Latin America Human Resource (HR) Technology Market Research Report – Segmented By Deploymenmt Mode (Cloud-Based Deployment, On-Premise Deployment), Application, End-User Industry, Enterprise Type & Country (Mexico, Brazil, Argentina, Chile and Rest of Latin America) - Industry Analysis From 2025 to 2033

Latin America Human Resource (HR) Technology Market Size

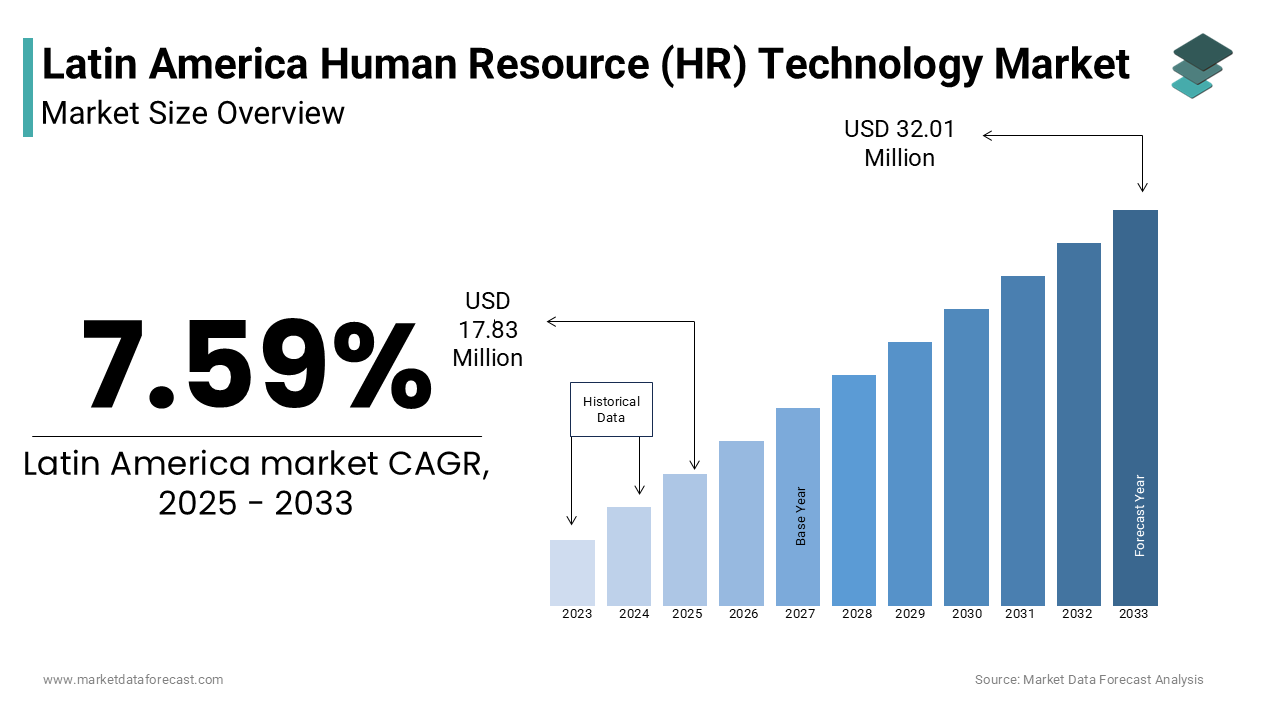

The Latin America Human Resource (HR) Technology Market was worth USD 16.57 million in 2024. The Latin America market is expected to reach USD 32.01 million by 2033 from USD 17.83 million in 2025, rising at a CAGR of 7.59% from 2025 to 2033.

