Latin America HVAC Market Size, Share, Trends & Growth Forecast Report Segmented By Equipment (Air Conditioning, Air Purifiers), End Use, And Country (Brazil, Mexico, Argentina, Chile And Rest Of Latin America), Industry Analysis From 2025 To 2033

Latin America HVAC Market Size

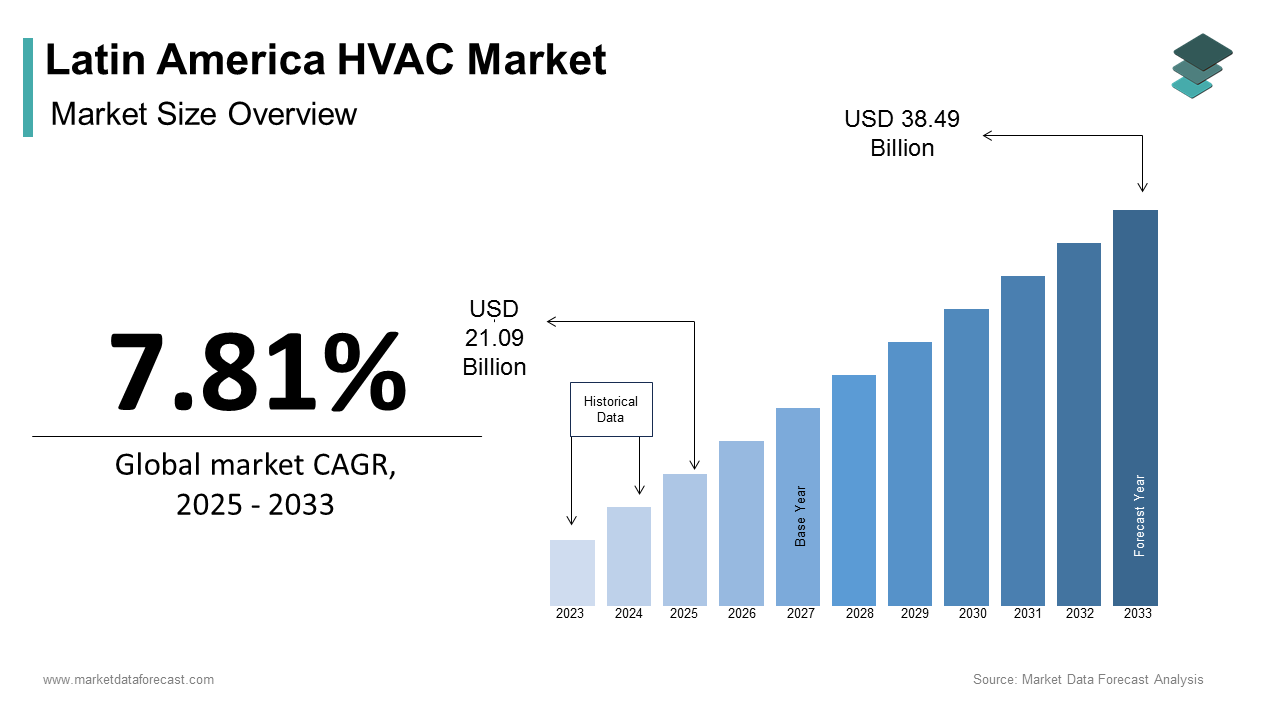

The Latin America HVAC Market size was calculated to be USD 19.56 billion in 2024 and is anticipated to be worth USD 38.49 billion by 2033, from USD 21.09 billion in 2025, growing at a CAGR of 7.81% during the forecast period.

The Latin American HVAC market covers the design, manufacturing, and distribution of heating, ventilation, and air conditioning systems used across residential, commercial, industrial, and institutional applications. This sector includes a wide range of products such as split and central air conditioners, heat pumps, ventilation units, chillers, and packaged rooftop units tailored for diverse climatic conditions and building typologies.

