Latin America Frozen Finger Chips Market Size, Share, Trends, Forecast, Research Report - Segmented By End-User (Food Service, Retail), and Region (Brazil, Mexico, Argentina, Chile & Rest of Latin America) – Regional Industry 2025 to 2033

Latin America Frozen Finger Chips Market Size

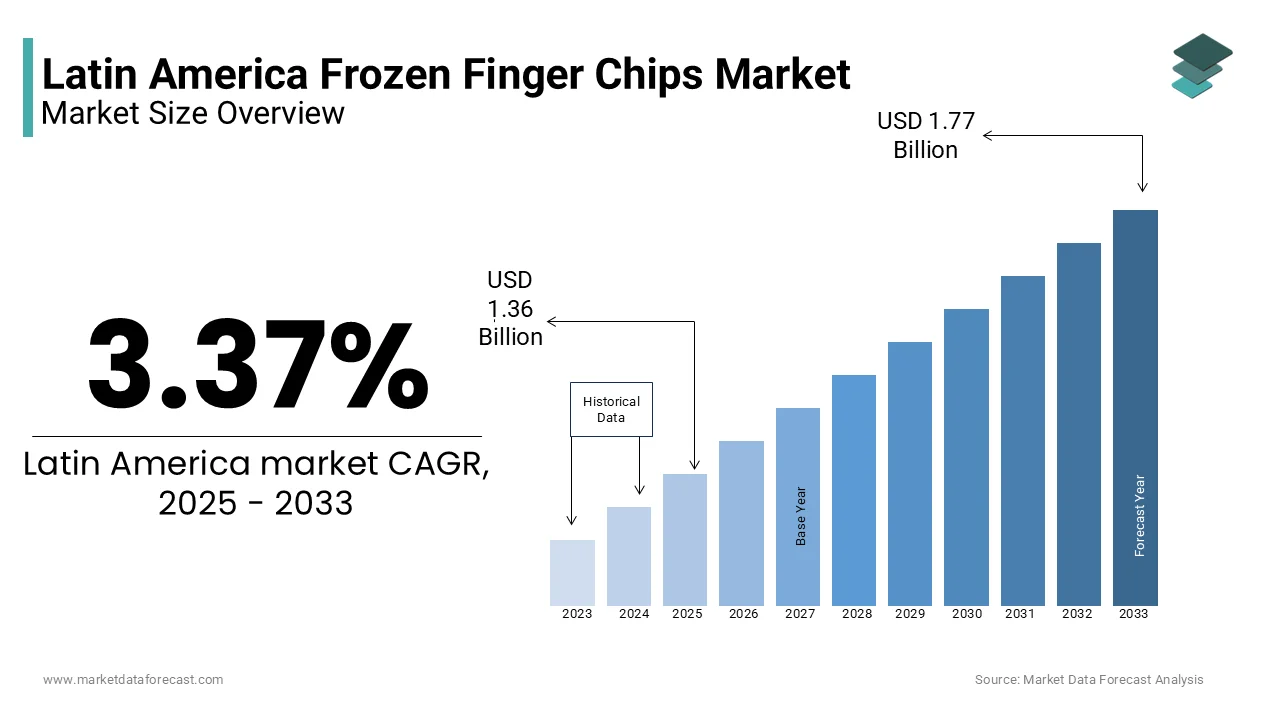

The Latin American frozen finger chips Market was valued at USD 1.32 billion in 2024. The global market size is expected to reach USD 1.36 billion in 2025 and USD 1.77 billion by 2033, with a CAGR of 3.37% during the forecast period.

The frozen finger chips are widely consumed across households, quick-service restaurants (QSRs), and foodservice establishments due to their convenience, consistent quality, and ease of preparation. The product category includes variations such as straight cut, crinkle cut, curly fries, and seasoned options, catering to a wide range of consumer preferences. Latin America has witnessed growing demand for frozen finger chips, driven by rapid urbanization, increasing fast food consumption, and expanding retail infrastructure. Countries like Brazil, Mexico, and Argentina have emerged as key markets, where rising disposable incomes and changing dietary habits support higher adoption of ready-to-cook foods. Additionally, the region’s strong agricultural base ensures a reliable supply of high-starch potatoes essential for producing crispy, high-quality frozen chips. As per the Food and Agriculture Organization (FAO), several Latin American countries have improved potato yields through better farming techniques and government-backed agricultural programs.

