reduced bitumen production amid financial constraints linked to volatile oil revenues. The unpredictability of crude markets complicates long-term planning for infrastructure projects, often resulting in delayed or canceled road construction initiatives.

Environmental Regulations and Sustainability Pressures

Environmental concerns and evolving regulatory frameworks have increasingly constrained the Latin American bitumen market. Governments across the region are implementing stricter emissions standards and promoting sustainable construction materials, which challenge traditional bitumen-based road paving methods. For instance, in 2023, Chile introduced new environmental policies requiring at least 30% recycled content in all new road construction projects, as reported by the Chilean Ministry of Environment. This shift toward green alternatives such as warm mix asphalt and bio-bitumen has limited conventional bitumen usage in major urban centers. Additionally, international climate agreements such as the Paris Agreement have pushed Latin American countries to reduce their carbon footprints, indirectly influencing procurement decisions in favor of eco-friendly substitutes.

MARKET OPPORTUNITIES

Adoption of Modified Bitumen and High-Performance Asphalt Solutions

The growing adoption of modified bitumen and high-performance asphalt solutions presents a significant opportunity for the Latin America bitumen market. Modified bitumen, which incorporates polymers such as SBS (styrene-butadiene-styrene) and APP (atactic polypropylene), offers enhanced durability, flexibility, and resistance to extreme weather conditions—factors that are particularly important in tropical and coastal regions of Latin America. In Ecuador, the Ministry of Transport mandated the use of modified bitumen in all new expressway projects starting in 2023, citing improved resilience against seismic activity and heavy rainfall.

Growth of Smart Cities and Sustainable Urban Planning

The emergence of smart city initiatives and sustainable urban planning across Latin America is opening new avenues for the bitumen market, particularly through the integration of intelligent road systems and environmentally conscious construction practices. Several cities in the region have adopted smart mobility frameworks that emphasize efficient traffic management and resilient infrastructure, both of which rely heavily on high-quality bitumen-based road surfaces. In Brazil, the Ministry of Cities reported that 45 municipalities had launched formal smart city programs by mid-2023, many of which included road resurfacing projects using premium-grade bitumen to support autonomous vehicle navigation and sensor-based traffic monitoring systems. Furthermore, Chile’s Ministry of Housing and Urbanism introduced guidelines encouraging the use of bitumen blends that incorporate recycled rubber from tires—a move aimed at enhancing pavement performance while addressing waste management challenges.

MARKET CHALLENGES

Supply Chain Disruptions and Logistics Constraints

Supply chain inefficiencies and logistical bottlenecks pose a major challenge to the Latin American bitumen market, hindering timely availability and cost-effective distribution. The region's reliance on imported bitumen, particularly in countries lacking sufficient refining capacity, exposes the market to delays caused by port congestion, inadequate rail infrastructure, and geopolitical trade uncertainties. In 2023, Venezuela and Bolivia faced severe shortages due to refinery outages and export restrictions, forcing them to import bitumen at premium prices from distant suppliers such as Spain and the United Arab Emirates. According to the World Bank Logistics Performance Index (LPI), Latin America lags behind other global regions in terms of supply chain efficiency, with countries like Paraguay and Peru scoring below average in customs clearance and infrastructure reliability. Also, Brazil, despite being the largest bitumen consumer in the region, experiences frequent transportation disruptions due to strikes and road blockades, particularly along major freight corridors such as BR-116. These logistical hurdles not only inflate operational expenses but also create inconsistencies in supply, making it difficult for contractors to adhere to project timelines and budgets.

