Latin America Heat Exchanger Market Size, Share, Trends, Forecast, Research Report - Segmented By Type (Shell & Tube, Plate & Frame, Air Cooled, and Others), Material, End-Use Industry, and Region (Brazil, Mexico, Argentina, Chile & Rest of Latin America) – Regional Industry 2025 to 2033

Latin America Heat Exchanger Market Size

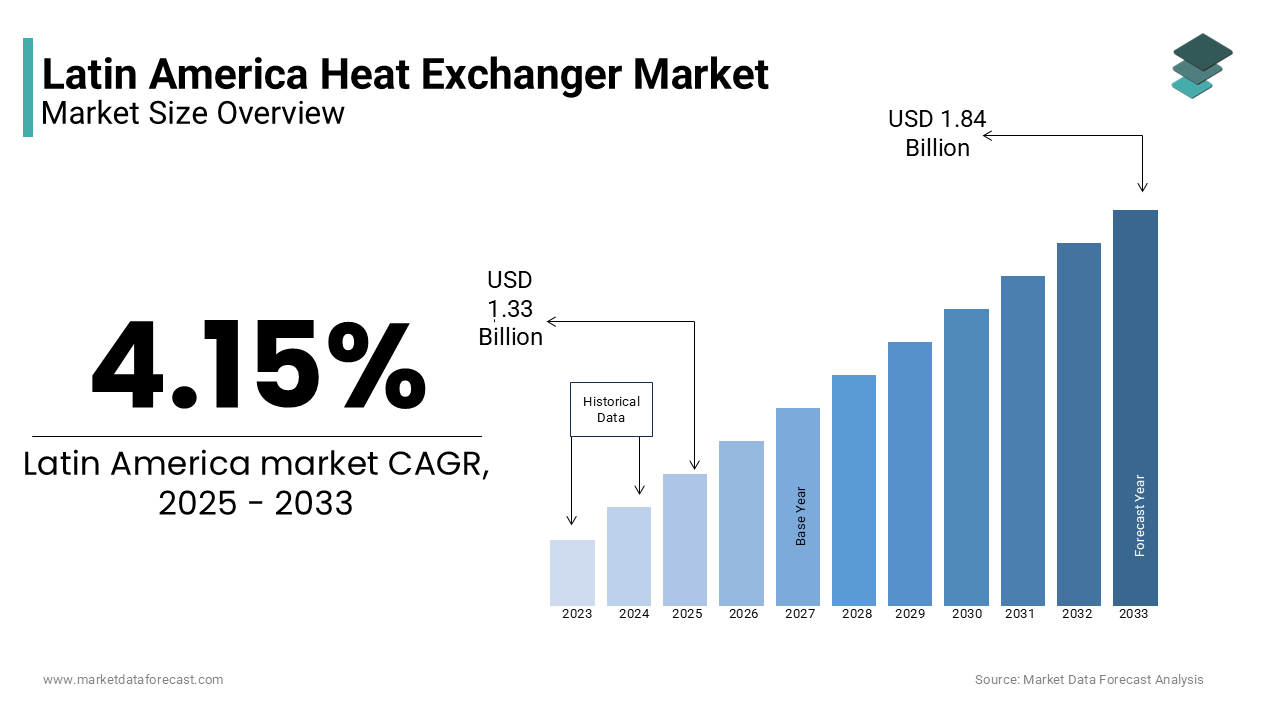

The Latin American heat exchanger market was valued at USD 1.28 billion in 2024. The global market size is expected to reach USD 1.33 billion in 2025 and USD 1.84 billion by 2033, with a CAGR of 4.15% during the forecast period.

The Latin America heat exchanger market refers to the regional industry involved in the design, manufacturing, and supply of equipment used for transferring thermal energy between two or more mediums. These devices are integral to a wide range of industrial applications including power generation, oil refining, chemical processing, HVAC systems, and food & beverage production. The market encompasses various types such as shell and tube, plate, and direct-contact heat exchangers, each tailored for specific operational conditions and performance requirements.

According to data from the Economic Commission for Latin America and the Caribbean, industrial activity across the region has been gradually recovering post-pandemic, with sectors like energy and petrochemicals witnessing renewed investment. This resurgence has directly influenced demand for efficient thermal management solutions, especially in countries like Brazil and Mexico where industrialization remains robust.