MARKET DRIVERS

Expansion of Quick-Service Restaurant Chains

One of the primary drivers fueling the Latin America frozen finger chips market is the rapid expansion of quick-service restaurant (QSR) chains across the region. As urban populations grow and lifestyles become increasingly fast-paced, consumers are turning to convenient, ready-to-eat meals that often include side portions of frozen finger chips. Similarly, in Mexico, where street food culture blends seamlessly with international fast food offerings, frozen finger chips are a staple accompaniment to burgers, sandwiches, and tacos. Local franchisees and independent eateries alike prefer using frozen finger chips due to their consistency, ease of storage, and minimal preparation time.

Rising Consumer Preference for Convenience Foods

A significant driver of the Latin America frozen finger chips market is the growing consumer preference for convenience foods among working professionals and dual-income households. As more individuals spend longer hours at work, there is a marked shift toward easy-to-prepare meal solutions that require minimal cooking effort. This trend is particularly pronounced in countries like Colombia and Peru, where home cooking traditions coexist with modern lifestyle demands. Supermarkets and hypermarkets also play a crucial role in driving adoption by offering bulk packs and promotional bundles that appeal to budget-conscious shoppers.

MARKET RESTRAINTS

Health Concerns Associated with Fried Foods

One of the primary restraints affecting the Latin America frozen finger chips market is the growing awareness of health risks associated with fried and high-fat foods. According to the Pan American Health Organization (PAHO), over 60% of adults in Latin America are overweight or obese, which is prompting public health campaigns that emphasize reducing consumption of deep-fried snacks and starchy foods. In response to these concerns, governments across the region have introduced regulatory measures aimed at curbing unhealthy eating habits. For example, Chile implemented strict front-of-package warning labels on foods high in fat, sugar, and sodium, which has led to a decline in sales for certain frozen and processed food categories.

Volatility in Potato Supply and Prices

Another significant restraint affecting the Latin America frozen finger chips market is the volatility in potato supply and pricing, which directly impacts production stability and cost structures. Potatoes are highly sensitive to climatic conditions, and fluctuations in weather patterns such as prolonged droughts or excessive rainfall can lead to yield shortages and price spikes. According to the Food and Agriculture Organization (FAO), potato prices in Latin America experienced a 35% year-over-year increase in 2022 due to adverse growing conditions in key producing regions like the Andean highlands and southern Brazil. In Argentina, for instance, unseasonal frost events in 2023 damaged over 20% of the potato harvest, leading to supply disruptions and forcing manufacturers to seek alternative sourcing channels at higher costs. Moreover, logistical hurdles in rural potato-producing areas further complicate procurement processes. In countries like Bolivia and Ecuador, inadequate transportation infrastructure delays deliveries and increases spoilage rates, adding another layer of complexity to the frozen finger chips supply chain.

MARKET OPPORTUNITIES

Growing Demand for Plant-Based and Alternative Frozen Side Products

An emerging opportunity for the Latin America frozen finger chips market lies in the rising consumer interest in plant-based and alternative frozen side products. According to Euromonitor International, the demand for non-potato frozen sides such as sweet potato fries, beetroot sticks, and cassava wedges has surged in recent years, particularly among health-conscious and flexitarian consumers. In Brazil, where cassava is a staple ingredient in local cuisine, companies have begun introducing frozen cassava-based finger chips as a gluten-free and nutrient-rich alternative to conventional fries. Similarly, in Mexico, where plant-based diets are gaining popularity, frozen finger chips made from yuca and taro root have found a niche audience seeking low-glycemic-index food options. Retailers and foodservice operators are capitalizing on this trend by expanding their frozen side menus to cater to diverse dietary needs.