Regulatory Uncertainty and Policy Instability

Regulatory uncertainty and policy instability present persistent challenges for the Latin American bitumen market, as inconsistent government directives and shifting taxation policies disrupt investment planning and production activities. In several countries, frequent changes in fuel pricing mechanisms and import duties have led to erratic cost structures for bitumen suppliers. According to the International Trade Centre (ITC), Argentina’s import licensing system for bitumen and related products underwent three major revisions between 2021 and 2023, creating confusion among stakeholders. Similarly, in Mexico, recent amendments to hydrocarbon regulations have affected the operations of private refiners, limiting domestic bitumen production capacity. In addition, political transitions in countries like Peru and Chile have resulted in abrupt shifts in infrastructure priorities, causing delays in previously approved road projects.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.20% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Mexico, Argentina, Chile and Rest Of Latin America |

|

Market Leaders Profiled |

Shell Bitumen, ExxonMobil, TotalEnergies, Chevron Corporation, Valero Energy Corporation, Nynas AB, Puma Energy, Repsol, CEPSA, Petroleos Mexicanos (Pemex) |

SEGMENTAL ANALYSIS

By Product Type Insights

The paving grade bitumen dominated the LatiAmericanca bitumen market by accounting for 58.5% of total consumption in 2024. This segment's supremacy is primarily attributed to its widespread use in road construction and highway development across the region. Countries such as Brazil, Mexico, and Argentina rely heavily on paving-grade bitumen for surface dressing, asphalt concrete mixtures, and pavement rehabilitation. The Pan-American Highway expansion projects have also significantly contributed to the demand for high-quality paving-grade bitumen. In Brazil alone, the Ministry of Infrastructure reported that over 45,000 kilometers of federal roads required maintenance or resurfacing between 2021 and 2023, further reinforcing the dominance of this product type. As urbanization accelerates and governments continue prioritizing road connectivity, paving-grade bitumen remains the most consumed product type in the Latin American bitumen market.

Polymer-modified bitumen (PMB) is emerging as the fastest-growing segment in the Latin American bitumen market, projected to expand at a CAGR of 6.2%. This rapid growth stems from increasing demand for durable and climate-resilient road surfaces, especially in countries exposed to extreme weather conditions and seismic activity. According to the Brazilian Association of Technical Standards (ABNT), PMB usage in major infrastructure projects has grown by 20% annually since 2021, driven by its superior resistance to rutting, cracking, and temperature fluctuations. With growing emphasis on resilient infrastructure and extended pavement durability, polymer-modified bitumen is gaining traction as a preferred choice among regional contractors and policymakers alike.

By Application Insights

Road construction remained the biggest application segment in the Latin American bitumen market in 2024. This overwhelming dominance is fueled by extensive government investments in transportation infrastructure aimed at improving mobility, economic integration, and trade efficiency. Colombia, too, has ramped up its road development efforts through the Fourth Generation (4G) Road Concessions Program, which includes funding for 30 strategic highway projects. Like, each kilometer of dual-lane highway requires approximately 2,500 tons of bitumen, highlighting the scale of demand driven by road construction activities across Latin America.

The waterproofing application segment is witnessing the highest growth within the Latin American bitumen market, expanding at a CAGR of approximately 5.8%. This surge is primarily driven by rising urbanization, increased investment in commercial real estate, and stricter building codes emphasizing moisture protection in infrastructure projects. As construction activities intensify and building standards evolve, waterproofing is emerging as one of the most dynamic segments in the Latin America bitumen market.

REGIONAL ANALYSIS

Brazil had the dominant position in the Latin American bitumen market by accounting for 38.6% of total regional consumption in 2024. As the continent’s largest economy and most populous nation, Brazil's extensive road network and continuous infrastructure development programs drive significant demand for bitumen. According to the National Department of Transport Infrastructure (DNIT), Brazil maintains over 1.7 million kilometers of roads, of which only 18% are paved, indicating substantial room for future expansion. Additionally, the World Bank reported that Brazil’s road freight transport accounts for 62% of all cargo movement in the country, necessitating durable and well-maintained road surfaces. The state-owned oil company Petrobras remains the primary domestic supplier of bitumen, producing over 3.2 million tons annually. However, supply constraints due to refinery outages have prompted increased imports from international suppliers such as Spain and the United States.

