Latin America Geothermal Energy Market Research Report – Segmented By Application (Power Generation, Residential & Commercial, Heating and Cooling), Technology & Country (Mexico, Brazil, Argentina, Chile and Rest of Latin America) - Industry Analysis From 2025 to 2033

Latin America Geothermal Energy Market Size

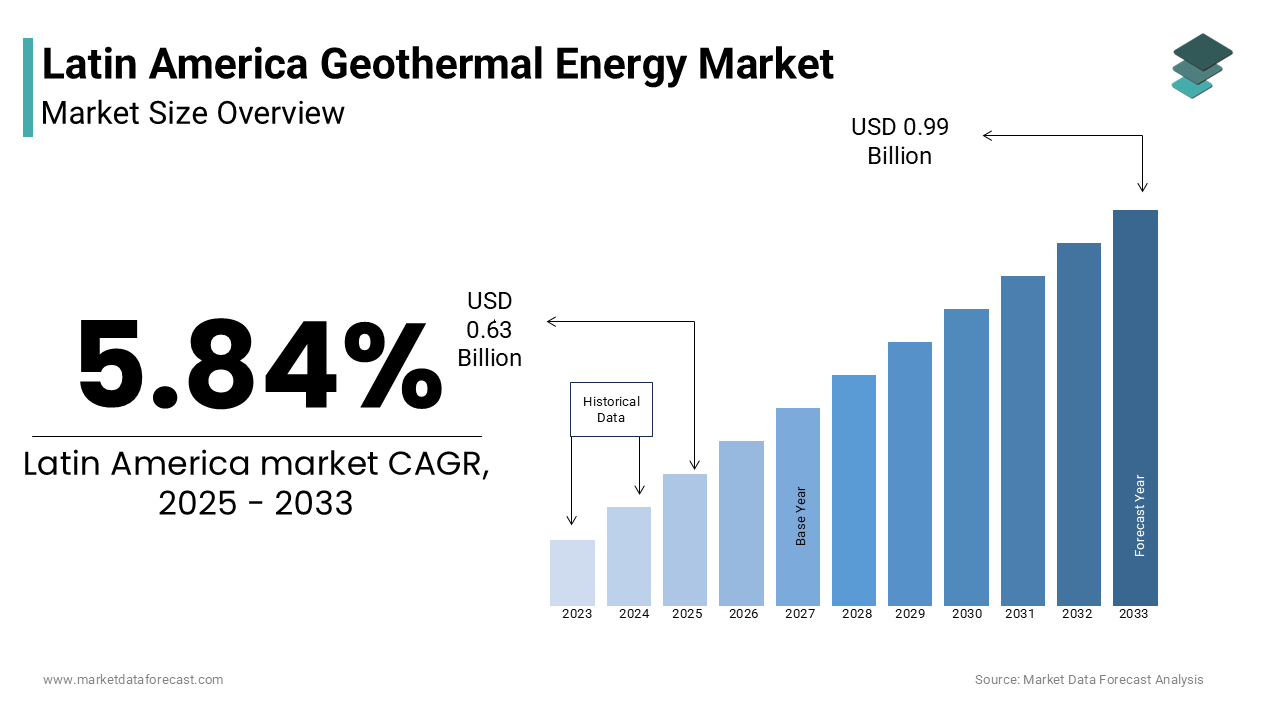

The Latin America Geothermal Energy Market was worth USD 0.59 billion in 2024. The Latin America market is expected to reach USD 0.99 billion by 2033 from USD 0.63 billion in 2025, rising at a CAGR of 5.84% from 2025 to 2033.

Geothermal energy is a renewable energy source derived from heat stored beneath the Earth's surface, offering a stable and sustainable alternative to fossil fuels. In Latin America, geothermal energy has emerged as a strategic component of national energy policies due to the region’s abundant volcanic and tectonic activity, which provides favorable geological conditions for high-temperature geothermal resources. Countries such as Mexico, El Salvador, and Costa Rica have been pioneers in harnessing this energy for electricity generation and industrial applications.

The push for clean energy diversification and climate change mitigation has further intensified interest in geothermal development across the region. According to the International Renewable Energy Agency (IRENA), Latin America accounts for a growing share of global geothermal capacity, with several countries integrating it into their long-term decarbonization strategies. This trend aligns with regional commitments under the Paris Agreement and broader efforts to reduce dependence on imported fossil fuels.