Expansion of E-commerce and Cold Chain Infrastructure

The rapid development of e-commerce and cold chain logistics presents a significant opportunity for the Latin America frozen finger chips market. According to a 2024 report by eMarketer, online grocery sales in Latin America are projected to grow by 19% annually through 2026, with frozen foods witnessing some of the highest growth rates due to enhanced last-mile delivery solutions. Platforms such as Amazon Fresh, MercadoLibre, and Rappi have expanded their frozen food offerings, enabling consumers to order frozen finger chips alongside other groceries with guaranteed temperature control during transit. Additionally, investment in cold chain infrastructure is strengthening the distribution network. In Brazil, for instance, government initiatives and private sector participation have led to the establishment of new refrigerated warehouses and transport hubs, improving product shelf life and reducing spoilage.

MARKET CHALLENGES

Intense Competition from Local and Global Brands

One of the most pressing challenges facing the Latin America frozen finger chips market is the intense competition between multinational corporations and regional food processors. The market is highly fragmented, with both global giants and domestic players vying for market share through aggressive pricing strategies, localized branding, and extensive distribution networks. This saturation creates a challenging environment for differentiation, compelling manufacturers to invest heavily in marketing, packaging innovation, and flavor customization to capture consumer attention.

Furthermore, brand loyalty remains relatively low, with 64% of surveyed consumers in a 2023 NielsenIQ study indicating they frequently switch between frozen finger chip brands based on promotions or store recommendations. This behavior makes it difficult for companies to establish long-term brand equity. Additionally, private-label and store-brand frozen finger chips have gained ground, offering similar taste profiles at lower price points, further eroding market share from established brands.

Energy Costs and Environmental Regulations

A significant challenge confronting the Latin America frozen finger chips market is the rising cost of energy and increasing environmental regulations governing food processing operations. The production and freezing of finger chips require substantial energy inputs for blanching, frying, freezing, and cold storage, making manufacturers highly susceptible to electricity price fluctuations.

Simultaneously, governments across the region are implementing stricter environmental policies aimed at reducing carbon emissions and promoting sustainable practices. In Brazil, for instance, the National Policy on Climate Change mandates industries to adopt greener technologies, pushing frozen food manufacturers to invest in energy-efficient equipment and eco-friendly packaging solutions. While these changes align with global sustainability goals, they also impose additional financial burdens on small and medium-sized enterprises operating within tight margins.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.37% |

|

Segments Covered |

By End-User and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Latin America include Brazil, Argentina, Mexico, and the Rest of Latin America |

|

Market Leaders Profiled |

McCain Foods, J.R. Simplot, Lamb Weston, Farm Frites, Aviko, Agristo, Alexia Foods, Cascadian Farm Organic, 11er Nahrungsmittel GmbH, and Agrarfrost GmbH, Co. KG, and others. |

SEGMENTAL ANALYSIS

By End-User Insights

The food service segment was the largest in the Latin America frozen chips market by holding 58.2% of the share in 2024, with a strong demand from quick-service restaurants (QSRs) like McDonald’s, Burger King, and local chains that rely heavily on frozen potato products for consistent quality and supply. Brazil and Mexico are key contributors, accounting for over 65% of total food service sales in the region. The segment’s importance lies in its bulk procurement, standardized operations, and influence on pricing trends across the industry.

The retail segment is projected to expand at a CAGR of 6.2% during the forecast period. Urbanization and rising middle-class incomes have boosted household consumption of convenient, ready-to-cook foods. In 2023, 72% of households in Argentina and 64% in Colombia purchased frozen chips at least once a month. Moreover, e-commerce growth—particularly in countries like Brazil and Chile has accelerated retail sales, with online grocery platforms reporting a year-on-year increase of 18% in frozen food categories. Supermarkets such as Walmart de México y Centroamérica and Carrefour Argentina have expanded frozen product lines, further boosting accessibility.