MARKET DRIVERS

MARKET DRIVERS

Expansion of Oil and Gas Infrastructure

A primary driver of the Latin America heat exchanger market is the ongoing expansion and modernization of oil and gas infrastructure across key producing nations. Countries such as Brazil, Mexico, and Argentina are investing heavily in upstream exploration, midstream transportation, and downstream refining operations, all of which rely extensively on heat exchangers for process heating, cooling, and condensation.

In Brazil, Petrobras has undertaken extensive refinery upgrades under its "Refinaria de Janeiro" initiative, aiming to improve crude distillation efficiency and reduce environmental impact.

Mexico’s state-owned oil company Pemex has also prioritized infrastructure renewal, launching a multi-year modernization plan in 2023 that includes the rehabilitation of six major refineries. As reported by the Mexican Energy Regulatory Commission, these upgrades involve replacing outdated thermal exchange systems with more efficient models capable of handling higher throughput while minimizing energy losses.

Additionally, Argentina’s Vaca Muerta shale development has spurred demand for heat exchangers used in natural gas processing plants and compressor stations. The Argentine Oil and Gas Institute noted that thermal management equipment procurement increased by 18% in 2023, reflecting the sector’s growing reliance on advanced heat transfer solutions.

Growth in Renewable Energy and Power Generation Projects

Another significant driver of the Latin America heat exchanger market is the increasing deployment of renewable energy infrastructure, particularly in solar thermal and biomass-based power generation. Governments across the region are pursuing cleaner energy alternatives to diversify their energy mix and meet international climate commitments, creating new opportunities for heat exchanger manufacturers.

Chile has emerged as a global leader in concentrated solar power (CSP), leveraging its high solar irradiation levels in the Atacama Desert. According to the Chilean Energy Ministry, over 4 gigawatts of CSP capacity is either under construction or in planning stages , all of which require specialized heat exchangers to convert solar energy into usable electricity through thermal cycles.

In Brazil, the government has intensified its support for bioenergy, particularly sugarcane-based ethanol and bagasse cogeneration. The Brazilian Sugarcane Industry Association reported that over 40 new sugar-alcohol plants were commissioned in 2023 , each requiring heat exchangers for steam recovery and process heating applications. These facilities rely on high-efficiency boilers and condensers to maximize energy utilization and reduce waste.

Similarly, Mexico’s wind and geothermal energy sectors have gained momentum, with the Mexican Association of Renewable Energy noting a 12% increase in installed renewable capacity in 2023. While primarily focused on electricity generation, these plants often incorporate hybrid thermal systems that integrate heat exchangers for temperature regulation and system efficiency.

MARKET RESTRAINTS

Economic Instability and Currency Volatility

Economic instability poses a significant challenge to the Latin America heat exchanger market, affecting both purchasing power and investment decisions across key end-use industries. Many countries in the region experience fluctuating inflation rates, political uncertainty, and currency devaluation, which impact the affordability of imported components and finished equipment. This extreme economic condition made long-term planning difficult for industrial operators and discouraged capital expenditures, including the acquisition of new heat exchangers.

Currency fluctuations also affect local manufacturers who rely on imported raw materials such as stainless steel, copper, and aluminum. These costs are often passed on to consumers, making heat exchangers less accessible to small and medium-sized enterprises that form a significant portion of the market.

Also, unstable macroeconomic conditions deter foreign investors from committing to large-scale energy and industrial projects, further limiting equipment demand.

Supply Chain Disruptions and Component Shortages

Supply Chain Disruptions and Component Shortages

Supply chain disruptions pose a significant challenge to the Latin America heat exchanger market, particularly for companies reliant on imported machinery and spare parts. Global supply bottlenecks caused by geopolitical tensions, shipping delays, and semiconductor shortages have had cascading effects on equipment availability and delivery timelines.

According to the World Bank’s 2023 Logistics Performance Index, several Latin American ports experienced prolonged congestion, reducing cargo throughput and increasing lead times for heat exchanger shipments. In Brazil, customs clearance delays at major ports like Santos and Rio de Janeiro resulted in extended waiting periods for imported equipment, impacting project schedules.

Besides, component shortages—especially in high-grade alloys and precision-engineered parts—have affected both OEMs and local distributors. Many manufacturers source critical components from Asia and Europe, where production slowdowns have constrained output. As reported by the Mexican Automotive Industry Association, some heat exchanger producers faced delays of up to six months in receiving essential parts in 2023. These logistical hurdles not only delay project execution but also inflate equipment costs, making it harder for smaller industrial operators to procure necessary thermal management solutions.