In addition to utility-scale power generation, geothermal energy is being explored for district heating, greenhouse agriculture, and aquaculture, particularly in Andean nations like Peru and Colombia. These diverse applications are attracting attention from both public institutions and private investors seeking scalable, low-emission energy solutions.

MARKET DRIVERS

Increasing Demand for Clean and Reliable Energy Sources

One of the primary drivers of the Latin America geothermal energy market is the rising demand for clean, baseload power that can support grid stability while reducing carbon emissions. Many countries in the region are facing growing electricity needs due to population growth, urban expansion, and industrial development, yet they are also committed to lowering greenhouse gas emissions under international agreements. According to the Economic Commission for Latin America and the Caribbean (ECLAC), over 60% of Latin American countries have included geothermal energy in their Nationally Determined Contributions (NDCs) under the Paris Agreement, recognizing its potential to contribute to sustainable energy transitions. Unlike solar and wind energy, which are intermittent, geothermal offers consistent output regardless of weather conditions, making it an attractive option for base-load power generation. In countries like El Salvador and Nicaragua, where energy security is a concern due to reliance on imported oil, geothermal has played a critical role in diversifying the energy mix. The Inter-American Development Bank (IDB) notes that geothermal currently supplies over 20% of El Salvador’s electricity demand, significantly improving energy independence and price stability. Furthermore, as concerns about air pollution and fuel price volatility grow, governments are prioritizing indigenous energy sources.

Government Support and Policy Frameworks Promoting Renewable Energy

Government policy support has been instrumental in driving geothermal energy development across Latin America. Several countries have implemented regulatory reforms, financial incentives, and institutional mechanisms aimed at accelerating geothermal exploration and project deployment. According to the International Renewable Energy Agency (IRENA), nearly all Central American nations have introduced feed-in tariffs or competitive bidding processes that prioritize renewable energy projects, including geothermal. The country’s Electricity Institute (ICE) has actively promoted geothermal development through long-term contracts and public investment in exploration drilling, setting a precedent for other nations. Similarly, in Mexico, the Federal Electricity Commission (CFE) has launched tenders to develop new geothermal plants in Baja California and Michoacán, backed by strong legal frameworks supporting private sector participation. Regional development banks such as the Inter-American Development Bank (IDB) and the Climate Investment Funds (CIF) have also provided concessional financing and risk-mitigation instruments to de-risk early-stage geothermal projects. These interventions have helped overcome capital-intensive barriers associated with exploration and drilling, encouraging greater private investment in the sector.

MARKET RESTRAINTS

High Initial Investment and Exploration Risks

One of the most significant restraints affecting the Latin America geothermal energy market is the high upfront capital required for exploration, drilling, and plant construction. Unlike solar or wind projects, geothermal development involves extensive geological surveys and exploratory drilling before confirming the viability of a site. Exploration risks further compound the challenge. A report by the United Nations Environment Programme (UNEP) highlights that only one out of every five exploratory wells drilled results in a commercially viable resource. This uncertainty discourages private investment, especially in markets where access to long-term financing is limited. In countries like Guatemala and Ecuador, despite promising geothermal potential, slow progress in project development has been attributed to these financial and technical risks. Public-private partnerships and multilateral support have helped alleviate some of these constraints, but without sustained investment in early-stage exploration and risk-sharing mechanisms, the pace of geothermal adoption remains constrained

Limited Technical Expertise and Skilled Workforce

Another major restraint facing the Latin America geothermal energy market is the lack of specialized technical expertise and a trained workforce capable of managing complex geothermal projects from exploration to operation. Unlike conventional energy sectors, geothermal requires a multidisciplinary skill set spanning geology, geochemistry, reservoir engineering, and environmental impact assessment—fields that remain underdeveloped in much of the region. According to the International Labour Organization (ILO), there is a significant gap between the demand for skilled professionals in the geothermal sector and the current availability of trained personnel in Latin America. Universities and technical institutions in countries like Honduras and Bolivia offer limited curricula focused on geothermal sciences, contributing to a shortage of qualified engineers and technicians. Moreover, the complexity of geothermal operations often necessitates foreign expertise, leading to higher project costs and reduced local ownership. In countries like Peru and Colombia, where geothermal exploration is still in its early stages, this skills gap has slowed down pilot projects and feasibility studies.

