Latin America Laboratory Automation Market Research Report – Segmented By Type (Modular Automation, Whole Lab Automation (WLA)), Equipment and Software Type, End-User & Country (Mexico, Brazil, Argentina, Chile and Rest of Latin America) - Industry Analysis From 2025 to 2033

Latin America Laboratory Automation Market Size

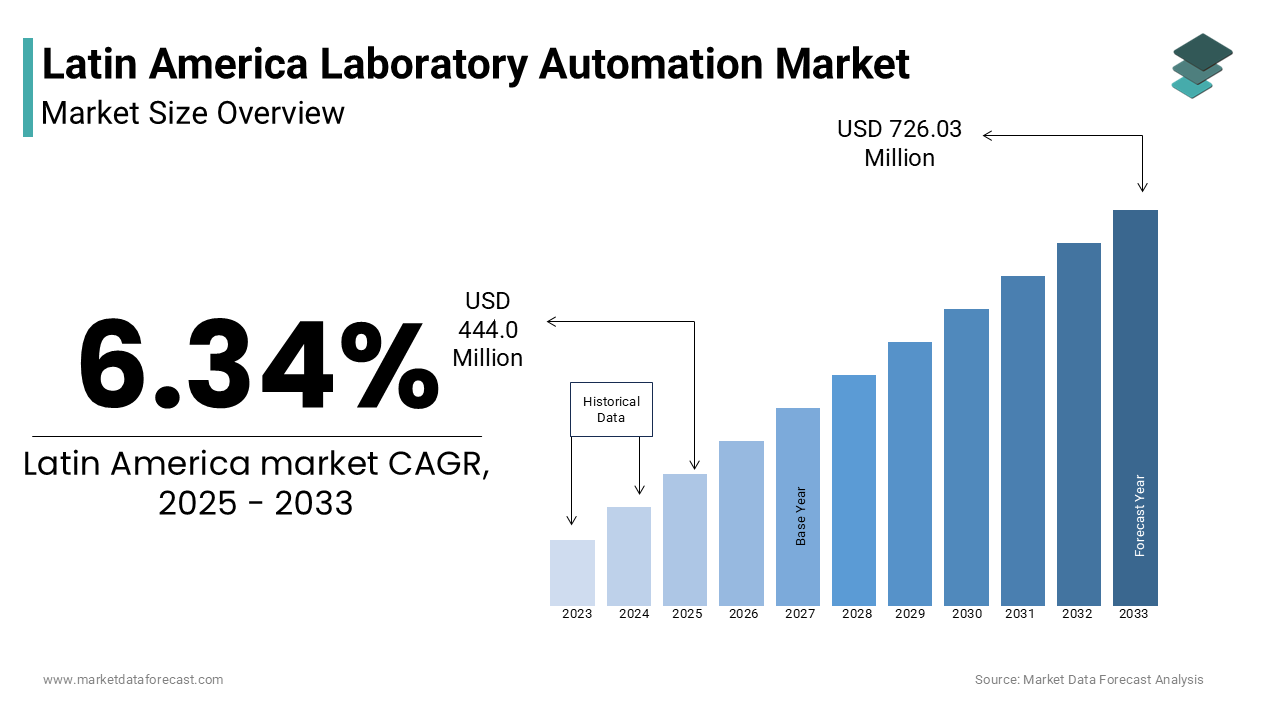

The Latin America Laboratory Automation Market was worth USD 417.53 million in 2024. The Latin America market is expected to reach USD 726.03 million by 2033 from USD 444.00 million in 2025, rising at a CAGR of 6.34% from 2025 to 2033.

The Latin America laboratory automation market refers to the integration of automated systems and technologies into laboratory workflows to enhance efficiency, accuracy, and throughput in clinical, pharmaceutical, biotechnology, and research settings. These systems encompass robotic platforms, liquid handling devices, laboratory information management systems (LIMS), and workflow automation solutions tailored for diagnostics and drug discovery. As healthcare infrastructure develops across the region, there is a growing emphasis on reducing manual errors and streamlining diagnostic processes.