MARKET OPPORTUNITIES

Adoption of Energy Efficiency Standards in Industrial Sectors

A growing opportunity in the Latin America heat exchanger market lies in the adoption of energy efficiency standards across key industrial sectors. Governments and regulatory bodies are increasingly implementing policies aimed at reducing energy consumption and carbon emissions, encouraging industries to upgrade their thermal management systems with high-performance heat exchangers.

In Brazil, the Ministry of Mines and Energy introduced updated energy efficiency regulations for industrial processes in 2023, mandating the use of high-efficiency heat exchangers in new and retrofitted facilities. Also, Chile has taken a similar approach, incorporating energy efficiency benchmarks into its national industrial policy. The Chilean Energy Efficiency Agency reported that more than 300 manufacturing firms adopted ISO 50001 energy management standards in 2023 , leading to increased investments in advanced heat recovery and waste heat utilization systems.

Moreover, Mexico’s Federal Electricity Commission (CFE) has launched incentive programs for companies that implement energy-saving technologies, including regenerative heat exchangers used in cement, glass, and metal processing industries. According to the Mexican Association of Industrial Equipment Manufacturers, these initiatives have contributed to a 14% increase in high-efficiency heat exchanger sales in 2023.

Expansion of Food and Beverage Processing Industries

The rapid expansion of the food and beverage processing sector in Latin America presents a significant opportunity for the heat exchanger market. With rising consumer demand for packaged and processed foods, companies are investing in modern production lines that require precise temperature control for pasteurization, sterilization, and refrigeration.

Brazil continues to be a global leader in agro-industrial production, particularly in coffee, orange juice, and soybean derivatives. According to the Brazilian Food Industry Association, over 60 new food processing plants were commissioned in 2023 , each requiring heat exchangers for fluid heating, cooling, and evaporation processes. As the food and beverage sector expands and adopts stricter hygiene and quality controls, the demand for specialized and corrosion-resistant heat exchangers is expected to rise across Latin America.

MARKET CHALLENGES

MARKET CHALLENGES

Regulatory Complexity and Environmental Compliance

Regulatory complexity and stringent environmental compliance requirements present a growing challenge for the Latin America heat exchanger market. Governments in the region are increasingly enforcing emission norms, safety standards, and environmental impact assessments that affect equipment specifications and project approvals.

Chile, for example, has implemented Euro VI emission standards for industrial equipment operating in urban areas, as outlined by the Chilean Environmental Assessment Service. This requires manufacturers and plant operators to invest in newer, more efficient heat exchangers that minimize thermal losses and reduce greenhouse gas emissions, potentially deterring smaller firms from upgrading their systems.

In Brazil, environmental licensing procedures for large-scale industrial and energy projects have become more rigorous, delaying start dates and affecting equipment procurement cycles. According to the Brazilian Institute of Environment and Renewable Natural Resources (IBAMA), the approval process for major processing plants can take over a year, disrupting procurement planning for heat exchanger suppliers. Furthermore, varying regulations across countries complicate cross-border equipment sales and installations.

Limited Local Manufacturing and Technological Capabilities

The lack of a robust domestic manufacturing ecosystem for high-end heat exchangers remains a persistent challenge in Latin America. Unlike in North America or Europe, where localized production supports rapid customization and after-sales service, most Latin American countries rely heavily on imports for precision-engineered thermal exchange systems.

Brazil is one of the few countries in the region with a developed industrial base, yet even there, the production of advanced shell-and-tube or plate heat exchangers remains limited.

This dependency on imports increases costs and extends delivery times, particularly for specialized equipment required in the oil and gas, chemical, and pharmaceutical industries. Additionally, the absence of local R&D centers limits innovation and adaptation to regional industrial needs.

While multinational manufacturers have established regional service hubs, the lack of skilled technical labor and engineering expertise hampers maintenance and repair capabilities, reducing overall equipment reliability.

REPORT COVERAGE

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.15% |

|

Segments Covered |

By Type, Material, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Latin America include Brazil, Argentina, Mexico, and the Rest of Latin America |

|

Market Leaders Profiled |

Alfa Laval AB, Danfoss A/S, Kelvion, Xylem Inc, API Heat Transfer, Mersen SA, Hisaka Works, Chart Industries Inc, Johnson Controls International PLC, HRS Heat Exchangers, SPX Technologies Inc, Koch Industries, Southern Co, Güntner, FUNKE, and others. |

SEGMENTAL ANALYSIS

By Type Insights

Shell and tube heat exchangers dominated the Latin America heat exchanger market, capturing 48.4% of total demand in 2024. This segment’s growth is primarily attributed to its widespread use across high-pressure and high-temperature industrial applications, particularly in the oil & gas, chemical, and power generation sectors.