MARKET OPPORTUNITIES

Expansion of Geothermal Applications Beyond Power Generation

A significant opportunity emerging in the Latin America geothermal energy market is the expansion of geothermal applications beyond traditional power generation into direct-use sectors such as district heating, greenhouse cultivation, and industrial processing. Countries with active volcanism, such as Chile, Argentina, and Ecuador, possess vast low-to-medium temperature geothermal resources suitable for these non-electric applications. According to the Food and Agriculture Organization (FAO), geothermal heating is increasingly being adopted in agricultural production, particularly in high-altitude regions where maintaining crop yields year-round is challenging. Also, geothermal could potentially supply heating for thousands of homes in southern regions, reducing reliance on liquefied petroleum gas and wood-burning stoves that contribute to deforestation and air pollution. With increasing awareness and technological advancements, Latin American countries are beginning to recognize the economic and environmental benefits of expanding geothermal beyond electricity generation, opening up new pathways for market growth and rural development.

Integration with Green Hydrogen Production Initiatives

An emerging opportunity in the Latin America geothermal energy market is its integration with green hydrogen production, driven by the global shift toward decarbonized energy carriers. Green hydrogen, produced via electrolysis powered by renewable energy, is gaining momentum as a key element of future energy systems, particularly in heavy industry and transportation. According to the International Energy Agency (IEA), Latin America is poised to play a crucial role in the global hydrogen economy due to its rich renewable resources, including geothermal. Countries like Mexico and Costa Rica are exploring the feasibility of using geothermal energy to produce hydrogen for domestic consumption and export. In Mexico, government-backed research institutions have initiated studies to assess the viability of co-located geothermal and hydrogen facilities in the Trans-Mexican Volcanic Belt, where high-temperature geothermal fields are concentrated. In addition, international energy companies operating in the region are evaluating geothermal-powered hydrogen hubs as part of corporate net-zero commitments. The Inter-American Development Bank (IDB) has identified geothermal as a prime candidate for green hydrogen production due to its ability to deliver continuous power without intermittency issues.

MARKET CHALLENGES

Regulatory Uncertainty and Lengthy Permitting Processes

One of the most pressing challenges confronting the Latin America geothermal energy market is the inconsistent regulatory environment and prolonged permitting procedures that delay project timelines and increase costs. While several countries have established frameworks to promote renewable energy, geothermal-specific regulations often lag behind, creating ambiguity around land rights, environmental compliance, and subsurface resource management. According to the World Bank, obtaining permits for geothermal projects in Latin America can take anywhere from five to ten years, compared to two to four years in more developed geothermal markets. In countries like Guatemala and Bolivia, overlapping jurisdictional responsibilities among different government agencies lead to bureaucratic inefficiencies and increased investor hesitation. In addition, unclear legal definitions regarding subsurface mineral rights complicate the allocation of geothermal resources.

Environmental and Social Opposition in Sensitive Areas

Environmental and social opposition presents a formidable challenge to geothermal energy development in Latin America, particularly in ecologically sensitive and culturally significant regions. Although geothermal energy is considered a clean and renewable resource, its extraction can result in land disturbance, water usage, and seismic activity, raising concerns among local communities and environmental groups. In El Salvador, for example, opposition from local stakeholders has led to project suspensions in areas with known geothermal potential, despite the country’s high dependency on imported fossil fuels. Moreover, in countries like Peru and Ecuador, geothermal sites often overlap with protected areas or indigenous territories, triggering legal disputes and social unrest. To overcome these obstacles, developers and policymakers must implement inclusive planning strategies, conduct thorough environmental impact assessments, and ensure that affected communities are engaged throughout the project lifecycle.

SEGMENTAL ANALYSIS

By Application Insights

The power generation segment dominated the Latin America geothermal energy market in 2024. This overwhelming dominance is attributed to the region’s abundant high-temperature geothermal resources that are well-suited for electricity production, particularly along the Pacific Ring of Fire. A primary driver of this segment's leadership is its integration into national energy grids as a reliable source of baseload renewable power. Countries like El Salvador and Costa Rica have successfully harnessed geothermal energy to reduce dependency on fossil fuels and imported electricity. Mexico also plays a critical role, with more than 1,000 MW of installed geothermal. In addition, international development banks such as the Inter-American Development Bank (IDB) have funded early-stage exploration projects across Guatemala, Honduras, and Colombia, further reinforcing the growth trajectory of the power generation segment.