According to data from the Economic Commission for Latin America and the Caribbean, urbanization and rising disposable incomes are reshaping lifestyle expectations, particularly in medium- and high-income households, where indoor comfort is increasingly prioritized. In countries like Brazil and Mexico, real estate development has surged, with new housing and commercial construction projects incorporating climate control systems as standard features.

Moreover, rising temperatures due to climate change have contributed to increased usage of cooling systems during extended summer periods. With increasing urban density, evolving architectural practices, and heightened awareness of indoor air quality, the Latin American HVAC market is undergoing a transformation that reflects global trends while addressing region-specific challenges and opportunities.

MARKET DRIVERS

Urbanization and Real Estate Development

One of the primary drivers of the Latin American HVAC market is the rapid pace of urbanization and associated real estate development. According to the United Nations Human Settlements Programme, over 80% of Latin Americans now reside in urban areas, with this figure expected to rise in the coming decade. This shift has led to a surge in residential and commercial construction projects, each requiring climate control systems to meet modern living and working standards.

Mexico has also experienced a construction revival, particularly in industrial parks and nearshoring developments. The Mexican Association of Industrial Parks noted that industrial real estate investments have risen in recent years, necessitating climate-controlled environments for production lines, warehouses, and office spaces.

In addition, the hospitality and retail sectors are contributing to HVAC demand. As urban centers continue to expand and property developers prioritize occupant well-being, the demand for HVAC equipment is expected to remain robust across Latin America.

Rising Demand for Energy-Efficient and Smart HVAC Systems

Another significant driver of the Latin American HVAC market is the growing preference for energy-efficient and smart climate control systems. With increasing electricity costs and environmental concerns, consumers and businesses are seeking HVAC solutions that offer improved performance with reduced energy consumption.

In Chile, the Ministry of Energy introduced updated efficiency standards under its "Energy Efficiency Program 2030", encouraging the adoption of variable refrigerant flow (VRF) and inverter-driven air conditioning units.

Similarly, in Argentina, Buenos Aires-based developers are integrating smart thermostats and remote-controlled HVAC systems into new residential and office complexes. The Argentine Chamber of Electronics and IoT indicated that smart HVAC sales grew in 2023, driven by younger demographics and tech-savvy property buyers.

In the commercial sector, multinational corporations expanding operations in Latin America are mandating LEED-certified building standards, which include high-performance HVAC installations.

MARKET RESTRAINTS

High Initial Investment and Affordability Issues

A major restraint facing the Latin American HVAC market is the high upfront cost of modern heating, ventilation, and air conditioning systems, which limits widespread adoption among lower-income populations. Despite growing awareness of indoor climate control benefits, affordability remains a critical barrier, particularly in rural and semi-urban regions.

In Honduras, where a significant share of the population lives below the poverty line, as per the World Bank, access to premium HVAC products remains minimal.

The Inter-American Development Bank noted in 2023 that limited access to financing options and weak credit availability further restrict consumer ability to purchase HVAC units.

Also, maintenance and installation costs add to the overall expense. Without affordable pricing strategies or government-backed incentive programs, the Latin America HVAC market will continue to face limitations in achieving full market penetration, especially in economically disadvantaged communities.

Fragmented Regulatory Landscape and Lack of Standardization

A persistent challenge for the Latin American HVAC market is the lack of harmonized regulations governing product efficiency, safety, and environmental compliance. Each country operates under distinct certification requirements, making it difficult for manufacturers to scale across borders without extensive modifications to their offerings.

According to the Andean Community Technical Regulation Council, these disparities create confusion among consumers and deter foreign investment in local production facilities.

In addition, labeling and performance claims vary widely across nations. While Brazil’s National Institute of Metrology, Quality, and Technology (INMETRO) enforces stringent energy efficiency labels, Ecuador and Guatemala have minimal oversight, allowing substandard products to enter the market unchecked.

These fragmented policies increase operational complexity for multinational brands and small local producers alike, slowing down innovation cycles and limiting consumer trust in available HVAC technologies.