REGIONAL ANALYSIS

Brazil was the largest contributor of the Latin America frozen finger chips market with 29.6% of share in 2024. According to the Brazilian Institute of Geography and Statistics (IBGE), domestic potato production reached over 4 million metric tons in 2023, supporting both local manufacturing and export activities. Additionally, the expansion of organized retail and the proliferation of quick-service restaurant chains have significantly boosted frozen finger chip consumption.

In urban centers like São Paulo and Rio de Janeiro, frozen finger chips are commonly purchased in bulk packs for home use, particularly during weekends and festive periods.

Mexico was ranked second with 25.3% of the Latin America frozen finger chips market share in 2024. Mexican consumers exhibit high per capita consumption of frozen potato products, with frozen finger chips being a staple side dish in both international and local fast food chains. According to the National Institute of Public Health of Mexico (INSP), the average person consumes more than 8 kg of frozen potato-based products annually, with finger chips making up a significant portion of this figure.

Argentina frozen finger chips market is likely to grow in the next coming years. Buenos Aires and Córdoba serve as primary consumption hubs, where frozen finger chips are frequently purchased for both home use and foodservice applications. According to the Argentine Chamber of Food Industries (COPAL), frozen potato product sales grew by 4.3% in 2023, driven by promotional campaigns and expanded distribution networks.

Supermarkets such as Carrefour and Jumbo have played a crucial role in boosting retail sales, offering branded and private-label frozen finger chip options that cater to diverse budget segments. Additionally, local fast food chains have increasingly incorporated frozen finger chips into their menus, further reinforcing their presence in daily consumption.

Chile frozen finger chips market is steadily growing with the country’s developed retail landscape and high per capita income support consistent demand for frozen foods, despite regulatory efforts aimed at curbing excessive consumption of processed items. Santiago and Valparaíso remain the main centers of frozen finger chip consumption, where working professionals and students frequently opt for convenient meal solutions. However, Chile’s stringent front-of-package labeling laws, implemented in 2016, have forced manufacturers to reformulate products to reduce fat and sodium content. While initially causing a dip in sales, these changes have led to the emergence of healthier frozen finger chip alternatives.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major key players in the Latin America frozen finger chips market are McCain Foods, J.R. Simplot, Lamb Weston, Farm Frites, Aviko, Agristo, Alexia Foods, Cascadian Farm Organic, 11er Nahrungsmittel GmbH, and Agrarfrost GmbH & Co. KG.

The Latin America frozen finger chips market is highly competitive, shaped by the presence of both multinational corporations and well-established regional producers. This dynamic environment fosters continuous innovation, aggressive branding, and strategic expansion initiatives aimed at capturing a larger consumer base. Global players leverage economies of scale, advanced production technologies, and extensive distribution networks to maintain dominance, while local manufacturers capitalize on cultural insights and proximity to raw materials to offer cost-effective solutions.

Competition extends beyond pricing, with companies differentiating themselves through product quality, packaging convenience, and alignment with health-conscious trends. The market also experiences frequent product launches and reformulations designed to meet shifting consumer expectations around nutrition and sustainability. Additionally, the rise of e-commerce and home meal solutions has intensified the need for brands to establish a strong digital presence and ensure seamless accessibility across multiple sales channels.

With increasing urbanization and rising disposable incomes, demand for frozen finger chips continues to grow, prompting companies to invest in capacity expansion, supply chain optimization, and localized marketing efforts. In this evolving landscape, adaptability and responsiveness to consumer behavior remain critical success factors.

TOP PLAYERS IN THE MARKET

McCain Foods Limited

McCain Foods is a global leader in frozen potato products and holds a strong presence in the Latin America frozen finger chips market. The company has established itself through extensive distribution networks, product innovation, and strategic partnerships with quick-service restaurants. McCain’s commitment to quality and consistency ensures its frozen finger chips remain a preferred choice among both commercial buyers and retail consumers across the region.

BRF S.A. (formerly Sadia and Perdigão)

As a major Brazilian food processing conglomerate, BRF plays a pivotal role in the frozen finger chips sector within Latin America. Leveraging its domestic production capabilities and deep understanding of local tastes, BRF offers a wide range of frozen finger chip variants tailored for both household and institutional use. Its integration into regional supply chains enhances efficiency and responsiveness to consumer demand.