MARKET DRIVERS

Rising Prevalence of Chronic and Infectious Diseases

One of the primary drivers fueling the growth of the Latin America laboratory automation market is the escalating burden of chronic and infectious diseases. Countries such as Brazil, Argentina, and Colombia are witnessing a surge in conditions like diabetes, cardiovascular diseases, and respiratory disorders. According to the World Health Organization (WHO), non-communicable diseases accounted for approximately 72% of total deaths in Latin America in 2023. In Brazil alone, diabetes prevalence reached 11.9% among adults in 2023, as per the International Diabetes Federation. This rising disease burden necessitates high-throughput diagnostic testing, which traditional manual methods cannot efficiently handle. Furthermore, the region has experienced recurring outbreaks of infectious diseases such as dengue, chikungunya, and yellow fever. Such spikes have intensified the demand for automated diagnostic platforms capable of processing large sample volumes with minimal turnaround time. Public health agencies and private laboratories are increasingly adopting automation technologies to meet these diagnostic demands effectively.

Expansion of Biopharmaceutical R&D Activities

Another critical driver of the Latin America laboratory automation market is the growing investment in biopharmaceutical research and development (R&D). Over the past few years, countries like Mexico, Brazil, and Chile have taken strategic steps to bolster their domestic pharmaceutical sectors. Similarly, Brazil's Ministry of Science, Technology, and Innovation reported that public and private funding for life sciences R&D reached USD 3.8 billion in 2023. This uptick in funding has spurred the establishment of new research centers and contract research organizations (CROs) that rely heavily on automated laboratory systems to streamline drug discovery and development processes. Automated liquid handlers, high-throughput screening systems, and integrated LIMS platforms are now becoming standard in these facilities. Moreover, multinational pharmaceutical companies are setting up regional hubs in Latin America to leverage lower operational costs and skilled labor pools.

MARKET RESTRAINTS

High Capital Investment and Maintenance Costs

A major restraint impeding the growth of the Latin America laboratory automation market is the substantial capital investment required for acquiring and maintaining automated systems. Laboratory automation solutions, including robotic arms, liquid handling systems, and integrated informatics platforms, depend on the complexity and scale of deployment. Also, ongoing maintenance, software upgrades, and specialized technician training add to the financial burden. For example, annual maintenance contracts for automated analyzers can cost a notable share of the initial purchase price. In countries like Peru and Ecuador, where public healthcare budgets remain limited, many institutions continue to rely on semi-automated or manual procedures to manage costs. Furthermore, currency fluctuations and import duties on medical equipment significantly inflate procurement prices.

Shortage of Skilled Professionals and Technical Expertise

Another significant constraint affecting the Latin America laboratory automation market is the shortage of trained personnel capable of operating and maintaining complex automated systems. The implementation of laboratory automation requires not only technical knowledge but also continuous training and adaptation to evolving software and hardware components. This gap is especially pronounced in countries such as Bolivia and Honduras, where access to advanced education and certification programs remains limited. The lack of skilled operators increases dependency on vendor support, leading to prolonged downtimes and reduced system utilization. Moreover, frequent staff turnover and inadequate training frameworks exacerbate the challenge of sustaining efficient automation workflows.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Data Analytics in Lab Systems

One of the most promising opportunities for the Latin America laboratory automation market lies in the integration of artificial intelligence (AI) and data analytics into laboratory workflows. AI-driven diagnostic tools are gaining traction globally for their ability to improve accuracy, reduce human error, and enable predictive diagnostics. In Latin America, the adoption of AI-enabled laboratory systems is still in its early stages but presents vast growth potential. In Brazil, several hospitals and research institutions have begun piloting AI-integrated pathology scanners and predictive analytics platforms to streamline cancer diagnosis and treatment planning. These advancements signal a shift toward smarter, more connected laboratories, offering automation vendors a growing market for next-generation solutions that combine robotics with intelligent data interpretation.

Growth of Telemedicine and Remote Diagnostics

The rapid expansion of telemedicine and remote diagnostics in Latin America is opening new avenues for the laboratory automation market. With increasing internet penetration and mobile device usage, healthcare providers are leveraging digital platforms to offer virtual consultations and remote monitoring services. This shift has created a demand for centralized, automated labs that can process samples collected from decentralized locations and deliver results digitally. In response, several private healthcare chains in Colombia and Chile have established hub-and-spoke lab models powered by automation to support remote diagnostics. For instance, Clínica Las Condes in Chile integrated an automated sample tracking and reporting system in 2023, allowing physicians to access real-time test results through cloud-based platforms. As remote healthcare delivery becomes more entrenched, the demand for automated, scalable, and interconnected lab systems will continue to rise, presenting a significant growth opportunity for automation solution providers in the region.