Mexico's strong industrial base, growing urbanization, and government-backed infrastructure initiatives support consistent bitumen demand. Under the National Infrastructure Plan 2020–2024, the Mexican government allocated USD 22 billion for road development, with more than half directed toward urban mobility and highway expansions. State-owned Pemex remains a key player in bitumen production, although declining refining capacity has resulted in increased reliance on imports from Canada and the U.S. Gulf Coast.

Argentina had a notable position in the Latin American bitumen market. The country's demand is primarily driven by federal and provincial road improvement initiatives aimed at enhancing connectivity and economic integration. Additionally, the World Bank reported that Argentina’s road freight sector handles over 85% of domestic cargo, underscoring the necessity for durable and well-maintained roadways. YPF, the country's leading energy firm, supplies the majority of domestically produced bitumen; however, frequent refinery disruptions have necessitated imports from European and Middle Eastern suppliers. Currency instability and inflationary pressures have also impacted procurement strategies, but continued government focus on road development, particularly in agricultural and export corridors, sustains bitumen demand.

Chile is driven by its structured infrastructure planning and growing emphasis on sustainable road construction. The Santiago Metropolitan Region alone saw the execution of over 1,200 kilometers of road maintenance projects between 2021 and 2023, requiring more than 400,000 tons of bitumen. Chile’s proactive approach to adopting environmentally friendly alternatives, such as warm mix asphalt and recycled bitumen blends, has also influenced market dynamics. The Ministry of Environment mandated the inclusion of at least 30% recycled content in new road projects starting in 2023, encouraging innovation while maintaining bitumen demand. Also, the Organization for Economic Co-operation and Development (OECD) reported that Chile’s Logistics and Transportation Investment Plan allocated USD 13 billion for infrastructure development through 2030, reinforcing long-term demand.

The remaining Latin American countries are playing pivotal roles in shaping demand patterns. Colombia stands out as a key market. Peru, too, has intensified road development efforts, particularly along the Southern and Northern Interoceanic Highways, which require high-grade bitumen resistant to varying climatic conditions. Ecuador’s Ministry of Transport mandated the use of polymer-modified bitumen in all expressway projects post-2023, recognizing its durability against seismic activity and heavy rainfall. Meanwhile, in Central America, Guatemala, and Panama have witnessed increased bitumen imports to support urban expansion and trade corridor improvements.

LEADING PLAYERS IN THE LATIN AMERICA BITUMEN MARKET

Petrobras (Brazil)

Petrobras is a dominant force in the LatinAmericana bitumen market, particularly within Brazil where it serves as the largest domestic producer and supplier. The company plays a crucial role in meeting national demand through its refining network, supplying bitumen for road construction and industrial applications. Beyond Brazil, Petrobras exports to neighboring countries, reinforcing its regional influence. Its vertically integrated operations allow for strategic control over production and distribution. The company has also been investing in research to develop modified bitumen products that meet evolving infrastructure needs.

Pemex (Mexico)

Pemex is Mexico’s primary bitumen producer and a key player in the Latin American market. A state-owned petroleum company, it supplies the majority of bitumen used in road construction and maintenance across the country. Pemex's extensive refining capacity supports large-scale infrastructure projects, ensuring a steady flow of bitumen into public and private sector contracts. In addition to traditional paving grade bitumen, the company has explored alternative formulations to align with sustainability trends. Despite operational challenges, Pemex remains central to Mexico’s bitumen supply chain.

YPF (Argentina)

YPF is Argentina’s leading energy company and the principal supplier of bitumen in the country. It plays an essential role in supporting Argentina’s road development initiatives by providing high-quality bitumen for both urban and rural infrastructure. YPF’s refineries ensure a consistent domestic supply, although import reliance increases during periods of low production. The company engages in technological upgrades to enhance product performance and adapt to environmental regulations. YPF’s strategic focus on infrastructure support and quality assurance makes it a key contributor to the Latin America bitumen market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players in the Latin America bitumen market is the expansion of refining and production capabilities. Companies are investing in upgrading existing facilities and establishing new processing units to ensure a stable domestic supply and reduce dependency on imports. These enhancements allow for greater control over product quality and availability, especially in high-demand regions like Brazil and Mexico.