One key driver behind this dominance is the extensive modernization of refining infrastructure in Brazil and Mexico.

Similarly, in Mexico, Pemex launched a comprehensive overhaul of six national refineries under its National Refinery Modernization Plan. As per the Mexican Energy Regulatory Commission, these upgrades required advanced thermal exchange systems capable of handling extreme process conditions, further boosting demand for shell-and-tube models.

Additionally, Chile’s growing solar thermal energy sector has also contributed to increased adoption. With continued investment in industrial and energy infrastructure, this segment remains central to the Latin American heat exchanger landscape.

Air cooled heat exchangers represent the fastest-growing segment in the Latin America heat exchanger market, projected to expand at a CAGR of 9.4%. This growth is driven by increasing demand for water-efficient cooling solutions in arid regions and industries seeking to reduce environmental impact.

A primary factor contributing to this expansion is the rise in natural gas production and processing in Argentina’s Vaca Muerta shale basin. In addition, Chile’s mining industry has increasingly adopted air cooled exchangers for mineral processing operations in the Atacama Desert, where water scarcity is a critical constraint.

Moreover, power generation projects in Brazil have seen a shift toward hybrid cooling systems that combine air cooling with minimal water usage. The Brazilian National Electric Energy Agency (ANEEL) indicated that new combined cycle power plants commissioned in 2023 featured air cooled heat exchangers in their exhaust heat recovery systems , enhancing efficiency while complying with environmental regulations.

By Material Insights

Carbon steel is the most widely used material in the Latin America heat exchanger market, accounting for 45% of total material consumption in 2024. Its dominance is due to its cost-effectiveness, mechanical strength, and compatibility with conventional industrial processes, making it the preferred choice for applications in oil refining, chemical processing, and heavy manufacturing.

One of the primary reasons for carbon steel’s leading position is its extensive utilization in Brazil’s refining and petrochemical sectors. Mexico’s state-owned oil company Pemex has also relied heavily on carbon steel for retrofitting aging pipelines and processing equipment. As reported by the Mexican Energy Regulatory Commission, carbon steel accounted for more than 60% of all heat exchanger materials procured in 2023 , particularly in heat recovery systems within midstream transportation networks.

Furthermore, Argentina’s expanding shale gas extraction activities in the Vaca Muerta formation have reinforced demand for carbon steel-based heat exchangers in compression stations and gas processing units. Despite its susceptibility to corrosion in certain environments, carbon steel remains the dominant material in Latin America due to its affordability and suitability for high-volume industrial applications.

Stainless steel is emerging as the fastest-growing material segment in the Latin America heat exchanger market, projected to expand at a CAGR of 10.2%. This growth is driven by increasing demand for corrosion-resistant and hygienic materials in food processing, pharmaceuticals, and clean energy applications.

A key factor fueling this trend is the expansion of the food and beverage industry across the region. In Brazil, the Ministry of Agriculture reported that over 60 new food processing plants were commissioned in 2023 , each requiring stainless steel plate heat exchangers for pasteurization, sterilization, and refrigeration processes. These units ensure compliance with hygiene standards while maintaining product integrity.

Chile’s lithium extraction boom has also contributed to rising stainless steel adoption. Additionally, Mexico’s pharmaceutical and biotech sectors have prioritized stainless steel heat exchangers for cleanroom HVAC systems and reactor cooling applications. With increasing emphasis on hygiene, durability, and chemical resistance, stainless steel is positioned for robust growth across Latin America’s evolving industrial sectors.

By End Use Industry

The petrochemical and oil & gas industry held the largest share of the Latin America heat exchanger market, accounting for 38.3% of total demand in 2024. This segment's dominance is rooted in the region’s vast fossil fuel reserves and ongoing investments in upstream exploration, midstream logistics, and downstream refining infrastructure.

Brazil continues to be a major contributor to this segment, with Petrobras executing a comprehensive modernization plan at its refineries.

Argentina’s Vaca Muerta shale development has also spurred demand for specialized heat transfer solutions in gas processing plants and compressor stations.

The power generation segment is rising as the quickest advancingcategory in the Latin America heat exchanger market, projected to expand at a CAGR of 11.0%. This rapid growth is fueled by the expansion of renewable energy sources such as concentrated solar power (CSP), biomass, and geothermal, all of which rely on advanced thermal exchange technologies.