MARKET CHALLENGES

Regulatory Complexity and Standardization Gaps

One of the foremost challenges facing the Latin America laboratory automation market is the fragmented regulatory environment and lack of standardized compliance protocols across the region. Each country in Latin America maintains its own set of regulatory requirements for medical devices and diagnostic equipment, making it difficult for automation vendors to achieve uniform market access. Meanwhile, countries like Argentina and Venezuela impose additional import restrictions and currency controls that complicate procurement and distribution. Furthermore, the absence of harmonized quality standards for laboratory automation systems hampers interoperability and integration with existing hospital IT infrastructures.

Infrastructure Limitations and Power Supply Instability

Another pressing challenge in the Latin America laboratory automation market is the variability in infrastructure quality, particularly concerning electricity supply and laboratory facility readiness. Many regions, especially in rural parts of Peru, Bolivia, and parts of northern Brazil, experience frequent power outages and voltage fluctuations, which pose serious risks to sensitive automation equipment. Even in urban centers, power surges and unstable grids can damage automation instruments, leading to costly repairs and downtime. In 2023, the Brazilian Institute of Geography and Statistics (IBGE) recorded over 1,500 unplanned power interruptions affecting healthcare institutions in the Amazon and Pará states alone. To mitigate this risk, laboratories must invest in backup power systems such as uninterruptible power supplies (UPS) and generators, adding to the overall operational costs. Additionally, outdated building infrastructure in many public hospitals limits the installation of space-intensive automation platforms.

SEGMENTAL ANALYSIS

By Type Insights

Modular automation had the largest share of the Latin America laboratory automation market by accounting for 58.3% in 2024. This segment’s dominance is primarily due to its adaptability and cost-effectiveness compared to fully integrated systems. Laboratories in countries such as Brazil and Mexico prefer modular solutions that can be scaled incrementally based on budget constraints and evolving operational needs. Besides, modular systems allow for selective automation of high-volume tasks like sample preparation and analysis without requiring a complete overhaul of lab infrastructure. Furthermore, vendors are increasingly offering customized modular packages tailored to regional demand, which has further accelerated adoption across both private and public sectors.

Whole Lab Automation is the fastest-growing segment in the Latin America laboratory automation market, projected to expand at a CAGR of 11.3%. The rapid growth is attributed to increasing investments in large-scale diagnostic hubs and academic research centers that require end-to-end automation for efficiency and data consistency. Moreover, multinational pharmaceutical companies setting up R&D facilities in Chile and Argentina are adopting WLA to align with global standardization requirements.

By Equipment and Software Type Insights

Automated clinical laboratory systems represented the biggest segment in the Latin America laboratory automation market by holding an estimated 64% market share in 2024. The main reason behind this dominance is the rising demand for rapid and accurate diagnostic testing in hospitals and diagnostic centers. With the increasing prevalence of chronic diseases such as diabetes and hypertension, there is a growing need for high-throughput testing capabilities. Additionally, the expansion of private diagnostic chains such as Dasa and Grupo Gamma in Brazil and Colombia has led to increased procurement of automated clinical systems.

The automated drug discovery laboratory systems segment is anticipated to grow at the highest CAGR of 12.1% during the forecast period. This rapid rise is driven by expanding biopharmaceutical R&D activities and increasing collaboration between academic institutions and pharmaceutical firms. Countries such as Mexico and Argentina have seen a surge in government-backed initiatives aimed at strengthening domestic drug development capabilities. The establishment of regional innovation hubs, such as the Buenos Aires Biotechnology Park, has further fueled the adoption of automated drug discovery tools. Apart from these, multinational companies including Merck and Roche have expanded their R&D presence in Latin America, bringing with them advanced automation technologies that support faster compound screening and analysis.