The Latin America human resource technology market refers to the suite of digital tools and platforms designed to streamline, manage, and optimize workforce-related functions such as recruitment, payroll, performance management, employee engagement, and learning and development. With the rapid digitization of business operations and increasing emphasis on remote work environments, HR tech solutions have become essential for organizations across industries. According to the International Labour Organization (ILO), Latin America has seen a significant rise in formal employment digitization, with governments promoting electronic payroll systems and digital labor compliance reporting. In Brazil, the Ministry of Economy mandated the use of digital employment records under the eSocial program, prompting widespread adoption of HR information systems. Similarly, Mexico has witnessed a surge in cloud-based HR platforms due to the expansion of SMEs and multinational corporations seeking scalable workforce solutions.

MARKET DRIVERS

Digital Transformation of Workforce Management Practices

One of the primary drivers fueling the growth of the Latin America HR technology market is the ongoing digital transformation of workforce management practices. Traditional manual processes related to employee onboarding, attendance tracking, payroll processing, and benefits administration are being replaced by integrated HR technology platforms. The implementation of digital payroll systems such as Mexico’s Nómina Electrónica has also accelerated this transition, ensuring compliance with tax authorities while reducing administrative burdens. Additionally, the proliferation of remote and hybrid work models post-pandemic has increased reliance on HR tech tools for time tracking, performance evaluation, and virtual onboarding. As reported by McKinsey & Company, employee self-service portals and mobile HR apps saw a 40% increase in usage across Latin American companies in 2023, reflecting a structural shift toward digital workplace engagement.

Rise in Adoption of AI and Analytics in HR Functions

Another key driver of the Latin America HR technology market is the growing integration of artificial intelligence (AI) and data analytics into human resources operations. Companies are increasingly leveraging AI-powered tools for talent acquisition, employee retention analysis, and personalized learning programs. Besides, predictive analytics tools are gaining traction in identifying flight risks among top performers, allowing HR leaders to proactively address attrition. These advancements show how AI and analytics are reshaping traditional HR strategies and driving market expansion in Latin America.

MARKET RESTRAINTS

Data Privacy Concerns and Regulatory Compliance Complexity

A major restraint impeding the Latin America HR technology market is the challenge posed by evolving data privacy regulations and the complexity of compliance frameworks. Many countries in the region have introduced or strengthened their data protection laws, requiring businesses to ensure secure handling of employee personal information. In Brazil, the implementation of the General Data Protection Law (LGPD) forced many organizations to reassess their HR software providers to ensure compliance, delaying procurement decisions. These regulatory hurdles create uncertainty for both domestic and international HR tech providers, limiting their ability to scale rapidly across diverse legal environments.

Limited Awareness and Resistance to Change Among SMEs

Another critical barrier to the growth of the Latin America HR technology market is the limited awareness and resistance to change among small and medium-sized enterprises (SMEs). While larger corporations have embraced digital HR tools, many SMEs continue to rely on outdated spreadsheets, paper-based processes, or minimal automation. Like, only a limited share of SMEs in Peru and Ecuador had adopted any form of digital HR solution in 2023, primarily due to budget constraints and lack of technical know-how. Furthermore, language barriers and the absence of localized support services deter some SMEs from adopting foreign-developed platforms. Without targeted education campaigns and affordable entry-level solutions tailored to local needs, the broader penetration of HR technology across the SME sector will remain constrained.

MARKET OPPORTUNITIES

Growth of Remote Work and Hybrid Employment Models

One of the most promising opportunities shaping the Latin America HR technology market is the continued expansion of remote work and hybrid employment models. The pandemic accelerated the shift toward decentralized workplaces, compelling organizations to invest in digital tools that facilitate communication, collaboration, and performance tracking. According to the International Labour Organization (ILO), over 45% of professionals in urban Latin America worked remotely at least three days a week in 2023, necessitating robust HR platforms capable of managing distributed teams. In response, vendors such as SAP SuccessFactors and BambooHR expanded their presence in the region, introducing features like virtual onboarding, real-time feedback mechanisms, and automated leave management. Moreover, the demand for digital identity verification and cybersecurity-enhanced HR platforms has surged as companies seek to protect sensitive employee data in remote settings.