MARKET OPPORTUNITIES

Expansion of Green Building Certifications and Sustainable Construction

A significant opportunity emerging in the Latin American HVAC market is the growing emphasis on green building certifications and sustainable construction practices. Governments, architects, and developers are increasingly adopting frameworks such as LEED, WELL, and local green building codes, all of which mandate energy-efficient and environmentally responsible HVAC installations.

In Brazil, the Green Building Council reported that the number of certified green buildings increased notably in 2023, with HVAC systems playing a crucial role in meeting energy consumption targets. Developers are opting for VRF systems, radiant cooling, and demand-controlled ventilation to reduce overall power usage and carbon footprint.

Chile has been particularly proactive in promoting sustainable architecture. According to the Chilean Center for Environmental Studies, more than 100 new commercial structures adopted energy-efficient HVAC designs in 2023, reflecting a broader policy push toward decarbonization.

These efforts align with national climate commitments and are expected to drive long-term demand for advanced climate control solutions across the region.

With an increasing focus on sustainability and building performance, the Latin American HVAC market stands to benefit significantly from the expansion of green construction initiatives.

Growth in Data Centers and Industrial Cooling Demand

The rapid expansion of digital infrastructure, particularly in data centers and industrial facilities, presents a compelling opportunity for the Latin American HVAC market. As cloud computing and digital services grow, so does the need for precision cooling systems that ensure optimal server room temperatures and prevent overheating-related downtime.

In Brazil, the Ministry of Communications identified a key increase in data center investments in 2023, with companies like Amazon Web Services and Google Cloud expanding their regional presence. These facilities require specialized HVAC systems such as precision air conditioning, chilled water systems, and modular cooling units to maintain stable operating conditions.

Mexico has also become a key hub for data center development due to its proximity to North America and strong telecommunications infrastructure. The Mexican Association of Data Centers reported that over USD 1.5 billion was invested in new data center projects in 2023, each requiring dedicated HVAC infrastructure to manage heat loads efficiently.

Apart from these, industrial sectors such as food processing, pharmaceuticals, and electronics manufacturing are investing in controlled-environment facilities that rely heavily on industrial HVAC and dehumidification systems. With digital transformation accelerating across Latin America, the demand for high-performance HVAC systems in data centers and industrial settings is poised for sustained growth.

MARKET CHALLENGES

Supply Chain Disruptions and Component Shortages

Supply chain disruptions pose a significant challenge to the Latin American HVAC market, particularly for companies reliant on imported components such as compressors, refrigerants, and electronic controls. Global supply bottlenecks caused by geopolitical tensions, semiconductor shortages, and shipping delays have had cascading effects on equipment availability and delivery timelines.

According to the World Bank’s 2023 Logistics Performance Index, several Latin American ports, including those in Colombia and Panama, experienced prolonged congestion, reducing cargo throughput and increasing lead times for HVAC imports. In Brazil, customs clearance delays at the Port of Santos extended equipment delivery periods by up to six weeks during the same period, affecting both residential and commercial project timelines.

In addition, component shortages—especially in high-efficiency compressors sourced from Asia—have affected production schedules for local assembly plants. As reported by the Mexican Association of Industrial Equipment Manufacturers, some HVAC producers faced delays of up to four months in receiving critical parts in 2023, limiting their ability to meet rising demand.

These logistical hurdles not only delay project execution but also inflate equipment costs, making it harder for smaller distributors and end-users to procure necessary HVAC systems.

Underdeveloped After-Sales Service Infrastructure

An ongoing challenge for the Latin American HVAC market is the underdeveloped after-sales service network, particularly in rural and semi-urban areas. Unlike in developed markets where regular maintenance and part replacements are easily accessible, many Latin American consumers face difficulties in obtaining technical support and spare parts, reducing system longevity and user satisfaction.

Moreover, trained technicians capable of diagnosing and repairing complex HVAC systems are limited in number, especially outside major cities. To address this, some manufacturers are launching training programs for local dealers and service providers, but progress remains slow.