Another prevalent approach is the adoption of advanced bitumen technologies, including polymer-modified and eco-friendly variants. By developing superior products that offer enhanced durability and environmental compliance, companies aim to cater to evolving regulatory standards and customer preferences across the region.

Lastly, strategic partnerships and collaborations have become critical tools for strengthening market presence. Key players engage in joint ventures, supply agreements, and technology-sharing initiatives with international firms and local contractors to improve distribution networks and access new markets effectively.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Latin America bitumen market include Shell Bitumen, ExxonMobil, TotalEnergies, Chevron Corporation, Valero Energy Corporation, Nynas AB, Puma Energy, Repsol, CEPSA, Petroleos Mexicanos (Pemex)

The Latin American bitumen market features a competitive landscape shaped by the presence of both state-owned enterprises and private industry players. National oil companies such as Petrobras in Brazil, Pemex in Mexico, and YPF in Argentina dominate domestic supply chains, leveraging their refining infrastructure and government backing to maintain strong positions. Alongside these, several multinational firms operate through import channels or joint ventures, offering specialized bitumen products tailored to regional demands. The competition intensifies in countries with growing infrastructure investments, where suppliers strive to differentiate themselves through product innovation, technical support, and logistical efficiency. Price volatility, regulatory shifts, and supply chain constraints further influence market dynamics, prompting companies to seek strategic alliances and diversify sourcing options. Additionally, the push toward sustainable and high-performance bitumen solutions has led to increased R&D efforts, with companies aiming to align with global trends while addressing local infrastructure needs. This evolving competitive environment underscores the importance of adaptability and long-term planning for sustained success in the Latin American bitumen industry.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Petrobras announced a strategic investment plan aimed at modernizing its refining units in São Paulo and Paraná to enhance bitumen output consistency and quality. This initiative was designed to strengthen its domestic supply chain and reduce import dependence.

- In June 2023, Pemex signed a technical collaboration agreement with a European bitumen technology firm to introduce advanced polymer-modified bitumen solutions in Mexican road projects, enhancing pavement durability and performance.

- In October 2023, YPF launched a new line of environmentally adapted bitumen products, developed in partnership with Argentine engineering firms, to comply with emerging sustainability standards and support green infrastructure initiatives.

- In February 2024, a leading international bitumen supplier established a regional logistics hub in Chile to streamline distribution across Andean markets, improving delivery times and service reliability for public and private infrastructure clients.

- In May 2024, a Brazilian asphalt additive manufacturer formed a joint venture with a European specialty chemicals company to develop customized bitumen modifiers tailored for tropical climate conditions, expanding its reach across South America.

MARKET SEGMENTATION

This research report on the Latin America Bitumen Market has been segmented and sub-segmented based on product type, application, and region.

By Product Type

- Paving Grade Bitumen

- Polymer Modified Bitumen

By Application

- Road Construction

- Waterproofing

By Region

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

1. What is driving the growth of the Latin America Bitumen Market?

The growth is driven by increasing infrastructure development, urbanization, and road construction activities across countries like Brazil, Mexico, and Argentina.

2. Which product type holds the largest share in the Latin America Bitumen Market?

Paving Grade Bitumen holds the largest market share due to its widespread use in highways and expressways

3. How is the demand for polymer-modified bitumen (PMB) changing?

The demand for PMB is increasing due to its superior performance in terms of durability and resistance to deformation under high traffic and extreme weather conditions.

4. Who regulates the quality and standards of bitumen in Latin America?

Government bodies and transportation ministries in each country set and regulate the standards for bitumen use, especially in public infrastructure projects.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com