Expansion of Outsourcing and Payroll Service Providers

Another transformative opportunity in the Latin America HR technology market is the rising trend of outsourcing HR and payroll functions through third-party service providers. As businesses seek to reduce administrative burdens and focus on core competencies, they are increasingly turning to managed HR services that offer end-to-end solutions including payroll processing, compliance reporting, and benefits administration. Also, companies have gained traction by providing integrated payroll and HR SaaS platforms tailored to SMEs. These providers leverage automation and cloud-based technologies to deliver scalable and customizable solutions, making them attractive to businesses of all sizes. Additionally, government-backed initiatives promoting digital payroll adoption, such as Argentina’s AFIP mandates, further reinforce the growth trajectory of outsourced HR services. As these trends continue, the demand for integrated HR technology platforms will expand across multiple industry verticals.

MARKET CHALLENGES

Integration Complexity with Legacy Systems

A pressing challenge in the Latin America HR technology market is the difficulty of integrating modern HR solutions with legacy enterprise systems still in use by many public and private sector organizations. A significant portion of the region's businesses operate on outdated infrastructure that lacks compatibility with contemporary cloud-based HR platforms, creating technical and financial barriers to adoption. In Argentina, state-owned enterprises struggled with consolidating fragmented payroll databases into unified HRIS platforms, delaying digital transformation efforts. Moreover, in rural areas of Guatemala and Honduras, many companies rely on manually maintained personnel records, making it difficult to transition to automated HR systems without extensive re-engineering.

Cybersecurity Threats Targeting Employee Data

Another major challenge facing the Latin America HR technology market is the increasing exposure to cybersecurity threats targeting employee data stored within HR systems. As HR departments adopt cloud-based platforms and centralized databases, they become attractive targets for cybercriminals seeking to exploit sensitive information such as identification documents, salary details, and banking credentials. According to ENISA (European Union Agency for Cybersecurity), the number of ransomware attacks against HR and payroll systems in Latin America rose by 42% in 2023, with Brazil and Mexico being the most affected. The Inter-American Development Bank (IDB) emphasized the urgent need for stronger encryption standards and access control protocols within HR tech solutions.

SEGMENTAL ANALYSIS

By Deployment Mode Insights

The cloud-based deployment mode dominated the Latin America human resource technology market by capturing an estimated 63.3% share in 2024. This dominance is primarily attributed to the increasing preference for scalable, cost-effective, and easily accessible HR solutions among businesses of all sizes. Additionally, vendors like SAP SuccessFactors and Oracle have expanded their regional cloud infrastructure, making it easier for companies to deploy secure and compliant HR solutions without investing in on-site servers.

The on-premise deployment segment is emerging as the fastest-growing within the Latin America HR technology market, projected to expand at a CAGR of 10.7%. This growth is fueled by increasing demand from large enterprises and government institutions that prioritize data sovereignty, regulatory compliance, and control over internal IT infrastructure. In Brazil, state-owned energy firms and financial institutions have mandated internal hosting of sensitive employee records to comply with national data localization laws. As data protection regulations evolve, this segment is expected to gain further traction among enterprises seeking full control over their HR data ecosystems.

By Application Insights

The payroll management application led the Latin America HR technology market by holding an estimated market share of 45.7% in 2024. This leading position is because of the region’s evolving labor regulations and the growing requirement for automated, error-free salary processing. Governments across Latin America have introduced mandatory digital payroll reporting frameworks to curb informal employment and enhance tax collection. For example, Brazil’s eSocial program mandates employers to submit integrated digital reports covering payroll, social security contributions, and occupational safety data, compelling businesses to adopt sophisticated payroll management systems. According to the Brazilian Ministry of Economy, over 90% of large enterprises and 65% of SMEs complied with digital payroll reporting mandates by the end of 2023, driving widespread adoption of HR software solutions. With increased enforcement of labor transparency laws and the rise of outsourced payroll services, payroll management remains the most critical and widely implemented HR technology application in the region.