The residential and commercial heating and cooling segment is emerging as the fastest-growing application of geothermal energy in Latin America, projected to expand at a CAGR of 7.6%. This growth is being driven by increasing adoption of ground-source heat pumps (GSHPs) in urban and industrial settings where stable thermal regulation is required. One of the key factors behind this rise is the growing demand for energy-efficient building solutions in cities like Santiago, Buenos Aires, and Bogotá, where heating and cooling account for a significant portion of energy consumption. Moreover, governments are promoting green building certifications and offering incentives for low-emission technologies. Universities and research institutions across Brazil and Argentina are also piloting GSHP installations in campus infrastructure, demonstrating their feasibility in diverse climatic conditions.

By Technology Insights

The binary and flash cycle plants constitute the largest technology segment in the Latin America geothermal energy market in 2024. These technologies are predominantly used for large-scale electricity generation and are well-suited to the region’s high-temperature geothermal fields found in volcanic zones. A key factor driving the dominance of this segment is the widespread availability of high-enthalpy geothermal resources in countries such as Mexico, El Salvador, and Costa Rica. Another important contributor is the long-term operational efficiency and reliability offered by these plants. Unlike dry steam or direct-use applications, binary and flash plants can operate continuously without weather dependence, making them ideal for utility-scale deployment. The Inter-American Development Bank (IDB) highlights that these technologies benefit from mature engineering standards and extensive global deployment experience, facilitating smoother project execution and investor confidence. Additionally, several Latin American countries are investing in plant upgrades and hybridization with other renewables to enhance efficiency.

Ground source heat pumps (GSHPs) are experiencing rapid adoption in the Latin America geothermal energy market, projected to grow at a CAGR of 8.2%. This segment is gaining traction due to its applicability in residential, commercial, and institutional buildings seeking efficient climate control solutions. One of the main drivers of this growth is the increasing emphasis on energy efficiency in urban infrastructure. In cities like São Paulo and Lima, where air conditioning demand is rising due to higher temperatures and population density, GSHPs offer a viable alternative to conventional HVAC systems by leveraging shallow ground heat for year-round temperature regulation. Furthermore, universities and hospitals are leading the way in adopting GSHP technology for district-level heating and cooling. With growing awareness of decarbonization targets and supportive policy frameworks, ground source heat pumps are emerging as a key enabler of decentralized, low-emission thermal energy solutions in Latin America.

REGIONAL ANALYSIS

Mexico had the largest share of the Latin America geothermal energy market by accounting for a 39.6% of total installed capacity in 2024. As one of the top geothermal producers globally, Mexico benefits from extensive volcanic activity along the Trans-Mexican Volcanic Belt, providing ideal conditions for high-temperature resource extraction. The country’s federal energy strategy includes aggressive renewable energy targets, with geothermal playing a crucial role in reducing reliance on fossil fuels. The Federal Electricity Commission (CFE) operates multiple geothermal power stations in Baja California and Michoacán, collectively producing over 1,000 MW of clean electricity annually. Recent funding initiatives have supported exploratory drilling and plant modernization efforts, enhancing overall efficiency and output

Chile’s strategic location along the Andean Volcanic Belt provides access to high-grade geothermal resources, particularly in the northern regions near active tectonic plates. One of the primary contributors to Chile’s geothermal progress is its commitment to carbon neutrality by 2050. As part of this initiative, the Chilean government has integrated geothermal into its National Energy Strategy, aiming to diversify the energy mix beyond hydroelectric and solar power. In addition, Chilean mining companies—major consumers of electricity—are exploring geothermal as a means to reduce emissions and operational costs. Several pilot projects in the Atacama region are assessing the viability of co-producing geothermal energy alongside lithium extraction operations, creating synergies between mineral processing and clean energy generation.

Argentina’s geothermal potential is primarily concentrated in the Andean provinces of Neuquén, Mendoza, and San Juan, where volcanic activity offers high-temperature resources suitable for electricity generation. One of the key drivers of Argentina’s geothermal development is the push for energy sovereignty amid fluctuating natural gas supplies. The Argentinean government has included geothermal in its RenovAr program, a renewable energy auction mechanism aimed at diversifying the national energy matrix. Another contributing factor is the growing interest from private investors and international agencies. Despite economic challenges, Argentina is gradually expanding its geothermal footprint, positioning itself as a key player in Southern Cone renewable energy development.