By End User Insights

Hospitals and diagnostic laboratories accounted for the largest end-user segment by capturing a 52.5% of the Latin America laboratory automation market in 2024. The sheer volume of diagnostic procedures performed in these settings drives the demand for automation solutions. According to the Pan American Health Organization (PAHO), over 150 million laboratory tests were conducted annually in public hospitals across Latin America as of 2023. The Brazilian Society of Clinical Pathology noted that automated immunoassay systems reduced average reporting times in major hospitals. Moreover, private diagnostic chains such as Dasa and Fleury have deployed automation extensively to meet rising consumer expectations for fast and reliable results.

Biotechnology and pharmaceutical companies are witnessing the quickest market advancement, with a projected CAGR of 12.6% through 2033. This growth is fueled by increasing R&D expenditure and the establishment of contract research organizations (CROs) across the region. Mexico has also emerged as a hub for outsourced drug development, with companies like Recipharm and WuXi AppTec setting up regional operations. Additionally, academic-industry collaborations, such as the partnership between the University of São Paulo and Pfizer, have accelerated the deployment of automated screening systems.

REGIONAL ANALYSIS

Brazil secured the top position in the Latin America laboratory automation market by commanding an estimated 34.9% market share in 2024. The country's progress is associated to its well-established healthcare infrastructure, rising burden of chronic diseases, and strong government backing for medical technology modernization. Moreover, Brazil’s thriving diagnostics industry, led by companies like Dasa and Fleury, has been instrumental in driving automation adoption. Also, academic institutions such as the University of São Paulo have integrated robotics into biomedical research, reinforcing the country’s technological advancement in laboratory sciences.

Mexico’s growth is propelled by expanding pharmaceutical R&D activities and increasing outsourcing of clinical trials. Additionally, the rise in chronic disease prevalence, particularly diabetes, has intensified demand for automated diagnostic testing. The Mexican Diabetes Federation reported that diabetes-related hospitalizations increased, prompting healthcare providers to adopt high-efficiency lab systems.

Argentina’s market expansion is driven by government initiatives to strengthen the biotechnology and pharmaceutical industries. The Buenos Aires Biotechnology Park, one of South America’s most advanced research clusters, has become a focal point for automation adoption in genomics and proteomics. Despite economic volatility, international investors have shown renewed interest in Argentina’s healthcare sector. These developments signal Argentina’s potential to emerge as a stronger player in the regional automation landscape.

Chile is distinguished by its technologically advanced healthcare ecosystem. The country leads in the implementation of digital health systems and automation-integrated diagnostics. Also, Chile ranks high in research output. The country’s stable regulatory environment and digital-first approach make it a promising destination for automation solution providers seeking long-term growth opportunities.

The “Rest of Latin America” category, comprising countries such as Colombia, Peru, Ecuador, and Central American nations, collectively added considerably to the regional market in 2024. While individual economies may not match the scale of Brazil or Mexico, the collective growth potential is significant. Also, healthcare investments in Colombia have grown in recent years. This diversified yet rapidly evolving market presents unique opportunities for automation vendors aiming to expand beyond traditional hubs.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Thermo Fisher Scientific Inc., Siemens Healthineers, Danaher Corporation, PerkinElmer Inc., Beckman Coulter, Inc. (a subsidiary of Danaher), Agilent Technologies, Inc., Tecan Group Ltd., Roche Diagnostics and Bio-Rad Laboratories, Inc. are some of the key market players in the market.

MARKET SEGMENTATION

This research report on the Latin American laboratory automation market is segmented and sub-segmented into the following categories.

By Type

- Modular Automation

- Whole Lab Automation (WLA)

By Equipment and Software Type

- Automated Clinical Laboratory Systems

- Automated Drug Discovery Laboratory Systems

By End User

- Hospitals and Diagnostic Laboratories

- Biotechnology and Pharmaceutical Companies

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

What challenges are faced in the adoption of laboratory automation in Latin America?

Common challenges include high initial costs, lack of technical expertise, limited infrastructure in rural regions, and regulatory hurdles.

What is the future outlook for the Latin America laboratory automation market?

From 2025 to 2033, the market is expected to grow at a steady CAGR, driven by technological advancements, the growing burden of diseases, and the increasing need for precision and speed in lab operations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com