The talent management application is the quickest expanding component of the Latin America HR technology market, projected to grow at a CAGR of 12.4% between 2025 and 2033. This surge is driven by the increasing focus on recruitment optimization, employee retention strategies, and skills development programs amid rising competition for skilled professionals. Like, Latin American companies reported a significant increase in voluntary employee turnover, prompting organizations to invest in AI-driven talent acquisition tools and personalized learning platforms. In Argentina, multinational corporations and startups alike have embraced predictive analytics to identify high-potential employees and reduce attrition rates. Besides, universities and corporate training centers are integrating digital upskilling platforms into their HR strategies, enhancing workforce readiness.

By End-User Industry Insights

The telecom and IT industry holds the largest share of the Latin America HR technology market, accounting for approximately 38% in 2024. This influence over the market is propelled by the sector's inherent reliance on digital transformation, agile workforce structures, and continuous innovation. According to the Economic Commission for Latin America and the Caribbean (ECLAC), the tech sector in Brazil alone created over 120,000 new jobs in 2023, necessitating scalable HR solutions to manage recruitment, performance tracking, and remote work coordination. In Mexico, the National Institute of Statistics and Geography (INEGI) reported that IT firms accounted for the highest rate of HR software adoption among private sector companies, with a high share utilizing cloud-based platforms for employee engagement and compliance. The rapid expansion of nearshore outsourcing hubs in countries like Colombia and Costa Rica has further intensified demand for advanced HR technologies capable of supporting multilingual, distributed teams.

The BFSI sector is a booming end-user segment in the Latin America HR technology market, projected to expand at a CAGR of 13.1% from 2025 to 2033. This development is attributed to increasing digitization efforts, regulatory compliance demands, and the need for enhanced risk management across financial institutions. Apart from these, insurance providers in Chile and Argentina are leveraging blockchain-enabled HR systems to streamline claims processing and improve employee credential verification. The Inter-American Development Bank emphasized that digital transformation initiatives in the financial sector are now integral to talent strategy, positioning BFSI as a key driver of HR technology adoption in Latin America.

By Enterprise Type Insights

The large enterprise segment commanded the largest share of the Latin America HR technology market by contributing 56.6% in 2024. This is primarily due to the complex workforce needs of multinational corporations, government agencies, and state-owned enterprises that require fully integrated HR information systems (HRIS) to manage thousands of employees across multiple locations. The World Bank reported that state-run pension funds and public sector entities in Argentina and Peru were also accelerating their transition to digital HR systems, reinforcing the continued leadership of large enterprises in shaping the regional HR technology landscape.

The small and medium-sized enterprise (SME) segment is the fastest-growing within the Latin America HR technology market, projected to expand at a CAGR of 14.3%. This rapid growth is driven by increasing awareness of digital HR tools, availability of affordable SaaS-based solutions, and government-backed initiatives promoting formalization and digital payroll adoption. According to the Inter-American Development Bank (IDB), only 32% of SMEs in Bolivia and Ecuador used digital HR systems in 2023, but adoption surged by nearly 40% in early 2024 due to simplified user interfaces and mobile-first platforms. Additionally, regional fintech firms such as Nubank and Mercado Pago launched bundled HR and payroll packages targeted specifically at small business owners.

REGIONAL ANALYSIS

Brazil occupied the top position in the Latin America HR technology market by commanding an estimated 35% market share in 2024. The country's progress is attributed to its robust regulatory environment, strong presence of multinational corporations, and proactive digital transformation policies. The National Confederation of Industry (CNI) reported a 28% increase in AI-driven HR analytics tool deployments among manufacturing firms, aimed at optimizing workforce efficiency. Also, the proliferation of remote work models has spurred demand for cloud-based HR platforms, with vendors such as SAP, Oracle, and local players expanding their offerings. With a digitally mature workforce and a growing startup ecosystem, Brazil remains at the forefront of HR technology adoption in Latin America.

Mexico is another key player in the Latin America HR technology market in 2024. The country’s growth is driven by expanding SMEs, increasing foreign direct investment, and government-backed digital payroll reforms. Additionally, nearshoring trends have attracted major U.S.-based companies to set up regional offices, further boosting demand for scalable HR solutions. These developments reinforce Mexico’s role as a key player in the Latin American HR technology landscape.