Competition from Informal and Unregulated Markets

The prevalence of informal and unregulated HVAC products presents a major challenge to the LatiAmericanca HVAC market. Counterfeit, substandard, and uncertified units flood local markets, particularly in small towns and border regions, undercutting legitimate players and eroding consumer confidence.

In Guatemala, the National Institute of Standards and Technology reported that nearly 25% of HVAC units sold in open-air markets failed to meet minimum efficiency benchmarks, posing serious safety and performance risks to users. These unverified products often mimic branded designs but lack the technological integrity required for effective climate control.

Moreover, the absence of strict enforcement mechanisms allows unlicensed sellers to operate with little accountability. Without stronger regulatory enforcement and consumer education, the informal market will continue to undermine the growth of reputable HVAC brands across Latin America.

Currency Fluctuations and Import Dependency

Currency volatility is a persistent issue impacting the Latin American HVAC market, particularly in countries that rely heavily on imported components and finished products. Many HVAC manufacturers source compressors, refrigerants, and electronic controls from China, South Korea, and the United States, making them vulnerable to exchange rate fluctuations.

This has discouraged both retailers and end-users from purchasing new units, slowing market growth despite rising demand.

Similarly, in Ecuador, the adoption of the U.S. dollar as legal tender has made imported HVAC products more expensive when domestic wages remain stagnant.

This dependency on foreign suppliers creates pricing uncertainty and reduces the ability of local distributors to offer competitive pricing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.81% |

|

Segments Covered |

By Equipment, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Mexico, Argentina, Chile and Rest Of Latin America |

|

Market Leaders Profiled |

Daikin, Carrier, Trane Technologies, Johnson Controls, LG Electronics, Midea Group, Lennox International, Samsung Electronics, Gree Electric Appliances, Rheem Manufacturing Company. |

SEGMENTAL ANALYSIS

By Equipment Insights

Air conditioning represented the largest segment in the Latin American HVAC market, capturing 58.4% of total equipment sales in 2024. This dominance is primarily attributed to the region’s tropical and subtropical climate zones, where cooling demand remains high throughout the year.

One key driver behind this segment’s leadership is the rapid expansion of residential real estate, particularly in urban centers. In cities like São Paulo and Bogotá, developers are increasingly incorporating climate control solutions as standard features to meet consumer expectations for comfort.

Moreover, commercial infrastructure growth has significantly contributed to air conditioning demand. The Mexican Association of Industrial Parks noted that industrial real estate investments rose in 2023, with most developments requiring air conditioning for office spaces, retail complexes, and logistics hubs. Malls and hospitality sectors have also seen a surge in installations, especially in coastal areas where tourism drives demand for temperature-controlled environments.

Moreover, rising temperatures due to climate change have extended the cooling season across several countries.

Air purifiers depicted the fastest-growing category in the Latin America HVAC market, projected to expand at a CAGR of 14.7%. This rapid growth is driven by increasing awareness of indoor air quality and health concerns related to pollution, allergens, and airborne pathogens.

A primary factor fueling this trend is the rise in respiratory illnesses linked to poor indoor air conditions. In Chile, the Ministry of Health recorded a notable increase in asthma-related hospital admissions in Santiago in 2023, prompting households and healthcare facilities to adopt air purification systems.

In addition, post-pandemic health consciousness has led to heightened demand for air purification in schools, offices, and commercial buildings.

Furthermore, e-commerce platforms such as MercadoLibre and Amazon Mexico have expanded their offerings to include portable and smart air purifiers, making them more accessible to consumers nationwide. The Argentine Chamber of Electronics and IoT reported a 22% increase in smart air purifier sales in 2023, indicating strong adoption among younger, tech-savvy demographics.

With ongoing urbanization and rising health awareness, air purifiers are poised to become a core component of HVAC systems across Latin America.