Chile has emerged as a global leader in CSP, leveraging its high solar irradiation levels in the Atacama Desert. According to the Chilean Energy Ministry, a significant amount of CSP capacity is either under construction or in planning stages , all of which require specialized heat exchangers to convert solar energy into usable electricity through thermal cycles.

In Brazil, the government has intensified its support for bioenergy, particularly sugarcane-based ethanol and bagasse cogeneration. Similarly, Mexico’s wind and geothermal energy sectors have gained momentum, with the Mexican Association of Renewable Energy noting a 12% increase in installed renewable capacity in 2023 . While primarily focused on electricity generation, these plants often incorporate hybrid thermal systems that integrate heat exchangers for temperature regulation and system efficiency.

REGIONAL ANALYSIS

Brazil

Brazil maintained the largest share of the Latin America heat exchanger market, accounting for 40.2% of total regional demand in 2024. As the continent’s largest economy and most industrialized nation, Brazil plays a pivotal role in shaping the regional heat exchanger landscape through its strong presence in refining, chemical processing, and agro-industrial sectors.

A major driver of growth is the country’s ongoing refinery modernization initiatives. Also, Brazil’s agro-industrial sector continues to expand. The facilities require precision thermal management systems for pasteurization, evaporation, and refrigeration processes, driving demand for plate heat exchangers and condensers.

Mexico

Mexico is experiencing a surge in demand for heat exchangers due to industrial expansion and energy infrastructure upgrades. A significant catalyst for growth is Pemex’s National Refinery Modernization Program, which includes the rehabilitation of six major refineries. In addition, nearshoring trends have led to increased establishment of manufacturing units, particularly in the automotive and electronics industries, both of which require precision cooling systems. With ongoing investment in logistics and real estate, Mexico continues to be a key growth engine in the Latin American heat exchanger market.

Argentina

Argentina has shown potential for growth due to recent policy reforms and increased investment in natural resource extraction and chemical processing.

A key development occurred in 2023 when the national government introduced Resolution 312/2023, aimed at attracting foreign capital into the energy and mining sectors. Additionally, Buenos Aires has prioritized the modernization of its transportation network. The city government launched a program to upgrade major highways and intercity rail links, indirectly boosting equipment demand. Furthermore, the expansion of e-commerce and logistics parks has spurred investment in warehouse construction, increasing the need for material handling equipment.

Chile

Chile distinguishes itself through its emphasis on sustainable construction practices and large-scale mining operations.

One of the primary drivers of equipment demand in Chile is the government’s commitment to modernizing public infrastructure while adhering to environmental regulations. Moreover, Chile’s status as the world’s largest copper producer fuels demand for heavy-duty heat exchangers. Open-pit mining operations require extensive use of haul trucks, excavators, and loaders designed for high-altitude conditions.

Moreover, renewable energy projects, particularly in solar and wind power, have gained traction. With a focus on sustainability and resource extraction, Chile continues to be an influential player in shaping heat exchanger trends across Latin America.

Colombia

Colombia has emerged as a key market for construction machinery, driven by expanding urban development and transportation infrastructure projects.

A significant portion of equipment demand comes from the government’s Fourth Generation Road Concession Program, which involves upgrading key national highways. Bogotá’s rapid urbanization has also spurred investment in public transport. Local construction firms responded by deploying excavators, loaders, and cranes for site preparation and foundation work. With continued infrastructure investment and urban expansion, Colombia is positioned to strengthen its influence in the Latin American heat exchanger ecosystem.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Alfa Laval AB, Danfoss A/S, Kelvion, Xylem Inc, API Heat Transfer, Mersen SA, Hisaka Works, Chart Industries Inc, Johnson Controls International PLC, HRS Heat Exchangers, SPX Technologies Inc, Koch Industries, Southern Co, Güntner, FUNKE are the key players in the Latin America heat exchanger market.

The Latin America heat exchanger market is highly competitive, characterized by the presence of global industry leaders, regional manufacturers, and emerging local players. International brands such as Alfa Laval, Kelvion, and SWEP dominate due to their technological expertise, brand recognition, and extensive dealer networks. However, they face increasing competition from European and Asian manufacturers that offer cost-effective alternatives tailored for mid-tier industrial applications.