Argentina is positioning itself as a growing contributor despite economic volatility. The country’s market expansion is driven by increasing digitalization efforts in both the public and private sectors. According to Argentina’s Federal Administration of Public Revenue (AFIP), mandatory digital payroll reporting was extended to all businesses with more than five employees in 2023, prompting a surge in HR software adoption. The Buenos Aires Metropolitan Area recorded the highest adoption rates, where over 60% of urban businesses used digital payroll platforms, as per a study conducted by the University of Buenos Aires. Besides, the government introduced new incentives for SMEs to adopt cloud-based HR solutions, aiming to reduce informal employment and improve labor transparency. The Inter-American Development Bank noted that fintech investment in Argentina rose by 22% in 2024, signaling renewed confidence in the sector. Despite macroeconomic challenges, Argentina is emerging as a dynamic player in the regional HR technology market.

Chile is distinguished by its technologically advanced business environment and high levels of digital adoption. Like, a significant portion of large enterprises utilize digital HR platforms, reflecting one of the highest penetration rates in the region. Chile has also been a pioneer in adopting AI-driven talent management systems, with Microsoft launching a localized version of Teams with enhanced HR integrations to support SMEs transitioning to flexible work arrangements. With a strong emphasis on workforce efficiency and digital governance, Chile continues to serve as a model for HR technology adoption in Latin America.

The “Rest of Latin America” category comprises countries such as Colombia, Peru, Ecuador, and Central American nations. While individual economies may not match the scale of Brazil or Mexico, the collective growth potential is significant. In Peru, the Superintendence of Tax Administration (SUNAT) reported a 35% increase in electronic payroll submissions, indicating a structural shift toward digital HR practices. This diversified yet rapidly evolving market presents unique opportunities for HR tech providers aiming to expand beyond traditional hubs.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

AP SE, Oracle Corporation, Workday, Inc., ADP, Inc., Ceridian HCM Holding Inc., Cornerstone OnDemand, Inc., Ultimate Software, UKG Inc. (Ultimate Kronos Group), BambooHR, and Zoho Corporation are some of the key market players.

The competition in the Latin America human resource (HR) technology market is intensifying as global software vendors, regional startups, and traditional payroll service providers vie for dominance in a rapidly evolving sector. Established international players such as SAP, Oracle, and Workday maintain a strong presence due to their comprehensive feature sets and integration capabilities. At the same time, niche HR tech firms and local SaaS providers are gaining traction by offering affordable, easy-to-use platforms tailored to the specific regulatory and operational needs of small and medium-sized enterprises. Government mandates promoting digital payroll adoption have further fueled this growth, creating opportunities for both domestic and foreign players to innovate and expand. Collaboration between public and private stakeholders is becoming more common, with joint ventures and pilot projects aimed at enhancing workforce digitalization and compliance. While urban centers and developed markets like Brazil and Mexico lead in adoption, emerging economies are catching up, driven by rising awareness of HR technology benefits and growing investments in digital transformation. This dynamic environment fosters continuous innovation, making the Latin American HR technology market one of the most strategically important regions in the global enterprise software landscape.

Top Players in the Latin America Human Resource (HR) Technology Market

SAP SuccessFactors

SAP SuccessFactors is a global leader in cloud-based HR management solutions and holds a strong position in the Latin America market. The company offers a comprehensive suite of applications covering payroll, talent management, performance evaluation, and workforce analytics. In Latin America, SAP has localized its offerings to align with regional labor laws and compliance requirements, making it a preferred choice for multinational corporations and large enterprises. Its integration with SAP’s broader enterprise resource planning (ERP) ecosystem provides seamless data flow across business functions. By collaborating with local partners and expanding its regional support infrastructure, SAP continues to drive digital transformation in HR processes across key markets such as Brazil, Mexico, and Colombia.