By End-Use Insights

The residential sector had the largest share of the Latin American HVAC market, accounting for 52.5% of total HVAC installations in 2024. This segment’s superiority is primarily attributed to rising homeownership rates, increasing disposable incomes, and evolving lifestyle preferences that prioritize indoor comfort.

One major driver of growth is the surge in middle-class population expansion across key economies. In Brazil, the World Bank reported that over three million new middle-income households were added between 2019 and 2023, each seeking improved living conditions including reliable air conditioning and ventilation systems. This demographic shift has been accompanied by increased spending on home appliances, particularly in urban centers like Rio de Janeiro and Medellín.

Mexico has also seen strong residential HVAC adoption, particularly in nearshoring-driven industrial regions such as Monterrey and Guadalajara. The Mexican National Household Income and Expenditure Survey indicated that urban households spent more on HVAC products in 2023 compared to the previous year, driven by rising property values and the modernization of apartment complexes.

Apart from these, government-backed housing programs are integrating HVAC systems into low-cost housing projects. With continued urban development and income growth, the residential HVAC segment remains the cornerstone of the Latin American market.

The commercial HVAC segment is emerging as the fastest-growing category in the Latin American market, projected to expand at a CAGR of 12.3%. This growth is fueled by expanding retail, hospitality, and corporate real estate sectors, all of which require efficient climate control solutions.

A key factor contributing to this expansion is the rapid development of shopping malls, hotels, and business parks. In Peru, the Lima Chamber of Commerce reported that retail and hospitality construction activity increased by 18% in 2023, necessitating centralized HVAC systems to enhance customer experience and operational efficiency.

Another driving force is the rise in multinational corporations establishing regional headquarters and service centers in Latin America. In Chile, foreign direct investment in the technology and financial services sectors grew significantly in 2023, leading to increased demand for precision cooling and ventilation in office towers and co-working spaces.

Moreover, healthcare infrastructure expansion has reinforced commercial HVAC demand.

REGIONAL ANALYSIS

Brazil HVAC Market Insights

Brazil maintained the largest share of the Latin American HVAC market, accounting for 38.3% of total regional demand in 2024. As the continent’s most populous country and a leader in economic output, Brazil drives significant demand for both residential and commercial climate control systems.

A major contributor to Brazil’s leadership is its extensive real estate development, particularly in São Paulo and Rio de Janeiro. Besides, the country's expanding commercial infrastructure, including mall and hotel construction, has further boosted HVAC demand. With continued investment in green building certifications and infrastructure upgrades, Brazil remains the cornerstone of the Latin American HVAC industry.

Mexico HVAC Market Insights

Mexico is positioned as an industrial and technological hub with strong trade ties to North America, Mexico is experiencing rising demand for climate control solutions across manufacturing, commercial, and residential sectors.

A significant catalyst for growth is the nearshoring trend, where global manufacturers are relocating production facilities closer to U.S. markets. The Mexican Association of Industrial Parks reported that industrial real estate investments rose in 2023, necessitating climate-controlled environments for production lines, warehouses, and office spaces.

Urbanization and rising disposable incomes have also played a role. With ongoing efforts to improve energy efficiency and indoor comfort, Mexico continues to be a key growth engine in the Latin American HVAC market.

Argentina HVAC Market Insights

Argentina has shown notable potential for growth, particularly in response to increasing institutional and sustainability-driven demand. Additionally, e-commerce platforms such as MercadoLibre have expanded their offerings to include a wide range of affordable and smart HVAC units, increasing accessibility for consumers nationwide. Despite economic volatility and inflationary pressures, Argentina is gradually strengthening its position in the Latin American HVAC market through targeted institutional policies and green building initiatives.

Chile HVAC Market Insights

Chile distinguishes itself through its emphasis on sustainable building practices and industrial applications, particularly in the mining and pharmaceutical sectors.

One of the primary drivers of HVAC demand in Chile is the government’s commitment to ensuring thermal comfort in public and healthcare settings.

The mining industry, which consumes large volumes of energy and requires controlled working environments, has increasingly adopted industrial HVAC solutions.