Market participants compete not only on price but also on product performance, durability, and after-sales service. As industrial processes become more complex and environmentally regulated, demand for high-efficiency, corrosion-resistant, and digitally integrated heat exchangers is growing. This has prompted manufacturers to invest in R&D, sustainability initiatives, and operator training programs to differentiate themselves.

Additionally, the fragmented nature of the market allows smaller domestic firms to capture niche segments, particularly in rural and mid-sized industrial projects. While multinational corporations leverage economies of scale and global experience, local players often benefit from regulatory familiarity and faster response times. As public and private investment in energy and infrastructure expands, the battle for market share is intensifying, prompting firms to adopt innovative strategies to maintain relevance and growth in Latin America.

TOP PLAYERS IN THE MARKET

Alfa Laval

Alfa Laval is a leading global provider of heat exchanger solutions with a strong presence in the Latin American market. The company offers a wide range of plate and shell-and-tube heat exchangers tailored for industries such as oil & gas, food & beverage, and power generation. Alfa Laval’s expertise in energy-efficient thermal management technologies positions it as a preferred partner for industrial clients seeking sustainable and high-performance solutions. Its focus on innovation, customer support, and localized service centers has reinforced its competitive edge across key markets like Brazil, Mexico, and Chile.

Kelvion

Kelvion plays a crucial role in shaping the Latin America heat exchanger landscape by offering customized thermal exchange systems for demanding applications in chemical processing, HVAC, and refrigeration. With a strong engineering background and a diverse product portfolio, Kelvion delivers both standard and specialized heat exchangers suited to regional industrial needs. The company’s strategic partnerships with local distributors and long-standing reputation for reliability have strengthened its foothold in the region, particularly in sectors requiring precision cooling and process optimization.

SWEP (A subsidiary of Dover Corporation)

SWEP specializes in brazed plate heat exchangers and has established itself as a key player in Latin America’s growing HVAC, refrigeration, and renewable energy sectors. Known for compact, high-efficiency designs, SWEP supports district heating, heat pump installations, and industrial cooling applications. The company’s commitment to sustainability and digital integration has made it a trusted brand among environmentally conscious operators and system designers across the region.

TOP STRATEGIES USED BY THE MARKET PLAYERS

One major strategy employed by leading players in the Latin America heat exchanger market is localized manufacturing and technical support expansion . Companies are increasingly establishing regional production units or partnering with local suppliers to reduce lead times, comply with import regulations, and offer equipment tailored to specific industrial conditions found in Latin American environments.

Another critical approach is customized product development for niche applications . Market leaders are investing in R&D to design heat exchangers that meet the unique demands of regional industries such as shale gas extraction, concentrated solar power, and agro-industrial processing. This enables manufacturers to differentiate their offerings and better serve specialized sectors.

Lastly, strategic collaborations with engineering firms and EPC contractors have become essential for securing large-scale infrastructure and energy projects. By aligning with project developers and system integrators, heat exchanger providers ensure early involvement in plant design and procurement cycles, enhancing their chances of winning contracts and maintaining long-term customer relationships.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Alfa Laval announced the expansion of its regional service center in São Paulo, Brazil, aimed at improving logistics efficiency and reducing equipment downtime for customers across South America.

- In June 2023, Kelvion launched a new line of corrosion-resistant heat exchangers specifically designed for use in Argentina’s Vaca Muerta shale gas operations, addressing the sector’s harsh operating conditions and reinforcing its brand presence in resource-rich regions.

- In September 2023, SWEP introduced an advanced brazed plate heat exchanger model optimized for solar thermal applications in Santiago, Chile, aligning with the country’s green energy policies and demonstrating its commitment to sustainable development.

- In January 2024, API Heat Transfer opened a new technical support hub in Monterrey, Mexico, focusing on preventive maintenance and diagnostics for large-scale industrial and transport projects, reinforcing its support network for key clients.

- In July 2023, Danfoss expanded its dealership network in Colombia, partnering with local distributor Termoingeniería to increase accessibility to its range of compact and high-efficiency heat exchangers used in food processing and refrigeration sectors.

MARKET SEGMENTATION

This research report on the Latin America heat exchanger market is segmented and sub-segmented into the following categories.

By Type

- Shell & Tube

- Plate & Frame

- Air Cooled

- Others

By Material

- Carbon Steel

- Stainless Steel

- Nickel

- Others

By End-Use Industry

- Chemical

- Petrochemical and Oil & Gas

- HVAC and Refrigeration

- Food & Beverage

- Power Generation

- Paper & Pulp

- Others

By Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com