Aurora Alimentos

Aurora Alimentos, one of Brazil's largest food cooperatives, significantly contributes to the frozen finger chips market by supplying high-quality frozen potato products domestically and for export. With a focus on sustainable sourcing and vertical integration, Aurora ensures consistent product availability and reliability, which isreinforcing its position as a key player in Latin America’s frozen finger chips landscape.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

One of the primary strategies employed by leading players in the Latin America frozen finger chips market is product diversification , where companies continuously introduce new cuts, flavors, and healthier alternatives to cater to evolving consumer preferences. This includes offering air-fryer-ready options and plant-based substitutes that align with modern dietary trends.

Another crucial approach is expanding cold chain infrastructure and strengthening logistics , ensuring efficient storage, transportation, and delivery of frozen products across both urban and rural areas. Companies are investing in refrigerated warehouses and partnering with distributors who specialize in temperature-controlled transport to maintain product integrity.

Lastly, enhancing brand visibility through digital marketing and strategic collaborations with QSRs has become essential. Companies are leveraging social media platforms, engaging influencers, and forming exclusive supply agreements with fast-food chains to boost product recognition and secure long-term contracts that reinforce their market presence.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, McCain Foods expanded its frozen potato processing facility in Argentina to enhance regional supply capabilities and support growing demand from both retail and foodservice sectors.

- In May 2024, BRF launched a new line of seasoned frozen finger chips in Mexico, targeting younger consumers seeking flavorful and convenient side options aligned with contemporary snacking habits.

- In August 2024, Aurora Alimentos partnered with a major supermarket chain in Brazil to introduce private-label frozen finger chips, aiming to strengthen retail presence and improve affordability for budget-conscious shoppers.

- In October 2024, Cargill announced an investment in cold storage infrastructure across Colombia to improve distribution efficiency and reduce spoilage rates for frozen finger chips in high-demand urban centers.

- In December 2024, Simplot entered into a strategic agreement with a Chilean quick-service restaurant group to become the exclusive supplier of frozen finger chips by securing a long-term contract and enhancing brand visibility in the country’s fast-food industry.

MARKET SEGMENTATION

This research report on the Latin America frozen finger chips market is segmented and sub-segmented into the following categories.

By End-User

- Food Service

- Retail

By Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Frequently Asked Questions

1. What are frozen finger chips?

Frozen finger chips, also known as frozen French fries, are pre-cut, blanched, and frozen potatoes ready for frying or baking.

2. Which countries are the major consumers of frozen finger chips in Latin America?

Brazil, Mexico, and Argentina are among the leading markets due to growing urbanization and fast-food demand.

3. What is driving the growth of frozen finger chips in Latin America?

Increased demand for convenience foods, fast food culture, and rising quick-service restaurants are key drivers.

4. Who are the major players in the Latin American frozen finger chips market?

Major companies include McCain Foods, Lamb Weston, J.R. Simplot, Aviko, and Farm Frites.

5. Where are frozen finger chips commonly sold in Latin America?

They are widely available in supermarkets, hypermarkets, online grocery platforms, and foodservice outlets.

6. Are there health concerns with consuming frozen finger chips?

While convenient, they can be high in sodium and fat; opting for oven-baked versions or low-oil cooking methods can help.

7. What packaging types are commonly used for frozen finger chips?

Frozen finger chips are usually sold in sealed, moisture-proof plastic bags that help retain freshness and prevent freezer burn.

8. Are organic or low-fat frozen finger chips available in Latin America?

Yes, with increasing health awareness, several brands offer organic, low-fat, and air-fried varieties.

9. Which distribution channels are growing in this market?

Online grocery platforms and convenience store chains are rapidly expanding as key distribution channels.

10. How is the demand for frozen finger chips impacted by fast food chains?

Fast food chains significantly boost demand as they rely heavily on consistent, high-quality frozen French fries.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com