Additionally, Santiago’s hospitality and education sectors have embraced point-of-use air purification and climate management systems to meet stringent hygiene and comfort standards. With a focus on sustainability and resource conservation, Chile continues to be an influential player in shaping HVAC trends across Latin America.

Colombia has emerged as a key market for climate control solutions, driven by expanding rural electrification, institutional programs, and urban consumer demand.

A significant portion of HVAC demand comes from the government’s "Agua Limpia y Ambiente Saludable" initiative.

Bogotá’s rapid urbanization has also spurred investment in residential HVAC systems. The city’s Air Quality Monitoring Program reported that outdoor PM2.5 levels exceeded WHO safety thresholds in several neighborhoods, leading to increased purchases of window and split air conditioners equipped with built-in filtration.

Moreover, the education and healthcare sectors are adopting HVAC technology to safeguard vulnerable populations. With continued infrastructure development and institutional support, Colombia is positioned to strengthen its influence in the Latin American HVAC ecosystem.

LEADING PLAYERS IN THE LATIN AMERICA HVAC MARKET

Carrier Global Corporation

Carrier is a global leader in heating, ventilation, and air conditioning solutions with a strong presence in the Latin America HVAC market. The company offers a comprehensive portfolio of residential, commercial, and industrial HVAC systems tailored to meet regional climate conditions and energy efficiency standards. Carrier’s emphasis on innovation, sustainability, and after-sales service has allowed it to establish long-term partnerships with real estate developers and government agencies. Its commitment to developing low-carbon cooling technologies aligns with Latin American countries’ growing focus on environmental responsibility and green building certifications.

Daikin Industries Ltd.

Daikin maintains a significant role in shaping the Latin American HVAC landscape through its advanced inverter technology, ductless mini-split systems, and variable refrigerant flow (VRF) solutions. The company has focused on expanding its distribution network across key markets such as Brazil, Mexico, and Chile, offering products that cater to both residential and commercial segments. Daikin’s investment in local training centers and technical support services reinforces its reputation for reliability and customer satisfaction, making it a preferred brand among architects, engineers, and facility managers across the region.

Johnson Controls International (JCI)

Johnson Controls plays a pivotal role in the Latin American HVAC market by delivering integrated building solutions that include smart HVAC controls, energy-efficient chillers, and precision air handling units. With a strong focus on commercial and institutional buildings, JCI has positioned itself as a go-to provider for large-scale HVAC projects in sectors such as healthcare, education, and data centers. The company’s integration of digital platforms and IoT-enabled monitoring systems supports Latin America’s shift toward intelligent building management and energy optimization.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players in the Latin American HVAC market is localized product development and manufacturing expansion. Companies are tailoring their HVAC offerings to suit regional climatic conditions, architectural styles, and consumer preferences, enhancing relevance and adoption rates in diverse markets.

Another critical approach is strategic collaborations with governments and infrastructure developers. Many international brands are engaging with public sector entities and private construction firms to integrate energy-efficient HVAC systems into new housing, hospital, and school projects, ensuring early involvement in procurement cycles.

Lastly, expanding digital sales channels and after-sales service networks has become essential for gaining a competitive advantage. Major players are investing in e-commerce platforms, mobile service centers, and remote diagnostics to improve customer experience and ensure timely maintenance support across both metropolitan and remote locations.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major players of the Latin America HVAC Market include Daikin, Carrier, Trane Technologies, Johnson Controls, LG Electronics, Midea Group, Lennox International, Samsung Electronics, Gree Electric Appliances, Rheem Manufacturing Company.

The Latin American HVAC market is highly competitive, featuring a mix of global industry leaders, regional manufacturers, and emerging local startups. International brands such as Carrier, Daikin, and Johnson Controls dominate due to their technological expertise, brand recognition, and extensive dealer networks. However, they face increasing competition from domestic firms and Chinese manufacturers offering cost-effective alternatives tailored for budget-conscious consumers.