Colombia contributed notably to the Latin America geothermal energy market in 2024. Although not traditionally known for large-scale geothermal production, Colombia possesses significant geothermal potential in the Andes mountain range, particularly around the Ruiz-Tolima volcanic complex. A major catalyst for geothermal development in Colombia is the need for diversified, drought-resistant energy sources. Hydroelectric power constitutes a substantial portion of the national grid, but prolonged dry seasons have prompted policymakers to explore alternatives that ensure consistent electricity generation. The government has taken steps to encourage private investment through incentive programs and streamlined permitting processes. The Inter-American Development Bank (IDB) has provided technical assistance to assess resource viability and attract independent power producers to develop pilot projects. Universities and research institutions are also playing a role, conducting feasibility studies on integrating geothermal with agricultural and rural electrification initiatives.

Costa Rica is renowned for its advanced renewable energy infrastructure, with a large share of its electricity coming from clean sources, including a significant contribution from geothermal. The country’s geothermal expansion is largely centered around the Miravalles field in Guanacaste Province, which has been developed in phases since the 1990s. Government policies have played a crucial role in fostering geothermal growth. Costa Rica’s National Decarbonization Plan includes specific targets for expanding indigenous renewable energy sources, with geothermal identified as a key enabler of long-term energy security. In addition, Costa Rica has actively participated in international knowledge-sharing initiatives, including those led by IRENA and the World Bank, to improve exploration techniques and reduce risks associated with deep drilling. As a model for clean energy transition, Costa Rica continues to influence geothermal development across Latin America.

Peru is still in the early stages of development, it has recognized the strategic value of geothermal energy in achieving its climate commitments and improving energy resilience. Peru’s geothermal potential is concentrated in the southern Andes, particularly in the Arequipa and Moquegua regions, where volcanic activity provides access to high-temperature reservoirs. A key driver of geothermal development in Peru is the growing demand for dispatchable renewable energy to complement variable solar and wind generation. It has introduced policy instruments such as feed-in tariffs and public tenders to attract private investment, though progress remains slow due to exploration risks and limited financing mechanisms. International cooperation has played a role in advancing the sector, with Japan and Germany supporting feasibility studies and technical training programs. Additionally, local universities are partnering with global institutions to build expertise in geothermal science and engineering.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Polaris Infrastructure, Enel Green Power, Energy Development Corporation (EDC), Eavor Technologies, Getech Group, and Comisión Federal de Electricidad (CFE) are some of the key market players latin america geothermal energy market.

The Latin America geothermal energy market is marked by a competitive yet evolving landscape, where global leaders and regional developers coexist under varying degrees of state involvement and private participation. While multinational firms such as Ormat Technologies, Enel Green Power, and Mitsubishi Corporation dominate large-scale power generation projects due to their technological expertise and financial strength, national utilities and emerging local developers are steadily gaining ground. Countries like Mexico, Chile, and Costa Rica have fostered competitive environments through structured bidding processes and policy incentives, encouraging both domestic and foreign players to participate.

However, unlike more mature markets in North America or Southeast Asia, Latin America faces challenges related to geological uncertainty, regulatory complexity, and financing constraints, which limit widespread competition. Despite these hurdles, the market is becoming increasingly dynamic as new entrants explore opportunities in district heating, industrial applications, and green hydrogen production. Additionally, the rise of public-private partnerships and international funding support is reshaping the competitive structure, allowing smaller developers to access capital and expertise previously dominated by industry giants. As awareness of geothermal’s potential expands and supportive frameworks evolve, the region is witnessing a gradual shift from monopolistic or state-controlled models to a more diversified and competitive marketplace.

Top Players in the Latin America Geothermal Energy Market

Ormat Technologies Inc.

Ormat Technologies is a global leader in geothermal energy and a key player in Latin America, where it has been instrumental in developing utility-scale power plants across Mexico, Guatemala, and Chile. The company specializes in both power plant equipment manufacturing and project development, offering integrated solutions from exploration to operation. In Latin America, Ormat’s presence supports regional goals for clean energy diversification and grid stability. Its innovative binary cycle technology has enabled efficient electricity generation from medium-temperature resources, making previously untapped geothermal fields viable. Through long-term power purchase agreements and public-private partnerships, Ormat continues to expand its influence while contributing to global advancements in renewable baseload power.

Enel Green Power

Enel Green Power is a major force in the Latin American geothermal energy sector, particularly in countries like Costa Rica, Chile, and Argentina. As part of the Enel Group, one of the world’s largest renewable energy operators, the company leverages its global expertise to develop sustainable geothermal projects tailored to local conditions. In Latin America, Enel focuses on integrating geothermal with other renewables to enhance energy security and reduce carbon emissions. Its operations emphasize environmental stewardship and community engagement, aligning with international sustainability standards. By investing in advanced exploration techniques and hybrid energy systems, Enel is strengthening geothermal’s role in the region’s transition toward cleaner, more resilient power generation.