Oracle HCM Cloud

Oracle Human Capital Management (HCM) Cloud plays a significant role in shaping the Latin America HR technology landscape by delivering unified, AI-enhanced HR solutions tailored for both public and private sector organizations. The platform supports core HR functions including recruitment, payroll, learning, and workforce planning, all within a scalable cloud architecture. In Latin America, Oracle works closely with government agencies and large enterprises to ensure compliance with evolving labor regulations while improving employee engagement through personalized experiences. Oracle’s emphasis on data-driven decision-making tools has made it a strategic partner for organizations seeking agility and insight into workforce dynamics. With an increasing focus on hybrid work environments, Oracle continues to expand its presence in the region.

BambooHR

BambooHR has emerged as a key player in the Latin American HR technology market, particularly among small and medium-sized enterprises seeking user-friendly, cost-effective HR solutions. Known for its intuitive interface and mobile-first approach, BambooHR offers essential features such as employee records, time tracking, benefits administration, and performance management. In Latin America, the company has focused on expanding its indirect distribution channels through partnerships with local resellers and payroll service providers to reach underserved SMEs. BambooHR’s ability to deliver streamlined HR automation without requiring extensive technical expertise has positioned it well in markets where digital adoption is accelerating but remains fragmented. As more businesses transition from manual systems, BambooHR is playing a crucial role in modernizing HR operations across the region.

Top Strategies Used by Key Market Participants

Key players in the Latin America human resource (HR) technology market are leveraging strategic initiatives to solidify their competitive edge. One major strategy involves the localization of products and services, allowing vendors to tailor their platforms to comply with diverse labor laws, language preferences, and cultural nuances across different countries. Another prevalent approach is strategic partnerships and channel alliances, where global HR tech firms collaborate with local payroll providers, system integrators, and government bodies to enhance market penetration and customer trust. Additionally, companies are focusing on enhancing user experience through AI-driven personalization and mobile accessibility, ensuring that HR platforms remain intuitive and adaptable to remote and hybrid work models. These strategies collectively help firms strengthen their foothold and respond effectively to the dynamic demands of the Latin American HR technology landscape.

RECENT MARKET DEVELOPMENTS

- In January 2024, SAP launched a new regional innovation center in São Paulo, Brazil, dedicated to customizing its SuccessFactors platform to meet the evolving labor compliance and digital transformation needs of Latin American enterprises.

- In March 2024, Oracle expanded its partnership network in Mexico by integrating its HCM Cloud platform with leading local payroll service providers, enabling faster deployment and improved regulatory alignment for mid-sized businesses.

- In May 2024, BambooHR announced a strategic collaboration with a Colombian HR outsourcing firm to offer bundled HR and payroll solutions tailored for SMEs, aiming to accelerate digital adoption among traditionally informal businesses.

- In July 2024, ADP entered the Chilean market with a localized version of its HR and workforce management platform, targeting multinational corporations setting up regional offices and requiring scalable HR solutions.

- In September 2024, IBM Watson Health partnered with Argentina’s Ministry of Labor to develop an AI-powered skills development platform designed to bridge employment gaps and improve workforce readiness across the public and private sectors.

MARKET SEGMENTATION

This research report on the Latin American human resource (HR) technology market is segmented and sub-segmented into the following categories.

By Deployment Mode

- Cloud-Based Deployment

- On-Premise Deployment

By Application

- Payroll Management

- Talent Management

By End-User Industry

- Telecom & IT Industry

- BFSI (Banking, Financial Services, and Insurance)

By Enterprise Type

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

What are the major factors driving the growth of HR technology in Latin America?

Key drivers include increasing adoption of cloud-based HR solutions, remote work trends, rising demand for data-driven HR decisions, and the need to improve employee experience and operational efficiency.

What are the key challenges faced by the HR technology market in Latin America?

Challenges include data privacy concerns, language and localization needs, regulatory compliance, and resistance to digital transformation in traditional sectors.

What is the growth outlook for the HR technology market in Latin America from 2025 to 2033?

The market is projected to grow at a strong CAGR due to increasing digital maturity across enterprises, with a focus on talent analytics, employee well-being, and hybrid work enablement.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com