Market participants compete not only on price but also on performance, durability, and after-sales service. As consumer awareness about indoor air quality and energy efficiency rises, demand for technologically advanced HVAC systems is growing, particularly in urban centers where disposable incomes are higher. This has prompted manufacturers to invest in product innovation, digital integration, and customer-centric service models to differentiate themselves.

Additionally, the fragmented nature of the market allows smaller players to capture niche segments, especially in rural and institutional applications. While multinational corporations leverage economies of scale and global experience, local players often benefit from regulatory familiarity and faster response times. As concerns over climate change and building efficiency intensify, the battle for market share is becoming more dynamic, pushing firms to adopt new strategies to maintain relevance and growth in Latin America.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Carrier announced the launch of a new regional logistics hub in Bogotá, Colombia, aimed at improving supply chain efficiency and reducing delivery lead times for residential and commercial HVAC units across South America.

- In June 2023, Daikin entered into a strategic partnership with CEMEX, one of Mexico’s largest construction firms, to incorporate Daikin-branded VRF systems in newly developed corporate office complexes and mixed-use buildings, reinforcing its presence in the commercial HVAC segment.

- In September 2023, Johnson Controls launched an educational campaign in São Paulo, Brazil, in collaboration with municipal authorities to promote the benefits of smart HVAC systems in public schools and healthcare facilities, positioning the company as a trusted partner for institutional climate control.

- In January 2024, Mitsubishi Electric expanded its product portfolio in Argentina by introducing a new line of compact ductless heat pumps specifically designed for high-altitude regions, catering to both residential and small business users seeking efficient year-round climate control.

- In July 2023, LG Electronics opened a dedicated customer service and training center in Santiago, Chile, focusing on technician certification and preventive maintenance for its range of split and multi-split air conditioning units, reinforcing its commitment to after-sales excellence and customer retention.

MARKET SEGMENTATION

This research report on the Latin American HVAC Market has been segmented and sub-segmented based on equipment, end-use, and region.

By Equipment

- Air Conditioning

- Air Purifiers

By End-Use

- Residential

- Commercial

By Region

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

1. What is driving the growth of the Latin America HVAC market?

The growth is driven by urbanization, rising construction activities, increasing demand for energy-efficient systems, and climate change prompting cooling needs.

2. Which countries in Latin America have the highest demand for HVAC systems?

Brazil, Mexico, and Argentina are the leading markets due to large populations, industrial development, and hot climate conditions.

3. What types of HVAC systems are most commonly used in Latin America?

Split air conditioners, centralized HVAC systems, and VRF (Variable Refrigerant Flow) systems are commonly used in residential, commercial, and industrial sectors.

4. Who are the key players in the Latin America HVAC market?

Major players include Daikin, Carrier, Trane Technologies, Johnson Controls, LG Electronics, Midea Group, Lennox International, Samsung Electronics, Gree Electric Appliances, and Rheem Manufacturing Company.

5. What are the major challenges facing the HVAC market in Latin America?

Challenges include economic volatility, high import tariffs, inconsistent regulations, and a lack of skilled technicians in some regions.

6. How is the demand for energy-efficient HVAC systems impacting the market?

Increasing energy costs and environmental regulations are pushing demand for inverter-based and eco-friendly HVAC solutions.

7. What role does government regulation play in the Latin America HVAC industry?

Governments are implementing energy efficiency standards and incentives, which are shaping product development and market entry strategies.

8. What technological advancements are influencing the HVAC market in Latin America?

Smart HVAC systems, IoT integration, automation, and environmentally friendly refrigerants are transforming the industry.

9. Which end-user segments contribute most to HVAC demand in Latin America?

The residential and commercial segments are the largest consumers, followed by the industrial and institutional sectors.

10. What is the future outlook for the Latin America HVAC market?

The market is expected to grow steadily due to increasing construction projects, climate-related needs, and rising awareness of indoor air quality and energy efficiency.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com