Mitsubishi Corporation (Geothermal Division)

Mitsubishi Corporation plays a significant role in the Latin America geothermal energy market through strategic investments, joint ventures, and technology partnerships. The company collaborates with local governments and independent power producers to finance and develop geothermal projects, particularly in Mexico and Central America. Mitsubishi brings extensive experience from Japan’s mature geothermal sector, supporting Latin American nations in overcoming technical and financial barriers to deployment. Its contributions extend beyond infrastructure development to include knowledge transfer and capacity-building initiatives that strengthen local expertise. With a focus on long-term sustainability and innovation, Mitsubishi is helping position Latin America as a growing hub within the global geothermal landscape.

Top Strategies Used by Key Market Participants

One of the primary strategies employed by leading players in the Latin America geothermal energy market is investing in early-stage exploration and risk mitigation. Given the high uncertainties associated with identifying viable geothermal reservoirs, companies are forming partnerships with government agencies and multilateral institutions to co-fund exploratory drilling and seismic surveys. This approach helps de-risk investment decisions and attract private capital for full-scale project development.

Another key strategy involves adopting hybrid energy models that integrate geothermal with solar, wind, and storage technologies. As demand for flexible and dispatchable renewable energy grows, companies are leveraging geothermal’s baseload capabilities to complement intermittent renewables. This not only enhances grid stability but also increases the economic viability of geothermal assets, especially in regions with evolving power markets and regulatory frameworks.

A third important strategy is strengthening community engagement and environmental compliance programs. Recognizing the social and ecological sensitivities surrounding geothermal development, companies are prioritizing transparent stakeholder consultation, benefit-sharing mechanisms, and impact-reduction measures. These efforts help secure social license and streamline permitting processes, enabling smoother project execution and long-term operational acceptance in diverse Latin American landscapes.

RECENT MARKET DEVELOPMENTS

- In February 2024, Ormat Technologies signed a strategic agreement with the Mexican Federal Electricity Commission (CFE) to upgrade and expand the Los Azufres geothermal complex in Michoacán. This initiative was aimed at improving plant efficiency and extending the field’s productive life, reinforcing Ormat’s leadership in Mexico’s geothermal sector.

- In May 2024, Enel Green Power launched a pilot geothermal-hydrogen integration project in northern Chile, exploring the feasibility of using geothermal energy for electrolysis-based hydrogen production. This move was intended to position Enel at the forefront of next-generation clean energy applications in Latin America.

- In September 2024, Mitsubishi Corporation announced a joint venture with a Guatemalan energy developer to conduct deep geothermal resource assessments in the Western Highlands. This collaboration was designed to unlock new geothermal sites and facilitate future project development in a region with high untapped potential.

- In January 2025, Alterra Power Corp., now part of TC Energy Renewables, secured a long-term power purchase agreement with Colombia’s state-run utility to supply geothermal-sourced electricity from a proposed plant near the Ruiz-Tolima volcanic belt. This agreement was expected to catalyze further investment in Colombia’s emerging geothermal market.

- In March 2025, Ram Power Corp. re-entered the Latin American geothermal space through an asset acquisition in Nicaragua, acquiring dormant exploration rights and existing well infrastructure. The move was intended to revive stalled projects and reinvigorate private sector interest in the country’s geothermal potential.

MARKET SEGMENTATION

This research report on the Latin America geothermal energy market is segmented and sub-segmented into the following categories.

By Application

- Power Generation

- Residential & Commercial Heating and Cooling

By Technology

- Binary & Flash Cycle Plants

- Ground Source Heat Pumps (GSHPs)

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

What is driving the growth of the geothermal energy market in Latin America?

Growth is driven by abundant geothermal potential, rising demand for renewable energy, government initiatives, international funding, and efforts to reduce carbon emissions.

What is the future outlook for ground source heat pumps in Latin America?

Ground source heat pumps are projected to grow rapidly due to rising demand for energy-efficient building solutions and increasing urbanization across countries like Brazil, Argentina, and Chile.

What challenges does the geothermal market face in Latin America?

Challenges include high upfront capital costs, exploration risks, regulatory complexities, and limited technical expertise in some countries.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com